Directory UMM :Journals:Journal Of Public Economics:Vol79.Issue1.Jan2001:

Teks penuh

Gambar

Dokumen terkait

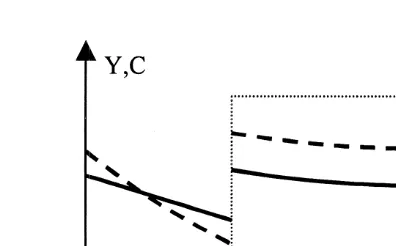

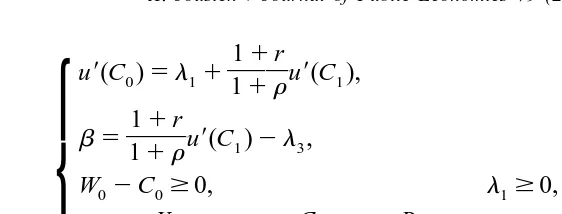

Whether capital income should be taxed or subsidized depends on the correlation between individual savings and consumption and not on the overall level of savings or the

The increase in the marginal capital income tax rate thus imposes a cost on a mimicker while a wealthy household revealing his true type is not affected, which means that

When taxes on wage income raise the after-tax rate of return on human capital investment, growth rates for sufficiently productive individuals may rise.. An increase in the

First, in order to assess whether the behavior of the very wealthy is affected by estate taxes, one must compare patterns of inter vivos giving for those with potentially

Many researchers over time have stressed the importance of incorporating the manufacturing perspective in the formulation of business strategy. Prior work in this area has tended

The following research proposition is examined: firms that make a higher level of commitment in adopting a more com- prehensive array of JIT practices experience greater benefits in

The large number of AnGR at risk in develop- ing countries, together with the limited financial resources available for conservation, mean that economic valuation (especially

al divergence in Gossypium occurred between the ancestor of the A-, D-, E-, and AD-taxa and the ancestor of the C-, G-, and K-genome species (Wendel and Albert, 1992; Seelanan et