LAMPIRAN A

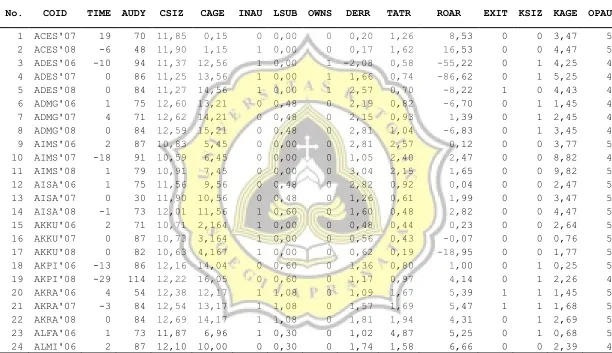

No. COID TIME AUDY CSIZ CAGE INAU LSUB OWNS DERR TATR ROAR EXIT KSIZ KAGE OPAU

No. COID TIME AUDY CSIZ CAGE INAU LSUB OWNS DERR TATR ROAR EXIT KSIZ KAGE OPAU

No. COID TIME AUDY CSIZ CAGE INAU LSUB OWNS DERR TATR ROAR EXIT KSIZ KAGE OPAU

No. COID TIME AUDY CSIZ CAGE INAU LSUB OWNS DERR TATR ROAR EXIT KSIZ KAGE OPAU

No. COID TIME AUDY CSIZ CAGE INAU LSUB OWNS DERR TATR ROAR EXIT KSIZ KAGE OPAU

No. COID TIME AUDY CSIZ CAGE INAU LSUB OWNS DERR TATR ROAR EXIT KSIZ KAGE OPAU

No. COID TIME AUDY CSIZ CAGE INAU LSUB OWNS DERR TATR ROAR EXIT KSIZ KAGE OPAU

No. COID TIME AUDY CSIZ CAGE INAU LSUB OWNS DERR TATR ROAR EXIT KSIZ KAGE OPAU

No. COID TIME AUDY CSIZ CAGE INAU LSUB OWNS DERR TATR ROAR EXIT KSIZ KAGE OPAU

No. COID TIME AUDY CSIZ CAGE INAU LSUB OWNS DERR TATR ROAR EXIT KSIZ KAGE OPAU

No. COID TIME AUDY CSIZ CAGE INAU LSUB OWNS DERR TATR ROAR EXIT KSIZ KAGE OPAU

519 UNVR'08 0 84 12,81 26,99 1 0,48 1 1,10 2,39 37,01 0 1 4,75 5 520 VOKS'06 -12 75 11,67 16,04 1 0,48 1 0,82 1,95 7,54 0 0 2,43 4 521 VOKS'07 0 78 11,91 17,04 1 0,48 1 1,61 1,69 6,67 0 0 3,43 4 522 VOKS'08 0 78 12,07 18,04 1 0,48 1 2,70 1,95 0,45 0 0 4,43 4 523 WEHA'07 0 66 11,01 0,59 1 0,85 0 0,58 0,55 4,02 0 0 1,26 5 524 WEHA'08 0 68 11,12 1,59 1 0,85 0 0,93 0,59 3,54 0 0 2,26 5 525 WICO'06 -13 85 11,45 12,41 0 0,30 0 1,40 2,10 -1,79 0 1 0,68 3 526 WICO'07 -28 77 11,39 13,41 0 0,30 0 1,71 2,18 -10,98 0 1 1,68 3 527 WICO'08 -29 86 11,36 14,41 0 0,30 0 2,52 2,28 -10,94 0 1 2,69 4 528 YPAS'08 1 65 11,26 0,825 0 0,00 0 0,52 1,54 10,35 0 0 3,43 5 529 ZBRA'06 -19 95 11,08 15,43 0 0,48 0 0,98 0,33 -7,89 0 0 8,19 3 530 ZBRA'07 60 25 10,97 16,43 0 0,48 0 0,79 0,29 -8,87 0 0 9,19 3 531 ZBRA'08 -13 97 10,88 17,43 1 0,60 0 0,70 0,36 -9,20 0 0 10,20 3 Keterangan :

COID : Company ID DERR : Debt to Equity Ratio

TIME : Timeliness TART : Total Asset Turnover Ratio

AUDY : Audit Delay ROAR : Return On Asset Ratio

CSIZ : Company Size EXIT : Extraordinary Items

CAGE : Company Age KSIZ : KAP Size

INAU : Internal Audit KAGE : KAP Age

LSUB : Subsidiaries OPAU : Opini AuditorLAMPIRAN B

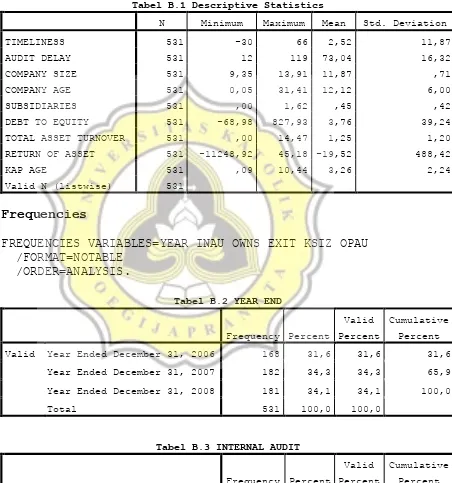

Tabel B.4 COMPANY STATUS Valid Haven’t Extraordinary Items 477 89,8 89,8 89,8

LAMPIRAN C

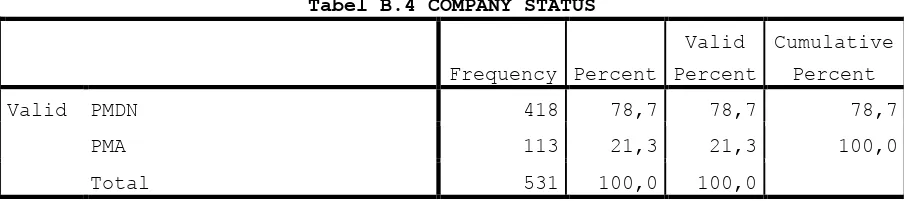

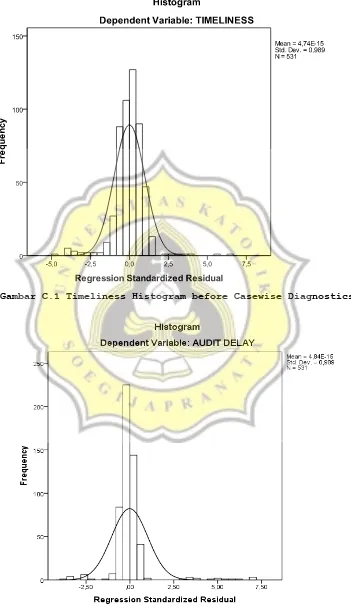

C.1 Normality Test before Casewise Diagnostics

/METHOD=ENTER CSIZ CAGE INAU LSUB OWNS DERR TATR ROAR

EXIT KSIZ KAGE OPAU

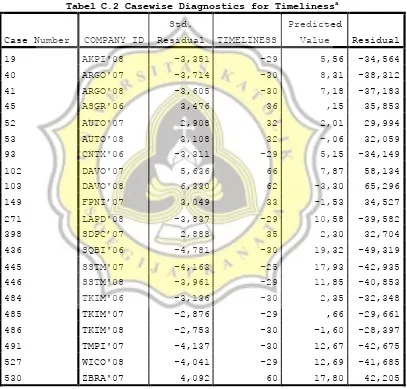

C.2 Casewise Diagnostics

Regression

REGRESSION

/DEPENDENT TIME

Regression

REGRESSION

/DEPENDENT AUDY

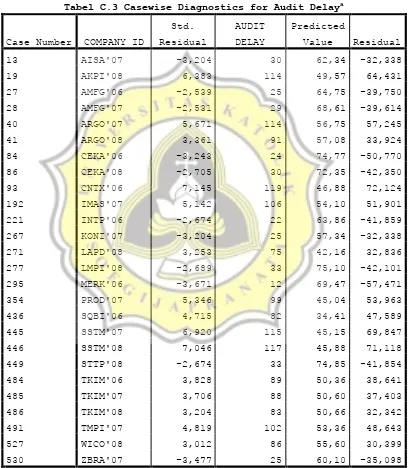

C.3 Normality Test after Casewise Diagnostics

/METHOD=ENTER CSIZ CAGE INAU LSUB OWNS DERR TATR ROAR

EXIT KSIZ KAGE OPAU

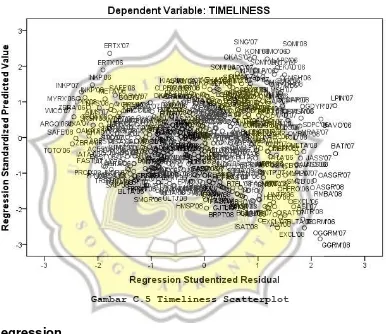

C.4 Heteroskedasticity Test

Regression

REGRESSION

/DEPENDENT TIME

/METHOD=ENTER CSIZ CAGE INAU LSUB OWNS DERR TATR ROAR EXIT KSIZ KAGE OPAU

/SCATTERPLOT=(*ZPRED ,*SRESID).

Gambar C.5 Timeliness Scatterplot

Regression

REGRESSION

/DEPENDENT AUDY

/METHOD=ENTER CSIZ CAGE INAU LSUB OWNS DERR TATR ROAR EXIT KSIZ KAGE OPAU

Gambar C.6 Audit Delay Scatterplot

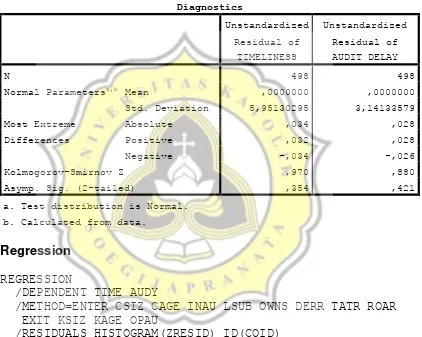

C.5 Autocorrelation Test

REGRESSION

/STATISTICS COEFF OUTS R ANOVA COLLIN TOL /DEPENDENT TIME AUDY

/METHOD=ENTER CSIZ CAGE INAU LSUB OWNS DERR TATR ROAR EXIT KSIZ KAGE OPAU.

Tabel C.5 Durbin Watson Test

Model dL Durbin-Watson 4-dU TIME 1,874 2,062 2,2126 AUDY 1,837 2,058 2,2126 a. Predictors: (Constant), OPINI AUDITOR, SUBSIDIARIES, DEBT TO EQUITY, RETURN OF ASSET, TOTAL ASSET TURNOVER, EXTRAORDINARY ITEM, COMPANY AGE, INTERNAL AUDIT, KAP AGE, COMPANY STATUS, KAP SIZE, COMPANY SIZE

C.6 Multicollinearity Test

Regression

REGRESSION

/MISSING LISTWISE

/STATISTICS COEFF OUTS R ANOVA COLLIN TOL /DEPENDENT TIME AUDY

/METHOD=ENTER CSIZ CAGE INAU LSUB OWNS DERR TATR ROAR EXIT KSIZ KAGE OPAU.

Tabel C.6 Multicollinearity Test

Model

Collinearity Statistics Tolerance VIF 1,2 (Constant)

LAMPIRAN D

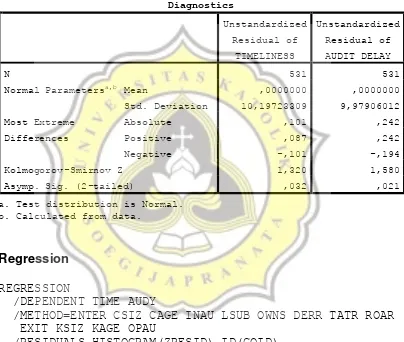

D.1 Regression for TIMELINESS

Tabel D.4 Coefficients (Timeliness)

Tabel D.5 Variables Entered/Removed (Audit Delay)b

a. Predictors: (Constant), OPINI AUDITOR, SUBSIDIARIES, DEBT TO EQUITY, RETURN OF ASSET, TOTAL ASSET TURNOVER, EXTRAORDINARY ITEM, COMPANY AGE, INTERNAL AUDIT, KAP AGE, COMPANY STATUS, KAP SIZE,

a. Predictors: (Constant), OPINI AUDITOR, SUBSIDIARIES, DEBT TO EQUITY, RETURN OF ASSET, TOTAL ASSET TURNOVER, EXTRAORDINARY ITEM, COMPANY AGE, INTERNAL AUDIT, KAP AGE, COMPANY STATUS, KAP SIZE, COMPANY SIZE

Tabel D.8 Coefficients (Audit Delay)

Model

Unstandardized Coefficients

Standardized Coefficients

t Sig. B

Std.

Error Beta

1 (Constant) 103,423 12,852 8,047 ,000 COMPANY SIZE -1,598 1,146 -,080 -1,394 ,164 COMPANY AGE -,113 ,105 ,049 -1,078 ,282 INTERNAL AUDIT -5,278 1,317 -,178 -4,009 ,000 SUBSIDIARIES 4,001 1,713 ,121 2,336 ,020 COMPANY STATUS -1,390 1,636 -,040 -,850 ,396 DEBT TO EQUITY ,008 ,015 ,024 ,564 ,573 TOTAL ASSET

TURNOVER

,506 ,497 ,044 1,017 ,309 RETURN OF ASSET -0,022 ,120 -,008 -,188 ,851 EXTRAORDINARY

ITEM