I

n the face of recent corporate scandals, ethical issues confronting accounting and finance profes-sionals are receiving increased attention. This attention demands that top managers emphasize business ethics throughout their organizations.1 But identifying the personal and corporate issues that impact ethical behavior in the workplace can be a chal-lenge! In particular, the manner in which an accounting professional approaches an ethical dilemma at work can be influenced by his or her organization’s overall posi-tion on ethics.2While many professionals treat ethics as an individual issue, the whole picture involves a great deal more. Ethicality at the organizational level provides the con-text that can drive an individual’s response to an ethical

dilemma in the workplace. The term “organizational ethics” may be new to many accounting and finance professionals. Organizational ethics is often comprised of a company’s general position on ethical conduct and social responsibility. It is indeed a context, but one that can be enhanced by compensating ethical behavior and reprimanding unethical behavior.3Employees and man-agers operating consistently within the ethical norms of a company can also build organizational ethics.4

ME A S U R I N G OR G A N I Z AT I O N A L ET H I C S

Accounting and finance professionals are often consid-ered experts in the measurement of corporate perfor-mance in many dimensions. Yet they may know less about the manner in which companies are evaluated

Organizational Ethics:

Measuring Performance

on this Critical Dimension

H

OW DO ACCOUNTING AND FINANCE PROFESSIONALS PERCEIVE THEIR EMPLOYER’

S ETHICAL VALUES? F

IND OUT,

AND BENCHMARKYOURSELF WITH THE RESULTS FROM A SURVEY OF

IMA

MEMBERS.

BY SA N D R A B . RI C H T E R M E Y E R, PH. D . , C M A , C P A ; MA R T I N M . GR E L L E R, PH. D . ; A N D SE A N R . VA L E N T I N E, D B A

EXECUTIVE SUMMARYThe authors apply a measure called the “corporate ethical values” (CEV) scale and look at

dif-ferences in ethical value ratings for several job categories, industries, certification, and organizational size. The results

can be useful to accounting and finance professionals and managers at all levels. Also learn what steps you can take to

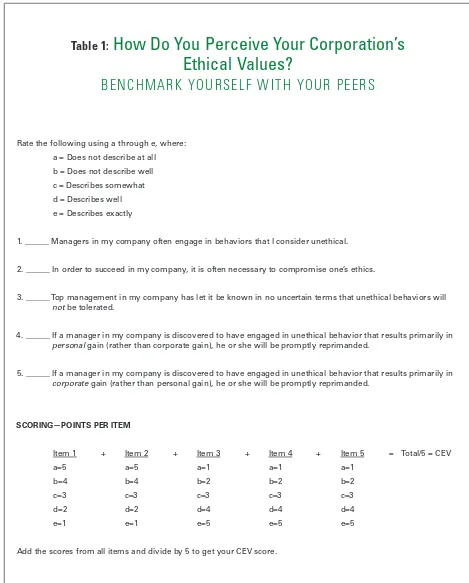

Table 1:

How Do You Perceive Your Corporation’s

Ethical Values?

B E N C H M A R K Y O U R S E L F W I T H Y O U R P E E R S

Rate the following using a through e, where: a = Does not describe at all b = Does not describe well c = Describes somewhat d = Describes well e = Describes exactly

1. ______ Managers in my company often engage in behaviors that I consider unethical.

2. ______ In order to succeed in my company, it is often necessary to compromise one’s ethics.

3. ______ Top management in my company has let it be known in no uncertain terms that unethical behaviors will

notbe tolerated.

4. ______ If a manager in my company is discovered to have engaged in unethical behavior that results primarily in

personalgain (rather than corporate gain), he or she will be promptly reprimanded.

5. ______ If a manager in my company is discovered to have engaged in unethical behavior that results primarily in

corporategain (rather than personal gain), he or she will be promptly reprimanded.

SCORING—POINTS PER ITEM

Item 1 + Item 2 + Item 3 + Item 4 + Item 5 = Total/5 = CEV

a=5 a=5 a=1 a=1 a=1

b=4 b=4 b=2 b=2 b=2

c=3 c=3 c=3 c=3 c=3

d=2 d=2 d=4 d=4 d=4

e=1 e=1 e=5 e=5 e=5

Add the scores from all items and divide by 5 to get your CEV score.

from an ethical standpoint, and this should be reme-died. Indeed, it is important for business professionals to periodically assess perceptions of the surrounding organizational ethical values because such beliefs can potentially influence employees’ attitudes and ethical decision making.5We will illustrate the use of one valid and reliable scale available that can be used to measure

an individual’s perception of “corporate ethical values” (CEV).6The CEV scale (and others like it) can serve as a managerial assessment tool, providing information regarding the awareness and effectiveness of a compa-ny’s ethics policies. The CEV measure consists of five statements about company ethics that are rated on an “agree-disagree” scale. The higher the CEV level, the GENERAL PARTICIPANT INFORMATION PERCENT OF SAMPLE

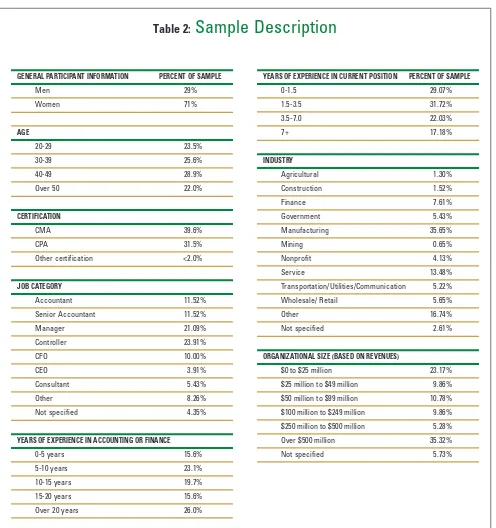

Men 29%

YEARS OF EXPERIENCE IN ACCOUNTING OR FINANCE

0-5 years 15.6%

5-10 years 23.1%

10-15 years 19.7%

15-20 years 15.6%

Over 20 years 26.0%

YEARS OF EXPERIENCE IN CURRENT POSITION PERCENT OF SAMPLE

0-1.5 29.07%

ORGANIZATIONAL SIZE (BASED ON REVENUES)

$0 to $25 million 23.17%

$25 million to $49 million 9.86%

$50 million to $99 million 10.78%

$100 million to $249 million 9.86%

$250 million to $500 million 5.28%

Over $500 million 35.32%

Not specified 5.73%

more an individual perceives that a company actively supports business ethics (see Table 1).

Measures such as CEV can be useful to a company trying to assess its overall organizational ethics. Measur-ing CEV across different departments, organizations, professions, and industries can provide information rele-vant to company decision makers.7It can foster discus-sion about ethics in the organization that highlights differences by job category, level of experience, and lev-el of involvement in decision making. In particular, indi-vidual and consolidated scores on the CEV scale could be discussed in ethics training, and consensus could be achieved regarding how to increase these scores in the future. The scale’s individual items related to manageri-al action, employee punishments, and employee rewards could also be evaluated separately and discussed in training sessions to better understand the current state of company policy in these areas. Such feedback would likely be invaluable to corporate leaders who must make policy decisions with implications for business ethics. Furthermore, evaluating ethical values can provide man-agers with an overall idea of the company’s apparent commitment to business ethics from an employee per-spective, which could make possible the development and improvement of helpful formal ethical programs such as ethics codes and training.8To illustrate, we will apply this approach to the profession itself.

HO W AC C O U N TA N T S PE R C E I V E TH E I R

EM P L OY E R S’ ET H I C A L VA L U E S

In a 2002 survey, we asked a sample of IMA members to rate their perception of the ethical values of their employer. We received 460 responses from a sample that is representative of the IMA regular membership. Table 2 describes the nature of our sample, which does not differ statistically from the regular IMA member-ship. In order to gather insight into how CEV may dif-fer in the accounting and finance profession, we compare the measure based on job category, industry, certification, and size of organization.

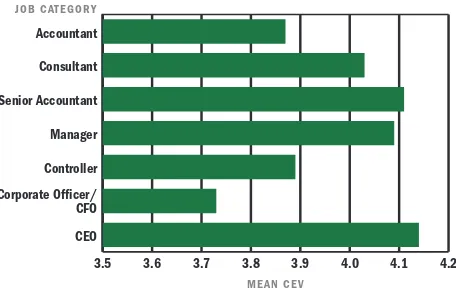

JO B CAT E G O R Y/ PO S I T I O N

Does CEV vary by level of responsibility or job catego-ry? To answer this question we looked at seven broad categories: accountant, senior accountant, manager,

con-troller, CFO, CEO, and consultant. There are reasons to expect such differences. For example, CEV may be higher for corporate officers because they typically have a direct hand in establishing the ethical climate. Mid-level managers’ perceptions of CEV can be affected by the tone of upper management because it is typically their responsibility to implement the ideas and objec-tives set by upper management. Mid-level managers who encounter ethical dilemmas may believe that they often cannot fix the problem without the support of upper management and that they have to “live with the situation.” The perception of mid-level managers typi-cally gets passed on to lower-level employees, who experience this conflict even more intensely. If lower-level employees believe that managers have a poor per-ception of the organization’s ethical values, they may have an even lower perception. On the other hand, a mid-level manager who believes that the organization’s ethical values are high can act with confidence and integrity, creating a more ethical context for subordi-nates. But while there may have been reasons to expect differences, none appeared for the seven types of posi-tions included in the study (see Figure 1).

IN D U S T R Y

We also examined the differences across six industry groups based on IMA membership classifications: finance, government, manufacturing, service, trans-portation/utilities/communication, and wholesale/retail. The ways an accounting professional can influence the

3.5 3.6 3.7 3.8 3.9 4.0 4.1 4.2

Figure 1:

Corporate Ethical Value

ethical climate varies dramatically depending on the industry in which they work. Ethical perceptions can be affected by the level of regulation or the degree of structure in an industry. For example, the banking or finance industry is highly regulated, and accountants who work in that industry may be more “in touch” with the ethical climate at their company. This may also be the case in the transportation, utilities, and communica-tion industries as these industries also face regulatory issues. Professionals in government settings where there is a great deal of structure and bureaucracy may also be more aware of the ethical atmosphere in their organizations. There are even popular stereotypes sug-gesting some industries are more ethical than others. While one can see modest variation among these means, Figure 2 shows the CEV scores by industry group are not statistically different from each other.

CE R T I F I C AT I O N

Professional certification may affect a professional’s abil-ity to reason ethically. Indeed, that is one of the reasons for certification, so one might expect certification to impact perception of ethical culture.

In order to determine if the level of ethical percep-tion is different for certified accounting and finance professionals and noncertified professionals, we ana-lyzed our sample in a few ways. First we compared the CEV perceptions of CPAs, CMAs, CFMs, CIAs, and CGFMs with those of people who did not report being certified. There is no significant difference in

percep-tion among the different types of certificapercep-tions. In addi-tion, we split the sample into two groups, one where participants have at least one type of certification and one where the participants have no certification. Again, the results indicate no significant differences between certified and noncertified accounting and finance professionals.

GE N D E R DI F F E R E N C E S

The popular press has highlighted the fact that some of the recent corporate scandals involve female whistle-blowers. Prior research indicates that there are differ-ences in terms of personal ethics between males and females. It may also be possible that gender plays a role in ethical perceptions. In our study, we compared the mean CEV of male participants with the mean CEV of female participants and found no significant difference.

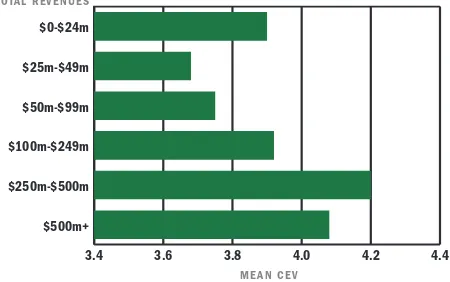

OR G A N I Z AT I O N A L SI Z E

There is also the potential for the size of an organiza-tion to affect the employee’s perceporganiza-tion of their organi-zation’s ethics. For example, a larger organization may have a more formal or established code of ethical con-duct and may spend more time or resources on commu-nicating ethics policies to employees. Large

organizations may also have an ethics officer or other personnel with the primary responsibility of imple-menting policies and procedures related to a code of ethics, conducting an ethics audit, fostering an ethical climate, and enhancing awareness regarding ethical

3.4 3.6 3.8 4.0 4.2 4.4

Figure 3:

Corporate Ethical Value

Ratings by Organizational Size

Figure 2:

Corporate Ethical Value

issues. On the other hand, smaller organizations may lack some of the formal procedures that a larger organi-zation has established, but employees may be more aligned with senior management because they may be “closer” to them or interact with them more frequently.

In our study, we used total revenues as the indicator of organizational size. The results indicate that there is a difference in the mean CEV measure based on organiza-tional size. The findings in Figure 3 generally indicate that the accounting and finance professionals perceive corporate ethical values as higher in larger organizations. The clear exception to this linear relationship is for the smallest organizations, with revenues from $0 to $25 mil-lion, which also have high CEV scores.

WH AT DO T H E RE S U LT S ME A N?

In this survey, we found that most of the differences in CEV that might have been identified are not present. But a lack of differences does not suggest a lack of results. It should be important, reassuring, and poten-tially quite satisfying to the profession that the differ-ences are not evident. This suggests a degree of consistency in ethical perceptions across accounting and finance professionals in different jobs and industries. The results may also be helpful to critics of the accounting profession or those involved with reform who are concerned with a “breakdown” in ethics due to structural factors.

Accounting and finance professionals learn a consis-tent set of ethical standards. If those standards are vio-lated in their organization, they are required to address the issue. If an ethical problem cannot be resolved, then they are expected to leave the organization. As such, there should not be a large number of accountants who perceive their organizations as unethical.

The results indicate that there are neither “bad” industries nor specific roles in which accounting and financial professionals are forced to tolerate unethical behavior. The limited differences found for organiza-tional size may be an exception that proves the rule. For example, there are well understood controls in small organizations just as there are in large organiza-tions. Between the two sizes there may be real ques-tions about which controls are appropriate.

The absence of differences based on industry, role,

gender, etc., do not mean that there are no differences. There are differences within industries and even within organizations. One can see patterns. Points of high CEV and low CEV become evident. These are the differ-ences that provide the impetus for accounting and financial professionals to take action.

US I N G DI F F E R E N C E S I N

ET H I C A L PE R C E P T I O N S

Differences in CEV (or other measures of ethicality) may be useful to foster discussion of ethics, standards, and expectations in an organization. For example, it may be useful to managers, controllers, and CFOs in terms of inquiring about their staff members’ ethical perceptions. A low measure may indicate that account-ing or finance staff members do not feel comfortable with the climate, and, perhaps, this may have an affect on how they feel about the financial information they prepare for decision makers in the organization.

Another way the CEV measure may be useful to accounting and finance managers is in terms of an indi-cator of how the users of financial information perceive the ethical climate in their organization. For example, if the CEV measure was low for users or “customers” of accounting and finance professionals, it may indicate a lack of faith in the internal or external information they report.

IM P R O V I N G ET H I C A L PE R C E P T I O N S

If managers measure ethical perceptions within their organization, what do they do if differences appear? In particular, if the differences suggest a portion of the organization see it as departing from high ethical stan-dards, what should be done?

A first step is to appreciate what the data actually address: perceptions. There may be a variety of causes, such as a temporary crisis, a failure in local supervision, or even new decisions or challenges that force people to address problems they have not addressed before. Once surfaced, these issues may be fixed by a quick response. They may also signal new ethical challenges that will need to be addressed in other parts of the organization.

taking a person’s temperature does not determine the appropriate treatment, a low CEV does not dictate spe-cific action. It targets the problem area. But then the target must be addressed.

The initial step is to explore with the category of employees what the problem is. This may be as sim-ple as visiting the manager or work group. In the case of a broader problem it may require a structured exploration, possibly in the form of a workshop or retreat. Of course, care needs to be taken so that employees who feel pressured to behave unethically have a safe environment in which they can speak can-didly. The good news is that there are a variety of actions that can be used to correct the situation once the problem is known.

For example, consider the situation in which employ-ees believe top management requires them to behave unethically. Assuming the problem is not that top man-agement is actually demanding unethical behavior (an issue that would require other actions from an account-ing or finance professional), there is either miscommu-nication or inconsistent demands are being made of the employees. In either case, clarifying the nature of the dilemmas the employees experience gives upper man-agement an opportunity to respond. If the problem is local and specific, this may be done as part of the same workshop or retreat in which the problem is explored. A more pervasive problem may require a training pro-gram that can deliver the message to a large number of employees.

Sometimes managers are the target of training. Do they provide a consistent message and back it up with the way they use rewards and sanctions? Do they clear-ly understand the directions and standards that top management supports? Often these discussions or train-ing can be integrated in unit/department retreats where other issues associated with company performance and integrity are considered.

Most of these solutions imply the existence of clear standards and expectations. Certainly, it is easy for a top management team who has worked together closely over an extended period of time to share a clear view of these expectations. It is also easy for them to forget that these expectations have not been articulated to the rest of the organization! This is one reason that formal codes

of conduct stating these implicit standards can be pow-erfully helpful tools. And, in the absence of such a code, do not be surprised if the initial efforts to articu-late the shared beliefs surface some areas of unrecog-nized differences among the top management group that have gone unnoticed. It may be that these differ-ences are at the heart of the employees’ confusion.

In a world filled with new markets, new technolo-gies, new competitors, and new products, there are also going to be new challenges, including ethical chal-lenges. The changing business environment confronts employees at all levels with new ethical dilemmas. The sooner the organization can recognize ethical problems, the sooner it can help employees respond in a manner that is consistent with company standards and beliefs. ■

Sandra B. Richtermeyer, Ph.D., CMA, CPA, is an associate professor of accountancy at Xavier University and IMA’s professor-in-residence. Her research interests include perfor-mance measurement, technology enablement for management accountants, and workplace concerns of management accountants. She can be reached at [email protected].

Martin M. Greller, Ph.D., is professor and chair of the HRM Program at the Robert J. Milano Graduate School of Management & Urban Policy. Prior to joining the universi-ty, he was an executive with The New York Times Company and management consultant helping companies address issues of organization effectiveness, design, and direction. He is an organizational psychologist licensed in New York and New Jersey. He may be reached at [email protected].

Sean R. Valentine, DBA, is an associate professor of man-agement at the University of Wyoming. His research interests include business ethics and organizational culture and his research has appeared in the Journal of Business Research, Journal of Business Ethics, and Human Relations. He is also actively involved with the develop-ment of professional ethics training. He can be reached at [email protected].

FU R T H E R RE A D I N G

EN D N O T E S

1 For example, Shelby D. Hunt, Van R. Wood, and Lawrence B. Chonko, “Corporate Ethical Values and Organizational Commit-ment in Marketing,” Journal of Marketing, July 1989, pp. 79-90; Linda Klebe Trevino, Kenneth D. Butterfield, and Donald L. McCabe, “The Ethical Context in Organizations: Influences on Employee Attitudes and Behaviors,” Business Ethics Quarterly, July 1998, pp. 447-476; and Linda Klebe Trevino and Katherine A. Nelson, Managing Business Ethics: Straight Talk About How to Do It Right, third edition, John Wiley & Sons, Inc., New York, 2004.

2 For example, Trevino and Nelson, 2004; Al Y.S. Chen, Roby B. Sawyers, and Paul E. Williams, “Reinforcing Ethical Decision Making through Corporate Culture,” Journal of Business Ethics, June 1997, pp. 855-865; and Douglas E. Ziegenfuss and Otto B. Martinson, “The IMA Code of Ethics and IMA Members’ Ethi-cal Perceptions and Judgments,” Managerial Auditing Journal, May 2002, pp. 165-173.

3 Hunt, et al., 1989. 4 Trevino, et al., 1998.

5 For example, Chen, et al., 1997; Hunt, et al., 1989; Trevino, et al., 1998; and Scott J. Vitell and D.L. Davis, “The Relationship between Ethics and Job Satisfaction: An Empirical Investiga-tion,”Journal of Business Ethics, June 1990, pp. 489-494. 6 Hunt, et al., 1989

7 Trevino and Nelson, 2004.