Full Terms & Conditions of access and use can be found at

http://www.tandfonline.com/action/journalInformation?journalCode=vjeb20

Download by: [Universitas Maritim Raja Ali Haji], [UNIVERSITAS MARITIM RAJA ALI HAJI

TANJUNGPINANG, KEPULAUAN RIAU] Date: 12 January 2016, At: 17:54

Journal of Education for Business

ISSN: 0883-2323 (Print) 1940-3356 (Online) Journal homepage: http://www.tandfonline.com/loi/vjeb20

The Effects of the 150-Credit-Hour Requirement

for the Certified Public Accountant (CPA) Exam on

the Career Intentions of Women and Minorities

James Lloyd Bierstaker , Martha A. Howe & Inshik Seol

To cite this article: James Lloyd Bierstaker , Martha A. Howe & Inshik Seol (2005) The Effects of the 150-Credit-Hour Requirement for the Certified Public Accountant (CPA) Exam on the Career Intentions of Women and Minorities, Journal of Education for Business, 81:2, 99-104, DOI: 10.3200/JOEB.81.2.99-104

To link to this article: http://dx.doi.org/10.3200/JOEB.81.2.99-104

Published online: 07 Aug 2010.

Submit your article to this journal

Article views: 29

View related articles

ABSTRACT. In most states, students

who sit for the certified public accountant

(CPA) examination are now required to

have 150 credit hours of college education.

In this article, the authors examined the

effects of this requirement on the career

intentions of women and minorities. The

authors collected data from 600 accounting

students and the results suggested that the

150-credit-hour requirement might deter

some women from pursuing the CPA, but

would not be a deterrent for minorities.

Copyright © 2005 Heldref Publications

The Effects of the 150-Credit-Hour

Requirement for the Certified Public

Accountant (CPA) Exam on the Career

Intentions of Women and Minorities

JAMES LLOYD BIERSTAKER MARTHA A. HOWE INSHIK SEOL VILLANOVA UNIVERSITY BENTLEY COLLEGE CLARK UNIVERSITY

VILLANOVA, PENNSYLVANIA WALTHAM, MASSACHUSETTS WORCESTER, MASSACHUSETTS

he 150-credit-hour requirement for the certified public accoun-tant (CPA) exam has become law in 48 out of 54 licensing jurisdictions. For many districts, this standard became effective in 2000. Although the ruling takes slightly different forms and became (or will become) effective at different times in different states, it basically requires that candidates for the CPA exam complete 150 semester hours of college education. In essence, this means that students must complete a fifth year of college to be eligible to sit for the exam. The expected advan-tages of 150 hours of study include better preparation of accounting stu-dents for careers in public accounting, ability to attract better students to the profession, enhanced image for the profession, more well-rounded educa-tion, and higher passing rates on the CPA exam (Novin & Tucker, 1993).

One of the major concerns about the required additional education has been that the cost of that extra year of col-lege may discourage students from entering the profession. In particular, the 150-hour requirement may have a disproportionate effect on minorities and women, whose commitment to public accounting as a long-term career has been somewhat tenuous. Prior to the 150-hour requirement, the accounting profession became increas-ingly successful in attracting women to

the profession, but had difficulty retaining them. The profession had a similar problem with retention of minorities, but had even more diffic-ulty in attracting them (Mitchell & Flintall, 1990).

Although research has mostly upheld the benefits of the 150-credit-hour requirement, unless minorities and women understand those benefits and perceive them to exceed their costs, the accounting profession may not succeed in attracting the best and the brightest from their ranks, and, in fact, may attract very few women and minorities at all (Carroll, 1997). Both the American Legislative Exchange Council (ALEC) and the State Regula-tory and Oversight Committee of the National Society of Public Accoun-tants oppose the 150-credit-hour rule and claim that the requirement would discriminate against minorities and lower income students who are less able to absorb the increased cost imposed by the additional education (Shapiro, 1995). However, it is possi-ble that women and minorities may be drawn into the accounting profession if they perceive it to be more prestigious because of the additional education requirements (Hollander & Spector, 1997).

Given the strong and growing market for accounting services among minority companies and the changing

demo-T

graphics of American society, it is more important than ever for the accounting profession to attract and retain women and minorities (Thibadoux, Jeffords, & Greenberg, 1994). In this study, we examined the perceptions of women and minority students regarding the 150-credit-hour rule and its possible effects on their career plans.

Literature Review

The 150-Credit-Hour Rule

Forty-five states have now adopted the 150-credit-hour rule, with Florida being the first in 1983. One of the initial arguments leading to the rule was that a 4-year baccalaureate education could no longer provide the broad range of knowledge and skills needed for success in the accounting profession, including problem-solving skills, technological skills, difficult technical issues, ethical issues, and matters of professional judg-ment (Bandy, 1990; Sharp & Stephens, 1994).

Another goal of enacting the 150-credit-hour rule was to attract better students into the accounting field (Novin & Tucker, 1993). However, some practitioners have been con-cerned that the new requirement will lead to a shortage of quality students choosing to pursue an accounting career (Frieswick, 2000). In fact, the American Institute of Certified Public Accountants (AICPA) reported that the number of students enrolled in accounting programs was down 23% from 1995 to 1999 (American Institute of Certified Public Accountants 1997, 1999) and Rankin and Cumming (2001) noted that the number of accounting majors at a school in Ohio dropped by about 20% with the incep-tion of the 150-credit-hour rule. They found that about 83% of those who did choose to major in accounting still planned to become CPAs, whereas that figure dropped to below two-thirds in other studies (Bierstaker, Howe, & Seol, 2004; Covaleski, 2000). Howev-er, to date, little research is available on the impact of the 150-credit-hour rule on the perceptions of women and minorities regarding the accounting profession.

Minorities in the Accounting Profession

The accounting profession has had a history of difficulty attracting minorities. In 1969 there were only 150, or just 0.15%, African American CPAs, in the United States (Mitchell & Flintall, 1990). In 1970, the AICPA council called for full integration of the CPA profession. By 1976, the number of African American CPAs had increased to 450, or 0.3%. In 1989, the number of African American CPAs was no more than 2,500, or less than 1%. As of 2001, minorities repre-sented approximately 5% of all CPAs in the United States (Giles, 2001).

The percentage of minority students enrolled in accounting programs has remained constant from 1995 to 2000 (Nelson, Vendrzyk, Ouirin, & Allen, 2002). However, many are choosing to go into fields other than public account-ing. Of those African American accoun-tants who do begin their careers in public accounting, few become partners and many leave to take jobs in industry, acad-emia, or nonprofit entities or to explore other opportunities (Mitchell & Flintall, 1990).

To date, there has been little research specifically on the effect of the 150-credit-hour requirement on minorities entering into the accounting profession. Carroll (1997) suggested that the extra year of education may discourage minorities from joining the accounting profession. However, Hollander and Spector (1997) pointed out that the rep-resentation of minorities was much higher in medicine and law than in accounting even though more education is required in those fields. Mitchell and Flintall (1990) indicated that many African American CPAs already pursue formal education beyond the baccalau-reate degree, with 32% holding master’s degrees, 3% holding law degrees, and 2% holding doctoral degrees. In addi-tion, Robinson-Backmon and Weisen-feld (2001) reported that African-Amer-ican women may be attempting to overcome perceived discrimination bar-riers by obtaining advanced degrees.

Women in the Accounting Profession

In contrast to minorities, the percent-age of women CPAs has increased signif-icantly over time. In 1975, women

repre-sented 11% of CPAs whereas, by 1990, that percentage had increased to 33% (Mitchell & Flintall, 1990), and by 1995, the percentage of women in the account-ing profession (52%) was greater than that of men (U.S. Department of Labor, 1996). Similarly, by 1995, more women (56%) than men were pursuing account-ing undergraduate degrees (AICPA, 1996). Furthermore, the percentage of women in graduate accounting programs (52%) has now surpassed the percentage of men (Nelson et al., 2002).

Although the percentage of women entering the profession may be growing, the percentage of female managers and partners is still relatively small com-pared with men. For example, an AICPA study revealed that 48% of all new hires over a 3-year period were women (Goodman, 1994), but during that same period only 26% of those admitted to partner were women. In addition, although 52% of accounting graduates in 1992 were women, only 13% of those who made partner at firms with more than 20 people were women. In general, attrition has been high for women CPAs (Anderson, Johnson, & Reckers, 1994; Earnest & Lampe, 1982). Possible reasons for this include work-life balance issues (Dalton, Hill, & Ramsay, 1997; Hooks, Thomas, & Stout, 1997), lifestyle preferences (Bernardi & Arnold, 1998; Bernardi & Hooks, 2001; Gaffney, McEwen, & Welsh, 1993; Reed & Kratchman, 1990; Street, Schroeder, & Schwartz, 1993), and gender discrimination (Robinson-Backmon & Weisenfeld, 2001) or per-ceived discrimination (Gaffney et al.; Reed & Kratchman; Street et al.).

Research regarding wage rates in accounting has shown that women accountants generally earn less than equally qualified men (Schroeder & Reichardt, 1995). Earnings differentials between male and female accountants appear to exist regardless of their level of education or work experience (Con-nor & Kemp, 1987; Schaefer & Zim-mer, 1995). Researchers have suggested that one of the major reasons for the lower earnings of women is labor mar-ket discrimination against women (Bell, Randel, & Williams, 1995). Similar to minorities, women who encounter barri-ers in the public accounting sector may

choose to go elsewhere or start their own firms to gain more control over their careers (May, 1994).

Research Questions

Although some authorities suggest that additional required education for entry in the public accounting field is a deterrent for minorities, others disagree, pointing to the high representation of minorities in fields such as medicine and law. Similarly, the recent shift toward a greater percentage of women in graduate accounting programs, and in the accounting profession in general, might suggest that the 150-credit-hour rule may not deter women from going into public accounting. However, given the retention problems that public accounting has with its minority and female employees, it is also possible that women and minorities tend to see a job in public accounting as a stepping stone, and they may be unwilling to invest the extra time and money for the 150-credit-hour requirement when pub-lic accounting is not their ultimate goal. The first research questions that we formed addressed the issue as it per-tained to the 150-credit-hour require-ment for the CPA exam: What impact does the 150-credit-hour rule have on minority students’ intentions to become a CPA? and What impact does the 150-credit-hour rule have on female stu-dents’ intentions to become a CPA?

If, as history has suggested, minority students envision public accounting as a stepping stone, they may be interested in pursuing different courses and degrees than nonminority students, who may be more drawn to a longer term public accounting career. As with minorities, women are less likely to remain in public accounting. Thus, as they plan for a future beyond public accounting, they may choose degrees that are more consis-tent with that inconsis-tent. For example, recent CPA candidates that worked in industry, government, and other organizations were most satisfied with their graduate education if they had earned an MBA rather than a more narrow graduate degree (Donelan & Philipich, 2001). This led us to form the following research questions: (a) Which degrees do minority students intend to pursue to complete the

additional required education? and (b) Which degrees do female students intend to pursue to complete the additional required education?

One of the expectations about the 150-credit-hour rule was that it would result in higher starting salaries and other com-pensation for accountants (Acton & Davidson, 1989). In fact, Frieswick (2000) reported that accounting salaries rose 31% from 1995–2000. However, other evidence has been less optimistic, pointing to little or no additional tuition assistance (Cumming & Rankin 1999; Rankin & Cumming, 2001) and just a moderate salary increase. For example, in Florida, 150-credit-hour hires started at about $2,000 (8.3%) more than 4-year hires (Donelan, 1999; Rankin & Cum-ming, 1998). Similarly, Hollander and Spector (1997) reported that master’s degree graduates received about $2,000 more from accounting firms than did undergraduates.

Because minorities and women may leave public accounting quickly to pursue jobs elsewhere, they may be more con-cerned about receiving adequate com-pensation for the additional educational costs required by the 150-credit-hour rule. For women, the benefit of a career in public accounting may be further reduced because of the lower salaries offered to women, and they may there-fore consider the 5th year of education to be too costly unless firm compensation for that 5th year is high. At the same time, they may have lower expectations that the firms will in fact provide adequate compensation for the extra cost of the 150-credit-hour requirement. The follow-ing questions in our research explored these issues: (a) What additional com-pensation do minority students expect? and (b) What additional compensation do female students expect?

METHODS

We developed a questionnaire to probe the perceptions of students regarding the benefits and costs of the 150-credit-hour rule, particularly as it affects women and minorities. The questionnaire was used to collect data from approximately 600 business stu-dents at one private business college and one public university in the Northeast in

a state where the 150-credit-hour requirement had been passed, but was not yet in effect. Large international accounting firms as well as smaller regional accounting firms typically hire students from the schools studied.

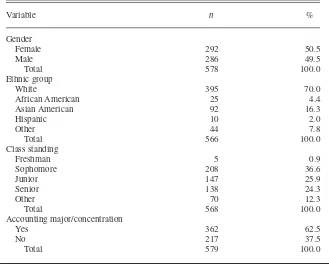

We distributed the questionnaires to students in accounting classes. Students were told that the purpose of the survey was to gather their perceptions regarding the 150-credit-hour rule. Although the questionnaire was optional, the response rate was nearly 100%. The demographic data for students is shown in Table 1. Sur-veys were evenly divided between gen-ders. Approximately 70% of students were White and 30% were minorities. About 37% of students were sopho-mores, 26% were juniors, 24% were seniors, and the remainder either gradu-ate students or students who were not fully matriculated. Slightly over half of the students reported that accounting was their intended major or concentration.

RESULTS

The first research question concerned the likelihood that minority students and female students intended to pursue the CPA, in light of the 150-credit-hour rule. Students were asked for their first choice among options that included pur-suing a CPA, a Certified Management Accountant (CMA), or neither. The results are shown in Table 2. We found moderately significant differences between minority and nonminority stu-dents,χ2(4,N = 527) = 8.9,p= .063, with about 43% of the minority students expressing their intention to pursue the CPA, as compared with 40% of nonmi-nority students, and about 22% of the minority students choosing the CMA, as compared to 16% of nonminority dents. The preference of minority stu-dents to become certified is clear. Over-all, about 66% of the minority students intend to pursue either the CPA or the CMA, versus about 57% of the nonmi-nority students.

Results for female students were sig-nificantly different from males’ respons-es,χ2(4,N = 537) = 11.404,p = .022, but in this case, the women were lesslikely to choose the CPA than men were (39% vs. 44%, respectively). However, women were far more likely than men were to

say that they intended to pursue the CMA (24% vs. 13%, respectively). Overall, women were more likely to choose certi-fication (either CPA or CMA) than men were (62.6% vs. 56.7%, respectively).

To assess students’ preferences as to how they would complete the additional 30 credits beyond the undergraduate degree, we asked for students’ first choices among various degree options. The results of our findings are shown in Table 3. There were no significant

dif-ferences between the minority and the nonminority students on this issue. Most students were interested in earning a master’s degree rather than simply tak-ing more undergraduate courses, with the most frequent choice by far being the MBA (64%), followed by a master’s of science, or MS (14%). Similarly, men and women were quite consistent in their response to the survey question about the degrees that they would prefer to earn for their additional 30 credits.

Both men and women strongly preferred an MBA (64%) to any other degree choice for the extra 30 credit hours.

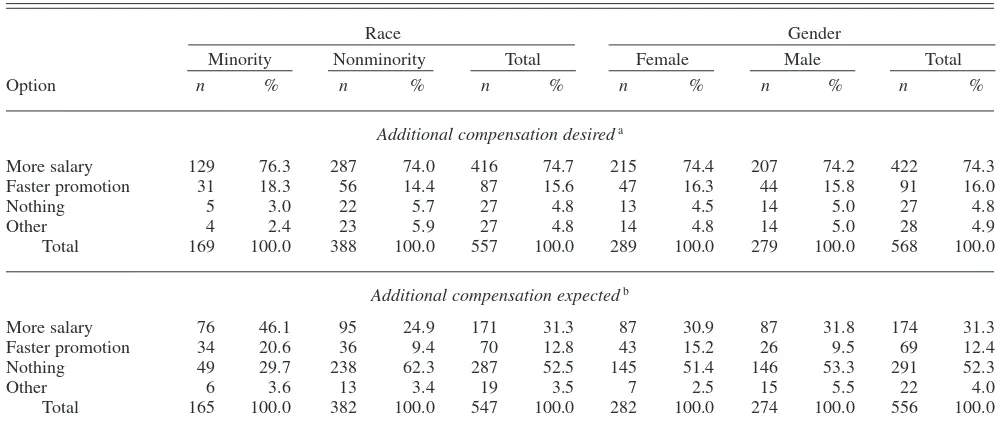

The last research question concerned compensation that students expected from employers for the additional year that they would need to spend in college (Table 4). In terms of what type of compensation students thought that their employers should offer, there were no significant differences between minority and nonminority students, with both groups choosing higher salary (75%), followed by faster promotion (16%). However, when asked what they actually expected firms to do in terms of compensation for the 5th year, the dif-ferences were highly significant,χ2(3,

N = 547) = 51.2, p = .0001. Minority students were more likely than were their counterparts to believe that the firms would offer a higher salary (46% vs. 25%, respectively), or that the firms would offer faster promotion (21% vs. 9%, respectively). Minorities were also less likely than their counterparts to believe that the firms would do nothing to compensate the students (30% vs. 62%, respectively).

Between men and women, there were no significant differences concerning the type of compensation they thought firms should offer, with the majority (74%) choosing higher salary. We found similar results when we asked men and women what they expected their employers would actually do. A majority (52%) of

TABLE 2. Impact of 150-Credit-Hour Requirement for Certified Public Accountant (CPA) Exam on Students’ Career Intentions, by Race and Gender

Racea Genderb

Minority Nonminority Total Female Male Total

Option n % n % n % n % n % n %

Pursue CPA anyway 69 43.7 149 40.4 218 41.4 103 38.6 118 43.7 221 41.2 Consider the CMA

instead 35 22.2 60 16.3 95 18.0 64 24.0 35 13.0 99 18.4

Pursue neither CMA

nor CPA 29 18.4 62 16.8 91 17.3 40 15.0 52 19.3 92 17.1

Consider other

majors 17 10.8 55 14.9 72 13.7 34 12.7 39 14.4 73 13.6

Other 8 5.1 43 11.7 51 9.7 26 9.7 26 9.6 52 9.7

Total 158 100.0 369 100.0 527 100.0 267 100.0 270 100.0 537 100.0

Note. Students were asked to indicate their first choice from the options presented. CMA = certified management accountant. a

χ2(4,N= 527) = 8.930,p= .063. b

χ2(4,N= 537) = 11.404,p= .022.

TABLE 1. Student Demographic Data

Variable n %

Gender

Female 292 50.5

Male 286 49.5

Total 578 100.0

Ethnic group

White 395 70.0

African American 25 4.4

Asian American 92 16.3

Hispanic 10 2.0

Other 44 7.8

Total 566 100.0

Class standing

Freshman 5 0.9

Sophomore 208 36.6

Junior 147 25.9

Senior 138 24.3

Other 70 12.3

Total 568 100.0

Accounting major/concentration

Yes 362 62.5

No 217 37.5

Total 579 100.0

both men and women thought that they were likely to receive no additional com-pensation from employers.

Conclusions

The results of this research, using data collected from approximately 600 accounting students, indicate that greater percentages of minority students are con-sidering both the CPA exam and the CMA exam than are nonminority stu-dents. This suggests that the 150-credit-hour requirement will not deter

minori-ties from becoming CPAs. However, we found that female students are less likely than are male students to plan to pursue the CPA, although they are more likely to be interested in the CMA, and more like-ly overall to prefer certification. This may indicate that the 150-hour requirement has had some deterring effect on the career planning of female students, with 38% intending to pursue the CPA, versus 42% of the male students.

In response to the concern that minori-ties would be less able to afford the cost

of the additional education required by the 150-credit-hour rule, we found that minority students are more optimistic than are nonminority students that they will receive additional compensation from employers for their 5th year of study. These findings may suggest that the outreach efforts of public accounting firms have been relatively successful with minority groups, who appear to value the CPA designation, and also trust that they will be appropriately compen-sated for their additional education. TABLE 3. Degrees Students Would Pursue to Obtain Required Education for Certified Public Accountant Exam, by Race and Gender

Racea Genderb

Minority Nonminority Total Female Male Total

Option n % n % n % n % n % n %

Master of Business

Administration 110 64.7 244 64.2 354 64.4 186 65.5 175 63.2 361 64.3 Master of Science 26 15.3 53 13.9 79 14.4 42 14.8 38 13.7 80 14.3 Graduate certificate 14 8.2 28 7.4 42 7.6 17 6.0 26 9.4 43 7.7 Bachelor of Science,

special designation 9 5.3 19 5.0 28 5.1 17 6.0 11 4.0 28 5.0

No preference 11 6.5 36 9.5 47 8.5 22 7.7 27 9.7 49 8.7

Total 170 100.0 380 100.0 550 100.0 284 100.0 277 100.0 561 100.0

Note. Students were asked to indicate their first choice from among the degree options. a

χ2(4,N= 550) = 1.528,p= .822. b

χ2(4,N= 561) = 4.128,p= .389.

TABLE 4. Desired and Expected Additional Compensation for Extra Cost of 150-Credit-Hour Requirement for Certi-fied Public Accountant Exam, by Race and Gender

Race Gender

Minority Nonminority Total Female Male Total

Option n % n % n % n % n % n %

Additional compensation desireda

More salary 129 76.3 287 74.0 416 74.7 215 74.4 207 74.2 422 74.3 Faster promotion 31 18.3 56 14.4 87 15.6 47 16.3 44 15.8 91 16.0

Nothing 5 3.0 22 5.7 27 4.8 13 4.5 14 5.0 27 4.8

Other 4 2.4 23 5.9 27 4.8 14 4.8 14 5.0 28 4.9

Total 169 100.0 388 100.0 557 100.0 289 100.0 279 100.0 568 100.0

Additional compensation expectedb

More salary 76 46.1 95 24.9 171 31.3 87 30.9 87 31.8 174 31.3 Faster promotion 34 20.6 36 9.4 70 12.8 43 15.2 26 9.5 69 12.4 Nothing 49 29.7 238 62.3 287 52.5 145 51.4 146 53.3 291 52.3

Other 6 3.6 13 3.4 19 3.5 7 2.5 15 5.5 22 4.0

Total 165 100.0 382 100.0 547 100.0 282 100.0 274 100.0 556 100.0

Note. Students were asked what types of compensation they thought employers shouldoffer and what they thought employers would actuallyoffer. aFor Race,χ2(3,N= 557) = 6.106,p= .107; for Gender,χ2(3,N= 568) = 0.112,p= .990. bFor Race,χ2(3,N= 547) = 51.179,p= .000; for Gender,χ2(3,N = 556) = 6.987,p= .072.

A limitation of this research is that it focused only on the perceptions of the students, not on the reality of whether or not the 150-credit-hour requirement has influenced the entrance of minorities and women into the accounting profes-sion. Further research is needed to determine if, with the inception of the 150-credit-hour rule, changes have occurred in the number of minorities and women taking the CPA exam, and in their attrition levels at CPA firms.

ACKNOWLEDGMENT

We thank the students who participated in this study.

NOTE

Correspondence concerning this article should be directed to Inshik Seol, Clark University, 950 Main Street, Worcester, Massachusetts 01610. E-mail: iseol@clarku.edu.

REFERENCES

Acton, D., & Davidson, S. (1989). The 150-hour requirement: How CPA firms plan to adapt. The Ohio CPA Journal, 48(2), 31–34.

American Institute of Certified Public Accoun-tants (AICPA). (1996). The supply of account-ing graduates and the demand for public accounting recruits. New York: Author. American Institute of Certified Public

Accoun-tants (AICPA). (1997). The supply of account-ing graduates and the demand for public accounting recruits. New York: Author. American Institute of Certified Public

Accoun-tants (AICPA). (1999). The supply of account-ing graduates and the demand for public accounting recruits. New York: Author. Anderson, J. C., Johnson, E. N., & Reckers, P. M. J.

(1994). Perceived effects of gender, family struc-ture, and physical appearance on career progres-sion in public accounting: A research note.

Accounting, Organizations and Society, 19, 483–491.

Bandy, D. (1990). Accounting education at the crossroads. The CPA Journal, 60(8), 12. Bell, K., Randel, R., & Williams, K. (1995).

Women in management accounting: Deter-mined to succeed. Management Accounting, 77(5), 20–29.

Bernardi, R. A., & Arnold, D. F. (1998). The gen-der mix at the upper staff levels in public accounting: A baseline evaluation. Advances in Accounting Behavioral Research, 1, 145–171. Bernardi, R. A., & Hooks, K. L. (2001). The

rela-tionships among lifestyle preference, attrition, and career orientation: A three-year longitudi-nal study. Advances in Accounting Behavioral Research, 4, 207–232.

Bierstaker, J., Howe, M., & Seol, I. (2004). Accounting majors’ perceptions regarding the 150-hour rule. Issues in Accounting Education, 19(2), 211–227.

Carroll, L. (1997). The 150-hour rule: Bad idea then, worse idea now. Accounting Today, 11(17), 2–3.

Connor, P., & Kemp, A. (1987). Gender differ-ences in labor market wages: A comparison of industrial sector effects and a decomposition within four occupations. Social Science Jour-nal, 24, 429–442.

Covaleski, J. (2000). 150-hour rule goes national.

Accounting Today, 14(7), 1–2.

Cumming, J., & Rankin, L. (1999). 150 hours: A look back. Journal of Accountancy, 187(4), 53. Dalton, D. R., Hill, J. W., & Ramsay, R. R. (1997). Women as managers and partners: Context spe-cific predictors of turnover in public account-ing. Auditing: A Journal of Practice & Theory, 16, 29–50.

Donelan, J. (1999). The 150-hour requirement: Implications for recruiting accounting gradu-ates. Ohio CPA Journal, 58(4), 41–44. Donelan, J. G., & Philipich, K. L. (2001). Getting

to 150 hours: A survey of CPA exam candi-dates. The CPA Journal, 71(8), 68–71. Earnest, K. R., & Lampe, J. C. (1982). Attitudinal

differences between male and female auditors.

The Woman CPA, 44(3), 13–20.

Frieswick, K. (2000, December). Where have all the CPAs gone? CFO: The magazine for senior financial executives,pp. 101–102.

Gaffney, M. A., McEwen, R. A., & Welsh, J. (1993). Gender effects on commitment of pub-lic accountants: A test of competing sociologi-cal models. Advances in Public Interest Accounting, 5, 45–73.

Giles, D. K. (2001). It is an exciting time for accounting majors. The Black Collegian, 31(2), 64–71.

Goodman, B. (1994). Firm barriers: Despite advances, women still shunned from the partner suite. Accounting Today, 8(12), 1–2.

Hollander, T. E., & Spector, C. A. (1997). The 150-hour rule lays a foundation for the future.

Accounting Today, 11(16) , 2–4.

Hooks, K. L., Thomas, P. B., & Stout, W. D. (1997). Retention of women in public

account-ing: Directions for the future. Advances in Accounting, 15, 17–48.

May, L. B. (1994). AWSCPA will promote equity within accounting, says president. Journal of Accountancy, 178(6), 16–18.

Mitchell, B. N., & Flintall, V. L. (1990). The sta-tus of the black CPA: Twenty five year update.

Journal of Accountancy, 170(2), 59–73. Nelson, I. T., Vendrzyk, V. P., Ouirin, J. J., &

Allen, R. D. (2002). No the sky is not falling: Evidence of accounting student characteristics at FSA schools, 1995–2000. Issues in Account-ing Education, 17(3), 269–287.

Novin, A. M., & Tucker, J. M. (1993). The com-position of 150-hour accounting programs: The public accountants’ point of view. Issues in Accounting Education, 8(2), 273–291. Rankin, L., & Cumming, J. (1998). Understanding

Ohio’s 150-hour education requirements. The Ohio CPA Journal, 57(1), 39–42.

Rankin, L., & Cumming, J. (2001). How Miami graduates responded to Ohio’s 150-hour law.

The Ohio CPA Journal, 60(2), 15.

Reed, S., & Kratchman, S. (1990). The effects of changing role requirements on accountants.

Advances in Public Interest Accounting, 3, 107–136.

Robinson-Backmon, I., & Weisenfeld, L. (2001). An investigation of perceived discrimination and career advancement curtailment: The African-American female accountant’s perspective.

Advances in Public Interest Accounting, 8, 241–275.

Schroeder, D., & Reichardt, K. (1995). Salary survey 1994. Management Accounting, 75(12), 24–34. Schaefer, J., & Zimmer, M. (1995). Gender and

earnings of certain accountants and auditors: A comparative study of industries and regions.

Journal of Accounting and Public Policy, 14, 265–291.

Shapiro, L. (1995). When more may be too much: The 150-hour rule. The National Public Accountant, 40(6), 7–11.

Sharp, R. F., & Stephens, R. G. (1994). Imple-menting the 150-hour rule: 1993 survey and curricula issues. The Ohio CPA Journal, 53(1), 9–15.

Street, D. L., Schroeder, R. G., & Schwartz, B. (1993). The central life interests and organiza-tional commitment of men and women employed by public accounting firms. Advances in Public Interest Accounting, 5, 201–229.

Thibadoux, G. M., Jeffords, R., & Greenberg, I. S. (1994). Plugging into minority markets. Jour-nal of Accountancy, 178(3), 50–56.

U.S. Department of Labor. Bureau of Labor Sta-tistics. (1996). Employment and Earnings (Bul-letin 2307, pp. 405, 407, 411). Washington, DC: Author.