It is a pleasure to present to you the report of my internship program on "An Analysis of the Financial Services of National Bank Ltd: A Study on Lake Circus Branch- Dhaka". Daliya Nowshin Nisha, ID No a student of Masters in Business Administration from Daffodil International University completed the internship report titled "An Analysis of the Financial Services of National Bank Ltd: A Study on Lake Circus Branch-Dhaka", under my supervision. I got full help from all the staff of the National Bank Limited, Lake Circus Branch.

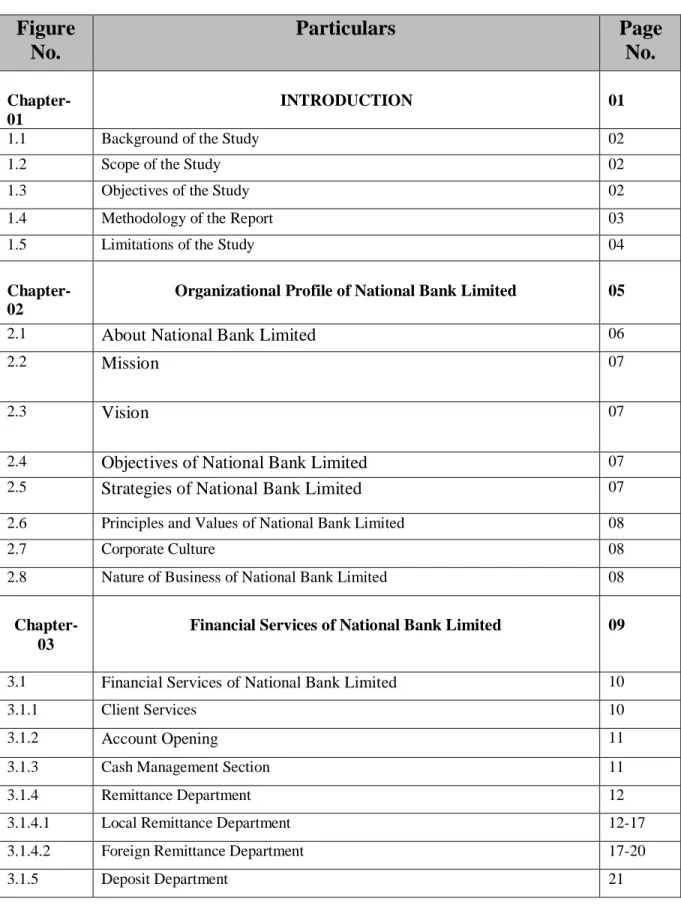

This report is created based on my three-month on-the-ground involvement with National Bank Limited, Lake Circus Branch. The data used are now collected from various sources, for example, work in the work area, extensive assistance of representatives, annual reports, the website of the National Bank, etc. In the second section, I have talked about National Bank Limited Summary, Corporate Information, Limitations, crucial, key evaluations, life objectives, head exercises,.

In the third part, I talked about the money management of Lake Circus Branch, National Bank Limited. As a major aspect of the need for a Master of Business Administration temporary placement program, I have been transferred to fulfill my entry-level position at National Bank Limited, Lake Circus Branch for a period of quarter of a year. To identify problems related to financial services of National Bank Limited, Lake Circus Branch;.

Essential information was gathered for the most part through the essayist's perception of the endorsement procedure and observation systems, chance meetings of officials, officials and workers of National Bank Limited, Lake Circus Branch.

Limitations of the study

ORGANIZATIONAL PROFILE OF NATIONAL BANK LIMITED

- About National Bank Limited

- Mission

- Vision

- Objectives of National Bank Limited

- Strategies of National Bank Limited

- Principles and values of National Bank Limited

- Corporate culture

- Nature of Business of National Bank Limited

National Bank Limited has its prosperous past, glorious present, upcoming future and ongoing projects and activities. Established as the first private sector bank wholly owned by Bangladeshi entrepreneurs, NBL has flourished as the largest private sector bank over time after facing many stresses and strains. The members of the board of directors are creative businessmen and leading industrialists of the country.

In order to keep pace with the times and be in harmony with national and international economic activities and to be able to provide all modern services, NBL as a financial institution automated all its branches with computer networks in accordance with the competitive commercial demand of the time . NBL currently operates through its 203 branches and agricultural branches spread across the country. It has agreements with 415 correspondents in 75 countries of the world, as well as with 37 foreign exchange companies in 13 countries.

To obtain an eternal seat in the hearts of individuals as a watchful friend in raising the national monetary standard by persistently raising degrees and expanding their client base administration in accordance with national and world needs is the ideal goal they must achieve. Ensuring the best quality of demographic administrations by making the best use of the latest data innovations, proper commitment to the national economy and a firm position at home and abroad as a leading bank in the country is their cherished vision. Supervise and work the bank in the most professional manner to upgrade budget execution and control trade costs..

Financial Services of National Bank Limited

Financial Services of National Bank Limited

- Client Services

- Account opening

- Cash management section

- Remittance Department

- Local Remittance Department

- Foreign Remittance Department

- Deposit Department

- Clearing Section

- Online Banking Services

- Accounts Department

In the branch, specific areas are introduced to give the organizations an authoritative game plan of the customers. Account opening procedure: National ID card, 2 copies of passport size photograph of the account opener, 1 copy of passport size photograph of the nominee of that account. This is one of the safest approaches to start cashing in one place and then to the next.

Liquidation of assets is one of the most important parts of the business Banks in the delivery of administrations to its customers. It is a request from the issuing branch to the withdrawing bank/office for installment of a specific total of cash to the recipient. On acceptance of the TT confirmation duplicate from giving branch, the details of TT are confirmed with respect to points of interest previously mentioned in the T.T.

Payment request is a request by a giving branch or bank on customer for a made installment of the amount referred to in that said pay on as per customer request. The customer of the compensation request has taken it into account after that approved official issuance of one charge and credit voucher. Request draft is an instrument containing a request for the giving branch on another branch known as withdrawal branch for the installment of a specific amount of cash to the beneficiary or at his request on request by the recipient who presents the draft itself.

After giving a bank check to the buyer, the issuing part of the bank sends instructions to the payee branch. The signature of the authorized officer of the issuing branch must be verified to ensure that the draft is genuine. On receipt of release from the administrative center, the given branch issues a brand new draft in place of the first announced lost one.

The recommended undo cost should be recovered from the candidate and only the quantity of the design minus the undo cost should be discounted. While the giving branch hands over the change, the beneficiary or purchaser of the change cannot give any directions for stopping payment to the concerned branch. If a paying branch receives a request from the beneficiary/endorsee or the buyer to stop the installment, it will approach them. to go to caring about the reason. If the customer has air conditioning at the bank, the money will be moved to the air conditioning.

Internal Assortment Bills (IBC): When the bank takes over the account as a collection branch specialist, the bank receives a consignment note. This is where the bank gets checks from an outside or neighborhood branch. Collects invoices and sends them to the receiving office.

PROBLEMS, RECOMMENDATIONS AND CONCLUSIONS

- Problems Identified

- Recommendations

- Conclusions

- References

The majority of the workers mostly consider their own benefit, which proves that the organization issue is here. NBL needs to expand their ATM stall and improve ATM administrations for consumer loyalty and to gain advertising image. Despite the fact that the presentation of general customer administrations is acceptable, their representatives ought to be gradually prepared.

The office should select master HR to give excellent customer support, which will bring viability of the bank's activity. Director of the branch ought to screen exercises of the official with the goal that the customers get skilled administrations. The achievement of banking is currently thoroughly relying on the variables, for example, basic leadership, effective and pleasant administrations, most extreme utilization of assets and presentation of new money-related items.

Despite having some issues, the presentation of the bank is good giving better. The bank is expanding its activity by expanding its branches to capture the market. So in the end it can be very well said that every association has its positives as much as the negatives the administration is determined to achieve in the choice of progress, it seems that in the not so distant future the negatives will be annihilated and the National Bank Limited will to arrive. the most significant level of achievement in the blink of an eye.