In the Unified Chart of Accounts, a revision of the needs of companies is required. The uniformity of financial statements, which are prepared within the framework of procedures and principles related to the arrangement and presentation of financial statements in the unified accounting system, cannot be changed.

Uniform Chart of Accounts

In Uniform Chart of Accounts coding, different code systems are used when numbering accounts. According to the Uniform Accounting System, enterprises must establish their accounting systems in accordance with the uniform accounting framework and chart of accounts.

Bank Uniform Chart of Accounts

Income and expenditure relating to discontinued activities and taxes on these income and expenditure (accounts 684 and 697).

Turkish Financial Reporting Standards (TFRS)

B)—Businesses subject to the regulation and supervision of the BRSA in accordance with the Banking Act—(i) Banks; (ii) Financial leasing companies; (iii) Factoring companies;. iv) Financing companies; (v) Asset management companies; (vi). Subject to independent audit and the implementation of FRS for LMEs in the preparation of individual and consolidated financial statements of institutions, institutions and enterprises other than the above; however, it will be able to implement the TFRS at the request of the relevant institutions, organizations and enterprises.

Financial Reporting Standards for Large- and Medium-Sized Enterprises (FRS for LMEs)

FRS for LMEs is a financial reporting framework that is subject to independent audit and is valid for financial statements submitted to general meetings of companies that do not apply the TFRS. It has been decided that FRS may be applied for LMEs in the preparation of the statutory and consolidated financial statements of the institutions, branches and companies that are not required to apply IFRS.

Conclusion

Bu bölüm, orijinal çalışmanın alıntılanması şartıyla herhangi bir ortamda sınırsız kullanıma, dağıtıma ve çoğaltmaya izin veren Creative Commons Attribution License (http://creativecommons.org/licenses/ .by/3.0) koşulları altında dağıtılmaktadır. gerektiği gibi . Büyük ve orta ölçekli işletmeler için finansal raporlama standardının (BOBİ FRS) Türkiye'nin tam set muhasebe ve finansal raporlama standartları (TMS/TFRS) ile karşılaştırılması.

TOP 1%

Introduction

In the development of any economy, the banking sector plays a key role, since it is primarily this sector that promotes the task of mediating between the so-called surplus agents (they do not use all their monetary resources, the savers) and the so-called deficit agents (require additional monetary resources); this is one of the reasons why there are banks in every country. Because they also transmit monetary and credit policies issued by central banks and/or governments to the general population in such a way that they become one of the key sectors of any economy, since an important part of savings, investment and financing goes through their mediation. Banks are important in any financial system; for example, in the United States in mid-2017, there were 7,836 member banks of the Federal Deposit Insurance Corporation.

40, 820, Organic Statute of the Financial System [8], in Article 2, it is explicitly stated that the main function of banking institutions is the collection of funds on a bank current account and the collection of other demand or fixed deposits. , with the primary goal of active credit operations.

Colombian banking sector

In terms of income, 61% of the total amount was concentrated in ten entities: 7 banks, 2 insurance companies and an administrator of pension and retirement funds: Bancolombia, Banco Agrario, Banco de Bogotá, Banco de Occidente, Davivienda, Protección, BBVA and Banco Corpbanca, insurance company Suramericana, insurance company Positiva and Porvenir administrator. In terms of profits, only 8 concentrated 66% of the sector's total profits; among these are Bancolombia, Banco Agrario, Banco de Bogota, Banco de Occidente, Davivienda, Banco Colpatria, Banco Popular and Suramericana Vida. According to [15], the Aval Group is one of the most important financial groups in Colombia; even on its website it calls itself "Colombia's largest financial group".

Another of the important groups is Grupo Bancolombia, which indicates that 142 years have passed since its birth [16]; this group originates from the merger of Bank of Colombia and Industrial Colombiano Bank, later merged with Conavi (2005) and Confisura.

Methodology

- Data envelopment analysis (DEA)

- CRS model

- VRS model

Otherwise, in the interruption of December 2016 and using the SFC as a source of information, it can be seen that within the Colombian financial system there are 25 banks that represent 11% of the total subjects of the sector, but in terms of participation. in assets, banks represent 93%. Looking at the behavior of the obligation, it is found that at the end of 2016, it is 475 billion ALL with an increase of 9% for this last year, and between 2010 and 2016 with an increase of 125% with an ever-trending increase in growth. The ratio between the given portfolio and public deposits (savings, CDT and current accounts) for the sector is 0.92, which represents that for every peso it captures, the sector puts in only 0.92 pesos.

One of the strengths of DEA is that a single efficiency score (%) is obtained for each unit, in a multi-input, multi-output context.

Review of current literature

Additionally, for each of these basic models there is the orientation to the inputs and the orientation to the outputs, depending on whether you want to prioritize the maximum decrease of inputs keeping the outputs constant or the total maximization of outputs with the constant inputs. The CRS and VRS models were used by [39] in their research to measure the efficiency of commercial banks in Slovenia, Poland, Austria, Hungary, Slovenia and the Czech Republic. The research in [46] proposes a model with a multi-step procedure that integrates robust methods, cluster analysis and DEA to identify and study the effectiveness of management in the banks' different branches.

50] examined the relative efficiency of 23 Colombian commercial banks over a period of 10 years with the CRS and VRS models oriented to inputs and outputs.

Specific methodological design

Islamic banks were studied by [42] comparing them with conventional banks using the Meta-Frontier Analysis (MFA) model. The main banks in Cambodia were studied by [47] through the DEA panel model for 13 years. Research from [49] focused on measuring the effectiveness of marketing as a measure of post-merger performance, and this was investigated through DEA applied to 20 M&A deals within the US commercial bank.

The same input and output variables were used by [52] and by (Rodríguez-Lozano) [57] to study insurance brokerage companies in the Colombian financial environment through DEA indicators, and also by [58] to determine the relative efficiency in two subsectors of the Colombian economy from 1993 to 2002 and [59] to determine the measure of relative efficiency in three subsectors of the Colombian economy from 1993 to 1999.

Results

- Analysis by groups

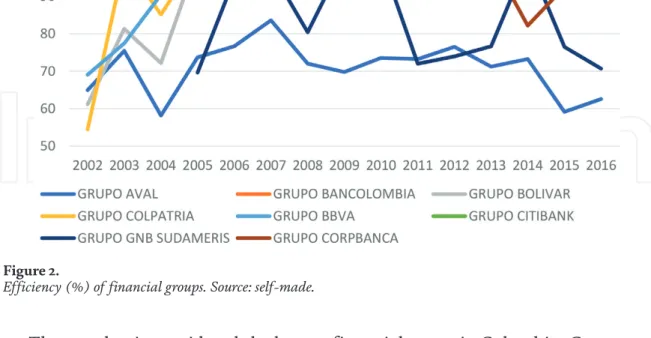

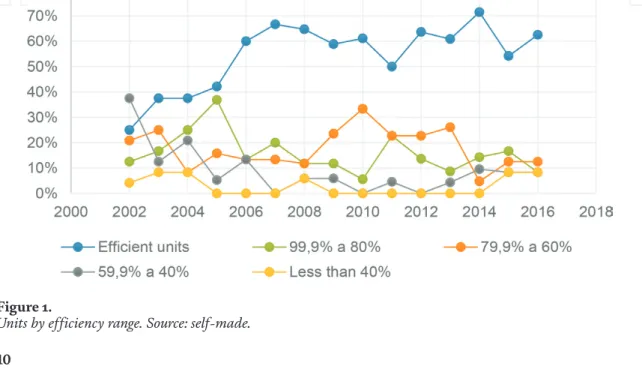

For 2016, despite the continued slowdown of the economy, the Colombian banking sector reported good results, for example a 17% increase in profits. Similarly, the participation of efficient banks improved to 63%, and the rest of the ranks were concentrated around the 10% share. On the other hand, the only efficient group in all 15 years of the study is Grupo Bancolombia.

The behavior of Grupo BBVA is very similar to that of Grupo Bolívar and Grupo Colpatria, but this group is not effective for 2016; although it is very close, its index is 93%.

Conclusions

Within this study, it has been possible to determine that of the 13 financial institutions that entered the sector during the study period and as previously mentioned, 62% have achieved such good results that at least 90% of the years of life have been efficient and when they are not, the indicator is over 90%. 15 years of the Colombian banking sector is 86%, despite having unleashed the first global financial crisis of this century and living in a severe economic recession worldwide. Otherwise, be a robust financial group, that doesn't mean you as a group have to be efficient.

This gap began in 2006 with a difference of 47% points, increasing for 2008 and ending in the last year of the survey at more than 50% points.

Recommendations

In this case, the country's creditors would normally be without any recourse because the debt contracts are designed, operationalized and maintained within the debtor country's legal framework. However, this position also creates an opportunity for delays and reticent behavior by giving creditors protections that are contractually derived from a legal system outside that of the debtor country. However, the solution to the national debt crisis would not be so simple, to paraphrase the legal positivist H.L.A.

This proposal is made in the context of the lack of support from countries that have the “major financial centers from which most of the national debt is issued” ([9], p. 47).

The conflict of law regime of sovereign debt restructuring

New York and English Law are often the choices of law in debt instruments because of their "insulating effect" against "legislative changes in the borrower's country" ([13], p. 4). Thus, the myriad of sovereign debt contracts is the core operational legal framework in resolving a sovereign debt crisis. The application of the international principle of State Sovereignty is determined to a large extent by the State's express and tacit waiver of such principle contained in the debt contracts.

In the first place, whether debt contracts are considered protected under an investment treaty would depend on the specific definition of "investment" under such treaty.

Establishing a treaty-based normative framework

In the next part, we will discuss this proposal by codifying the norms of the UN General Assembly resolution 69/319, which is based on the treaty. A broad codification of the norms of UN General Assembly Resolution 69/319 would be a compromise between a "soft law" approach (usually in the form of guidelines that countries can adopt) and a "hard law" approach. A degree of flexibility is required in SDRs, particularly given the rapidly changing nature of the sovereign debt market (see generally [20]).

The broad codification of the standards in UN General Assembly Resolution 69/319 would in itself be an important step towards establishing a multilateral normative framework in SDR.

The principle of sustainability

Although this recognition may be limited to the extent that it affects a state's willingness to pay its debt, the IMF's definition is significant to the extent that it involves an assessment of the social and political situation in the debtor state in connection with a sovereign debt crisis. The expansion of the government's asset base also prevents the unlimited accumulation of future debt. In the context of SDR, "inclusive economic growth" ultimately means the increased likelihood that the debtor state will pay its debts.

The treaty's codification of "inclusive economic growth and sustainable development" as part of the principle of sustainability helps the SDR to go beyond a purely financial framework of sustainability.