Barry Eichengreen,University of California, Berkeley

1. INTRODUCTION

The champions of European monetary unification long argued that the creation of a single European currency and a European Central Bank would transform the international monetary system and the operation of international financial markets. The first anniversary of the euro is an obvious occasion on which to ask “were they right?” The answer, as with many questions economic, is yes and no. Yes, the euro has fundamentally altered the opera-tion of financial markets and relaopera-tions. But, no, the results have not been those anticipated by many champions of the single currency. Many experts anticipated that the advent of the euro would transform the international monetary system by creating a new monetary unit that would quickly come to rival the dollar as a reserve currency, a vehicle currency, and an invoicing currency. The shift into euros by central banks, governments, and market participants the world over would cause Europe’s new currency to appreciate sharply, reflecting the changing balance of portfolio demands, or so it was predicted. And as the monetary steward of a relatively large, relatively closed continental economy, the European Central Bank would feel little pressure to counter these trends. Consequently, the euro was likely to display considerable volatility in its early days. In the event, neither the phenomenon nor its consequence has obtained. The euro has not overtaken or even pulled abreast of the dollar as an international currency. Predictions of a large-scale shift of international reserves from dollars to euros have not been borne out, as far as we can tell.

Address correspondence to B. Eichengreen, University of California at Berkeley, 549 Evans Hall, Berkeley, CA 94720-3880.

This article was prepared for a symposium on the first year of the euro forthcoming inThe Journal of Policy Modeling.For helpful comments I am grateful to Philipp Hartmann and Richard Portes.

Journal of Policy Modeling22(3):355–368 (2000)

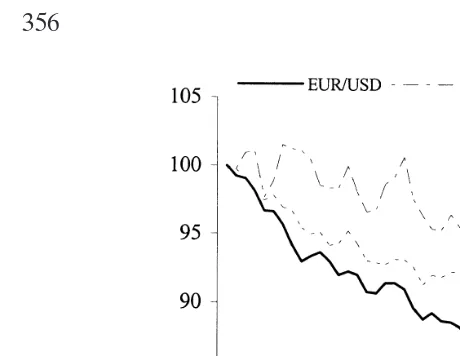

Figure 1. Euro exchange rate.

Exchange-rate volatility has not been high by historical standards. And, of course, the euro has been weak rather than strong against the dollar through its first year.

But whereas the euro’s impact on the international monetary and financial system has been less than predicted, its impact on European financial markets and the European economy has been immeasurably greater. The reorganization of European financial markets has been profound. National stock and futures exchanges have formed crossborder alliances. Hostile takeover bids have proliferated. The cost of capital for start-ups has fallen. The speed of these changes has been breathtaking, their implications far reaching. This revolution in European finance implies that the European economy will be market driven to a far greater extent in the future than in the past. It implies the decline of the national champions on which European industrial policy has long been based. These were not consequences that were widely predicted— nor were they implications that necessarily would have been wel-comed—by the architects of Europe’s monetary union.

2. THE FIRST YEAR OF THE EURO

that the currency’s fall has been general: the downward trend against sterling and the yen as well as against the dollar is unmistak-able.1

There is no shortage of explanations for the weakness of the euro. These include: (a) policy missteps by an inexperienced ECB Board, notably inadvertent disclosure of interest-rate changes to the press in advance of official announcements, which raised doubts about the competence of the new central bank. (b) The failure of ECB to release its inflation forecasts, to articulate the model on which those forecasts were based, and to adopt a trans-parent basis for its policy decisions, which arguably undermined the new institution’s credibility. (c) Public disagreements among ECB officials over the advisability of greater transparency. (d) The large volume of euro-denominated security issues by non-Euroland residents (described below) and the quick conversion of the proceeds into dollars. (e) The Italian Government’s deficit overrun and the exception Italy was granted from the strictures of the Growth and Stability Pact, which reinforced doubts about fiscal prospects in the Club Med countries. (f) The confrontational attitude of some EU officials, notably now former German finance minister Oskar LaFontaine, toward the ECB. (g) The uncertain commitment of certain European governments to market-friendly reform, as pointed up in the Schroeder Government’s response to the financial difficulties of the construction firm Holzmann and to the prospect of Vodaphone’s takeover bid for Manesmann.

Future event-study analyses are likely to demonstrate that many of these factors, however much attention they attracted at the time, played less of a role in the behavior of the euro exchange rate than suggested by much contemporary commentary. Far and away the most important factor in the decline of the euro against the dollar in 1999 was the weakness of the European economy relative to that of the United States. Where Europe was growing at barely 2 percent, the United States was surging ahead at more than twice that rate. With demand growing relatively slowly and excessive capacity pervasive in Europe, a weak euro was the mar-ket’s way of pricing European goods into international markets. The same general explanation holds for the yen: expectations of

1A prominent exception is the euro-Swiss franc rate, for reasons consistent with my

accelerating economic recovery pushed up the Japanese currency against the euro in the second half of 1999.2

This perspective suggests that the weakness of the euro during its first year does not reflect the incompetence of the ECB or flaws in the design of Europe’s monetary union. Rather, it is the markets’ natural response to cyclical asymmetries, between the United States and Europe in particular, which has had the effect of limiting what would otherwise be serious growth strains (of opposite sorts) in the respective regions. The euro’s weakness does not indicate that Europe’s great monetary gamble is less than a success.

At the time of writing, the consensus forecast is for European economic growth to accelerate relative to U.S. economic growth. It follows that the euro should regain some of the ground lost against the dollar in 1999.

3. THE EURO AND THE INTERNATIONAL MONETARY SYSTEM

What has not happened is the sharp appreciation of the euro against the dollar predicted by some observers. Authors like McCauley (1997) and Bergsten (1997) suggested that the euro would quickly be pushed up by 35 to 70 percent against the dollar by the portfolio shift of central banks, governments, and market participants into the new European currency.3The euro, in other

words, would quickly come to rival the dollar in the international domain, in ways that had profound implications for equilibrium exchange rates. This has not happened.

In the long run, there remains every prospect of the euro becom-ing an increasbecom-ingly important reserve, vehicle, and invoicbecom-ing cur-rency. The further deepening and widening of European securities markets (analyzed below) will stimulate the demand for reserves denominated in euros. At the same time, EMU will make available instruments with the relevant characteristics. Historically, Conti-nental European currencies have had only a limited reserve-cur-rency role because the Bundesbank’s opposition to short-term

2The euro-Swiss franc rate offers proof by counterexample insofar as the strength of

euro relative to the franc reflects the even greater macroeconomic difficulties experienced by Switzerland over the period.

3Alogoskoufis and Portes (1997) foresee an appreciation of the euro by 40 percent

finance prevented the German finance ministry from floating Trea-sury bills. Central banks with a demand for short-term, liquid government securities consequently had no choice but to hold dollars. (Some central banks used bond futures to shorten the duration of their holdings of German government bonds, but these operations were expensive.) Now the presence of other debt-issuing governments in the euro area ensures the availability of a supply of euro-denominated Treasury bills.

Some modest indications of the euro’s growing reserve-currency role can be observed. Late in 1999, the Hong Kong Monetary Authority announced the intention of increasing the share of its reserves held in euros from 10 to 15 percent. Argentina, Brazil, Canada, the Philippines, and South Africa launched government bond issues denominated in euros, and are likely to hold euro reserves to hedge the currency risk. Some 50 European and Afri-can countries either peg to or pursue a tightly managed float against the euro or a basket in which the euro has a heavy weight, which makes euros the obvious instrument for use in foreign-exchange-market intervention. But a massive shift into euro-denominated reserves, leading to the sharp appreciation of the euro against the dollar, as predicted by some analysts, has simply not occurred.

One possibility is that the shift from the dollar to the euro has only been delayed by the flight to quality in the wake of Russia’s default, by the all but failure of the Connecticut-based hedge fund Long-Term Capital Management, and by the cyclical weakness of the European economy, all of which caused the euro to un-derperform. There are reasons to think that this last factor—that so long as the euro was weak, central bankers were reluctant to shift their portfolios out of dollars—has been particularly impor-tant.4A senior central bank official from the Philippines, the first

Asian country to issue a euro-denominated bond (in March), observed in mid-1999, for example, that her central bank wished to build up its reserves of European currency in anticipation of growing trade and debt transactions with the euro-zone, but that the timing would depend “on how quickly the euro stabilizes.”5

More generally, as Montagnon (1999) wrote on the occasion of the Asian Development Bank’s 1999 annual meeting, “Asian gov-ernments, which include five of the world’s seven largest holders

of reserves, have cold-shouldered the euro because of its weakness since its launch.” Now that the consensus forecast is for the euro to strengthen against the dollar as growth in Europe accelerates relative to growth in the United States, this long-delayed process of reserve reallocation may finally get underway.6

The other interpretation, to which I subscribe, is that the stabil-ity of the demand for reserves denominated in different currencies reflects the stability of its underlying determinants. The central banks with the largest reserves—those of China and Hong Kong SAR, for example—continue to peg to the dollar, and all the evidence we have (e.g., Eichengreen and Mathieson, 2000) sug-gests that currency pegs continue to matter for reserve-holding behavior. In addition, old reserve-holding habits die hard. One need only consider the tendency for central banks to hold reserves in the form of gold to be impressed by this point. The currency composition of central banks’ reserves is slow to change because habits are slow to change. And central banks are reluctant to contemplate a radical change in their portfolios, reserve portfolios and otherwise, for fear that this will signal a lack of policy conti-nuity.

The same conclusion applies to the invoicing and vehicle-cur-rency roles of the euro. Given sufficient time, the creation of a euro area whose share of world trade is larger than that of the United States will make the euro more attractive as a vehicle and invoicing currency. But the attractions of shifting to the euro are a function of how many other market participants also shift. There is little incentive to be first, lending the international role of curren-cies a strong element of inertia. This is the implication of both economic theory (Kiyotaki, Matsui, and Matsuyama, 1993) and historical evidence (Eichengreen, 1998).7

Finally, two mechanical effects work to limit the importance of the euro as an international currency in the short run. First, on January 1, 1999, the Eurosystem’s reserves previously denomi-nated in euro-area national currencies became domestic assets,

6As Roach (1999, pp. 2–3) writes, “I have had many officials warn me of the coming

asset allocation shift out of dollars and into euros . . . With Asian authorities collectively managing close to $650 billion in currency reserves . . . the implication of this asset allocation shift out of dollar-denominated assets should not be taken lightly. These guys are still overweight in dollars, and believe me, virtually all are thinking about reducing their exposure to the world’s largest international debtor” (pp. 2–3).

7The continued tendency of petroleum and other commodity prices to be quoted in

which reduced the share of European currencies in global foreign-exchange reserves. Second, turnover on European foreign ex-change markets has declined with the advent of the euro. The Bank of England (1999) estimates that turnover between the euro and the other major currencies was 15 to 30 percent lower in 1999 than it was in the EMU-11 currencies in 1998.8Turnover has also

been lower in the forward and futures markets. This response was predictable: it reflects the replacement of the EMU-11 currencies by the euro and the elimination of crosscurrency trades within Euroland. But that it was predictable does not make it unimpor-tant. An installed base is critical in markets where network exter-nalities are pervasive, and this effect works to reduce the installed base.

Thus, the advent of the euro has had less impact on the interna-tional monetary system than many observers had supposed. Vola-tilities for the euro/dollar exchange rate implied by euro/dollar options have been broadly similar to those for the DM/dollar rate prior to the Asian crisis. Realized month-on-month changes of 2 percent are also very much in line with the historical behavior of the dollar/DM rate. The forecasts of Hartmann (1996), Cohen (1997), and Breedon and Chi (1998) that the euro/dollar rate would be significantly more volatile than the DM/dollar rate have not been borne out. Nor is there evidence of large shifts from dollars to euros by central banks and other asset holders around the world. In all these respects, then, the impact of EMU on the international monetary system has been more modest than predicted. Those who appreciate the historical imbeddedness and inertial character of international monetary arrangements will not be surprised.

4. THE EURO AND THE EUROPEAN FINANCIAL SYSTEM

Where the euro has had an unexpectedly large impact is on the structure and operation of Europe’s own markets—as opposed to international markets and the markets of the rest of the world. It was widely anticipated that the elimination of currency risk would stimulate the creation of deep and wide European markets

8The average size of deals also appears to be smaller now than before the launch of

in government and corporate bonds, commercial paper, and equi-ties (Portes and Rey 1998). A deeper and wider market would deliver a more efficient allocation of financial resources, enhancing the international competitiveness of the European economy in turn. This, after all, was part of the raison d’eˆtre for the Single Market program, of which monetary unification was supposed to be the capstone (viz. Emerson, 1991).

But many observers were skeptical that either the effects or the benefits would be large. Bid-ask spreads in most segments of Europe’s financial markets were already narrow; it was hard to believe that the elimination of spreads of only a few basis points would revolutionize the European economy. The continent’s mixed banks were deeply entrenched; their crossholdings of indus-trial shares were extensive. The steady progress of securitization to the contrary notwithstanding, it was hard to believe that the modest economies of scale conferred on securities markets by the advent of the single currency would lead to the rapid displacement of bank intermediation.

In fact, EMU has transformed Europe’s financial markets more quickly than anticipated by all but the most ardent euro-enthusi-asts. This, in turn, raises three questions: What has happened? Why has it happened? And to what effect?

As expected, bid-ask spreads in government bond markets have fallen to U.S. levels. The German 10-year bond has emerged as the common interest-rate benchmark at the long end of the market.9It

has also become the largest-volume contract in futures markets worldwide. The mechanisms behind the integration of government bond markets are clear. Euro-area governments redenominated their outstanding debt stocks in euros at the beginning of 1999, and all their new issues are in euros. Banks have greater incentive to diversify their portfolios across the bonds issued by different euro-area governments. Before EMU, regulation and the fact that national central banks took only domestic government bonds as collateral for their lending encouraged home-country bias; now, the bonds issued by any euro-area government are equally free of currency risk and equally eligible as collateral at the ECB. Pension funds and life insurance companies, for their part, are no

9A benchmark, to become established, required large tranches of bonds to exist in the

longer prevented by currency-matching rules from expanding their holdings of securities issued by euro-area governments other than those of their home country.

As the market deepens and gains liquidity, denominating issues in euros becomes more attractive, and the growth of the market feeds on itself. In the second and third quarters of 1999, issues denominated in euros and dollars accounted for about 40 percent of the currency denomination of international bonds and notes each.10 The dollar and the euro are also of roughly equal

impor-tance when “home currency” issuers are excluded. This contrasts with the historical situation, when nonresident issues denominated in dollars outnumbered those denominated in European currenc-ies by roughly two to one.11

The growth of Europe’s corporate bond market has been espe-cially impressive, and it is here that the economic implications are particularly profound. Euro-denominated corporate bond issu-ance by euro and noneuro area companies rose from E30 billion in the first three quarters of 1998 to E117 billion in the first three quarters of 1999. To be sure, recovery from Russia’s default and from the LTCM debacle, which had a depressing effect on the market in the third quarter of 1998, had something to do with this, but the role of the euro is undeniable. Financial institutions continue to dominate this market, but the share of nongovernment euro-denominated issuance accounted for by nonfinancial private corporations has risen from 7 percent of the total in 1998 to 18 percent in 1999 (first three-quarters in each case). Meanwhile, the average size of nongovernmental issues has risen by 50 percent. The elimination of currency risk has allowed borrowers to arrange exceptionally large transactions, while investors’ reorientation from strategies focusing on interest rate convergence to a search for yield has allowed lower rated borrowers to access the market. Thus, between the first 9 months of 1998 and the first 9 months of 1999, the share of corporate bond issuance accounted for by Baa issues rose from 4 percent to 15 percent.

Importantly, from the point of view of the present analysis, this development seems to have been largely internal to Europe. The story is not that the advent of the euro unleashed a pent-up demand for securities denominated in euros by investors from

10The remainder being accounted for mainly by Japanese yen, along with a few other

subsidiary currencies.

other parts of the world, in response to which the volume of euro-denominated issues went through the roof, but that the creation of a more liquid market in Europe stimulated both the supply and demand of euro-denominated debt securities there. As Det-ken and Hartmann (2000) put it, “most of the euro bonds and notes supplied via the international primary debt market . . . are effectively held by euro area residents and not by external invest-ors so far.”

The story in the commercial paper market is broadly similar. The volume of outstanding paper rose by a third in the 12 months ending in October 1999. It can be expected to rise further with the removal of remaining bureaucratic obstacles, notably French regulations preventing mutual funds from investing more than a small proportion of their assets in commercial paper issued by entities resident in other European countries. The liquidity and transparency of the commercial paper market was further en-hanced when, in September 1999, intermediaries trading commer-cial paper began reporting transactions through Trax, a trade matching system for international securities that provides real-time data on transactions. This has significantly lessened the de-pendence on the banking system of European companies requiring short-term funding.

The unsecured money market has similarly grown as a result of the euro. International banks have been able to book large money-market deals on a crossborder basis at very fine bid-ask spreads. Money market interest rates have converged. There has been a sharp increase in the volume of interest rate swaps, which are used to hedge against volatility in the overnight rate in the market for maturities up to 3 months.

Equity markets are also growing and integrating rapidly. The high-tech sector is one obvious beneficiary: trading on EASDAQ and the Neue Markt is rising particularly rapidly, although volumes are still low by the standards of NASDAQ. The crosscountry correlation of equity market returns has risen as a result of eco-nomic and monetary union (Portes, 1999). This should lead to the consolidation of trading in a smaller number of more liquid securities markets, a la the United States. (Gehrig, 1999). The scramble of European stock and derivatives exchanges to form crossborder alliances is a manifestation of the pressure.

winds of competition into previously sheltered sectors of the Euro-pean economy. The euro was supposed to make this process irre-versible. But not even the new currency’s most dedicated propo-nents imagined how quickly competitive pressures would intensify, because they failed to anticipate the mechanism: hostile takeover bids. Firms that fail to maximize value and efficiency now become the target of takeovers, not just because the Single Market has removed the barriers to crossborder mergers but, critically, be-cause the euro and the associated revolution in European financial markets has reduced the cost of acquisitions. The increased avail-ability of funds has provided considerable stimulus to the merger and acquisition activity that has been the dominant feature of the corporate sector in 1999. “Acquirers have been able to rapidly refinance large syndicated loans in the international bond market,” as BIS (1999, p. 16) has put it. The most visible case in point is the E8 billion issue floated to finance Olivetti’s takeover of Tele-com Italia, an issue on this scale being inconceivable prior to EMU. But the effects are general: about 40 percent of all European corporate issues in the first three-quarters of 1999 were related to mergers and acquisitions. According to KPMG, the volume of crossborder merger and acquisition activity in Europe rose by 107 percent in the first three-quarters of 1999, to $440 billion, plausibly as a result.

The long-standing system of industrial crossholdings, in which banks hold shares in the corporations to which they lend, no longer offers insulation, because banks come under the same pressure to maximize return in the new Europe. And in Germany, where the system was most deeply entrenched, proposed changes in the capital gains tax treatment of sales by banks of their industrial shares promise to speed the divestiture of those holdings.

This new state of affairs leaves governments with less leverage over their industrial partners. Politicians who lean on firms to support employment at the expense of the bottom line expose those companies to shareholder dissatisfaction and takeover threats. Favoring domestic mergers over crossborder mergers is no solution, for the new national companies, even if large by Europe’s historical norms, are small by international standards. Thus, encouraging Olivetti to acquire Telecom Italia still does not insulate the combined company from Deutsche Telekom or MCI-Worldcom at some future date.

sector. It has lowered the cost of capital for start-ups that seek to realize their value through IPOs and sharpened the incentives for entrepreneurial initiative. Entrepreneurs in sectors like soft-ware have long complained of the difficulty of raising venture capital in Europe. Now, with the growth of IPOs, the incentives to supply venture capital have been strengthened, and even Europe’s large, slowly moving banks have leapt into the breech. More of the dynamism of the European economy will thus derive from the small-firm sector, less from Europe’s long-established industrial behemoths. Again, the implication is that governments will have less leverage over the evolution of the economy in the future than the past.

5. CONCLUSION

In its first year of operation, the euro delivered both more and less than advertized. It did not produce the revolution in interna-tional finance promised by some observers of the internainterna-tional monetary system. But its implications for European financial mar-kets have been more immediate and far-reaching than anticipated even by the new currency’s most enthusiastic proponents. It is not that their forecasts were fundamentally flawed, but that their tim-ing was off. One is reminded of the first law of forecasttim-ing: give them a prediction or give them a date, but never give them both. If this conclusion is warranted, then with sufficient time the remaining elements of the forecast should be validated. The re-structuring of European capital markets and the rapid growth of financial transactions in euros will support an expanding interna-tional role for Europe’s new currency. Given time, the growth of securitized finance will create a platform from which the euro can challenge the dollar for international financial supremacy and overcome the network externalities and institutional inertia that, for now, sustain the dollar’s international preeminence. At that point we will possess one more observation with which to answer the chicken-and-egg question of what mainly supports what: a large and liquid domestic securities market or a currency’s interna-tional role. In other words, the argument will have been definitively resolved in favor of the former.12

12I think of this as the debate between Bergsten (1997) and Portes and Rey (1998),

The other principle demonstrated by the first year of the euro is the law of unintended consequences. One of the motivations for European integration, in the minds of political leaders like Delors, Mitterand, and Kohl, was to create a more civilized alter-native to U.S.-style market capitalism. One cannot help but con-clude that by using the single currency to cement the Single Mar-ket, they instead opened the door to remaking the European economy along American lines. Prominent among the conse-quences will be a more heavily market-based financial system, and all the things that follow from it: more entry and exit, more hostile takeovers, a more dynamic small-firm sector, more preoc-cupation with the bottom line, less employment security, and less opportunity for industrial policy. All this follows from the advent of the euro. Who would have ever guessed?

REFERENCES

Alogoskoufis, G., and Portes, R. (1997) The Euro, the Dollar, and the International Monetary System. InEMU and the International Monetary System(P. Masson, T. Krueger, and B. Turtelboom, Eds.). Washington, DC: International Monetary Fund, pp. 58–78.

Bank of England. (1999)Practical Issues Arising from the Euro.London: Bank of England. Bank for International Settlements. (1999)International Banking and Financial Market

Developments.Basle: BIS.

Bergsten, C. F. (1997) The Impact of the Euro on Exchange Rates and International Policy Coordination. InEMU and the International Monetary System(P. Masson, T. Krueger, and B. Turtelboom, Eds.). Washington, DC: International Monetary Fund, pp. 17–38.

Breedon, F., and Chui, M. (1998) Will the Euro Be Stable?Economic Outlook23:30–33. Cohen, D. (1997) How Will the Euro Behave? InEMU and the International Monetary System(P. Masson, T. Krueger, and B. Turtelboom, Eds.). Washington, DC: Interna-tional Monetary Fund, pp. 397–417.

Detken, C., and Hartmann, P. (2000) The Euro and International Capital Markets. Unpub-lished manuscript, European Central Bank.

Eichengreen, B. (1998) The Euro as a Reserve Currency.Journal of the Japanese and International Economies12:483–506.

Eichengreen, B., and Mathieson, D. (2000) The Currency Composition of International Reserves: Retrospect and Prospects. Unpublished manuscript, University of Califor-nia at Berkeley and International Monetary Fund.

Emerson, M., et al. (1991)One Market, One Money.Oxford: Oxford University Press. Gehrig, T. (1999) Cities and the Geography of Financial Centres. InThe Economics of

Cities(J. Thisse, and J.-M. Huriot, Eds.). London: Routledge.

Kiyotaki, N., Matsui, A., and Matsuyama, K. (1993) Toward a Theory of International Currency.Review of Economic Studies60:283–307.

McCauley, R. M. (1997)The Euro and the Dollar.BIS Working Paper No. 50. Basle: BIS. Montagnon, P. (1999, May) Asia Spurns Weak Euro in Favour of Dollar.Financial

Times3:1.

Portes, R. (1999) Global Financial Markets and Financial Stability: Europe’s Role. CEPR Discussion Paper No. 2298.

Portes, R., and Rey, H. (1998) The Emergence of the Euro as an International Currency.

Economic Policy26:307–343.

Reuters. (1999) China Eyes Euro Reserves Despite Weakness. April 12, 6:42 Eastern time, http://biz/yahoo.com/rf/990412/dp.html.