DAFTAR LAMPIRAN

Lampiran I

Data

Return

Saham Rata-rata Indeks LQ-45

Lanjutan Lampiran I

Data

Return

Saham Rata-rata Indeks LQ-45

No

Kode

Emiten

Hari Perdagangan

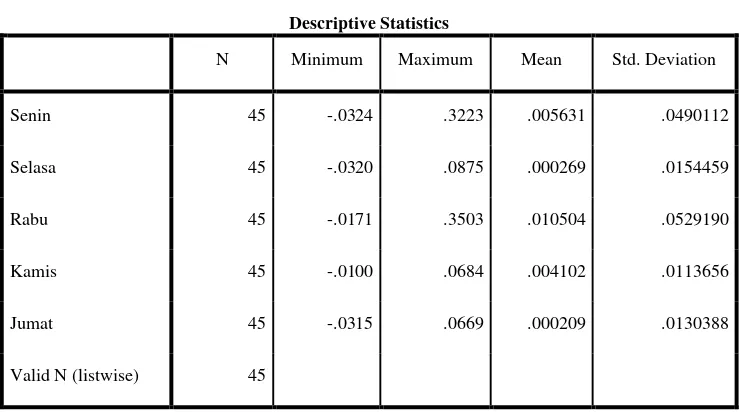

Lampiran 2

Tabel Analisis Deskriptif

Descriptive Statistics

N Minimum Maximum Mean Std. Deviation

Senin 45 -.0324 .3223 .005631 .0490112

Selasa 45 -.0320 .0875 .000269 .0154459

Rabu 45 -.0171 .3503 .010504 .0529190

Kamis 45 -.0100 .0684 .004102 .0113656

Jumat 45 -.0315 .0669 .000209 .0130388

Valid N (listwise) 45

One-Sample Kolmogorov-Smirnov Test

Unstandardized

Residual

N 45

Normal Parametersa,b Mean .0000000

Std. Deviation .00415161

Most Extreme Differences Absolute .073

Positive .073

Negative -.069

Kolmogorov-Smirnov Z .487

Asymp. Sig. (2-tailed) .971

a. Test distribution is Normal.

Uji Heteroskedastisitas

a. Dependent Variable: absut

Uji Autokorelasi

a.

Predictors: (Constant), Jumat, Kamis, Rabu, Selasa, Senin

Hasil Uji Multikolinieritas

Coefficientsa

Model

Unstandardized Coefficients

Standardized

Coefficients

t Sig.

Collinearity Statistics

B Std. Error Beta Tolerance VIF

1 (Constant) -.001 .001 -1.553 .128

Senin 1.039 .015 .763 70.635 .000 .850 1.176

Selasa .135 .046 .031 2.945 .005 .876 1.142

Rabu .891 .013 .707 67.068 .000 .894 1.118

Kamis .943 .059 .161 15.910 .000 .974 1.027

Jumat 1.032 .055 .202 18.816 .000 .864 1.157

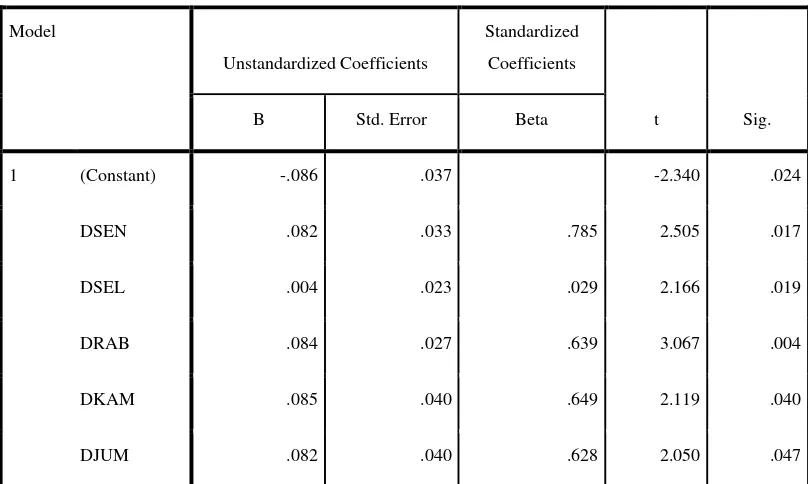

Lampiran 3

Tabel Analisis Hipotesis Pertama

Coefficientsa

a. Dependent Variable: Return_Saham

Tabel Analisis Hipotesis Kedua

Coefficientsa