Full Terms & Conditions of access and use can be found at

http://www.tandfonline.com/action/journalInformation?journalCode=vjeb20

Journal of Education for Business

ISSN: 0883-2323 (Print) 1940-3356 (Online) Journal homepage: http://www.tandfonline.com/loi/vjeb20

Back to the Future: Implementing a Broad

Economic, Inquiry-Based Approach to Accounting

Education

Thomas J. Frecka , Michael H. Morris & Ramachandran Ramanan

To cite this article: Thomas J. Frecka , Michael H. Morris & Ramachandran Ramanan (2004) Back to the Future: Implementing a Broad Economic, Inquiry-Based Approach to Accounting Education, Journal of Education for Business, 80:2, 69-74, DOI: 10.3200/JOEB.80.2.69-74 To link to this article: http://dx.doi.org/10.3200/JOEB.80.2.69-74

Published online: 07 Aug 2010.

Submit your article to this journal

Article views: 15

View related articles

n this article, we argue for a broad economics framework and an inquiry-based approach to accounting education and illustrate how such an approach has been implemented suc-cessfully in the curricula at two univer-sities. We included the following major features in the project: (a) a focus on inquiry or discovery-based learning, (b) the use of a broad economics frame-work that includes contracting notions and information concepts to motivate the demand for accounting information and to supplement a decision-useful-ness framework, and (c) the elimination of a “silo” approach to accounting edu-cation through an integration of finan-cial and managerial topics, together with auditing, tax, not-for-profit, and international topics.

Our primary objective in this article is to motivate accounting educators to consider and implement revisions to their undergraduate accounting curric-ula at a time when there is substantial evidence that the accounting education model used at most schools is broken or obsolete. With this objective in mind, we describe an initiative undertaken at the University of Notre Dame and the University of Illinois with the hope that it may stimulate accounting education innovation at other institutions.

Citing a growing gap between what accountants do and what accounting

educators teach, the Bedford Committee (1986) called for a complete reorienta-tion of accounting educareorienta-tion toward breadth at the undergraduate level and specialization at the graduate level. Later, the then Big Eight (1989) firms endorsed the Bedford Committee and offered their own criticisms of account-ing education, includaccount-ing concerns about a passive learning environment and the lack of integration.

A 20%–25% decline in the number of accounting graduates in the late 1990s and concerns about the overall quality of

the remaining accounting students led the American Accounting Association (AAA), the American Institute of Certi-fied Public Accountants (AICPA), the Institute of Management Accountants (IMA), and the then Big Five accounting firms to commission a study by Albrecht and Sack (2000) to determine causes. The strong conclusion of the study, as evidenced by practitioner views, is that our current accounting education model is still broken and obsolete.

The Call for Discovery-Based or Inquiry-Based Learning

Calls for inquiry-based, discovery-based, or similar conceptual approaches to learning are pervasive in educational literature. For example, the Accounting Education Change Commission (AECC, 1990), Boyer (1990), and the Boyer Commission on Educating Undergraduates in the Research Univer-sity (1998) have focused on “learning to learn.” Eleven AECC grants responded to the call for experimentation with a focus on undergraduate accounting edu-cation. The two major thrusts of change resulting from the grants are (a) a move-ment away from a preparer’s emphasis and toward a user’s emphasis and (b) an increased attention on the development of professional skills (e.g., critical thinking, lifelong learning, listening,

Back to the Future: Implementing a

Broad Economic, Inquiry-Based

Approach to Accounting Education

THOMAS J. FRECKA MICHAEL H. MORRIS RAMACHANDRAN RAMANAN

University of Notre Dame Notre Dame, Indiana

I

ABSTRACT.Motivated by concerns about the quality of accounting educa-tion and calls for a broader, more active approach to learning by numer-ous accounting educators and practi-tioners over the past 2 decades, the authors of this article sought to pro-vide a framework and example materi-als to address those issues. The frame-work makes use of broad, economic contracting notions to supplement the traditional decision-usefulness ap-proach to accounting. The contracting perspective more explicitly considers the incentives of all parties to the var-ious contracts with the entity and the information environment in which decisions are made. The approach, which can be applied with any text-book in multiple settings, supports a “discovery” mode of learning focus-ing on the methods and skills of inquiry, analysis, judgment, and deci-sion making.

speaking, and writing). Although both of these directions of change are impor-tant, they do not provide a change in the conceptual paradigm for accounting education, nor do they address the con-cerns about lack of breadth that are at the heart of most of the criticisms of accounting education.

Supplementing the Traditional Decision-Usefulness Approach With a Contracting and

Information Framework

From a financial reporting stand-point, the basis for the conceptual framework used by the Financial Accounting Standards Board (FASB) is a decision-usefulness approach in which the primary focus is on the char-acteristics of useful information (e.g., relevance and reliability) for investors and creditors. In this article, we expand the decision-usefulness model to in-clude the building of accounting under-standing on a foundation of standard economic and contracting notions that are not normally addressed within the traditional decision-usefulness para-digm. Beaver (1998) noted that the two primary concerns of economics are efficiency and equity. Accounting plays an important role in providing information relevant for addressing these two concerns.

Focusing first on the efficiency per-spective, we see that economic theory is developed based on perfect market assumptions, including the assumption that all information is free and known to everyone. However, perfect market assumptions do not hold in the real world. A constraint on efficient contracting is that one party to the contract usually has superior information, knowledge, or abil-ity to process information relative to the other party. Thus, the usual information environment provides an unlevel playing field. Information asymmetry is a funda-mental notion in the information eco-nomics literature and a pervasive problem throughout the economy. Information asymmetry arises in both precontracting (adverse selection) and postcontracting (moral hazard) settings. The demand for accounting arises in this asymmetric environment because of the need for facilitating efficient contracting. Without

such market imperfections, there would be no demand for accounting.

In addition to providing more account-ing disclosures that level the information playing field, parties can also mitigate postcontractual opportunism by entering into incentive-compatible contracts. Given that all economic agents seek eco-nomic gain while having incentives to behave opportunistically, their challenge is to structure contracts that are fair and that create incentives for efficient eco-nomic activity.

The second primary concern of eco-nomics, equity, generally leads to a dis-cussion of regulatory considerations. Although one could advance a “litany of abuse” argument to support the need for regulating accounting information, Beaver (1998) noted that a more elegant argument can be developed based on market failures. Given an accounting free-rider problem in which users do not pay for financial accounting informa-tion, the price system cannot be used for determination of an optimal supply of information. The free-rider problem potentially leads to an undersupply of information and can be used to justify regulation to support not only equity but also the efficiency objective. Again, the economic framework provides a much richer setting for considering account-ing issues and principles such as full disclosure.

Supplementing Decision-Usefulness With Accountability and Stewardship Notions

Laughlin and Puxty (1981), Gray, Owen, and Adams (1996), and others have criticized the decision-usefulness framework for undermining the stew-ardship function, for giving priority to financial stakeholders instead of society as a whole, and for giving little consid-eration to the role of preparers and the goals of the entity. Stewardship and accountability notions have taken on increasing importance in the wake of the Enron, WorldCom, and other recent accounting failures and are at the heart of new regulatory controls such as the Sarbanes-Oxley Act.

A contracting framework facilitates a discussion of such accountability notions. Ijiri (1983) noted that an

accountability-based framework focuses on the relation between the accountor (supplier of accounting information) and the accountee (user of the accounting information). In this framework, the user is not the only driver of the infor-mation generated; rather, the objective is to provide a fair system of informa-tion flow between the accountor and accountee. What is “fair” is determined as a result of negotiations between the accountor and accountee. In this con-text, Ijiri noted the importance of the accounting information qualities of objectivity and verifiability. These qual-ities protect both parties by assuring that the information is not biased or mis-leading. Also, when contracts are silent about information requirements, Ijiri noted that other qualities become important, including relevance, useful-ness, or representational faithfulness of economic reality.

Although the contracting approach is probably most consistent with a stake-holder theory of the firm, stakestake-holder theory is a subset of contracting. For example, a competitor generally would not be considered a stakeholder in the firm, but management may enter into contracts with competitors to expand the market over which they are compet-ing. Competitors may contract to put on a trade show to expand the market, thus becoming parties to an expansion con-tract without becoming stakeholders in each other’s firms. Another more recent example of competitors contracting with each other has occurred in the automobile insurance industry. Insur-ance companies recently have combined their resources to address the problems at the most dangerous intersections in the country. By entering into contracts to make some intersections safer, the competitors are preserving lives and reducing costs for the entire industry, without directly becoming stakeholders in each other’s firms. Thus, the contract-ing approach easily can accommodate a variety of accountability notions in these situations.

Contracting Framework and Discovery Learning

Building on the above discussion, we used the following contracting

tions to systematically direct student attention, initiate discussion, and orga-nize the analysis of any accounting topic or business situation:

• Who are the parties (entities) involved in the transaction or business situation?

• What is the primary interest (incen-tive) of each party?

• What are the primary risks and rewards to each party to the contract?

• What major decisions are to be made by each party?

• What information could be provided to assist in the negotiated settlement of each contract?

• How will performance be mea-sured, and what mechanisms will ensure accountability, enforcement, and incen-tive compatibility for each party?

• What role does accounting play in this business setting, and what qualities of the information are most important to each contracting party?

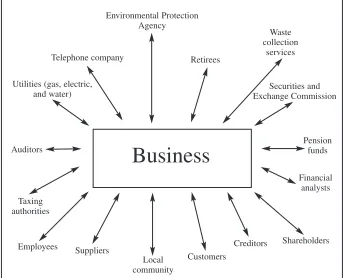

Answers to these questions provide a frame of reference for constructing an entity diagram that details the parties and the resource flows arising from each contract (see Figure 1). This dia-gram leads to a discussion of each

enti-ty’s incentives, information require-ments, and controls necessary for suc-cessful execution of the contract. The approach not only serves as a starting point for introducing each topic or situ-ation, but the questions serve as a useful teaching tool for proceeding from a dis-cussion of why accounting is desired or necessary to how accounting assists contracting parties in assessing risks and rewards, monitoring, and control-ling activities.

Advantages of a Contracting Framework

A contracting approach helps to inte-grate the many subareas of accounting and attacks the traditional tribal struc-ture of accounting education, a limita-tion recently resurrected by Demski (2002a). Initiating classroom discussion with contracting questions that establish the entities, incentives, resource flows, and the need for information breaks down this stovepipe approach in teach-ing accountteach-ing. Once one adopts the contracting framework for a firm, one can analyze external contracts in the same way as internal contracts. In other words, managerial accounting issues are

addressed alongside financial account-ing issues, which makes the segregation unnatural.

Unlike the decision-usefulness approach, the contracting perspective does not stop at blurring the distinction between managerial and financial accounting. It ties the many other subar-eas of accounting together, helps define the domain of accounting, and allows for more complex business problem analysis. For example, tax effects be-come an important consideration in most contracts, because tax authorities are “uninvited third parties” in other-wise bilateral contracts.

An example from Scholes and Wolf-son (1992) best illustrates the richness of a contracting perspective extending to considerations outside the narrow boundaries of financial and managerial accounting. Consider the decision to either lease or buy business equipment. In most countries, the government encourages capital investment by pro-viding tax incentives to the owner through rapid depreciation write-off. Alternatively, if a business rents the equipment, the rental payments may be tax deductible over the period of the lease. The decision-usefulness perspec-tive would emphasize collection and use of the information about the user’s mar-ginal tax rate, discount factors, and cash flows from each alternative to determine whether renting or buying has the high-est present value for the user.

Thus, one expands the analysis through the contracting perspective not only to examine the transaction from the acquirer’s view but also to facilitate con-sideration of the provider’s decision vari-ables. Each party can have unique mar-ginal tax rates, cost of capital (discount) factors, and profitability status. If the user of the equipment is a firm with a low marginal tax rate, the user may find it more desirable to rent the equipment. If the owner of the equipment is a firm with a high tax bracket, the owner would find it more attractive to lease it and retain the depreciation tax benefit. Both businesses have incentives to enter into a contract (because each needs the other), but the property rights are arranged so that the low-tax-bracket business effectively sells its excess depreciation tax benefit to the high-tax-bracket business. This

transac-Business

Environmental Protection Agency

Telephone company Retirees

Waste collection

services

Utilities (gas, electric, and water)

Auditors

Taxing authorities

Employees Suppliers

Pension funds

Customers

Creditors Shareholders Financial

analysts Securities and Exchange Commission

Local community

FIGURE 1. Entity diagram.

tion is accomplished through reduction of the rental rate to the low-tax-bracket lessee in exchange for the right of the lessor to take rapid depreciation, for tax purposes, on the equipment. The negoti-ated settlement is dependent on the unique characteristics of each party in the transaction and can result in a solu-tion quite different from the one that might be reached by considering only the user. In this case, the acquirer may be motivated to forgo the depreciation tax benefit because it is more than offset by lower rental rates. Thus, this kind of analysis allows for a much richer discus-sion of financial accounting standards related to leasing and the ethics of off-balance-sheet financing.

It should be evident from this exam-ple that we are proposing an approach that is much broader than one based on a purely legalistic view of the firm. In the broader approach, implicit contracts become increasingly important because, in many relationships, it is not the legal system that is enforcing performance but, rather, social norms, trust, and/or mutual gain. For example, a firm might establish wellness programs (for the encouragement of physical exercise and provision of facilities) or family coun-seling centers for its employees. Although these centers are part of the benefits for workers, they are driven not by a threat of legal action but by a belief in the productivity effects of having happy employees and a desired negoti-ated reduction in medical and insurance costs owing to healthier workers.

Having a framework based on con-tracting also allows the instructor to deemphasize the rule-based method of instruction and, instead, to focus on information concepts. Contracting par-ties outside the firm, such as sharehold-ers and creditors, require accurate perfor-mance measures to reduce information asymmetry and make better resource allocation decisions. The need for high quality income measures for discrete time periods necessitates the use of accrual accounting procedures. Curricu-lar coverage of financial accounting top-ics such as stock-option compensation and accrual accounting pension expense recognition can be justified and their content explained based on demand for relevant and reliable performance

mea-sures by outside parties in the contracting nexus. Such disclosures reduce the infor-mational advantage of inside parties and provide monitoring mechanisms for con-tract enforcement, concon-tract negotiation, and efficient allocation of resources.

Finally, a contracting framework also facilitates an emphasis on accounting research throughout the curriculum, a goal recently reinvigorated by Demski (2002b). Principal/agent investigations are natural fallouts from the owner/ management contracts or management/ employee contracts. With the contractu-al emphasis on performance, studies examining the relative value of cash versus accrual performance measures provide interesting additions to the accounting courses. The contract that the entity has with equity holders and the impact that accounting performance measures have on the resource alloca-tion decisions of owners allow instruc-tors to introduce capital market research into the classroom. Empirical research results on earnings quality, income smoothing, and the impact of transitory/ permanent or expected/unexpected earn-ings components on stock prices provide evidence that leads to interesting discus-sions and higher level learning based on a consideration of contractual relation-ships between owners and management.

The Not-for-Profit Example

As an example that demonstrates the versatility of the contracting approach, we present a case that examines the operations of a center for the homeless. The providers of the resources for the center include donors, volunteers, and, to a limited extent, federal and local gov-ernments. The executive director and the board of directors have responsibility for the stewardship of the resources, which flow to the beneficiaries of the center. Although there are continual resource flows from the providers to the center, the contracts have no tangible resource flows from the center back to the providers (other than the government-provided tax deduction for financial con-tributions). Unlike situations involving stockholders in a for-profit entity, there are no tradable residual claims and no owners. The accounting system is still very important to the parties contracting

for a homeless shelter, but it is clearly of a different form.

Multiple accounting topics are illus-trated according to the contractual orga-nization of a not-for-profit entity. In the class, we also discuss the importance of a mission statement and use of re-sources consistent with the mission statement for maintaining the tax-exempt status. The discussion invariably turns to the need for an independent audit to provide an assertion about the appropriate use of the resources of the center. Not-for-profit entities place heavy reliance on budgets and adher-ence to line-item budgets for various activities of the center. Students spend a significant amount of time examining the budget of the entity, including per-forming a sensitivity analysis of differ-ent scenarios of resource availability. In this context, we also compare the topic of revenues and expenditures for not-for-profit entities with an income state-ment for a for-profit firm.

Performance evaluation, a managerial accounting topic, has important rele-vance for the center. The class examines a balanced scorecard of financial and nonfinancial measures, along with the inherent difficulties in measuring true rehabilitation of a guest of the center. This case provides a real-life example to illustrate all of the above interconnected accounting topics. Because several stu-dents typically volunteer in not-for-profit entities, they tend to engage more actively in these discussions and enhance the learning of the whole class.

Limited-Information-Environment Example

A second example focuses on a scuba-diving business that is considering an expansion contract to provide services and instruction at a new location on the beach in the Cayman Islands. The case contains traditional managerial account-ing considerations involved in the deci-sion whether to expand or not, such as incremental variable and fixed costs, rel-evant costs, and return on investment. The case also necessitates consideration of traditional financial accounting impli-cations of the expansion, such as addi-tional debt load, income considerations, and liquidity effects.

However, the real value of this case arises when students consider the estab-lishment of contracts with a business in the Cayman Islands, where the business is not required to file tax returns, has no threat of tax audits, has no requirements to provide audited financial statements, and is able to choose from an array of international financial accounting stan-dards. Students quickly realize that the information environment provides increased risk for outside parties to con-tracts with the scuba business. Without a tax system, which generally provides incentives to report lower income, and without financial audits to provide a rea-sonable level of assurance, management would possess an unusual information advantage and would have a tendency to be less risk averse, more freewheeling, and more prone to overstatement of actual results. In this situation, banks would negotiate for lower borrowing limits or higher interest rates or would require more detailed information on people than they would in less asym-metric precontracting environments. Ownership structure would shift to more monitoring, more oversight, and more control, with potentially more local or hands-on stewardship in the exaggerated

postcontractual asymmetric-information environment. In the absence of more ownership involvement, students may be asked to consider the form of com-pensation contracts that would achieve management behavior consistent with the long-term goals of the business. Under conditions of increased risk to outside creditors and investors, the scuba business may also experience a higher cost of capital for all decisions, including the proposed expansion.

Contracting Notions in Advanced Accounting Courses

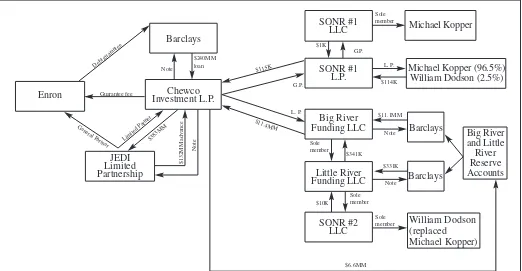

A familiarity with contracting con-cepts is a prerequisite for understanding the business motivation and the account-ing requirements for complex business transactions involving multiple entities, firm restructurings, and financial instru-ments. In Figure 2, we present the entity diagram for Chewco, one of Enron’s spe-cial purpose entities. Instructors can use this complex diagram to illustrate (a) how contracts are written to specify rights, obligations, and payoffs of con-tracting parties; (b) control issues; and (c) why ownership equity is important for an entity. For example, there were

concerns about the fairness of the terms of the contract with respect to Enron and the payoff function based on the nonin-dependent status of Kopper, the manager of Chewco and an Enron employee. The diagram also make clear the importance of organizational form and the maneu-vering through companies with limited liability and various partnership arrange-ments to give the appearance that Enron did not control Chewco. Finally, the dia-gram illustrates how the then 3% rule for nonconsolidation worked and why the rule was violated for Chewco. Issues concerning ethics and related-party transactions are also easily addressed in this case.

Conclusion

In this article, we proposed the use of a broad economic, inquiry-based frame-work for learning about accounting and its role in society. The approach advo-cated is consistent with the recommen-dations of the Bedford Committee (1986), recommendations of Albrecht and Sack (2000), and suggestions by Demski (2002a) and a host of other accounting scholars and practitioners. The approach exposes students to a

Enron Michael Kopper (96.5%) William Dodson (2.5%) Michael Kopper

Debt guarantee

Guarantee fee

General P

artner Limited P artner

FIGURE 2. Chewco entity diagram. From the Report of Investigation by the Special Investigative Committee of the

Board of Directors of Enron Corporation, William C. Powers, Jr., Chairman, February 1, 2002, p. 51.

broad range of accounting topics and provides a stronger conceptual linkage of general education, business educa-tion, and accounting education than does the traditional decision-usefulness approach that focuses on only one entity, the user of accounting information. An economics-based conceptual framework for studying accounting, in conjunction with an inquiry-based approach to learn-ing, is consistent with the blueprint pro-vided by the Boyer Commission (1998) for enriching undergraduate education at research universities.

Little evidence exists that a broad economic-based approach to account-ing education is optimal for all schools and all students, yet it is consistent with the recommendations of practically all of the critics of accounting education. Given these criticisms and the general belief that the approach to accounting education is too narrow, our purpose in this article has been to explain how a contracting approach can be imple-mented, suggest advantages of such an approach, share example materials, and call for additional exploration with the approach.

NOTES

1. See Stone and Shelley (1997) for assessment results.

2. See Scott (1997), especially chapters 1 and 2, for an in-depth discussion of this idea.

3. Today, even the concept of “competition” is

blurring as entities enter into more joint-venture agreements. Contracting notions help explain the motivation behind such ventures and their infor-mation requirements.

4. Magill and Quinzii (1998) noted that the field of economics did not develop until it was separated from the field of law, about 200 years ago. They expressed surprise “that it takes so long for econo-mists to recognize the fundamental importance of law and, above all, contracts for a proper under-standing of the functioning of an economy” (p. 15). 5. The Homeless Center and Scuba Diving Cases have been published and distributed by the American Institute of Certified Public Accoun-tants (AICPA) for instructor use in accounting courses. The full text of the cases and solutions can be found in AICPA (1998) and AICPA (1997).

REFERENCES

Accounting Education Change Commission (AECC). (1990, Fall). Objectives of education for accountants: Position statement number

one. Issues in Accounting Education,307–312.

Albrecht, S. W., & Sack, R. J. (2000). Accounting education: Charting a course through a perilous

future. Accounting Education Series, 16.

Sara-sota, FL: American Accounting Association. American Institute of Certified Public

Account-ants (AICPA). (1997). Center for the Homeless,

Inc. In L. Nanni & R. Ramanan,1996 AICPA

professor/practitioner cases. NewYork: Author. American Institute of Certified Public Accoun-tants (AICPA). (1998). Should the scuba busi-ness dive into the expansion? In M. H. Morris

& A. M. Crowe,1997 AICPA

professor/practi-tioner cases. New York: Author.

Beaver, W. H. (1998). Financial reporting: An

accounting revolution. Upper Saddle River, NJ: Prentice Hall.

Bedford Committee (American Accounting Asso-ciation Committee on the Future Structure, Content, and Scope of Accounting Education). (1986, Spring). Future accounting education:

Preparing for the expanding profession. Issues

in Accounting Education,168–195.

Big Eight (Arthur Andersen & Co., Arthur Young;

Coopers & Lybrand; Deloitte, Haskins, & Sells; Ernst & Whinney; Peat Marwick Main & Co.; Price Waterhouse; and Touche Ross). (1989).

Perspectives on education: Capabilities for success in the accounting profession. New York: Author.

Boyer, E. (1990). Scholarship reconsidered:

Prior-ities of the professoriate. Princeton, NJ: Carnegie Foundation for the Advancement of Teaching. Boyer Commission on Educating Undergraduates

in the Research University. (1998). Reinventing

undergraduate education: A blueprint for America’s research universities. Princeton, NJ: Carnegie Foundation for the Advancement of Teaching.

Demski, J. (2002a, Summer). President’s

mes-sage. Accounting Education News,1. [Sarasota,

FL: American Accounting Association.] Demski, J. (2002b). Reinvigorating accounting

scholarship. Accounting Education News

(Annual Meeting Issue), 3. [Sarasota, FL: American Accounting Association.]

Gray, R., Owen, D., & Adams, C. (1996).

Accounting and accountability: Corporate social and environmental reporting in a chang-ing world. London, UK: Prentice Hall. Ijiri, Y. (1983). Accountability-based conceptual

framework. Journal of Accounting and Public

Policy, 2(2), 75–81.

Laughlin, R., & Puxty, A. G. (1981, Spring). Decision-usefulness orientation, wrong cart,

wrong horse. British Accounting Review,

43–87.

Magill, M., & Quinzii, M. (1998). Incomplete

markets. Cambridge, MA: MIT Press.

Powers, W. C., Jr. (2002, February 1). Report of

investigation by the Special Investigative Com-mittee of the Board of Directors of Enron Corp. Houston, TX: Enron Corporation.

Scholes, M. S., & Wolfson, M. A. (1992). Taxes

and business strategy: A planning approach. Englewood Cliffs, NJ: Prentice Hall.

Scott, W. R. (1997). Financial accounting theory.

Upper Saddle River, NJ: Prentice Hall. Stone, D. N., & Shelley, M. K. (1997). Educating

for accounting expertise: A field study. Journal

of Accounting Research(Supplement), 35–61.