Financial Performance 2Q05

Teks penuh

Gambar

Garis besar

Dokumen terkait

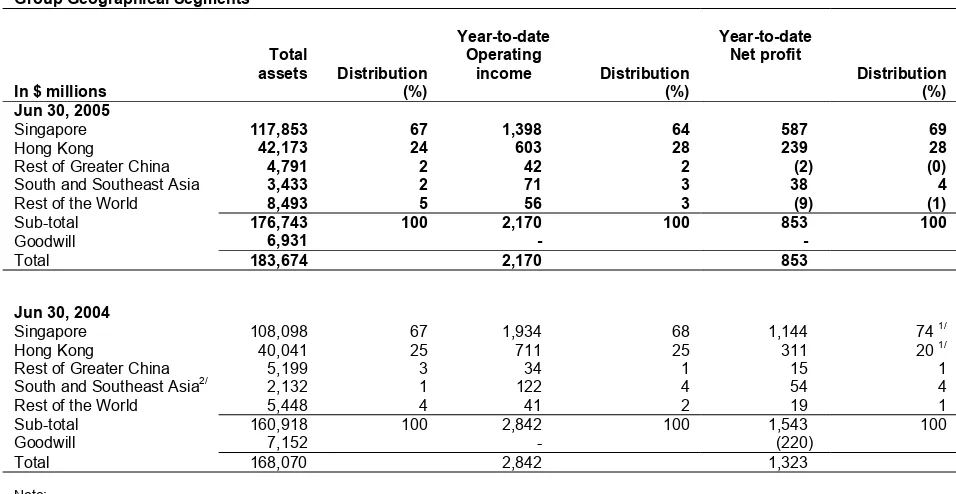

Of the three basis point NIM increase this quarter, two basis points came from Hong Kong and one basis point was from Singapore.. Melissa Kuang

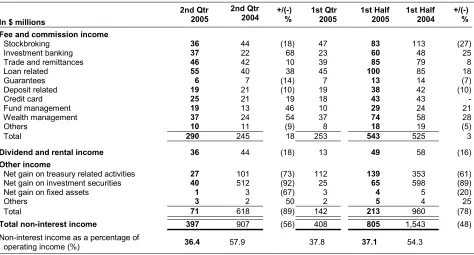

Non-interest income fell 19% from the previous quarter as loan-related fees and trading income declined, which were partially offset by better wealth management revenues and

The higher trading income boosted other non-interest income to $306 million from $269 million a year ago and $87 million in the previous quarter.... An increase in staff costs in

Figures for Hong Kong geographical basis and converted to S$ using monthly closing rates. Based on

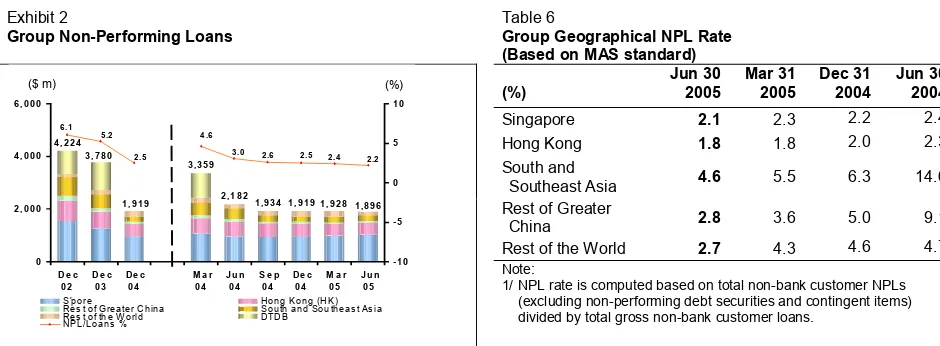

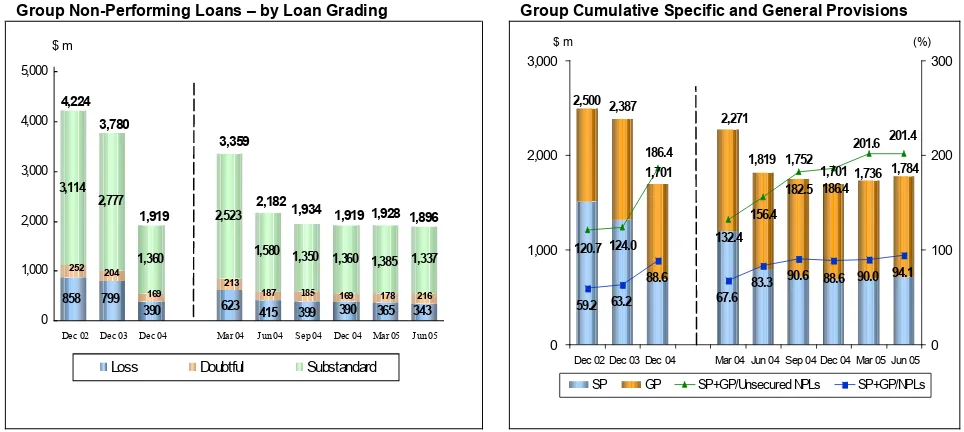

Specific allowances for other assets increased from $35 million in the previous quarter to $84 million and was for investments in debt securities issued by certain US and

Operating profit before tax increased 25% from a year ago and 2% from the previous quarter to $188 million due to higher operating income, partly offset by higher operating

Compared to first quarter 2004, net profit after taxation declined 7% mainly due to lower operating income and an increase in provision charge.. • Net interest income was up 9%

Third quarter 2001 (3Q01) net interest income of S$588 million was 24.6% and 14.7% higher than second quarter 2001 (2Q01) and third quarter 2000 (3Q00) respectively, largely due to