Directory UMM :Journals:Journal Of Public Economics:Vol78.Issue3.Dec2000:

Teks penuh

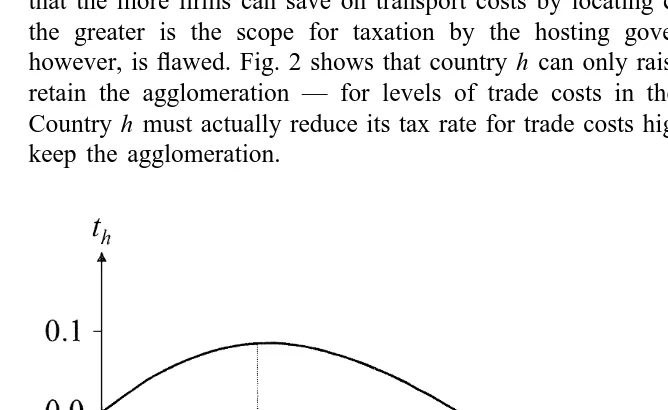

Gambar

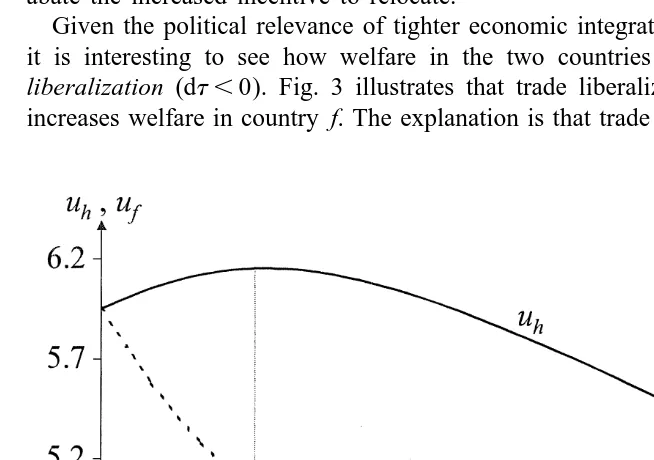

Dokumen terkait

Proost, Marginal tax reform, externalities and income distribution 343 McGarry, K., The cost of equality: unequal bequests and tax avoidance 179. Newey, W.,

Borsch-Supan, A., Incentive effects of social security on labor force participation: evidence in?. Germany and across

The policy parameters, the annual money growth rate (or the inflation tax rate) p˙ ( 5 ( z 2 1)/5), and capital gains tax rate t , are calibrated so that the model can predict how

analysis indicates that actual railroad wheat transport prices in the study area declined following the mergers which is consistent with the conclusion of the network model

The model comprises four main parts: (i) the project scheduling based assembly on the " rst level, (ii) coordination of fabrication and assembly, (iii) the lotsizing

Then in order to enhance the solution of the Lagrangean heuristic, another procedure is developed to attain capacity feasibility in case of hierarchical relaxation before the

The robustness vector is a measure of how much the performance alters with respect to ITAE and noise bandwidth for all combinations of production lead time at 50%, 100%, and 150% of

The approach taken here is to use an asymptotic approximation for the & undershoot ' , the amount by which stock has fallen below the re-order level by the time an order is