Lampiran 1. Hasil Uji Normalitas Total Assets

Case Processing Summary

24 100,0% 0 ,0% 24 100,0%

24 100,0% 0 ,0% 24 100,0%

Kelompok Perusahaan split

non split Total Assets

N Percent N Percent N Percent

Valid Missing Total

Cases

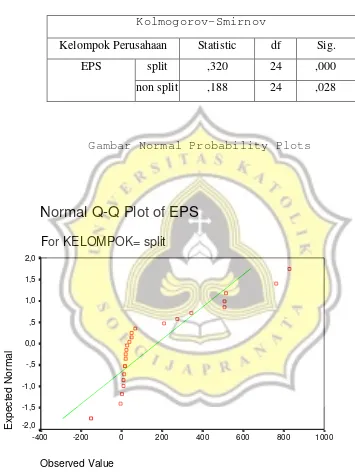

Descriptives

1109397 453488,6

171284,8

2047510

691650,7 424250,5 4,9E+12 2221631 134848,0 10637680 10502832 668562,3

3,861 ,472

15,972 ,918

1121763 446847,5

197388,1

2046137

714472,1 434843,5 4,8E+12 2189097 130103,0 10419785 10289682 747213,3

3,777 ,472

15,310 ,918

Mean

Lower Bound Upper Bound 95% Confidence

Interval for Mean

5% Trimmed Mean Median

Variance Std. Deviation Minimum Maximum Range

Interquartile Range Skewness Kurtosis Mean

Lower Bound Upper Bound 95% Confidence

Interval for Mean

5% Trimmed Mean Median

Variance Std. Deviation Minimum Maximum Range

Interquartile Range Skewness Kurtosis Kelompok Perusahaan

split

non split Total Assets

Statistic Std. Error

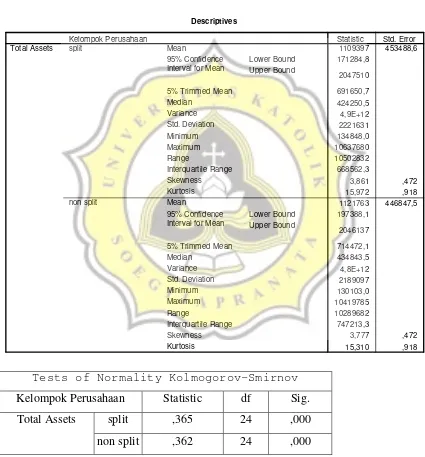

Tests of Normality Kolmogorov-Smirnov

Kelompok Perusahaan

Statistic

df

Sig.

split

,365

24

,000

Total Assets

non split

,362

24

,000

Normal Q-Q Plot of Total Assets

For KELMPK= split

Observed Value

12000000 10000000 8000000 6000000 4000000 2000000 0

-2000000 -4000000

Expected Normal

2,0

1,5

1,0

,5

0,0

-,5

-1,0

-1,5 -2,0

Normal Q-Q Plot of Total Assets

For KELMPK= non split

Observed Value

12000000 10000000 8000000 6000000 4000000 2000000 0

-2000000 -4000000

Expected Normal

2,0 1,5

1,0

,5

0,0

-,5

-1,0

-1,5 -2,0

Case Processing Summary

24 100,0% 0 ,0% 24 100,0%

24 100,0% 0 ,0% 24 100,0%

kelompok perusahaan split

non split TALN

N Percent N Percent N Percent

Valid Missing Total

Cases

Descriptives

13,102888 ,2292994

12,628546

13,577229

13,011619 12,956350 1,262 1,1233329 11,8119 16,1799 4,3680 1,518000

1,098 ,472

1,190 ,918

13,119600 ,2314197

12,640872

13,598328

13,032694 12,981150 1,285 1,1337205 11,7760 16,1592 4,3832 1,622675

1,025 ,472

,940 ,918

Mean

Lower Bound Upper Bound 95% Confidence

Interval for Mean

5% Trimmed Mean Median

Variance Std. Deviation Minimum Maximum Range

Interquartile Range Skewness Kurtosis Mean

Lower Bound Upper Bound 95% Confidence

Interval for Mean

5% Trimmed Mean Median

Variance Std. Deviation Minimum Maximum Range

Interquartile Range Skewness Kurtosis kelompok perusahaan

split

non split TALN

Statistic Std. Error

Tests of Normality

Kolmogorov-Smirnov

Kelompok Perusahaan

Statistic

df

Sig.

split

,125

24

,200

TALN

non split

,136

24

,200

Gambar Normal Probability Plots

Normal Q-Q Plot of TALN

For KELOMPOK= split

Observed Value

17 16

15 14

13 12

11

Expected Normal

2,0

1,5

1,0

,5

0,0

-,5

-1,0

-1,5 -2,0

Normal Q-Q Plot of TALN

For KELOMPOK= non split

Observed Value

17 16

15 14

13 12

11

Expected Normal

2,0 1,5 1,0 ,5 0,0 -,5 -1,0 -1,5 -2,0

Lampiran 3. Hasil Uji Beda Independent Sampel T-test Total Assets

(ln)

Group Statistics

24 13,102888 1,1233329 ,2292994 24 13,119600 1,1337205 ,2314197 kelompok perusahaan

split non split TALN

N Mean Std. Deviation

Std. Error Mean

Independent Samples Test

,007 ,932 -,051 46 ,959 -,016713 ,3257811 -,6724758 ,6390508

-,051 45,996 ,959 -,016713 ,3257811 -,6724773 ,6390523

Equal variances assumed Equal variances not assumed TALN

F Sig.

Levene's Test for Equality of Variances

t df Sig. (2-tailed)

Mean Difference

Std. Error

Difference Lower Upper

95% Confidence Interval of the

Lampiran 4. Hasil Uji Normalitas ROI

Case Processing Summary

24 100,0% 0 ,0% 24 100,0%

24 100,0% 0 ,0% 24 100,0%

kelompok perusahaan split

non split ROI

N Percent N Percent N Percent

Valid Missing Total

Cases

Descriptives

8,325833 1,3014938 5,633488

11,018178 7,965926 8,335000 40,653 6,3759916 -4,2900 29,3500 33,6400 6,692500

1,127 ,472

4,598 ,918

,084167 2,5854465 -5,264237

5,432570 -,025648 1,870000 160,429 12,66605 -24,7300 28,4700 53,2000 17,307500

-,146 ,472

,115 ,918

Mean

Lower Bound Upper Bound 95% Confidence

Interval for Mean

5% Trimmed Mean Median

Variance Std. Deviation Minimum Maximum Range

Interquartile Range Skewness

Kurtosis Mean

Lower Bound Upper Bound 95% Confidence

Interval for Mean

5% Trimmed Mean Median

Variance Std. Deviation Minimum Maximum Range

Interquartile Range Skewness

Kurtosis kelompok perusahaan

split

non split ROI

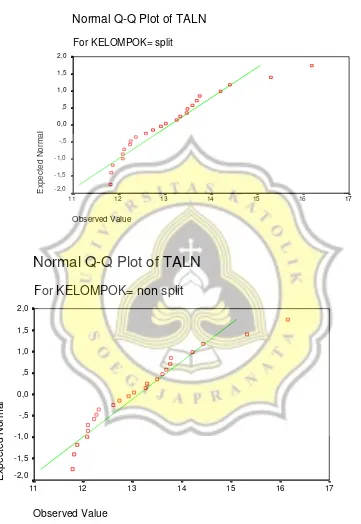

Tests of Normality

Kolmogorov-Smirnov

Kelompok Perusahaan

Statistic

df

Sig.

split

,165

24

,091

ROI

non split

,109

24

,200

Gambar Normal Probability Plots

Normal Q-Q Plot of ROI

For KELMPK= split

Observed Value

30 20

10 0

-10

Expected Normal

2,0 1,5 1,0 ,5 0,0 -,5 -1,0 -1,5 -2,0

Normal Q-Q Plot of ROI

For KELMPK= non split

Observed Value

30 20

10 0

-10 -20

-30

Expected Normal

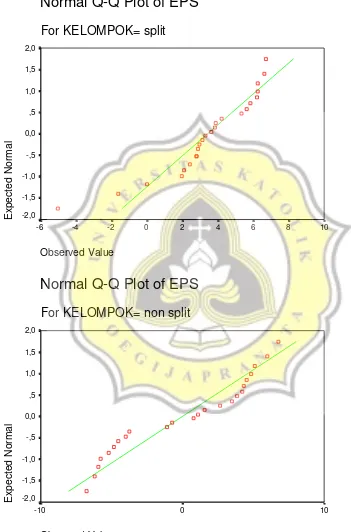

Lampiran 5. Hasil Uji Normalitas EPS

Case Processing Summary

24 100,0% 0 ,0% 24 100,0%

24 100,0% 0 ,0% 24 100,0%

kelompok perusahaan split

non split EPS

N Percent N Percent N Percent

Valid Missing Total

Cases

Descriptives

172,2494 53,92814 60,690550

283,8083

153,1753 32,500000 69797,875 264,1929 -153,000 827,0000 980,0000 313,5000

1,338 ,472 ,784 ,918 -27,6681 63,97119 -160,003

104,6664

-29,9646 2,554000 98215,509 313,3935 -870,000 871,0000 1741,000 190,5000

,077 ,472 3,907 ,918 Mean

Lower Bound Upper Bound 95% Confidence

Interval for Mean

5% Trimmed Mean Median

Variance Std. Deviation Minimum Maximum Range

Interquartile Range Skewness

Kurtosis Mean

Lower Bound Upper Bound 95% Confidence

Interval for Mean

5% Trimmed Mean Median

Variance Std. Deviation Minimum Maximum Range

Interquartile Range Skewness

Kurtosis kelompok perusahaan

split

non split EPS

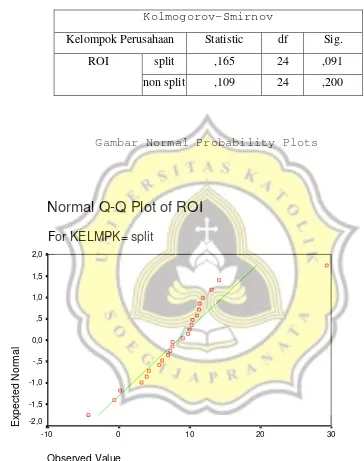

Tests of Normality

Kolmogorov-Smirnov

Kelompok Perusahaan

Statistic

df

Sig.

split

,320

24

,000

EPS

non split

,188

24

,028

Gambar Normal Probability Plots

Normal Q-Q Plot of EPS

For KELOMPOK= split

Observed Value

1000 800

600 400

200 0

-200 -400

Expected Normal

Normal Q-Q Plot of EPS

For KELOMPOK= non split

Observed Value

1000 0

-1000

Expected Normal

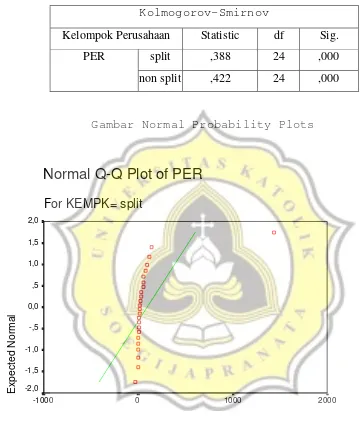

Lampiran 6. Uji Normalitas PER

Case Processing Summary

24 100,0% 0 ,0% 24 100,0%

24 100,0% 0 ,0% 24 100,0%

kelompok perusahaan split

non split PER

N Percent N Percent N Percent

Valid Missing Total

Cases

Descriptives

91,552083 59,27306 -31,0636

214,1678

35,226944 17,700000 84319,109 290,3775 -32,9500 1440,990 1473,940 51,742500

4,741 ,472 22,908 ,918 -9,052917 10,85284

-31,5037

13,397895

1,171204 1,490000 2826,820 53,16785 -256,390 13,9000 270,2900 10,900000

-4,755 ,472 23,018 ,918 Mean

Lower Bound Upper Bound 95% Confidence

Interval for Mean

5% Trimmed Mean Median

Variance Std. Deviation Minimum Maximum Range

Interquartile Range Skewness

Kurtosis Mean

Lower Bound Upper Bound 95% Confidence

Interval for Mean

5% Trimmed Mean Median

Variance Std. Deviation Minimum Maximum Range

Interquartile Range Skewness

Kurtosis kelompok perusahaan

split

non split PER

Tests of Normality

Kolmogorov-Smirnov

Kelompok Perusahaan

Statistic

df

Sig.

split

,388

24

,000

PER

non split

,422

24

,000

Gambar Normal Probability Plots

Normal Q-Q Plot of PER

For KEMPK= split

Observed Value

2000 1000

0 -1000

Expected Normal

2,0 1,5 1,0 ,5 0,0 -,5 -1,0 -1,5 -2,0

Normal Q-Q Plot of PER

For KEMPK= non split

Observed Value

100 0

-100 -200

-300

Expected Normal

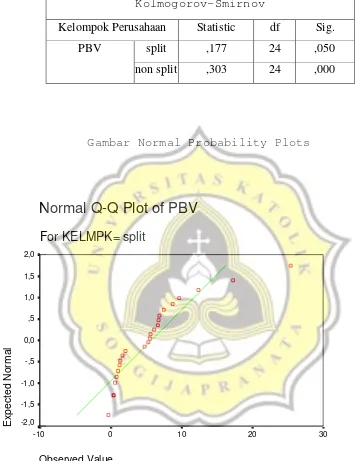

Lampiran 7. Uji Normalitas PBV

Case Processing Summary

24 100,0% 0 ,0% 24 100,0%

24 100,0% 0 ,0% 24 100,0%

kelompok perusahaan split

non split PBV

N Percent N Percent N Percent

Valid Missing Total

Cases

Descriptives

5,752917 1,2282904 3,212004

8,293829

5,063704 5,420000 36,209 6,0173694 -,2700 25,4200 25,6900 6,250000

1,822 ,472 4,139 ,918 1,418333 ,9196377

-,484082

3,320749

,898241 ,735000 20,298 4,5052864 -6,5100 20,6300 27,1400 2,220000

3,401 ,472 15,792 ,918 Mean

Lower Bound Upper Bound 95% Confidence

Interval for Mean

5% Trimmed Mean Median

Variance Std. Deviation Minimum Maximum Range

Interquartile Range Skewness

Kurtosis Mean

Lower Bound Upper Bound 95% Confidence

Interval for Mean

5% Trimmed Mean Median

Variance Std. Deviation Minimum Maximum Range

Interquartile Range Skewness

Kurtosis kelompok perusahaan

split

non split PBV

Tests of Normality

Kolmogorov-Smirnov

Kelompok Perusahaan

Statistic

df

Sig.

split

,177

24

,050

PBV

non split

,303

24

,000

Gambar Normal Probability Plots

Normal Q-Q Plot of PBV

For KELMPK= split

Observed Value

30 20

10 0

-10

Expected Normal

Normal Q-Q Plot of PBV

For KELMPK= non split

Observed Value

30 20

10 0

-10

Expected Normal

Lampiran 8 Uji Normalitas EPS(ln),PER (ln), PBV (ln)

Case Processing Summary

24 100,0% 0 ,0% 24 100,0%

24 100,0% 0 ,0% 24 100,0%

24 100,0% 0 ,0% 24 100,0%

24 100,0% 0 ,0% 24 100,0%

24 100,0% 0 ,0% 24 100,0%

24 100,0% 0 ,0% 24 100,0%

kelompok perusahaan split

non split split non split split non split EPS

PER

PBV

N Percent N Percent N Percent

Valid Missing Total

Descriptives

2,702862 ,4406273 1,791355

3,614370

2,784827 2,871300 4,660 2,1586242 -3,4949 7,2730 10,7679 2,659825

-,766 ,472 2,110 ,918 ,295017 ,4201474 -,574124

1,164158

,463005 ,848050 4,237 2,0582935 -5,5466 2,6318 8,1784 3,292125

-1,135 ,472 1,203 ,918 Mean

Lower Bound Upper Bound 95% Confidence

Interval for Mean

5% Trimmed Mean Median

Variance Std. Deviation Minimum Maximum Range

Interquartile Range Skewness

Kurtosis Mean

Lower Bound Upper Bound 95% Confidence

Interval for Mean

5% Trimmed Mean Median

Variance Std. Deviation Minimum Maximum Range

Interquartile Range Skewness

Kurtosis kelompok perusahaan

split

non split PER

Descriptives

1,244662 ,2399012 ,748389

1,740936

1,260500 1,689800 1,381 1,1752713 -,9675 3,2355 4,2030 1,771100

-,451 ,472 -,712 ,918 ,359033 ,2300685 -,116900

,834966

,337682 ,425550 1,270 1,1271007 -1,8733 3,0267 4,9000 1,292725

,193 ,472 ,669 ,918 Mean

Lower Bound Upper Bound 95% Confidence

Interval for Mean

5% Trimmed Mean Median

Variance Std. Deviation Minimum Maximum Range

Interquartile Range Skewness

Kurtosis Mean

Lower Bound Upper Bound 95% Confidence

Interval for Mean

5% Trimmed Mean Median

Variance Std. Deviation Minimum Maximum Range

Interquartile Range Skewness

Kurtosis kelompok perusahaan

split

non split PBV

Tests of Normality

Kolmogorov-Smirnov

Kelompok Perusahaan

Statistic

df

Sig.

split

,172

24

,065

EPS (ln)

non split

,170

24

,070

Kolmogorov-Smirnov

Kelompok Perusahaan

Statistic

df

Sig.

split

,126

24

,200

PER (ln)

non split

,144

24

,200

Kolmogorov-Smirnov

Kelompok Perusahaan

Statistic

df

Sig.

split

,188

24

,027

PBV(ln)

Gambar Normal Probability Plots

Normal Q-Q Plot of EPS

For KELOMPOK= split

Observed Value

10 8

6 4

2 0

-2 -4

-6

Expected Normal

2,0 1,5 1,0 ,5 0,0 -,5 -1,0 -1,5 -2,0

Normal Q-Q Plot of EPS

For KELOMPOK= non split

Observed Value

10 0

-10

Expected Normal

Normal Q-Q Plot of PER

For KELOMPOK= split

Observed Value

8 6

4 2

0 -2

-4

Expected Normal

2,0 1,5 1,0 ,5 0,0 -,5 -1,0 -1,5 -2,0

Normal Q-Q Plot of PER

For KELOMPOK= non split

Observed Value

4 2

0 -2

-4 -6

Expected Normal

Normal Q-Q Plot of PBV

For KELOMPOK= split

Observed Value

4 3

2 1

0 -1

-2

Expected Normal

2,0 1,5 1,0 ,5 0,0 -,5 -1,0 -1,5 -2,0

Normal Q-Q Plot of PBV

For KELOMPOK= non split

Observed Value

4 3

2 1

0 -1

-2

Expected Normal

Lampiran 9. Hasil Uji Beda Independent Sampel T-test

ROI

Group Statistics

24

8,3258

6,37599

1,30149

24

,0842

12,66605

2,58545

jenis perusahaan

split

non split

ROI

N

Mean

Std. Deviation

Std. Error

Mean

Independent Samples Test

9,091 ,004 2,847 46 ,007 8,2417 2,89455 2,41524 14,06809

2,847 33,953 ,007 8,2417 2,89455 2,35893 14,12440 Equal variances

assumed Equal variances not assumed ROI

F Sig.

Levene's Test for Equality of Variances

t df Sig. (2-tailed)

Mean Difference

Std. Error

Difference Lower Upper 95% Confidence Interval of the

Difference t-test for Equality of Means

Group Statistics

24

3,417629

2,7605501

,5634949

24

,016500

4,5789380

,9346718

24

2,702863

2,1586242

,4406273

24

,295017

2,0582935

,4201474

24

1,244662

1,1752713

,2399012

24

,359033

1,1271007

,2300685

kelompok perusahaan

split

non split

split

non split

split

non split

EPS

PER

PBV

N

Mean

Std. Deviation

Std. Error

Mean

Independent Samples Test

15,123 ,000 3,116 46 ,003 3,401129 1,0913927 1,2042697 5,5979887

3,116 37,768 ,003 3,401129 1,0913927 1,1912751 5,6109832

,009 ,926 3,955 46 ,000 2,407846 ,6088319 1,1823308 3,6333609

3,955 45,896 ,000 2,407846 ,6088319 1,1822560 3,6334357

,643 ,427 2,664 46 ,011 ,885629 ,3323915 ,2165598 1,5546985

2,664 45,920 ,011 ,885629 ,3323915 ,2165282 1,5547301

Equal variances assumed Equal variances not assumed Equal variances assumed Equal variances not assumed Equal variances assumed Equal variances not assumed EPS

PER

PBV

F Sig.

Levene's Test for Equality of Variances

t df Sig. (2-tailed)

Mean Difference

Std. Error

Difference Lower Upper

95% Confidence Interval of the

Lampiran 11. Hasil Uji beda Mann-Whitney PBV(ln)

Ranks

24 29,52 708,50

24 19,48 467,50

48 kelompok perusahaan

split non split Total PBV

N Mean Rank Sum of Ranks

Test Statisticsa

167,500 467,500 -2,485 ,013 Mann-Whitney U

Wilcoxon W Z

Asymp. Sig. (2-tailed)

PBV

Grouping Variable: kelompok perusahaan a.