THE INFLUENCE OF GOOD CORPORATE GOVERNANCE

(GCG) IMPLEMENTATION TOWARD QUALITY

SUSTAINABILITY REPORTING (SR) DISCLOSURE

(SURVEY ON INDONESIA COMPANIES LISTED IN INDONESIASTOCK EXCHANGE)

By:

Berliansyah Nugraha Putra Student ID: 108082100012

ACCOUNTING DEPARTMENT INTERNATIONAL CLASS PROGRAM FACULTY OF ECONOMICS AND BUSINESS

STATE ISLAMIC UNIVERSITY SYARIF HIDAYATULLAH JAKARTA

THE INFLUENCE OF GOOD CORPORATE GOVERNANCE

(GCG) IMPLEMENTATION TOWARD QUALITY

SUSTAINABILITY REPORTING (SR) DISCLOSURE

(SURVEY ON INDONESIA COMPANIES LISTED IN INDONESIASTOCK EXCHANGE)

By:

Berliansyah Nugraha Putra Student ID: 108082100012

ACCOUNTING DEPARTMENT INTERNATIONAL CLASS PROGRAM FACULTY OF ECONOMICS AND BUSINESS

STATE ISLAMIC UNIVERSITY SYARIF HIDAYATULLAH JAKARTA

ii

THE INFLUENCE OF GOOD CORPORATE GOVERNANCE

(GCG) IMPLEMENTATION TOWARD QUALITY

SUSTAINABILITY REPORTING (SR) DISCLOSURE

(SURVEY ON INDONESIA COMPANIES LISTED IN INDONESIASTOCK EXCHANGE)

Undergraduate Thesis

Submitted to Faculty of Economy and Business

As Partial Requirement for Acquiring Bachelor Degree of Economics

By:

Berliansyah Nugraha Putra Student ID: 108082100012

Under Supervision of:

Supervisor I Supervisor II

Prof. Dr. Margareth Gfrerer Atiqah, SE, M. Si ID. 19820120 200912 2 004

ACCOUNTING DEPARTMENT INTERNATIONAL CLASS PROGRAM FACULTY OF ECONOMICS AND BUSINESS

STATE ISLAMIC UNIVERSITY SYARIF HIDAYATULLAH JAKARTA

v

CURRICULUM VITAE

Personal Detail

Full Name : Berliansyah Nugraha Putra Nick Name : Berly

Address : Ciledug Indah 2, Jalan Garuda 1 D 1 No 14/A Ciledug Tangerang – Banten 15158

Mobile Number : 0813 80880 435

E-mail : [email protected] Date of Birth : Jakarta, April 8th, 1990

Sex : Male

Religion : Moslem

Nationality : Indonesian

Competences and Personality : Hard worker, Good working in team, Available work in pressure.

Educational Background School Year

Elementary SDI Al-Hasanah Tangerang 1996-2002 Junior High School YPI An-Nisaa’ Tangerang 2002-2005 Senior High School SMAN 90 Jakarta 2005-2008 University State Islamic University Syarif 2008-Now

Hidayatullah Jakarta

Major : International Accounting

Non Formal Education

1. EF Pamulang ( Real English, Advance) 2010-2011

2. Chinese Course (Basic) 2012

3. Germany Course (Pre-intermediate) 2005

vi Working Experience

1. Computer Technician at CrownBase.Net Ciledug Tangerang 2009-2015 2. Cooker at Resto Pawon Bu Puji Ciledug Tangerang 2009-Now 3. Quality Control Standard Food and Beverage at Pawon Bu Puji 2010-Now 4. Quality Control Standard of Berlian’s Bakery, Cake and Cookies 2015-Now

Organization Experience

1. Chairman of Islamic extracurricular (ROHIS) SMPI AN-NISAA’ 2003 2. Vise chairman of Islamic extracurricular (ROHIS) SMA 90 JKT 2007 3. Chairman of Remaja Masjid Al-Muhajirin Ciledug Tangerang 2010-2012

Conference Participations

1. Climate Change Economy held by DAAD alumni (February 14, 2012) 2. Summer School in Weyden, Germany with theme “Renewable Energy- Leadership and Entrepreneurship”, supported by DAAD

(10-18 September 2011)

3. Seminar about Economic Issues in global was held by United Nation (2010)

Activity of Co-curricular

1. Company visit to BMW Center Germany 2012 2. Company visit to P.T. Sucofindo Jakarta Selatan 2008

This statement, I create with the truly as the consideration.

Sincerely

vii

FOREWORD

Assalammu'alaikum Wr.Wb

All Praise to Allah SWT as the Hearer, the Seer and above all an abundance of grace, Taufiq, as well as his guidance. So, because Allah SWT I can finish this research on time.

Shalawat always gives to the Prophet of Muhammad SAW and all his family and friends who always helped him in establishing Dinullah in this earth.

With the strength, intelligence, patience, and strong desire from Allah SWT, it is a pleasure and honorable to finish this mini thesis as graduation pre requirement for bachelor degree. I believe there is an invisible hand that has helped me going through this process.

My special thank for my Mom, Puji Arwati Zaini, who has been helping and support her son to finish the thesis. You are the embodiment of angels in human form. So, I want to make you always smile because your happiness is the best moment that I’ve ever had. You always pray and give spirit, you always pray for the pleasure for your family and your sons. Thank you mama.

viii

scarification has been paid off your son has got her bachelor degree. Thank you also, you always pray for me in your sholah.

I believe I am nothing without each one of you who has helped me in finishing this mini thesis. Thus, in this very special moment, let me say many thanks to all of them who have been helping me the process of this thesis, including:

1. Dr. M. Arief Mufraeni, Lc., Msi., as the Dean of Faculty of Economics and Business.

2. Prof. Dr. Margareth Greferer, as thesis supervisor I. A special person who always give me spirits and motivation to keep continue with study until finish my mini thesis. Also a mentor, who has provided direction and guided me, gives the great knowledge and thank you for your time. So, Alhamdulillah this mini thesis has done.

3. Atiqah, SE, MS., Ak., as thesis Supervisor II who has provided direction, guidance, and thank you for your time and your helping. So I can finish this thesis.

4. All Lecturers who have taught patiently, may what they have given are recorded in Allah SWT almighty and all staff UIN Jakarta, special thanks to Mr. Sugi and Mr. Bonic " thanks you have taught me and given explanation about thesis"

ix

Gugun, and Danke Prima for my Friend from Germany ‘Sebastian’ who

already help me in understanding about environmental indicators and motivate me. Thanks all who could not mention one by one "Thanks for your prayers and forward your ways.

6. Seniors and juniors prodi int'l accounting and management. Thank you brothers and sisters for your pray and spirits.

7. Resto Pawon Bu Puji Team and Berlian’s Bakery Team. You are amazing team that I’ve ever had. Let’s meet you again with another goal and achievement to be successful on 2016.

I realize this mini thesis is still far from perfection, thus suggestions and constructive criticism from all parties are welcome, in order to improve my thesis. Finally, only Allah SWT will return all and I hope this mini thesis will be useful to all parties, especially for writers and readers in general, may Allah bless us and recorded as the worship of Allah’s hand. Amin.

Wassalamu’alaikum Wr.Wb.

Jakarta, December 2015

x ABSTRAK

Penelitian ini bertujuan untuk menganalisis faktor karakteristik Good Corporate Governance (GCG) dalam perusahaan yang dapat mempengaruhi kualitas pengungkapan laporan keberlanjutan pada Laporan keberlanjutan perusahaan-perusahaan yang ada di Indonesia. Faktor-faktor karakteristik Good Corporate Governance yang digunakan antara lain ukuran Dewan Komisaris, proporsi KomisarisIndependen dan ukuran Komite Audit.

Populasi dari penelitian ini adalah semua perusahaan di Indonesia yang telah menerbitkan laporan keberlanjutan pada tahun 2009 hingga 2014. Total sampel penelitian adalah 5 perusahaan yang ditentukan melalui purposive sampling. Penelitian ini menganalisis pada laporan tahunan perusahaan dengan metode Content analysis. Analisis data dilakukan dengan uji asumsi klasik dan pengujian hipotesis dengan metode regresi linear berganda.

Hasil dari penelitian ini menunjukkan bahwa faktor Dewan Komisaris dan Dewan Komisaris Independen berpengaruh signifikan terhadap kualitas pengungkapan laporan keberlanjutan di Indonesia, sedangkan ukuran Komite Audit, tidak berpengaruh signifikan terhadap kualiatas pengungkapan laporan keberlanjutan di Indonesia.

xi ABSTRACT

This study aimed to analyze the characteristics of good corporate governance (GCG) in a company that can affect the quality of sustainability reporting disclosure on sustainability report companies that exist in Indonesia. Factors characteristics of good corporate governance which is used are the size of the Board of Commissioners, Independent Commissioner Proportion and size of the Audit Committee.

The populations of this research were all Indonesian companies which has published a sustainability report in 2009 to 2014. The total sample are 5 companies determined through purposive sampling. This study analyzed the company’s annual reports with Content analysis method. Data analysis was performed with the classical assumption and hypothesis testing with multiple linear regression method

Results from this study indicate that factors Board of Commissioner are significantly influence the quality of disclosure of Sustainability Report in Indonesia, while the size of Audit Committee does not significantly influence the quality of disclosure of Sustainability Report in Indonesia.

xii

LIST OF CONTENTS LIST OF CONTENTS

SUPERVISION SIGN ... ii

CERTIFICATION OF THESIS EXAM SHEET ... iii

SHEET STATEMENT AUTHENTICY SCIENTIFIC WORKS ... iv

CURRICULUM VITAE ... v

FOREWORD ... vii

ABSTRAK ... x

ABSTRACT ... xi

LIST OF CONTENTS ... xii

LIST OF FIGURE ... xvii

LIST OF TABLE ... xviii

CHAPTER I INTRODUCTION 1.1.Background ... 1

1.2. Problem Definition ... 3

1.3. Purpose of this Research ... 3

1.4. Benefit of Research ... 4

CHAPTER II LITERATURE REVIEW 2.1 Introduction... 5

2.2. Theory Development ... 7

2.2.1. Agency Theory ... 7

2.2.2. Earning Management ... 10

2.3. Good Corporate Governance ... 11

2.3.1 Theoretical Foundation of Corporate Governance ... 12

xiii

2.3.3. National Committee of Governance (KNKG)

Definition of GCG ... 15

2.3.4 Good Corporate Governance Mechanism ... 19

2.3.4.1 General Meeting of Shareholders ... 21

2.3.4.2 Board of Commissioners and Board of Directors ... 20

2.3.4.3 Board of Commissioners ... 20

2.3.4.4 Board of Directors ... 20

2.3.5 The Impact of Corporate Governance Disclosure of Firm Performance ... 21

2.3.6 Good Corporate Governance Development in Indonesia ... 23

2.4. Sustainability Report ... 25

2.4.1 The Concept of Sustainable Development ... 26

2.4.2 Sustainability Report Definition in General ... 29

2.4.3 Global Reporting Initiative (GRI) Definition of Sustainability Report ... 31

2.4.4 Impact of Sustainability Disclosure of Firm Performance ... 33

2.4.5 Relationship between GCG and Sustainability Reports ... 35

2.4.6 Sustainability Report in Indonesia ... 37

2.5 Previous Research ... 39 2.5.1 Analisis Pengaruh Good Corporate Governance

xiv

2014)... 39

2.5.2 Corporate Governance and Sustainability (Alena Kocmanová, Jiří Hřebíček, Marie Dočekalová, 2011) ... 40

2.5.3 Corporate Governance, Sustainability and the Assessment of Default Risk (Christina James-Overheu, Asian Journal of Finance & Accounting) ... 41

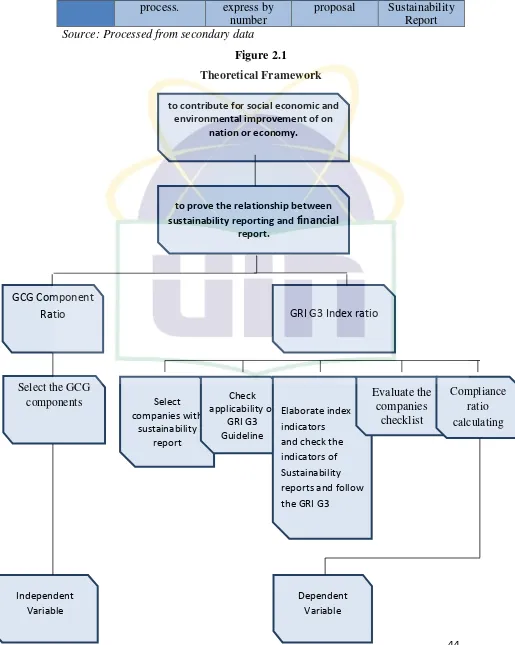

2.6 Theoretical Framework ... 41

2.7 Hypothesis Development ... 45

CHAPTER III RESEARCH METHODOLOGY 3.1. Scope of Research ... 46

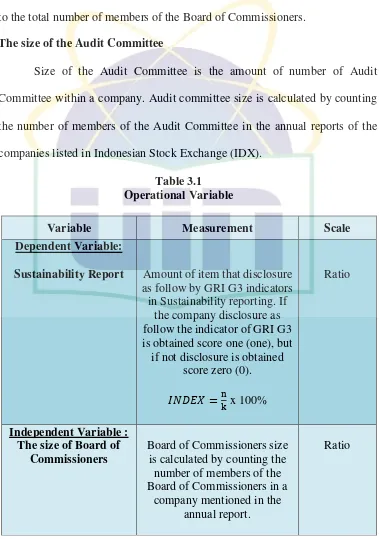

3.1.1 Dependent Variable ... 46

3.1.2 Independent Variable ... 47

1. The size of Board of Commissioners ... 47

2. The proportion of Independent Commissioners ... 47

3. The size of the Audit Committee ... 48

3.2. Sampling Method... 49

3.3.Data Collection Method ... 50

3.4. Analysis Method ... 51

3.4.1 Descriptive Method ... 51

3.4.2 Classical Assumption ... 52

1. Normality Test... 52

xv

3. Heteroscedasticity Test ... 53

4. Autocorrelation... 54

3.4.3 Multiple Regression Analysis ... 55

a. Simultaneous Regression Analysis (Test - F) 56

b. Partial Regression Testing (T-test) ...……… 56

3.4.4 Coefficient Determination Test (R2) ... 56

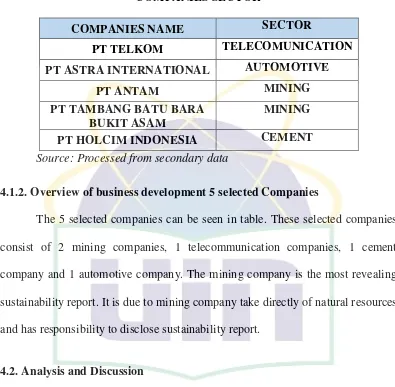

CHAPTER IV FINDING AND ANALYSIS 4.1. General Description of Research Object ... 58

4.1.1. Overview of 5 selected Companies ... 58

4.1.2. Overview of business development 5 selected Companies ... 59

4.2. Analysis and Discussion ... 59

4.2.1.Descriptive Analysis ... 59

4.2.1.1 Independent Variable (GCG Components) . 60 4.2.1.2 Dependent Variable (Sustainability Report Indicator) ... 69

4.2.2 Classical Assumption ... 75

1. Normality Test... 75

2. Multicollinearity Test ... 77

3. Heteroscedasticity Test ... 78

4. Autocorrelation ... 79

4.2.3 Multiple Regression Analysis ... 80

a. Simultaneous Regression Analysis (Test - F) 82

xvi

4.2.4 Coefficient Determination Test (R2) ... 84

4.3.Interpretation... 85

1. The influence of Board of Commissioners to the quality of Sustainability Report Disclosure ... 85

2. The influence of Board of Independent Commissioners to the quality of Sustainability Report Disclosure ... 85

3. The influence of Audit Committee to the quality of Sustainability Report Disclosure ... 86

CHAPTER V CONCLUSION AND RECOMMENDATION 5.1Conclusion ... 87

5.2Recommendation ... 89

REFERENCE ... 91

xvii

LIST OF FIGURE

Figure 2.1 Theoretical Framework ... 44

Figure 4.1 The Compliance with Size of Board of Commissioners in 2009 – 2014 ... 60

Figure 4.2 The Compliance with Size of Independent Commissioners in 2009 – 2014 ... 63

Figure 4.3 The Compliance with Size of Audit Committee in 2009 – 2014 .. 67

Figure 4.4 The Compliance with GRI G3 Index in 2009 ... 70

Figure 4.5 The Compliance with GRI G3 Index in 2010 ... 70

Figure 4.6 The Compliance with GRI G3 Index in 2011 ... 71

Figure 4.7 The Compliance with GRI G3 Index in 2012 ... 72

Figure 4.8 The Compliance with GRI G3 Index in 2013 ... 73

xviii

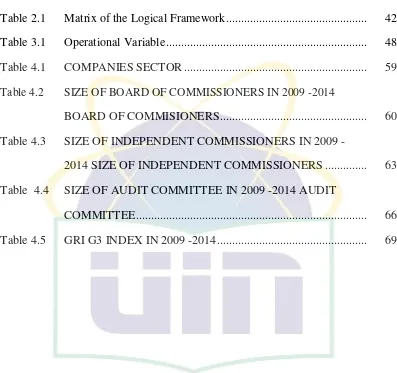

LIST OF TABLE

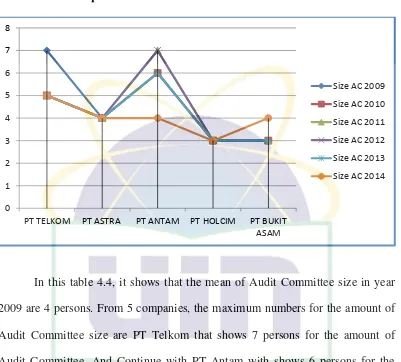

Table 2.1 Matrix of the Logical Framework ... 42 Table 3.1 Operational Variable ... 48 Table 4.1 COMPANIES SECTOR ... 59 Table 4.2 SIZE OF BOARD OF COMMISSIONERS IN 2009 -2014

BOARD OF COMMISIONERS ... 60 Table 4.3 SIZE OF INDEPENDENT COMMISSIONERS IN 2009

-2014 SIZE OF INDEPENDENT COMMISSIONERS ... 63 Table 4.4 SIZE OF AUDIT COMMITTEE IN 2009 -2014 AUDIT

1 CHAPTER I

INTRODUCTION

1.1.Background

In the last decade, especially in Indonesia, the sustainability reporting began to receive attention by stakeholders, especially among investors. Investors are not only rely simply on the financial statements consisting of balance sheet, income statement, cash flows, and notes to the financial statements as a tool to make investment decisions. Trend of making sustainability reporting is increasing every year, according to Indonesian sources Sustainability Report Award (ISRA) and some information about the company official web page up until the year of 2014 was 60 companies that have issued sustainability reports.

Practices and disclosure Sustainability Report is a logical consequence of implementation of the concept and mechanism of Good Corporate Governance (GCG), which principally functioned as states that the company needs to consider the interests of their stakeholders, according with the existing rules and establish active cooperation with stakeholders for the sustainability of the companies in a long term.

2 Another side, in this unprecedented economic growth era, achieving sustainability can be seemed more of an aspiration than a reality. As economies globalize, new opportunities in generating prosperity and quality of life are arising though the trading, knowledge-sharing, and access to technology. However, these opportunities are not always available for an ever-increasing human population, and accompanied by new risks to the stability of the environment. The indicators used in measuring of sustainability in companies are developed continuously by some different international organizations with the aim of achieving an internationally acknowledged sta Therefore, based on phenomena above, the author interested to analyze “The Influence Of Good Corporate Governance

(Gcg) Implementation Toward Quality Sustainability Reporting (Sr)

Disclosure”dard. The most widely international activity known is the Global Reporting Initiative (GRI) which concentrates on standardization of a report on sustainable development (Sustainability Report).

Therefore, based on phenomena above, the author interested to analyze “The Influence Of Good Corporate Governance (Gcg) Implementation

Toward Quality Sustainability Reporting (Sr) Disclosure”

3 This research has been done by Alena Kocmanová, Jiří Hřebíček, Marie Dočekalová in 2011 concern with the research of “Corporate Governance and Sustainability”. The paper focuses on Sustainability and Corporate Governance from the point of view of integration and, in connection with the measurement of corporate performance, Corporate Sustainability Reporting is also gaining in importance. The end of the results show that Corporate governance is understood as the key element in achieving economic performance and growth ensuring increased trust of the investors. It covers a wide range of relationships between the company management, governing bodies, stakeholders and other parties with justified interests.

1.2. Problem Definition

In problem definition, the current and require situation is formed as a structured description of the design problem, with the goal of creating an explicit statement on the problem and possibly the direction of idea generation. Also, it clearly written down and provides a global understanding of the problem and its relevant aspects.

1. Are Board of Commissioners influence the quality of Sustainability Report Disclosure?

2. Are Board of Independent Commissioners influence the quality of Sustainability Report Disclosure?

3. Are Internal Auditor influence the quality of Sustainability Report Disclosure?

4 The purpose of this research is to investigate the extent of qualified sustainability reports printed voluntary by companies listed on the Indonesian Stock Exchange regarding to the requirements provided by GRI G3 guideline. The purpose is as follow by:

1. To observe and clarify the influence the Board of Commissioners to the quality of Sustainability Report disclosed.

2. To observe and clarify the influence the Board of Independent Commissioners to the quality of Sustainability Report disclosed.

3. To observe and clarify the influence Audit Committee to the quality of Sustainability Report disclosed.

1.4. Benefit of Research

Some benefits of this research are:

1. Contribute to the development of the science of Management Accounting, primarily on how the implementation of GCG in a company can influence the company's decision to disclose qualified sustainability report practice in the company's annual report.

2. It provides a practical contribution to the company / management about the benefits implementation and mechanisms of good corporate governance (GCG) and disclosure of sustainability report for the company.

3. As reference material or reference for those who will perform further research on this issue.

5 CHAPTER II

LITERATURE REVIEW

2.1 Introduction

Each company is committed to implementing the highest standards of corporate governance in every aspect of the business operations. Good corporate governance principles are embodied in values, Code of Business Principles, business processes, controls and standard operating procedures, and how companies strive to ensure that these are internalized and consistently practiced by every board of the Company.

Corporate governance has recently received much attention due to Adelphia, Enron, WorldCom, and other high profile scandals, serving as the impetus to such recent U.S. regulations as the Sarbanes-Oxley Act of 2002, considered to be the most confiscate corporate governance regulation in the past. If better corporate governance is related to better firm performance, better-governed firms should perform better than worse-better-governed firms.

6 In other side, manager has a prerogative to expropriate a firm’s assets by undertaking projects that giving benefits themselves personally, but impact the shareholder wealth adversely (Jensen and Meckling, 1976; Shleifer and Vishny, 1997). Effective corporate governance reduces “control rights” stockholders and

creditors confer on managers, increasing the managers probability invest in positive net present value projects, (Shleifer and Vishny, 1997), and suggesting that better-governed firms in having better operating performance as the proxy for firm performance.

Prominent examples of corporate scandals in the US, UK and many others in different continents of the world, many of which were caused by, or at least exacerbated by governance weaknesses, give rise to financial community’s which concern about the appropriateness of the firm profitability or growth prospects in valuing a firm as well as the necessity of effective control mechanisms in ensuring the investors’ funds in value-maximizing projects. However, there is no unequivocal evidence to suggest that better corporate governance enhances firm performance in different market settings (Klein, Shapiro and Young, 2005).

7 many companies still remain unconvinced and to them, “the practical adoption of good governance principles has been “patchy” at best, with “form over substance”

of the norm” (Bradley, 2004, pp. 8-9).

2.2. Theory Development

2.2.1. Agency Theory

Since the publication of Jensen and Meckling's seminal work in 1976, agency theory has become an important part of modern financial economics. It is commonly cited as one of the key areas in the development of modern financial considerations. This principles have been extended provide explanations of merger activity and corporate restructuring, dividend policies, executive compensation, composition of corporate boards, and capital structure, among other issues.

Agency theory is the basis of the theory underlying the company's business practices used at this time. The theory develops from the synergy of economic theory, decision theory, sociology, and organizational theory. Main principle of this theory suggested a working relationship between the investor who gives authority and agency who receive authority, called manager.

8 More formally, Jensen and Meckling (1976) define an agency relationship as a contract under which one or more persons (the principals), engage another person (the agent), to perform some service on their behalf that involves delegating some decision making authority to the agent. In an organizational context, a firm hires agents in part to exploit economies in specialization. Shareholders who are the owners or principals of the company, hires the gents to perform work. Principals delegate the running of business to the directors or managers, who are the shareholder’s agents (Clarke, 2004).

Jensen and Meckling assume that the behavior of all parties, both principals and agents, is motivated by self-interest. However, utility of wealth maximization is remains the single human motivator in their entire theory. They have individual goals and perquisites that will sometimes take precedence. Self-interest is defined as maximization of the utility of personal wealth. In making this assumption, Jensen and Meckling make no assertion about its morality. Rather, they simply claim that it is the best descriptor of human motivation. Nevertheless, this assertion generates a great deal of criticism in the literature of financial ethics. Meanwhile, the agency theory developed by Michael Johnson, considers that the company's management as "agents" for the shareholders, will act with full awareness of their own interest, not as the wise and prudent and also fair to shareholders.

9 theory suggests that employees or managers in organizations can be self-interested.

In further development, agency theory got a broader response deemed as better reflect of reality. Some various considerations of corporate governance were developed by relying on agency theory where the management should conduct with full compliance according to various rules and regulations exist.

Eisenhardt (1989) use three assumptions on human nature to clarify the agency theory are: (1) general human selfishness (self-interest), (2) humans have a limited power of thinking about the future perception (bounded Rationality), and (3) people always avoid risk (risk averse). Based on the assumption of human nature, manager as human will most possibility act opportunistic that relates to prioritizing personal interests.

The world of business has competition at its very core. Competition exists not only among firms, but within firms, as employees compete for recognition, promotions, and salary increases. Agency theory acknowledges this world, but did not create it. As reconceptualized, Agency Theory provides a basis for ethical behavior. It focuses on the responsibilities of the firm to society as a whole.

10 2.2.2. Earning Management

Healy and Wahlen (1999), in their article states that earning management were often happened by the management to increase compensation and job security. Beside it, earning management is also done to avoid rules breaking in a loan contract, reduce regulatory cost, or increase regulatory benefit (Cornett et al., 2008).

Earning management is not only done by the management for their benefit, but also for major shareholder, even though it will cause loss for the minor shareholder. This fit the statement of Laporta et al (1999, 2000) that present an argument that the real problem of most big company listed on Indonesia Stock Exchange’s agency conflict is to limit the resources usage by the major

shareholders (who are the controller shareholder) that can cause mean of resources transfer from the company to major shareholder’s benefit.

Cheung et al. (2005) has done a study about tunneling activities in China that shows there are transaction done between the companies listed in the Stock Exchange with the major shareholder. The research shows that the transaction done by them can cause bad effects to minor shareholders. Jiang et al. (2005) then documented practices done by most of China’s company, where major shareholders used company’s loan for their own benefit. Tunneling activities

11 earning management activities, GCG need to be applied (Klein, 2002; Warfield, Wild, and Wild, 1995; Dechow, Sloan, Sweeney, 1996; Beasley, 1996).

Ortega and Grant (2003) stated that earning management is possible because there is flexibility in a financial report making in order to change the operational profit of a company. In other words, Abdelghany (2005) explains that earnings management is revenue manipulation done to fulfill the target stated by the management. Lo (2008) then relates earnings management and earnings quality, where a company that did earnings management the most has a bad earning quality. But a company that didn’t do earning management doesn’t always have good earning quality, because earning quality is affected by many factors. This opinion is supported by Schipper and Vincent (2003) whom states that earning management will affect earning quality.

2.3. Good Corporate Governance

As explanation of the agency theory and earning management, so each company has to commit to implementing the highest standards of corporate governance in every aspect of the business operations to implement the principles of Good Corporate Governance.

Corporate governance consists in contributing to not only corporate prosperity, but also to the responsibility. Along with the increasing of global markets investors’ development activity, these will be focusing on demand higher standards of responsibility, conduct and performance.

12 even find that capital only available for those who conform to the internationally accepted standards of corporate governance and publishing of information. These are only some of the reasons leading to the worldwide improvement of the Corporate Governance standard and, in some degree to its convergence. The defining of corporate governance is not a matter of unified terminology.

Policies and corporate governance in the future should be more attentive to the needs of stakeholders (Murtanto, 2005; 4). Disclosure on the economic aspects, environmental and social has now become a way for companies to communicate the accountabilities form to stakeholders. This is known as sustainability reporting, or triple bottom line reporting recommended by the Global Reporting Initiative (GRI).

2.3.1 Theoretical Foundation of Corporate Governance

Corporate governance lacks any accepted theoretical base or commonly accepted paradigm as yet (Carver, 2000; Tricker, 2000; Parum, 2005; Larcker, Richardson and Tuna, 2007; Harris and Raviv, 2008). Citing Pettigrew (1992), Tricker (2000) and Parum (2005) argue that corporate governance research lacks coherence of any form, either empirically, methodologically or theoretically, means that only piecemeal attempts have been made to understand and explain how complex modern organization is run.

13 Stiles and Taylor (2002) argue that fragmentation of these various perspectives has led to a lack of consensus regarding corporate governance and the actual role of the board of directors in the organization as the nature of board’s

contribution (and the expectations placed upon it) depends heavily on which theoretical perspective used. However, these frameworks often overlap theoretically and do share significant commonalities (Solomon and Solomon, 2004).

2.3.2 Definition of Corporate Governance

According to Cadbury (2000) in Dima Jamali (2008), Corporate Governance (CG) defines as “the system by which companies are directed and controlled”. The control aspect of CG encompasses the notions of compliance, accountability, and transparency (MacMillan, Money, Downing and Hillenbrad, 2004), and how managers exert their functions through compliance with the existing laws and regulations and codes of conduct (Cadbury, 2000). The importance of CG lies in its quest at crafting/continuously refining the laws, regulations, and contracts that govern companies’ operations, and ensuring that shareholder rights are safeguarded, stakeholder and manager interests are reconciled, and that a transparent environment is maintained wherein each party is able to assume its responsibilities and contribute to the corporation’s growth and value creation (Page, 2005). Governance thus sets the tone for the organization, defining how power is exerted and how decisions are reached.

14 the promise they make to investors. Another way to say this is that corporate governance is about reducing deviance by corporation where deviance is defined as any actions by management or directors that are at odds with the legitimate, investment-backed expectations of investors. Good corporate governance, then, is simply about keeping promises. Bad governance (corporate deviance) is defined as promise breaking behavior

The OECD Principles of Corporate Governance, inter alia referred to in

the EU Commission’s Action Plan on Company Law and Corporate

Governance, take a slightly broader view: “Corporate governance involves a set

of relationships between a company’s management, its board, its shareholders and other stakeholders. Corporate governance also provides the structure through which the objectives of the company are set, and the means of attaining those objectives and monitoring performance are determined. Good corporate governance should provide proper incentives for the board and management to pursue objectives that are in the interests of the company and its shareholders, and should facilitate effective monitoring.” This definition goes beyond the definitions

cited above mainly insofar as a company’s objective(s) and the mechanism for setting the objective(s) are treated as a corporate governance issue, not as endogenously given. Put succinctly, corporate governance “deals with the ways in

which suppliers of finance to corporations assure themselves of getting a return on their investment.”

15 discussion regarding implementation of corporate governance that the company has taken and intends to take in the last financial statement period. The discussion must at least contain Board of Commissioner, Directors, Audit Committee, Other Committees, job description and function of corporate secretary, description of company internal control system and internal control audit, detailed description of the company risks and preventive action toward the risks, description of social responsibility activities and expenditure, Any lawsuit in which the Issuer or Public Company, any of its directors or commissioners is involved, and description of place/address that can be reached by the shareholders or public to obtain company information.

2.3.3. National Committee of Governance (KNKG) Definition of GCG

Regarding to KNKG (2006), GCG is necessary to enhance the creation of an efficient and transparent market that is consistent with the laws. Hence, the implementation of GCG needs to be supported by three inter-related pillars; (1) the regulatory, supervisory and enforcement authorities as regulator/policy makers, (2) business community as market participants, and (3) public as users of products and services of the business community. The basic principles that must be implemented by each pillar are:

1. The regulatory, supervisory and enforcement authorities develop laws and regulations that will promote the creation of a healthy, efficient and transparent business climate, implement and maintain it, and support it with a consistent law enforcement.

16 3. The public as users of the products and services of the business sectors and as the party impacted by the existence of a company demonstrate its concern and exercises an objective and responsible social control.

Some principles explained by KNKG (2006), that each company must ensure that principle of Good Corporate Governance is applied in every business aspect and at all levels of the company. The principles of Good Corporate Governance to achieve business sustainability of the company (GCG) are:

1. Transparency

To maintain objectivity in running the business, the company must provide materials and relevant information in easy way that accessible and understandable by stakeholders. Companies should take the initiative to disclose not only certain cases as seen and made by regulations, but also important cases for decision-making by shareholders, creditors and other stakeholders.

17 and the level of compliance, and important incident that can affect the condition of the company.

2. Accountability

Companies must be transparent and accountable of business performance in responsibly. Thus, a company must be properly managed, scalable and accordance with the company's interests by taking account of interests of shareholders and other stakeholders. Accountability is a necessary prerequisite needed to achieve sustainable performance.

In other side, companies should clearly define the roles and responsibilities of each company’s comity and all employees clearly consist with the vision, mission, corporate values, and corporate strategy. It must ensure that all comities of the company and all employees have the ability conform to the duties, responsibilities, and roles in the GCG implementation.

Another, Companies should ensure that there is an effective system of internal control in company management and should have a range of performance measures for all companies consist with the business objectives of the company, and has a reward and punishment system. In carrying out its duties and responsibilities, every comity of company and all employees must hold on business ethics and code of conduct that has been agreed upon.

3. Responsibility

18 Company’s comity must adhere to the principle of circumspection and ensuring compliance with the laws exist, basic estimation and regulations companies (by-laws). It also should implement social responsibility by taking care on society and the environment especially round company by make adequate planning and implementation.

4. Independency

To expedite the implementation of good corporate governance principles, the company should be managed independent so that each comity does not dominate in each other and no intervention by other parties.

Each company comity should avoid domination by any party, undeterred by the certain special interests, free from collision interest (conflict of interest) and from any influence or pressure, so decision-making can be done objectively.

Each commitee of the company must carry out its functions and duties accordance with the statutes and regulations, not dominate by each other or passing the duty from the others to others.

5. Fairness

In conducting its activities, the company should always consider of shareholders interests and others stakeholders according to principles of fairness and equality.

19 of their respective positions. It also should provide fair and equitable treatment to stakeholders in accordance with the benefits and contributions given by the company.

2.3.4 Good Corporate Governance Mechanism

The organs of a company, consisting of the General Meeting of Shareholders, the Board of Commissioners, and the Board of Directors, have an important role in implementing the GCG effectively. The organs of a company shall carry out their respective functions in accordance with an applicable provision based on the principle that each organ is independent in carrying out its duty, function and responsibility in the sole interest of the company;

2.3.4.1 General Meeting of Shareholders

The General Meeting of Shareholders is a company’s organ that facilitates

20 2.3.4.2 Board of Commissioners and Board of Directors

The management of a limited liability company in Indonesia is adopting a two board system, namely the Board of Commissioners and the Board of Directors, each of which has a clear authority and responsibility based on their respective functions as mandated by the articles of association and laws and regulations (fiduciary responsibility). Yet, they both have the responsibility to maintain the company sustainability in the long term. Accordingly, the Board of Commissioners and the Board of Directors must have the same perception regarding the company’s vision, mission and values.

2.3.4.3 Board of Commissioners

The Board of Commissioners as an organ of the company shall function and be responsible collectively for overseeing and providing advices to the Board of Directors and ensuring that the Company implements the GCG. However, the Board of Commissioners is prohibited from participating in making any operational decision. Each of the members of the Board of Commissioners, including the Chairman, has equal position. The duty of the Chairman of the Board of Commissioners as primus inter pares is to coordinate the activities of the Board of Commissioners.

2.3.4.4 Board of Directors

21 their respective assignments and authorities. However, the execution of tasks by each member of the Board of Directors remains to be a collective responsibility. The position of each respective member of the Board of Directors including President Director is equal. The duty of the President Director as primus inter pares is to coordinate the activities of the Board of Directors. For the Board of Directors to be able to effectively exercise its duties, the following principles shall be observed:

1. The composition of the Board of Directors shall enable it to make effective, right and timely decisions and to act independently;

2. The members of the Board of Directors must be professional that possess the integrity, experience and capability required for carrying out their respective duties;

3. The Board of Directors shall be responsible to manage the company for the purpose of achieving profitability and ensuring the company’s sustainability; 4. The Board of Directors shall be accountable for its management to the General

Meeting of Shareholders in accordance with applicable laws and regulations.

2.3.5 The Impact of Corporate Governance Disclosure of Firm

Performance

22 investors and the cost of capital. Firstly, low stock price result from the investors’

anticipation of possible diversion of corporate resources. Theoretical models by La Porta, Lopez-de-Silanes, Shleifer and Vishny (2002) and Shleifer and Wolfenzon (2002) also predict that in the existence of better legal protection, investors become more assured of less expropriation by controlling bodies and hence, they pay more for the stocks. Secondly, through reducing shareholders’

monitoring and auditing costs, good corporate governance is likely to reduce the expected return on equity which should ultimately lead to higher firm valuation. There exists a well number of anecdotal evidence of a link between corporate governance practices and firm performance. But the empirical studies mainly focus on specific dimensions or attributes of corporate governance like board structure and composition; the role of non-executive directors; other control mechanisms such as director and managerial stockholdings, ownership concentration, debt financing, executive labour market and corporate control market; top management and compensation; capital market pressure and short-termism; social responsibilities and internationalization.

23 are considered collectively.3 Hence, researchers often attempt to measure overall corporate governance and try to identify the relationship between corporate governance and firm performance.

2.3.6 Good Corporate Governance Development in Indonesia

The Indonesian business world needs various instruments to increase its competitiveness. One key instrument from a shareholder’s viewpoint is good

corporate governance. Companies who implement good corporate governance in a proper and continuous manner have an advantage over other companies who do not implement or have not implemented good corporate governance. Challenges faced by the business world will continue to become more complex. The challenges for business will be increasingly not limited by borders as information technology development continues to penetrate our daily lives. The challenges vary from the very simple to the vary complex. The Code and its application by business will benefit businesses in responding to these many challenges. The Code is intended to be dynamic and evolutionary in nature. It will need to reflect the changes in the business environment in this era of globalization, and the business world is faced with a new paradigm, the stakeholders’ value added maximization paradigm. Without providing a value increase, it is difficult for the business to maintain its competitiveness. The higher competitiveness will start as companies gain enough experience and the benefit from good corporate governance implementation.

24 publicly listed companies on 2014. The corporate governance roadmap is formulated by all stakeholders of corporate governance in Indonesia and supported by International Financial Corporation (IFC), a World Bank subsidiary.

It is expected that this GCG roadmap can be used as the main reference for comprehensively improving practices and regulations related to good corporate governance in Indonesia, particularly for issuers and publicly listed companies, said Chairman of OJK Board of Commissioners Muliaman D. Hadad. Considering Indonesian’s role in Association of South East Asian Nations (ASEAN) region, this roadmap will give a positive contribution for improving good corporate governance. The aim is so that the GCG roadmap can stand equally to the roadmap in ASEAN region, in the framework of welcoming ASEAN Economic Community in 2015.

The roadmap is created to provide overall description about various aspects of corporate governance that must be improved, namely: corporate governance framework, shareholders protection, stakeholders’ roles, transparency of information, as well as roles and responsibilities of the board of commissioners (BOC) and board of directors (BOD). The roadmap is arranged using main references and refers to international standards related to good corporate governance.

25 implementation in issuers and publicly listed firms in Indonesia becomes first priority now. This roadmap exists to facilitate the priority realization.

OJK and IFC have been committed to leverage the quality of GCG implementation in companies in Indonesia, particularly those in financial services sector, based on corporation agreement signed on June 17th, 2013. IFC is a subsidiary of the World Bank, which has been contributing to the development of 48 corporate governance codes in 32 countries.

OJK realizes that contributions from all stakeholders of corporate governance in Indonesia are very significant in achieving the objectives of the roadmap. Considering the matter, OJK has formed corporate governance task force (CGTF), which has a special task to develop corporate governance roadmap together with IFC. This task force encompasses representatives from regulatory institutions (Bank Indonesia, State-Owned Enterprises Ministry, Taxation Directorate General, State Development and Finance Comptroller, Indonesian Accounting Association, and Indonesia Stock Exchange) and governance institutions (National Committee on Governance Policy, Indonesian Institute for Corporate Directorship, Indonesian Institute for Corporate Governance, and Indonesian Institute of Commissioners and Directors).

2.4. Sustainability Report

26 market participants. Broad empirical evidence supports the notion that ESG factors are relevant to companies’ economic performance and, thus, are relevant to investment analysis (Margolis et al., 2007; Orlitzky et al., 2003).

For a number of years, the investment community has had extensive discussions of the quality of sustainability reporting, which constitutes a primary reason for the community’s skepticism toward integrating ESG into investment decision-making processes (Juravle and Lewis, 2008; Sullivan, 2011). Recently, however, the content quality of corporate sustainability reports has improved significantly (Foretica, 2011). This change is the result of greater awareness of corporate governance issues, which in turn leads to greater transparency (Kolk, 2008), and of a growing number of mandatory sustainability frameworks around the world (Ioannou and Serafeim, 2011).

Moreover, a number of sustainability initiatives have found wide-spread adoption on a global scale.Nevertheless, the question of the reporting format for sustainability reports has increasingly arisen in research and practice (Eccles & Krzus, 2010; Eccles & Serafeim, 2011). Reports have increasingly arisen in research and practice (Eccles & Krzus, 2010; Eccles & Serafeim, 2011).

2.4.1 The Concept of Sustainable Development

27 whether the resources would be sufficient for future growth). In addressing the issue, Hubbard (2008) stated that the Brundland Commission (WCED 1987) developed the term “sustainable development” defining as: “Development that

meets the needs of the present without compromising the ability of future

generations to meet their own needs”

It is argued that globally we must ensure that our generation’s consumption patterns do not negatively impact on future generation’s quality of life (Deegan, 2000, p. 300). In 1998, Elkington developed the term “triple bottom line” to argue the case for reporting environmental and social performance

together with economic performance. The triple bottom line concept implied that economic, environmental, and social performance were to be balanced and were of equal importance (Hubbard, 2008). Elkington’s first theory is capitalism must

satisfy legitimate demands for economic performance. Elkington echoes Adam Smith’s theory that the firm has one and only one goal to satisfy the desires of shareholders by making profits.

28 Corporate responsibility strategies are perceived to be related to sustainable development. Sustainability philosophy assumes that we abandon a narrow version of a classical economic theory and develop corporate strategies that include goals that go beyond just maximizing shareholder’s interest.

Attention is directed to the demands of a wider group of stakeholders since the firm’s success depends on stakeholder’s satisfaction (Bucholz and Roshenthal,

2005; Freeman, 1984; Hardjano and Klein, 2004; Michael and Gross, 2004 in Lopez et al, 2007)

Companies are becoming aware that they can contribute to sustainable development process (Lopez et al, 2007). Sustainable development is obtained through the management of environmental, natural, economic, social, cultural and political factors. These issues are interrelated and therefore should not be considered independently (Sage, 1999, p. 196 in Lopez et al, 2007).

29 2.4.2 Sustainability Report Definition in General

Sustainability report is a new term which is widely used to explain the communication of the companies’ effect on social, environmental and economic performance which is also referred to as “triple bottom line reports” (profits, people, and planet). Many large companies publish such kind of reports especially for the company which is socially environmentally sensitive such as oil and gas, mining, chemical, automotive, computers, and electronics (Choi, 2006, p. 158). It is published to fulfill the need of wide range of stakeholders which is not only limited to investors and creditors, but also include employees, customers, suppliers, governments, activist groups, and the general public’s.

Hubbard (2008) states the purpose of sustainability reporting is to provide information which holistically assesses organizational performance in a multi-stakeholder environment. In the social area, it is focus on contributing back to the society and community, providing growth and development opportunities for employees and improving relationships and practices for customers, suppliers, governments and communities. The notion of reporting against the three components (or bottom lines) of economic, environmental, and social performance is directly tied to the concept and goal of sustainable development (Deegan, 2000, p. 289)

Triple bottom line reporting, if properly implemented, will provide information to enable others to assess how sustainable an organization’s or a community’s operations are. The perspective taken is that for an organization to

30 by such measures as profitability), minimize or ideally eliminate its negative environmental impacts and act in conformity with societal expectations. These three factors are obviously highly interrelated (Deegan, 2000, p.289).

A sustainability report can be thought of as an impact statement for the entire corporation, which is defined not only in terms of natural resources and climatological effects, but also in terms of economic and social impacts of labor practices, charitable endeavors, and governance structures (Leibs, 2007, December).

Sustainability report is closely related with corporate social responsibility reporting which has a voluntary character. Social responsibility reporting refers to the measurement and communication of information about company’s effect on employee welfare, the local community, and the environment. Information on company welfare may involve working conditions, job security, equal opportunity, workforce diversity, and child labor. Environmental issues may include the impact of production process, products, and services on air, water, land, biodiversity, and human health (Choi, 2006, p. 158).

31 2.4.3 Global Reporting Initiative (GRI) Definition of Sustainability Report

Global Reporting Initiative (GRI) is a network- based organization that has pioneered the development of the world’s most widely used sustainability reporting framework.

Sustainability reports based on the GRI framework can be used to benchmark organizational performance with respect to laws, norms, codes, performance standards and voluntary initiatives; demonstrate organizational commitment to sustainable development; and compare organizational performance. GRI promotes and develops this standardized approach to fulfill demand for sustainability information.

As economy globalizes, new opportunities tend to generate prosperity and quality of life that are arising are accompanied by new risks to the stability of the environment. According to Global Reporting Initiative (2011), there is a contrast between the improvement in the quality of life and alarming information about the state of the environment and the continuing burden of poverty and hunger on millions of people. It raises an issue about how to create new and innovative choices and ways of thinking. New knowledge and innovations in technology, management, and public policy are challenging organizations to make new choices in the way their operations, products, services, and activities impact the earth, people, and economics. It is the Global Reporting Initiative’s (GRI) mission to fulfill this need by providing a trusted and credible framework for sustainability reporting that can be used by organizations of any size, sector, or location.

32 the organization’s commitments, strategy, and management approach. The GRI

Reporting Framework is intended to serve as generally accepted framework for reporting on an organization’s economic, environmental, and social performance.

Furthermore, The Global Reporting Initiative (GRI) is an Amsterdam-based nonprofit organization, which is made up of stakeholders mainly from business, government, and social advocacy groups (Leibs, 2007, December 1). For the past eight years, GRI’s framework has been available as at least one formal framework to follow when communicating corporate sustainability efforts and exposures (Leibs, 2007, December 1). Although it is widely used, GRI’s

framework is not an officially sanctioned standard (Leibs, 2007, December 1). The GRI’s generally accepted framework for companies implementing

sustainability reporting continues to evolve (“How accountants,”2002, October). Now in its third iteration, the GRI framework has become much more detailed regarding the performance indicators companies are urged to measure and monitor (Leibs, 2007, December). By providing in six comprehensive categories guidance on details such as how to craft a broad statement of strategy and which specific performance indicators to measure, the GRI framework has brought increasing levels of rigor to the practice of sustainability reporting (Leibs, 2007, December).

33 2.4.4 Impact of Sustainability Disclosure of Firm Performance

It can be generalized that sustainability reports does have an association with company performance. However, further analysis shows that only social performance disclosure has an association with company’s performance. For

companies, improving sustainability performance is important. Even it is as important as improving company’s financial performance. Sustainability means

the development that meets the needs of the present without compromising the ability of future generations to meet their own needs. It means that, in running the business, a company need to concern to the needs of future generations.

The consumptions made by a company as the input to produce and to provide goods and services, should not negatively impact the quality of the consumption of future generation. It is important to remind, especially for companies, that generating profit is not merely the aims of the business. Being care and responsible to the environment become important aspects in running the business in order to increase the company’s reputation, increase profitability and

bring benefits to the entire stakeholders.

Obviously, stakeholders such as employees, suppliers, governments, activist group, investors, and communities’ around the business are very important

34 For investors, it is important for them to be selective in making investment decision. Besides making investment decision based on information of financial performance, it would be better if investors also consider about the performance of companies in managing sustainability. They should consider about this non-financial aspect in making investment and lending decision. Investing in profitable and socially responsible companies would be better than investing in a company with a high profitability but have been neglecting the environment. High profitability might be look good in the eye of only one part of stakeholder that is investors. Whereas, high performance of sustainability might be look good in the eye of the entire stakeholders.

35 sustainability reporting process function more like traditional performance management reporting and give management more current information, which they can use to make decisions about emissions, energy usage, and other critical business matters (Leibs, 2007, December).

2.4.5 Relationship between GCG and Sustainability Reports

At present companies tend to focus on sustainable development as well as sustainability, which brings with it changes to the corporate culture as well as society. Sustainability has three important dimensions for all companies: economic growth, social responsibility and responsibility for the environment. The social and environmental responsibility, however, cannot become separated from economic growth. Profitability and growth create jobs and wealth; companies have to continue to provide products and services that people need.

Sustainability is therefore a strategy of the process of sustainable development. It acquires special importance when the process helps people progress toward sustainability or may, on the contrary, dissuade them from engaging in the process. Sustainability is the ability to sustain the quality of life or the ability to maintain quality, which means that each generation has a responsibility for the quality of life and needs to continue improve it. Sustainability in connection with the business environment has become part of the general awareness as a result of environmental approaches implemented in companies.

36 value for the owners (on competitiveness), as they follow from the environmental, economic and social dimensions.

The defining of sustainability relates to the concept of the strategy known as the strategy of sustainable development, according to the authors (Hart, 1995; Shrivastava, 1996; Stead & Stead, 1995) in relation to the company.

The strategy of sustainability of the company currently includes a broad approach aimed at the integration of economic, environmental and social dimensions.

Based on the most extensive study on CEOs so far (Accenture, 2010), 93% of them believe the sustainability issues will be important for future success of companies. In 2007 72% of CEOs believed that sustainability issues should be fully integrated into the strategy and running of the company, while in 2010 this belief is expressed by 96%, which proves the increasing interest in sustainability.

37 There is a fuzzy relation, too, between the environmental and the economic performance (Horváthová, 2010). The relation of the social and Corporate Governance performances and the relation of the social - environmental performances and the economic performance should be the subject of further research.

It is important to create measurable and relevant goals of sustainable development and suitable metrics, and further integrated reporting on the financial and non-financial information on the internet basis. The companies who provide insufficient and incomplete information, while its delayed provision is also a flaw, are regarded by investors as involving greater risk and in consequence they are inclined to invest smaller amounts in such companies (Bartes,1994).The solution is offered by the reporting integrating the financial and nonfinancial indicators. The same principles should be applied to both the financial and nonfinancial indicators. In both cases they should be relevant, measurable, comparable, motivating and clearly understandable.

2.4.6 Sustainability Report in Indonesia

Sustainable Reporting is a report containing the company's performance in three aspects, namely economic, environmental, and social. The objective of this report was to be the assessment of whether a company has been able to overcome issues related to sustainability, such as energy savings and conversion.

38 with reference to the reporting standards issued by the Global Reporting Initiative (GRI). The number of companies that make sustainability reporting in Indonesia is the highest in Southeast Asia. In Malaysia, the number of reporting issuer is only about 10 companies. Meanwhile, in Singapore there are 15 companies (NCSR, 2012). Indonesian companies have gone public have an obligation to make a sustainability report in accordance with the Article 66 paragraph 2 of Law No. 40 Year 2007 regarding Limited Liability Company. Through the application of Sustainability Reporting company is expected to develop in a sustainable growth based on business ethics

The National Development of Indonesia is not separate from the Sustainable Development objective which is “To fulfill the need for humans now without demolishing the capability of future generations in fulfilling their needs”

(Brunt land Report 1987). For this reason, the strategy of development must be based upon 3 (three) main pillars in sustainable development, which are: Environment, Social and Economic”. This strategy has been conducted by the

business community with its concept of Corporate Social Responsibility (CSR) or in a broader sense can be described as Corporate Sustainability (CS).

39 NCSR has been declared on June 23, 2005 by 5 (five) major independent organizations which are the Indonesian Management Accountants Institute (IAMI / prev. IAI-KAM), the Indonesian-Netherlands Association (INA), National Committee on Governance (KNKG), Forum for Corporate Governance in Indonesia (FCGI) and the Public Listed Companies Association (AEI).

2.5 Previous Research

This literature review tries to find out the research conducted in this field and to what this thesis could contribute. The following researches have been conducted in this field:

2.5.1 Analisis Pengaruh Good Corporate Governance (Gcg) Terhadap

Kualitas Pengungkapan, Sustainability Report (Abdul Aziz, Desember

2014)

This research aims to analyze the characteristics of good corporate (GCG) in a company that can affect the quality of sustainability reporting disclosure on sustainability report or Sustainability Report corporations in Indonesia. Factors characteristics of good corporate governance which is used are, the size of the Board of Commissioners, the proportion of Independent Commissioner, the size of the Audit Committee, managerial ownership, institutional ownership, share ownership is concentrated, and the size of the company.

40 concentrated, and the size of the company does not significantly influence kualiatas disclosure of SR Indonesia.

2.5.2 Corporate Governance and Sustainability (Alena Kocmanová, Jiří Hřebíček, Marie Dočekalová, 2011)

The paper focuses on Sustainability and Corporate Governance from the point of view of integration and, in connection with the measurement of corporate performance, Corporate Sustainability Reporting is also gaining in importance.

In accordance with the OECD principles (OECD Principles, 2004) it is assumed that the effectively functioning Corporate Governance system within the company and across the whole economy assists to create the confidence and trust necessary for existence of the market economy. A very wide spectrum of sectors coming under the Corporate Governance also appears when trying to define this term succinctly. Integrated with sustainability which is defined as corporate strategy, long-term corporate goals are followed along with effectiveness, performance and competitiveness by means of incorporating of economic, environmental and social aspects into corporate governance.