Lampiran I

Sampel Perusahaan

NO

KODE

PERUSAHAAN

1

DVLA

PT Darya-Varia Laboratoria Tbk

2

KLBF

PT Kalbe Farma Tbk

3

MERCK

PT MERCK Tbk

4

PYFA

PT Pyramida Farma Tbk

5

SQBB

PT Taisho Pharmaceutical Indonesia Tbk

6

TSPC

PT Tempo Scan Pacific Tbk

7

MBTP

PT Martina Berto Tbk & Subsidiaries

8

TCID

PT Mandom Indonesia Tbk

9

ADES

PT Akasha Wira International Tbk

10

CEKA

PT Cahaya Kalbar Tbk

11

DLTA

PT Delta Djakarta Tbk dan Entitas Anak

12

ICPB

PT Indofood CBP Sukses Makmur Tbk

13

MLBI

PT Multi Bintang Indonesia Tbk

14

MYOR

PT Mayora Indah Tbk

15

ROTI

PT Nippon Indosari Corpindo Tbk

16

SKLT

PT Sekar Laut Tbk

17

STTP

PT Siantar Top Tbk

18

ULTJ

PT Ultrajaya Milk Industry & Tranding Company Tbk

19

KICI

PT Kedaung Indah Can Tbk

20

GGRM

PT Gudang Garam Tbk

Lampiran 2

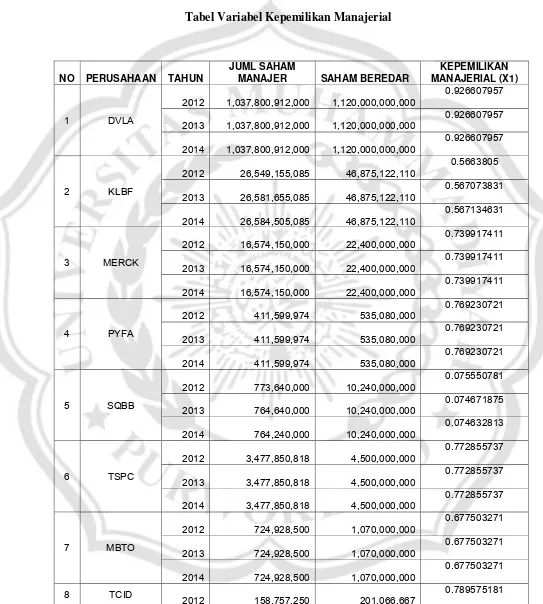

Tabel Variabel Kepemilikan Manajerial

NO PERUSAHAAN TAHUN

JUML SAHAM

MANAJER SAHAM BEREDAR

KEPEMILIKAN MANAJERIAL (X1)

1 DVLA

2012 1,037,800,912,000 1,120,000,000,000

0.926607957

2013 1,037,800,912,000 1,120,000,000,000

0.926607957

2014 1,037,800,912,000 1,120,000,000,000

0.926607957

2 KLBF

2012 26,549,155,085 46,875,122,110

0.5663805

2013 26,581,655,085 46,875,122,110

0.567073831

2014 26,584,505,085 46,875,122,110

0.567134631

3 MERCK

2012 16,574,150,000 22,400,000,000

0.739917411

2013 16,574,150,000 22,400,000,000

0.739917411

2014 16,574,150,000 22,400,000,000

0.739917411

4 PYFA

2012 411,599,974 535,080,000

0.769230721

2013 411,599,974 535,080,000

0.769230721

2014 411,599,974 535,080,000

0.769230721

5 SQBB

2012 773,640,000 10,240,000,000

0.075550781

2013 764,640,000 10,240,000,000

0.074671875

2014 764,240,000 10,240,000,000

0.074632813

6 TSPC

2012 3,477,850,818 4,500,000,000

0.772855737

2013 3,477,850,818 4,500,000,000

0.772855737

2014 3,477,850,818 4,500,000,000

0.772855737

7 MBTO

2012 724,928,500 1,070,000,000

0.677503271

2013 724,928,500 1,070,000,000

0.677503271

2014 724,928,500 1,070,000,000

0.677503271

8 TCID

2012 158,757,250 201,066,667

2013 48,806,917 201,066,667

0.242739971

2014 48,795,029 201,066,667

0.242680847

9 ADES

2012 542,347,113,000,000 589,896,800,000,000

0.919393211

2013 542,347,113,000,000 589,896,800,000,000

0.919393211

2014 542,347,113,000,000 589,896,800,000,000

0.919393211

10 CEKA

2012 273,735,500 297,500,000

0.920119328

2013 275,985,500 297,500,000

0.927682353

2014 275,985,500 297,500,000

0.927682353

11 DLTA

2012 9,341,223,000 16,013,181,000

0.58334587

2013 9,341,223,000 16,013,181,000

0.58334587

2014 9,341,223,000 16,013,181,000

0.58334587

12 ICBP

2012 4,695,839,000 5,830,954,000

0.805329454

2013 4,698,339,000 5,830,954,000

0.8057582

2014 4,698,339,000 5,830,954,000

0.8057582

13 MLBI

2012 16,064,390,000,000 21,070,000,000,000

0.762429521

2013 16,064,390,000,000 21,070,000,000,000

0.762429521

2014 16,064,390,000,000 21,070,000,000,000

0.762429521

14 MYOR

2012 253,472,012 766,584,000

0.330651321

2013 295,717,347 894,347,989

0.330651324

2014 295,717,347 894,347,989

0.330651324

15 ROTI

2012 764,862,700 1,012,360,000

0.755524418

2013 3,581,223,500 5,061,800,000

0.7075

2014 3,581,223,500 5,061,800,000

2013 743,600,500 1,310,000,000

0.567633969

2014 743,600,500 1,310,000,000

0.567633969

18 ULTJ

2012 1,865,392,526 2,888,382,000

0.645826115

2013 1,859,752,526 2,888,382,000

0.643873465

2014 1,862,473,526 2,888,382,000

0.644815515

19 KICI

2012 114,229,420 138,000,000

0.82774942

2013 114,936,620 138,000,000

0.832874058

2014 114,936,620 138,000,000

0.832874058

20 GGRM

2012 1,471,291,700,000 1,924,088,000,000

0.764669651

2013 1,471,291,700,000 1,924,088,000,000

0.764669651

2014 1,471,291,700,000 1,924,088,000,000

0.764669651

21 HMPS

2012 4,303,168,205 4,383,000,000

0.981786038

2013 4,303,168,205 4,383,000,000

0.981786038

2014 4,303,168,205 4,383,000,000

Lampiran 3

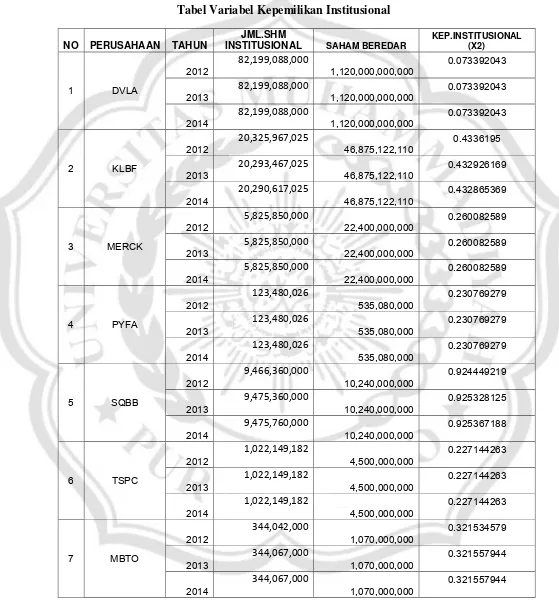

Tabel Variabel Kepemilikan Institusional

NO PERUSAHAAN TAHUN

JML.SHM

INSTITUSIONAL SAHAM BEREDAR

KEP.INSTITUSIONAL (X2)

1 DVLA

2012 82,199,088,000 1,120,000,000,000 0.073392043 2013 82,199,088,000 1,120,000,000,000 0.073392043 2014 82,199,088,000 1,120,000,000,000 0.073392043

2 KLBF

2012 20,325,967,025 46,875,122,110 0.4336195 2013 20,293,467,025 46,875,122,110 0.432926169 2014 20,290,617,025 46,875,122,110 0.432865369

3 MERCK

2012 5,825,850,000 22,400,000,000 0.260082589 2013 5,825,850,000 22,400,000,000 0.260082589 2014 5,825,850,000 22,400,000,000 0.260082589

4 PYFA

2012 123,480,026 535,080,000 0.230769279 2013 123,480,026 535,080,000 0.230769279 2014 123,480,026 535,080,000 0.230769279

5 SQBB

2012 9,466,360,000 10,240,000,000 0.924449219 2013 9,475,360,000 10,240,000,000 0.925328125 2014 9,475,760,000 10,240,000,000 0.925367188

6 TSPC

8 TCID 2012 42,309,417 201,066,667 0.210424819 2013 42,259,750 201,066,667 0.210177801 2014 42,271,638 201,066,667 0.210236926

9 ADES

2012 47,549,687,000,000 589,896,800,000,000 0.080606789 2013 47,549,687,000,000 589,896,800,000,000 0.080606789 2014 47,549,687,000,000 589,896,800,000,000 0.080606789

10 CEKA

2012 23,764,500 297,500,000 0.079880672 2013 21,514,500 297,500,000 0.072317647 2014 21,514,500 297,500,000 0.072317647

11 DLTA

2012 6,671,958,000 16,013,181,000 0.41665413 2013 6,671,958,000 16,013,181,000 0.41665413 2014 6,671,958,000 16,013,181,000 0.41665413

12 ICBP

2012 1,135,115,000 5,830,954,000 0.194670546 2013 1,132,615,000 5,830,954,000 0.1942418 2014 1,132,615,000 5,830,954,000 0.1942418

13 MLBI

2012 5,005,610,000,000 21,070,000,000,000 0.237570479 2013 5,005,610,000,000 21,070,000,000,000 0.237570479 2014 5,005,610,000,000 21,070,000,000,000 0.237570479

14 MYOR

2012 513,111,988 766,584,000 0.669348679 2013 598,630,642 894,347,989 0.669348676 2014 598,630,642 894,347,989 0.669348676

15 ROTI

16 SKLT 2012 26,136,000 690,740,500 0.037837654 2013 26,136,000 690,740,500 0.037837654 2014 26,136,000 690,740,500 0.037837654

17 STTP

2012 566,399,500 1,310,000,000 0.432366031 2013 566,399,500 1,310,000,000 0.432366031 2014 566,399,500 1,310,000,000 0.432366031

18 ULTJ

2012 1,022,989,474 2,888,382,000 0.354173885 2013 1,028,629,474 2,888,382,000 0.356126535 2014 1,025,908,474 2,888,382,000 0.355184485

19 KICI

2012 23,770,580 138,000,000 0.17225058 2013 23,063,380 138,000,000 0.167125942 2014 23,063,380 138,000,000 0.167125942

20 GGRM

2012 452,796,300,000 1,924,088,000,000 0.235330349 2013 452,796,300,000 1,924,088,000,000 0.235330349 2014 452,796,300,000 1,924,088,000,000 0.235330349

21 HMPS

Lampiran IV

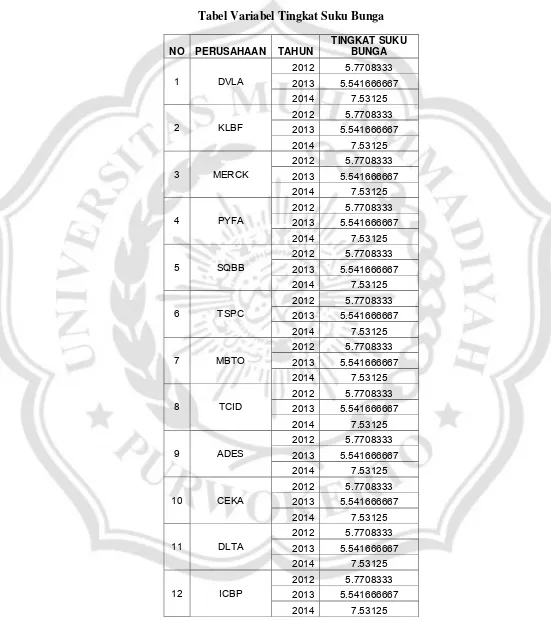

Tabel Variabel Tingkat Suku Bunga

NO PERUSAHAAN TAHUN

TINGKAT SUKU BUNGA

1 DVLA

2012 5.7708333 2013 5.541666667 2014 7.53125

2 KLBF

2012 5.7708333 2013 5.541666667 2014 7.53125

3 MERCK

2012 5.7708333

2013 5.541666667 2014 7.53125

4 PYFA

2012 5.7708333 2013 5.541666667

2014 7.53125

5 SQBB

2012 5.7708333 2013 5.541666667 2014 7.53125

6 TSPC

2012 5.7708333 2013 5.541666667 2014 7.53125

7 MBTO

2012 5.7708333

2013 5.541666667 2014 7.53125

8 TCID

2012 5.7708333 2013 5.541666667

2014 7.53125

9 ADES

2012 5.7708333 2013 5.541666667 2014 7.53125

10 CEKA

2012 5.7708333 2013 5.541666667 2014 7.53125

11 DLTA

2012 5.7708333 2013 5.541666667 2014 7.53125

12 ICBP

2012 5.7708333

13 MLBI

2012 5.7708333

2013 5.541666667 2014 7.53125

14 MYOR

2012 5.7708333 2013 5.541666667

2014 7.53125

15 ROTI

2012 5.7708333 2013 5.541666667 2014 7.53125

16 SKLT

2012 5.7708333 2013 5.541666667 2014 7.53125

17 STTP

2012 5.7708333

2013 5.541666667 2014 7.53125

18 ULTJ

2012 5.7708333 2013 5.541666667

2014 7.53125

19 KICI

2012 5.7708333 2013 5.541666667

2014 7.53125

20 GGRM

2012 5.7708333 2013 5.541666667 2014 7.53125

21 HMPS

Lampiran 4

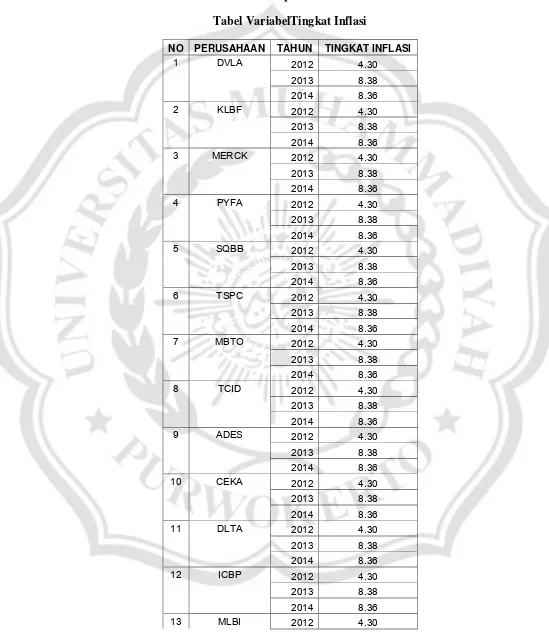

Tabel VariabelTingkat Inflasi

NO PERUSAHAAN TAHUN TINGKAT INFLASI

1 DVLA 2012 4.30

2013 8.38

2014 8.36

2 KLBF 2012 4.30

2013 8.38

2014 8.36

3 MERCK 2012 4.30

2013 8.38

2014 8.36

4 PYFA 2012 4.30

2013 8.38

2014 8.36

5 SQBB 2012 4.30

2013 8.38

2014 8.36

6 TSPC 2012 4.30

2013 8.38

2014 8.36

7 MBTO 2012 4.30

2013 8.38

2014 8.36

8 TCID 2012 4.30

2013 8.38

2014 8.36

9 ADES 2012 4.30

2013 8.38

2014 8.36

10 CEKA 2012 4.30

2013 8.38

2014 8.36

11 DLTA 2012 4.30

2013 8.38

2014 8.36

12 ICBP 2012 4.30

2013 8.38

2014 8.36

2013 8.38

2014 8.36

14 MYOR 2012 4.30

2013 8.38

2014 8.36

15 ROTI 2012 4.30

2013 8.38

2014 8.36

16 SKLT 2012 4.30

2013 8.38

2014 8.36

17 STTP 2012 4.30

2013 8.38

2014 8.36

18 ULTJ 2012 4.30

2013 8.38

2014 8.36

19 KICI 2012 4.30

2013 8.38

2014 8.36

20 GGRM 2012 4.30

2013 8.38

2014 8.36

21 HMPS 2012 4.30

2013 8.38

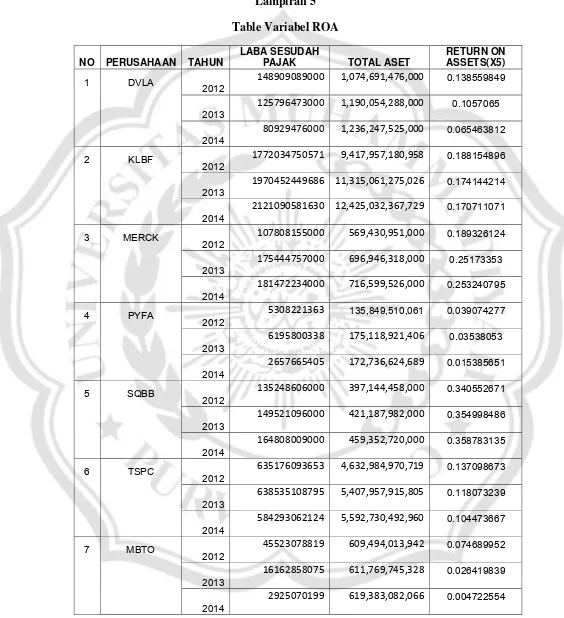

Lampiran 5

Table Variabel ROA

NO PERUSAHAAN TAHUN

LABA SESUDAH

PAJAK TOTAL ASET

RETURN ON ASSETS(X5)

1 DVLA

2012

148909089000 1,074,691,476,000 0.138559849

2013

125796473000 1,190,054,288,000 0.1057065

2014

80929476000 1,236,247,525,000 0.065463812

2 KLBF

2012

1772034750571 9,417,957,180,958 0.188154896

2013

1970452449686 11,315,061,275,026 0.174144214

2014

2121090581630 12,425,032,367,729 0.170711071

3 MERCK

2012

107808155000 569,430,951,000 0.189326124

2013

175444757000 696,946,318,000 0.25173353

2014

181472234000 716,599,526,000 0.253240795

4 PYFA

2012

5308221363 135,849,510,061 0.039074277

2013

6195800338 175,118,921,406 0.03538053

2014

2657665405 172,736,624,689 0.015385651

5 SQBB

2012

135248606000 397,144,458,000 0.340552671

2013

149521096000 421,187,982,000 0.354998486

2014

164808009000 459,352,720,000 0.358783135

6 TSPC

2012

635176093653 4,632,984,970,719 0.137098673

2013

638535108795 5,407,957,915,805 0.118073239

2014

584293062124 5,592,730,492,960 0.104473667

7 MBTO

2012

45523078819 609,494,013,942 0.074689952

2013

16162858075 611,769,745,328 0.026419839

2014

8 TCID

2012

150803441969 1,261,572,952,461 0.119536046

2013

160563780833 1,465,952,460,752 0.109528641

2014

174908419101 1,853,235,343,636 0.094380036

9 ADES

2012

83376000000 389,094,000,000 0.21428241

2013

55656000000 441,064,000,000 0.126185769

2014

31021000000 504,865,000,000 0.061444148

10 CEKA

2012

58344237476 1,027,692,718,504 0.056772065

2013

65068958558 1,069,627,299,747 0.0608333

2014

41001414954 1,284,150,037,341 0.031928835

11 DLTA

2012

213421077000 745,306,835,000 0.286353307

2013

270498062000 867,040,802,000 0.311978469

2014

288073432000 991,947,134,000 0.290412082

12 ICBP

2012

2282371000000 17,753,480,000,000 0.128559077

2013

2235040000000 21,267,470,000,000 0.105091955

2014

2531681000000 24,910,211,000,000 0.101632258

13 MLBI

2012

453405000000 1,152,048,000,000 0.393564331

2013

1171229000000 1,782,148,000,000 0.657200749

2014

794883000000 2,231,051,000,000 0.35628186

14 MYOR

2012

744428404309 8,302,506,241,903 0.089663095

2013

1088764111939 9,710,223,454,000 0.112125547

2014

16 SKLT

2012

11663883341 249,746,467,756 0.046702896

2013

11440014188 301,989,488,699 0.03788216

2014

16480714984 331,574,891,637 0.049704352

17 STTP

2012

74626183474 1,249,840,835,890 0.05970855

2013

114437068803 1,470,059,394,892 0.077845201

2014

123465403948 1,700,204,093,895 0.07261799

18 ULTJ

2012

353431619485 2,420,793,382,029 0.145998259

2013

325127420664 2,811,620,982,142 0.115637002

2014

283360914211 2,917,083,567,355 0.097138429

19 KICI

2012

2259475494 94,955,970,131 0.023794981

2013

7419500718 98,295,722,100 0.07548142

2014

4703508241 96,745,744,221 0.048617211

20 GGRM

2012

4068711000000 41,509,325,000,000 0.098019204

2013

4383932000000 50,770,251,000,000 0.086348441

2014

5395293000000 58,220,600,000,000 0.092669828

21 HMPS

2012

9945296000000 26,247,527,000,000 0.378904115

2013

10818486000000 27,404,594,000,000 0.394769067

2014

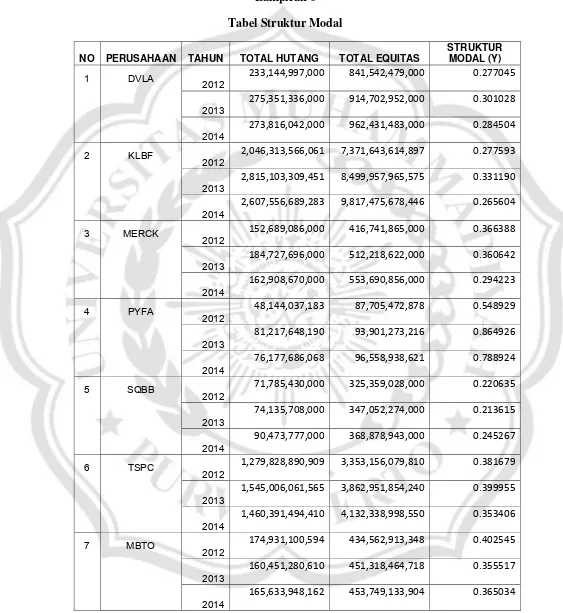

Lampiran 6

Tabel Struktur Modal

NO PERUSAHAAN TAHUN TOTAL HUTANG TOTAL EQUITAS

STRUKTUR MODAL (Y)

1 DVLA

2012

233,144,997,000 841,542,479,000 0.277045

2013

275,351,336,000 914,702,952,000 0.301028

2014

273,816,042,000 962,431,483,000 0.284504

2 KLBF

2012

2,046,313,566,061 7,371,643,614,897 0.277593

2013

2,815,103,309,451 8,499,957,965,575 0.331190

2014

2,607,556,689,283 9,817,475,678,446 0.265604

3 MERCK

2012

152,689,086,000 416,741,865,000 0.366388

2013

184,727,696,000 512,218,622,000 0.360642

2014

162,908,670,000 553,690,856,000 0.294223

4 PYFA

2012

48,144,037,183 87,705,472,878 0.548929

2013

81,217,648,190 93,901,273,216 0.864926

2014

76,177,686,068 96,558,938,621 0.788924

5 SQBB

2012

71,785,430,000 325,359,028,000 0.220635

2013

74,135,708,000 347,052,274,000 0.213615

2014

90,473,777,000 368,878,943,000 0.245267

6 TSPC

2012

1,279,828,890,909 3,353,156,079,810 0.381679

2013

1,545,006,061,565 3,862,951,854,240 0.399955

2014

8 TCID

2012

164,751,376,547 1,096,821,575,914 0.150208

2013

282,961,770,795 1,182,990,689,957 0.239192

2014

569,730,901,368 1,283,504,442,268 0.443887

9 ADES

2012

179,972,000,000 209,122,000,000 0.860608

2013

176,286,000,000 264,778,000,000 0.665788

2014

209,066,000,000 295,799,000,000 0.706784

10 CEKA

2012

564,289,732,196 463,402,986,308 1.217708

2013

541,352,365,829 528,274,933,918 1.024755

2014

746,598,865,219 537,551,172,122 1.388889

11 DLTA

2012

147,095,322,000 598,211,513,000 0.245892

2013

190,482,809,000 676,557,993,000 0.281547

2014

227,473,881,000 764,473,253,000 0.297556

12 ICBP

2012

5,766,682,000,000 11,986,798,000,000 0.481086

2013

8,001,739,000,000 13,265,731,000,000 0.603189

2014

9,870,264,000,000 15,039,947,000,000 0.656270

13 MLBI

2012

822,195,000,000 329,853,000,000 2.492610

2013

794,615,000,000 987,533,000,000 0.804647

2014

1,677,254,000,000 553,797,000,000 3.028644

14 MYOR

2012

5,234,655,914,665 3,067,850,327,238 1.706294

2013

5,816,323,334,823 3,839,300,119,177 1.514944

2014

6,190,553,036,545 4,100,554,992,789 1.509687

15 ROTI

2012

538,337,083,673 666,607,597,550 0.807577

2013

1,035,351,397,437 787,337,649,671 1.315003

2014

16 SKLT

2012

120,263,906,808 129,482,560,948 0.928804

2013

162,339,135,063 139,650,353,636 1.162468

2014

178,206,785,017 15,336,810,620 11.619547

17 STTP

2012

670,149,495,580 579,691,340,310 1.156045

2013

775,930,985,779 694,128,409,113 1.117849

2014

882,610,280,834 817,593,813,061 1.079522

18 ULTJ

2012

744,274,268,607 1,676,519,113,422 0.443940

2013

796,474,448,056 2,015,146,534,086 0.395244

2014

651,985,807,625 2,265,097,759,730 0.287840

19 KICI

2012

28,398,892,246 66,557,077,885 0.426685

2013

24,319,143,497 73,976,578,603 0.328741

2014

18,065,657,377 78,680,086,844 0.229609

20 GGRM

2012

14,537,777,000,000 26,605,713,000,000 0.546416

2013

21,353,980,000,000 29,416,271,000,000 0.725924

2014

24,991,880,000,000 33,228,720,000,000 0.752117

21 HMPS

2012

12,939,107,000,000 13,308,420,000,000 0.972250

2013

13,249,559,000,000 14,155,035,000,000 0.936032

2014

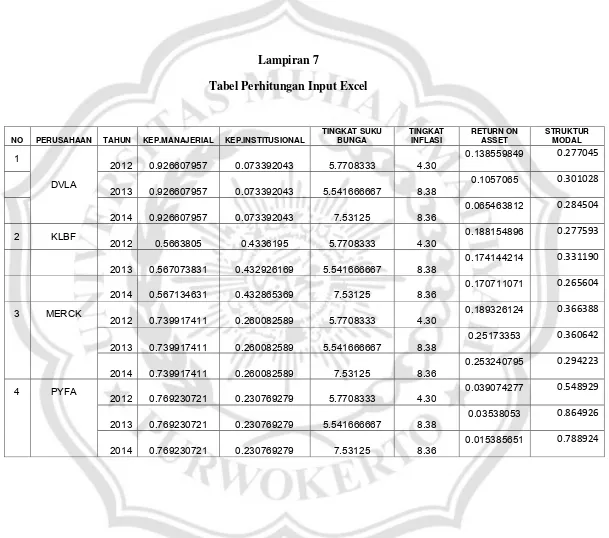

Tabel Perhitungan Input Excel

NO PERUSAHAAN TAHUN KEP.MANAJERIAL KEP.INSTITUSIONAL

TINGKAT SUKU BUNGA

TINGKAT INFLASI

RETURN ON ASSET

STRUKTUR MODAL

1

DVLA

2012 0.926607957 0.073392043 5.7708333 4.30

0.138559849 0.277045

2013 0.926607957 0.073392043 5.541666667 8.38

0.1057065 0.301028

2014 0.926607957 0.073392043 7.53125 8.36

0.065463812 0.284504

2 KLBF

2012 0.5663805 0.4336195 5.7708333 4.30

0.188154896 0.277593

2013 0.567073831 0.432926169 5.541666667 8.38

0.174144214 0.331190

2014 0.567134631 0.432865369 7.53125 8.36

0.170711071 0.265604

3 MERCK

2012 0.739917411 0.260082589 5.7708333 4.30

0.189326124 0.366388

2013 0.739917411 0.260082589 5.541666667 8.38

0.25173353 0.360642

2014 0.739917411 0.260082589 7.53125 8.36

0.253240795 0.294223

4 PYFA

2012 0.769230721 0.230769279 5.7708333 4.30

0.039074277 0.548929

2013 0.769230721 0.230769279 5.541666667 8.38

0.03538053 0.864926

2014 0.769230721 0.230769279 7.53125 8.36

2013 0.074671875 0.925328125 5.541666667 8.38

0.354998486 0.213615

2014 0.074632813 0.925367188 7.53125 8.36

0.358783135 0.245267

6 TSPC

2012 0.775248204 0.224751796 5.7708333 4.30

0.137098673 0.381679

2013 0.775248204 0.224751796 5.541666667 8.38

0.118073239 0.399955

2014 0.775248204 0.224751796 7.53125 8.36

0.104473667 0.353406

7 MBTO

2012 0.677503271 0.321534579 5.7708333 4.30

0.074689952 0.402545

2013 0.677503271 0.321557944 5.541666667 8.38

0.026419839 0.355517

2014 0.677503271 0.321557944 7.53125 8.36

0.004722554 0.365034

8 TCID

2012 0.789575181 0.210424819 5.7708333 4.30

0.119536046 0.150208

2013 0.242739971 0.210177801 5.541666667 8.38

0.109528641 0.239192

2014 0.242680847 0.210236926 7.53125 8.36

0.094380036 0.443887

9 ADES

2012 0.919393211 0.080606789 5.7708333 4.30

2013 0.927682353 0.072317647 5.541666667 8.38

0.0608333 1.024755

2014 0.927682353 0.072317647 7.53125 8.36

0.031928835 1.388889

11 DLTA

2012 0.58334587 0.41665413 5.7708333 4.30

0.286353307 0.245892

2013 0.58334587 0.41665413 5.541666667 8.38

0.311978469 0.281547

2014 0.58334587 0.41665413 7.53125 8.36

0.290412082 0.297556

12 ICBP

2012 0.805329454 0.194670546 5.7708333 4.30

0.128559077 0.481086

2013 0.8057582 0.1942418 5.541666667 8.38

0.105091955 0.603189

2014 0.8057582 0.1942418 7.53125 8.36

0.101632258 0.656270

13 MLBI

2012 0.762429521 0.237570479 5.7708333 4.30

0.393564331 2.492610

2013 0.762429521 0.237570479 5.541666667 8.38

0.657200749 0.804647

2014 0.762429521 0.237570479 7.53125 8.36

0.35628186 3.028644

14 MYOR

2012 0.330651321 0.669348679 5.7708333 4.30

0.089663095 1.706294

2013 0.330651324 0.669348676 5.541666667 8.38

0.112125547 1.514944

2014 0.330651324 0.669348676 7.53125 8.36

2013 0.7075 0.2925 5.541666667 8.38

0.086693488 1.315003

2014 0.7075 0.2925 7.53125 8.36

0.088001318 1.231897

16 SKLT

2012 0.962162346 0.037837654 5.7708333 4.30

0.046702896 0.928804

2013 0.962162346 0.037837654 5.541666667 8.38

0.03788216 1.162468

2014 0.962162346 0.037837654 7.53125 8.36

0.049704352 11.619547

17 STTP

2012 0.567633969 0.432366031 5.7708333 4.30

0.05970855 1.156045

2013 0.567633969 0.432366031 5.541666667 8.38

0.077845201 1.117849

2014 0.567633969 0.432366031 7.53125 8.36

0.07261799 1.079522

18 ULTJ

2012 0.645826115 0.354173885 5.7708333 4.30

0.145998259 0.443940

2013 0.643873465 0.356126535 5.541666667 8.38

0.115637002 0.395244

2014 0.644815515 0.355184485 7.53125 8.36

0.097138429 0.287840

19 KICI

2012 0.82774942 0.17225058 5.7708333 4.30

2013 0.764669651 0.235330349 5.541666667 8.38

0.086348441 0.725924

2014 0.764669651 0.235330349 7.53125 8.36

0.092669828 0.752117

21 HMPS

2012 0.981786038 0.018213962 5.7708333 4.30

0.378904115 0.972250

2013 0.981786038 0.018213962 5.541666667 8.38

0.394769067 0.936032

2014 0.981786038 0.018213962 7.53125 8.36

Lampiran 8

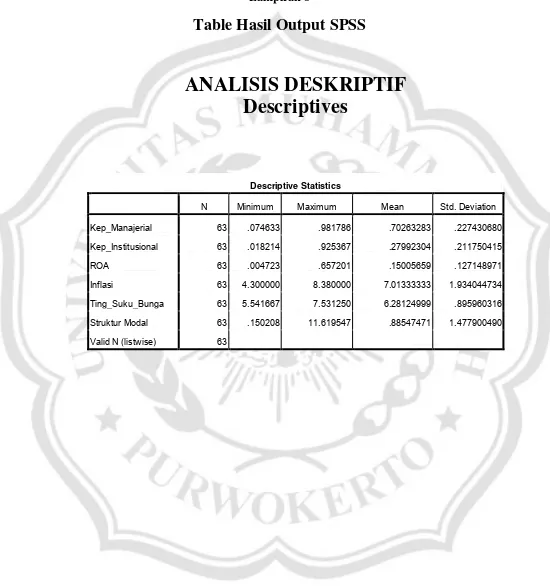

Table Hasil Output SPSS

ANALISIS DESKRIPTIF

Descriptives

Descriptive Statistics

N Minimum Maximum Mean Std. Deviation

Kep_Manajerial 63 .074633 .981786 .70263283 .227430680

Kep_Institusional 63 .018214 .925367 .27992304 .211750415

ROA 63 .004723 .657201 .15005659 .127148971

Inflasi 63 4.300000 8.380000 7.01333333 1.934044734

Ting_Suku_Bunga 63 5.541667 7.531250 6.28124999 .895960316

Struktur Modal 63 .150208 11.619547 .88547471 1.477900490

UJI NORMALITAS

NPar Tests

One-Sample Kolmogorov-Smirnov Test data awal (N=63) Unstandardized

Residual

N 63

Normal Parametersa Mean .0000000

Std. Deviation 1.42403746

Most Extreme Differences Absolute .277

Positive .277

Negative -.202

Kolmogorov-Smirnov Z 2.201

Asymp. Sig. (2-tailed) .000

a. Test distribution is Normal.

One-Sample Kolmogorov-Smirnov Test data akhir (N=43) Unstandardized

Residual

N 43

Normal Parametersa Mean .0000000

Std. Deviation .21798877

Most Extreme Differences Absolute .115

Positive .115

Negative -.082

Kolmogorov-Smirnov Z .754

Asymp. Sig. (2-tailed) .620

Lampiran 9

DATA CASEWISE

Casewise Diagnosticsa Case

Number Std. Residual Struktur Modal Predicted Value Residual

37 1.187 2.492610 .73023480 1.762375203E0

39 1.136 3.028644 1.34211631 1.686527694E0

48 6.739 11.619547 1.61061354 1.000893346E1

a. Dependent Variable: Struktur Modal

Casewise Diagnosticsa Case

Number Std. Residual Struktur Modal Predicted Value Residual

2 -1.056 .301028 .72990138 -4.288733837E-1

3 -1.062 .284504 .71575084 -4.312468382E-1

20 -1.011 .355517 .76597913 -4.104621342E-1

22 -1.208 .150208 .64072081 -4.905128059E-1

28 1.303 1.217708 .68846560 5.292423986E-1

30 1.604 1.388889 .73733541 6.515535901E-1

38 1.079 .804647 .36656095 4.380860517E-1

40 2.641 1.706294 .63366083 1.072633171E0

41 2.027 1.514944 .69171575 8.232282469E-1

42 1.999 1.509687 .69798370 8.117033008E-1

44 1.441 1.315003 .72957962 5.854233847E-1

45 1.337 1.231897 .68876144 5.431355598E-1

49 1.206 1.156045 .66643232 4.896126817E-1

56 -1.022 .328741 .74394223 -4.152012335E-1

57 -1.210 .229609 .72120522 -4.915962169E-1

61 1.199 .972250 .48524228 4.870077152E-1

63 1.408 1.102563 .53068083 5.718821681E-1

UJI AUTOKORELASI

Model Summaryb

Model R R Square

Adjusted R

Square

Std. Error of the

Estimate Durbin-Watson

1 .268a .072 -.010 1.485182520 1.689

a. Predictors: (Constant), Ting_Suku_Bunga, Kep_Institusional, ROA, Inflasi,

Kep_Manajerial

b. Dependent Variable: Struktur Modal

UJI MULTIKOLENIARITAS

Model

Unstandardized Coefficients

Standardized

Coefficients Collinearity Statistics

B Std. Error Beta Tolerance VIF

1 (Constant) .286 .423

Kep_Manajerial .583 .314 .487 .241 4.151

Kep_Institusional .127 .366 .097 .213 4.691

ROA -.772 .428 -.283 .669 1.495

Inflasi .038 .020 .270 .837 1.195

Ting_Suku_Bunga -.054 .045 -.171 .814 1.228

UJI HETEROKESDASTISITAS

Coefficientsa

Model

Unstandardized Coefficients

Standardized Coefficients

t Sig.

B Std. Error Beta

1 (Constant) .054 .235 .227 .821

Kep_Manajerial .095 .174 .177 .544 .589

Kep_Institusional .040 .203 .068 .195 .846

ROA -.032 .238 -.026 -.134 .894

Inflasi .014 .011 .226 1.297 .203

Ting_Suku_Bunga -.008 .025 -.055 -.309 .759

ANALISIS REGRESI BERGANDA

Regression

Variables Entered/Removedb Model

Variables Entered

Variables

Removed Method

1 Ting_Suku_Bun

ga, ROA, Inflasi, Kep_Manajerial, Kep_Institusional

a

. Enter

a. All requested variables entered.

b. Dependent Variable: Struktur Modal

Model Summary

Model R R Square

Adjusted R Square

Std. Error of the Estimate

1 .623a .388 .306 .232251164

a. Predictors: (Constant), Ting_Suku_Bunga, ROA, Inflasi, Kep_Manajerial, Kep_Institusional

ANOVAb

Model Sum of Squares df Mean Square F Sig.

1 Regression 1.268 5 .254 4.701 .002a

Residual 1.996 37 .054

Total 3.264 42

a. Predictors: (Constant), Ting_Suku_Bunga, ROA, Inflasi, Kep_Manajerial, Kep_Institusional b. Dependent Variable: Struktur Modal

Coefficientsa

Model

Unstandardized Coefficients

Standardized Coefficients

t Sig.

B Std. Error Beta

1 (Constant) .286 .423 .676 .503

Kep_Manajerial .583 .314 .487 1.860 .071

Kep_Institusional .127 .366 .097 .348 .730

ROA -.772 .428 -.283 -1.801 .080

Inflasi .038 .020 .270 1.921 .062

Coefficientsa

Model

Unstandardized Coefficients

Standardized Coefficients

t Sig.

B Std. Error Beta

1 (Constant) .286 .423 .676 .503

Kep_Manajerial .583 .314 .487 1.860 .071

Kep_Institusional .127 .366 .097 .348 .730

ROA -.772 .428 -.283 -1.801 .080

Inflasi .038 .020 .270 1.921 .062

Ting_Suku_Bunga -.054 .045 -.171 -1.198 .238