This three-year project will ease congestion in the area and is expected to be completed by February 2017. The second phase of the Western Aqueduct pipeline is underway, while the first phase of the Northern Aqueduct is nearing completion. This is mainly due to people seeking work in the developed areas of the city.

MAYOR’S REPORT (BUDGET SPEECH) 1

In December 2014, the KOMOSO AWARD for an astonishing achievement in the implementation of the Expanded Public Works Programme. This is one of the ways to promote service excellence in the Metropolitan Police.

COUNCIL RESOLUTIONS 1

- BUDGET RELATED RESOLUTIONS

- ESTIMATES OF INCOME AND EXPENDITURE

- RECAPITULATION: VALUATION OF RATEABLE PROPERTY

- EXEMPTIONS, REBATES AND REDUCTIONS

- RESIDENTIAL PROPERTY

- PUBLIC BENEFIT ORGANISATIONS

- LIFE RIGHTS SCHEMES AND RETIREMENT VILLAGES

- SCHOOLS NOT FOR GAIN

- BED AND BREAKFAST UNDERTAKINGS

- GUEST HOUSE UNDERTAKINGS

- BACK–PACKER LODGES, HOLIDAY ACCOMODATION AND STUDENT ACCOMMODATION

- NATURAL AND OTHER DISASTERS

- MUNICIPAL PROPERTIES

- NATURE RESERVES AND CONVERSATION AREAS

- ECONOMIC DEVELOPMENT

- SPECIAL RATING AREAS

- CONSULATES

- PHASING IN OF RATES

- DATE OF OPERATION OF DETERMINATION OF RATES That this determination comes into operation on 1 July 2015

- FINAL DATE FOR PAYMENT OF RATES

- ADMINISTRATION CHARGE ON ARREAR RATES

- DOMESTIC WATER DEBT RELIEF PROGRAM

- ELECTRICITY DEBT RECOVERY USING THE 80/20% OR 50/50% PREPAYMENT SYSTEM

- BUDGET RELATED POLICIES

- CAPITAL EXPENDITURE ESTIMATE

- BORROWINGS TO FINANCE THE CAPITAL BUDGET

- HOUSING/HOSTELS DEFICIT

- NEW FUNCTIONS/ SERVICES

- MEASURABLE PERFORMANCE OBJECTIVES

- PARTICULARS OF INVESTMENTS

- REMUNERATION OF COUNCILLORS AND SENIOR OFFICIALS

- UNFUNDED MANDATES

- IMPACT OF HOUSING EXPENDITURE ON THE CASH RESERVES

- FREE BASIC SERVICES

That the following reductions in the market value of the property and discounts on the interest rates payable are approved and are approved in accordance with the Pricing Policy. That the following phasing in rates be approved and approved in accordance with Section 21 of Local Government:.

EXECUTIVE SUMMARY 1

- INTRODUCTION

- OVERVIEW OF THE 2015/16 MTREF

- STRATEGIC PRIORITIES FOR THE 2015/2016 YEAR

- KEY ISSUES

- PERFOMANCE, ACHIEVEMENTS AND CHALLENGES

- SERVICE DELIVERY

- INSTITUTIONAL TRANSFORMATION

- SERVICE DELIVERY STANDARDS, LEVELS OF SERVICES, OUTCOMES, TIMETABLE FOR ACHIEVEMENTS AND FINANCIAL IMPLICATIONS

- FINANCIAL PERFORMANCE (2013/14 AND 2014/15): PARENT MUNICIPALITY

- OPERATING BUDGET

- CAPITAL BUDGET

- ALIGNMENT WITH NATIONAL AND PROVINCIAL PRIORITIES

- FINANCIAL STRATEGY, ONGOING VIABILITY AND SUSTAINABILITY

- FINANCIAL STRATEGY

- BUILT ENVIRONMENT PERFORMANCE PLAN ( BEPPS )

- MUNICIPAL SERVICE FINANCIAL MODELLING FOR ETHEKWINI

- INFRASTRUCTURE DELIVERY MANAGEMENT SYSTEMS (IDMS)

- MUNICIPAL ENTITIES

The strategic objectives of the projects are defined in the municipality's energy strategy and Durban's draft climate change strategy. The municipality received a glowing report from the provincial COGTA regarding the implementation of the 2014/15 IDP.

OPERATING REVENUE FRAMEWORK 1

SOURCES OF FUNDING REVENUE

OPERATING EXPENDITURE FRAMEWORK 1

CAPITAL EXPENDITURE 1

CAPITAL BUDGET

INFRASTRUCTURE EXPENDITURE TRENDS

Economic Development

Electricity

Reduction of the housing provision program in function of the reduction of subsidies and the economic climate.

Human Settlements

Refuse Removal

Sanitation

Undertaken income – budget increased by R 80.4 million. to R 705.5 million to accurately reflect the cost of free basic services.

Roads

Water

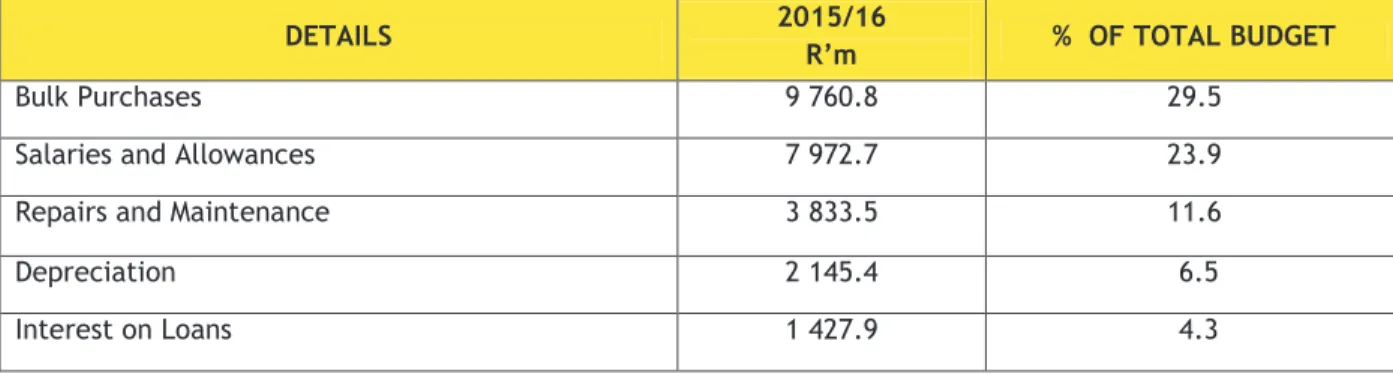

MAJOR ITEMS OF EXPENDITURE

- HUMAN SETTLEMENTS, ENGINEERING, TRANSPORT AND INFRASTRUCTURE

- CORPORATE AND HUMAN RESOURCES

- GOVERNANCE

ANNUAL BUDGET TABLES

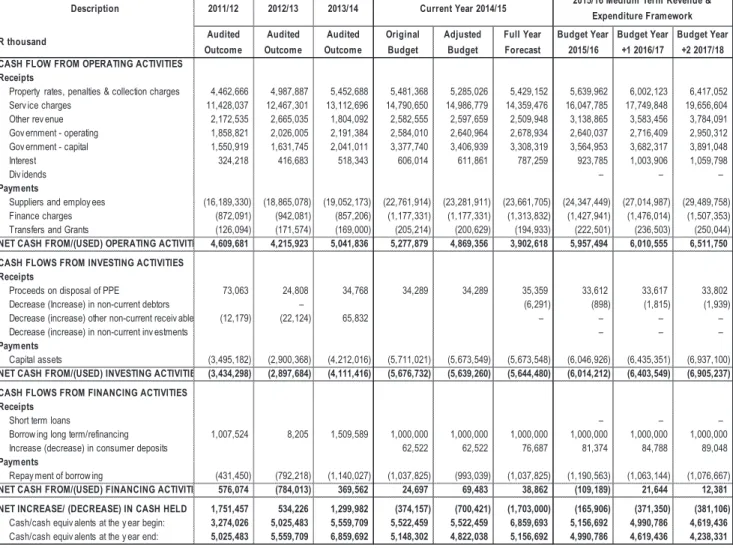

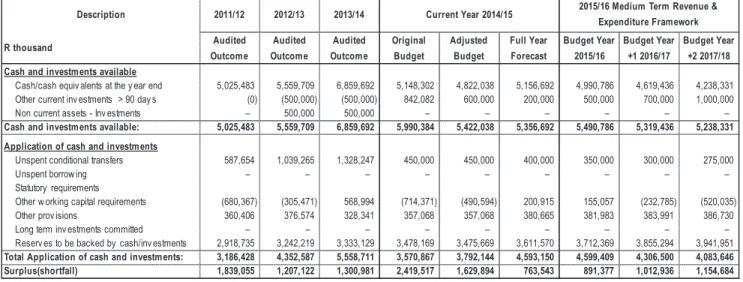

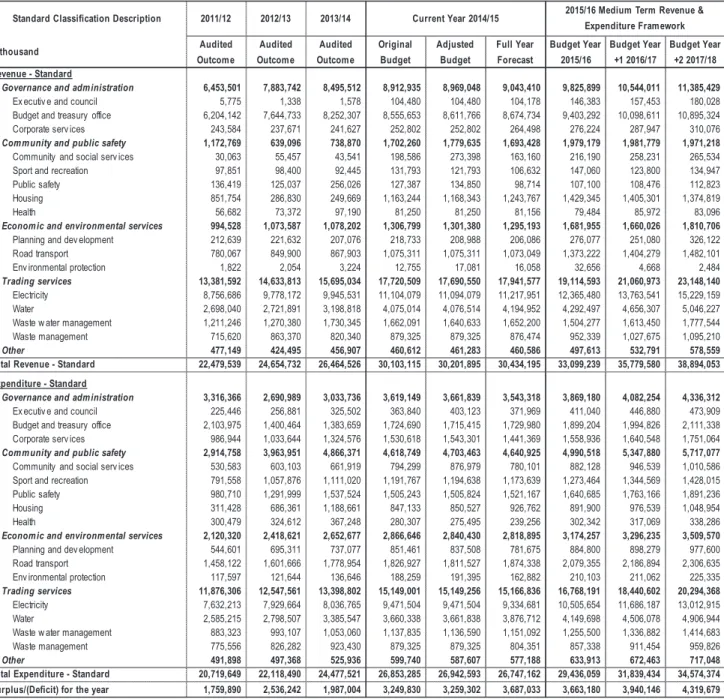

The table provides an overview of the amounts to be approved for operational performance, as well as the commitment of the municipality to clear backlogs in basic services. This requires the simultaneous assessment of financial performance, financial position and cash flow budgets, along with the capital budget. Internally generated funds are financed from a combination of current operating surplus and accumulated cash surpluses from previous years.

Although the council attaches great importance to the municipality's financial sustainability, this does not come at the expense of services for the poor. This table facilitates an overview of the budgeted operating result in relation to the city's organizational structure. The reason is that the ownership and the municipality's net assets belong to the community.

For example, the assumption of the collection rate will affect the cash position of the municipality and consequently determine the level of cash and cash equivalents at the end of the year. It shows the expected level of cash inflow versus cash outflow likely to result from budget execution.

OVERVIEW OF THE ANNUAL BUDGET PROCESS 2

- OVERVIEW

- POLITICAL OVERSIGHT OF THE BUDGET PROCESS

- PROCESS FOR CONSULTATIONS WITH EACH GROUP OF STAKEHOLDERS AND OUTCOMES

- SCHEDULE OF KEY DEADLINES RELATING TO THE BUDGET PROCESS

The mechanism through which the municipality's needs are identified and priorities are set is the Integrated Development Plan (IDP). Both the operating budget and the capital budget have been evaluated through a prioritization mechanism that ensures alignment with the development strategy of the municipality. The key to strengthening the link between priorities and spending plans lies in increasing political oversight of the budget process.

MFMA section 53, subsection 1, letter a, states that a municipality's mayor must provide political guidance on the budget process and the priorities that must guide the preparation of the budget. Political oversight of the budget process gives the government, and especially the municipality, the opportunity to manage the tension between competing political priorities and fiscal realities. Therefore, the presentation of the budget proposal in the city council on March 31, 2015 was followed by extensive publication of the budget documentation in the municipality's newspaper, Metro eZasegagasini.

In relation to the Municipal Systems Act and in the context of the Municipal Financial Management Act, hearings were held in April 2015 on the budgets of various regions in the eThekwini area, where each region consisted of a number of departments. The budget timetable for the preparation of the 2015/16 budget cycle was approved in August 2014, well before the start of the budget year and in accordance with the MFMA.

OVERVIEW OF ALIGNMENT OF BUDGET WITH IDP 2

- KEY NATIONAL AND PROVINCIAL GUIDING DOCUMENTS

- DEVELOPMENT CHALLENGES

- POLITICAL PRIORITIES AND LINKAGES TO THE IDP

- IDP OVERVIEW AND KEY AMENDMENTS

- IDP REVIEW PROCESS AND STAKEHOLDER PARTICPATION

- LINK BETWEEN THE IDP AND THE BUDGET

Given the strategic framework outlined, it is clear that the city's budget must be a pro-growth budget that meets basic needs and builds on existing skills and technology. The municipality's delivery plan is organized into eight separate but related plans. These priorities lead to the creation of structures that support, house and associate other actions and activities – the building blocks around which actions and prioritization take place. All operating and capital programs in the 2015/16 medium-term budget were assessed through a prioritization mechanism developed to ensure alignment with the development strategy of the municipality.

The IDP was the foundation of the priorities defined in the strategic plan, and all resources are directed towards achieving the priorities. The IDP is a five-year plan, the main purpose of which is to ensure the development of the local community in an integrated way, which includes strategic business units in the municipality, relevant strategic stakeholders and the community. The municipality is committed to addressing people's needs and values community and stakeholder input.

As set out in the Municipal Systems Act (2000), in the review of the five-year EDP, a stakeholder consultation process is necessary. It is critically important that the municipality ensures that there is full consultation with the community and strategic stakeholders.

MEASURABLE PERFORMANCE OBJECTIVES AND INDICATORS 2

- KEY FINANCIAL RATIOS / INDICATORS

- FREE AND SUBSIDISED BASIC SERVICES

- DRINKING WATER QUALITY AND WASTE WATER MANAGEMENT

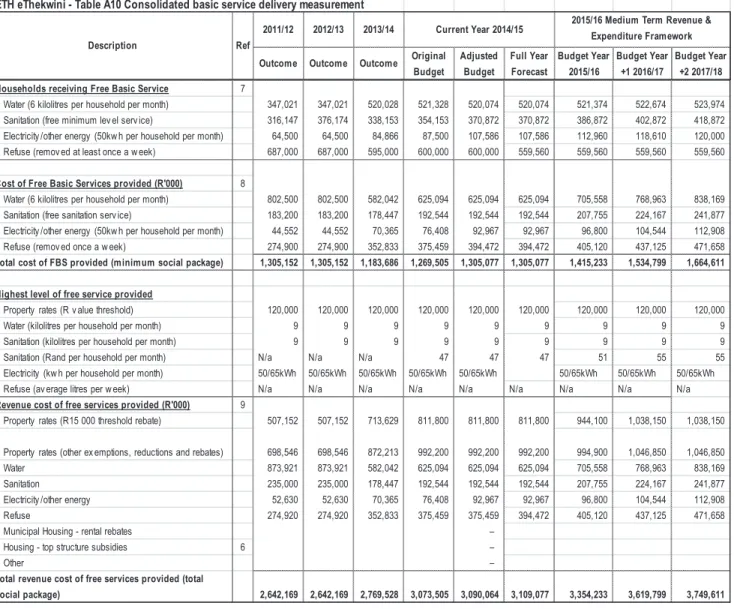

One of the aims of a local authority is to ensure the provision of services to communities in a sustainable manner. The constitution states that a municipality must structure and manage its administration, budget and planning to give priority to the basic needs of the community and to promote their social and economic development. The basic social package is a confirmation of the municipality's commitment to push back the boundaries of poverty by providing social welfare to those residents who cannot afford to pay, due to unfavorable social and economic realities.

The estimated cost of the welfare package (ie loss of income) is approximately R3.4 billion for the 2015/16 financial year. Details of the initiatives proposed by the council in this regard are detailed below. Assistance to eligible households is governed by municipal budget policies, which are reviewed annually based on modeling the effects of tariffs on all residential properties.

EThekwini Water Services fulfills the role of the water service authority while Umgeni Water is the water service provider for the municipal area. EThekwini Water and Sanitation Unit is committed to providing safe drinking water of the highest quality as well as treating waste water responsibly so that it does not have a negative impact on human health or our environment.

OVERVIEW OF BUDGET RELATED POLICIES 2

- ASSESSMENT RATES POLICY

- CREDIT CONTROL AND DEBT COLLECTION POLICY

- TARIFF POLICY

- SUPPLY CHAIN MANAGEMENT POLICIES

- INVESTMENT / CASH MANAGEMENT AND BORROWING POLICIES

- VIREMENTS BUDGET POLICY

- ASSET MANAGEMENT PLAN

- ACCOUNTING POLICY

- FUNDING AND RESERVES POLICY

- BUDGET POLICY

The policy reflects and represents the context of a specific government policy that finds expression within the provisions of the Municipal Finance Management Act 56 of 2003. The main objectives of the policy are to provide, promote and implement theoretical guidelines, governance processes and procedures within the management chain of supply. In accordance with the regulations and National Treasury Circulars, the policy was reviewed and approved by the council on 2013-10-30.

Highlights of the policy include a contract register which ensures procurement plans are in place before any work is issued. As required by the Municipal Financial Management Act, and in accordance with the Municipal Cash Management Regulations, the Investment Framework Policy and Guidelines have been revised with the revised policy adopted by Council on 2013-08-28. To ensure compliance with Section 28 of the MFMA, and the Municipal Budget and Reporting Regulations, procedures have been formulated in relation to the transfer of funds and the adjustment budget reporting.

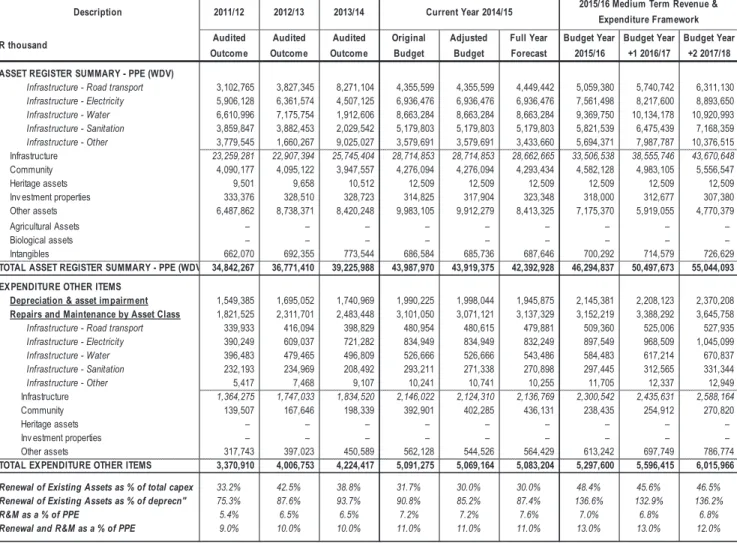

The purpose of the Asset Management Plan is to improve the management of the city's assets, predict future asset problems and define the future costs of maintaining all infrastructure assets. In order to ensure compliance of the financial statements with GRAP, the accounting policies were changed and approved by the council on 06/29/2006.

OVERVIEW OF BUDGET ASSUMPTIONS 2

- KEY FINANCIAL ASSUMPTIONS

- CREDIT RATING OUTLOOK

- BORROWING AND INVESTMENT OF FUNDS

- PRICE MOVEMENTS ON SPECIFICS

- TIMING OF REVENUE COLLECTION

- AVERAGE SALARY INCREASES

- CHANGING DEMAND CHARACTERISTICS (DEMAND FOR SERVICES)

- ABILITY OF THE MUNICIPALITY TO SPEND AND DELIVER ON THE PROGRAMS

The 2015/16 Capital Budget of R 6.0 billion is financed by R3.6 billion from government grants, R1.4 billion of internally generated funds and R1.0 billion in external loans. The chart below shows the Total Capital Budget since 2009 and indicates its funding sources. The dominance of annuity loans within eThekwini's loan portfolio is largely due to the City's ability to obtain competitive interest rates from financial institutions. This graph reflects the relationship between External Debt and Total Operating Income and is an indicator of the ability to afford Debt.

Cash, which is excess to immediate requirements, is invested in short-term money market instruments under a strict investment policy, which specifies that cash holdings are placed only in Africa's "big 4 banks". South and Investec. Cash and investments are expected to be around R5.0 billion at the end of the current financial year. Being the economic center of the province, the city's water demands are increasing rapidly.

This is the result of economic growth, urbanization of the population and the associated expansion of (residential) developments. In this regard, expenditure on capital projects is estimated to increase to 118% of the capital budget in 2014/2015.

OVERVIEW OF BUDGET FUNDING 2

- LOAN DEBT AND INVESTMENTS

- SOURCES OF FUNDING

- SAVINGS AND EFFICIENCIES

- Costs Savings and Productivity Improvement Initiatives

- ENERGY OFFICE

- INVESTMENTS – CASH BACKED

- COLLECTION RATES FOR EACH REVENUE SOURCE

- LEVELS OF RATES, SERVICE CHARGES AND OTHER FEES AND CHARGES

Contract register: A contract register database is used to control all payments above R 200,000. The first phase of the automation of the contract register has been completed, in that the contract register is now in the JDE account system. The main aim of this project is the analysis of the spending trends and prices to be included in the municipality's VKB price catalogue. An Energy Management Steering Committee (OBSC) will be constituted with membership representing each of the entities responsible for major energy use within the municipality.

Responsibility for the implementation of each of the interventions identified by the OBBS will be assigned to the entity within the municipality unit that is most directly responsible for the system in question. The determination of the effective property tax rate is therefore an integral part of the municipality's budgeting process. A valuation date of 1 July 2011 has been determined, with implementation of the valuation roll coming into effect from 1 July 2012.

The tariff increases are necessary due to the increase in the cost of bulk purchases, maintenance of existing infrastructure, new infrastructure provision and to ensure the financial sustainability of the services. The increase in the household waste collection rate for the 2015/16 year is mainly due to salary increases, conversion of agency staff to permanent and the increased cost of purchasing waste bags.

GRANT ALLOCATIONS 2

LEGISLATION COMPLIANCE STATUS 2

SERVICE DELIVERY AND BUDGET IMPLEMENTATION PLAN (SDBIP) 2

STATISTICAL INFORMATION 2

CONSOLIDATED BUDGET

DETAILED

BUDGET SUPPORTING TABLES