P

, A

B

T

OWARDS

SH

S

H

A

A

R

R

I

I

’

’

A

A

H

H

B

B

A

A

N

N

K

K

I

N

E

AST

J

AVA

CENTRE FOR BUSINESS & ISLAMIC ECONOMICS STUDIES FACULTY OF ECONOMICS – BRAWIJAYA UNIVERSITY

AND

Iwan Triyuwono SE., Ak., MEc., PhD (0811361570)

iwantri@yahoo.com ; iwant@fe.unibraw.ac.id

Munawar Ismail, SE, DEA., PhD (0823413202)

Maryunani, SE., MSi, Dr (08161956276)

Ghozali Maskie, SE, MSi (081655355)

Didied P. Affandy, SE., Ak., MBA (0811313349)

affandy@telkom.net; affandy@fe.unibraw.ac.id

Nurkholis, SE., Ak., MBuss (0816554895)

finish this research entitled "Customer's Potency, Preference, and Behavior Towards

Shari’ah Bank in East Java."

This research is intended to describe that: (1) customer's behavior towards

conventional bank is influenced by customer's characteristic and marketing stimuli

factors, (2) customer's behavior towards shari’ah bank is influenced by customer's

characteristic and marketing stimuli factors, (3) some customer's characteristic and

marketing stimuli variables are dominantly influencing the customer's behavior that are

conducting transactions with shari’ah bank, (4) economic potency of an area and

customer's preference are the determinant factors of the shari’ah bank's development.

The result of this research is expected to become knowledge and information related

shari’ah bank.

From this research, we can understand the factors that influence the customers to

choose shari’ah bank, including the most dominant factors. Also, from the analysis in

this research, we can understand that there are some regions that have higher

preferences compared to other regions related to economic condition and local culture

aspects.

The outcome of this research is expected to extent our knowledge about

customer's behavior towards, and the potential development of, shari’ah bank and

become the base to make a policy. Hopefully, this research is useful, Amien ya Rabbal

Alamin.

Malang, 27 November 2000 Center for Business & Islamic Studies Faculty of Economics - Brawijaya University

Iwan Triyuwono SE., Ak., MEc., PhD.

Towards Shari’ah Bank in East Java " is conducted by the Center for Business &

Islamic Studies, Faculty of Economics of Brawijaya University, in cooperation with The

Headquarter of Bank Indonesia based on the Agreement Contract No. 2/4/DPN, 3 July

2000.

We are very thankful for this cooperation, and we hope that the tie of

silaturrahmi can still be maintained through similar activities to develop humankind's

economy.

We realize that this research would not be going so well without the cooperation

with other parties. Thus, we would like to express much gratitude for those who have

helped us in this research process. Those parties are:

1. The office of Bank Indonesia in Malang.

2. Research Administration Team.

3. The Students of Economic Faculty Brawijaya University as enumerators.

4. The Lecturers of Economic Faculty Brawijaya University as supervisors.

Once again, thank you for these helps. Hope that Allah SWT bless us all, amien.

Malang, 27 November 2000

Center for Business & Islamic Studies Faculty of Economics - Brawijaya University

Iwan Triyuwono SE., Ak., MEc., PhD.

1. I

NTRODUCTION1.1.Background

Research about customer’s behavior, characteristics, and perception towards

shari’ah bank in Indonesia is quite rare. But a preliminary research conducted by

Wibisana et al. (1999) in East Java could give a simple tentative illustration about

customer’s behavior and perception towards shari’ah bank. Another research on the

same problem is conducted in Jordan by Erol and El-Bdour (1989) and El-Bdour

(1984).

A Preliminary Study in Customer’s Perception towards Shari’ah Bank in East Java

(Wibisana et al. 1999) showed a variety in customer’s perception towards shari’ah

bank. Knowledge about interest, for example, demonstrated that most (55%) of the

respondents said that it is halal (allowed). This perception is supported by some ulama

and santri stating that interest is halal. From all 60 respondents only 10% said that it is

haram, the rest said that it is subhat and don’t know. This finding indicated that the

customer has not yet known the presence of shari’ah bank. (Wibisana et al. 1999, 43-8;

cf. Erol and El-Bdour 1989; El-Bdour 1984).

The above finding is not so different with the finding of Erol and El-Bdour (1989).

This research, conducted in Jordan, showed that the customer actually is more

profit-oriented than religion-profit-oriented. In other words, religious motive is not a dominant factor

considered to choose shari’ah bank, yet the strongest motive is based on profit-oriented

motive (Erol and El-Bdour 1989, 33). This finding also reinforces the previous research

from El-Bdour (1984).

What has been revealed above is a portrait of the customer’s perception over

shari’ah bank. Nevertheless, customer’s perception about bank interest is only one

variable that influences customer’s perception towards shari’ah bank. A more in-depth

and complete research is still needed to understand the customer’s preference and

behavior towards shari’ah bank.

Further study needs to understand more about how many customer that: (i) is only

willing to have relationship with shari’ah bank and not willing to have relationship with

of conventional banks that use interest system, and (iii) is having economic and service

quality motive. Also, it is also necessary to conduct a research about what variables

influence customer’s preference to shari’ah bank (BI 2000, 2). This research is

important to give an input to Bank Indonesia in making policies, especially about

shari’ah bank in Indonesia.

1.2.Research Objectives

1. Explaining that customer’s behavior towards conventional bank is influenced by

customer’s characteristic and market stimuli factors.

2. Explaining that customer’s behavior towards shari’ah bank is influenced by

customer’s characteristic and market stimuli factors.

3. Knowing that some customer’s characteristic and market stimuli variables are

dominantly influencing the customer’s behavior transacting with shari’ah bank.

4. Explaining that area’s economic potency and customer’s preference are the

determinant factors for the development of shari’ah bank.

1.3.Outcomes

The outcomes of this research are information about:

1. the profile and characteristics of the customer preferred to shari’ah bank.

2. Factors that influence customer to choose shari’ah bank and conventional bank.

3. The most dominant factors that influence customer to choose shari’ah bank.

4. Regions in East Java that have high preference to choose shari’ah bank with their

economic and cultural conditions.

1.4.Scope of Research

This research covered 15 Regions in East Java: Malang, Tuban, Jember, Lumajang,

Gresik, Sidoarjo, Surabaya, Kediri, Jombang, Pasuruan, Probolinggo, Ponorogo,

Pamekasan, Situbondo, and Banyuwangi.

The respondents for every region are 100 persons (90 persons from individual

The subjects of research are decision-making behavior, customer’s characteristic

(social, cultural, personal, and psychological aspects), marketing stimuli (product, price,

2. R

ESEARCHM

ETHODBasically, this research is descriptive and qualitative research. Descriptive research

is used to explain that economic potency is a part that covers the development of

shari’ah bank, while qualitative research explains the influence of customer’s

characteristics and market stimuli on shari’ah bank.

This research uses a marketing theory approach developed by Kotler (1997) with

the following framework:

Source: Kotler (1997) modified

2.1.Research Variables

Important variables in this research are customer behavior, customer characteristics,

marketing stimuli, and other stimuli.

Customer behavior is decision-making process and physical activities conducted by

someone in evaluating, using, or leaving product and service (Loudon and Bitta 1993,

5). The indicators of Customer Behavior are problem recognition, information search,

evaluation of alternatives, purchase decision, and post-purchase decision.

Customer characteristics are customer’s traits that influence the decision process to

purchase goods or services. Customer’s characteristics are cultural, social, personal, and

psychological (Kotler 1997, 172). Therefore, this variable is broken into four

dimensions: cultural, social, personal, and psychological dimensions.

MARKETING STIMULI

• Product

• Price

• Promotion

• Place

OTHER STIMULI

• Economy

BANK CUSTOMER’S

CHARACTERISTICS

• Cultural

• Social

• Personal

• Psychological

BANK CUSTOMER’S

Marketing stimuli is the marketing factors that encourage someone to conduct an

economical transaction. This variable has four dimensions: product, price, place and

promotion dimensions (see Kotler 1997, 92).

Other stimuli are other factors that also have the power to encourage someone in

taking an economical decision. These stimuli have four dimensions: economy,

technology, politic, and culture (see Kotler 1997, 172). In this research, for the purpose

of simplicity, the dimension used is economy dimension. The indicators are: income

level, real sector business potency, and financial sector. These variables are used to

describe the economic potency that is predicted to be influencing shari’ah bank’s

development.

2.2.Variable Instrumental Test

The indicators mentioned above, empirically and statistically need to be tested for

validity, considering that not all indicators posed in a variable are empirically

significant to represent the variable. For this purpose, a factorial analysis will be used in

this study so that the variable analyzed is really visualizing the variables expected.

2.3.Data Analysis

This study analyzes data through descriptive and qualitative analyses. Descriptive

analysis is necessary to explain that social and economic phenomena can be used as a

base or platform in making a policy related to the effort to develop shari’ah bank,

especially in the research area.

Meanwhile, the quantitative method is needed to explain the factors influencing the

customers to choose shari’ah or conventional bank and also to find the most dominant

factor that affects them in making the decision. We could also find which region that

has high preferences to shari’ah bank. Quantitative method analysis mentioned here is

factorial analysis and continued to Logit/Probit analysis.

Factorial analysis is used in simplifying or clustering indicators that are related with

economic actors’ characteristic variable. Remembering that there might be a correlation

between many indicators, a reduction is needed to those indicators in becoming a

that there cannot be any correlation between variables or describing factors, so that by

factorial analysis we will obtain a non-interacting (non-correlating) variables.

3. P

ROFILEO

FR

ESPONDENTSThe respondents of this research are composed of two groups, individual

customers and respondents from companies.

To give a more concrete illustration about the profile of respondents, this chapter

will discuss the respondents’ profile that prefers to choose shari’ah bank. The first part

discusses the individual customers, and the second part discusses the respondents from

companies.

3.1.Individual Customers Who Prefer to Choose Shari’ah Bank

From the gathered data it is noted that there are 441 respondents (32,6% of the total

individual respondents) who prefer to choose shari’ah bank. From those numbers 13

respondents (2,9%) are already becoming the customer of shari’ah bank. This relatively

low number of shari’ah bank’s customers is not so surprising since in one side, the

number of shari’ah bank in East Java is small and in another side, many of the customer

has not yet familiar with shari’ah bank.

Most of the respondents (95%) that are prefer to choose shari’ah bank are Islam,

while the rest are non-Islam. This fact indicates that Islamic people up to now are still

the pillar of shari’ah bank.

With university (44,4%) and high school (38,1%) education, they are working as

public servants (34,3%), private employees (20,1%), merchant (18,3%), farmer (5,9%),

and others (21,4%). Mostly (70,4%) are living in cities and suburban, while 29,6% is

living in rural areas. From this work composition, there is a possibility that if they

become the customer of shari’ah bank, they will use saving facility (because most of

them are government and private employees). Even if they use the financing facility,

there will be a great possibility that most of the financing is consumptive financing,

such as: murabahah or bai bi tsaman ajil. Productive financing (such as mudharabah or

musyarakah) might only be used by merchants.

Another thing that should be noted is how far the respondents understand about

shari’ah bank. Some deemed that shari’ah bank is just the same as conventional bank,

same as interest system, and sharing system is the same as interest system. But some

respondents were saying otherwise that interest system is not the same as sharing

system. According to the gathered data, 44,2% respondents who prefer to choose

shari’ah bank agree with the statement that bank’s interest is the same as riba. This

means that less than half of the respondents are saying that interest is haram. But 55,8%

of the respondents that prefer to choose shari’ah bank are having a notion that interest is

halal. This notion indicates that they (as much as 61,2%) do not understand or do not

know the operation of shari’ah bank. This finding is still consistent with the research

conducted by Wibisana et al. (1999) that concluded that 55% of the respondents were

thinking that bank's interest is halal. Only 10% of the respondents were saying that it is

haram, and the rest (35%) were saying that it is subhat and do not know.

From this individual customer group, 51,2% of the individual customers agreed and

very agreed that they always judge the strengths and weaknesses of the banks that they

know. 35,4% of the individual customers was neutral about the statement, while 14,9%

disagreed.

Meanwhile, 26,07% of the individual customers agreed and very agreed with the

statement that shari’ah bank are an urgent need in their life. 23,05% of the individual

customers disagreed with the statement, and 50,9% was neutral. This statement is

supported with 55,6% individual customers that agreed and very agreed to choose

shari’ah bank after gathering information. As many as 15,9% respondents disagreed

with the statement, and 28,5% were neutral.

Related to the statement above, 46,8% of the individual customers agreed and very

agreed that, for them, information from many sources about shari’ah bank are very

important in deciding whether or not to choose shari’ah bank. 37,8% of the individual

costumers was neutral with the statement, and 15,4% disagreed. This indicates that their

choice over shari’ah bank is based on a rational consideration. This is supported by

50,70% individual customers that agreed and very agreed with the statement. 32,1%

individual customers are neutral to the statement, and only 17,2% that disagreed with

the statement.

However, another statement that should be noticed is that they will still use the

agreed and very agreed by 42,4% of the individual customers. 34,8% is neutral to the

statement, and only 22,7% disagreed. Individual customers who said that they use

shari’ah bank based on loyalty and faith (religion) with considering the cost-benefit and

the service 41,2% agreed and very agreed, 40,2% were neutral and only 18,53%

disagreed.

After gathering information about shari’ah bank, 43,11% respondents agreed and

very agreed to choose it, 42,2% was neutral and 18,5% disagreed. Meanwhile,

respondents who agreed and very agreed to choose shari’ah bank after conducting a

judgment was 37,71%, 51,15% were neutral and only 11,14% disagreed.

From the series of the above statements, we can temporarily conclude that the

presence of shari’ah bank in the society will get a positive respond, as long as the bank

can give a suitable service with the local customers and profitable. The faith that has

already been planted in the society needs to be developed, because most of the

individual customers are showing a positive real step, especially in their loyalty based

on faith (religion).

3.2. Company customers that prefer to choose Shari’ah Bank

The company customers that participate in this research were 150 respondents.

From these 150 respondents, only 54 (or 36%) respondents who prefer to choose

shari’ah bank, and from these 54 respondents, only 4 respondents that have already

been the member of shari’ah bank (or only 7% from the total company respondents that

prefer to choose shari’ah bank, or only 2% from the total company respondents).

The companies that prefer to choose shari’ah bank are mostly (53,7%) located

in town. Only some (25,9%) are located in rural areas, while 20,4% located in suburbs.

If we combine the companies that are located in towns and suburbs, the number reaches

74,1%. So, most of the companies that prefer to choose shari’ah bank are located

around towns.

The legal form of the company can directly illustrate the ownership status and

the management model (managed traditionally or modernly), and indirectly can

choose shari’ah bank are sole proprietor companies (56,6%). Only 7,4% are public

companies.

Most of the companies that prefer to choose shari’ah bank are small companies

with total assets of Rp. 1 million or less. The proportion of this group is reaching

55,6%. Nevertheless there are respondents that have assets more than Rp. 2 billion, and

the number is quite significant (9,4%). This phenomenon illustrates that shari’ah banks

actually have an opportunity to give services to many levels of company. Of course this

is subjected to the internal capabilities of the shari’ah banks itself in giving services to

their customers.

Conforming to the size of the assets owned, the phenomenon of workforce in

companies that prefer to choose shari’ah bank is having a parallel pattern. It means that

the number of company that has less than 10 employees is similar to the number of

company that has the lowest assets (50%). All of these 2 groups, companies with low

assets and few employees, belong to small-scale companies. Nonetheless, it should be

noted that there are also companies with more than 40 employees. For the former group,

the number reaches 7,4% from the total companies that prefer to choose shari’ah bank.

Another things that should be noted is whether or not the company that prefer to

choose shari’ah bank has a sufficient understanding of the presence of shari’ah bank.

From the available data, it is understood that their notion of shari’ah bank is different

for every group of companies. For non-customer companies, their notion is very low, in

which only 10% that understand the shari’ah bank and its products. Meanwhile,

companies that partially understand are only 22%, and the companies that do not

understand at all reaches 68%.

This phenomenon is very different compared to the companies that have already

become the customer of shari’ah bank. For this group, the numbers of customer that

understand shari’ah bank very well is very large (75%), and none are understand it

partially. The group that does not understand at all reaches 25%. It is clear that the

companies that are already becoming the customer of shari’ah bank are having a better

notion than the opposite.

From the above group of companies, it is understood that 84% respondents

judge the strengths and weaknesses of those banks and 46% of these companies are

located in towns. Respondents that are neutral to the statement are 13%, while 3%

disagreed.

Meanwhile, 62% respondents agreed and very agreed to the statement that

shari’ah bank is an urgent need in their life, in which 38% of them are located in towns.

The number of companies that disagreed with the statement reaches 20%, while 18%

were neutral. This statement is supported by 32% company respondents that agreed and

very agreed that before choosing shari’ah bank they always gather information about

the bank. From 26% that agreed (another 6% stated very agree) with the statement, 13%

of them live in town. Respondents that disagreed with the statement are 40%, while

26% were neutral.

Related to the statement above, 77% of company respondents (43% of them

located in towns) agreed and very agreed to the statement that, for them, information

from many sources about shari’ah bank is very important to make a choice about

shari’ah bank. As many as 19% of respondents were neutral to that statement, and 4%

disagreed. This indicates that their choice on shari’ah bank is based on rational

considerations. 86% respondents that agreed and very agreed (45% are located in

towns) supported this statement, 11% were neutral and only 3% disagreed.

However, another statement from respondents that should be concerned is that

they will still use shari’ah bank if the service is good. This statement is supported by

73% of respondents (46% are located in towns). 23% were neutral to the statement, and

only 4% disagreed.

From a simple definition given above, it is understood that company customers

4. C

USTOMER'

SB

EHAVIORT

HATP

REFERT

OC

HOOSEC

ONVENTIONALB

ANKIn this part, the customers who have preferences to conventional bank are also separated

into two groups: individual customers and company customers. The characters of each

group will also be explained.

4.1.Individual Customers

From the factorial analysis used in this research, there are 17 factors that influence

their preference to conventional bank. Basically, individual customers that prefer to

choose conventional bank is affected by rational factors, such as Information and

Rational Judgment (Factor 1). For them, the most important thing is to get information

about the bank that he will choose before making a decision to choose conventional

bank in fulfilling day-to-day transactional needs.

Based on that information, they will make a sound judgment. Rational judgment

here is "economic rational judgment". It means that a cost-benefit analysis is the main

consideration in decision-making.

Information usually gathered by customers through advertising (factor 4) of the

bank and from reference group (factor 15), such as parents, siblings, husband/wife,

professional colleague, and so forth. Meanwhile, information gathered concerns

payment period (factor 5), product size (factor 6), product diversity (factor 8), collateral

(factor 11), and location (factor 13) that will be considered as an economic rational

judgment in selecting conventional bank. Information content that is needed by

customers theoretically came from marketing mix, which consists of product, price,

promotion, and place. This marketing mix is the element of marketing stimuli.

Besides marketing stimuli, customer's characteristic variables that consist of

cultural, social, personal, and psychological factors are also influencing in choosing

conventional bank. Factors that are included here are: humanity and activities (factor 2),

religious and moral orientation (factor 3), lifestyle (factor 7), the needs of savings and

lifecycle stage (factor 14), reference group (factor 15), role and status (factor 16), and

the need to borrow (factor 14).

The interesting thing from the finding is that orientation and moral factors (factor 3)

are the most influential factors in determining the choice to conventional bank. Some

reason why these factors are influential has been explained before, such as: they deemed

that having transaction with conventional bank is not against the religion or morality or,

in other words, they do not have choices other than conventional bank, and they do not

know shari’ah bank.

Other factors are economic and culture. Economic factor is a logical consequence

from a rational characteristic of customers. This means that the selection of

conventional bank cannot be separated from a cost-benefit calculation. Meanwhile,

cultural factor is another characteristic that also plays a role in how the customers

perceive and choose conventional bank as a right choice for his life.

4.2.Company customers

By using the same method and analytical tool, a factorial analysis for all indicators

asked to company respondents, this research has identified 11 factors that affect the

company customers' preference to become the customer of conventional bank.

Generally, this research identifies some factors that affect customers' preference to

choose conventional bank. Rational company customers' behavior (factor 1) proves that,

empirically, characteristic of this company customers group is rational. It means that,

before making a choice to one particular bank, they will first gather enough information

about the bank, by conducting an economic judgment of the services given by the bank.

If we look at how the customer's characteristic for company customers that have

preference to conventional bank, generally it can be concluded that they concern about

efficiency and effectiveness rate (factor 4), humanitarian (factor 6), moral and religion

and the opinion of the reference group (factor 9), and materialism (factor 11). Beside

those characteristics, the age of the company and its role in the society are also

contributing to the preference of company customer group to choose conventional bank.

The result of this research also shows empirically that beside customer's

contribute to the company customer's preference to choose conventional bank. These

factors are product price (factor 2), quality of service (factor 3), the belief of the

product's looks (factor 4), bank's location and image (factor 8), and the promotion and

advertising program (factor 10). Finally, by considering those factors above, the result

of this research has shown empirically how is the behavior of this company customers

group towards their preference to conventional bank.

Basically, customer characteristics (individually or company) that prefer to choose

conventional bank is having a rational characteristic. It means that the customer always

consider the cost-benefit rational calculation in making a decision to choose

conventional bank as the right choice to conduct financial transactions. Consequently,

they always seek for much information (product, price, location, image, and so forth.)

first about the bank that they are interested to. There is no difference in this rational

judgment aspect between individual and company customers. Shortly, both individual

and company customers are using rational judgment in choosing their bank.

Although both are "rational economic", hierarchically (from factor hierarchy with

highest-to-lowest eigenvalues) there seems to be a difference. This difference lies in the

degree of weight put on economic aspect. Company customers put a higher degree of

weight (from the product price, quality of service, efficiency and effectiveness level,

and belief in product's look factor) than the individual customers.

From an economic point of view, this phenomenon is quite normal, because

companies have a conventional objective to maximize their profit. With this objective,

the concern of companies to ethic values (that is shown in humanistic and religious

factors) is lower than the individual customers.

In contrary, individual customers (even though they have economic orientation) do

not put to much weight on profit maximization (that is shown from payment period,

product size, product diversity, and collateral factors with lower level compared to

humanity and moral and religious orientation). In other words, individual customers are

5. C

USTOMERS' B

EHAVIORT

HATP

REFERT

OC

HOOSESHARI’AH

B

ANKIn this part, the customers that have preferences to shari’ah bank also divided into

two groups, namely: individual customers group and company customers group.

5.1.Individual Customers

From the factorial analysis, it is known that there are 15 factors that influence the

individual customers in selecting shari’ah bank. Those factors are: Information and

Rational Judgment (factor 1), Humanist and Dynamic Characteristic (factor 2),The Size

and Flexibility of Services (factor 3), Modern Lifestyle (factor 4), Need (factor 5),

Location (factor 6), Faith and Attitude (factor 7), Materialism (factor 11), Age and

Lifecycle (factor 12), Post-Purchasing Behavior (factor 13), Direct Promotion (factor

14), and Religion (Factor 15).

Individual respondents that have preferences towards shari’ah bank are very

rational. The meaning of "rational" here is that they will make decision if everything is

quite clear for them, and they will choose a bank if the bank could really give a better

benefit than other bank.

From the cultural characteristic, those who have preferences to shari’ah bank are

having some characteristics. They are humanist and also dynamic. Besides, they want a

more modern life, materialists, having a clear attitude and faith, always noticing their

status and roles in every action, and trying to practice their religion in daily livings.

Those cultural characteristics above have implications to the development of

shari’ah bank. Thus, shari’ah banks have to take into account the cultural behavior of

their potential customers, so the customers can accept their existence. For example, the

existence of shari’ah bank has to give a modern impression to the customers, be able to

advance the roles and status of the customers, and be able to give a material benefit.

One thing that should be avoided is the negative judgment given by the customers to

shari’ah banks.

Customers' choice over banks is also influenced by the internal capabilities of the

that should be noticed is the size and flexibility of credit service, the services offered

related to the customers' needs, easy-to-reach location, reference or role of family,

practicability in saving wealth, evolution and innovation from the variance and service

model, post-purchasing evaluation, and direct promotion. Those factors are included in

economic factor (marketing stimuli).

5.2.Company Customers

There are 14 factors affecting companies to choose shari’ah bank. Those factors

are: Dynamic and Efficiency (factor 1), Promotion (factor 2), Safety and the Speed of

Service (factor 3), Price (factor 4), Easiness in Getting Loans (factor 5), Brand Name

(factor 6), Product Form (factor 7), Faith and Attitude (factor 8), Role and Status (factor

9), Business Partner (factor 10), Society's Norms and Ethics (factor 11), Location

(factor 12), Materialism (Factor 13), and Age and Lifecycle of the Company (Factor

14).

Company customers that have preferences towards shari’ah bank are dynamic,

efficient, and humanist. Besides, they also have a firm belief and attitude, notice their

roles and status in making action, prioritizing ethics that prevalent in the society rather

than religious morality, and materialists. This shows that cultural aspect has an

important role in determining their preference towards shari’ah banks for company

respondents. The implication of cultural factor is the same as in the case of individual

customers, in which the presence of shari’ah bank have to give a modern image to their

customers.

Related to the decision to select a bank, company respondents are more rational, in

which they are more concerning about economic factors (marketing stimuli) in selecting

a bank. From those factors, the most considered factors for those who prefer to choose

shari’ah bank are promotion, security and the speed of service, low price (loan),

easiness in getting loans and payment facilities, bank's image, varied products, business

partner role in decision making, and reachable and comfortable location.

If those two types of respondents are compared, we will find a behavioral

difference, in which cultural factor hold a more important role for individual

factors (marketing stimuli) have a bigger influence than in the case of individual

respondents.

Remembering that information availability is a very important factor for the two

types of respondents in decision-making, yet in the other hand the customer's

knowledge about shari’ah bank is still very low, socializing the presence and principles

6. L

OGITM

ODELE

STIMATIONO

NS

OCIETYP

REFERENCET

OWARDS

HARI’AHB

ANKAnalysis at this stage divided into two, which are individual customers’

preference and company customers' preference.

5.1.Individual customers

This analysis is required to reveal factors being considered as well as influence

individual to choose a bank. Respondents asked to answer many questions' items. For

the convenience of interpreting, those items need to be reproduced using factor analysis

tools.

The outcome of the estimation revealed that not every factor that is used as

independent variables are significant. From those factors only seven are significant. The

equation and the Logit estimation table shown below:

Y= -1.6451+ 0. 9931 + 0.2334 F12 + 0.37267 F13 - 0.5015 F14 +2.6041 F5 + 0.4671

F6 + 0.2411 F7

TABLE 1

LOGIT ESTIMATION RESULTS

NO. OF FACTOR

FACTOR NAME B STANDARD ERROR

WALD SIG R

Constant -1.6451 .3379 23.7000 .0000

Factor 1 Information and rational consideration .9931 .1131 77.0894 .0000 .2223 Factor 12 Religious and Moral Orientation .2334 .0843 7.6720 .0056 .0611 Factor 13 Age and Life Cycle Stage .7267 .1077 45.5353 .0000 .1692 Factor 14 Reference Group (Family) -.5015 .1026 23.8759 .0000 -.1200 Factor 5 Location 2.6041 .1583 270.5665 .0000 .4204 Factor 6 Life Style .4671 .1027 20.6778 .0000 .1109 Factor 7 Belief and attitude .2411 .0975 6.1105 .0134 .0520

Source: Processed Primer Data

1. Information and Rational Consideration. If related with the interpretation model, it

means that respondents who relation with bank will consider this factor. Considering

the table above, regression coefficient of this factor is positive. It means that this

someone understands better about the bank (from supplied information and doing

rational consideration), the decision to choose Shari’ah Bank is higher.

2. Religious and Moral Orientation. This factor influence individual customers to

choose a bank that is Shari’ah Bank. The choice tends to Shari’ah Bank because the

regression coefficient is positive. The religious and moral factor will support one’s

choice to use Shari’ah Bank for his/her economic activity. In other words, higher the

religious and moral orientation of the society, the chance they will choose Shari’ah

Bank also higher.

3. Age and Life Cycle Stage. This factor also considered by respondents in choosing a

bank. Because the regression coefficient of this factor is positive, this factor will

support one’s preference toward Shari’ah Bank. In this context, an individual who

understands his/her age and life stage also understands the form and kinds of his/her

needs. Higher understanding of this factor will result in higher support one’s choice

for Shari’ah Bank.

4. Preference Group (Family). This is also the factor that influences one’s choice for

a bank. This factor has negative regression coefficient. Negative figure means that

this factor will lessen the chance for someone to choose Shari’ah Bank. In other

words, spouse lessens one’s choice for Shari’ah Bank.

5. Location. The location factor describes convenience and accessibility offered by a

bank. The location factors factor influence society’s choice for a bank. If a bank pays

attention to this factor, the possibility that people choose the bank for financial

transaction will be higher. It means that more convenience and accessibility of a

Shari’ah Bank will result higher possibility for the people to come and using the

product offered by the bank.

6. Life Style. Life style factor influence one’s choice to choose Shari’ah Bank

(Regression coefficient positive). Life style in consumer behavior theory usually

categorized as personal aspect. Even exact computation is hard to do, it is generally

believed that life style has a big influence in the decision making for transaction

(bank).

7. Belief and attitude. This factor will support one’s choice in choosing Shari’ah Bank

that interaction with Shari’ah Bank is profitable and practicable based on Shari’ah.

This belief gives possibility for them to choose Shari’ah Bank.

Other things that should be noted here are: there are seven factors that influence

the decision for Shari’ah Bank, one most dominant factor is Location (wald=

270.5665), then followed by other factors which are: Information and Rational

Consideration (wald77.0894), Age and Life cycle Stage (wald= 45.5353), Reference

Group /Family (wald= 23.8759), Life Style (wald= 20.6778), Religious and Moral

Orientation (wald= 7.6720), belief and attitude (wald= 6.1105).

From this analysis we found that religious and moral primordial factor is not the

main and dominant factor in influencing one’s choice for Shari’ah Bank (even that we

know this factor has influence on the choice for Shari’ah Bank). Our society is

rational-pragmatic society, so the factors influence their choice is also rational-rational-pragmatic,

Location factor for example, is the form of their rational-pragmatic stance. People in our

society want practical things. They would rather choose bank which location is easily

accessible, and convenience.

Other form of this rationality is information and rational consideration. This factor

indicates that information is required for an individual to be able to consider and make

decision. There are many information sources available for the people, for example are,

advertising and reference group, but in this research Reference Group (family) has

negative coefficient, which means lessen the possibility for one to choose Shari’ah

Bank. It is possibly because Reference Group (Family) does not understand what

Shari’ah Bank is, which result in “conservative” attitude by give no recommendation

for Shari’ah Bank. However, this factor can be handled by socialize Shari’ah Bank to

the society.

Other rationalism is that the people in the society know what they need. The age

and life cycle stage factor indicate that one’s need for products of banks depends on age

and the level of life complexity.

6.2.Company Respondent

In the factor analysis process, there are 72 indicator extracted into factors. The

result of the analysis show there are 46 significant indicators that become 16 factors.

Those 16 factors formulated into factor in the logit model.

Result of the estimation shows that not every factor used as independent variable

is significant. From 16 variables analyzed using the model, only five factors significant.

The result of the Logit estimation with equation presented below:

TABLE 2

LOGIT ESTIMATION RESULTS

NO. OF FACTOR

FACTOR NAME B STANDARD ERROR

WALD SIG R

Constant -.8674 .2391 13.1565 .0003

Factor 1 Information and Rational Consideration 1.0673 .2938 73.1966 .0003 .2431 Factor 2 Price -.3580 .2112 2.8739 .0900 -.0679 Factor 6 Role and Status .5425 .2412 5.0562 .0245 .1270 Factor 7 Advertising .5036 .2302 4.7844 .0287 .1212 Factor 8 Belief and attitude .7517 .2148 12.2462 .0005 .2325

Source: Processed primer data

1. Information and Rational Consideration. This factor shows that the company

customers gather information about Shari’ah Bank, then consider the option

rationally (Not dogmatic because religious sentiment exist) before making the

decision. Since this factor has positive coefficient, it will support company to choose

Shari’ah Bank.

2. Price. This factor is the form of rational economic consideration as we see in factor

1. This factor, according to Logit Analysis, has negative coefficient. This means that

the price factor will lessen the possibility a company will choose Shari’ah Bank. If

Shari’ah Bank charge high price, the company respondent will not choose Shari’ah

Bank. If the price charged relatively low, the more likely consumer will choose

shari’ah bank.

3. Roles and Status. Logit Model shows positive coefficient for this factor, it means

that role and status factor will support a company to do transaction with Shari’ah

Bank. Higher role and status of a company in society results in higher possibility the

4. Advertising. Based on the table above, regression coefficient of this factor is

positive. It means that advertising will support the respondent company to choose

Shari’ah Bank.

5. Beliefs and Attitude. Using the Logit Analysis Model, this factor has positive

coefficient. It means that this factor support company to use products offered by

Shari’ah Bank. Higher belief and attitude of a company that Shari’ah Bank runs its

operation using Shari’ah ethics and gives economic benefit as well, result in higher

possibility for the company customers to choose shari’ah bank.

The description above shows a phenomenon that the most dominant factor

influencing company customers preference toward Shari’ah Bank is information a

rational consideration, which has wald score 73.1966. Then followed by other factors

respectively, Belief and Attitude (wald= 12.2462), Role and Status (wald= 5.0562),

Advertising (wald= 4.7844), and Price (wald= 2.8739).

Based on the facts gathered in this research, we emphasized that religious and

moral factor (explicitly) not one of the factors uses by the company customers to do

transaction with Shari’ah Bank. Even the dominant factor is Information and rational

consideration. Factors that known as company “culture”, which are: belief and attitude,

and role and status, also become the factors that give influence to the decision to choose

Shari’ah Bank. Other factors, which included in marketing stimuli are advertising and

price.

6.3.Logit Analysis for Study Regions

This study also shows that among 15 study regions, we can compare which

region(s) has the most preference for Shari’ah Bank. Using Logit Analysis, if we rank

region by the Wald statistic score, the big-five regions are: Situbondo, Kediri,

Lumajang, Jombang and Ponorogo, and Malang. More detail data can be seen in table 3,

TABLE 3

MAP OF THE REGIONS HAVE PREFERENCE TO SHARI’AH BANK, ECONOMIC GROWTH GROUP,

AND CULTURAL GROUP

NO. CITY NAME WALD STATISTIC RANK ECONOMIC GROWTH GROUP

CULTURAL GROUP

1. Situbondo 0.7858 1 Lagged E 2. Kediri 0.6823 2 Intermediate JP 3. Lumajang 0.6662 3 Lagged JP/E 4. Ponorogo 0.5847 4 Intermediate JP 5. Jombang 0.5847 4 Intermediate JP/E 6. Malang 0.5776 5 Congested JP/E 7. Jember 0.5737 6 Lagged JP/E 8. Gresik 0.5626 7 Congested E 9. Surabaya 0.5212 8 Congested E 10. Banyuwangi 0.5189 9 Lagged JP/E 11. Pamekasan 0.5178 10 Lagged E 12. Sidoarjo 0.5178 10 Congested E 13. Tuban 0.3998 11 Lagged JP/E 14. Pasuruan 0.3972 13 Congested E 15. Probolinggo 0.3566 14 Lagged E

Source: Primer Data (Processed)

Notes: E = Egalitarian Society; JP = Javanese Peasant Society.

The first group, to make illustration easier, which in the first until sixth position

comprise seven regions, which are: Situbondo, Kediri, Lumajang, Ponorogo, Jombang,

Malang, and Jember. This group has higher preference level towards Shari’ah Bank

than the second Group. The second group positioned in Seventh to thirteenth, comprises

of Gresik, Surabaya, Banyuwangi, Pamekasan, Sidoarjo, Tuban, Pasuruan, and

Probolinggo, has lower preferences toward Shari’ah Bank than the first.

The first group generally considered has “intermediate” economic growth- that

comprises Kediri, Ponorogo, and Jombang- and “Lagged” which comprises Situbondo,

Lumajang, and Jember.1 From this map we can that regions have preference toward Shari’ah Bank are included in Intermediate and Lagged.

For the Shari’ah Bank has location and operation in those regions to be

successful, the bank needs to learn the character and culture of the society. Based on the

data we can see that generally the people in the regions in the first group are a mix of

Egalitarian Society and Javanese peasant society. The egalitarian society has characters

as frank, critical, not afraid of conflict, and has more tendency to follow informal leader,

while the Javanese peasant society has closed character, tend to avoid conflict, and

follow formal leader.

Different from the first group, the second group- seen from the economic

growth-comprises of “congested” and “lagged” regions. People in the congested regions are

used to conventional ban, and feel that the growth of their business and economic, and

that may be the cause they have lower preference compare to the first group. People in

the lagged regions might think that any bank (Shari’ah as well as conventional) has the

same function, both have no substantial difference. From that point of view we can

understand why they have lower preference than the first group.

The second group generally included in the Egalitarian Society, who are frank,

critical, not afraid of conflict, and tend to follow informal leader. It is possible that these

people will accept Shari’ah Bank easier (even they relatively do not have high

preference). This is possible since these people have frank character, so the chance they

accept Shari’ah Bank quite high. That is why clear and transparent information about

Shari’ah Bank very important for the regions have egalitarian people.

The map above is not absolute, because statistically Logit model is an estimation

model based on primer data gathered in this research. That’s why, as the consequences

of this finding have no absolute value, we cannot found Shari’ah Bank in the regions

included in the first group immediately. In other words, feasibility studies in those

7. T

HEM

APPINGO

FE

CONOMICP

OTENTIAL, C

ULTURE,

S

OCIETYA

NDP

REFERENCET

OWARDS

HARI’AHB

ANKThis chapter will illustrate economic potentials, culture, and society preference

toward Shari’ah Bank.

6.2.Economic Potential

In the case of economic potential, East Java province can be divided into some

corridors that are north-south corridor, north-west corridor, East corridor, North

corridor.

North - south corridor

This corridor spread along Gresik Sidoarjo Mojokerto Pasuruan Malang

-Blitar region, occupied by approximately 11.9 million or 35 % of total East Java

Population. Economic output from this corridor was 49.3 Trillion rupiahs or 55% of the

East Java total. The most dominant is Processing industry with 35 of shares, followed

by the trading sector, Hotel and restaurant, accounted for 19%, farming with 7 %, and

other services approximately 39%. This region considered as congested, but suffers the

most from the economic crisis, because many industries were using imported

component in huge amount (foot loose industry).

Other economic indicators we can notice in this region are:

1. Food source sector, plantation, fishery, forestry, has production base in Mojokerto

Regency, Malang, and Blitar.

2. Fishery has production base in Sidoarjo Regency, and Pasuruan.

3. Processing industry sector based in Gresik, Surabaya, and Sidoarjo.

4. Potential regions for trading sector are Gresik, Sidoarjo, Mojokerto, Pasuruan,

North-West Corridor

This corridor lies along Jombang Kediri Tulungagung Trenggalek

-Nganjuk - Madiun - Ponorogo - Pacitan - Magetan, occupied by approximately 8.1

million or 24 % of the total East Java population. Economic output from this corridor

around 18.4 trillion rupiahs, or 21% of the total East Java output. The most dominant

industries in this region respectively are processing industry with 41%, and then

agriculture sector with 195 of share, Trading, hotel and restaurant 19%, and other

services accounted for 21%. This region called intermediate, which suffer quite high

from the economic crisis, but not as bad as the North - South corridor.

From the characteristic, this corridor region considered as intermediate, this

indicates that the region has potency as the base of banking, especially Shari’ah Bank,

With market share such as Processing industry, Agricultural sector, Trading, Hotel and

Restaurant, and other services industry. Based on that target market, the operation of

Shari’ah Bank, can be focused on those activities, while keeps holding on the mutual

benefit values of banking, and timely service.

Other economic indicators of this corridor are:

1. Food Sector, plantation, and Farming, which production base in Jombang, Kediri,

Trenggalek, Nganjuk, Madiun, Pacitan, and Magetan.

2. Fishery sector based in Tulungagung, Trenggalek, and Pacitan.

3. Processing Industry Sector based in Jombang.

4. We can find trading industry in regions such as: Jombang, Kediri, Tulungagung,

Nganjuk,Ponorogo, Pacitan and Magetan.

East Corridor

This corridor spread from Probolinggo Situbondo Bondowoso Lumajang

-Jember - Banyuwangi, with population approximated at 7 million or 20% of the East

Java Province total. Economic of this corridor generate output around 11,5 Trillion

rupiahs, or about 13 % of the East Java total output. Dominated by farming, which

accounted for 33%, trading with 20%, industry 10%, and other services as much as

37%. This corridor considered as lagged, with production based on primer sector

government for this corridor has big contribution, but the role of the government in t he

development of PDRB generally quite low when compared to the South - North and

North - West Corridor. The effect of the economic crisis in this corridor is not as bad as

the previous two corridors.

Different than the first two corridors, this corridor’s characteristic considered as

lagged. It’s indicates that as the base of banking, especially Shari’ah Bank, the target

in this corridor mostly comes from low economic with the production based on primer

sector (agriculture). Focusing on this market, while keeps the mutual benefit values of

banking, and the right service, the operation of Shari’ah Bank can be focused on

fostering, assisting, and training.

Other indication we can use in extending the Shari’ah Bank line of services, is the

development perspective of this corridor, which is production base development

focused on:

1. Agricultural sector, and plantation with the production base in the regions around

Bondowoso, Lumajang, and Jember.

2. Animal Husbandry, in the regions around Situbondo, Bondowoso, and Lumajang.

3. Fishery Sector based in Situbondo and Banyuwangi.

4. Processing Industry sector in the regions around Probolinggo, Jember, and

Banyuwangi.

North Corridor

Regions included in this corridor are: Ngawi - Bojonegoro - Tuban - Lamongan

- Bangkalan - Sampang - Pamekasan - Sumenep, with population around 7.4 million

or 21%of the East Java total population. The economic in this corridor has output

around Rp. 10.2 trillion or 11% of the East Java total. Dominated by agricultural with

37%, Trading 19%, Processing 7%, and other services with 37%. This corridor

considered as Lagged and the economic growth is lower than other corridors.

Production base is in the primary sector (agricultural), government intensity has

dominant role in the development of this corridor, this means that government fund

North - West, and East Corridors. The impact of the economic crisis is not as big as the

North - South and North - West Corridors.

Same as the previous corridor (East Corridor), regions in this corridor

considered as Lagged and the economic growth’s lower than any other corridors. It’s

indicates that as the base of banking, especially Shari’ah Bank, the target in this

corridor mostly comes from low economic with the production based on primer sector

(agriculture). Focusing on this market, while keeps the mutual benefit values of

banking, and the right service the operation of Shari’ah Bank can be focused on

fostering, assisting, and training

Other indication we can use in extending the Shari’ah Bank line of services, is the

development perspective of this corridor, which is production base development

focused on:

1. Food Source Sector with production base in Lamongan, Bojonegoro, Ngawi,

Bangkalan and Sampang.

2. Plantation Sector with production base in Bojonegoro, Ngawi, Pamekasan, and

Sumenep.

3. Animal Husbandry in the regions such as Bangkalan, Sampang and Pamekasan.

4. Processing Industry in Tuban, and Sumenep.

7.2.Culture

Refer to ancient history, East Javanese has characteristics that generally can be

divided into two major groups. Those are : (a) Javanese peasant societies and egalitarian

societies. From this point of view, the Javanese peasant societies’ characteristics rooted

from the Mataram culture, and tend to formal leader (more dominant Javanese culture),

while egalitarian has the characteristics tend to follow informal leader (Islam), mostly

Maduranese ethnic, tend to say something frankly.

Based on this approach, the first society group (the Javanese peasant societies)

approximated settled in the regencies west and south of East Java, while the second

group (egalitarian societies) approximated settled in the regencies north and east of East

Java. This is not a straight classification, because East Java has been through so much

city, and town borders. But the simplification in this study is that we can make

prediction that the society group in the Pamekasan, Surabaya, Gresik, Sidoarjo,

Probolinggo, Pasuruan and Situbondo Regency, more dominant as egalitarian societies,

that hold the religious belief (Islam) quite strong. While the society group of Lamongan,

Mojokerto, Ponorogo and some part in the Malang Regency, Lumajang, Jember, and

Banyuwangi, is dominated by the society group that is influenced by Mataram culture

and tend to follow formal leader (more dominant Javanese culture).

However, the characteristics of the societies that generally divided into Javanese

peasant society and egalitarian societies are important to understand the societies

preference and behavior toward Shari’ah Bank. Since the characteristics of the societies

are the critical success factors for Shari’ah Bank policy making in each region, city or

town in East Java Province.

7.3.Individual Customers' Preference towards Shari’ah Bank.

Based on those analysis, generally speaking, we can see that most respondent do

not agree with the statement that Shari’ah Bank is a critical need in the respondents’

life. The behavior of the respondents reflected in the attitude shows the sign that the

bank is not the main solution for their needs (immediate). Moat respondents agree with

the other eight statements. Conclusion from those eight statements shows the sign that

respondents think that Shari’ah Bank existence is needed. However, in the case of

banking operation the sense of business is thicker than the Islamic sense.

Further study about the respondents’ behavior in each sampled regency shown in

TABLE 4.

INDIVIDUAL RESPONDENTS’ BEHAVIOR THAT AGREE WITH THE EXISTENCE OF SHARI’AH BANK

IN THE EAST JAVA PROVINCE

NO. REGION 1 2 3 4 5 6 7 8 9 BIGGEST

PERCENTAGE AVERAGE

RANK

1. Malang 14.4 53.9 60.0 63.4 53.3 68.9 68.9 50.0 55.6 59.3 6 2. Lumajang 18.9 44.5 54.4 41.1 46.7 51.1 58.9 47.8 51.1 49.5 13 3. Probolinggo 8.9 52.3 56.7 73.3 50.0 55.6 65.6 31.1 44.5 53.6 10 4. Ponorogo 31.1 58.9 64.4 72.2 58.9 62.2 76.7 43.3 53.3 61.2 5 5. Kediri 23.3 57.8 52.2 55.6 38.9 50.0 51.1 36.7 50.0 49.0 14 6. Tuban 13.3 61.1 57.7 47.8 48.9 63.3 67.7 43.4 54.5 55.6 8 7. Gresik 32.2 77.8 75.6 70.0 61.1 81.1 77.8 67.8 72.2 72.9 2 8. Surabaya 17.8 22.2 55.6 55.6 61.1 51.1 58.9 61.1 44.4 51.3 11 9. Sidoarjo 25.6 42.2 36.7 47.8 46.7 45.6 46.7 48.9 37.8 44.1 15 10. Pasuruan 28.9 56.7 55.6 68.9 60.0 57.8 62.2 52.2 60.0 59.2 7 11. Pamekasan 25.6 60.0 51.1 64.5 54.4 54.5 61.1 46.7 43.3 54.5 9 12. Banyuangi 22.2 66.6 61.2 68.9 58.9 66.7 64.4 51.1 64.5 62.8 4 13. Situbondo 33.3 72.3 65.6 71.1 62.3 72.3 61.2 62.2 68.8 67.0 3 14. Jombang 32.2 77.8 75.6 70.0 61.2 81.2 77.8 67.8 72.3 73.0 1 15. Jember 24.5 47.8 51.1 55.6 37.8 56.9 60.0 42.3 48.8 50.0 12

23.5 59.8 64.4 61.7 61.7 61.2 63.9 50.2 54.7 57.5

Source: Processed Primer Data

Notes:

1. = Shari’ah Bank is an immediate need for a company’s operation

2. = Company always gathers information before choosing Shari’ah Bank

3. = Information from various sources in the decision making process is important for a company

4. = Company always assessing the strength and weaknesses of each bank they know

5. = Company choose Shari’ah Bank based on rational consideration

6. = Company makes the decision (choose Shari’ah Bank) after gathers information.

7. = Company makes the decision after assessing a bank

8. = Company will keep on using Shari’ah Bank as long as it is has benefit and good services

9. = Company chooses Shari’ah Bank based on the loyalty and belief (religious) of the company and also assessing the benefit

and services given.

The table above presenting the information based on the average of the

respondents’ behavior who agree about the existence of Shari’ah Bank in the research

region, the respondent’s behavior presented by five elements/ parameters, which are:

1. Prior to choose a bank, respondents always gathers information about the bank;

2. To be able to make a choice over Shari’ah Bank, respondents need information

from various sources.

3. Based on a number of banks they know, respondents always assess the strength and

4. Respondents will choose Shari’ah Bank after gathering information; and

5. Respondents will make decision (to choose Shari’ah Bank) after assessing (toward

the bank).

Related to those five behavior elements, there are top five of the percentages in

seven regencies. Those seven regencies are considered as congested (North - South

Corridor) including Gresik, Pasuruan, and Malang Regency; Two from intermediate

region (North - West Corridor), which are Ponorogo and Jombang Regency; Two

regencies from the lagged region (East Corridor), which are Situbondo regency, and

Banyuwangi Regency.

Based on the number of respondents' behavior in responding the existence of

Shari’ah Bank and in biggest average, there are three regencies has best prospect for

Shari’ah Bank. Those three regencies that are considered to be dominated by egalitarian

societies and Islam are Jombang, Gresik, and Situbondo.

From the table 5 below we can see that the first highest ranks (1-3) of the

respondents’ behavior toward Shari’ah Bank existence, spreads respectively in

Jombang Regency (intermediate region with strong economic crisis impact), Gresik

Regency (congested region with strong economic crisis impact), and Situbondo regency

(Lagged Regency which the economic based on agricultural sector).

Second highest ranks (4-6), of the respondents' behavior toward Shari’ah Bank,

respectively spread in Banyuwangi Regency (Lagged region with production based on

primary sector), Ponorogo Regency (Intermediate region with strong economic crisis

TABLE 5

INDIVIDUAL RESPONDENTS GROUPING BASED ON REGIONAL ECONOMIC GROWTH AND

AGREEMENT TOWARD THE EXISTENCE OF SHARI’AH BANK IN EAST JAVA.

NO. REGION BEHAVIOR SCORE AVERAGE RANK

REGION CATEGORY ECONOMIC

BASED ON GROWTH EXPLANATION

1. Malang 59.3 6 C *) 2 Lumajang 19.5 13 L

3. Probolinggo 53.6 10 L

4. Ponorogo 61.2 5 I *) 5. Kediri 49.0 14 I

6. Tuban 55.6 8 L

7. Gresik 72.9 2 C *) 8. Surabaya 51.3 11 C

9. Sidoarjo 44.1 15 C

10. Pasuruan 59.2 7 C *) 11. Pamekasan 54.5 9 L

12. Banyuwangi 62.8 4 L *) 13. Situbondo 67.0 3 L *) 14. Jombang 73.0 1 I *) 15. Jember 50.0 12 L

_ X = 57.5

Notes::

JP& E: Javanese Peasant and Egalitarian Societies E: Egalitarian Societies

JP: Javanese Peasant Societies I: Intermediate Region L: Lagged Region C: Congested Region

*): Regency with Highest respondents behavior rank toward Shari’ah Bank

Third highest rank (ranks 7-9), The respondents' behavior toward Shari’ah Bank

spread in Pasuruan Regency (congested region), Tuban Regency and Pamekasan

Regency (lagged and regions that have low occupation rate).

Fourth highest ranks (10-12 ranks), the respondents’ behavior spread in

Probolinggo Regency, and Lumajang Regency (Lagged region with production based

on Primary sector); Surabaya Regency (congested region and suffer the most from the

economic crisis because the industries depends on imported components).

Fifth highest ranks (13-15 ranks), the respondents’ behavior spread in Kediri

regency (Lagged region and has lowest growth). Jember Regency (Lagged region that

based on primary sector), Sidoarjo Regency (congested region but suffer from the

7.4.Company customers' preference toward Shari’ah Bank

By doing further analysis about company behavior toward Shari’ah Bank in the

sampled regions, it shows that:

Based on Table 6, there are six elements of behavior of the company customers

that agree with the existence of Shari’ah Bank:

1. Companies will choose Shari’ah Bank after gathering information.

2. Information from various sources is important for companies to be able to make

decision in choosing Shari’ah Bank.

3. Companies always make assessment about the strengths and weaknesses of banks

they know.

4. Companies will keep on using Shari’ah Bank as long as it gives benefits and has

good service.

5. Companies use Shari’ah bank based on loyalty and belief (religious) in assessing

benefit and services.

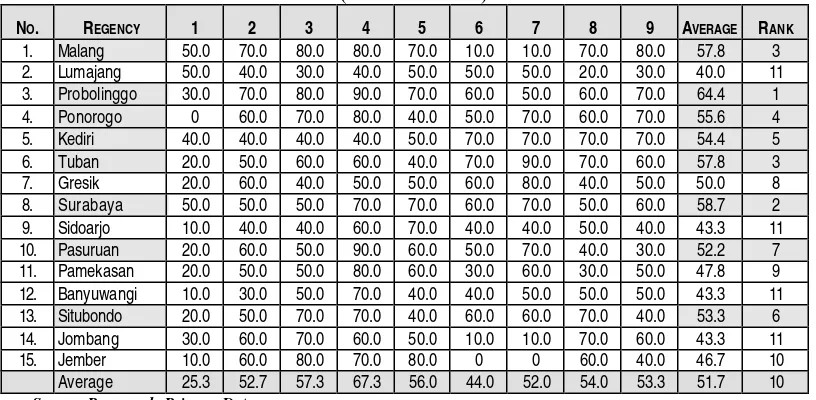

TABLE 6

COMPANIES’ BEHAVIOR THAT AGREE (52.7%) WITH THE EXISTENCE OF SHARI’AH BANK

(IN PERCENTAGE)

NO. REGENCY 1 2 3 4 5 6 7 8 9 AVERAGE RANK

1. Malang 50.0 70.0 80.0 80.0 70.0 10.0 10.0 70.0 80.0 57.8 3 2. Lumajang 50.0 40.0 30.0 40.0 50.0 50.0 50.0 20.0 30.0 40.0 11 3. Probolinggo 30.0 70.0 80.0 90.0 70.0 60.0 50.0 60.0 70.0 64.4 1 4. Ponorogo 0 60.0 70.0 80.0 40.0 50.0 70.0 60.0 70.0 55.6 4 5. Kediri 40.0 40.0 40.0 40.0 50.0 70.0 70.0 70.0 70.0 54.4 5 6. Tuban 20.0 50.0 60.0 60.0 40.0 70.0 90.0 70.0 60.0 57.8 3 7. Gresik 20.0 60.0 40.0 50.0 50.0 60.0 80.0 40.0 50.0 50.0 8 8. Surabaya 50.0 50.0 50.0 70.0 70.0 60.0 70.0 50.0 60.0 58.7 2 9. Sidoarjo 10.0 40.0 40.0 60.0 70.0 40.0 40.0 50.0 40.0 43.3 11 10. Pasuruan 20.0 60.0 50.0 90.0 60.0 50.0 70.0 40.0 30.0 52.2 7 11. Pamekasan 20.0 50.0 50.0 80.0 60.0 30.0 60.0 30.0 50.0 47.8 9 12. Banyuwangi 10.0 30.0 50.0 70.0 40.0 40.0 50.0 50.0 50.0 43.3 11 13. Situbondo 20.0 50.0 70.0 70.0 40.0 60.0 60.0 70.0 40.0 53.3 6 14. Jombang 30.0 60.0 70.0 60.0 50.0 10.0 10.0 70.0 60.0 43.3 11 15. Jember 10.0 60.0 80.0 70.0 80.0 0 0 60.0 40.0 46.7 10 Average 25.3 52.7 57.3 67.3 56.0 44.0 52.0 54.0 53.3 51.7 10

Source: Processed Primary Data Notes:

1 =Shari’ah Bank is an immediate need for company

2 = Prior choosing Shari’ah Bank, company gathers information about the bank.

3 = Information from Various Sources are important for company prior choosing Shari’ah Bank. 4 = Company always asses the strength and weaknesses of banks they know.

5 = Company chooses Shari’ah Bank based on rational consideration.

6 = Company makes decision (choosing Shari’ah Bank) after gathers information. 7 = Company always makes decision after assessing.

8 = Company will keep on using Shari’ah Bank as long as it gives benefit and good service.

Company customers’ behavior that agree with the existence of Shari’ah Bank

based on highest ranks (scored above average) are in seven Regions, respectively:

Probolinggo, Surabaya, Tuban, Malang, Ponorogo, Kediri, Situbondo, and Kediri.

Classification based on the relation between company agreement about Shari’ah

Bank existence and growth: (a) lagged region that has lowest growth (Tuban region; (b)

lagged region with production based on primary sector (agricultural), including

Probolinggo and Situbondo; (c) Intermediate region with moderate economic crisis

impact (Ponorogo and Kediri); and (d) Congested region but suffer the most from the

8. C

ONCLUSIONSA

NDS

UGGESTION8.1.Conclusions

Individual customers who have preference towards Shari’ah Bank mostly are

Javanese or Maduranese Moslems. However that does not mean that there won’t be any

non-Moslem or Chinese to become customer. They who have preference mostly live in

downtown or urban areas and just a few who are farmers.

Like individual society respondents, most of the companies' respondents who

have preference toward Shari’ah Bank are come from down town or urban areas..

Companies that interested about Shari’ah Bank mostly are Proprietorship or small

companies. Companies' respondents who already be customers are informed better

about Shari’ah Bank than who are not.

Based on Logit estimation, there are seven factors that influence the decision to

choose or not to choose Shari’ah Bank. Rank by the level of influence those are: (1)

Location, (2) Information and Rational Consideration, (3) Age and Life Cycle Stage, (4)

Reference Group (family), (5) Life Style, (6) Religious and Moral Orientation, and (7)

Belief and Attitude.

Religious and moral primordial factor are not the main or dominant factor in

influencing the choice for Shari’ah Bank. Our Society is rational-pragmatic, so the

factors influence they are also rational-pragmatic. Location factor, for example, is a

form of their rationalism-Pragmatism. The society wants a bank that has easily

accessible, and convenience. Other form of rationalism is information and rational

consideration factor. This factor indicates that information is required for someone to be

able to make assessment and decision. There is various information sources use by the

society, for example are advertising and reference group.

However, the reference group in this research has negative coefficient, it means

lessen the possibility someone will choose Shari’ah Bank. It may be caused because the

reference group (family) does not have adequate information