Customer Satisfaction

with Internet Banking

in Brunei Darussalam:

Evaluating the Role of Demographic Factors

Afzaal H. Seyal

Institute of Technology Brunei

Md. Mahbubur Rahim

Monash University, Australia

ABSTRACT

The pioneering study highlights the online banking customers’ satisfaction and investigates the demographic factors that are significant predictors in assessing online banking customers’ satisfaction in Brunei Darussalam. The study uses a survey approach methodology of four hundred customers of the four major banks in Brunei Darussalam. Data from the indi-vidual customers confirms that 31% of them are using Internet banking and 46% of the respondents are satisfied with Internet banking. Factors such as income level, Internet experience, age and educational level are significant determinants of overall satisfaction with online banking. However, gender has no impact in determining the overall satisfac-tion. The model tested with hierarchical regression analysis has a good fit with 66% of variance being explained by all the independent variables towards the customers’ satisfac-tion. Based upon the results some recommendations were made.

INTRODUCTION

Internet banking refers to the practice of conducting financial transactions by customers over the Internet through a bank’s website (Shao, 2007). One key characteristic of internet banking is that customers are not required to use any proprietary software installed in their computers for accessing banking services. Internet banking is gaining growing popularity particularly among retail customers due to: a) its 24/7 availability and low transaction costs (Talmor, 1995), and b) its ability to serve as a convenient alternative channel (Leon-ard, 2002). In short, internet banking is not constrained by time and place (Hiltunen et al., 2002). As a result, this form of banking has attracted considerable adoption by the re-tail banking customers. For instance, an estimated one million internet banking users are reported in South Africa (Goldstuck, 2004). In the South Asian region evidence suggests its growing adoption. In Malaysia, Dahlan et al. (2002) found Internet banking a new ex-perience for Malaysian banking customers. In Hong Kong, Chan and Lu (2004) reported that basic transactions and securities trading are the most popular types of operations that Hong Kong customers carry out in Internet banking. The uptake of internet banking is also growing in Australia where some sources indicate the existence of millions of users (Sathye, 1999). In Thailand, Koedrabruen and Raviwongse (2002) found that in more than half of their sample, Internet users are very interested in using Internet banking facili-ties for fund transfers, payments for goods purchased and to pay utility bills and also found that there was potential growth for retail Internet banking. In Singapore, Tan and Teo (2000) reported that Internet banking was started in 1998 and since then there has been tremendous growth of Internet service users and the services offered by the local banks.

We further conjecture that satisfaction with internet banking is likely to be influ-enced by the demographic profile of customers. Our assertion is rooted in the findings of the contemporary e-business and IT literature which suggest that end-users’ satisfaction with internet-enabled IT systems (such as various forms of B2C and B2E applications) is affected by demographic factors. Our belief is also consistent with the views of the diffu-sion of innovation (DOI) researchers (e.g. Rogers, 1985) who suggest that demographic variables often affect the uptake of new innovations. It is thus important to evaluate the influence of demographic factors in relation to internet banking in order to find out how various constructs that comprise customer satisfaction are affected by those factors. We believe that the intention of customers (who are initial adopters) to continue to use inter-net banking could be seriously affected when interinter-net banking fails to satisfy their chang-ing requirements. Accordchang-ing to David (2007), culture is known to have an impact on customers’ behavior and satisfaction. As a result, it is essential to determine the current level of customer satisfaction with internet banking and address how various demo-graphic factors affect customer satisfaction.

In the light of the above discussion, it seems particularly true within the context of Brunei Darussalam, a small sultanate located in South East Asia, where major banks have introduced internet banking operations in recent years and that no empirical stud-ies have ever been undertaken in Brunei to assess any aspects of internet banking usage or satisfaction from the customers’ perspective. The technology adoption in Brunei Darus-salam reflects a distinctive pattern compared to the other Asia-Pacific economies and more commonly embedded within its own culture. Although the study does not include cultural dimension of Hofstede’s typology, however, we can borrow the notion to strengthen our point to explore Bruneian IT adoption. According to Hofstede, (2001) societies such as Brunei has medium to high power distance index (PDI) and uncertainty avoidance index (UAI) which creates an environment that are highly rule-oriented with laws in order to reduce the amount of uncertainty. In these societies, role of demograph-ics have a vital affect on the technology acceptance (Cardon & Marshall, 2008). This was also noticed among several other Brunei-based studies among students to study soft-ware piracy (Rahim et al., 1999), students’ attitudes (Seyal et al. 2002) and Internet usage (Seyal & Rahman, 2003) that demographical variables remained significant.

internet banking will help the bank management to identify the areas of improvement in their future internet banking offerings.

The paper is organized as follow: after the introduction, a brief but critical analysis of the relevant literature on internet banking is presented. We then briefly describe the measuring of customer satisfaction with internet banking and provide an overview of the economy, infrastructure and internet banking in Brunei Darussalam. Next, we describe our research approach. We then present and discuss the research findings. Finally, we conclude with recommendations for practitioners and researchers alike.

LITERATURE ANALYSIS

The literature on internet banking is steadily growing and a content analysis of the litera-ture is recently reported by Shao (2007). We extend Shao’s synthesis by critically analyz-ing the existanalyz-ing literature and notanalyz-ing that studies on internet bankanalyz-ing can be grouped into five broad categories depending on the themes of investigation. These include: a)

adoption factors affecting decision of potential customers, b) behavioral issues of custom-ers towards internet banking, c) drivcustom-ers of banks to introduce internet banking, d) im-pact of internet banking on bank performance, and e) characteristics of internet banking websites. In the following sections, we now briefly describe each of these categories with several representative studies highlighting the broad theme of each category and a sum-mary is produced in Table 1. We, however, acknowledge that our review is by no means exhaustive but our analysis of the literature is an attempt to identify the broad trends in the current internet banking literature.

The first category, which dominates the existing internet banking literature, focuses on the factors that affect the decision of potential individual customers to adopt/use inter-net banking. In general, the factors include the attributes of innovation (e.g. complexity, security, ease of use, perceived usefulness) and the characteristics of adopters (i.e. demo-graphic profile). Studies of Sethye (1999), Liao et al. (1999), Tan and Teo (2000), Chung and Paynter (2002), Ramayah et al. (2003) and Cheah et al. (2005) represent this stream who used theoretical arguments drawn from such theories as Theory of Reasoned Action (TRA), Technology Adoption Model (TAM) and Theory of Planned behavior (TPB) to explain an individual’s adoption of internet banking. These studies are characterized by cross-sectional surveys and use of statistical techniques. The findings of this stream of stud-ies are important because a deep understanding of the factors encouraging/inhibiting cus-tomers to adopt internet banking practices is useful to bank management. This stream of studies, however, does not indicate how satisfied the customers are with internet banking.

The second stream of literature focuses on the behavior issues of adopters with in-ternet banking. In particular, this group of studies determines the attitude and satisfac-tion of customers with internet banking. The works of Mols (1998), Liao and Cheung (2002), Buys and Brown (2004), and Arunachalan and Sivasubramanian (2007) repre-sent this stream. These studies, too, rely on cross-sectional surveys and examine such is-sues as customer attitudes, customer satisfaction, and customers’ sensitivity to price and customers’ expectations of quality attributes from internet banking. The strength of these studies is that they shed useful light on post-adoption aspects of internet banking. However, these studies did not look at how various demographic factors may affect those behavioral aspects.

Similar to the previous stream, the fourth stream of research is concerned with in-ternet banking from bank management perspective. It, however, focuses on the impact of internet banking on bank performance. The works of Furst et al. (2002) and Swierczek et al. (2005) are notable examples of this line of research. Swierczek et al. (2005) investi-gated the relationship between IT, productivity and bank profitability in the two groups of Asia-Pacific banks and found that both banks through pervasive use of internet bank-ing have increased productivity and received both strategic and operational benefits. On the other hand, Furst et al. (2002) revealed that internet banks have better accounting efficiency ratio and higher returns on equity than non-Internet banks.

Finally, the fifth stream of research is concerned with the characteristics of the in-ternet banking websites. For instance, Diniz (1998) surveyed the websites of 121 banks in the United States and grouped the functionality offered by the internet banking web-sites into three areas: information delivery, transaction, and customer relationship. Ac-cording to Diniz, large banks are doing better at the basic and intermediary level. In Malaysia, Suganthi et al. (2001) found that all domestic banks have a web presence but only four of the ten major banks had transactional capabilities. The remaining sites were at informational level. In another study, Awamleh and Fernandes (2005) evaluated web-sites of foreign and local banks in the United Arab Emirates (UAE) and stressed more on the infrastructure and interface of the internet banking with the customers.

Our research reported in this paper falls into the second stream of research identi-fied above. We, however, seek to extend this stream by examining the influence of several demographic variables in explaining the variations in customer satisfaction with internet banking in the context of the Brunei Darussalam.

AN OVERVIEW OF THE ECONOMY, E-BUSINESS INFRASTRUCTURE AND INTERNET BANKING IN BRUNEI DARUSSALAM

Brunei Darussalam is strategically located between two technological hubs (i.e. Singa-pore and Malaysia). It has a total population of nearly 0.390 million (Brunei Statistical Year Book, 2005) with economic activity dominated by the oil and gas sector. The gross domestic product per capita was B$ 23,865 (US$1=1.560) in 2004. Brunei is culturally different not only from those of the western nations but also from several of Asia-Pacific countries. Realizing the limitation as to the size of the domestic market, Brunei business environment is determined to utilize the Internet as a major development tool. The gov-ernment has conceived an IT vision and has taken a range of measures to improve the IT infrastructure and the Internet business environment in the country.

e-Society programs. In order to achieve this vision, the government has allocated B$788 million or US$450 million for e-Government and setup Brunei Darussalam Information Technology (BIT) Council to gear up the task of e-Government in the 21st century (EG21) (www.bit.gov.bn). BIT Council aims to promote effective IT application, facilitating best practice in the private sector and reducing the cost of doing business to business and busi-ness to consumer and has planned to achieve 50% of e-Busibusi-ness program. According to world Internet users’ statistics, the total number of internet users in Brunei Darussalam is 135,000 thus making 33.5% of the total population penetration in 2007 (www.internet-worldstats.com). According to Brunei Year book (2006), every third house has a PC.

In 2001, Brunei banking and finance industry accounted for 5% of B$ 389 million of country’s GDP. Interestingly, Brunei Darussalam has no central bank. However, the government via Banking Act and Finance Companies Act regulates the banking activi-ties to ensure stable and fiscally sound business environments. A total of nine banks, many of which are branches of major global players, currently serve Brunei population. In addition, there are four finance companies in operation to supplement the banks in providing financial services to the Brunei residents (www.bifc.finance.gov.bn). Table 2 provides some useful statistics of major banks operating in Brunei Darussalam. It can be noticed that except for Standard Chartered bank all major banks have established inter-net banking operations in Brunei Darussalam. All the major three banks that have

internet baking operations offer such services as fund transfers, credit card activities, statements of accounts and bill payment.

RATIONAL OF INCLUSION OF DEMOGRAPHIC FACTORS AND OF CUSTOMER SATISFACTION

The fundamental assertion underlying our research model is that customer satisfaction with internet banking is likely to differ depending on their demographic factors. A total of five demographic factors were considered important which have previously been re-ported to be related to user satisfaction with IT and e-business applications. They in-clude: gender, age, income, educational level and internet experience. Although, the inclusion of the demographics were significant predictors of several IS applications (Sher-man et al. 2000; Nayak, et al. 2006), however, it has produced conflicting results as well (Shaw and Grant, 2002; Ono and Zabdny, 2003; McMurtrey et al. 2008). Within the context of e-banking, a study report (www.researchnews.osu.edu/archive/ebanking.htm) at Ohio State University examined the role that factors such as age, income, and educa-tional level play in consumer’s adoption of e-banking technology and found that it is not only the demographics but their personal attitude about the technology that remained significant for e-banking adoption. Lee (2010) studied the role of demographics on the perception of e-Commerce adoption in South Korea and found that effects of demo-graphic factors have moderated in information technology attitude towards the benefits of EC and its adoption regardless of gender, age, education and income level.

Based on above assertions our research model includes these variables and detailed explanations are offered below describing how each of these factors may affect customer satisfaction with internet banking.

Gender

female employees. Ramayah and Jantan (2004) found males exhibit higher use of the Internet in messaging, browsing and downloading activities. However, Awamleh and Fernandes (2005) did not support gender differences among Internet banking custom-ers’ satisfaction study in UAE.

Age

Age is considered a significant variable among various IS adoption studies in studying the attitudes towards computers (Kay, 1992) and the Internet (Mukherjee and Nath, 2003). However, in the various studies it has produced varying results. According to the 1998 Household Internet Use Survey (The Daily, 1999) in Canada the age group 35–54 were most likely to use the Internet followed by the under 35 years of the age. Krut et al. (1998) found that age, gender and race were positively associated with technology usage. Teo (2001) supported age as a crucial factor in Internet adoption. However, Ramayah and Jan-tan (2004) found that age is negatively associated with the students’ use of the Internet.

Income

Several previous studies in Information Systems studied the impact of income as one of the factors associated with the use of computers and the Internet. Teo (2001) found that income level was a significant factor in Internet use. Awamleh and Fernendes (2005) no-ticed income appeared to be a significant factor in transaction security among customers’ satisfaction.

Educational Level

Several researchers have highlighted the importance of education not only in the formation of positive attitude toward the technology usage but also as a factor that is significant in the actual usage of Information Technology. Kay (1992) has reported that in general, people with higher educational qualifications have a favorable predisposition in regards to com-puter use. Al-Jabri et al. (1997) and Seyal et al. (2002) have found the relationship of edu-cational qualifications with positive attitudes towards the use of the computer. Mendoza and Toledo (1997) in their study of demographics and behavior of the Chilean Internet population found a significant relationship between higher education and Internet usage.

Internet Experience

suggested the external factors such as computer experience had a direct effect on behavioral components in terms of technology usage. Black et al. (2001) found that previous experi-ence with the Internet is one of the strongest influencing factors that effect Internet bank-ing adoption. Similarly, in Malaysia, Ndubisi et al. (2001) and Ramayah, et al. (2003) have examined various external factors that affect the technology acceptance and found prior experience with technology is significantly related with the technology adoption.

Customer Satisfaction

The MIS researchers over the last three decades have been conducting various studies surrounding the evaluation of IS success (Swanson, 1974, Schewe, 1976, Delone and McLean, 1992). They linked the IS success to the overall satisfaction level of the end-user (Ives et al. 1983). At the outset, because of the absence of a proper measurement the searchers used the users’ perception as a measure of the success of IS. Later on, MIS re-searchers focused on the development of instrument to measure both user information system satisfactions (Bailey and Pearson, 1983; Ives, et al. 1983; Doll et al. 1994) and end-user computing satisfaction (e.g., Doll and Torkzadeh, 1988; Doll et al. 1994; Etezedi-Amoli and Farhoomand, 1996). Within the context of e-banking Mattila, (2001) concedes that customers’ satisfaction is a key to success in Internet Banking and banks will use different media to customize products and services to fit customers’ spe-cific needs in future. Similarly, Hiltumen et al. (2004) have remarked that there are at least two major human computer interaction (HCI)s whereas, Lindgaard and Dudek, (2003) emphasizes that now is an ideal time for HCI researchers to analyze user satisfac-tion because there is a growing interest in how to attract and increase the number of on-line customers in e-business and e-commerce. They also stress that HCI researchers should reveal a structure of user satisfaction, determine how to evaluate it and conclude how it is related to the overall user experience of online customers.

issues that was raised by Etezedi-Amoli and Farhoomand (1991) but test-retest studies have further demonstrated the reliability and stability of the instrument (Doll and Torkzaddeh, 1991; Hendrickson et al 1994). Etezedi-Amoli and Farhoomand (1996) de-veloped another instrument to measure end user computing satisfaction that uses six fac-tors. They proposed that in the end-using computing evaluation of the systems’ success can best be made by its users as they are the ones to evaluate as to what changes the new system brings in the working environments and its relationship with the customers. How-ever, Doll and Torkzadeh EUCS instrument was used by number of previous researchers (Dowing, 1997, 1999; Igbaria and Tan 1997; Gelderman, 1998; McHaney et al. 1999).

Literature review further reveals that with the proliferation of the Internet busi-nesses and allied services various researchers have developed instrument to measure cus-tomer information satisfaction (Palvia, 1996; Lele, 1987; Spreng et al. 1996; Giese and Gote 2000). There is no doubt in saying that the Internet and Web-computing has drasti-cally changes the working and functioning of the various organizations across the globe. Although there is a big competition among the business firms within and across various business sectors to establish web presence on the Internet and to reach millions of the cus-tomers on the super highway thus making the ubiquitous computing a virtual reality. Wang and Tang (2001) developed an instrument to measure customer satisfaction toward websites. They have a view that both previously developed instrument by Ives et al. (1983) and Doll and Torkzadeh (1991) was specifically designed to measure EUS within the or-ganization. Wang and Tang (2001) therefore developed and empirically validated a 21– item, seven factors instruments for measuring information satisfaction with websites that market digital products and services. Based on their premise, Brown and Buys (2005) measured the customer satisfaction with the Internet banking websites in South Africa and empirically tested the 19–item, five factors instrument that measures customer sup-port, security, ease of use, transaction and payment and information content and innova-tion. In addition few other studies have focused on websites users’ satisfaction in general (Liao & Cheung, 2002) and online banking in particular (Cheah et al., 2005).

the need for adaptation of the instrument. Thirdly, as our study aims to target popula-tion from several demographical layers therefore we agree with the suggespopula-tions of Ray-mond (1985) to use an instrument that should be simple short and easy to answer and that Doll and Torkzadeh’s (1988) instrument was selected for this study.

In the past very few studies have combined the two basic streams of information sys-tem that is the user satisfaction and the role of demographics in predicting satisfaction within the context of Internet banking. Therefore there exists a gap on the empirical stud-ies focusing on online banking customers’ satisfaction using standard satisfaction construct and the role of the demographical variables within the South-Asian context. To best of our knowledge, no prior study exists in the Brunei Darussalam. Therefore, to fill-in the gap, the present study was launched to determine the online banking customer’ satisfaction in Brunei Darussalam. It will be relevant for the readers if we briefly discuss the following:

It is evident from the above information that Internet-banking in Brunei is still at an infancy stage. However, gradually it is gaining in confidence with the increasing num-ber of satisfied customers. It is, however, deemed necessary to find an answer to the fol-lowing research questions so that based upon the study findings we could recommend some implications for the relevant authorities:

1. To access and determine the online banking customers’ satisfaction.

2. To access and determine the various demographic factors that lead to Internet-banking customers’ satisfaction.

METHODOLOGY

The Instrument

The study undertakes the instrument used by Doll and Torkzadeh, 1988 that measures end user satisfaction across five components: content, accuracy, format, ease of use and timeliness using twelve questions with Likert-type scales. All questions relating to satis-faction on the survey used a 5-point Likert scale, with “1” being extremely dissatisfied to “5” being extremely satisfied. The instrument consisting of demographical profile and five different constructs of measuring over all satisfaction such as: content, accuracy, for-mat, ease of use and timeliness. Table 3 summarizes the basic descriptive statistics of these constructs.

Sample

dropped out because they were not filled-in properly. Therefore three hundreds and eighty questionnaires were retained for the purpose of the research with the response rate of 76%. The response rate was found satisfactory for the logical deduction of the analy-sis. Table 5 reflects the demographical and organizational profile of the respondents.

Instrument reliability and validity

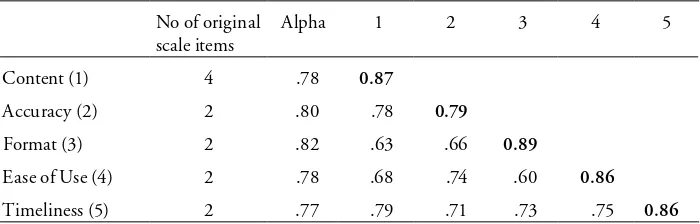

Several techniques were used to assess the reliability coefficient, Cronbach (1951) (a), and to assess face, construct and convergent validity. In order to ascertain face validity, an initial questionnaire was passed through routine editing after it was given to the panel of experts consisting of two academics from the Business Department of the Institute of Technology, one HR practitioner and a few senior bank officers located in the close prox-imity of the author’s work place. They were asked to respond to the questionnaire and very few comments in fact were received and some minor changes were done to enhance the clarity. Table 4 shows the reliability coefficients and convergent validity for the vari-ous constructs.

Table 4 Pearson Correlations and AVE Table for Discriminant Validity

No of original scale items

Alpha 1 2 3 4 5

Content (1) 4 .78 0.87

Accuracy (2) 2 .80 .78 0.79

Format (3) 2 .82 .63 .66 0.89

Ease of Use (4) 2 .78 .68 .74 .60 0.86

Timeliness (5) 2 .77 .79 .71 .73 .75 0.86

Correlation is significant at the 0.01 level (2-tailed), Diagonal represents average variance extracted in bold

There are several types of validity measures that include face validity and con-structs validity. Campbell and Fiske (1959) propose two types of validity: convergent and discriminating validity. Convergent validity is measured by average variance extracted

for each construct during the reliability analysis that should be 0.5 or 50% or better. Table 4 show the reliability values for the various constructs with variance extracted in diagonal format given in bold. Cronbach’s (α) for the constructs ranged from 0.79 to

0.86 indicating a sufficient level of reliability and convergent validity of all constructs. In general, results show that both validities are satisfied.

FINDINGS AND ANALYSIS

Three hundred and eighty questionnaires received were analyzed using SPSS version 13 for descriptive analysis, correlation and multiple regression analysis to assess customers’ satisfaction. Table 5 describes the demographic characteristics of respondents.

The results in Table 5 indicate that only 44% of customers are satisfied with the online banking. The majority of the respondents are young females having a first degree. They have access to the Internet, possess adequate knowledge and skill and belong to an income group ranging from $3000 and above per month and are government servants. Table 5 shows other demographics.

Statistical Analysis

In line with the principles of multivariate data analysis, we conducted a zero-order corre-lation between the independent demographical variables and the dependent variable, customers’ satisfaction, before conducting the hierarchical regression analysis to answer our first research question. The main reason for the correlation analysis is to find the di-rectional support for the predicated relationship and to show that collinearity among the independent variables is sufficiently low so as not to affect the stability of regression anal-ysis (Hair et al. 1979). From the correlation analanal-ysis it was reported that none of the variables are highly-inter-correlated, so the problem of multicollinearity does not exist thus fulfilling Hair et al.’s (1979) criterion that says that variables to qualify for multicol-linearity should have a coefficient of correlation 0.80 or higher.

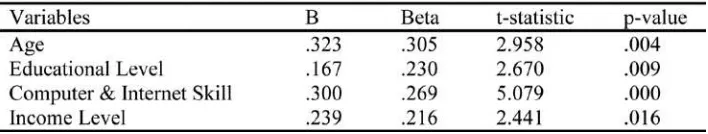

In addition about 66% of the variance is shared by the four independent variables indicat-ing that the model is effective in predictindicat-ing adoption.

DISCUSSION

The first objective of the study was to access and determine online banking customers’ satisfaction. This was achieved through the use of the construct used by Doll and Torkza-deh, 1988. The multi-dimensional construct has both content and construct validity and sufficient reliability and confirms the structure and dimensionality of the user satisfaction and provides evidence that customers’ satisfaction is a robust measure of user satisfaction (Doll & Torkzadeh, 1988). On this scale online banking customers’ satisfaction was mea-sured and it was found that around 50% of the customers are satisfied. However, only 42% are satisfied with the clarity and content of the websites. The result therefore partially supports Liao and Cheung, (2002) that user experience, involvement, user friendliness and accuracy are important quality attributes toward Internet-based e-banking.

To fulfill the second objective of the study to assess and to determine the role of demographical variables towards the overall customers’ satisfaction, hierarchical regres-sion analysis was used. It was found that four out of five demographical variables such as: age, educational level, income level and prior experience with Internet significantly deter-mine the overall customers’ satisfaction. Our results therefore partially support Awamleh and Fernandes (2005) that security, convenience, age, income and number of years as an Internet banker contribute toward customer satisfaction of Internet banking in UAE. Our results are inline with Berger and Gensler’s (2007) work on Internet banking cus-tomers in Germany that online banking cuscus-tomers are younger, better educated, their occupational and income status and belong to the urban areas are significant. In our re-gression analysis the Beta coefficients explain the relative importance of each indepen-dent variable. The highest beta coefficient in our analysis in Table 5 shows that in comparison age ranks first due to its high value followed by the prior Internet experience, followed by income level and finally educational level. The result also shows that the re-gression model has significant predictive power with 66% of the total variance being ex-plained by the four variables. Surprisingly, the variable gender remained insignificant

Table 6 Hierarchical Regression Analysis for Customers’ Satisfaction

besides the fact that 57% of the respondents are females and this does not support prior studies of Ramayah and Jantan (2004), Dahlan et al. (2002) and Cheah et al. 2005. However, our results support prior study of Awamleh and Fernandas, (2005) that gender does not appear to be a factor in determining satisfaction with the Internet banking.

The study, as secondary finding, highlights the problems associated with the on-line banking as perceived by the users. The users are concerned about the security fea-tures not properly addressed in some of the banks’ websites and several others mentioned about their lack of knowledge about the Internet and the low speed of the Brunet (the main ISP in the Brunei).

CONCLUSION

This study is the first of its kind conducted in Brunei Darussalam and has fulfilled its ob-jectives. It has evaluated demographical factors that are significant in determining the satisfaction of customers in using Internet banking. Banks in Brunei Darussalam do not use their websites strategically to improve customer relationship or add real value. Online customers are concerned about the lack of security features, slow speed of the Internet, and lack of Internet skill. All these can be addressed by the management of the relevant finan-cial institutions and once started using strategically the banks can further gear up the confidence of online customers and more and more customers will turn to online banking in Brunei Darussalam. Once customers are convinced about the multifarious advantages of online banking, they will start asking for this service from their banks which will in-crease the pressure on the bank authorities to keep their customers satisfied. The banks can further provide some incentives to their online customers to attract more non-users such as some promotion or lucky draws to increase their satisfied customers’ base.

Limitation: Researchers such as Etezadi-Amoli and Farhoomand, (1996) state that the primary purpose for measuring end-user computing satisfaction is to predict certain behaviors and measurement of end-user computing satisfaction and it should be more closely tied to attitude-behavior theory. The present research does not consider the attitu-dinal dimension of the customers so does not predict the customers’ behavior directly and would be undertaken by the future researchers. In addition the present research does not undertake the variables such as; security of the transactions and perceived risk that need to addressed in the future research.

PRACTICAL IMPLICATIONS

strategies. The behavioral segment can group customers in term of usage, loyalty, benefits sought and customers’ satisfaction. Bank authorities using this aspect can further devise the strategies to better match customers’ needs, better opportunities for growth, retaining existing customers and finally to gain the market segment. Bank can develop better cus-tomer’s relationship by knowing the customers’ satisfaction on e-banking.

In addition, bank authorities can design an extensive customer orientation and training programs for both types of customers who are educated, young, high earning and have previous Internet experience in order to retain them as satisfied customers with the other groups of prospective customers of using the e-banking who are older in age, belongs to lower income, and are less educated and possess no prior Internet experience. In fact, these potential customers always have an anxiety of using e-services. So given them special programs and incentive with massive campaign, bank authorities could fur-ther enhance their customers base and achieve the critical mass.

ACKNOWLEDGEMENT

The authors are thankful to Mike Cross for his valuable comments and editing the early version of this manuscript.

REFERENCES

Al-Jabri, M., and Al-Khaldi, A.M. (1997) “Effects of User Characteristics on Computer Attitudes among Undergraduate Business Student”, Journal of End-User Computing, Spring, 16–21.

Aladwani, A. M. (2001) “Online Banking: A Field Study of Drivers, Development Challenges, and Expec-tations”. International Journal of Information Management, 21, 213–225.

Arunachalan, L., and Sivasubramanian, M. (2007) “Theoretical Framework to Measure User Satisfaction in Internet Banking”, Academic Open Internet Journal, 20. Online available: www.acadjournal.com Awamleh, R. and Fernandes, C. (2005) “Internet Banking: An Empirical Investigation into the Extent of

Adoption by Banks and determinants of Customer Satisfaction in the UAE”, Journal of Internet Banking and Commerce, Vol. 10(1).

Bailey, J. E., and Pearson, S. W. (1983) “Development of a Tool for Measuring and Analyzing Computer User Satisfaction”, Management Science, 29(5),

Beckett, A., Hewer, P., and Howcroft, B. (2000) “An Exposition of Consumer Behavior in the Financial Services Industry”, The International Journal of Bank Marketing, 18(1).

Bell, M. (1995) “The Impact of IT Education and Training”, Computer Bulletin, BCS, Feb.

Berger, S. C., and Gensler, S. (2007) “Online Banking Customers: Insights from Germany”, Journal of Internet Banking and Commerce, Vol. 12(1)

Black, N.J., Lockett, A., Winklhofer, H., and Ennew, C. (2001) “The adoption of Internet Financial Services: A Qualitative Study”, International Journal of Retail and Distribution Management, 29(8), 390–398. Brown, I., and Buys, M. (2005) “Customer Satisfaction with Internet Banking Website: An Empirical Test

and Validation of a Measuring Instrument”, SACJ, 35, 29–38.

Buys, M., and Brown, I. (2004) “Customer Satisfaction with Internet Bank Websites: An Empirical Test and Validation of a Measuring Instrument”, Proceedings of SAICSIT, 44–52.

Cardon, P.W., and Marshall, B. A. (2008) “National Culture & Technology Acceptance: The Impact of Uncertainty Avoidance”, Issues in Information Systems, 9(2), 103–110.

Chan, S and Lu, M. (2004) “Understanding Internet Banking Adoption and User Behavior: A Hong Kong Perspective”, Journal of Global Information Management, 12(3), 21–43.

Cheah, K.G., Sanmugam, A., and Tan, S.Y. (2005) “The Profiling the Internet Banking Adopter”, Journal of Internet Banking and Commerce, Vol. 10(1).

Chung, W. and Paynter, J. (2002) “An Evaluation of Internet Banking in New Zealand”, Proceedings of the 35th Hawaii International Conference in System Sciences. IEEE Hawaii, September, 1–9. Corrocher, N. (2002) “Does Internet Banking Substitute Traditional Banking?” Empirical Evidence from

Italy Working Paper (ESPR), No134, November 2002.

Cronbach, L.J. (1951). Coefficient Alpha and the Internal Consistency of Test. Psychometrika, 16, 297–334. Dahlan, N., Ramayah, T., Koay, A.H. (2002) “Data Mining in the Banking Industry: An Exploratory

Study”, Proceedings of International Conference on Internet Economy and Business, Kuala Lumpur, Malaysia.

David, M. (2007) “Culture, Context and Behaviour”, Journal of Personality, 75(6), 1285–1320.

Delone, W. H. and McLean, E. R. (1992) “Information Systems Success: The Quest for the Dependent Variable”, Information Systems Research, 3(1), 60–95.

Doll, W. J., and Torkzadeh, G. (1988) “The Measurement of End-User Computing Satisfaction”, MIS Quarterly, 12(2), 259–274.

Doll, W. J., and Torkzadeh, G. (1991) “The Measurement of End-User Computing Satisfaction: Theoreti-cal and MethodologiTheoreti-cal Issues”, MIS Quarterly, March, 5–10.

Doll, W. J., and Xia, W., and Torkzadeh, G. (1994) “A Confirmatory Factor Analysis of the End-User Computing Satisfaction Instrument”, MIS Quarterly, 18, 453–461.

Diniz, E. (1998) “Web Banking in USA”, Journal of Internet Banking and Commerce, Vol. 3(2), June. Dowing, C.E. (1997) “Rhetoric or Reality? The Professed Satisfaction of Older Customer with

Informa-tion Technology”, Journal of End-User Computing, 9(1), 15–21.

Etezadi-Amili, J., and Farhoomand, A. F. (1991) “On End-User Computing Satisfaction”. MIS Quarterly, 15(1), 1–4.

Etezadi-Amili, J., and Farhoomand, A. F. (1996) “A Structural Model of End-User Computing Satisfaction and User Performance”, Information and Management, 30(2), 65–73.

Furst, K., Lang, W., and Nolle, E. D. (2002) “Internet Banking Development and Prospect”. Working Paper, Center for Information Policy Research, Harvard University, USA, April.

Gefen, D., and Straub, D. (1997) “Gender Difference in Perception and Adoption of E-mail: An Extension to the TAM”, MIS Quarterly, 21, 389–400.

Gelderman, M. (1998) “The Relation between User Satisfaction, Usage of Information Systems and Per-formance”, Information and Management, 34, 11–18.

Giese, J.L., and Gote, J.A. (2000) “Defining Consumer Satisfaction”, Academy of Marketing Science Re-view, online available: www.amsreview.org/amsrev/theort/giese00–01.html

Goldstuck, A. (2004) “Online Banking in South Africa 2004”, URL http://www.theworx.biz/bank04.htm Hair, J.F, Anderson, R.E., Tatham, R.L., and Black, W.C. (1998). Multivariate Data Analysis with Readings,

[NJ: Prentice-Hall].

Hendrickson, A., Glorfeed, K., and Cronan, T. (1994) “On the Repeated Test-Retest Reliability of the End-User Computing Satisfaction Instrument: A Comment”, Decision Sciences, 25(4), 655–667. Hiltunen, M., Heng, L., Helgesen, Laukka, M., and Luomalu, J. (2002) Mobile User Experience

[Hel-sinki: IT Press]

Igbaria, M., and Tan, M. (1997) “The Consequences of Information Technology Acceptance on Subse-quent Individual Performance”, Information and Management, 32, 113–121.

Ives, B., Olsen, M., and Baroudi, J. J. (1983) “The Measurement of User Information Satisfaction”, Com-munications of the ACM, October, 785–793.

Kay, R.H. (1992) “Understanding Gender Difference in Computer Attitudes”, Journal of Research on Computing Education, 25(2), 159–171.

Koedrabruen, P., and Raviwongse, R. (2002) “A Prototype of a Retail Internet Banking for Thai Customers”, Scuola Superiore Guglielmo Reissi Romoli (SSGRR), May 31st.

Kraut, R., Mukhopadhay, T., Szypula, J., Kiesler, S., and Scherlis, W. (1998) Communication and Infor-mation: Alternative Use of the Internet in Household”, Proceedings of the CHI 98, New York: ACM. Lawis, J. (2002) “Psychometric Evaluation of the PSSUQ Using Data from Five Years of Usability Studies”,

International Journal of Human-Computer Interaction, 14(3–4), 463–488.

Lee, J-W. (2010) “The Roles of Demographics as the Perceptions of Electronic Commerce Adoption”, Academy of Marketing Studies Journal, 14(1), 2–11.

Lele, M. (1987) The Customer is Key: Gaining an Unbeatable Advantage through Customer Satisfaction [NY: John-Wiley]

Leonard, R. (2002) “Prepare for the Future of Online Banking”, IT in Banking, ITWeb, www.itweb. co.za/sections/industryinsight/itinbanking/leonard02061.asp

Liao, S, Shao, Y.P., Wang, H., and Chen, A. (1999) “The Adoption of Virtual Banking: An Empirical Study”, International Journal of Information Management, 34(4), 283–295

Liao, Z., and Cheung, M. T. (2002) “Internet-based E-Banking and Consumer Attitudes: An Empirical Study”. Information and Management, 39, 283–295.

Linsdgaard, G., and Dudek, C. (2003) “What is the Evasive Beast We Call User Satisfaction”, Interacting with Computers

MacHaney, R.R., Hightower, R., and White, D. (1999) “EUCS, Test-Retest Reliability in Representa-tional Model Decision Support System”, Information and Management, 36(2), 109–119.

Mattila, M. (2001) “Essays on Customers in the Dawn of Interactive Banking: Unpublished doctoral dis-sertation, University of Jyvaskyla, Jyvaskyla.

McMurtrey, M. E., McGaughey, R. E., and Dowrey, J. R. (2008) “seniors and information technology: are we shrinking the digital divide”, Journal of International Technology & Information Management, 17(2), 121–135.

Mendoza, M. R. and Toledo, J. A.A. (1997) “Demographic and Behavior of the Chilean Internet Popula-tion”, JCMC, 31(1) Jan.

Mols, N. (1998) “The Behavioral Consequences of PC Banking”. International Journal of Bank Market-ing, 16(5), 195–201.

Mukherjee, A., and Nath, P. (2003) “A Model of Trust in Online Relationship Banking”, International Journal of Bank Marketing, 20(3), 102–110.

Nayak, L., Priest, L., Stuart, H. I., and White, A. (2006) “Website Design Attributes for Retrieving Health Information by Older Adults: An Application of Architectural Criteria”, Universal Access in the In-formation Society, 5, 170–179.

Ndubisi, N., Jantan, M., and Richardson, S. (2001) “Is the Technology Acceptance Model valid for Entrepre-neurs? Model Testing and Examining Usage Determinants”, Asian Academy of Management Journal, 6(2), 31–54.

Ono, H., Zavodny, M. (2002) “Gender and the Internet”, SSE/EFI Working Paper Series in Economics and Finance 495. Stockholm, Sweden.

Rahim, M. M., Seyal, A. H., and Rahman, M. N. (1999) “Software Piracy among Computing Students: A Bruneian Scenario”, Computers and Education, 32, 301–321.

Rahim, M. M., and Li-J. (2009) “An Empirical Assessment of Customer Satisfaction with Internet Bank-ing Application: An Australian Experience”, in the proceedBank-ings of 12th international conference on computers and information technology, Dhaka, Bangladesh.

Ramayah, T., and Jantan, M., Noor, M., Naseer, M., Razek, R.L., and Ling, K. P. (2003) “Receptiveness of Internet Banking by Malaysian Consumers”, Asian Academy of Management Journal, 8(2), 1–29. Ramayah, T., and Jantan, M. (2004) “Internet Usage among Malaysian Students: The Role of

Demo-graphic and Motivational Variables”, The Journal of Management Awareness, 7(2), 59–70.

Raymond, L. (1985) “Organizational Characteristics and MIS Success in the Context of Small Business”, MIS Quarterly, 9(1), 37–52.

Rogers, E. (1985) Diffusion of Innovations [NY: Free press]

Sathye, M. (1999) “Adoption of Internet Banking by Australian Consumers: An Empirical Investigation”, International Journal of Bank Marketing”, Vol. 17(7), 324–334.

Schewe, C. D. (1976) “The Management Information System Users: An Exploratory Behavioral Analysis” Academy of Management Journal, Vol. 19(4), 577–590.

Seyal, A.H., Rahim. M. Md., and Rahman, M.N. (2000) “Computer Attitudes of Non-Computing Aca-demics: A Study of Technical Colleges in Brunei Darussalam”, Information and Management, 37, 169–180.

Seyal, A.H., Rahim. M. Md., and Rahman, M.N. (2002) “A Study of Computer Attitudes of Non-Com-puting Students of Technical Colleges in Brunei Darussalam”, Journal of End-User ComNon-Com-puting, April-June, 40–47.

Seyal, A.H., and Rahman, M. N. (2003) “Student Use of the Internet: An Extension of TAM in Technical & Vocational Institutions in Brunei Darussalam”, Australasian Journal of Information System, 10(2), 91–104.

Shao, G. (2007) “The Diffusion of Online Banking Research Trends from 1998 to 2006”, Journal of Inter-net Banking and Commerce, 12(2), online available: http://www.arraydev.com/commerce/jibc/ Shashaani, L. (1997) “Gender Difference in Computer Attitudes and Use among College Students”,

Jour-nal of EducatioJour-nal Research in Computing, 51.

Shaw, L., Grant, L. (2002) “User divided? Exploring the gender gap in Internet Use”, Cyber Psychology & Behavior, 5(6), 517–527.

Sherman, R.C., End, C., Kraan, E., Cole, A., Campbell, J., Birchmeier, Z., and Klausner, J. (2000) “The Internet gender gap among college students: Forgotten, but not gone” Cyber Psychology and Behav-ior, 3(5), 885–894.

Spreng, R.A., MacKenzie, S. B., Olshavsky, R.W. (1996) “A Reexamination of the Determinants of Cus-tomer Satisfaction”, Journal of Marketing, 60(3), 15–32.

Suganthi, S., Balachander, K.G. and Balachandran. (2001) “Internet Banking Patronage: An Empirical Investigation of Malaysia”, Journal of Internet Banking and Commerce, Vol. 6 (1), May. http://www. arraydev.com/commerce/jibc

Swanson, B. (1974) “Management Information Systems: Appreciation and Involvement”, Management Science, 21, 178–188.

Swierczek, F.W., Shrestha, P. K., and Bechter, C. (2005) “IT Productivity and Profitability in Asia-Pacific Banks”, Journal of Global Information Technology Management, Vol. 8(1), 6–26.

Talmor, S. (1995) “New Life for Dinosaurs”, The Banker, Vol. 145. September, 75–78.

Tan, M and Teo, T. (2000) “Factors Influencing the Adoption of Internet Banking”. Journal of the Asso-ciation for Information Systems, 1(5), 1–42.

Teo, T. S. H. (2001) “Demographic and Motivational Variables associated with Internet Usage Activities”, Internet Research: Electronic Networking Applications and Policy, 11(2), 125–131.

Teo, T.S.H., Lim, V.K.G, (2000) “Gender differences in Internet Usage and Task Preferences”, Behaviour and Information Technology, 19(4), 283–295.

The Daily Canada. “Household Internet Use Survey-1998”, July 15th, 1999.

Venkatesh, V., and Davis, F.D. (1996) “A Model of the Antecedents of Determinants of Perceived Ease of Use, Development and Test”, Decision Sciences, 27(3), 451–481.

Venkatesh, V., and Morris, M. G. (2000) “Why Don’t Men Stop to Ask for Directions, Gender, Social Influ-ence and their Role in Technology Acceptance and Usage Behavior”, MIS Quarterly, 24(1), 115–139. Wang, Y., and Tang, T. (2001) “An Instrument for Measuring Customer Satisfaction towards Websites