Informasi Dokumen

- Sekolah: Bata Shoe Organization

- Mata Pelajaran: Business Administration

- Topik: Bata Annual Report 2014

- Tipe: annual report

- Tahun: 2014

- Kota: Jakarta

Ringkasan Dokumen

I. Company Profile

PT Sepatu Bata Tbk. is an associate company of the Bata Shoe Organization, producing a wide range of footwear including leather shoes, sandals, and sports shoes. Established in 1931 in Indonesia as a shoe importer, the company has evolved significantly, including being listed on the Jakarta Stock Exchange in 1982. The company has made strategic decisions such as relocating manufacturing to Purwakarta and expanding its retail footprint with flagship stores.

1.1 Company Overview

Bata has a rich history in Indonesia, starting as an importer and transitioning to a manufacturer. Key milestones include the establishment of the Purwakarta factory in 1994 and significant expansions in retail presence, such as the opening of the largest store in 2009. The company focuses on a diverse product portfolio, including licensed brands that enhance market reach.

1.2 Vision and Mission

Bata aims to strengthen its position as a leader in the footwear industry while enhancing shareholder value in both the short and long term. The mission is to operate as a dynamic and flexible organization, responding effectively to market conditions and customer needs.

1.3 Organizational Structure

As of December 31, 2014, the organizational structure includes a Board of Commissioners and a Board of Directors, overseeing various departments such as retail, finance, and marketing. The hierarchy supports effective decision-making and operational efficiency, crucial for navigating the competitive footwear market.

II. Board of Commissioners’ Report

The Board of Commissioners highlights the company's robust performance in 2014, despite challenging economic conditions. The focus remains on operational efficiency and strategic expansion, including opening new stores and enhancing product offerings to attract customers. The board emphasizes teamwork and innovation as critical success factors in a competitive market.

2.1 Economic Challenges

The report acknowledges the challenges posed by rising commodity prices and their impact on consumer purchasing power. The board stresses the importance of efficiency across all operations to remain competitive during these times.

2.2 Strategic Initiatives

The company is committed to expanding its retail network and improving customer service through various initiatives, including staff training programs. These efforts are designed to enhance the shopping experience and increase customer loyalty.

III. Financial Highlights

In 2014, PT Sepatu Bata Tbk. reported a net sales increase of 12% to IDR 1.008 trillion, with net profit rising by 59% to IDR 70.8 billion. The financial performance reflects the successful execution of strategic initiatives aimed at expanding market presence and enhancing operational efficiency.

3.1 Key Financial Metrics

The financial highlights include significant growth in gross profit and net income, demonstrating the effectiveness of the company's strategies. Key ratios indicate a healthy balance between assets and liabilities, supporting the company's financial stability.

3.2 Comparative Analysis

A comparison of financial performance over the past two years shows consistent growth, with net sales and profits increasing steadily. This trend underscores the company's resilience and ability to adapt to market challenges.

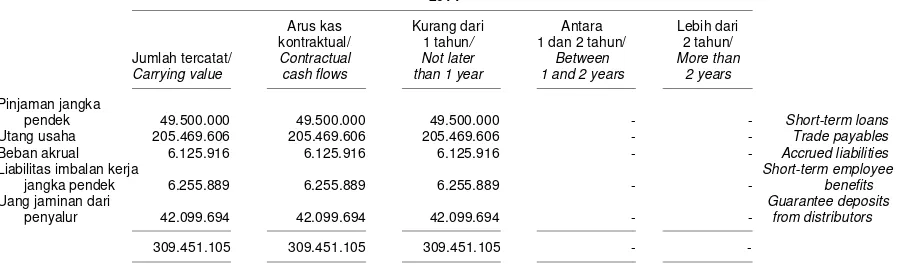

IV. Management Discussion and Analysis

The management discussion focuses on operational reviews and financial performance analysis, emphasizing the company's ability to meet its financial obligations and collect receivables effectively. The analysis highlights the importance of maintaining a strong capital structure to support growth initiatives.

4.1 Operational Review

The operational review indicates that the company has streamlined processes to improve efficiency. The management is optimistic about future growth prospects, given the favorable market conditions and strategic investments in technology and infrastructure.

4.2 Financial Performance Analysis

The analysis of financial performance over the last two years reveals a positive trend in profitability and asset management. The company's ability to generate cash flow and maintain liquidity is critical for sustaining growth and funding future projects.

V. Corporate Governance

PT Sepatu Bata Tbk. adheres to strong corporate governance practices, including a comprehensive Code of Ethics applicable to all employees and business partners. The company is committed to transparency and accountability in its operations, which is essential for building stakeholder trust.

5.1 Governance Structure

The governance structure includes a well-defined hierarchy and committees that oversee various aspects of the business, ensuring compliance with regulations and ethical standards. The board plays a critical role in strategic decision-making and risk management.

5.2 Corporate Social Responsibility

The company is dedicated to contributing positively to society, particularly through initiatives aimed at supporting underprivileged children. The Bata Children Program exemplifies the company's commitment to social responsibility and community engagement.