FACTORS AFFECTING FINANCIAL PERFORMANCE OF

Islamic Banking in Indonesia is still in infancy. Thus, there is still wide opened area that needs to be empirically tested. This research was purposed to empirically examine and analyze the influence of Capital Structure, Productive Asset Quality, Liquidity, Cost Efficiency and Equity Profitability on Islamic Banks’ Financial Performance of Listed in Bank Indonesia. The samples used in this research are three Islamic banks listed in Bank Indonesia (Bank Syariah Mandiri, Bank Muamalat Indonesia and Bank Mega Syariah Indonesia). Purposive sampling method and multiple regression analysis were used. The results of this research show that the independent variables simultaneously have a significant impact on dependent variables. Partially variables of CAR and BOPO have no significant effect on the financial performance, and Variables of NPL, ROE and LDR have significant impact on financial performance.

Keywords: Financial Performance, Islamic Banks, Indonesia

1. INTRODUCTION

Financial institutions possess a very strategic role for national economic activity, namely as a vehicle that is able to collect and distribute public funds effectively and efficiently toward the improvement of people’s living standard. In addition, financial intermediary institutions/financial intermediaries as a vital supporting infrastructure to support the economy (Indrawaty, 2008).

However, instability of financial performance of Islamic banks can be seen from the development (ROA) from the years 2007-2009. Here is the growth of Islamic banking financial ratios according to Sharia Banking Statistic Data, CAR in 2007 was 2.07 percent and in 2008 experiences a decrease amounted to 1.42 percent, and in 2009 rising to 1.48 percent.

Table 1 – Sharia Banks Financial Ratios

1

Lecturers, Semarang University, Corresponding author: dyahjanie@gmail.com

2

Lecturers, Semarang University

3

The measurements above were using performance assessment instruments in conventional banks which already exist. The unavailability of specific instrument to assess the performance of Islamic banking raises a question, whether such instruments are significantly able to measure the performance of Islamic banking that is basically different from conventional banking services which have been exist longer before (Setyowati & Suciningtyas, 2010).

2. LITERATURE REVIEW

One factor that must be considered in the management of the bank is the measurement of bank performance using financial statement analysis. Size is often used in analyzing the financial performance of banks is the ratio of the bank’s financial statements. From this ratio can be concluded that bank performance is presented in the form of numbers that can be analyzed, and results of ratio analysis that will be utilized as sources of information and guidance on working procedures by the bank and utilized as the basis for decision making by other interested parties (Setyowati & Suciningtyas, 2010).

The previous results studies (Zainuddin & Jogiyanto, 1999; Abidin & Cabanda, 2006; Prasetyo W. , 2007) of variable CAR, demonstrate that it significantly influences financial performance, however other several previous research (Budihantho, 2001; Mawardi, 2004; Rindawati, 2007; Indrawaty, 2008) also indicate that CAR does not significantly affect the financial performance.

H1= It is suspected that Islamic banking capital structure (CAR) influence Islamic

banking financial performance (ROA).

The results of previous studies on variable NPL that have been conducted by Zainuddin (1999), Abidin & Cabanda (2006), Wahyu Prasetyo (2007) Erna Rindawati (2007), and Heni Endrawati (2008), suggests that the variable has a significant effect on the financial performance, conversely the results from Budihanto (2001) and Wisnu Mawadi (2004), suggest that the NPL has no significant influence on the financial performance.

H2= It is suspected that Islamic banking productive asset quality (NPL) influences

Results of previous studies (Zainuddin & Jogiyanto, 1999; Budihantho, 2001; Prayudo, 2003; Abidin & Cabanda, 2006) on ROE notes that there is a significant effect of rentability on financial performance, yet other research (Rindawati, 2007; Indrawaty, 2008), suggests that ROE does not significantly influence financial performance.

H3 = It is suspected that Islamic banking rentability variable (ROE) influences

Islamic banking financial performance (ROA).

The results of previous studies on BOPO variable that have been performed by Prayudo (2003) and Prasetyo W. (2007), reveal a significant effect that BOPO variable has on the financial performance, but nevertheless research conducted by Mawardi (2004), Rindawati (2007), Indrawaty (2008) prove that the variable does not significantly influence financial performance.

H3 = It is suspected that Islamic banking cost efficiency (BOPO) influences Islamic

banking financial performance (ROA).

Studies that have been conducted previously (Zainuddin & Jogiyanto, 1999; Budihantho, 2001; Prayudo, 2003; Abidin & Cabanda, 2006; Rindawati, 2007; Indrawaty, 2008), on LDR variables, shows that the variable BOPO significant impact on financial performance, still there was also a research (Prasetyo W. , 2007) resulting that the LDR variable is not significant to the financial performance.

H5= It is suspected that Islamic banking LDR influences Islamic banking financial

performance (ROA)

Based on the description of the background of these problems, the issues that were analyzed can be formulated as follow: How variables of Capital Structure, Productive Assets Quality, Liquidity, Cost Efficiency, Rentability/Profitability affect the financial performance of Islamic Banks listed in Bank Indonesia both partially and simultaneously.

The objective of this study is to empirically examine the influence of these variables Capital Structure, Assets Quality, Liquidity, Cost Efficiency, Equity and Profitability (Rentability), either partially or simultaneously on the financial performance of Islamic Banks listed in Bank Indonesia.

The population used in this study was all commercial Islamic banks operating and has its headquarters in Indonesia and listed in the Bank Indonesia. There were 11 Islamic banks listed in the Bank Indonesia.

The sampling technique carried out by selecting a sample aimed (purposive sampling) by the method of selecting a sample based on the consideration (judgmental sampling) the sampling is based on certain considerations (Indriantoro & Supomo, 2002). Using a purposive sampling method, then in this study population of 11 the number of members there were three Islamic banks available data and were eligible to be sampled. In accordance with the purposive sampling where practicality factors as primary considerations (speed and low cost) then three banks were taken of all Islamic banks to serve as a sample.

Based on the criteria of availability of financial statements over a period of three years in succession, namely: 2007, 2008 and 2009, there are three banks that are eligible to serve as the study sample, namely: Bank Muamalat Indonesia, Bank Syariah Mandiri, Bank Syariah Mega Indonesia. Bank BRI Syariah and Bank Syariah Bukopin were not available because they started to operate in October 2008. Meanwhile, Panin Bank Syariah, Bank Syariah Victoria, BCA Bank Syariah, Bank BNI Syariah, Bank Jabar Banten Sharia and Sharia Maybank started to operate in 2010.

The data in this study is the data sourced from the Quarterly Financial Statements of Commercial Sharia Banks at Bank Indonesia. The data obtained was taken through the website of Bank Indonesia (http://www.bi.go.id), Bank Syariah Mandiri (http://www.syariahmandiri.co.id), Bank Mega Syariah (http://www.megasyariah.co.id), Bank Muamalat (http://www.bankmuamalat.co.id), and the library at the office of Bank Indonesia in Semarang.

Where:

Before testing the hypothesis, first performed testing to determine whether the classical assumptions of regression models meet the criteria BLUE (Best Linear Unbiased Estimator) so it fits to predict the effect of independent variables on the dependent variable, which include multicollinearity, normality, and autocorrelation, heteroscedasticity (Prasetyo W. , 2007).

4. RESULTS

The classical assumptions test results shows that the regression model meet the criteria BLUE. (See Table 2, Table 3 and Figure 1):

Table 2 – Classical Assumptions Test Results

Figure 1 - Heteroscedasticity

Table 3 – Multicollinearity Table

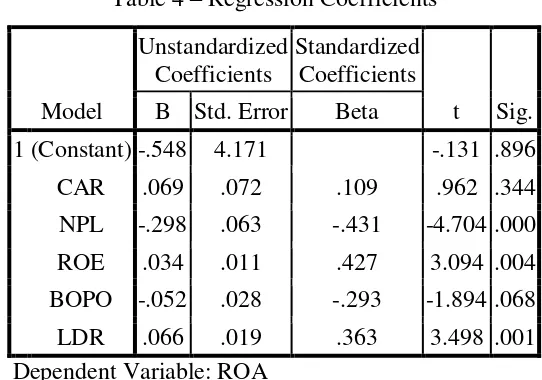

From the results of the regression coefficients obtained data processing as shown in the table above, so the regression equation can be arranged as follows:

Based on the table above, the regression coefficient of Islamic banks can be explained as follows:

The data processing results show that CAR has a coefficient of 0.109 with a probability of 34.4 percent error rate. It is greater than the significance level of 5 percent. Thus, variable CAR is partially and positively related to but insignificantly influences the financial performance of Islamic banks.

The data processing results demonstrate that the NPL has a coefficient of -0.431 with a probability of 0 percent error rate. It is smaller than the significance level of 5 percent. Therefore, Ho2 is rejected. It indicates that variable NPL is partially and negatively related to and significantly influences the financial performance of Islamic banks.

The data processing results prove that the variable ROE has a coefficient of 0.427 with a probability of 0.04 percent error rate. It is smaller than the significance level of 5 percent. Consequently, the Ho3 is rejected. It implies that the variable ROE is partially and positively related to and significantly affects the financial performance of Islamic banks.

The data processing results confirm that variable has a coefficient of -0.293 with a probability of 6.8 percent error rate. It is greater than the significance level of 5 percent. Hence, Ho4 is rejected. It suggests that the variable BOPO is partially and negatively related to but insignificantly influences the financial performance of Islamic banks.

The data processing results exemplify that the LDR has a coefficient of 0.363 with a probability of 0.01 percent error rate. It is smaller than the significance level of 5 percent. As a result, the Ho5 is rejected. It denotes that variable LDR partially and positively related to and significantly affect the financial performance of Islamic banks.

From the data processing results can be concluded that the independent variables (CAR, NPL, ROE, BOPO and LDR) hold a significance of F-value for 29.473 with a probability of 0.000. The probability is smaller than the 0.05 level. Accordingly, it means that the independent variables altogether (simultaneously) maintain a significant influence on the financial performance of Islamic banks.

NPL, ROE, BOPO and LDR. While as much as 19.7 percent of other factors are not discussed here.

The data processing results show that partially variable CAR has no significant effect on the financial performance of Islamic banks. It is inconsistent with research conducted by Prasetyo W. (2007) that the variable CAR significantly influences financial performance. Yet it is coherent with research conducted by Mawardi (2004) with the result that CAR insignificantly affects on ROA. It is consistent with research conducted by Indrawaty (2008) indicating that the CAR does not have a significant influence on financial performance.

The data processing results show that the variable NPL significantly affects ROA. This is consistent with study conducted by Prasetyo W. (2007) that NPL variable significantly influences the financial performance of banks. It is also consistent with investigation conducted by Mawardi (2004) that the NPL partially and negatively affect financial performance (ROA). Yet it is inconsistent with the study conducted by Indrawaty (2008) which results that the NPL does not have a significant effect on financial performance.

The data processing results confirm that the variable ROE significantly affects the financial performance of Islamic banks (ROA). This is consistent with the research conducted by Indrawaty (2008) that variable ROE have a significant impact on financial performance.

The data processing results show that the BOPO variable insignificantly effects the financial performance of Islamic banks (ROA). It is not in accordance with research conducted by Prasetyo W. (2007) where the BOPO variable has a significant influence on financial performance.

The data processing results that the LDR variable has a significant influence on the financial performance of Islamic banks (ROA). It is not in accordance with research conducted by Prasetyo W. (2007) that variable LDR insignificantly influences the financial performance of Islamic banking.

5. CONCLUSION

Partially Islamic banking financial performance articulated in financial ratios of the variable CAR, NPL, ROE, BOPO and LDR. After conducting examination, it is discovered that CAR and BOPO variables do not have significant influence on financial performance, while the NPL, ROE and LDR variables have significant influence on Islamic Banking financial performance.

Simultaneously the financial performance of Islamic banks set forth in the financial ratios of the variable CAR, NPL, ROE, BOPO and LDR have a significant effect on the financial performance of Islamic banks, so the instrument can also be used to assess the performance of Islamic banks.

The coefficient of determination (Adjusted R2) was obtained 0.803 means that 80.3 percent of Islamic bank financial performance (ROA) is affected by the variables of CAR, NPL, ROE, BOPO and LDR. While the other remaining factors as much as 19.7 percent is not examined in this study.

This research is expected to benefit several parties. Researchers, it is expected to increase valuable knowledge of practitioners associated with theoretical knowledge and to gain experience and new knowledge about Islamic banking. For Islamic banking business, the result of this study is expected to be able to be used as a guide for decision-making in determining the policy and as notes or corrections to maintain and improve its performance if there are shortcomings and weaknesses. As for academic purpose, it is expected to be used as a reference for the continuation of research in the future.

The limitation in this study is of there are only a few Islamic banks in Indonesia that has sufficient financial statements for research purpose as this field is still relatively new.

REFERENCES

Abidin, & Cabanda. (2006). Kinerja Keuangan dan Produksi Bank Asing dan Bank Swasta Nasional Sebelum dan Sesudah Krisis. Manajemen Usahawan Indonesia, 6, 3-9.

Abustan. (2009). Analisis Perbandingan Kinerja Keuangan Perbankan Syariah dengan

Perbankan Konvensional. Universitas Gunadharma, Fakultas Ekonomi. Jakarta:

Unpublished.

Budihantho, M. H. (2001). Analisis Kinerja Bank Perkreditan Rakyat Syariah di Jawa

Timur. Universitas Brawijaya, Program Magister Manajemen . Malang:

Unpublished.

Indrawaty, H. (2008). Analisis Faktor-faktor yang Mempengaruhi Kinerja Keuangan BMT: Studi Pada BMT Sarana Wiraswasta Muslim Kota Malang. Jurnal

Akuntansi, XII (02).

Mawardi, W. (2004). Analisis Faktor yang Mempengaruhi Kinerja Keuangan Bank

Umum di Indonesia. Semarang: Universitas Diponegoro.

Prasetyo, I. (2008). Analisis Kinerja Keuangan Bank Syariah dan Bank Konvensional di Indonesia. Jurnal Aplikasi Manajemen, 6 (2).

Prasetyo, W. (2007). Pengaruh Rasio Camel terhadap Kinerja Keuangan pada Bank.

Semarang: Universitas Diponegoro.

Prayudo, Y. A. (2003). Analisis Pengaruh Variabel CAMEL terhadap Laba Usaha pada

Bank Umum Swasta Nasional (Tbk). Program Magister Manajemen, Universitas

Malang. Malang: Unpublished.

Rindawati, E. (2007). Analisis Perbandingan Kinerja Keuangan Perbankan Syariah

dengan Perbankan Konvensional. Yogyakarta: Universitas Islam Indonesia.

Setyowati, & Suciningtyas. (2010). Perbandingan Kinerja Perbankan Syariah dengN Perbankan Konvensional Pasca Fatwa MUI Tahun 2004. Sultan Agung , XLVII

(121).

APPENDIX

Table 1 – Sharia Banks Financial Ratios

Ratios 2007 2008 2009

CAR 10,67% 12,81% 10,77% ROA 2,07% 1,42% 1,48% ROE 40,38% 38,79% 26,09% NPF / NPL 4,05% 1,42% 4,01% FDR / LDR 99,76% 103,65% 89,70% BOPO 76,54% 81,75% 84,39%

Source: BI Sharia Banking Directory

Table 2 – Classical Assumptions Test Results

No Test Indicator Conclusion

1 Autocorrelation DW= 2,150 Undetected positive and negative autocorrelation

2 Heteroscedasticity See Figure 1 Undetected heteroscedasticity

3 Multicollinearity See Table 3 Undetected multicollinearity

4 Normality K-S Zscore = O,725 Normally distributed residuals

Source: SPSS Output

Figure 1 - Heteroscedasticity

Table 3 – Multicollinearity Table Dependent

Variables VIF Conclusion

CAR 2,292 VIF < 10 Undetected Multicollinearity NPL 1,488 VIF < 10 Undetected Multicollinearity ROE 3,378 VIF < 10 Undetected Multicollinearity BOPO 4,239 VIF < 10 Undetected Multicollinearity LDR 1,906 VIF < 10 Undetected Multicollinearity

Source: SPSS Output

Table 4 – Regression Coefficients

Model

Unstandardized Coefficients

Standardized Coefficients

t Sig. B Std. Error Beta

1 (Constant) -.548 4.171 -.131 .896 CAR .069 .072 .109 .962 .344 NPL -.298 .063 -.431 -4.704 .000 ROE .034 .011 .427 3.094 .004 BOPO -.052 .028 -.293 -1.894 .068 LDR .066 .019 .363 3.498 .001 Dependent Variable: ROA