i

The Influence of Good Corporate Governance Implementation

towards The Firm Performance: The Study on Manufacturing

Companies Listed in Malaysian Stock Exchange

Period (2010-2014)

By:

NADIAH INTAN SAHARA

1111082100005

INTERNATIONAL PROGRAM

ACCOUNTING DEPARTMENT

FACULTY OF ECONOMICS AND BUSINESS

ISLAMIC STATE UNIVERSITY SYARIF HIDAYATULLAH

JAKARTA

vi

CURRICULUM VITAE

Personal Identities

Name : Nadiah Intan Sahara

Gender : Female

Place of Birth : Muara Enim

Date of Birth : September 29th 1993

Address :Dsn III Desa Sidomulyo RT/ RW 001/003 Kecamatan Muara Lakitan Kabupaten Musi Rawas Sumatera Selatan Mobile Number : 081213582474

Email Address : [email protected]

Formal Education

Collage : University Utara Malaysia 2015 UIN Syarif Hidayatullah Jakarta 2016

Senior High School : Darunnajah Islamic Boarding School Jakarta 2011 Junior High School : Darunnajah Islamic Boarding School Jakarta 2008 Elementary School : Madrasah Islamiyah Negeri Prabumulih 2004

Affiliation

Academic:

Participant in Entrepreneur University IM4U (1 Malaysia for Youth) workshop in Universiti Sains Malaysia (2014) IM4U is an initiative of Malaysian government that encourage volunteering among Malaysian youth.

Participant in ― Talk on Financial Services Act (FSA) and Islamic

vii

Participant in Industry Talk: Building Ethical Leaders held by Universiti Utara Malaysia and Northern Illinois University USA (2014)

Participant in UUM-CIMA Student Conference : “Empowering Leaders of

Tomorrow” CIMA is stand for Chartered Institute of Management

Accountant

Participant in International Entrepreneurial Networking Course (2013) Participant in Festival IYC ―Indonesia Youth Conference‖ (2013)

Participant in ―Seminar Interaktif Transformation of Capital Market:

Pengaruh Implementasi Kebijakan Otoritas Terhadap Iklim Investasi Pasar Modal‖ (2013)

Participant in ―PPI UUM International Conference: Social Transformation Towards Sustainability Society‖ (2013)

Participant in ―Seminar Nasional Indonesia Berkarakter‖ held by Ministry

of Education and Culture of Indonesia (2012)

Non Academic:

Member of Entrepreneurial Action Us (ENACTUS) , in 4Nature Department, Universiti Utara Malaysia (2013-2014)

HMJ (Himpunan Mahasiswa Jurusan) in Islamic states university of Syarif Hidayatullah Jakarta as The Student Affairs Department (2012-2013) OSDN ( Organizations of Darunnajah ) in Darunnajah Islamic Boarding

viii

The Influence of Good Corporate Governance Implementation towards The Firm Performance: The Study on Manufacturing Companies Listed in

Malaysian Stock Exchange Period (2010-2014)

ABSTRACT

This research is aimed to analyze the influence of good corporate governance implementation towards the firm performances: the study on manufacturing companies listed in the Malaysian stock exchange. In this study, good corporate governance is categorized into four indicators, which the size of board of directors, the size of boards of independence, managerial ownership and institutional ownership. This research is categorized as a quantitative research and used a secondary type of data. The data collection techniques in this research is downloading the annual report of the manufacturing companies in Malaysia that listed on the website www.bursamalaysia.com. This research uses purposive sampling method. Based on the purposive sampling method and the criteria, from 300 manufacturing companies listed, there are only 57 manufacturing companies chosen to be the research sample, so that there 285 sample units from the period 2010 - 2014. The analysis method used in this research is a model of multiple linear regression analysis that processed by using SPSS 18 for Windows7. Data analysis was performed by Descriptive Statistical Analysis, Classical Assumptions Test, Hypothesis Test, Coefficient Determination Test (R²-test). The classical assumptions test includes: Multicollonearity Test, Heteroscedasticity Test, Autocorrelation Test and Normality Test. Hypothesis Test includes: Partial Significance Test (t-test) and Simultaneous Significance Test (f-test). The results showed that the size of board of directors has influenced the firm‘s performance. In addition, the size of board of independence, managerial ownership and institutional ownership does not influence the firm's performance.

Keywords: Good Corporate Governance, Firm‘s Performance (ROA) and

ix

Pengaruh Pelaksanaan Good Corporate Governance terhadap Kinerja Perusahaan: Studi pada Perusahaan Manufaktur yang Terdaftar di Bursa

Efek Malaysia Periode (2010-2014)

ABSTRAK

Penelitian ini bertujuan untuk menganalisis pengaruh pelaksanaan good corporate governance terhadap kinerja perusahaan, studi pada perusahaan manufaktur yang terdaftar di bursa efek malaysia. Dalam penelitian ini, good corporate governance dikategorikan menjadi empat indikator, ukuran dewan direksi, ukuran dewan independensi, kepemilikan managerial dan kepemilikan institusional. Penelitian ini dikategorikan sebagai penelitian kepustakaan kuantitatif, yang menggunakan jenis data sekunder. Teknik pengumpulan data dalam penelitian ini adalah dengan men-download dokumen yaitu laporan keuangan tahunan perusahaan manufaktur di Malaysia yang terdaftar di situs www.bursamalaysia.com. Penelitian ini menggunakan metode purposive sampling. Berdasarkan metode purposive sampling dan kriteria, dari 300 perusahaan manufaktur yang terdaftar, hanya ada 57 perusahaan manufaktur terpilih menjadi sampel penelitian, sehingga terdapat 285 unit sampel dari periode 2010 - 2014. Metode analisis yang digunakan dalam penelitian ini adalah model analisis regresi linier berganda dengan bantuan software SPSS 18 untuk Windows7. Analisis data dilakukan dengan deskriptif analisis statistik, uji asumsi klasik, uji hipotesis, uji koefisien determinasi (R²-test) & uji variabel operasional. Uji asumsi klasik meliputi: Multicollonearity, Heteroskedastisitas, Autokorelasi dan Normalitas. Uji hipotesis Parsial termasuk uji signifikansi (t-test) dan uji simultan Signifikansi (f-test). Hasil penelitian menunjukkan bahwa dewan direksi ukuran memiliki mempengaruhi kinerja perusahaan. Selain itu, dewan ukuran kemerdekaan, kepemilikan manajerial dan kepemilikan institusional tidak mempengaruhi kinerja perusahaan.

Kata Kunci: Good Corporate Governance, Kinerja Perusahaan (ROA) dan

x

FOREWORD

Bismillaahirahmaanirrahiim

Alhamdulillah, my praise and gratitude to Allah SWT, the almighty creator of the universe who always gives his grace, guidance and blessing infinite, so that I can finish this paper with title ―The Influence of Good Corporate Governance

Implementation towards The Firm Performance (The Study on Manufacturing Companies Listed in Malaysian Stock Exchange Period 2010-2014)‖ as one of the

a requirement for completing my Bachelor Degree, in Accounting Major faculty of Economy and Business Islamic State University Syarif Hidayatullah Jakarta.

With the weaknesses that exist, the author will not be fully realized apart from the mistakes and shortcomings. Therefore, in this moment the author apologizes for the mistakes and shortcomings that exist in this paper. In order to complete

this thesis, the author gets of many highly valuable assistance in form of moral and material from various parties with a single-minded. On this occasion, with all

humility there is no better word to conveyed, except Praise and thanks are very sincere to:

1. My Mother and Father who has relentlessly giving a beautiful prayer,

passion and motivation for me, especially in order to completing my degree and finishing this paper. Without you two I am nothing.

2. Dr. M. Arief Mufraini, Lc., as the Dean of Economic Faculty of UIN Syarif Hidayatullah Jakarta. Yessi Fitri, SE., Ak., M.Si and Hepi Prayudiawan, SE, MM, AK as the Head of study program Economic

xi

3. Dr. Amilin, SE., Ak., M.Si as thesis supervisor I, you are my mentor who has provide me a direction, guided me and helped me during the work on

this thesis. I would like to say thank you very much for your time and knowledge that you have shared to me so that I can finished this thesis.

4. Yulianti. SE, M.Si as thesis supervisor II, I would like to say Thank you very much for my best mentor that have guided me along the way with your carefulness, specificity and punctuality so that I able to finish this

thesis on time.

5. All the lectures who have taught me patiently, hopefully what they have

given to me are recorded in Allah SWT almighty and all staff UIN Syarif Hidayatullah Jakarta, special Thanks to Mr. Mardani Bonyx that have provided me a lot of information and gave me the official staffs that I

needed in college.

6. All my friends from International Accounting 2011 Dian, Depe, Sinta,

Ilma, Siti, Maya, Didit, Erwin, Arif, Yusuf, Taufik. And thanks also to my friends from International Management 2011 Ima, Balgis, Rendy, Zian, Maulidan, Uji, Vidro, Rozi, Iqbal. Thanks for the unforgettable moment

that we had been through together until this far and special thanks for some of you that already shared and taught me your valuable experiences

especially in finishing this thesis.

Jakarta, July 2nd 2015

xii

TABLE OF CONTENTS

INFORMATION PAGE

Cover i

Certification From Supervisor ii

Certification of Comprehensive Exam iii

Certification of Thesis Examination iv

Sheet Statement Authenticity Scientific Work vi

Curriculum Vitae vii

Abstract viii

Abstrak x

Foreword xiv

Table of Content xvi

List of Tables xvii

List of Appendix xviii

Chapter I INTRODUCTION

A. Background 1

xiii

C. Research Objectives 8

D. Research Benefits 9

Chapter II LITERATURE REVIEW

A. Theory Development 10

1. Theory Agency 10

2. Good Corporate Governances 12 a. The Size of Board of Commissioner 17

b. The Size of Board of Director 18 c. The Size of Board of Independent 21 d. The Ownership Structures 22

i. Managerial Ownership 23 ii. Institutional Ownership 24

e. Firm Performance 25

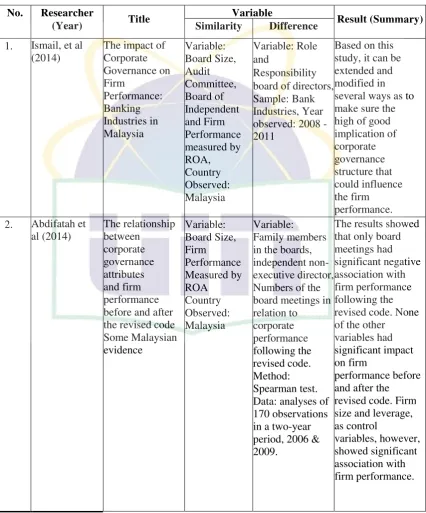

B. Previous Research 26

C. Theoretical Frameworks 36

D. Hypothesis Development 38

Chapter III RESEARCH METHODOLOGY

A. Scope of Research 42

B. Sampling Method 43

C. Data Collection Method 44

xiv

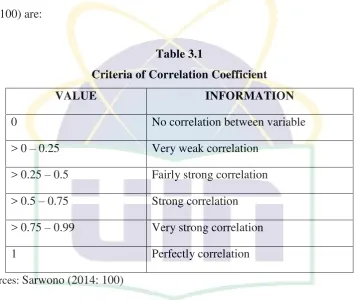

1. Descriptive Statistical Analysis 45

2. Classical Assumption Test 46

a. Normality Test 46

b. Multicollinearity Test 46

c. Autocorrelation Test 47

d. Heteroscedasticity Test 48

3. Coefficient of Determination (R2) 48

4. Multiple Regression Analysis 49

5. Hypothesis Testing 51

a. Partial Significance Test (t-test) 51

b. Simultaneous Significance Testing (f-test) 51

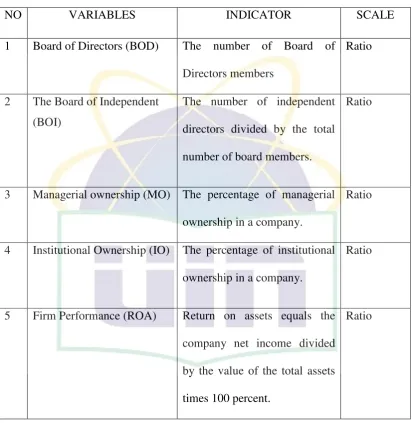

6. Operational Variables 52

a. Independent Variables 52

b. Dependent Variable 53

Chapter IV ANALYSIS AND DISCUSSION

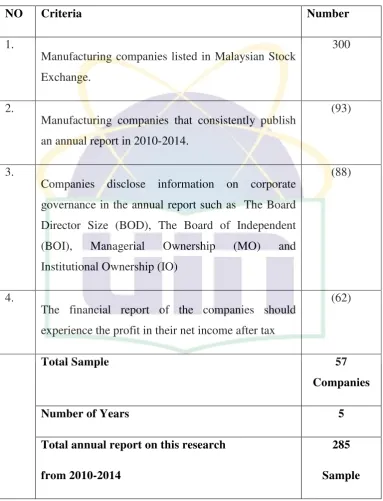

A. General Description of Research Object 55

xv

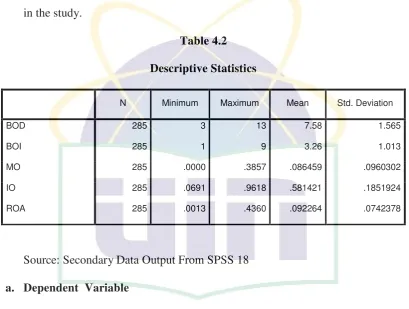

1. Descriptive statistic 57

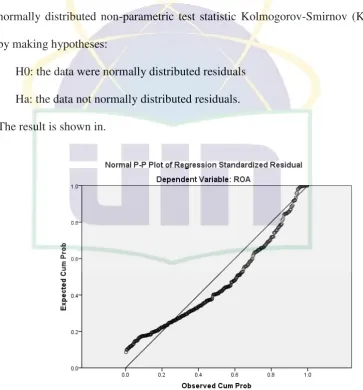

2. Classic Assumption Test 59

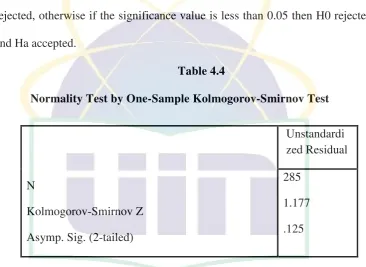

a. The Result of Normality Test 59

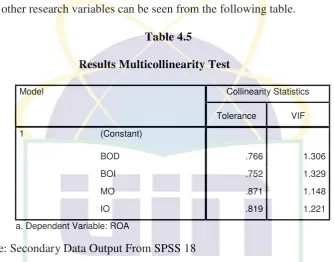

b. The Result of Multicollinearity Test 61

c. The Result of Autocorrelation Test 61

d. The Result of Heterocedasticity Test 63

3. Coefficient of Determination (R2) 64

7. Multiple Regression Analysis 65

8. Hypothesis Testing Result 67

a. Partial Significance Test (t-test) 67

b. Simultaneous Significance Testing (f-test) 73

c. Hypothesis Testing Result 74

Chapter V CONCLUSIONS AND RECOMMENDATIONS

A. Conclusion 75

xvi

REFERENCE 77

APPENDIX I 83

xvii

LIST OF TABLES PAGE

Table 2.1 The Relevant Previous Research 32

Table 2.1 Theoretical Framework 36

Table 3.1 Criteria of Correlation Coefficient 49

Table 3.2 Summary of Variable Operational Research 55

Table 4.1 Sample Selection Process 56

Table 4.2 Descriptive Statistics 57

Table 4.3 Normal P-P Plot of Regression Standardized Residual 59 Table 4.4 Normality Test by One-Sample Kolmogorov-Smirnov Test 60

Table 4.5 Results Multicollinearity Test 61

Table 4.6 Result Autocorrelation (Durbin Watson test) 62

Table 4.7 Durbin Watson Test Bound 62

Table 4.8 Scatter Plot 63

Table 4.9 Coefficient Determination 64

Table 4.10 Regression Analysis 65

Table 4.11 Partial Test Results (t-Test) 65

Table 4.12 Simultaneous Test Results (f-Test) 73

xviii

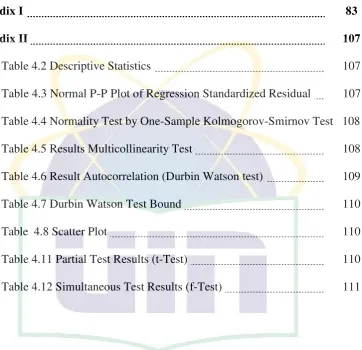

LIST OF APPENDICES PAGE

Appendix I 83

Appendix II 107

Table 4.2 Descriptive Statistics 107

Table 4.3 Normal P-P Plot of Regression Standardized Residual 107 Table 4.4 Normality Test by One-Sample Kolmogorov-Smirnov Test 108

Table 4.5 Results Multicollinearity Test 108 Table 4.6 Result Autocorrelation (Durbin Watson test) 109

Table 4.7 Durbin Watson Test Bound 110

Table 4.8 Scatter Plot 110

Table 4.11 Partial Test Results (t-Test) 110

1 CHAPTER I INTRODUCTION

A. Background

Nowadays, the business has involved with changing operating paradigms. With corporations growing larger and larger, the need for enter the foreign capital

market and access them for their capital needs has given rise to the new challenges in the governance of the international business. The pre-transition era was justified by the need to protect domestic market, but with corporation

growing in huge proportions and spreading their wings all across, the need to open up domestic market for entry of foreign business became a necessity. After the

Second World War, when world over economies needed to be rebuilt, increased cooperation among countries becomes a must for international movement of goods and services. The development of the world capital markets shows that the

capital markets increasingly integrated. Likewise, in the ASEAN region, one form of such integration carried out in the presence of the ASEAN Capital Markets

Forum (Nugent & Goh Ching , 2014).

ACMF consisted of 10 capital market regulator in the jurisdiction of ASEAN are Brunei Darussalam, Cambodia, Indonesia, Laos, Malaysia, Myanmar, the

Philippines, Singapore, Thailand and Vietnam. Currently, the ACMF led by the Securities and Exchange Commission of Thailand. Capital market integration in

2

competitive cost using capital market intermediaries to provide services across ASEAN based on the consent of the country of origin. One strategy to support the

achievement of the integration objectives as set out in the Implementation Plan is to strengthen the implementation of good corporate governance aspects of the

companies that exist in the region. (Purwanti et al, 2010)

The growth of corporations that led to the demand for more and more capital encourage the protectionist regimes to open up their economies and enable more

foreign investment flowing into domestic business. Control and command based structures had to be done away with. Instead a new form of governance structure,

which was led by market-based economic systems, primarily dominated by the private sector, had to be embraced. Now most governments over the world are relinquishing state control over industry, and private sector is being incentivized

to accept the new challenges of globalization. (Klettner et al, 2014). The efficient economic policies and stable political systems are a big draw among the investor.

The countries that have opened themselves to the world market have good legal systems in place providing protection to investors that attracted more capital in the process of globalization. As the demand for capital is growing in both the

developed and the developing economies, the need for establishing good governance practices has gained momentum. The emergence of supranational

corporation as a response to the globalization efforts has thus posed a big challenge to the prevalent culture and governance practice of nation.

The issue that arises regarding corporate governance emerged as a reaction to

3

implementation of corporate governance principles believed to be the main cause of economic insecurity which led to deteriorating economic conditions in several

Asian countries. The current business development has increased many fierce rivalries between companies in the business world have forced the company to be

able to think more widely and creatively. Otherwise, the company will be obsolete, and causing them to lose their customers because it‘s less of innovation with the presence of products that are tedious. Therefore, it is very challenging in

implementing the good corporate governance in a company, because all parties need to work together and having one purpose which to achieve the company

objective.

Good Corporate Governance in Indonesia began active when the financial crisis in 1997-1998 has had dramatic social, economic and political effects. That

event brought the Rupiah down by almost 80% and dramatically increased poverty. According to several experts, the recession in Indonesia was fuelled by

many institutional weaknesses, among which the lack or inadequate enforcement of the central bank‘s regulations along with irregular banking practices and the

extremely poor financial regulation. Since then, it is fair to say that, although there

is still plenty of room for improvement, the awareness, enthusiasm as well as legal and regulatory framework on corporate governance in Indonesia has changed and

improved dramatically in recent years. Indonesia had done a lot of initiatives and efforts to implement good corporate governance, both from government side as well as private. Those initiatives and efforts include establishment of corporate

4

support corporate governance implementation process in the country. More specifically, Indonesia has taken several steps towards improving corporate

governance standards and enhancing legislation. A national committee for Good Corporate Governance has been established in 1999 under the supervision of the Coordinating Minister for Economic Affairs and issued the first Indonesia‘s Code

of Good Corporate Governance in 2001, which was then amended in 2006. The Capital Market and Financial Institutions Supervisory Body (currently has merged

into OJK), has continued to introduce and amend its regulation and enforced them, which resulted in improved investors‘ protection. Corporate governance

rules for banks were introduced in 2006 and Bank Indonesia has actively monitored and enforced their implementation. (Suri & Hadad, 2014). Other than the implementation of GCG in Indonesia, the researcher will explain about the

implementation of GCG in Malaysia. This is because in this study the researcher are more concern with the implementation of GCG in Malaysia, in order to

determine how the implementation of GCG in the neighbor country which has becoming the develop country.

The Malaysian Good Corporate Governance journey is start when

Malaysia recognized the value of good governance and it reason that are committed to promoting and sustaining a strong culture of corporate governance.

Investor confidence in Malaysia was severely affected during the 1997/98 Asian Financial Crisis. Policy makers learnt valuable lessons and focused their attention, amongst others, on the need to raise corporate governance standards. They

5

Corporate Governance (Code) in the year 2000 to strengthen their corporate governance framework. Since then, they have embarked on a journey to

continuously improve their corporate governance framework. The Code was revised and securities and companies laws were amended. The Audit Oversight

Board was established to provide independent oversight over external auditors of companies. The Securities Industry Dispute Resolution Center was established to facilitate the resolution of small claims by investors. Statutory derivative action

was introduced to encourage private enforcement action by shareholders. (Anwar, 2012)

The previous researcher (Yusuf, 2013) conducted a study on the effect of Good Corporate Governance and ownership structure as an independent variable, the value of the company and as the dependent variable; GCG can be categorized

into three indicators, such as the size of the board of directors, independent directors / external. And the audit committee size and ownership structure are

categorized into two indicators, managerial ownership and institutional ownership. Results from this study indicate that the variable value of the company simultaneously influenced by the size of the board of directors, independent

directors, audit committee size, managerial ownership and institutional ownership. In addition, the results also showed that the size of the board of directors has a

positive significant effect on the value of the company and independent directors have a significant negative effect on the value of the company, while, the size of the audit committee, managerial ownership and institutional ownership has no

6

Moreover, there is another previous research conducted by (Febriyanto, 2013) the research on the analysis of the implementation of good corporate

governance on corporate performance (empirical study companies listed on stock exchanges in Indonesia in 2008-2012) with four independent variables, such as:

independent board, the size of the board of directors, institutional ownership, managerial ownership and one dependent variable: the company's performance measured by the Tobin's Q. The results showed that the independent board, board

of directors, institutional ownership, the managerial ownership has a significant effect on the performance of the company.

The differences in this study with the previous study are:

1. The years observed in this study was in 2010-2014. The years of previous study were in 2008-2012. The reason why researchers use the year 2010 to

2014, it is because the period shows the actual conditions associated with the problem under study.

2. The country observed in this study is the researcher chooses the data from Malaysian Country while the previous study was using the data from Indonesia Country. This is because the researchers wanted to try to determine

how the application of good corporate governance in other countries, especially developed country.

3. In this study, researchers focused only on one industry that is the manufacturing industry. While the previous study was not have the specific industry just company that listed in Indonesian Stock Exchange. The

7

than that industrial manufacturing is one of the largest industries in Malaysia therefore it is expected to help the researchers to examine the study in the

broader scope.

4. In this research the researcher use 5 variables which the independent variable

is Board of Director Size (BOD), Board of Independent (BOI), Managerial Ownership (MO) Institutional Ownership (IO) and the dependent variable is Firm Performance as measured by return on asset (ROA). While the previous

study use the size of the Board of Directors, Independent Directors, Managerial ownership and Institutional ownership as the independent variable and company performance as the dependent variable that measured by Tobin‘s

Q.

Based on the description above, the researchers are motivated to conduct the

research entitled:

The Influence of Good Corporate Governance Implementation towards Firm

Performance: The Study on Manufacturing Companies Listed in Malaysian

Stock Exchange Period (2010-2014)

B. Problem Formulation

Based on the background above, it is found that the problem formulation in this research is:

8

4. Does the Institutional Ownership (IO) influence the firm performance?

5. Does the size of Board of directors (BOD), the size of board of independent

(BOI), managerial ownership (MO) and institutional ownership (IO) influence the firm performance?

C. Research Objectives

The purpose of this study was to analyze empirically the influence of good

corporate governance towards the firm performance:

1. To determine the influence of the Board of Director (BOD) towards the firm performance

2. To determine the influence of the Board of Independent (BOI) towards the firm performance

3. To determine the influence of Managerial Ownership (MO) towards the firm

performance

4. To determine the influence of Institutional Ownership (IO) towards the firm

performance.

5. To determine the influence of Board of directors (BOD), board of independent (BOI), managerial ownership (MO) and institutional ownership (IO) on the

9

D. Benefits of Research

This research will provide the following benefits:

1. Theoretical Benefit

Theoretically this research is beneficial as the input materials and

contributions, thoughts in an effort to increase the data resource and reference for the university regarding Good Corporate Governance. For further research as the additional reference materials in reviewing issues

related to GCG and its influence to the firm performance.

2. Practical Benefit

This research is a good opportunity for the researcher to applying the theory, particularly the theory in the field of Accounting and management into the world of actual practice that can improve the understanding of the

researcher, especially in the scope of good corporate governance and its influence to the firm performance. For the company, as the consideration for

business on how big the good corporate governance can influence their firm performance, and it is also beneficial for the industry product that Listed in Malaysian Stock Exchange: to give contribution for the firms to understand how

important the good corporate governance concept on their firm performance. Other than that, this research is beneficial for others, especially for investors,

10 CHAPTER 2

LITERATURE REVIEW

A. Theory Development

1. Theory Agency

Basic agency was developed in the economics literature during 1960s and 1970s in order to determine the optimal amount of the risk- sharing among

different individuals (Spence & Zeckhauser, 1971 cited in Javed & Iqbal, 2006) However, gradually the domain of the agency theory was extended to

the management area for determining the cooperation between various people with different goals in the organization, and attainment of goal congruence. In 1980s, agency theory was also appeared extensively in the managerial

accounting realms to determine the optimum-incentive contracting among different individuals and establishing suitable accounting control mechanisms

to monitor their behaviors and actions (Namazi, 2013).

When compared to publicly traded firms, small businesses come closest to the type of firms depicted in the stylized theoretical model of agency costs

developed by Jensen & Meckling (1976). Agency costs arise when the interests of the firm's managers are not aligned with those of the firm's

owner(s), and take the form of preference for on the-job perks, shirking, and making self-interested and entrenched decisions that reduce shareholder wealth. The magnitude of these costs is limited by how well the owners and

11

Jensen & Meckling (1976) also define an agency relationship as a contract under which one or more persons (the principals) engage another person (the

agent) to perform some service on their behalf which involves delegating some decision making authority to the agent. If both parties to the relationship

are utility maximize there is good reason to believe that the agent will not always act in the best interests of the principal. The principal can limit divergences from his interest by establishing appropriate incentives for the

agent and by incurring monitoring costs designed to limit the aberrant activities, of the agent. In addition, an agency operates under the condition of

risk and uncertainty. In effect, the basic agency theory usually assumes that both individuals are risk averse. Under this circumstance, the amount and content of the produced accounting information and other information sources

would become a significant issue in risk sharing and controlling the agent's actions (Javed & Iqbal, 2006).

Good Corporate Governance (GCG) is a concept that is based on the agency theory, which expected to serve as a tool to give confidence to investors that they will receive a return on the funds they

had invested. GCG deals with how investors are confident that managers will give you an advantage for them, convinced that the manager will not

12

words, corporate governance is expected to work to suppress or reduce the

cost of an agency.

2. Good Corporate Governance (GCG)

There is no single definition of corporate governance that can be applied to

all situations and jurisdictions. The various definitions that exist today largely depend on the institution or author, country and legal tradition. IFC (International Finance Corporation, 2014) defines corporate governance as ―the structures and processes for the direction and control of companies.‖ The

Organization for Economic Cooperation and Development (OECD, 2004),

Principles of Corporate Governance, offers a more detailed definition of corporate governance as:

―The internal means by which corporations are operated and controlled

[…], which involved a set of relationships between a company’s management,

its board, its shareholders and other stakeholders. Corporate governance also

provides the structure through which the objectives of the company are set,

and the means of attaining those objectives and monitoring performance are

determined. Good corporate governance should provide proper incentives for

the board and management to pursue objectives that are in the interests of the

company and shareholders, and should facilitate effective monitoring; thereby

13

According to James (2009), corporate governance is concerned with ways of bringing the interests of (investors and managers) into line and ensuring

that firms are run for the benefit of investors. Corporate governance is concerned with the relationship between the internal governance mechanisms of corporations and society‘s conception of the scope of corporate

accountability. In order to include the structures, processes, cultures and systems that engenders the successful operation of organizations.‘ Corporate

governance is also seen as the whole set of measures taken within the social entity that is an enterprise to favor the economic agents to take part in the

productive process, in order to generate some organizational surplus, and to set up a fair distribution between the partners, taking into consideration what they have brought to the organization (Klettner et al, 2014)

The principles of GCG are transparency, accountability, responsibility, independency, and fairness and equity. In addition to these five principles, in

order to be effective, GCG management must work together to carry out the principles of GCG regulations. There are six principles of GCG implementation according to OECD (2004), namely:

a. Ensuring the basis of effective corporate governance framework b. The rights of shareholders and principal owner

c. Equal treatment of shareholders d. Role of stakeholders

e. Disclosure and transparency; and

14

The Basic Principles of Good Corporate Governance Various rules and system as a regulator in management of company‘s need to be poured in

form of principles that must be adhered to the concept of Good Corporate Governance. In generally, there are 5 (five) basic principles

(KNKG. 2006), namely:

1. Transparency

To maintain the objective of corporate must provide information, which

is material and relevant in a way that is easily accessible and understood by stakeholders. Companies should take the initiative to reveal not only the problem that required by law, but also the importance for

decision-making by shareholders, creditors and other stakeholders. The corporate must provide the information timely, adequately, clearly,

accurately, and all the important events that may affect the condition of corporate.

2. Accountability

Corporate must be accountable for their performance in a transparent and fair. It must be properly managed, scalable, and in accordance with the

interests of the company to remain stakeholder‘s interests. Specify details of duties and responsibilities of each organization and all employees.

15

effective system of internal control to be manage in the company.

3. Responsibility

The corporate must comply with laws and regulations and carry out responsibilities for people and the environment. So, the business can be

maintained in the long run and gained recognition as the Good Corporate Governance. The organization must adhere to the principle of prudence and ensure compliance with regulatory laws, statutes and regulations. Corporate

should be carried out social responsibility. Corporate has to be responsible in management to the principle of corporate, as well as existing of some

regulation.

4. Independency

The corporate should be managed independently, so the individual

companies do not dominate other organs and no intervention by other parties. Each organ must avoid domination by any party, is not affected by particular

interests, independent of other interests, influence and pressure. Each organ shall carry out the functions and duties in accordance with the statutes and regulations, and not dominate the other, or passing the buck between each

other. Independency state whereas the corporate are managed by professional without any conflict interest and pressure from any side, which will be

16

parties. Each organization of corporate has to avoid the domination any party, not influenced by special interest, free from conflict and pressure, so the

decision-making will be done objectively. Each organ must perform its functions and duties in accordance with the statutes and regulations, do not

dominate others and passing the buck between each other to realize an effective internal control.

5. Fairness

To carry out these activities, the company should pay attention to the interests of stakeholders based on the principle of equality and fairness. Corporate provide equal treatment to all stakeholders. Corporate provides the

opportunity for stakeholders to give advice and opinion for company‘s performance and open access of information in accordance with the principles

of transparency within the scope of the position. Equality and fairness defined as fair and equal treatment in fulfilling the right of stakeholder arising under

treaties and laws, which have applied. Fairness also includes fulfill the right of investors, legal system and enforcement of regulations, which protect investors. Fairness is expected to make the entire of company‘s assets are well

managed and prudent; also expect to protect all members. Corporate should provide the opportunity for stakeholders to provide input and expression to the

17

The implementation of corporate governance guidelines is meant to have a purpose and benefits as follows (Forum Corporate Governance Indonesia (FCGI,

2001):

(1) Achieving a sustainable growth of the company through a management system

based on the principles of transparency, accountability, responsibility, independence, and fairness.

(2) Encouraging the empowerment and independence of the functions of each

organ of the company, e.g., the board of commissioners, the board of directors, and the general meeting of shareholders (GMS).

(3) Encouraging shareholders, the board of commissioners, and the board of directors to take decisions and actions based on the value of high moral and compliance with laws and regulations.

(4) Encouraging the emergence of awareness and corporate social responsibility towards society and the environment.

(5) Optimizing shareholder value while considering other stakeholders, and (6) Improving the competitiveness of enterprises, both nationally and

internationally, thereby increasing confidence in the market which can

encourage the flow of investment and sustainable economic growth.

a. Board of Commissioner Size (BOC)

Indonesia adopted two-tier board system. Companies incorporated under the Indonesia Company Law (2007) must have two boards, supervisory board that performs the monitoring role and management board that perform the

18

independent of the executive or management board, consistent with the characteristic of the continental European governance model. The two-tier

board makes a clear separation between the Board of Directors and Board of Commissioners. Board of Commissioners has very important roles in the

company, especially in the implementation of good corporate governance. The Board of Commissioners lies at the core of corporate governance-charged with ensuring strategic guidance mechanism. Since management is responsible for the firm‘s efficiency and competitiveness and Board of Commissioners is the

proper focal point of the corporation‘s perpetuation and success (Anitawati,

2011).

Board of Commissioners has responsibility to supervise the quality of information in the financial statement. This is important to consider management need on doing earning management, which could affect the

decreasing of investor belief. In order to overcome this problem, Board of Commissioners has permitted to have an access on company information.

Board of Commissioners does not have authority in the company, so Board of Director responsible to deliver the information that related to the company. Additionally, the function of Board of Commissioners is to make sure a

company has done social responsibility and consider the stakeholder need as good as monitoring the effectively of corporate governance practice (National

19

b. The Board of Director Size (BOD)

The board of directors is a party to a corporate entity tasked with carrying

out the operation and management of the company. According to the limited liability company act, which can be appointed as a board member is an

individual who is able to carry out legal action and not been declared bankrupt or become a member of the directors or commissioners who were found guilty of causing the company to go bankrupt, or a person who never convicted of

committing adverse financial criminal state within five years prior to appointment. (Paul, 2000).

The boards of directors are fully responsible for all operations and management of the company in order to carry out the interests in achieving company goals. The board of directors is responsible for the affairs of the

company with external parties such as suppliers, customers, regulators and legal parties. With such a large role in the management of the company,

directors basically have a significant controlling interest in resource management companies and funds from investors. Functions, powers, and responsibilities of directors is expressly stipulated in Law no. 40 of 2007 on

Limited Liability Company. In this law, the board has the task, among others: 1.) A leading publishing company with corporate policies.

2.) Choose, assign, and supervise duties of the employee and the manager. 3.) Approve the annual budget of the company.

20

Board size is the number of the board of director in the company which is generally composed of inside and outside members and responsible to run the company‘s business. Most of the researchers found that, the larger board size

negatively impacts the value of the firm. Literatures on board size and firm

value are firstly emerged in the early 1990s with the article of Lipton & Lorsch (2009). The advocated small board since they believed that the board would become ineffective when a group grows too large, thereby building on

the organizational behavior theory, Yusuf, (2013).

The Malaysian Code of Corporate Governance (FCGM, 2012) outlines the

principal responsibilities of the board of directors in public listed companies, which are:

1) To review and adopt a strategic plan for the company

2) To oversee the conduct of the company‘s business to evaluate whether the business is being managed properly

3) To identify principal risks and ensure the implementation of appropriate systems to manage these risks

4) To undertake succession planning, including appointing, training, fixing

compensation, and replacing senior management (where applicable)

5) To develop and implement an investor relations program or shareholder

communication policy for the company; and

6) To review the adequacy and the integrity of the company‘s internal control systems and management information systems, including systems for

21

The Board of Directors is also as the Corporate Governance guarantor. Shareholders elect the Board of Directors to oversee management and to assure that stakeholders‘ long-term interests are served. Through oversight,

review, and counsel, the Board of Directors establishes and promotes business and organizational objectives. The Board oversees the company‘s business

affairs and integrity, works with management to determine the company‘s

mission and long-term strategy, performs the annual Chief Executive Officer

(CEO) evaluation, oversees CEO succession planning, establishes internal controls over financial reporting, and assesses company risks and strategies

for risk mitigation. (Naciri, 2008 pg. 24)

c. The board of Independent Size (BOI)

The independent board is an important point in corporate governance

principles that repeatedly examined in many research. Nowadays, it is widely recognized that independent board play an important role in a sound

governance structure (California Public Employees, 2010 cited in Yusuf, 2013). According to OECD GC Principles, the board should be comprised of at least a majority of ―independent directors‖.

Board should consider assigning a sufficient number of independent board members capable of exercising independent judgment to task where there is a

22

and key executives and board remuneration (OECD, 2004). When investigating the composition of board of directors, we can see how different the company describes the definition of ―independence‖ which is disclosed

and observed in its annual proxy statement. Then their compliance will be

evaluated if they follow the rule at least one third directors of the board are independent directors.

d. Ownership Structure

The ownership structure is the shareholding in the company, particularly the number of majors (either individually or together) will determine the

extent and intensity control to management. Ownership structure is the percentage of shares held by the insider and the outsider shareholder. Insider party, i.e. shareholders who are aligned as a director and commissioners.

Outsider party, i.e. shareholders that have by the institutions, individuals and other outside the company. Company ownership can be seen from the point of

the concept of corporate governance, as the owner of an external mechanism, which is strongly associated with the commissioners and directors (Anderson et al 2003).

The firm‘s ownership structure can have a large impact on the firm‘s

control structure, innovation culture and resource allocation. If the firm has

shareholders, different existing or potential shareholders can have different qualities as sources of capital and/or providers of ancillary services such as control services or services designed to foster innovation. Ownership

entrepreneur-23

shareholders each committed to innovation, the firm is more likely to have a strong innovation culture. The firm is less likely to have a strong innovation

culture when it has a highly dispersed share ownership structure. Ownership concentration is thus one of the factors that can bring benefits. Large

shareholders are better at fostering innovation compared with small shareholders (Mantysaari, 2012)

Agency problem is problems arising from the parties involved have

different interests with each other. The ownership structure is a mechanism to reduce the conflict between management and shareholders (Faisal, 2004). So

the agency problem can be mitigated by the presence of the ownership structure, due to the presence of structured ownership structure, believed to have the ability to influence the future course of the company that may affect

the agency costs incurred by the company. Ownership structure can be individual investors, government, and private institutions. The ownership

structure is divided into several categories. Specifically ownership structure category includes ownership by managerial ownership and institutional ownership.

1) Managerial Ownership (MO)

Managerial ownership is ownership of shares that management receives in

other words the management as well as a shareholder (King & Santor, 2009) According to Jansen & Meckling (1976) one way in order to reduce the conflict between the principal and the agent can be done by increasing

24

in a company will encourage pooling of interests between principal and agent so that managers act in accordance with the wishes of shareholders.

Managerial ownership can also align the interests between managers and shareholders so that managers will be careful in taking decisions because they

directly share in the benefits and impact of the making the wrong decision (Faisal, 2004).

The greater the proportion of managerial ownership in the company, the

managers tend to try harder and motivated to create the optimal company performance because managers have an obligation to maximize the welfare of

the shareholders, yet on the other hand, managers also have an interest to maximize their welfare (Faisal, 2004). The Manager will seek to reduce conflicts of interest resulting in lower agency costs and can reduce the

tendency of managers to perform an opportunistic action.

2) Institutional Ownership (IO)

Institutional ownership is ownership of shares owned by domestic institutions, foreign institutions, government institutions such as insurance companies, banks, investment companies and other. Institutional ownership

may indicate the presence of institutional investors that strong corporate governance mechanisms which can be used to monitor the management of the

25

behalf of the owner of individual private (Anderson et al 2003). The majority of institutions is a Limited Liability Company. It is the Ownership by

institutional investors is likely to encourage more optimal monitoring the management performance, since share ownership represents a source of power

that can be used to support or otherwise of the management performance. Jensen & Meckling (1976) suggest that institutional ownership has a very important role in minimizing agency conflicts that occur between managers

and shareholders.

e. Firm Performance

The company's performance is a term used for part or all of the actions or

activities of an organization in a period with reference to a standard amount as the cost of past or projected, on the basis of efficiency, accountability or the

accountability of management and the likes (Javed & Iqbal 2006). The company is an entity formed the scene of a unity of the various functions and

operational performance work systematically to achieve a certain goal. The goal of a company is an objective to be achieved all stakeholders in the company. To achieve these objectives, the parties interested in the company

should cooperate systematic way to yield optimal performance. One way to know whether a company in carrying out its operations in accordance with a

26

Performance is a picture of the level of achievement of the results of the implementation of an operational activity. Assessment of performance here is

a method and process assessment task execution performance of a person or a group of people or work units within a company or organization in accordance

with the performance standards or goals set. In realizing the vision and mission of the organization, companies need to have a measure to gauge how the achievement of goals and objectives within a specific time period.

(Abdifatah et al, 2014)

B. Previous Research

After collecting several reference and journal regarding the

implementation of Good Corporate Governance in the company, the researcher found that there are several studies which are associated with this

study. Therefore, to see the differences between the study and it also can be as the added information regarding the same issues, here there some conclusion

from the previous studies which is founded as the relevant study:

1. The impact of Corporate Governance on Firm Performance: Banking

Industries in Malaysia.

This study was examined the relationship of corporate governance and firm performance of banking industries in Malaysia. Besides that, it were

27

using the three methods of statistical analysis to analyze the impact of corporate governance which are the descriptive analysis, correlation analysis

ad multivariate analysis which to view the significant that exits between ROA and BOS, BOD, AC and BID. Besides that, they investigate the effectiveness

of banking industry in Malaysia through the annual report of each bank in Malaysia that recorded from 2008 to 2011. And the result shows that, there is a positive relationship between BOS, BOD, AC, and ROA. Therefore there is

a negative relationship between BID and ROA. (Ismail et al, 2014)

2. The Relationship between Corporate Governance Attributes and Firm

Performance before and after the revised code some Malaysian evidences.

This study was examined the impact of corporate governance attributes and ownership structure patterns on corporate performance of Malaysian listed

companies following the revised code on corporate governance in 2007. To provide an insightful assessment on the revised code‘s implications on firm

performance, data before (2006) and after (2009) the revised code in 2007 were analyzed. The study involves analyses of 170 observations in a two-year period, 2006 and 2009. The sample of the study was selected on the basis of a

stratified random sampling procedure to allow a representative sample of the various sectors listed on Bursa Malaysia. Based on data extracted from the

annual reports of 2006 and 2009, corporate performance was captured using accounting performance indicators (return on assets and return on equity). In addition to descriptive analyses, multiple regression analysis was used to

28

firm performance. The findings revealed a decreasing trend of the financial performance of the sample companies over the two-year period which this

study attributes to the recent global financial meltdown. In terms of corporate governance compliance, the results showed that there were cases of

non-compliance of the basic requirements of the corporate governance code in Malaysia even after the revised code in 2007. In addition, the multiple regression results showed that only board meetings had significant negative

association with firm performance following the revised code. None of the other variables had significant impact on firm performance before and after

the revised code. Firm size and leverage, as control variables, however, showed significant association with firm performance. (Abdifatah et al, 2014)

3. The Implementation of Good Corporate Governance and Its Impact on

Corporate Performance: The Mediation Role of Firm Size (Empirical

Study from Indonesia).

This research aims is to examine the effect of good corporate governance implementation on corporate performance as measured by EVA. This research use manufacture companies which are listed in Indonesian Stock Exchange

period 2006-2010 as the samples, purposive sampling was used to determine sample criteria which are: go public manufacturing companies in period

2006-2010 which consistently publish annual report and financial report on the website of Indonesia Stock Exchange (IDX) of its own site: companies that have selected as the 40 companies with the larger size. Path analysis was

29

this research shows that implementation of GCG can effect directly on corporate performance as measured by EVA, and it shows effect indirectly

through firm size. In other word, firm size has a mediation role in impact the good corporate governance implementation on corporate performance. (Nur‘ainy et al, 2013)

4. The Corporate Governance as a value driver for Firm Performance:

Evidence from India.

The study was examined the corporate governance issues India and establish the relationship between corporate governance and financial performance. The sample comprises 141 companies belonging to the ―A‖

group India, a composite measure of corporate governance is developed comprising three indicators – legal, board and proactive indicators. Data on

the three indicators and financial performance were procured from secondary sources. In the step-wise multiple regression analysis, the influence of these three indicators and the composite measure of corporate governance was

examined on firm performance after controlling the confounding effects of firm size. The board and the proactive indicators influence the firm

performance significantly whereas legal compliance indicator does not do so. The composite corporate governance measure is a good predictor of firm

30

5. Corporate Governance and Firm Performance: A Study of Sri Lankan

Manufacturing Companies

Corporate governance is about putting in place the structure, processes and mechanism that ensure that the firm is being directed and managed in a way

that enhances long term shareholder value through accountability of managers and enhancing organizational performance. Corporate governance refers to a set of rules and incentives by which the management of a company is directed

and controlled. Hence good corporate governance maximizes the profitability and long term value of the firm for shareholders. There is a great awareness among the researchers to carry out the researches in ―corporate governance‘.

Very little researches on ―corporate governance‖ are available in Sri Lanka

and need to be empowered companies to pay a special attention on corporate governance. In a way, the present study is initiated on ―corporate governance

and firm performance‖ with the samples of 28 manufacturing companies using

the data representing the periods of 2007 – 2011. Board structure, board committee, board meeting and board size including executive directors, independent non-executive directors, and non-executive directors were used as

the determinants of corporate governance whereas return on equity (ROE) and return on assets (ROA) were used as the measures of firm performance. The

study found that determinants of corporate governance are not correlated to the performance measures of the organization. Regression model showed that corporate governance don‘t affect companies‘ ROE and ROA. Further

31

6. Corporate Governance and Firm Performance: Empirical evidence from

Vietnam

This empirical study, the first of its kind, seeks to quantify the relationship between corporate governance and the performance of firms in Vietnam. As

part of this study, the authors undertook an intensive review of literature to identify a range of elements that contribute to overall corporate governance. In this study, corporate governance is considered to consist of the following

elements: (i) the size of the board; (ii) the presence of female board members; (iii) the duality of the CEO; (iv) the education level of board members; (v) the

working experience of the board; (vi) the presence of independent (outside) directors; (vii) the compensation of the board; (viii) the ownership of the board; and (ix) block holders. Using the flexible generalized least squares

(FGLS) technique on 77 listed firms trading over the period from 2006 to 2011. The findings of this study indicate that elements of corporate

governance such as the presence of female board members, the duality of the CEO, the working experience of board members, and the compensation of board members have positive effects on the performance of firms, as measured

by the return on asset (ROA). However, board size has a negative effect on the performance of firms. This study also presents that ownership of board members has a nonlinear relationship with a firm‘s performance. (Duc Vo &

35

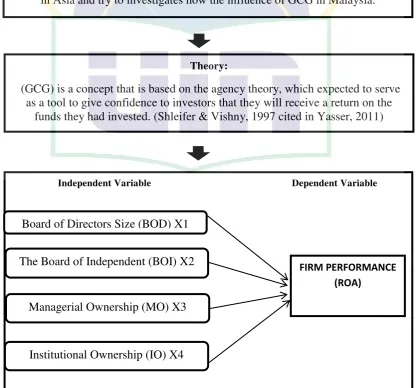

C. Theoretical Frameworks

Theoretical framework is the feminist theories and the feminist movements

have vehemently demonstrated that knowledge cannot be considered neutral or objective. Traditionally, researchers have engendered knowledge on the basis of

the dominant perspective and behavior in society, which was the male one (androcentrism). As a consequence, knowledge has been blind to the specific historical, political, social and personal conditions on which it was reported,

making invisible gender differences. Feminist epistemologies have claimed that knowledge is dynamic, relative and variable and that it cannot be considered an

aim itself but a process. (Camarasa, 2007)

Corporate governance is the process on which organizations are managed and controlled. Good corporate governance and firm involvement are two factors that

related to the firm performance, usually the better good corporate governance and firm involvement of the company the better performance will be. One of the

ways to measure firm performance is by firm value. Firm value is a measurement of company performance on the implementation of financial functions. After passing through some processes, it has been found the theoretical

36 Figure 2.2

Theoretical Framework

The Influence of GCG Implementation towards The Firm Performance: The Study on Manufacturing Companies Listed in Malaysian Stock Exchange

Period (2010-2014)

Independent Variable Dependent Variable

Board of Directors Size (BOD) X1

The Board of Independent (BOI) X2

Managerial Ownership (MO) X3

FIRM PERFORMANCE (ROA)

Institutional Ownership (IO) X4

v

Background:

The issue that arises regarding corporate governance emerged as a reaction to various corporate failures due to poor corporate governance. Weak

implementation of corporate governance principles believed to be the main cause of economic insecurity which led to deteriorating economic conditions in several Asian countries. Therefore, the researcher choose one of the Developed Country

in Asia and try to investigates how the influence of GCG in Malaysia.

Theory:

(GCG) is a concept that is based on the agency theory, which expected to serve as a tool to give confidence to investors that they will receive a return on the

funds they had invested. (Shleifer & Vishny, 1997 cited in Yasser, 2011)

v

37

Hypothesis Test

Test result and analysis Classical Assumptions Test

Multiple Regressions

38

D. Hypothesis Development

Hypothesis is considered as a tentative statement that proposes a possible

explanation to some phenomenon or event. Based on the literature review previously, the hypothesis development can be describes as:

1. Board of Director Size (BOD) to Firm Performance

Board size is the number of board of directors of the company which is generally composed of inside and outside members and responsible

to run company‘s business. The total member of director must be adjusted with the complexity of firm, but still considering the effectiveness of decision

making. The previous studies conducted by Jensen (1993), Lipton & L'orsch (1992) found that there is no significant influence between board of directors size on firm performance. It is because the company that has a large of board

of director size cannot do the coordination, communication, and decision-making better than the company that has a smaller board of director.

Other than that there also research conducted by Febriyanto (2013) & Amyulianthy (2012), they find that Board of Directors size has influence the Firm Performance. This is because having a large size of the board of directors

will be able to improve the firm performance in a way that more members can contributes to positive things. Therefore, the board‘s facilities will be better in

39

such way that it: (1) has a proper understanding of the role and responsibilities, and competence to deal with the current and emerging issues

of the business. (2) Exercises independent judgment. (3) Encourages enhanced performance of the company. (4) Can effectively review and challenge the

performance of management.

H1: The Board of Director Size influence the Firm Performance

2. The Board of Independent to Firm Performance

An Independent director (also sometimes known as an outside director) is a director (member) of a board of directors who does not have a material or

pecuniary relationship with company or related persons, except sitting fees. Independent Directors do not own shares in the company. (Some sources state executive directors are different from independent ones in that

non-executive director are allowed to hold shares in the firm while independent directors are not. In the study by Shukeri et al, (2012) found that there is

negative effect between boards of independent towards the firm performance.

Different with the research done by Gani & Jermias (2006) found that board independence is tied to company performance by looking at different

strategies. They find that board independence has a significantly more positive effect on performance for firms pursuing a strategy of cost efficiency

than for those pursuing a strategy of innovation.

40

3. Managerial Ownership to Firm Performance

There also research has done by Haryani et al. (2011) they find that the

managerial ownership does not influence on firm performance in Indonesia caused by the structure of managerial ownership in Indonesia is still very

small compared to the institutional ownership of corporations listed on the Indonesia Stock Exchange. With small holdings, the managers do not feel they have the company so that the company's performance. Thus, managerial

ownership has not been able to be a mechanism that increases the company performance.

Different with the results that done by Ali, Salleh & Hassan (2008) investigated the factor influencing firm performance by considering only non-financial companies based on the reason that the non-financial sector is subject to

certain regulation and different from other industry. The study analyzed 1000 Bursa listed companies from 2000 to 2003 and proved positive relationship

between managerial ownership and firm performance. Furthermore, Amyulianthy (2012) also found that the managerial ownership has influenced firm performance.