Directory UMM :Data Elmu:jurnal:M:Multinational Financial Management:Vol10.Issue2.2000:

Teks penuh

Gambar

Dokumen terkait

niger group, had moderate and moderate to high degrees of aggregation (patchiness), respectively, in two peanut ®elds with a history of a¯atoxin contamination: Lloyd's index

by limiting their time horizons and the way in which variances are referenced, run the risk of confusing an initial response of the market to the issue of options which induce

Under the Naı¨ve Approach, the DoD estimates the total US dollar equivalent of its overseas commitments for the upcoming fiscal year by using the spot exchange rate at some point in

Out of the thirteen bilateral exchange rates, evidence of PPP is found for only one (the Mexican peso/U.S. dollar rate) under traditional tests for unit roots, while seven of

To calculate the predictive mean one needs the conditional distribution of losses given the parameter of interest (often the conditional mean) and the prior distribution of

In the second case, if a firm expects that the permits will be given free for the firms existing at the future moment of policy change, it may enter the industry before the

The comparative plot of drop size distribution resulted from image processing technique and pellet method for a sprinkler nozzle of 5 mm diameter operating at a pressure of 14 m

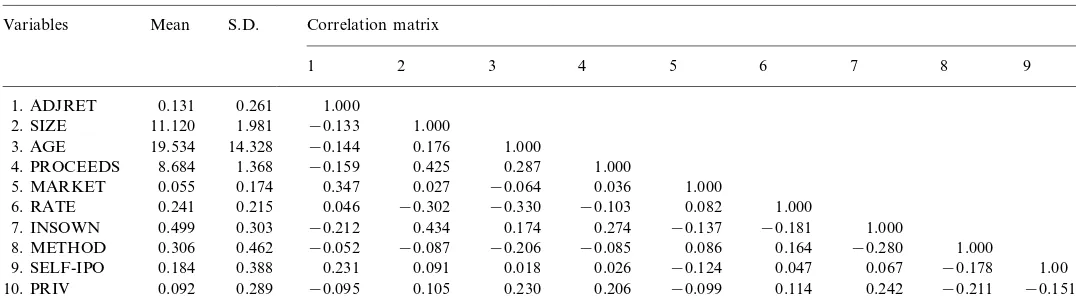

SIZE: firm size measure by logarithm of total assets; WC: working capital measured by current assets divided by current liabilities; LEVERAGE: leverage measured by current liabilities