LAMPIRAN

Proses Pemilihan Sampel

No

Kode

Saham

Kriteria Sampel

Keterangan

Sampel

1

2

3

4

1

AGRO

-

2

BABP

-

-

3

BACA

Sampel 1

4

BAEK

Sampel 2

5

BBCA

Sampel 3

6

BBKP

Sampel 4

7

BBMD

-

8

BBNI

Sampel 5

9

BBNP

Sampel 6

10

BBRI

Sampel 7

11

BBTN

Sampel 8

12

BCIC

-

13

BDMN

Sampel 9

14

BEKS

-

-

15

BINA

-

16

BJBR

-

17

BJTM

-

18

BKSW

-

19

BMAS

-

20

BMRI

Sampel 10

21

BNBA

Sampel 11

22

BNGA

Sampel 12

23

BNII

Sampel 13

24

BNLI

Sampel 14

25

BSIM

-

26

BSWD

Sampel 15

27

BTPN

Sampel 16

28

BVIC

Sampel 17

29

DNAR

-

30

INPC

Sampel 18

31

MAYA

Sampel 19

32

MCOR

Sampel 20

33

MEGA

Sampel 21

34

NAGA

-

35

NISP

Sampel 22

36

NOBU

-

37

PNBN

Sampel 23

38

PNBS

-

39

SDRA

-

40

ADMF

Sampel 24

41

BBLD

Sampel 25

42

BFIN

Sampel 26

43

BPFI

Sampel 27

44

CFIN

Sampel 28

45

DEFI

Sampel 29

46

HDFA

-

47

IMJS

-

48

MFIN

Sampel 30

49

MNGA

-

50

TIFA

-

51

TRUS

Sampel 31

52

VRNA

Sampel 32

53

WOMF

Sampel 33

54

AKSI

-

55

HADE

Sampel 34

56

KREN

Sampel 35

57

OCAP

-

58

PADI

-

59

PANS

Sampel 36

60

PEGE

Sampel 37

61

RELI

Sampel 38

62

TRIM

-

63

YULE

-

64

ABDA

Sampel 39

65

AHAP

Sampel 40

66

AMAG

Sampel 41

67

ASBI

-

68

ASDM

Sampel 42

69

ASJT

Sampel 43

70

ASMI

-

71

ASRM

Sampel 44

72

LPGI

-

73

MREI

Sampel 45

74

PNIN

Sampel 46

75

APIC

Sampel 47

76

ARTA

Sampel 48

77

BCAP

Sampel 49

79

GSMF

-

80

LPPS

-

81

MTFN

-

82

PNLF

-

83

SMMA

Sampel 50

84

VICO

-

Perusahaan yang Menjadi Sampel

No

Kode Saham

Nama Emiten

1

BACA

Bank Capital Indonesia Tbk

2

BAEK

Bank Ekonomi Raharja

3

BBCA

Bank Central Asia Tbk

4

BBKP

Bank Bukopin Tbk

5

BBNI

Bank Negara Indonesia Tbk

6

BBNP

Bank Nusantara Parahyangan

7

BBRI

Bank Rakyat Indonesia Tbk

8

BBTN

Bank Tabungan Negara (Persero) Tbk

9

BDMN

Bank Danamon Indonesia Tbk

10

BMRI

Bank Mandiri (Persero) Tbk

11

BNBA

Bank Bumi Arta Tbk

12

BNGA

Bank CIMB Niaga Tbk

13

BNII

Bank Internasional Tbk

14

BNLI

Bank Permata Tbk

15

BSWD

Bank of India Indonesia Tbk

16

BTPN

Bank Tabungan Pensiunan Nasional Tbk

17

BVIC

Bank Victoria International Tbk

18

INPC

Bank Artha Graha International Tbk

19

MAYA

Bank Mayapada International Tbk

20

MCOR

Bank Windu Kentjana International

21

MEGA

Bank Mega Tbk

22

NISP

Bank NISP OCBC Tbk

23

PNBN

Bank Pan Indonesia Tbk

24

ADMF

Adira Dinamika Multi Finance Tbk

25

BBLD

Buana Finance Tbk

26

BFIN

BFI Finance Tbk

27

BPFI

Batavia Prosperindo Finance Tbk

28

CFIN

Clipan Finance Indonesia Tbk

29

DEFI

Danasupra Erapacific Tbk

30

MFIN

Mandala Multifinance Tbk

31

TRUS

Trust Finance Indonesia Tbk

32

VRNA

Verena Multi Finance Tbk

33

WOMF

Wahana Ottomitra Multiartha Tbk

34

HADE

HD Capital Tbk

35

KREN

Kresna Graha Sekurindo Tbk

36

PANS

Panin Sekuritas Tbk

37

PEGE

Panca Global Securitiest

38

RELI

Reliance Securities Tbk

39

ABDA

Asuransi Bina Darta Tbk

40

AHAP

Asuransi Harta Aman Pratama Tbk

41

AMAG

Asuransi Multi Artha Guna Tbk

42

ASDM

Asuransi Dayin Mitra Tbk

43

ASJT

Asuransi Jasa Tania Tbk

44

ASRM

Asuransi Ramayana Tbk

45

MREI

Maskapai Reasuransi

46

PNIN

Panin Insurance Tbk

47

APIC

Pacific Strategic Financia Tbk

48

ARTA

Artavest Tbk

49

BCAP

PT MNC Kapital Indonesia Tbk

50

SMMA

Sinar Mas Multiarta Tbk

Hasil Tabulasi Data

Perhitungan Index Smothing

Nama Perusahaan CV Laba CV

Pendapatan

Index Smoothing Bank Capital Indonesia Tbk 0,382265856 1,390363374 0,274939533 Bank Ekonomi Raharja Tbk 0,297568217 0,141293276 2,106032405 Bank Central Asia Tbk 0,542865879 0,302473423 1,794755631 Bank Bukopin Tbk 0,247131691 0,152768635 1,617686066 Bank Negara Indonesia (Persero) Tbk 0,238402554 0,147081331 1,620889285 Bank Nusantara Parahyangan Tbk 0,334349641 0,294945073 1,133599684 Bank Rakyat Indonesia Tbk 0,243444384 0,111187472 2,189494731 Bank Tabungan Negara (Persero) Tbk 0,225399738 0,218924525 1,029577378 Bank Danamon Indonesia Tbk 0,172341294 0,145300743 1,186100572 Bank Mandiri (Persero) Tbk 0,296710023 0,200916129 1,476785487 Bank Bumi Arta Tbk 0,337369019 0,649680723 0,51928433 Bank CIMB Niaga Tbk 0,237821653 0,149717322 1,588471196 Bank Internasional Indonesia Tbk 0,737476538 0,218471723 3,375615513 Bank Permata Tbk 0,212585815 0,175421849 1,211854828 Bank of India Indonesia Tbk 0,355114072 0,236758887 1,499897541 Bank Tabungan Pensiunan Nasional

Tbk 0,405583053 0,274479308 1,477645278

Ukuran Perusahaan

Nama Perusahaan Total Aktiva LN Aktiva

2011 2012 2013 2011 2012 2013

Bank Capital Indonesia Tbk

4.694.939.000.000

5.666.177.000.000

7.139.276.000.000 29,17751 29,36554 29,59663

Bank Bumi Arta Tbk

4.045.672.277.612 28,71727 28,87906 29,02867

Adira Dinamika Multi Finance Tbk

16.889.452.000.000

25.460.457.000.000

30.994.411.000.000 30,45771 30,86815 31,06483

BFI Finance Tbk

8.293.324.000.000 29,29963 29,51361 29,74647

Batavia Prosperindo Finance Tbk

368.493.042.965

529.226.619.902

799.047.730.064 26,63269 26,99468 27,40669

Clipan Finance Indonesia Tbk

4.785.503.756.000

4.853.634.854.000

6.074.469.071.000 29,19661 29,21075 29,43512

Trust Finance Indonesia Tbk

398.071.054.390

420.849.484.963

335.839.867.603 26,70990 26,76554 26,53990

Verena Multi Finance Tbk

1.512.172.883.000

1.955.435.569.000

2.100.164.342.000 28,04457 28,30163 28,37304

Panin Sekuritas Tbk

1.370.081.722.849 28,07733 28,13896 27,94589

Panca Global Securities

241.131.626.040

178.227.033.261

199.353.075.862 26,20861 25,90632 26,01834

Asuransi Ramayana Tbk

810.254.708.119

1.070.925.850.176

Winner/Losser Stock

Nama Perusahaan Rata-Rata Harga Saham Penutupan Bulanan IHSG Status Saham 2010 2011 2012 2013 2010 2011 2012 2011 2012 2013

Bank Capital Indonesia Tbk

Adira Dinamika Multi Finance Tbk

Batavia Prosperindo Finance Tbk

Clipan Finance Indonesia Tbk

Trust Finance Indonesia Tbk

Verena Multi Finance Tbk

Panca Global Securities

Asuransi Ramayana Tbk

Nilai Perusahaan

Nama PerusahaanPBV 2011

PBV

2012 PBV2013 Bank Capital Indonesia Tbk 0,19 0,83 0,8

Bank Bumi Arta Tbk 0,67 0,73 0,65

Adira Dinamika Multi Finance Tbk 2,87 1,95 1,45

BFI Finance Tbk 1,83 1,08 1,17

Batavia Prosperindo Finance Tbk 1,31 0,96 1,99 Clipan Finance Indonesia Tbk 0,75 0,62 0,56 Trust Finance Indonesia Tbk 1,9 1,09 0,89

Verena Multi Finance Tbk 0,7 0,47 0,38

Panin Sekuritas Tbk 1,18 2,42 2,77

Panca Global Securities 1,09 1 1,15

Asuransi Ramayana Tbk 0,81 1,31 1,17

Debt to Equity Ratio

Nama Perusahaan DER 2011 DER 2012 DER 2013

Bank Capital Indonesia Tbk 6,7119441 7,613987 6,876607 Bank Bumi Arta Tbk 5,2233876 5,666949 6,168059 Adira Dinamika Multi Finance Tbk 2,8199598 4,055924 4,146876 BFI Finance Tbk 1,2418668 1,295888 1,441111 Batavia Prosperindo Finance Tbk 1,2449985 1,807863 2,620954

Clipan Finance Indonesia Tbk 1,2014191 0,981162 1,197049 Trust Finance Indonesia Tbk 1,3923102 1,238944 0,64919 Verena Multi Finance Tbk 7,1515399 7,945392 7,210698 Panin Sekuritas Tbk 0,9910989 0,744566 0,329497

Leverage Financial

Nama Perusahaan

Debt Ratio 2011

Debt Ratio 2012

Debt Ratio 2013

Bank Capital Indonesia Tbk 0,87033101 0,883909733 0,873042028 Bank Bumi Arta Tbk 0,839315811 0,850006356 0,860492217 Adira Dinamika Multi Finance Tbk 0,738217143 0,802212231 0,80570739 BFI Finance Tbk 0,553943172 0,564438666 0,590350504 Batavia Prosperindo Finance Tbk 0,5545654 0,643857276 0,723829712

Clipan Finance Indonesia Tbk 0,545747551 0,495245816 0,544844086 Trust Finance Indonesia Tbk 0,581994015 0,553360865 0,393641868 Verena Multi Finance Tbk 0,877323793 0,888210606 0,878207669

Nama Perusahaan Index Smoothing LN Aktiva

Winner/Losser Stock

Nilai

Perusahaan DER Debt Ratio Bank Capital Indonesia Tbk 0,274939533 29,17750624 0 0,19 6,711944059 0,87033101

Bank Bumi Arta Tbk 0,51928433 28,71727349 1 0,67 5,223387647 0,839315811

Adira Dinamika Multi Finance Tbk 0,219280339 30,4577104 1 2,87 2,819959836 0,738217143

BFI Finance Tbk 0,521807003 29,29962885 1 1,83 1,241866816 0,553943172

Batavia Prosperindo Finance Tbk 0,613322213 26,63268767 1 1,31 1,244998481 0,5545654

Clipan Finance Indonesia Tbk 0,77754511 29,19661241 1 0,75 1,201419062 0,545747551 Trust Finance Indonesia Tbk 0,845269274 26,70989635 0 1,9 1,392310247 0,581994015 Verena Multi Finance Tbk 0,607072381 28,04456873 1 0,7 7,151539876 0,877323793 Panin Sekuritas Tbk 0,918806245 28,07732544 1 1,18 0,991098933 0,497764785

Panca Global Securities 0,502789198 26,20860879 0 1,09 0,679699031 0,40465525 Asuransi Ramayana Tbk 0,693119655 27,42061449 1 0,81 4,929406101 0,831349045 Bank Capital Indonesia Tbk 0,274939533 29,36553576 0 0,83 7,613986573 0,883909733

Bank Bumi Arta Tbk 0,51928433 28,87906341 0 0,73 5,66694917 0,850006356

Adira Dinamika Multi Finance Tbk 0,219280339 30,86814766 1 1,95 4,055924351 0,802212231

BFI Finance Tbk 0,521807003 29,51361044 1 1,08 1,29588791 0,564438666

Batavia Prosperindo Finance Tbk 0,613322213 26,99468257 1 0,96 1,807863067 0,643857276 Clipan Finance Indonesia Tbk 0,77754511 29,21074899 0 0,62 0,981162381 0,495245816

Trust Finance Indonesia Tbk 0,845269274 26,76554109 0 1,09 1,238943974 0,553360865 Verena Multi Finance Tbk 0,607072381 28,30163408 1 0,47 7,945392451 0,888210606 Panin Sekuritas Tbk 0,918806245 28,13896318 0 2,42 0,744566306 0,426791635 Panca Global Securities 0,502789198 25,90632404 1 1 0,113163985 0,101659761

Bank Bumi Arta Tbk 0,51928433 29,02866885 0 0,65 6,168058845 0,860492217

Adira Dinamika Multi Finance Tbk 0,219280339 31,06482801 0 1,45 4,146876155 0,80570739

BFI Finance Tbk 0,521807003 29,74647197 0 1,17 1,441111264 0,590350504

Batavia Prosperindo Finance Tbk 0,613322213 27,40668652 0 1,99 2,620954325 0,723829712

Clipan Finance Indonesia Tbk 0,77754511 29,43511571 0 0,56 1,197049339 0,544844086 Trust Finance Indonesia Tbk 0,845269274 26,5399003 1 0,89 0,649190382 0,393641868 Verena Multi Finance Tbk 0,607072381 28,37303672 1 0,38 7,210697592 0,878207669 Panin Sekuritas Tbk 0,918806245 27,94589151 1 2,77 0,329496881 0,247835768 Panca Global Securities 0,502789198 26,01834334 1 1,15 0,139565407 0,122472484

Hasil Olah Statistik

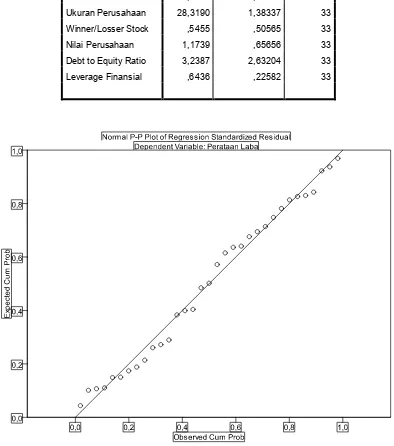

Hasil Statisitk Deskriptif

Descriptive StatisticsMean Std. Deviation N

Perataan Laba ,5903 ,21077 33

Ukuran Perusahaan 28,3190 1,38337 33

Winner/Losser Stock ,5455 ,50565 33

Nilai Perusahaan 1,1739 ,65656 33

Debt to Equity Ratio 3,2387 2,63204 33

Leverage Finansial ,6436 ,22582 33

Grafik Normal Probability Plot

Hasil Uji Kolmogorov-Smirnov

One-Sample Kolmogorov-Smirnov TestUnstandardized

Residual

N 33

Normal Parametersa,b Mean ,0000000

Std. Deviation ,16520365

Most Extreme Differences Absolute ,091

Positive ,091

Negative -,080

Kolmogorov-Smirnov Z ,521

Asymp. Sig. (2-tailed) ,949

a. Test distribution is Normal.

b. Calculated from data.

Hasil Nilai

Tolerance

dan VIF

Model

Collinearity Statistics

Tolerance

VIF

1 (Constant)

Hasil

Coefficient Correlations

Debt to Equity

Ratio

-,862 -,191 ,332 ,179 1,000

Covarian

ces

Leverage

Finansial

,125 ,005 -,002 -,004 -,009

Winner/Losser

Stock

,005 ,004 ,000 -8,040E-5 ,000

Nilai

Perusahaan

-,002 ,000 ,003 ,000 ,001

Ukuran

Perusahaan

-,004 -8,040E-5 ,000 ,001 ,000

Debt to Equity

Ratio

-,009 ,000 ,001 ,000 ,001

a. Dependent Variable: Perataan Laba

Hasil Uji Park

CoefficientsaModel Unstandardized

Coefficients

Standardized

Coefficients

t Sig. B Std. Error Beta

1 (Constant) -6,290 9,091 -,692 ,495

Ukuran Perusahaan ,141 ,355 ,084 ,397 ,695

Winner/Losser Stock ,305 ,822 ,066 ,371 ,713

Nilai Perusahaan ,740 ,705 ,209 1,050 ,303

Debt to Equity Ratio ,347 ,367 ,393 ,945 ,353

Leverage Finansial -6,979 4,464 -,679 -1,563 ,130

a. Dependent Variable: LnU2i

Hasil Uji Run Test

Runs TestUnstandardized

Residual

Test Valuea ,00084

Cases < Test Value 16

Cases >= Test Value 17

Total Cases 33

Number of Runs 16

Z -,349

Hasil Analisis Regresi Berganda

CoefficientsaModel Unstandardized

Coefficients

Standardized

Coefficients

t Sig. B Std. Error Beta

1 (Constant) 2,645 ,719 3,676 ,001

Ukuran Perusahaan ,073 ,028 -,480 2,602 ,015

Winner/Losser Stock -,025 ,065 -,060 -,384 ,704

Nilai Perusahaan -,023 ,056 -,070 -,404 ,689

Debt to Equity Ratio -,053 ,029 -,656 -1,807 ,082

Leverage Finansial ,354 ,353 ,379 1,002 ,325

a. Dependent Variable: Perataan Laba

Nilai Koefisien Determinasi

Model SummarybModel

R R Square

Adjusted R

Square

Std. Error of the

Estimate

dimension0

1 ,621a ,386 ,272 ,17985

a. Predictors: (Constant), Leverage Finansial, Winner/Losser Stock,

Nilai Perusahaan, Ukuran Perusahaan, Debt to Equity Ratio

b. Dependent Variable: Perataan Laba

Hasil Uji Signifikansi Simultan

ANOVAbModel Sum of

Squares df Mean Square F Sig.

1 Regression ,548 5 ,110 3,390 ,017a

Residual ,873 27 ,032

Total 1,422 32

a. Predictors: (Constant), Leverage Finansial, Winner/Losser Stock, Nilai Perusahaan, Ukuran

Perusahaan, Debt to Equity Ratio

Hasil Uji Signifikansi Parsial

CoefficientsaModel Unstandardized

Coefficients

Standardized

Coefficients

t Sig. B Std. Error Beta

1 (Constant) 2,645 ,719 3,676 ,001

Ukuran Perusahaan ,073 ,028 -,480 2,602 ,015

Winner/Losser Stock -,025 ,065 -,060 -,384 ,704

Nilai Perusahaan -,023 ,056 -,070 -,404 ,689

Debt to Equity Ratio -,053 ,029 -,656 -1,807 ,082

Leverage Finansial ,354 ,353 ,379 1,002 ,325