LAMPIRAN Lampiran 1

30 SQBI

Taisho Pharmaceutical Indonesia

Tbk. √ 20

31 TSPC Tempo Scan Pacific Tbk. √ 21

32 TCID Mandom Indonesia Tbk. √ 22

33 MBTO Martina Berto Tbk. √ 23

34 MRAT Mustika Ratu Tbk. x -

35 UNVR Unilever Indonesia Tbk. √ 24

36 KICI Kedaung Indah Can Tbk. √ 25

37 KDSI Kedawung Setia Industrial Tbk. √ 26

38 LMPI Langgeng Makmur Industri Tbk. x -

39 CINT Chitose Internasional Tbk. [S] x -

No Kode Leverage 2012

No Kode Leverage 2013

No Kode Leverage 2014

No Kode Likuiditas 2011

Current Assets Current Liabilities Current Ratio

1 ADES 128,835 75,394 1.71

2 DLTA 577,645 96,129 6.01

3 ICBP 8,580,311 2,988,540 2.87

4 INDF 24,501,734 12,831,304 1.91

5 MYOR 4,095,299 1,845,792 2.22

6 MLBI 656,039 659,873 0.99

7 ROTI 190,231 148,209 1.28

8 SKLT 105,145 61,944 1.70

9 STTP 313,986 303,434 1.03

10 AISA 1,726,581 911,836 1.89

11 ULTJ 924,080 607,594 1.52

12 CEKA 619,191 367,060 1.69

13 GGRM 30,381,754 13,534,319 2.24

14 HMSP 14,851,460 8,489,897 1.75

15 DVLA 696,925 144,280 4.83

16 KLBF 5,956,123 1,630,589 3.65

17 KAEF 1,263,030 459,694 2.75

18 MERK 491,726 65,431 7.52

19 PYFA 61,889 24,367 2.54

20 SQBI 277,856 48,868 5.69

21 TSPC 3,121,980 1,012,653 3.08

22 TCID 671,882 57,216 11.74

23 MBTO 459,791 112,665 4.08

24 UNVR 4,446,219 6,474,594 0.69

25 KICI 56,090 7,726 7.26

No Kode Likuiditas 2012

No Kode Likuiditas 2013

No Kode Likuiditas 2014

No Kode Profitabilitas 2011

No Kode Profitabilitas 2012

No Kode Profitabilitas 2013

No Kode Profitabilitas 2014

No Kode Size 2011

Total Aset Ln Total Aset

1 ADES 316,048 12.66

2 DLTA 696,167 13.45

3 ICBP 15,222,857 16.54

4 INDF 53,585,933 17.80

5 MYOR 6,599,846 15.70

6 MLBI 1,220,813 14.02

7 ROTI 759,137 13.54

8 SKLT 214,238 12.27

9 STTP 934,766 13.75

10 AISA 3,590,309 15.09

11 ULTJ 2,179,182 14.59

12 CEKA 823,361 13.62

13 GGRM 39,088,705 17.48

14 HMSP 19,376,343 16.78

15 DVLA 928,291 13.74

16 KLBF 8,274,554 15.93

17 KAEF 1,794,242 14.40

18 MERK 584,389 13.28

19 PYFA 118,034 11.68

20 SQBI 361,756 12.80

21 TSPC 4,250,374 15.26

22 TCID 1,130,865 13.94

23 MBTO 541,674 13.20

24 UNVR 10,482,312 16.17

25 KICI 87,419 11.38

No Kode Size 2012

Total Aset Ln Total Aset

1 ADES 389,094 12.87

2 DLTA 745,307 13.52

3 ICBP 17,753,480 16.69

4 INDF 59,324,207 17.90

5 MYOR 8,302,506 15.93

6 MLBI 1,152,048 13.96

7 ROTI 1,204,945 14.00

8 SKLT 249,746 12.43

9 STTP 1,249,841 14.04

10 AISA 3,867,576 15.17

11 ULTJ 2,420,793 14.70

12 CEKA 1,027,693 13.84

13 GGRM 41,509,325 17.54

14 HMSP 26,247,527 17.08

15 DVLA 1,074,691 13.89

16 KLBF 9,417,957 16.06

17 KAEF 2,080,558 14.55

18 MERK 569,431 13.25

19 PYFA 135,850 11.82

20 SQBI 397,144 12.89

21 TSPC 4,632,985 15.35

22 TCID 1,261,573 14.05

23 MBTO 609,494 13.32

24 UNVR 11,984,979 16.30

25 KICI 94,956 11.46

No Kode Size 2013

Total Aset Ln Total Aset

1 ADES 441,064 13.00

2 DLTA 867,041 13.67

3 ICBP 21,267,470 16.87

4 INDF 78,092,789 18.17

5 MYOR 9,709,838 16.09

6 MLBI 1,782,148 14.39

7 ROTI 1,822,689 14.42

8 SKLT 301,989 12.62

9 STTP 1,470,059 14.20

10 AISA 5,020,824 15.43

11 ULTJ 2,811,621 14.85

12 CEKA 1,069,627 13.88

13 GGRM 50,770,251 17.74

14 HMSP 27,404,594 17.13

15 DVLA 1,190,054 13.99

16 KLBF 11,315,061 16.24

17 KAEF 2,471,940 14.72

18 MERK 696,946 13.45

19 PYFA 175,119 12.07

20 SQBI 421,188 12.95

21 TSPC 5,407,958 15.50

22 TCID 1,465,952 14.20

23 MBTO 611,770 13.32

24 UNVR 7,485,249 15.83

25 KICI 98,296 11.50

No Kode Size 2014

Total Aset Ln Total Aset

1 ADES 504,865 13.13

2 DLTA 991,947 13.81

3 ICBP 24,910,211 17.03

4 INDF 85,938,885 18.27

5 MYOR 10,291,108 16.15

6 MLBI 2,231,051 14.62

7 ROTI 2,142,894 14.58

8 SKLT 331,575 12.71

9 STTP 1,700,204 14.35

10 AISA 7,371,846 15.81

11 ULTJ 2,917,084 14.89

12 CEKA 1,284,150 14.07

13 GGRM 58,220,600 17.88

14 HMSP 28,380,630 17.16

15 DVLA 1,236,248 14.03

16 KLBF 12,425,032 16.34

17 KAEF 2,968,185 14.90

18 MERK 716,600 13.48

19 PYFA 172,737 12.06

20 SQBI 459,353 13.04

21 TSPC 5,592,730 15.54

22 TCID 1,853,235 14.43

23 MBTO 619,383 13.34

24 UNVR 14,280,670 16.47

25 KICI 96,746 11.48

No Kode Nilai Perusahaan 2011

Closing Price Equity Jumlah Saham Price Book Value

1 ADES 1,010 125,746 590 4.74

2 DLTA 111,500 572,935 16 3.11

3 ICBP 5,200 10,709,773 5,831 2.83

4 INDF 4,600 31,610,225 8,780 1.28

5 MYOR 14,250 2,424,669 767 4.51

6 MLBI 359,000 530,268 21 14.22

7 ROTI 3,325 546,441 1,012 6.16

8 SKLT 140 122,900 691 0.79

9 STTP 690 490,065 1,310 1.84

10 AISA 495 1,832,817 2,926 0.79

11 ULTJ 1,080 1,402,447 2,888 2.22

12 CEKA 950 405,059 298 0.70

13 GGRM 62,050 24,550,928 1,924 4.86

14 HMSP 39,000 10,201,789 4,383 16.76

15 DVLA 1,150 727,917 1,120 1.77

16 KLBF 3,400 6,515,935 10,156 5.30

17 KAEF 340 1,252,506 5,554 1.51

18 MERK 132,500 494,182 22 5.90

19 PYFA 176 82,397 535 1.14

20 SQBI 127,500 302,500 1 0.42

21 TSPC 2,550 3,045,936 4,500 3.77

22 TCID 7,700 1,020,413 201 1.52

23 MBTO 410 400,542 1,070 1.10

24 UNVR 18,800 3,680,937 7,630 38.97

25 KICI 180 64,298 138 0.39

No Kode Nilai Perusahaan 2012

Closing Price Equity Jumlah Saham Price Book Value

1 ADES 1,920 209,122 590 5.42

2 DLTA 255,000 598,212 16 6.82

3 ICBP 7,800 11,986,798 5,831 3.79

4 INDF 5,850 34,142,674 8,780 1.50

5 MYOR 20,000 3,067,850 767 5.00

6 MLBI 740,000 329,853 21 47.11

7 ROTI 6,900 666,608 1,012 10.48

8 SKLT 180 129,483 691 0.96

9 STTP 1,050 579,691 1,310 2.37

10 AISA 1,080 2,033,453 2,926 1.55

11 ULTJ 1,330 1,676,519 2,888 2.29

12 CEKA 1,300 463,403 298 0.84

13 GGRM 56,300 26,605,713 1,924 4.07

14 HMSP 59,900 13,308,420 4,383 19.73

15 DVLA 1,690 841,546 1,120 2.25

16 KLBF 1,060 7,371,644 50,780 7.30

17 KAEF 740 1,437,066 5,554 2.86

18 MERK 152,000 416,742 22 8.02

19 PYFA 177 87,705 535 1.08

20 SQBI 238,000 325,359 1 0.73

21 TSPC 3,725 3,353,156 4,500 5.00

22 TCID 11,000 1,096,822 201 2.02

23 MBTO 380 434,563 1,070 0.94

24 UNVR 20,850 3,968,365 7,630 40.09

25 KICI 270 66,557 138 0.56

No Kode Nilai Perusahaan 2013

Closing Price Equity Jumlah Saham Price Book Value

1 ADES 2,000 264,778 590 4.46

2 DLTA 380,000 676,558 16 8.99

3 ICBP 10,200 13,265,731 5,831 4.48

4 INDF 6,600 38,373,129 8,780 1.51

5 MYOR 26,000 3,938,761 894 5.90

6 MLBI 1,200,000 987,533 21 25.52

7 ROTI 1,020 787,338 5,062 6.56

8 SKLT 180 139,650 691 0.89

9 STTP 1,550 694,128 1,310 2.93

10 AISA 1,430 2,356,773 2,926 1.78

11 ULTJ 4,500 2,015,147 2,888 6.45

12 CEKA 1,160 528,275 298 0.65

13 GGRM 42,000 29,416,271 1,924 2.75

14 HMSP 62,400 14,155,035 4,383 19.32

15 DVLA 2,200 914,703 1,120 2.69

16 KLBF 1,250 8,499,958 46,875 6.89

17 KAEF 590 1,624,355 5,554 2.02

18 MERK 189,000 512,219 22 8.12

19 PYFA 147 93,901 535 0.84

20 SQBI 304,000 347,052 1 0.88

21 TSPC 3,250 3,862,952 4,500 3.79

22 TCID 11,900 1,182,991 201 2.02

23 MBTO 305 451,318 1,070 0.72

24 UNVR 26,000 4,254,670 7,630 46.63

25 KICI 270 73,977 138 0.50

No Kode Nilai Perusahaan 2014

Closing Price Equity Jumlah Saham Price Book Value

1 ADES 1,375 295,799 590 2.74

2 DLTA 390,000 764,473 16 8.16

3 ICBP 13,100 15,039,947 5,831 5.08

4 INDF 6,750 41,228,376 8,780 1.44

5 MYOR 20,900 4,100,555 894 4.56

6 MLBI 11,950 553,797 2,107 45.47

7 ROTI 1,385 960,122 5,062 7.30

8 SKLT 300 153,368 691 1.35

9 STTP 2,880 817,594 1,310 4.61

10 AISA 2,095 3,592,829 3,219 1.88

11 ULTJ 3,720 2,265,098 2,888 4.74

12 CEKA 1,500 537,551 298 0.83

13 GGRM 60,700 33,228,720 1,924 3.51

14 HMSP 68,650 13,498,114 4,383 22.29

15 DVLA 1,690 962,431 1,120 1.97

16 KLBF 1,830 9,817,476 46,875 8.74

17 KAEF 1,465 1,811,144 5,554 4.49

18 MERK 160,000 553,691 22 6.36

19 PYFA 135 96,559 535 0.75

20 SQBI 315,000 368,879 1 0.85

21 TSPC 2,865 4,132,339 4,500 3.12

22 TCID 17,525 1,283,504 201 2.74

23 MBTO 200 453,749 1,070 0.47

24 UNVR 32,300 4,598,782 7,630 53.59

25 KICI 268 78,680 138 0.47

No Kode Operating Performance 2011

No Kode Operating Performance 2012

Operating Profit Total Revenue Operating Profit Margin

1 ADES 76,631 476,638 0.16

2 DLTA 517,388 1,719,815 0.30

3 ICBP 2,842,060 21,574,792 0.13

4 INDF 6,870,594.00 50,059,427 0.14

5 MYOR 1,156,560 10,510,626 0.11

6 MLBI 607,261 1,566,984 0.39

7 ROTI 199,403 1,190,826 0.17

8 SKLT 11,664 401,724 0.03

9 STTP 93,117 1,283,736 0.07

10 AISA 459,778 2,747,623 0.17

11 ULTJ 429,341 2,809,851 0.15

12 CEKA 91,289 1,123,520 0.08

13 GGRM 6,025,681 49,028,696 0.12

14 HMSP 13,383,257 66,626,123 0.20

15 DVLA 196,166 1,087,380 0.18

16 KLBF 2,308,017 13,636,405 0.17

17 KAEF 278,495 3,735,339 0.07

18 MERK 141,248 929,877 0.15

19 PYFA 8,898 176,731 0.05

20 SQBI 171,457 387,535 0.44

21 TSPC 742,207 6,630,810 0.11

22 TCID 210,086 1,851,153 0.11

23 MBTO 54,075 717,788 0.08

24 UNVR 6,498,107 27,303,248 0.24

25 KICI 3,080 94,787 0.03

No Kode Operating Performance 2013

No Kode Operating Performance 2014

Lampiran 3

Hasil Output SPSS Statistik Deskriptif

Descriptive Statistics

N Minimum Maximum Mean Std. Deviation

Leverage_DER 104 .11 3.03 .7757 .55185 Likuiditas_CR 104 .51 11.74 2.7614 1.87655 Profitabilitas_ROE 104 .01 1.44 .2751 .31653 Size_LnTotalAset 104 11.38 18.27 14.5330 1.70879 NilaiPerusahaan_PBV 104 .36 53.59 6.4994 10.75311 OperatingPerformance_OPM 104 .00 .86 .1626 .14450 Valid N (listwise) 104

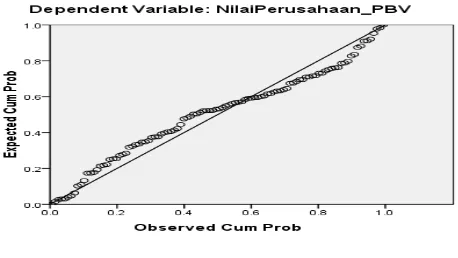

Grafik P-Plot

Uji Kolmogorov-SmirnovTest (K-S)

One-Sample Kolmogorov-Smirnov Test

Unstandardized Residual

N 104

Normal Parametersa,,b Mean .0000000 Std. Deviation 3.40729229 Most Extreme Differences Absolute .097

Positive .097

Negative -.083

Kolmogorov-Smirnov Z .988

Asymp. Sig. (2-tailed) .283

a. Test distribution is Normal. b. Calculated from data.

Uji Multikolinieritas

Coefficientsa

Model

Collinearity Statistics Tolerance VIF

Uji Heteroskedastisitas Scatterplot

Uji Autokorelasi Runs Test

Runs Test

Unstandardized Residual

Test Valuea .27081 Cases < Test Value 52 Cases >= Test Value 52

Total Cases 104

Number of Runs 47

Z -1.182

Asymp. Sig. (2-tailed) .237 a. Median

Statistik Deskriptif Setelah Transformasi

Descriptive Statistics

N Minimum Maximum Mean Std. Deviation

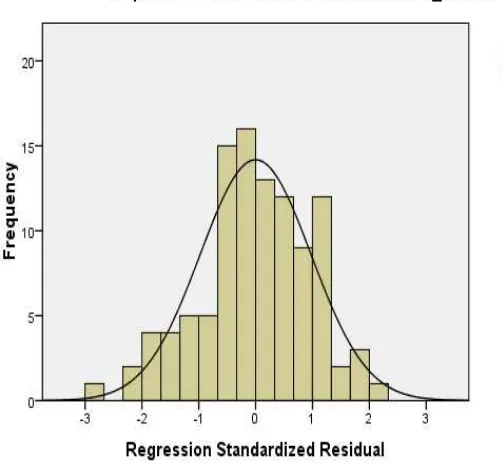

Uji Normalitas Setelah Transformasi Histogram Setelah Transformasi

Uji Kolmogorov-SmirnovTest (K-S) Setelah Transformasi One-Sample Kolmogorov-Smirnov Test

Unstandardized Residual

N 104

Normal Parametersa,,b Mean .0000000 Std. Deviation .68472007 Most Extreme Differences Absolute .070

Positive .043

Negative -.070

Kolmogorov-Smirnov Z .711

Asymp. Sig. (2-tailed) .693

a. Test distribution is Normal. b. Calculated from data.

Uji Multikolinieritas Setelah Transformasi Coefficientsa

Model

Collinearity Statistics Tolerance VIF

1 Leverage_DER .366 2.733 Likuiditas_CR .515 1.942 Profitabilitas_ROE .445 2.245 Size_LnTotalAset .863 1.159 OperatingPerformance_OPM .686 1.457 a. Dependent Variable: LnNilaiPerusahaan_LnPBV

Uji t Profitabilitas_ROE 2.931 .272 .761 10.783 .000 Size_LnTotalAset .215 .043 .302 4.984 .000

Lampiran 4

Jadwal Penelitian

1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 Pengajuan Judul Proposal Tesis

Bimbingan Propos al Tesis Kolokium Proposal Tesis Pengolahan Data Analisis Data Bimbingan Penulisan Tesis Seminar Hasil Tesis Penyelesaian Tesis Ujian Komprehensif

Tahapan Penelitian

2015/2016