LAMPIRAN Lampiran 1: Data Perusahaan Sampel

No Kode Nama Sampel

1 AGRO Bank Rakyat Indonesia Agro Niaga Tbk Sampel 1 2 BACA Bank Capital Indonesia Tbk Sampel 2 3 BBCA Bank Central Asia Tbk Sampel 3

4 BBKP Bank Bukopin Tbk Sampel 4

5 BBNI Bank Negara Indonesia (Persero) Tbk Sampel 5 6 BBNP Bank Nusantara Parahyangan Tbk Sampel 6 7 BBRI Bank Rakyat Indonesia (Persero) Tbk Sampel 7 8 BBTN Bank Tabungan Negara (Persero) Tbk Sampel 8

9 BDMN Bank Danamon Indonesia Tbk Sampel 9 10 BMRI Bank Mandiri (Persero) Tbk Sampel 10 11 BNBA Bank Bumi Arta Tbk Sampel 11 12 BNGA Bank CIMB Niaga Tbk Sampel 12

13 BNII Bank Mybank Indonesia Tbk Sampel 13 14 BNLI Bank Permata Tbk Sampel 14 15 BSIM Bank Sinar Mas Tbk Sampel 15 16 BSWD Bank Of India Indonesia Tbk Sampel 16

17 BTPN Bank Tabungan Pensiunan Nasional Tbk Sampel 17 18 BVIC Bank Victoria International Tbk Sampel 18 19 INPC Bank Artha Graha International Tbk Sampel 19 20 MAYA Bank Mayapada International Tbk Sampel 20

21 MCOR Bank Windu Kentjana International Tbk Sampel 21

22 MEGA Bank Mega Tbk Sampel 22

23 NISP Bank NISP OCBC Tbk Sampel 23 24 PNBN Bank Pan Indonesia Tbk Sampel 24

No Kode Debt to Equity Ratio (DER)

2011 2012 2013 2014 2015 1 AGRO 9,014 9,863 5,123 6,063 5,185 2 BACA 6,712 7,614 6,877 8,497 10,543 3 BBCA 8,070 7,516 6,736 6,065 5,601

4 BBKP 12,073 12,147 10,179 10,589 11,523 5 BBNI 6,903 6,658 7,109 5,591 5,262 6 BBNP 10,276 11,419 8,489 7,320 6,205 7 BBRI 8,432 7,498 6,894 7,205 6,765 8 BBTN 11,172 9,872 10,350 10,844 11,396

9 BDMN 4,494 4,422 4,839 4,927 4,496 10 BMRI 7,204 6,778 6,721 6,648 6,161 11 BNBA 5,223 5,667 6,168 7,562 4,323 12 BNGA 8,080 7,715 7,455 7,196 7,328

13 BNII 10,934 10,975 10,327 8,783 9,012 14 BNLI 10,090 9,548 10,739 9,843 8,711 15 BSIM 11,864 7,300 5,335 5,727 6,594

16 BSWD 5,004 5,798 6,917 8,275 4,460 17 BTPN 7,305 6,640 6,031 5,108 4,600 18 BVIC 8,737 8,769 10,131 10,475 9,477 19 INPC 15,620 9,612 7,126 7,625 8,082 20 MAYA 6,785 8,301 8,955 11,683 9,313

21 MCOR 10,572 7,595 6,454 7,007 6,137 22 MEGA 11,696 9,414 9,865 8,580 4,932 23 NISP 8,079 7,841 6,226 5,918 6,341 24 PNBN 6,852 7,431 7,220 6,430 4,944

No Kode Return On Asset (ROA)

2011 2012 2013 2014 2015 1 AGRO 9,438 8,175 0,010 9,710 9,623 2 BACA 5,923 8,421 9,872 8,056 7,469 3 BBCA 0,028 0,026 0,029 0,030 0,030

4 BBKP 0,013 0,013 0,013 9,194 0,010 5 BBNI 0,019 0,021 0,023 0,026 0,018 6 BBNP 0,010 0,010 0,011 0,010 7,763 7 BBRI 0,032 0,034 0,034 0,030 0,029

8 BBTN 0,013 0,012 0,012 0,772 0,011 9 BDMN 0,024 0,026 0,023 0,014 0,013 10 BMRI 0,023 0,025 0,026 0,024 0,023

11 BNBA 0,014 0,016 0,014 0,010 0,867 12 BNGA 0,019 0,022 0,020 0,010 0,179 13 BNII 0,707 0,010 0,011 0,497 0,726 14 BNLI 0,011 0,010 0,010 0,856 0,135 15 BSIM 0,676 0,015 0,013 0,729 0,664

16 BSWD 0,023 0,022 0,023 0,020 0,734 17 BTPN 0,030 0,033 0,031 0,025 0,022 18 BVIC 0,016 0,014 0,014 0,495 0,405 19 INPC 0,523 0,649 0,011 0,472 0,284

20 MAYA 0,013 0,015 0,016 0,012 0,014 21 MCOR 0,561 0,014 0,989 0,541 0,668 22 MEGA 0,017 0,021 0,789 0,899 0,015

No Kode Ukuran Perusahaan

2011 2012 2013 2014 2015 1 AGRO 21,971 22,120 22,357 22,577 22,847 2 BACA 15,362 15,550 15,781 16,040 16,314 3 BBCA 19,761 19,909 20,023 20,130 20,203

4 BBKP 17,862 18,000 18,056 18,186 18,363 5 BBNI 19,516 19,625 19,773 19,848 20,047 6 BBNP 22,606 22,829 23,024 22,971 22,877 7 BBRI 19,968 20,128 20,255 20,503 20,594

8 BBTN 18,306 18,532 18,692 18,789 18,962 9 BDMN 18,771 18,864 19,032 19,092 19,052 10 BMRI 20,129 20,270 20,413 20,567 20,629

11 BNBA 28,717 28,879 29,029 29,271 29,513 12 BNGA 18,932 19,101 19,204 19,267 19,291 13 BNII 18,369 18,567 18,761 18,781 18,876 14 BNLI 18,434 18,697 18,926 19,038 19,023 15 BSIM 16,628 16,534 16,675 16,872 17,143

16 BSWD 28,364 28,563 28,912 29,280 29,437 17 BTPN 17,658 17,895 18,059 18,133 18,210 18 BVIC 23,192 23,387 23,677 23,785 23,870 19 INPC 30,585 16,840 16,869 16,971 17,039

20 MAYA 23,284 23,566 23,902 24,312 24,580 21 MCOR 15,680 15,687 15,885 16,095 16,127 22 MEGA 17,941 17,993 18,012 18,015 18,038

No Kode Audit Delay

2011 2012 2013 2014 2015

1 AGRO 0 1 1 1 1

2 BACA 0 0 0 0 0

3 BBCA 0 0 1 1 1

4 BBKP 0 0 0 0 0

5 BBNI 0 0 1 1 1

6 BBNP 0 0 1 1 1

7 BBRI 1 1 1 1 1

8 BBTN 1 1 1 1 1

9 BDMN 1 1 1 0 0

10 BMRI 0 1 1 1 1

11 BNBA 0 0 0 0 0

12 BNGA 1 1 1 1 1

13 BNII 1 1 1 1 1

14 BNLI 1 1 1 1 0

15 BSIM 1 0 0 0 0

16 BSWD 0 0 0 0 0

17 BTPN 1 1 1 1 1

18 BVIC 0 0 0 0 0

19 INPC 0 0 0 0 0

20 MAYA 0 0 0 0 0

21 MCOR 0 0 0 0 1

22 MEGA 0 0 1 0 0

23 NISP 1 1 1 1 1

24 PNBN 0 0 0 1 1

Lampiran 2: Hasil Olah Data SPSS

Statistik Deskriptif

N Minimum Maximum Mean Std.

Deviation Statistic Statistic Statistic Statistic Statistic DER

(X1)

125 3.20893 15.62025 7.8745819E0 2.31070996

ROA (X2)

125 .01005 9.87173 .8940099 2.41556664

Ukuran Perusahaan (X3)

125 15.36200 30.58517 2.0039989E1 3.58170847

Audit Delay

a. Dependent Variable: Audit Delay (Y)

Uji Autokorelasi

Uji Heteroskedastisitas

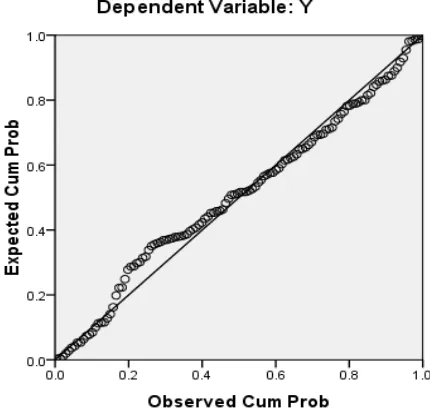

Uji Normalitas

RES2

N 125

Normal Parametersa Mean .4675 Std. Deviation .12367 Most Extreme

Differences

Absolute .065

Positive .064

Negative -.065

Grafik Histogram

Analisis Linier Berganda

a. Dependent Variable: Audit Delay (Y)

Pengujian Signifikansi Parsial (Uji t)

Model t Sig.

1 (Constant) 4.336 .000 DER (X1) -1.143 .255

ROA (X2) -1.142 .256

Ukuran Perusahaan (X3) -2.591 .011

a. Dependent Variable: Audit Delay (Y)

Pengujian Signifikansi Simultan (Uji F)

Model Sum of