Volume 15 Number 1 June 2015 Page 237 - 266

THE RATIONALITY PROHIBITION OF RIBA (USURY) Sofhian

IAINSultanAmaiGorontalo ([email protected])

Abstract

Usury (henceforth called as riba) in fact has long been known and have been progressing in meaning. The study of riba was not only discussed seriously by Muslims but also other religions. If flashed back to more than two thousand years ago, the study of riba has been discussed by non-Muslims, such as Hindu, Buddhist, Jewish, Greek, Roman and Christian. In Islam, debate about riba and bank interest indicated that the problem of riba very closely related to the issue of muamalah especially those that occur in Banks and Non- Bank financial. Riba evolution concept toward interest cannot be separated from the development of the financial institutions. Therefore, this journal examine and analyze the substance of the issues of interest in a rational perspective, and at the end of this journal offers loss and profit sharing system as an alternative solution to the system of interest in transaction systems of bank and non- bank. Ketertarikan mengenai kajian riba senantiasa menjadi diskusi yang tidak mengalami kejenuhan, dan bahkan masih sangat hangat didiskusikan dalam ilmu ekonomi dalam Islam. Hal ini terlihat dari pembahasan mengenai riba yang senantiasa memberi warna dalam diskursus pemikiran umat Islam dan perdebatannya hampir tidak menemukan titik temu. Perdebatan pemikiran mengenai riba dan bunga bank menunjukkan bahwa persoalan riba sebenarnya sangat terkait erat dengan persoalan muamalah khususnya yang terjadi pada lembaga-lembaga keuangan Bank dan Non Bank. Evolusi konsep riba ke bunga tidak lepas dari perkembangan lembaga-lembaga keuangan tersebut. Oleh karena itu, jurnal ini mencermati dan menganalisis secara subtansi tentang persoalan riba dalam perspektif rasional, dan di akhir tulisan ini menawarkan sistem loss and profi sharing sebagai solusi alternatif pengganti sistem bunga dalam sistem transaksi pada lembaga keuangan bank dan non bank.

A. Introduction

Ribatermstronglyassociatedwithmuamalahactivities . Theconceptof riba is one of prohibition in the transaction within the economic system of Islam, besides implementation of zakat and the prohibition of maisir (gambling), gharar and others bathil (false) things. In muamalah , the prohibition of riba will guarantee the flow of investment into direct line , the implementation of zakat will increase aggregate demand and encourage investment flows into the property, while prohibition of maisir (gambling) , ghararandothersbathil(false)thingswillensureinvestment flowsintothereal sector for productive purposes, which will eventually increase the aggregate offer.1

Essentially, the prohibition ofriba is an absolute commandto stay far awayfromribabecauseintheQuranithasclearlyunlawfulnessascontainedin surahAl – Baqarah/2: 275

&]X,7]"^=>VE8,O > )82 >2G4, 9)F>&>E8,

-,!G/ ,

& G4,O4(_",789,`(#G4,`Q_", ,$%F

-\,FDL&789,W,a4#b9c79W%=7G6&dKZL aUe

+,%60,fAg#

“ Those who consume interest cannot stand [on the Day of Resurrection] except as one stands who is being beaten by Satan into insanity. That is because they say, "Trade is [just] like interest." But Allah has permitted trade and has forbidden interest. So whoever has received an admonition from his Lord and desists may have what is past, and his affair rests with Allah . But whoever returns to [dealing in interest or usury] - those are the companions of the Fire; they will abide eternally therein.”

The elimination of riba in Islamic economy can be defined as the elimination of usurythatoccurs in thebuying andselling anddebt-receivable. Inthiscontext,thevariousspeculativetransactionswhichcontainghararshould be prohibited. Similarly, interest that categorized as riba nasi'ah must be eliminatedfromtheeconomyactivity.

Riba actually very closely related to the financial and banking problems. It was not lost in our minds yet about the tragedy of the financial crisis in 1997 in which Indonesia's economy is very low, even had become a multidimensional crisis. Indonesia 's economy is dragged in the range of this

1

Ascarya, Akad dan Produk Bank Syariah, (Jakarta; Raja Grafindo Persada,

prolonged crisis allegedlydue to themanagement of monetary policywas not effective2. Besides that, triggered also by the foreign debt problem that had been turnedintoa "timebomb" thosepulverize theIndonesianeconomyatthat time. Entrepreneursconglomerate thatrevered as "the largest tax payer",were like a "pillagers" of national level. Bank was not treated as agencies to help governments andcommunities tofinancenationaldevelopment, butratherasa meansoflootingpublicfundsandthepublicbyconglomerates.3

As the consequence,Indonesia's economic growth reached about 7 % per yearsuddenlydroppedspectacularlytominus 15 % in 1998,thenled toan inflationto 78 % ,thenumberoflayoffsincreased,decreasedpurchasingpower and bankruptcy partlyconglomerate and businessworld. Ina short time, from July 1997 until March 13, 1999, the government had closed no less than 55 banks,inadditiontotakingover 11 banks(BTO)andnineotherbankshelped torecapitalize . Meanwhile,allstate-ownedbanksandrecapitalizedBPDshould participate. From 240 banks that existed before the financial crisis, that was only 73 privatebankscansurvivewithoutgovernmentassistance.4

The empiricalfacts above showsthatthe conventional bankingsystem usinginterest,wasveryunstableandcouldnotmonetaryflowscharacterizedby high interestrates , soit hada negative spread . Buton the contrary, Shari'ah banking system had shown itself to be a formidable system and free from negativespreadsbecauseitdidnotbasedonthesystemofinterest.

Thus,thiswritingattemptstodiscusstheissueofribainIslamicfinance perspective. Thediscussionwillstartfromthehistoricalbackgroundrevealsthe emergence ofriba,itsconceptandinterest inIslamic economic,theconcept of rationalityRibainIslamicfinance,profitandlosssharingasrationalsolutionto the interest , which includes the concept of money in Islam , money in the economic system of Islam , the prohibition of riba in the Islamic financial system , how to develop money that does not contain riba, and in the end discussionofthispaperoffers profit and loss sharing asthealternativesolution tothesystemofinterest.

B. Background of Riba

The concept of riba in fact has long been known and have been progressing in meaning . The study of riba , it was not only discussed by Muslims, but various groups outside of Islam - was looking at this issue seriously . Ifflashedbacktomorethantwothousandyearsago,infactthestudy

2

Mustafa Edwin Nasution, dkk, Pengenalan Eksklusif Ekonomi Islam,

(Jakarta: Kencana, 2006),p. 261.

3

Mubyanti,Membangun Sistem Ekonomi, (Yogyakarta:BPFE, 2007),p. 274

4

ofribahasbeendiscussedbynon-Muslims,suchasHindu,Buddhist,Jewish, Greek,RomanandChristian.5

TheconceptofribaamongJews,knownbytheterm " neshekh " stated as being forbidden and despised . This prohibition is widely availablein their scriptures,both intheOldTestamentandalsoinTalmudlaws . Manyversesin the Old Testament which prohibits the imposition of interest on loans to the poor and condemned the search of the treasure with burdening the poor with usury6areasfollows:

1. TheBookofExodus(Exodus)chapter 22 verse 25 statesasfollows: " Ifyoulendmoneytooneofmypeople,thepooramongyou,donot act asdebtcollectorsagainsthim;youshallnot chargeinterestmoney toit " .

2. TheBookofDeuteronomy(Dt )ofArticle 23,paragraph 19, statesas follows:

" Thoushall notlendtothybrother,eithermoneyorfoodoranything thatcanbepracticedasinterest " .

3. BookLevicitus(Leviticus)chapter 25 verses 36-37 statesthefollowing: " Donottakeinterestorprofitfromit,butyoumustfearyourGodand your brother may live with thee . Thou shall not give him thy money uponusury,nordoyougiveyourfoodbyaskingusury".

InAncientGreeksandRomansperiod,thepracticeofribawasbecome a prevailingtradition.7AroundsixthcenturyBCto 1 AD,therearesometypes ofinterest. 8Meanwhile,inthe Romanperiod,aroundthe V centuryBCtothe fourth AD , there were laws that allow the population taking interest for the interest rate in accordance with "the law justified maximum level (maximum legalrate) . Theinterestratevariesaccordingtothechangingtimes,buttheway totakeitwasnotjustifiedbywayofcompoundinterest(doublecountable).

a. Maximuminterestisjustified b. RegularloaninterestinRome

c. FlowersintheterritoryconqueredRome d. SpecialinterestByzantium

Nonetheless, thepractice ofmakingsuch interestwasdisgracedbythe Greek philosophers, including Plato ( 427-347 BC ) and Aristotle ( 384

-5

Muhammad Syafi’iAntonio,Bank Syariah: dari Teori ke Praktek, (Jakarta: GemaInsaniPress, 2001),p. 42.

6

Ibid,p. 43.

7

Islahi Abdul Azim, Economic Concepts of Ibn Taimiyah, (London: The IslamicFondation, 1988),p. 124.

8

MuhammadSyafi’iAntonio,op.cit., p. 43.

9

322SM),asdidtheRomanphilosophers,suchasCato( 234-149 BC),Cicero( 106- 43 BCE)andSeneca( 4 BC- 65 AD)condemnedthepracticeofinterest, whichhedescribedasinhumaneacts .10

The concept of riba among Christians has different opinion , which generallycanbegroupedintothreeperiodsasfollows:

First, the view of early Christian pastors ( I- XII century ) which forbaderibabaseontheOldTestamentandthelawsofthechurch. Inthefourth century AD the Roman Catholic Church forbade riba for pastors, then expanded to the public on the fifth century AD. In the eighth century AD , under the reign of Charlemagne , the Roman Catholic Church declared the practiceofribaasacrime .11

Second,theviewamongChristianscholars( XII- XVIcentury)which tends to allow interest , with new ground through the efforts of the law legitimizes,interestcanbedividedintointerest andusury . Fromtheirpointof view, interestisthe wasallowedwhileusuryisexcessive interest . Thosewho contributed their thought for this case were Robert of Courcon (1152-1218) , William of Auxxerre (1160-1220) , St. Raymond of Pennaforte (1180-1278), St. Bonaventure(1221-1274)andSt. ThomasAquinas( 1225-1274 ) .12

Third , theviews ofthe Christian reformers( XVIcentury- 1836 ) as MartinLuther( 1483-1536 ),Zwingli( 1454-1531 ),Bucer( 1491-1551 )and John Calvin ( 1509-1564 ) which led to Christianity justifies the interest (interest) . Inthisperiod, KingHenry VIIIdecidedtoseparatefromtheRoman Catholic Church ,and in 1545 the interest inthe UK officiallyallowed ifwas notmorethan 10 % . ThispolicyisfurtherstrengthenedbyQueenElizabethIin 1571.13

Relatedtothehistorical backgroundabove,hencetheentireofmodern banking operationbegan togrowsincethesixteenthcenturyADusedasystem of interest. Theinterestratesystembegan to grow,tookroot,and ingrainedin the modern banking industry so it was difficult to be separated. In fact, they assumethattheinterestisthecenterofrotationofthebankingsystem. Without interest, thenthe bankingsystem becomeslifelessandeventuallythe economy willbeparalyzed.14

10

IslahiAbdulAzim,op.cit., p. 124.

11

Iqbal Zamir dan Mirakhor Abbas, An Introduction to Islamic Finance,

(Wiley:John WileyandSons(Asia)Pte, 2007),p. 71.

12

MuhammadSyafi’iAntonio,op.cit. p. 47.

13

Adiwarman Karim, Ekonomi Islam, Suatu Kajian Kontemporer, (Jakarta: GemaInsaniPress, 2001),p. 72.

14

Muhammad Abdul Mannan, Islamic Economic, Theory and Practice,

Besidesthat,ribawasstrictlyprohibitedinIslam. Prohibitionofribain the Qur'annot revealedatonce,but gradually,inlinewiththereadiness ofthe community at that time, such as the prohibition of alcoholic drink. The prohibitionofribastagesintheQur'ancanbeexplainedasfollows:

The meaning: And [remember:] whatever you may give out in usury so that it might increase through [other] people's possessions will bring [you] no increase in the sight of God -whereas all that you give out in charity, seeking God's countenance, [will be blessed by Him: for it is they, they [who thus seek His countenance] that shall have their recompense multiplied!

The second stage, in the beginning Medina period, riba was loudly condemned, in line with the prohibition on the books earlier. Riba equalized with those who take other’s wealth and threatened both sides with a painful chastisementfromAllah(Qur'an,An-Nisa': 160-161 ). 16

For wrongdoing on the part of the Jews, We made unlawful for them [certain] good foods which had been lawful to them, and for their averting from the way of Allah many [people],160. And [for] their taking of usury while they had been forbidden from it, and their consuming of the people's wealth unjustly. And we have prepared for the disbelievers among them a painful punishment.161

Thethirdphase,theprohibitionofribatobeassociatedinanadditional multiplier (QS . Ali Imron: 130 ) . Thisversewasrevealedafter Uhudwar 3 Hijriyah. Thetermof double shouldnotbeunderstoodasarequirementthenthe definition was forbidden not only for doubled one but also for the little, the prohibitionofribawasgenerallyacceptedhappened .17

15

ReligionDepartment,Quran and its translation. 16

Ibid.

17

+0L4e#%,3)n, 1;3., $#[A,., 9 L 0;&>E8,

nA>2%9Lop 2%G6

q

rss

t

6!789, 1 0;&>E8,%*>#>

G4,&C

u0v=0)

O you who have believed, fear Allah and give up what remains [due to you] of interest, if you should be believers.278. And if you do not, then be informed of a war [against you] from Allah and His Messenger. But if you repent, you may have your principal - [thus] you do no wrong, nor are you wronged.279

C. The concept of Riba and interest in Islamic Economics 1. Definition and Types of Riba

Etymologically,thewordof " ar - riba " means ‘zada wa nama' ,which means toadd and grow. 18 In the Qur'an, the word " ar-riba " and its various forms ofderivativescalledfortwentytimes;eightofthemformthewordriba itself . ThiswordisusedintheQur'anwithanassortment ofmeanings,suchas growth, added, fertilize, expands, andbecomes large and numerous. Although different, but in general it means to grow, both qualitatively and quantitatively.19

Whereas the terminology, riba is generally definedas a favored profit (treasure) of one party against the other party in the transaction of sale or exchange ofsimilargoodswithoutrewardagainsttheseadvantages.20Inother terms,ribaisunderstoodaspaymentofadebtthatmustberepaidbythedebtor is greaterthanthe amountofthe loan in exchange for a graceperiod thathas elapsedtime.21By ignoringthe differences opinion,generallyfuqaha ' agreed that thereare twokindsofriba ,the ribafadl(as thefirstdefinition )andriba nasi'ah(asthedefinitionofasecond) .

However,Abu Zahraand YunusRafiqal-Misrimadedivision ofriba that somewhat different from other scholars. According to both, riba was differentiate to the debt - receivable called riba nasi'ah happened to purchase thatcalledas riba nasa ' and riba fadl . Al-Misriemphasizestheimportance of

18

AbadiAl-Fairuz,Al-Qamus al-Muhit, (Beirut:Daral-Fikr, 1998),p. 332.

19

SaeedAbdullah,Islamic Banking and Interest, A Study of Prohibition of Riba and its Contemporary Interprestetion, (Leiden:E.J. Brill, 1996),p. 20.

20

Abdurrahmanal-Jaziri,Kitab al-Fiqh ‘ala Mazahib al-Arba’ah, (Beirut:Dar al-Fikr, 1972), p. 221.

21

thedistinctionbetween riba nasi'ah and riba nasa ' inordertoavoidmistakesin identifyingvariousformsofriba.

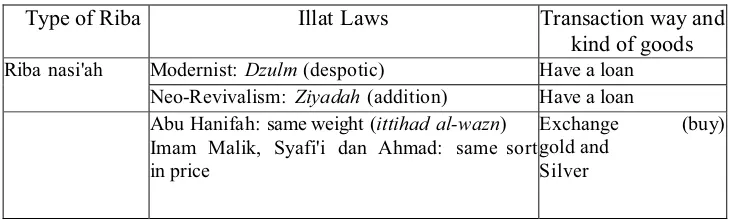

Tabel 1. Riba Typology according to Abu Zahrah abd Yunus al-Mishri

Riba

Transaction Type Elements Gloss

debt-receivable Riba Nasi'ah Postponement and addition

Agree for the unlawfulness if it is dzulm and Purchase Riba Nasa' Postponement Stillunderikhtilaf

Riba Fadl addition Source: Muslim, 2005: 132

Riba nasi'ah as what by Arab Jahiliyyah with the main characteristic manifold and exploitative agreed the unlawfulness by Muslim scholars. The current debateable is riba nasi'ah which not multiply and in a certain extent seemed not exploitative, asthe muchdiscussed relatedto bankinterest. While riba fadl still debated among Muslim scholars. Hassan is one of the scholars whodisagreewiththeunlawfulnessundersomereasons.

Expert oftafsir who allowedribafadlwere at-Tabari (diedin 310 H0. WhilethosefromRasulullah’sfriendsandtabi'inareIbnAbbas (diedin68 H0, IbnUmar(diedin73 H),ZaidibnArqam(diedin 66 H),UsamahbinZaid(died in 54 AH), Urwah bin Zubair (died in 94 H),Ikrimah (d. 105 H), ad-Dahhak (diedin105 H),andSa'idIbnMusayyab(diedin 94 H0. Theirreasonwasbased on hadith "Look, riba was only on riba nasi'ah". According to these scholars (Ridho, 1374 H; 113-114), riba fadl is the surplus of transaction prices from similar goodsnot becauseofdelaysorimmediatepayment. Theforbidden riba according to them was riba which contains added because there was a delay time(nasi'ah).

Table 2. Illat of Riba Laws

TypeofRiba IllatLaws Transactionwayand

kindofgoods Ribanasi'ah Modernist:Dzulm (despotic) Havealoan

Neo-Revivalism: Ziyadah (addition) Havealoan AbuHanifah:sameweight(ittihad al-wazn)

Imam Malik, Syafi'i dan Ahmad: same sort inprice

Exchange (buy) goldand

Source: Muslim, 2005: 135.

Theabovedifferencesaremainlyduetovaryinginterpretationsofriba. Despiteribainal-Quranandal-Hadithexplicitlyjudgedillegitimate, butthe separator unclearly defined, so it appeared diversity of interpretations. Furthermore, this issue also has implications for understanding the Muslim scholars afterRasulullah’sfriendgeneration. Infact,untilnowthisissueisstill beingdebatedendlessly.

2. Definition of interest

Etymologically , the interest in The American Heritage Dictionary of the EnglishLanguageisdefinedastheinterestisachargeforafinancialloan, usuallyapercentageoftheamountloaned .22Similardefinitionscanbefoundin the OxfordEnglishDictionaryis defined asmoney paidfor the use ofmoney lent (theprincipal)or forforbearance ofa debt ,Accordingto afixed ratio ( rate per cent ) . While in the Legal Encyclopedia for Home and Business is definedascompensationforuseofmoneythewhichisdue .23

While ribaisoften translated inEnglish as " usury " whichmeans the actoflendingmoneyatExorbitantorillegalrateofinterest . 24Otherdefinitions in the Oxford English Dictionary is defined as the fact or practice of lending money at interest;especially inlater use , thepractice of charging,taking or contracting to receive , excessive or illegal rate of interest for money for the loan . IntheLegalEncyclopediaforHomeandBusinessisdefinedasanexcess overthelegalratechargedtheborrowerfortheuseofmoney .25

Intheeconomic historyofEuropedistinguishedbetween " usury " and " interest" . Usury is definedastheactivitiesoflendingmoney "wheremoreis askedthanisgiven" . Theword "usury" isderivedfromtheLatin "usura" which

22 W

irdyaningsih et.al, Bank dan Asuransi Islam di Indonesia, (Jakarta,

Kencana, 2005),p. 21.

23

Tim Pengembangan Perbankan Syariah Institut Bankir Indonesia, Bank Syariah:Konsep, Produk dan Implementasi Operasional, (Jakarta:Djambatan, 2001),p.

36.

24W

irdyaningsih,et.al,op.cit., p. 25.

25

Tim PengembanganPerbankan SyariahInstitutBankirIndonesia, op.cit., p.

37

Ribafadl AbuHanifah:samesize(ittihad al-kail) Imam Malik: same sort (ittihad al-jins) and includingfood

Ahmad: foodunderconditioncanbemeasured

means "use " meansusingsomething . Thus,usuryisthepricethatmustbepaid forusingthemoney .

While the word " interest" is derived from the Latin "intereo" which meanstolose "tobelost ". OtherssaythattheinterestisderivedfromtheLatin " interesee" which meansitcomes inthemiddle(tocomeinbetween )thatis compensationforlossesthatariseinthemiddleofa transactioniftheborrower does not return the appropriate time ( compensation or penalty for delayed repaymentofaloan) . Infurtherdevelopments, " interest" isnotonlydefined as the compensationdueto delayin paymentof debts, butinterpreted also as compensationforlostopportunity(opportunityloss) .26

Fromthisdefinition,itisclearthat "interest" and "usury" asweknowit todayis essentiallythesame . Bothmeans extramoney,usuallyin percentage. The term "usury" arose because there was not consolidation of the financial markets at that time that the authorities have to set an interest rate that is considered "reasonable". However, after the consolidation of institutions and financial markets, the two terms were being lost because there is only one interestrateonthemarketinaccordancewiththelawofsupplyanddemand.

3. Criticism of the Theories of Interest

Inacapitalisteconomicsystem,interestisaveryimportantelement. In factitcanbesaidthatthepowerofthecapitalistsystemofeconomyisinterest. However it turns out, various theories are unable to explain the interest for certainwhetherthenecessaryinterestinaneconomyorwhetherinterestroleto encourage realinvestment and not pushed to speculate. It is necessary for in-depthanalysisofthetheoriesofinterest.

In general, the development of the theory of interest can be grouped into 2 (two),the PureTheoryofInterestandMonetary TheoryofInterest. The economists who support the first theory group were Adam Smith and David Ricardo, they were as adherents Classical Theory of Interest, N.W senior as Abstinence Theory ofInterest, Marshallasthe pioneer ofProductivity Theory of Interest and Bohm Bawerk, a pioneer of Austrian Theory of Interest. Meanwhile, supporter of the theory group was A. Lerner as a pioneer ofThe Loanable Funds Theory of Interest and Keynesian Theory of Interest cash balance.27

In the repertoire of classical economics, the famous characters were Adam SmithandDavid Ricardo. Adherentsofthe classicaltheoryviewedthat theinterestrateascompensationpaidtothelenderbytheborrowerasaservice ongainsfromlendingmoney. Therefore,theinterestisremunerationonsavings

26

Rivai Veithzal,op.cit., h. 762.

27

Tim PengembanganPerbankan SyariahInstitutBankirIndonesia, op.cit., p.

expectations. Since people will not save without anyhope ofremuneration of savings,sothistheoryholdsthateconomicinterestwithoutinterestareunlikely towork.28

Besides that,AdamSmithsawtheproblemasanissueofinterestrates and stressedtheimportance ofinterstwith 2 (two)foundations ,namely( 1 ) to raise sufficient capital supply ; and ( 2 ) because of the importance of the advantageofenablingthesustainabilityofcapital .29

However it turns out , this theory has several weaknesses , which are not all savers intend to lend their money, so without interest people are also willing to save, and when the bank lent money at all illogical to say as a sacrifice .30

Meanwhile, the theoryof abstinence thatfounded bySenior viewthat interestisthepricepaidasanactofabstinence. Accordingtohim,thisisanact of abstinence for not taking action or produce activities so that if someone borrows money to someone else, then he must pay the rent on the money borrowed.31 This theory has been criticized on the grounds that the pain of sacrifice " holdlust " isdifferentaccordingtothelevelofincomesavers. Orcan be savers do not choose to lend his money in orderto remain liquidsavings. Thusthereisnoreasonforhimtoearninterest.32

Marshall’s view as a pioneer of interest productivity theory was differentfromhispredecessor. Thistheorytreatedproductivityasa wealththat obtained in capital and the capital productivityis influencedby interest rates. Interestrateitselfisdeterminedbytheinteractionofsupplyanddemandcurves savings. If supply is greater than demand savings, then interest rates will go downandtheinvestmentwillincreaseandviceversa.33

The criticism to Smith, Ricardo and Senior can also be used to demonstrate the weakness of Marshall’s theory. It is realized that ensure a balance between savings and investment is the level of income, not interest rates. The changeininterest rateshas smalleffectonsavings. The increaseof savings is not alwaysfollowed byan increase oninvestment orit can be said that the high investmentisnot affected bylowinterestrates. Thiscase can be proved evenindepressioncondition,despitethereis adeclineininterestrates, but the investment does not increase. Therefore, the argument that said that

28

Muhammad, Teknik Perhitungan Bagi Hasil dan Profit Margin pada Bank Syari’ah, (Yogyakarta:UIIPress, 2001),p. 13.

29

Afzalur Rahman, Economics Doctrines of Islam, Terjemahan Soeroyo dan Nastangin,(Jakarta:DanaBhakti Wakaf, 2002),p. 17.

30

Muhammad,op.cit., p. 15

31

MuhammadSyafi’iAntonio,op.cit., p. 69.

32

Tim PengembanganPerbankan SyariahInstitutBankirIndonesia, op.cit., p.

42.

33

interest rate is determined by the capital productivity is the spinning reason becausethecapitalproductivityitselfisdeterminedbyinterestrates.34

In anotherhand,BohmBawerkhasdeveloped a theoryofinterestthat issimilartotheSenior’stheory. TheAustrianpioneertheoryofinterestor time preference theory arguesthatthemarginal productivityofgoodsisnowhigher than the marginal productivity of goods for the future. This theory is generalizedonthebasisofsubjectivepsychologicalviewthatmakesmisguided understanding to the theory of interest. First, most people save without consideration thatthe savings inthe futurewill be more thanthe currenttime, butratherforspecificpurposes,suchasschool,marriage,retirement,andsoon. Secondly , the middle to upper level of society fertilizing their wealth for prestigeandsocialstanding,it'snotbecausethemarginalproductivityofgoods isnowhigherthangoodsforthefuture .35

The description above indicates that no single pure theory of interest that was able to explain and prove that the necessary interest in an economic activity. Some people then turned to the theory of monetary interestto try to explainhowtodeterminetheinterestrateeventhoughtheydonothaveasolid foundationonthedefinitionoftheinterestitself.

Whereas the view of Monetary Interest, one of them is Lerner who initiatedtheloanablefundstheory. Thistheorygoesfromtheconceptofinterest arising from savings and investments. This theory holds that the interest is determined bythe interactionofsupplyand demandfor loanablefunds. While the theory of interest Keynes argued that the interest rate is determined by demand and supply ofmoney. Therefore, Keynesians believe thatsavings and investment are alwaysequal invalue (balance). Thefirst stream did notagree withthisargument. Fromtheirpointofview,assumingtheplannedsavingswill always be equal tothe planned investmentsis unfounded. Accordingto them, the interestrateisdeterminedbythecreditpriceandthereforeregulatedbythe interaction of supply and demand for capital . 36This theory is considered ambiguous because the analysis mix between the notion of inventory (stock) withflow.

The thought of monetary interest theory recently is performed by Keynes. Heconsidersthattheinterestisnotapriceorremunerationonsavings, butisthepaymentforaloan. Ingeneral,monetaryinteresttheoryconsidersthat interest payments as opportunist actions to gain advantage and to loan. Therefore, Keynescalled it as speculation motive. This motifis definedas an attempt to guarantee profit in the future. In this theory, speculation activities undertakeneconomic actors willaffectinterest ratesand turns,andfinally will

34

TimPengembanganPerbankanSyariahInstitutBankirIndonesia,loc.cit. 35

Ibid,p. 43.

36

affect investment in production and employment levels.37 Meanwhile, Islam forbids all forms of speculation because the activity can be categorized as maysir(gambling).

Whenthisisobserved,someinteresttheories,thetheoryofpureinterest and monetary interest have a number of disadvantages. Both groups of these theoriesareunabletoexplainwithcertaintywhethertheinterestisneededinan economyorwhether interesthas arole toencouragerealinvestmentandnot a speculation. Therefore,theclaimemergewithregardtotheinteresttheoryuntil analternativesolutionappearwithproductionsharingtheoryinshari'abanking.

4. Overview of Muslim Scholars (Ulama) About Bank Interest.

Muslim scholars instruction (fatwa) about the prohibition of bank interest, had been established in an Islamic research meeting, which was attended by 150 Muslim scholars in the second conference in May 1965 in Cairo, Egypt. After that various international forums and national scholars issuedafatwaprohibitingthebankinterest.

ThedecisionoftheinternationalIslamicinstitutions,asfollows:38 1. The Council of Islamic Studies of al-Azhar, Cairo, the al-Azhar DSI

conference inthemonthofMuharram 1385 H / MinMay 1965,which decidedthat "interestinanyformofaloanisforbiddenriba"

2. DecisionIIConferenceofIslamicBank, Kuwait, 1403 H / 1983. 3. Majma 'al-Fiqh al-Islami, the Islamic Conference Organization, in

DecisionNo. 10 AssemblyMajma 'IslamicFiqh,atthe 2ndConference of OIC in Jeddah, Saudi Arabia on 10-16 Rabi' ats-Thani 1406 H / December 22 to 28, 1985, which decided that "all additional and interestona loan thatmaturesandcustomers cannotaffordit, aswell asadditional(orinterest)onloansfromthebeginningofthe agreement istwopicturesofribathatisforbiddenbytheShari'a.

4. Rabita al-'Alam al-Islami, in decision No. 6, in 9th session held in Mecca on 12-19 Rajab 1406 H, which decided that "the prevailing bankinterestinconventionalbankingisforbiddenriba".

5. Answeral-AzharFatwaCommitteeonFebruary 28, 1988.

WhilethedecisionofIslamicinstitutionsinIndonesia,asfollows:39

1. Muhammadiyah in the Legal Affairs Committee in 1968 in Sidoarjo decidedthat "thebankinterestofgovernment'sismutasyabihat”.

37

Ibid,p. 14-15.

38

Ascarya,op.cit., p. 15,

39

2. Nahdlatul Ulama in Bahsul Masa'il Standing Committee, National ConferenceBandarLampungin 1992 issuedafatwaonbankinterestto accommodate threedecisions,namelythe bankinterest isharam, halal anddoubtful(syubhat).

3. The Indonesian Ulama Council in the workshop in Cisarua 1991 decidedthat 1)thebankinterestisriba; 2)bankinterestisnotsameas riba;and 3)thebankinterestisclassifiedasdoubtful(syubhat).

4. Lajnah Ulama Fatwa Committee in Indonesia, the Indonesian Ulama Council, in MUI Silaknas on December 16, 2003 decided that " the bankinterestisriba".

5. PP Muhammadiyah, Muhammadiyah fatwa Legal Affairs Committee No. 8 in June 2006 it was announced at the National Workshop Bussiness Gatheringand EconomicCouncil Muhammadiyahon 19-21 August 2006 decidedthatthe "bankinterestisharam(unlawful)".

5. Controversy Regarding Riba and Bank Interest

Thepolemicsurroundingthebankinterestcannotbeseparatedfromthe issueoftheIslamiclegalbasiswhichcalledthemu'amalatwherethesettingsis donebynashingeneral,anditisnotdescribedindetail,incontrasttotheissue of worship and aqaid. Besides, the core problem lies in the difference in determining the 'illataroundriba. SomeMuslimscholars use "ziyadah" (extra) andsomeotherwhouse "dzulm" (disadvantage).

At least, there are two views of a group of Muslim scholars who are very concerned looking at the status of the bank interest, namely the neo-revivalismand modernist. Neo-revivalismis a movementthatwantsto elevate the relevance of Islamin public life today,as well asto show the strength of Islam to the Western. Neo-revivalism considered as movements tend textual because theytendtoseetheissue ofriba(interest)fromitsliteralside,without seeing what is practiced in the pre-Islamic period (Saeed, 1996: 49). This movementemergedinthefirsthalf ofthe 20thcenturywhichisa continuation oftheIslamicrevivalmovementthatemerged 19thcenturyandbeginningofthe 20thcentury. Theemergenceofthismovement wasareactionofsecularization that occurredinIslam. Theybelieved that Western cultureasa causeofmoral decadence andmaterialisticlifestyle. Therefore,Muslimsshould notaltogether reject Islam and accept the values, ideas and systems of Western civilization. TheybelievedIslamasareligionthathasabrilliantcivilization.40

This movement focuses on several important issues of Muslims , especially westernizationinMuslimandasanattempt tofortifythemselves by placing Islam as a way of life and refuse to interpret the nash (texts) . The characteristics of this group are as follows : ( 1 ) al - Quran and as- Sunnah

40

kaffah setwayoflife withallthe sanctityandpuritywithoutinterferencefrom the new interpretation by considering the time and circumstances ; ( 2 ) the functions performedijtihadonlytotheissues notexplicitlymentionedinnash; and ( 3 )none of the legal nash, both the Qur'anand Sunnahthat need to be reinterpretedandmodified.41

The views of neo - revivalism, like Maududi and Sayyid Qutb about bank interestalso cannot be separated from these characteristics. About riba , they put more emphasis on formal legal aspects of the prohibition of riba , which views allforms of interestare forbidden. Although theydiscussfurther about theissueofinjusticein riba,ingeneral theydonotsaythat theinjustice as the reason of the prohibition. 42An expert in Islamic economics also emphasized "riba has the same meaning and import as interest"43 . The underlying reasons,according toMuslimare: 44 ( 1)The statement set out in theQur'anmustbetakenliteralmeaning,regardlessofwhatispracticedinpre -Islamic;( 2)TheQur'anhasstatedthattheonlyprincipalistaken,thenthere isnochoicebuttointerpretribaaccordingtothestatement.

The views oftheNeo-Revivalistsabout ribaasinterestis basedona literalinterpretationofthestatementfromQur'an "intubtumfawalakumru'usu amwalikum". The term "ru'usu amwalikum" is defined as a loan. Therefore, theyarguethatanyextraoverandabovetheloancanbecategorizedasriba.45

The secondgroupis modernists. Thegroupstressed the importanceof refresherIslamicthoughtbywayofrevivingijtihadthatusedasatooltoobtain the relevant ideas of al-Quran and as-Sunnah and trying to formulate legal needs. Inmoredetail, Saeed Iqbalin identifyingexisting 5 modernisttraits,46 namely (1) selective in using the Sunnah; (2)develop a pattern of systematic thinking by eliminating the assumption that decides about the end of the thinkingactivity;(3)makesadistinctionbetweenshariahandfiqh;(4)avoiding understand that accentuated sectarian, and (5) change the characteristics of thinkingmethod.

Based on the above characteristics, among modernists such as Fazlur Rahman,MuhammadAsad,an-NajjarSaidandAbdal-Moneiman-Namirmore emphasis on the moral aspect in understanding the prohibition of riba and override the formal legal riba itself. Rational understanding of the riba prohibition liesin theinjustice asthe reasontoforbidribabase on Qur'anthat

41

Ibid,p. 8.

42

Ibid,p. 849.

43

M. Umar Capra, Towards a Just Monetary System, (London: Islamic Fondation, 1995),p. 57.

44

MuslimMuslihun,op.cit., p. 147.

45

SaeedAbdullah,op.cit., p. 119.

46

said "La tadzlimun wa la tudzlamun", therefore riba is distinguished by bank interest. The groupis also basedits opinion on the classical Muslim scholars, such as al-Razi, Ibn al-Qayyim and Ibn Taymiyyah that the riba prohibition relatedtothemoralaspectreferstothepracticeofribainpre-Islamic.47

Basedontheexplanationabove,apparentlyribaisprohibitedbecauseit contains an element of exploitation to the poor, not the interest factor. This exploitation is done through loans that are trying to take advantage from the loanthatresultingmiseryofothers. Somemodernistviewsonbankinterestwas permissibleaccordingtoMuslimsduetosomefactors:48

1. The existence of need and dharurah(emergency) in economic life, as Sanhuri’sopinion

2. There is a difference between consuming loan with productive loan, productive loan is allowed but consuming loan is not permissible, as Doulibisaid.

3. Thereisadifferencebetweenriba(usury)andinterest. Inthisviewriba is forbidden, not bank interest,as well asthe viewof HafniNasifand AbdulAzizJawish.

4. Theexistence of inflationary economic intheeconomicmechanism,so that the rising of interest rates will correct the creditors disadvantage causedbyinflation,asSyauqiDunyasaid.

From above description, apparently the debate around bank interest related to the riba problem will not be end. Two opinions were conflicting betweenmodernistandneo-revivalismisimpossibletomeeteachotherbecause eachgrouplookedfromdifferentperspectiveandapproach.

The group that tend to align interest with riba in approaching the problemofformallegalsideorMinhaji " 49doctrinaire-deductive-normative

" . According to him, to answer the various issues that arose, usul fiqh as a science which is competent in this fiel recognizes two approaches, namely doctrinaire-normative-deductiveandempirical-historical-inductive. Insome certain laws , to understand Qur'an,Sunnah and relationsbetween them, ijma, ijtihad andthe processessurroundingitrequireda combinationofbothmodels oftheseapproachessimultaneously.

Thiscanbeseen fromtheirdiscussion whojustput nash,textandless putattentiontotheobjectiveaspectsoftheexistenceofbanksasacollectorand distributor of funds (financial intermediary) that have great impact on the economicandsocial.

47

Ibid,p. 41.

48

MuslimMuslihun,op.cit., p. 148.

49

Ontheotherhand,agroupthatsupportsthelawfulnessofbankinterest, approach this issue more emphasis on the objective existence of banks, or Minhaji’s term " empirical -historical - inductive ". Yet this group did not ignoreatallaspectsofthetext,theyplaced nash inanideal-moralpositionthat keepputtheirownproductoflawintheirheart(Rahmi, 2001: 150 ) .50

D. The concept of Riba in Islamic Finance Rationality

The controversy among Muslim scholars’ opinion toward riba and interestratesshowedthattheproblemofribaisverycloselyrelatedtotheissue of money. The evolutionofthe concept ofriba tointerestcannot be separated from the development of financial institutions. Financial institutions were arising from capital requirements to finance industry and commerce. That is why, it should be examined in depth the issue of ribaassociated with Islamic financialproblems.

1. The concept of Money in Islam

Money isknownas somethingthatis generallyacceptedbythe public aslegaltender,well usedtopayfor purchasesofgoods andservices orusedto pay off debts. Inother words, moneyis anintegralpartofhuman lifebecause money is a means of facilitating the movement of goods and services in all economicactivities.

Generally, the money based on the function or purpose use can be definedasanobjectwhichcanbeexchangedwith otherobjects;canbeusedto measure otherobjects; asastore ofwealth andtopaythe debtin thefuture. 51 Meanwhile, Samuelson in Ascarya define money as a medium of exchange modern and standard units to set prices and debt. In line with the above definition, AbbottLawrenceinterpret moneyis anythinggenerallyacceptedby certaineconomicareasasameansofpaymentforthepurchaseordebt.52

Meanwhile,someconventionaleconomicliteraturedefinesmoneyfrom therolesandfunctionsofmoneyitselfintheeconomy,namelymoneyas( 1 )a mediumofexchange ;( 2 )astoreofvalue;( 3)Theunitofaccount / measure of value; and( 4 )the standard for deferredpayment.53 Whilethe motive of holding money, according to Keynesin Karim , thereare three motives: (1 ) transaction motive; (2)The precautionary motive; and (3) speculative motive. The third motive of this, the interest rate as the cost of opportunity appears,

50

RahmiNispan, KonsepIbnuQayyimal-JauziyahTentangRiba”dalam Tesis Magister IAINSunan Kalijaga Yogyakarta, 2001,p. 150.

51

Rivai Veithzaldkk,op.cit., p. 3.

52

Ascarya,op.cit., p. 22

53

where thehighertheinterestrate,thelowerthespeculativedemandformoney, andviceversa.54

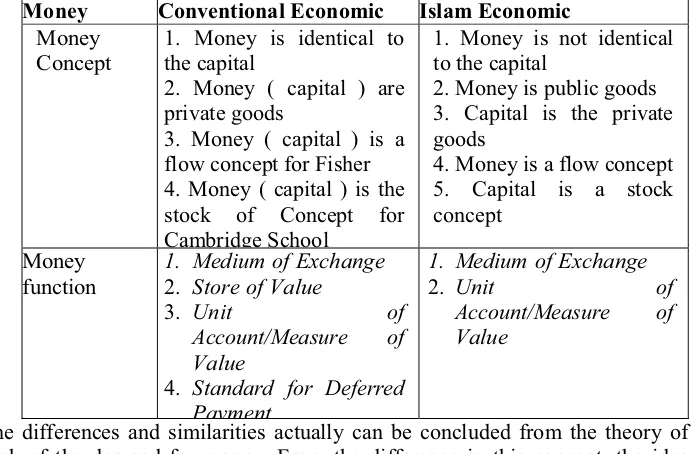

The concept of money is somewhat different from the concept of money in Islamic economics as a new paradigm in the world economy. In Islamic economics,the concept ofmoney isvery clear andfirmthat moneyis money, money is not capital. In contrast, the concept of money raised in conventionaleconomicsisofteninterpretedasinterchangeabilitynamelymoney asmoneyandmoneyascapital.55

According to Ibn Taymiyya in Islahi , money in Islamis a means of exchangeandameasureofvalue . Themoneyisintendedasameasureanitem, through money,thevalueofthegoodswillbeknownandtheydonotuseitfor theirself orconsumed. Similarthingalsoexpressedbyhisstudent,IbnQayyim thatmoneyandcoinsdoesnotintendedfortheobjectitself,butforthepurpose ofobtaininggoods(asamediumofexchange) .56Inrelationtotheconceptof money, al-Ghazali inMuhammad revealed that: "moneyis like glass, has no color, butitcanreflect allcolors. Moneydoesnothave aprice,but themoney canreflectonalltheprices".57

Fromthedefinitionsandtheoriesaboutmoneyabove,generallymoney inIslamisdefinedasamediumofexchangeandmeasureofvalueofgoodsand services to facilitateeconomic transactions. Thus, money is not a commodity. Therefore, the motive of holding money in Islam is for the transaction and precautiononly,andnotforspeculation.58

Another difference regarding the concept of money between Islamic economics and conventional economics is money is something that is flow concept and the capital is something that is a stock concept. Whereas in conventional economics there are two (2) views on the concept of money as follows:

First,theconcept ofIrvingFisher ,asstatedbyFredericS. Mishkinin Karimthatthefasterthevelocityofmoney,thegreatertheincomeearned. This couldmeanthatmoneyisaflowconcept. Inotherwords,thereisabsolutelyno correlation between the necessity of holding money (demand for holding money)withinterestrates.59

Thisconceptcanbeexpressedinthefollowingequation:

54

Adiwarman Karim,Ekonomi Makro Islam, (Jakarta:RajaGrafindoPersada,

2007),p. 182-183.

55

Ibid,p. 77.

56

IslahiAbdulAzim,p. 140

57

Muhammad,Dasar-dasar Keuangan Islam, (Yogyakarta:UPPAMP YKPN,

2005),p. 46.

58

Ascarya,op.cit., p. 22-23.

59

Adiwarman Karim,Ekonomi Makro Islam, (Jakarta:RajaGrafindoPersada,

Second, theconcept ofPigou MarshallofCambridge in Karim(2007 : 78 )as wasstatedbyMishkin,whichwasexpressedinthefollowingequation:60

Marshall mathematical equationabove shows that demand for holding money isaproportion(k)ofthetotalrevenue(PT). Thelargerthek,thegreater thedemandforholdingmoney(M)toacertainincomelevel(PT). Itshowsthat the concept of Marshall stated that money is a stock concept. Therefore, the Cambridge groupsaysthatmoneyis onewayto storewealth. InIslam,capital is private goods,whilethe moneyis public goods. When the moneyflowsare public goods (flow concept) and then settles into a person's ownership (stock concept) and the money is being privately owned (private goods). The description of the money concept as a flow concept and publicgoods can be explainedasfollows:

2. Money as a Flow Concept

In Islam, money is a flow concept, while capital is a stock concept (Muhammad, 2004: 71). The faster the velocity of money, the better. Money can be likenedto water. If the waterflowed, then the water will be clean and healthy. Butifthewaterisallowedtostagnateinoneplace,thenthewaterwill be muddy (gross). Likewise money, it rotates to production can lead to economic prosperityandpublic health. Meanwhile,if themoneywasdetained, itcancauseabreakdownoftheeconomysoastocausetheeconomiccrisis. So, the money should be used for investment in the real sector. If only saved money,thennotonlydonotgetareturn,butalsoissubjectedtozakat.

60

Ibid,p. 78

MV = PT Description:

M = Amountofmoney

V = velocityofmoneyLevels P = pricelevelofgoods T = Numberoftradedgoods

M = kPT Description:

3. Money as Public Goods

Money as public goods is characterized as items that can be used by peoplewithoutblockingotherpeopletouseit. 61Moneyaspublicgoodslikened highways and capitalas privategoods likenedasvehicle. The highwaycan be usedbyanyonewithoutexception,butthepeoplewhohaveavehiclehaslarger opportunityinusingthehighwaycomparedtopeoplewhodonothavevehicles. So does with money. Money as public goods can be used more by the community richer. It is not because their deposits in the bank, but because of their assets, such as houses, cars, stocks, and others that are used in the productionsector,thusprovidinga greateropportunityforthe persontoobtain more money. Thus, thehigherthe productionlevel,the greatertheopportunity to take advantage from the money (public goods). Therefore, stockpiling is prohibitedbecausedeterothersfromusingsuch public goods.

Table 3. The concept of money according to the Economic Conventional and Islamic Economics

Money Conventional Economic Islam Economic

Money Concept

1. Money is identical to thecapital

1. Money is not identical tothecapital

2. Moneyispublicgoods 3. Capital is the private goods

The differences and similarities actually can be concluded from the theory of each of the demand for money. From the difference in this concept, the idea appears about economic interest in the outcome of conventional and Islamic economicswhichwasappliedinthebankingconcept.

61

4. Money in the Islamic Economic System

In the history of Islamic economy, the importance of money is confirmed by the opinion of the Prophet Muhammad who advocate that the better trading ( fair ) is the trade that uses the medium of money ( dinar or dirham),ratherthantheexchangeofgoods(barter)whichcanleadtoribawhen theexchangeofgoodsadifferentkindofquality.

By the existence ofmoney, the economy (in the perspective ofIslam) can takeplacewitha better,thatis maintainedandincreased turnovervelocity between the human (economic actors). Due to the presenceof money, charity activities, infaq, sadaqah, endowments, kharaj, jizya, and others can be smoothlyheld. Withthe existenceofmoney aswell,theactivityoftheprivate sector,public,andsocialcantakeplaceatafasteracceleration .

Thedifferenceconceptofmoneybetweenconventional economicsand Islamic economics has implications for the economy. In conventional economics,thesystemofinterestandfunctionsofmoneywhichcanbelikened toacommoditycausesitsownmarketwithmoneyasacommodityandinterest astheprice . Thismarketisgrowingmonetarymarketparalleltotherealmarket (goodsandservices)intheformofmoneymarket,capitalmarket,bondmarket and derivatives market. As a result, in the conventional economy arising dichotomy real and monetary sectors . Furthermore, the rapid development in the monetarysectorhasbeensiphoningmoneyandproductivityorvalueadded generatedrealsectorsothatthemonetarysectorhasinhibitedthegrowthofthe real sector , has even narrowed the real sector , causing inflation and hamper economicgrowth.62

This inflationwill furthermade referenceto raiseinterest rates. When the level of profit expected by investors and entrepreneurs is lower than the prevailing interest rates, then certainly the entrepreneurs andinvestors will be reluctanttoinvest. Theoretically,intheconventionalfinancialsystem,someone willinvest tothelevelofmarginalefficiencyofcapital(marginalefficiencyof capital) equal to the rate of return on interest payments due to investment behavior depends on the interest rate and the rate of profit expectations. The higher the interest rate, the lower the level of investment will be. This will certainly exacerbatethe unemploymentproblemif capital ownersare reluctant toinvestbecauseoftheprofitstheymakelessthantheprevailinginterestrates. Termination of this investment will indirectly result in not exploited the economic resourcesandreduceemploymentopportunitiesfor peoplewhoneed ajoborevenoccurlayoffs.63

62

Ascara,op.cit., p. 25-26.

63

A. Mansur, Konsep Uang dan Bank: Studi Komparasi Antara Ekonomi

KonvensionaldanEkonomiIslam,dalam Ontologi Kajian Islam, Seri 9, 2005,p. 206

The dichotomy of the real sector and monetary economics does not occur in Islambecauseof the absence ofinterest andbanningtrade systemas commoditymoneysothatpatternsofIslamiceconomyistherealeconomywith the function of money as a medium of exchange to facilitate the activitiesof investment,productionandtradeintherealsector.

5. Prohibition of Riba in Islamic Financial System

The prohibition of usury, according to Qaradawi has benefit lesson hiddenbehindtheprohibition,thatistheembodimentofafairequationbetween property owners (capital) tobusinesses, as well as the risks andconsequences take full of a sense andresponsibility. The principle ofjustice in Islamis not partialtooneside,butbothareinabalancedposition.

The concept of prohibition of riba in Islam can be explained with its economic advantages contain in it compared with conventional economic concept . Riba is economically more an attempt to optimize the flow of investment by maximizing the possibility of prohibiting their investment throughascertainment(interest). Thehighertheinterestrate,themorelikelythe unstoppableflow ofinvestmentis. Itcanbelikenedtosucha dam. Thehigher thedamwall,thegreatertheflowofwaterisstoppable.64

With the prohibition of riba , the wall that separate the flow of investments isnothingsothe flow runsmoothlywithouta hitch. Thisiscould be seen when Indonesia was hit by the financial and banking crisis in 1997 -1998. At that time, banks' interest rates soared high to reach 60 %. With the interest rates ashigh as it canbe saidalmost noone who daredto borrowfor investmentbank. ThiscanbeillustratedinFigure 1

Figure 1 FlowInvestmentunstoppable

Source:Ascarya, 2007: 18 .

64

Ascaryah,op.cit., p. 17.

advantage

Graphically, it canbeshownthatthe increasedrateofy % to x % has reduced thenumber ofpossibleinvestmentfromQ1 intoQ2 (seechart 1). The increase in interestrates has been to stem the flow of investment ofQ1 - Q2. Becauseofthis,theribaisforbiddeninIslam(besidesreasonsofmorality) . Graph 1. InterestRateandInvestmentRelations

x%

y%

Source:Ascarya, 2007: 19 .

From the explanation above,the implications ofthe prohibition of riba in the realsector,accordingAscarya,asfollows:65

1. Tooptimizeinvestmentflowssmoothlychanneledtotherealsector. 2. Topreventtheaccumulationofwealthtoagroupofpeople,whenithas

the potential to exploit the economy (the exploitation of economic actors on other actors; exploitation of the system on economic operators);

3. To prevents interferences in the real sector, such as inflation and the declineinmacro-economicproductivity;

4. To encourage the creation of economic activity fair, stable and sustainable through a mechanism for the results (profit-loss sharing) productive.

Thus, due to the prohibition of riba in Islam make the flow of investment to be optimal and channeled to productive sectors. Meanwhile, in the conventional system interest system makes optimal investment flows into and not smooth due partly obstructed. Whereas in the absence of gambling prohibition,someinvestmentsarenotchanneledtoproductivesectorsasshown inFigure 2

Figure 2. TheflowofinvestmentsintheIslamicandConventionalSystem

65

IslamSystem

Anti-Riba Anti-gambling

P

p

X%

p

Riba gambling

ConventionalSystem

Source: Ascarya, 2007: 21.

Furthermore , when riba only includes usury, the focus of Islamic economic development will just lead to improvements and completeness of Islamic economic regulation of infrastructure, which include Islamic financial institutions (banks sharia, shariah insurance, capital markets shari'ah, and so on). However,when ribaincludinginterest, thenfocus onthe development of Islamic economics also lead to macroeconomic structure and gold-based monetarymanagement(fullbodiedmoney)inthelong-termdimension.66 6. The Ways of Money Development without Containing Riba

Ribaisaformofeconomictransactionswheretheunlawfulnessdidnot caused by its substance, however due to transactions performed ( haram lighairihi ). Therefore, actually, riba can be removed in some ways that describedinTable 4 asfollows:

Table 4. HowtoEliminateCausesRiba

RIBATYPE THECAUSE

FACTOR

HOW TOELIMINATETHE CAUSEFACTOR Ribaal-Fadl Gharar (uncertain to

both parties)

Bothpartiesmustensure

the following factors : 1 ) the quantity; 2 )quality; 3 )price; 4)timeofdelivery

66

RibaNasi’ah

Returnwithoutrisk, revenuewithoutcharge

Bothsidesmadeacontract which details the rights and obligations ofeachtoensure the absence ofanypartywhoearna return without risk or enjoy revenuewithoutthecosts

Riba Jahiliyah

Voluntarycommercial lendingbecauseeveryloan thattakeaprofitfromitis riba

Donottakeanybenefitfrom goodness contract ( tabarru ) If theywanttotakeprofitfrom the use of business agreement ( tijarah ) not contract goodness (tabarru ' )

Source: Karim, 2007: 42.

The teachings of Islam prohibits riba and encouraged the people to invest because there is a fundamental difference between the investment and riba. AccordingtoAntonio,thedifferencescanbeanalyzedfromthedefinition toeachofmeaning,namely:67

1. Investing is risky business activities for dealing with the element of uncertainty. Thus,theacquisitionofhisreturnisuncertainandnotfixed. 2. To lendthe moneyis less riskybusiness because of itsacquisition ofthe

returnofinterestisrelativelydefiniteandfixed.

This investment can bedone through economic cooperation is carried out in all lines of economic activity, either production or consumption and distribution. One form of cooperation in the business of Islamic economics is

Musharaka or Mudaraba. Through this transaction, both parties to the

partnership will not get interest, but profit and loss sharing of economic cooperationasmutuallyagreed. Profit-loss sharing canberegardedasasystem ofcooperationthatemphasizesfairnessintheIslamicbusiness,soitcanbeused asanalternativesolutioninsteadofthesystemofinterest.

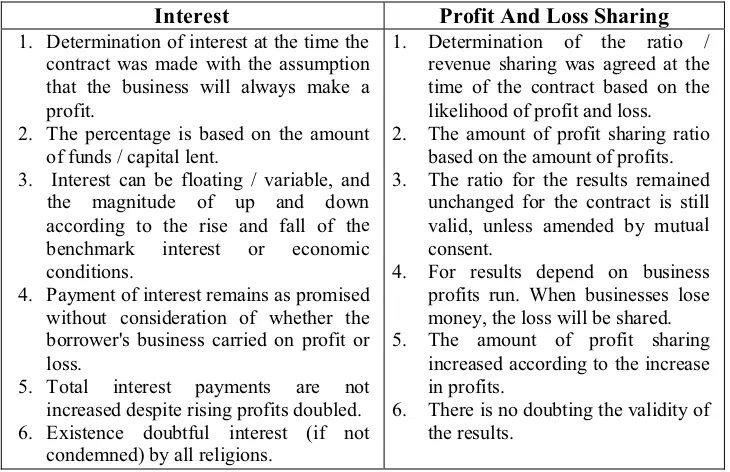

E. Profit and Loss Sharing as rational solution toward Interest

As analternative to the system of interestin conventional economics, Islamic economic system offers profit and loss sharing, when the owners of capital(surplus spending unit)incollaborationwithemployers(deficit spending units) to conduct business activities. When generating business resulted the profits, itisshared andifthebusinessactivitiessufferedaloss,the lossis also equally shared. The system of this profit sharing can be in Musharaka or mudaraba withdifferentvariations.

67

Inmudaraba,therearebusinesscooperationbetweentwopartieswhere party of shahibul mall provides the entire capital, while the other party as mudharib (manager). Mudaraba business profits are divided according to the agreement set forth in the contract, whereas loss is borne by the owners of capital losses aslongasthat isnot dueto mudharib’snegligence. However,if thelosswascausedby mudharib’s negligence,heshouldalsoberesponsiblefor thelosses.68

Another alternative as the change of interest is equity participation through theexpected rateofreturn is called Musharaka. Therealsectoris the most important sector highlighted by Islamic economy because it is directly related to the increase of output and finally the welfare of society. All components in the economy geared to encourage the real sector, both in motivatingbusinessesandintermsoffinancing.69

Expectations return,differentwiththeinterestratethatalwaysjustified by time value of money, butitis associatedwiththe economic value of money. Thus,thefactorsthatdeterminethevalueoftimeishowsomeoneusedthetime. Themoreeffectiveandefficient,thehigherthe valueoftimeis. Byusingtime effectively to work and strive will generate revenue that can be valued by money. Thiscontrastswiththetimevalueofmoney,whichisnotinproportion to consider the probability of deflation, in addition to inflation. Because in reality, the uncertainty is always occurred, and become unfair if only demand for certainty, as whatoccur inconventional economicsthrough the concept of time valueofmoney. Therefore, investorinIslamhasnorighttoaskfora rate ofreturnwherethevalueisremainedandnoonehasrighttoreceiveadditional principalembeddedcapitalwithoutparticipationtotakearisk.70

Thus, the system of profit and loss sharing, both mudharabah and musyarakah will be able to ensure justice and the absence of the exploited. Through a revenue sharing system will also awaken equity and solidarity as wellascreatingamoreequitableeconomicorder.71

Whereas in the conventional economy, riba system, fiat money, commodity money, and the permissibility of speculation will lead to the creationofmoney(currencyanddemanddeposits)andtheinhalationofmoney in the monetary sector for gaining profit without risk. As a result, money or investments thatshould bechanneledtotherealsectorfor productivepurposes largelyfledtoinhibitthegrowthofthemonetarysectorandtherealsectoreven

68

Ibid,p. 95.

69

Masyhuri dkk, Teori Ekonomi dalam Islam, (Yogyakarta: Kreasi Wacana,

2005),p. 108-109.

70

Ibid,p. 109-110.

71

shrinks. Furthermore,thecreation ofmoneywithoutanyvalueadded willlead toinflation. Finally,theobjectivesofeconomicgrowthwillbehampered. Figure 3. Interest on Economic Implications

Thus, Islam encourages the practice of profit and loss sharing and forbiddenriba. Althoughbothcanprovidebenefitstotheownersofcapital,but bothhaveaveryfundamentaldifference.

ThatdifferencecanbeexplainedinTable 5 below. Table 5. The difference between interest and Sharing

Interest Profit And Loss Sharing

1. Determinationofinterestatthetimethe contract wasmade withthe assumption that the business will always make a profit.

2. The percentage is basedonthe amount offunds / capitallent.

3. Interest canbe floating / variable, and the magnitude of up and down according to the rise and fall of the benchmark interest or economic conditions.

4. Paymentofinterestremainsaspromised without consideration of whether the borrower's business carriedon profitor loss.

5. Total interest payments are not increaseddespiterisingprofitsdoubled.

6. Existence doubtful interest (if not condemned)byallreligions.

1. Determination of the ratio / revenuesharing wasagreed atthe time of the contract based on the likelihoodofprofitandloss.

2. The amount ofprofit sharingratio basedontheamountofprofits.

3. The ratio for the resultsremained unchanged for the contract is still valid, unless amended by mutual consent.

4. For results depend on business profits run. When businesses lose money,thelosswillbeshared.

5. The amount of profit sharing increasedaccordingtotheincrease inprofits.

Source:Antonio, 2001: 61.

Meanwhile, the profit-sharing system and the prohibition of riba in Islamic economywillencouragetheinvestment climatebechanneledsmoothlyintothe realsectorforthe purposeoffullyproductive. Thiswill ensurethedistribution of wealth and income and foster real sector. By increasing productivity and employment opportunitiesandtostriveforeconomicgrowtheventuallywillbe pushedandachievedthewelfareofsociety(seeFigure 4).

Figure 4. Implications for the Economy Results

Source:Ascarya, 2007: 28.

Description and illustration above shows that the model of profit and loss sharing isa model ofIslamic financenon-riba(notinterest-based), which can be an alternative solution to the banking system. This model may have implications for the creation of a just economic activity, towards achieving stableandsustainablepublicwelfare.

F. Conclusion

Pure Interest theory and the monetary theory are the concepts that basically do not have a strong foundation in sustaining the resilience of a country’s economy,andinthe conceptofIslamiceconomics,interestispart of the implementation ofRiba,. Therefore, prohibition ofriba asone ofthe main pillars of Islamic economics that aims to create a system that supports the investmentclimatemustbe applied. Theimplicationsofribaprohibitioninthe realsector,whichcanencouragetheoptimizationofinvestments,preventingthe buildup of assets at a group of people, prevent inflation and a decrease in productivityandencouragethecreationofeconomicactivityfair.

ThepresenceofIslamiceconomicsinthemiddleofthecommunityisto create economic justice and income distribution towards the achievement of socialwelfare. Islamputseconomicjustice forall businesses,not familiarwith

Profitand losssharing

Wealthandincome distribution

IncreasingReal Sector

Productivityand Opportunity

theterm "creditor" and "debtor",butpartnerswhoareequallybeartheriskwith afullsenseofresponsibility. Finally, profit and loss sharing system canbeused as analternativesolution thesystemofinterestinIslamisa rationaleconomic system.

REFERENCE

Abadi,Al-Fairuz, 1998. Al-Qamus al-Muhit, Beirut:Daral-Fikr.

Antonio dan Muhammad Syafi'i. 2001. Bank Syari'ah: Dari Teori ke Praktik, Jakarta:GemaInsaniPress.

Arifin,Zainul, 1999. Memahami Bank Syari’ah, Jakarta:Alvabet.

Ascarya, 2007. Akad dan Produk Bank Syariah, Jakarta: RajaGrafindo Persada.

Chapra dan M. Umer, 1995. Towards a Just Monetary System, London: IslamicFoundation.

Djamil, Fathurrahman . 1995. Metode Ijtihad Majelis Tarjih Muhammadiyah, Jakarta:LogosPublishing House.

Iqbal, Zamir dan Abbas Mirakhor, 2007. An Introduction to Islamic Finance, Wiley:John WileyandSons(Asia)PteLtd.

Islahi,Abdul Azim. 1 9 8 8 . Economic Concepts of Ibn Taimiyah, London: The IslamicFoundation.

Jaziri, Abdurrahman, 1 9 7 2 . Kitab al-Fiqh 'ala Mazahib al-Arba'ah, Beirut: Dar al-Fikr.

Karim, Adiwarman, 2007. Bank Islam: Analisis Fiqh dan Keuangan, Jakarta:RajaGrafindo Persada.

Karim, Adiwarman, 2 0 0 1 . Ekonomi Islam, Suatu Kajian Kontemporer, Jakarta: Gema InsaniPres.

Karim, Adiwarman, 2007. Ekonomi Makro Islami, Jakarta: RajaGrafindo Persada.

Mannan, Muhammad Abdul, 1 9 9 7 . Islamic Economic, Theory and Practice, terj. Nastangin, Yogyakarta: DanaBhakti Wakaf.

Mansur, A., “Konsep Uang dan Bank: Studi Komparatif antara Ekonomi Konvensional danEkonomi Islam”, dalam Ontologi Kajian Islam, seri 9,Juli 2005.

Masyhuri dkk., 2005, Teori Ekonomi dalam Islam, Yogyakarta: Kreasi Wacana.

Journal of Islamic Studies, IAIN Sunan Kalijaga Yogyakarta, No. 63/VI/1999.

Mubyarto, 2007. Membangun Sistem Ekonomi, Yogyakarta:BPFE.

Muhamad, 2001. Teknik Perhitungan Bagi Hasil dan Profit Margin pada bank Syari'ah,Yogyakarta: UUIPress.

Muhamad, 2005. Dasar-Dasar Keuangan Islam, Yogyakarta.

Muhamad, 2005. Manajemen Bank Syari'ah, Yogyakarta: UPPAMP YKPN. Muslim,Muslihun, 2005. Fiqh Ekonomi, Mataram: LKIM.

Nasution, Mustafa Edwin dkk, 2006. Pengenalan Eksklusif Ekonomi Islam, Jakarta: Kencana.

Rahman,Afzalur. 2002. Economics Doctrines of Islam, terj. Soeroyo dan Nastangin,Jakarta:DanaBhakti Wakaf.

Rahmi, Nispan, 1 3 7 4 H. "Konsep Ibnu Qayyim al-Jawziyah Tentang Riba", dalam Tesis Magister Agama, IAIN Sunan Kalijaga Yogyakarta, 2001. Ridha, Al-Manar, Mesir: Mathba'ah M. Ali Shihab waAbduh.

Rivai, Veithzal , 2007. dkk, Bank and Financial Institution Manajement

Conventional and Sharia System, Jakarta: RajaGrafindo Persada,

2007.

Saeed, Abdullah, Islamic Banking and Interest, A Study of Prohibition of Riba and its Contemporary Interpretation, Leiden:E.J. Brill.

Suharto, Ugi , “Paradigma Ekonomi Konvensional dalam Sosialisasi EkonomiIslam”,dalam ISEFID Review, Vol.3,No.3, 2004.

Tim Pengembangan Perbankan Syari'ah Institut Bankir Indonesia, 2 0 0 1 . Bank Syari'ah: Konsep, Produk dan Implementasi Operasional, Jakarta: Djambatan.

At-Tirmidzi, Abu Isa Muhammad bin Isa bin Saurah, 1 9 6 4 . Sunan at-Tirmidzi wa Huwa al-Jami' as-Shahih,Beirut: Daral-Fikr.

Vogel, Frank E. dan Samuel L. Hayes, 2 0 0 7 . Islamic Law and Finance:

Religion, Risk, and Return, terj. M. Sobirin, dkk, Bandung:

Nusamedia.

Wirdyaningsih et.al, 2 0 0 5, Bank dan Asuransi Islam di Indonesia, Jakarta: Kencana.