Development of Retail Industry in Indonesia Tulus Tambunan

Recent Development

The evaluation of development of the retail industry in Indonesia shows that the industry has been developed in a 10 year-cycle, and its long period of development can be divided into subsequent stages. However, this cycle tends to shorten due to many factors, such as the rapid increase of income per capita, global trade and financial liberalization, and technological progress. The development cycle of the industry is given as follows. Before 1960s, there was the episode of traditional retailers or independent (small) traders. In the 1960s there was the period when modern retail was introduced marked by the opening of the first department store SARINAH in JL. MH Thamrin (Central Jakarta). During the 1970s-1980s, it was the first expansion era of modern retail with the emergence of many supermarkets, department stores and groceries such as Matahari, Hero, Golden Truly, Pasar Raya dan Ramayana; it was also the era of development of drug stores.

In the early 1980s, shopping malls were limited to Sarinah, Ratu Plaza, Gajah Mada Plaza, Blok M and Pasar Baru. Since then, major shopping malls have been constructed all over town. The growing middle class has been flocking to the shopping malls in recent years to buy an ever growing variety of consumer goods. Foreign department chains such as Metro (Singapore), Sogo (Japan) and Marks & Spencer's (UK) have tested the waters by opening outlets in prestigious malls.

In the 1990s, it was the second expansion era of modern retail or the era of development of Convenience Store (C-Store), High Class Department Store, Branded Boutique (high fashion) and Cash and Carry. The development of C-store was marked by the rapid growth of Indomaret dan AMPM. The development of High Class department Store and High Fashion Outlet was marked by the entrance of SOGO, Metro, Seibu,Yaohan, Mark & Spencer and various other high fashion outlets. The development of Cash and Carry was marked by the establishment of Makro, followed by local retailers with the same form such as GORO, Indogrosir and Alfa. Most malls have a good retail mix with several anchor department stores, small clothing boutiques, stationery/book stores, framers, toy stores, household furnishings and even car dealers. Visit the various malls to familiarize yourself with the stores available. The information desk near the main entrance often has a brochure or listing of all the stores in the mall. Malls are not only a place to shop, but increasingly, a recreation site with clean, air-conditioned environment. Movie theaters, ice-skating rinks, arcades, laser tag, simulated rock climbing, simulator rides, coin-operated children's rides, food courts and restaurants abound. Families can entertain their kids and have a nice meal or snack. They can find various restaurants featuring Indonesian, Asian and western menus; from snacks to fast food to family restaurants.

This rapid expansion of foreign retailers accompanied with strong domestic consumption was the most important driving force behind the smooth recovery of the Indonesian retail sector after severe damage during the 1998 riot. According to the Association of Indonesian Retail Companies (APRINDO), the estimated cost of the riot damage was around Rp2.5 trillion. APRINDO has estimated that Indonesians spent about Rp200 trillion on retail products in 2000 and the sector grew more than 20% in 2001. Some Rp35 trillion of this went to modern retail outlets, including Hero premises and Rp165 trillion was spent at traditional markets and community shops. In 2002, total sales of Indonesia's retail sector amounted to approximately $4 billion, which generated by some 5,000 retail outlets. In terms of growth rate, in the fourth quarter of that year, the retail sector registered only 3% growth. In the first quarter of 2003, the sector experienced modest growth of only 4% compared to the same period in 2002. In many years before, the growth for this quarter was typically at least 20%. Due to the decrease in consumer expenditure and increase in operating costs, namely the increases in electricity, fuel, and telephone charges in 2003, the sector was expected to experience a slower growth of 3 percent in 2003. For 2005, APRINDO predicts that the Indonesian retail market will pick up and book an estimated sales turnover of $8.75 billion.

Other than increasing costs, the retail sector had faced a few barriers throughout 2002 and 2003. There were several bombings, natural disasters and regional issues that discouraged consumers from spending. The Bali bombing in October 2002 and JW Marriott Hotel bombing on 5 August 2003 have discouraged people from venturing into public places, especially shopping centres and malls. The extra tight security checks at these places proved a negative factor among consumers, who tended to stay at home. The same conditions were also evident particularly in major cities such as Jakarta and Medan, and compounded by the SARS (Severe Acute Respiratory Syndrome) outbreak.

However, since many years the major retailers in Indonesia have been planning big expansions of their businesses to get a larger chunk of the country's expanding economy. Alfamart, a minimarket operator since 1999, is leading the charge by planning to increase its outlets by 80% from 1,000 to 1,800 locations in the country. The company's ultimate goal is to establish between 5,000 and 10,000 mini-markets in Indonesia. The decision to expand, according to Alfamart managing director Pudjianto, will eventually sideline traditional stores. Competitor Indomaret, meanwhile, has also revealed its plans to open 600 more outlets, boosting its stores to 1,600.1

Any expansion will be less appealing to retailers, yet the growing competition will force these retailers to maintain such a strategy especially in sectors such as supermarkets, convenience stores and hypermarkets. In addition, the retail industry can take advantage of continuing property development, especially in terms of shopping centres, trade centres and malls. These new constructions will definitely result in greater retail sales area to many retail formats.

Supermarkets and hypermarkets have also been planning to expand their presence, with one of the operators, Hypermart, looking to triple its outlets to 18 in 2004-2005. According to AC Nielsen, the number of retail outlets in Indonesia, which was estimated to be 1.75 million, is the second-biggest in the Asia Pacific after

1

China with 3.2 million. Based on a study by MasterCard International in early 2004, Indonesia was forecast to top the year-on-year retail sales growth for the first semester with 16.9% to China's 12.75%.2

APRINDO has estimated that total retail sales in 2004 reached about Rp 300 trillion (US.6 billion), and is predicted to grow by between 15% and 20% in 2005. APRINDO data shows that sales in 2,720 modern stores nationwide experienced a 28% growth from Rp 35 trillion in 2003 to Rp 45 trillion in 2004. Although spending increased at both traditional and modern retailers, the growth at modern retailers was predicted 12% higher than at traditional markets. According to APRINDO, at the current growth rates, the market share of traditional stores, currently at 70%, would drop by 2% per year. The most recent data from AC Nielsen revealed that the share of consumer spending at modern markets has increased by 40% from 21.8% in 2000 to 30.4% in 2004.3

Based on data from Central Bureau of Statistics (BPS), in 2000, Indonesian consumers spent about US$100 per person per year for consumption in traditional retail, or about Rp150 trillion based on current exchange rate of the rupiah and total population.4While, for consumption in modern retail, based on information from APRINDO, total spending in the same year reached Rp 25 trillion, So, in that year, total retail consumption expenditure was Rp.175 trillion.5

Although retail sector, especially the modern one, has been growing very fast in Indonesia, according to Euromonitor data in 2000,6the retail outlet intensity or total units per 1,000 persons in the country is lower than in some smaller neighbor countries such Malaysia and Thailand, but higher than that in e.g. Singapore (Chart 1). This difference may be attributed not only to income per capita, but also country size, condition of infrastructure, regulations and many others.

Chart 1. Intensity of Retailers in a number of countries, 2000 (units per 1,000 persons)

0 2 4 6 8 10 12 14 16 18 Thai

land China Japan

Net herla nds Mal aysi a Indone sia Singa pore Hong Kong Germ any Aus tralia Ind

ia

UK USA

Phi lippi

ne

Source: McGoldrick (2002)

2

APRINDO. 3

Jakarta Post, 4 August 2005. 4

Bisnis Indonesia, 7-9-2001. 5

Hendri Ma’ruf (2005), Pemasaran Ritel (Retail Marketing), Jakarta: PT Gramedia Pustaka Utama. 6

There are currently more than 527 supermarkets in Indonesia, most of them in Jakarta, the greater Jakarta area (Botabek) and Surabaya. However, with a total population of some 208 million people, supermarket penetration remains very limited, representing only one supermarket for nearly 500,000 people.7

Overview of retail sector in a report called Indonesian Food & Beverage Retail Report from the Canadian Embassy in Jakarta in March 2000 gives number and location of supermarkets/mini-market in Jakarta (Center, South, East, West and North) before the crisis. As can be seen in Chart 2, supermarket has expanded more rapidly than minimarket, although the difference varies between region within the city. According to this report, Jakarta had 313 outlets of supermarket and mini-markets before the crisis. Of these were 185 supermarkets and 128 mini-market outlets. There were around 940 supermarkets nationwide. South Jakarta had the largest number with 88 outlets and North Jakarta the smallest number with 44 outlets. Before the May riots in 1998, joint ventures with foreign operators were a rising trend, as Indonesian retailers sought technical and managerial expertise from abroad. Most notables are Hero's strategic alliance with Dairy Farm International Holdings of Hong Kong. In May 1998, rioters turned on retail stores in the cities, causing immense damage. No less than 36 supermarket outlets and 9 wholesale stores were burned and looted by rioters. Altogether, leading retailers suffered an estimated US$414 million in damages, not including losses endured by countless smaller stores. Some Operators got back on their feet quickly. Hero Supermarket, one of the biggest retailers, managed to re-supply its looted stores just hours after the riots with the aid of its central distribution partner, David's Asia. In view of future trouble, reopening supermarkets also changed their stocking system by ordering limited supplies weekly, rather than monthly as before.

Chart 2. Supermarket and Minimarket in Jakarta by Region, 2000

Source: APRINDO

8

Further, based on data from AC Nielsen, Chart 3 shows retail market share in Indonesia for the period May 2002-April 2003. As can be seen, the share of West Java (including Depok, Bogor, Tangerang and Bekasi) was the highest at 20.7%, followed by Central Java 16.3%, East Java 15.9%, Jakarta (DKI) 15.0%, North Sumatra 11.0%, South Sumatra 7.8%, and other regions 13.4%. This figure suggests that the distribution of retail,

7

APRINDO 8

especially modern outlets, is mainly concentrated in the west part of the country. This relates to the fact that the larger portion of the country’s population is found in that part, which is also much more developed with higher income per capita compared to the eastern part of the country. Especially, people with high purchasing power live in Bandung and in three districts i.e. Bogor, Tangerang and Bekasi that surrounding Jakarta but located in the province of West Java. This makes West Java as the highest province in Indonesia with respect to the national share of retail market.

Chart 3: National Share of Retail Market by Region in Indonesia: May 2002-April 2003

0 5 10 15 20 25

West Java Central Java

East Java DKI North Sumatra

South Sumatra

Others

%

Source: AC Nielsen

The 1998 Liberalization Policies and the Growth of Modern Retailers

Historically, foreign companies in Indonesia had been prohibited by law from distributing their own products, and both retail and distribution remain closed to foreign investment. Many new players, however, have entered the retail market, despite this prohibition. In light of the prohibition on direct investment, foreign involvement in retail is limited to licensing and franchising. The products of manufacturing or processing companies in which foreigners own equity may be sold at the wholesale level, generally understood to permit sales only to distributors. The rules on distribution by foreign companies were relaxed through a series of laws in 1987, 1989 and 1996. Foreign manufacturing joint ventures may now set up a separate joint venture distribution company in which a majority of the equity may be held by the foreign party and may also import complementary goods produced by overseas parties to complement their own product lines. Such products may be sold in addition to the companies' locally produced products. However, restrictions still exist, and the Indonesian market remains in many ways closed to foreign distribution and trade.

When a now-equity partnership entered into between the FDI companies and the SEs, such as under a general trading agency, or sub-contracting arrangement, there is no restriction on the percentage of shares that may be held by the foreign investor. It could 100% percent foreign owned. In both types of partnerships, the foreign investor is required to "foster" the SEs through assistance in area such as technology, marketing, human resources, business management and financing.9

Soon after this liberalization policy, many large, modern foreign retailers, which have been particularly active in the hypermarket sector, began to invest in Indonesia, and competition in the Indonesian retail industry has been very steep. Although some foreign retailers failed and closed down their outlets, many are successful and expanding their business. In Indonesia, there are no regulations governing where a retailer can establish outlets. As a result, many large retailers are strategically located in the heart of Indonesia's big cities and compete directly with smaller retailers.

As a direct consequence of this new regulation, traditional regional retailers which dominate retail trade in certain regions in Indonesia (especially big cities like Jakarta, Surabaya, Semarang, Yogyakarta, Bandung, Medan dan Makasar) are slowly being threatened by modern retail outlets, not only from abroad but also from domestic. Some of these traditional retailers are Sri Ratu and Rita in Central Java, Macan Yaohan and Maju Bersama in Medan, AdA in Semarang, and Yogya and Borma in Bandung. This traditional retail includes small "mom and pop" provision shops, some of which are in markets. Distribution channels are long and complex. Little imported product is carried by these outlets except for fresh fruit and beef offal. An estimated 60% of imported fresh fruit goes through traditional markets.

Consumer loyalty to traditional retail shops is still strong due to long tradition. However, modern retailers with stronger capital, such as Hero and Matahari, are starting to expand to these regions. These modern retailers also have the advantage of up-to-date service, high technology systems and modern outlets, which are more attractive to the young consumers. While, the traditional retailers have problems in expanding their business outside their territory, such as Yogya, whose performance in Jakarta is moderate, compared to its strong position in Bandung.

So, in Indonesia now, two distinct categories of retailers serving different consumers segments can be identified, i.e. modern retailers, targeted the higher-income groups and expatriates offering wide selections of Western fresh and processed foods in a modern store environment while the other, i.e. traditional retailers, serviced the lower-income up to the middle income families. The modern retail business in the country can further be divided into three parts namely hypermarket, supermarket and minimarket. Currently, such as Carrefour, Makro, Alfa, Indo Grosir and Goro represent the hypermarket industry. For supermarket, the representative players are Hero, Matahari, Ramayana Super indo, Gelael, Diamond, and many other supermarket surrounding Jakarta such as Bandung (West Java), Surabaya (East Java), and Denpasar (Bali). Minimarkets are numerous but represent by the large chains, Indo Maret, Circle K, and Am-Pm.

Modern retail stores, especially hypermarkets and supermarkets offer a wide range of food and beverage products. Among these which have achieved significant growth in annual sales include the following: infant

9

milk formula (53%), cheese (51%), energy drinks (50%), snack foods (45%), liquid milk (40%), chocolate (39%), baby foods (35%), health foods (35%), sweetened condensed milk (35%), and biscuits (28%). The modern retailers are also concentrating on improving their marketing of quality fresh produce, a substantial portion of which is imported, as is exemplified by the number of fruit boutiques that have emerged.10

They are generally located as anchor stores in shopping centers. An increasing number of Indonesians are shopping at these stores, particularly affluent middle and upper income groups. These retails stores generally also contain in-store bakeries, café/food service area, and prepared meals. In addition, mini-markets and other shops, which carry a small range of convenience food items including fresh fruits, are found throughout Indonesia’s major urban centers.

Despite the growth in the modern retail sector, the majority of Indonesians continue to shop at traditional stores conveniently located to their homes or places of work. These stores sell the commonly demanded food and beverage products, which are familiar to the majority of consumers. So, the traditional sector is expected to continue to dominate the distribution system in the country for the foreseeable future.

Rangkuti (2004) (see footnote 10) attempts to explain this by looking at consumer purchasing habits in Indonesia, that have changed dramatically following the 1998/99 economic crisis and continue to evolve. He has made the following generalizations about current consumer behavior:

- purchasing more staple foods, rather than luxury items, and minimizing impulse buying; - extremely price conscious in their purchases and exhibiting less store and brand loyalty; - shopping more frequently for food and buying smaller quantities per shopping trip;

- shifting purchases of some staple items to traditional outlets and shopping more frequently at discount venues in the modern sector;

- eating out less often; instead, shopping in supermarkets to eat at home;

- buying smaller package sizes and placing less value on the quality and appearance of packaging; - buying local rather than imported products when satisfactory local substitutes are available; - consuming more fresh food items;

- less nutrition-conscious.

In the modern retail sector, distribution channels will shorten. Large retailers will increasingly import (particularly produce) directly from foreign exporters, or will be supplied directly by local manufacturers and fresh produce producers. They will put in place central warehousing and distribution systems in the big cities, utilizing modern technology and equipment. They will open more outlets in cities on Java outside of Jakarta to make these systems efficient. Adequate infrastructure is a major problem on the other islands. For example, a period of two weeks often lapses between order placement and delivery (see footnote 10). Comparable changes will also occur in the traditional sector. National distributors are setting up central distribution systems to

10

expand direct delivery to traditional market outlets. More direct delivery by manufacturers to traditional retail outlets is anticipated.

Based on information from Alfa homepage, as shown in Table 1, in 1996, the ratio between number of modern retail outlets and that of traditional ones was around 25% and in 1998, it declined due to the May 1998 riot, and in 1999, it went up again to 33.3%. As the Indonesian economy has recovered from the 1997/1998 crisis and the real income per capita in the country has been increasing annually since the negative growth of GDP in 1998 by more than 13%, the ratio of modern-traditional retail in Indonesia in recent years was expected to be much higher than that in 1999.

Table 1: Development of Modern and Traditional Retail in Indonesia (unit)

Tahun Modern retail Tradisional retail

1996 11 44

1997 12 50

1998 9 32

1999 10 30

Source : Alfa Retailindo, Tbk (homepage).

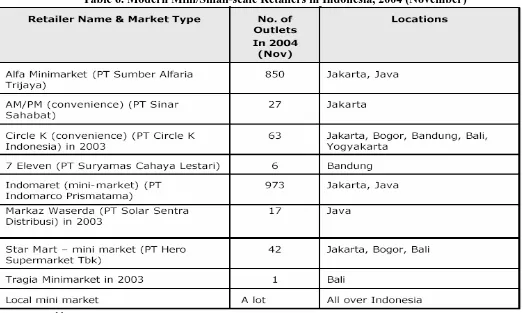

Data from AC Nielsen,11as shown in Table 2, the share of traditional retail outlet is still larger than that of modern one, but declining, while that of the modern one continued to increase annually during the period under review. This does not come as a surprise for two reasons. First, as presented in Table 3, Henri Ma’ruf’s12estimates that total revenue of traditional is much higher that that of modern retails. Second, according to AC Nielson,13modern retail in Indonesia has 5,079 outlets as compared to 1,745,589 traditional outlets.

Table 2: Market share of traditional and modern retail outlets in Indonesia (not end year position (%)

2000 2001 2002 2003

Hyper-/supermarket Minimarket Traditional market

16.7 3.4 79.8

20.5 4.6 74.9

20.2 4.9 74.9

21.1 5.1 73.8 Source: AC Nielsen

Data from Euromonitor in 2000 show that top five (5) retailers in Indonesia own about 4.7% of total national retail trade.14With the estimation in Table 3 that total retail trade in Indonesia in that year reached about Rp 182.2 trillion, these five big retailers have thus a total revenue of Rp 8.56 trillion. In that year, all hypermarkets and supermarkets as the big and modern retailers have market share of 16.7% or a total revenue of Rp 30.5 trillion. In 2003, these two big retailers occupied 21.1% market share in Indonesia or equivalent to Rp 56.1 trillion. Besides these two big retailers that enjoyed market share increases, minimarket also experienced an increase in its market share in the same year, from 3.4% in 2000 to 5.1% in 2003, or in rupiah value from Rp 6.2 trillion to Rp 13.6 trillion.

11

Bisnis Indonesia (“Arah Bisnis & Politik”), December 2003. 12

See footnote 5. 13

Bisnis Indonesia, 20-8-2004. 14

Table 3: Total revenues of traditional and modern retail outlets in Indonesia (Rp trillion)

2000 2001 2002 2003

Hyper-/supermarket 30.5 46.3 48.8 56.1

Minimarket 6.2 10.4 11.8 13.6

Traditional market 145.5 169.2 181.1 196.3

Total 182.2 226.0 241.8 266.0

Source: Henri Ma’ruf (2005).

As comparison, based on estimation of a research institute in Jakarta, by the end of 2001, total consumption expenditure in modern retail outlets was about Rp36.7 trillion. According to this institute, modern retail in the country will increase by around 23%-26% per year in 2005.15

Traditional retail, on the other hand, in the form of warung, shop and market, experienced a decline in its share during the same year from 79.8% to 73.8%, although in term of rupiah value, its revenue increased from Rp 145.5 trillion to Rp 196.3%.

In overall, Table 3 shows that during that period the total growth of revenues of hyper-/supermarket and minimarket is much higher than that of traditional market, i.e. 83.9% and 119.4%, respectively, versus 34.9%. Although, total annual revenue of traditional retail is still higher

16

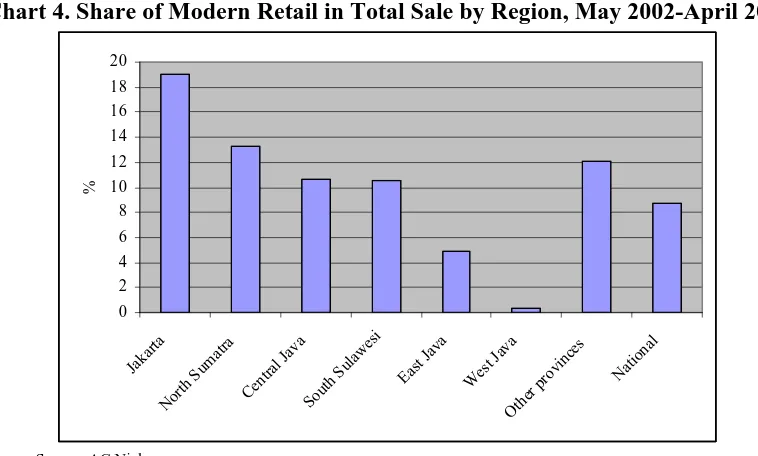

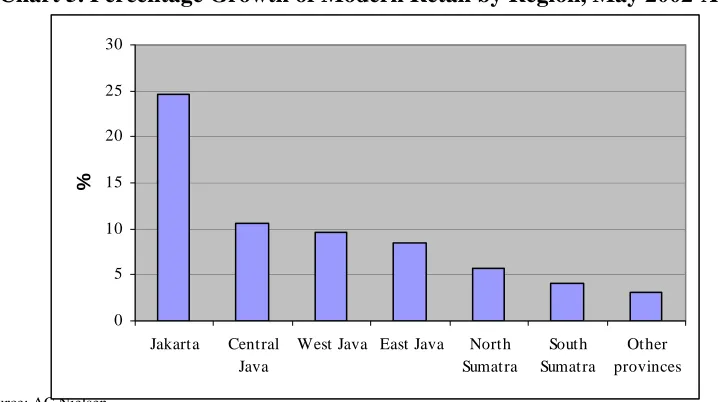

Further, and more interestingly, based on AC Nielsen data, the next two figures, Charts 4 and 5 indicate that Jakarta is the region where the modern retailers enjoyed the highest share in total national retail trade and in growth. This does not come as a surprise since the country’s wealth is concentrated in this capital. Moreover, modern retail’s consumers in Jakarta are not only the city’s residents but also from the city’s surrounding growing districts like Bogor, Tangerang, Bekasi and Depok.

Chart 4. Share of Modern Retail in Total Sale by Region, May 2002-April 2003

0 2 4 6 8 10 12 14 16 18 20 Jak arta Nort h Su

mat ra

Cent ral Ja

va

Sout h Su

law esi East Jav a West Java Othe r prov

inces Nat

ional

%

Source: AC Nielsen

According to Rangkuti (2004) (see footnote 10), about 1.7 million traditional markets exist in Indonesia, accounting for 73% of total distribution. Growth in the traditional sector is 5% per year, compared to 16% growth in the modern retail market. Although the traditional sector still dominates the retail food business, Indonesia’s retail industry continues to evolve away from the traditional market and modest kiosk network to modern hypermarkets and superstores. The number of modern retail outlets (supermarkets, warehouse clubs,

15

Bisnis Indonesia, 13-11-2001. 16

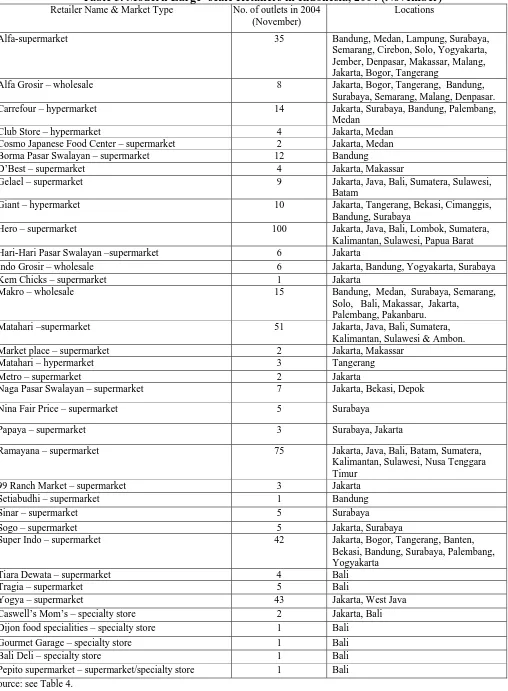

hypermarkets, wholesale, convenience stores, etc.) increased about 36%, 19.5%, 148.3%, and 64.7% from 1999-2003. This growth occurred at a time when many other segments of Indonesia’s broader economy were stagnating. Big retailers continue to expand and competition among the major retailers remains fierce (Table 4). Table 5 presents a list of modern retailers in Indonesia by number and location.

Chart 5. Percentage Growth of Modern Retail by Region, May 2002-April 2003

Source: AC Nielsen 0 5 10 15 20 25 30

Jakarta Central Java

West Java East Java North Sumatra

South Sumatra

Other provinces

%

Table 4. Number of retail outlets and sales 1999-2003

Table 5. Modern Large- scale Retailers in Indonesia, 2004 (November)

Retailer Name & Market Type No. of outlets in 2004

(November)

Locations

Alfa-supermarket 35 Bandung, Medan, Lampung, Surabaya,

Semarang, Cirebon, Solo, Yogyakarta, Jember, Denpasar, Makassar, Malang, Jakarta, Bogor, Tangerang

Alfa Grosir – wholesale 8 Jakarta, Bogor, Tangerang, Bandung,

Surabaya, Semarang, Malang, Denpasar.

Carrefour – hypermarket 14 Jakarta, Surabaya, Bandung, Palembang,

Medan

Club Store – hypermarket 4 Jakarta, Medan

Cosmo Japanese Food Center – supermarket 2 Jakarta, Medan

Borma Pasar Swalayan – supermarket 12 Bandung

D’Best – supermarket 4 Jakarta, Makassar

Gelael – supermarket 9 Jakarta, Java, Bali, Sumatera, Sulawesi,

Batam

Giant – hypermarket 10 Jakarta, Tangerang, Bekasi, Cimanggis,

Bandung, Surabaya

Hero – supermarket 100 Jakarta, Java, Bali, Lombok, Sumatera,

Kalimantan, Sulawesi, Papua Barat

Hari-Hari Pasar Swalayan –supermarket 6 Jakarta

Indo Grosir – wholesale 6 Jakarta, Bandung, Yogyakarta, Surabaya

Kem Chicks – supermarket 1 Jakarta

Makro – wholesale 15 Bandung, Medan, Surabaya, Semarang,

Solo, Bali, Makassar, Jakarta, Palembang, Pakanbaru.

Matahari –supermarket 51 Jakarta, Java, Bali, Sumatera,

Kalimantan, Sulawesi & Ambon.

Market place – supermarket 2 Jakarta, Makassar

Matahari – hypermarket 3 Tangerang

Metro – supermarket 2 Jakarta

Naga Pasar Swalayan – supermarket 7 Jakarta, Bekasi, Depok

Nina Fair Price – supermarket 5 Surabaya

Papaya – supermarket 3 Surabaya, Jakarta

Ramayana – supermarket 75 Jakarta, Java, Bali, Batam, Sumatera,

Kalimantan, Sulawesi, Nusa Tenggara Timur

99 Ranch Market – supermarket 3 Jakarta

Setiabudhi – supermarket 1 Bandung

Sinar – supermarket 5 Surabaya

Sogo – supermarket 5 Jakarta, Surabaya

Super Indo – supermarket 42 Jakarta, Bogor, Tangerang, Banten,

Bekasi, Bandung, Surabaya, Palembang, Yogyakarta

Tiara Dewata – supermarket 4 Bali

Tragia – supermarket 5 Bali

Yogya – supermarket 43 Jakarta, West Java

Caswell’s Mom’s – specialty store 2 Jakarta, Bali

Dijon food specialities – specialty store 1 Bali

Gourmet Garage – specialty store 1 Bali

Bali Deli – specialty store 1 Bali

Pepito supermarket – supermarket/specialty store 1 Bali

Source: see Table 4.

facilities. Central purchasing takes place from importers or distributors and items are delivered to a central warehouse or directly to stores.

Table 6. Modern Mini/Small-scale Retailers in Indonesia, 2004 (November)

Source: see Table 4.

The presence of the modern retailers, however, often violate Law No. 2/2002 issued by the Jakarta administration on private markets in the city, which regulates pricing policies, a minimum distance from traditional markets and cooperation with informal businesses. According to APRINDO, just as they have done in the developed world, large-scale modern retailers such as hypermarkets, which are taking over the top end of the retail trade, with larger discounts and promises of a one-stop shopping experience to mushroom in major cities, are causing severe dislocations in the rest of Indonesia's food chain, from smaller supermarkets down to wet markets to the warungs where housewives sell cigarettes and candy out of their living room windows. Certainly, the hypermarkets are growing fast. They have become Asia's new hobbyhorse, self-service retail outlets so big that with as much as 50,000 square feet under a single roof they look like warehouses on the outside. On the inside, they sell everything from steaks to sandals, televisions to toothpicks, garden tools to sports equipment. It is estimated that hypermarkets will control close to 38.5 percent of the retail market space in the country by 2005 while supermarkets and department stores are expected to contract to 29.6% from 32.9%, Mini-markets are expected to expand to 4.7% from 4.2% as consumers use them as pantries for day-to-day incidental shopping.

country's largest food and beverage retailer, intends to acquire Tops super market chain, with 22 outlets, for Rp111 billion (US$13.5 million) making it one of largest midsized chains, with 111 outlets throughout Indonesia.

The small and medium businesses, especially the traditional ones that have been dwarfed by hypermarkets and midsized chains like Hero and Alfa are worried about the growing competition they face. In responding to this development, APRINDO has been pressing the government to impose a zoning law to regulate the number of both foreign and domestic retailers running similar businesses in the same area, so to prevent overcrowding an already saturated marketplace. The association complains not only about major groups but also others such as Indomaret and Super Indo. Indomaret has 650 outlets around the country and Super Indo has almost 60 outlets in Jakarta and other cities such as Bandung, Yogyakarta, Surabaya and Palembang. Also, the National Committee for Healthy Competition (KPPU) has prevented the Indomart chain from establishing new outlets near smaller independent retail players called 'warungs.'

While the zoning laws are yet to be implemented, there has already been a fair amount criticism as to how the government would implement a fair zoning system similar to Europe's, which has a business zone system that was imposed several years ago after small traders and mom-and-pop shops complained about unfair practices of giant hypermarkets in their location. It becomes even more complicated when Indonesia is supposed to follow in the tracks of the ASEAN Free Trade Agreement (AFTA) that is supposed to open up the local protected retail markets to foreign competition. Finding that balance between foreign investments and local interests is a difficult proposition for the government.

Prospect for the future

Growth of large retailers such as supermarkets and hypermarkets, in Indonesia is expected to continue. The number of mini-markets and other small stores is also predicted to grow. The greatest expansion is anticipated on the islands of Java and Bali. More mini-markets are expected to open in residential areas and cities outside of Jakarta. This growth of modern retailers is being driven mostly by strong domestic consumption, which remains one of the only engines of overall economic growth in Indonesia up to know. In Indonesia, as elsewhere, the growth of modern retail such as hypermarkets and supermarkets can be related to increased demand for the services they can provide, resulting from17:

- rapid urbanization;

- per capita income growth and the growth of a “middle class”;

- increasing employment of women, with a consequent increase in the opportunity cost of their time. Families are said to be “cash rich, time poor” and this has led to a demand for meals that are easier to prepare and for retail outlets that offer a wider range of prepared products. This trend has been enhanced by the development of new products that meet the needs of this new market;

- “westernization” of lifestyles, particularly among younger people; - demographic trends, with an increasing proportion of young people;

17

- growing use of credit cards, which in developing countries are rarely accepted by corner shops or traditional wet markets;

- changes in family structure with (especially in Asia) a growing proportion of nuclear families and, even, one-person households, as opposed to extended families;

- reduction of effective food prices for consumers because of supermarkets’ greater ability to control costs through economies of scale, improved logistics, etc. This may not, however, always apply to fresh produce;

- growing access to refrigerators, allowing larger quantities of food to be stored, and to cars, allowing shopping to be done away from the immediate vicinity of the home and for larger quantities to be purchased at any one time;

- increased travel, exposing people in other regions to modern retailing techniques in the USA and parts of Europe, to a wider range of products and, particularly for fresh fruits and vegetables, to the possibility of being able to consume many products “out of season”.

However, in Indonesia as in other Asian countries most households continue to use traditional retailers for fruits and vegetables even though they may use supermarkets for other products. There remains the perception, and possibly the reality, that wet market supplies are fresher and often cheaper. Unless a consumer happens to live close to a supermarket, traditional markets are also more convenient for consumers accustomed to walking to make daily purchases of fruits and vegetables. Thus, the traditional retail sector in Indonesia will continue to dominate Indonesian food retailing.

Modern retail such as hypermarkets and supermarkets often lack a sufficient range of horticultural produce to encourage consumers to switch from wet markets, particularly outside of the major cities. Nevertheless, they continue to make inroads because of their competitive prices, more reliable, if not better, quality and the fact that they offer “one-stop” shopping.

In this new millennium, some trends have been emerged and some new trends will soon emerge that all will certainly affect the retail sector in Indonesia. They include:

- wave of entrance of foreign retailers, especially in large sized and very modern outlets; - evolution in new forms of retail, e.g. e-retailing;

- more families with double income as both husband and wife work; - growth of satellite cities surrounding big cities;

- increasing mobility and declining leisure time; - house-keeper becomes more expensive;

- growth in the use of household PC and more use of internet;

Appendix

Hero18

Indonesia's largest supermarket chain PT Hero Supermarket plans to open three hypermarkets on the outskirts of Jakarta this year to stem a steady drop in the chain's market share against very strong competition from foreign retailers. Founded in 1971, PT HERO SUPERMARKET, a publicly listed company on the Jakarta Stock Exchange, continues its unprecedented expansion and growth as Indonesia's pre-eminent food retailer. HERO supermarkets have consistently out-performed the rapidly expanding Indonesian market,and the company has remained the industry leader since the early-1980's,with a current domestic share of over 40%.

Hero already covers Jakarta and other major centers of population in the regions with its 90 supermarkets, 25 convenience stores, and 38 pharmacies. The supermarkets bring in some 90% of sales revenue from a wide range of fresh food, groceries, and electronic goods. In the first nine months of 2002 sales rose 19% to Rp667 trillion (about US$74.8 billion) but soaring costs, particularly after a 15% hike in electricity prices, have taken their toll.

Carrefour19

France's Carrefour, the world's second-largest retailer, is active in eight countries in Asia, including China, where it is ranked as the leading foreign distributor. The favoured store format is the hypermarket. Total Carrefour outlets in Asia was 112 and increased to 127 in 2002 (see table below). In 2003 Carrefour opened its first discount stores under the Dia fascia in China followed by supermarkets in 2004.

Carrefour took the plunge and entered Indonesia at the height of the 1997/98 economic crisis. Carrefour opened its first two outlets when, in June 1998, the Indonesian government eliminated many restrictions on foreign retail operations. It was closely followed by another giant French player, Continent, with three outlets. When the French parent companies merged in a $16.5 billion deal under the name Carrefour, Continent stores disappeared, leaving five Carrefour outlets. After the merger, the number of Carrefour's outlets in Jakarta has now increased to seven, with approximately 3,500 employees, or about 400-450 employees per outlet.

Number of Carrefour Hypermarket Outlets in Asian Countries, 2001-2002

Period Country 2001 2002 Taiwan China Japan Korea Thailand Malaysia Indonesia Singapore Hong Kong Asia Total 26 27 3 22 15 6 8 1 4 112 28 32 4 25 17 6 10 1 4 127 Source: Carrefour. 18 APRINDO. 19

Makro

Makro Asia arrived on the scene in Indonesia in 1991 under a management-cooperation agreement with SHV Holdings in the Netherlands. The first outlet opened in Jakarta in September 1992 and in the next four years nine stores were opened. During the 1998 riots Makro lost one store but that has been reopened and they have since have opened three more stores: in Semarang, Surabaya and Medan. The company opened its first outlet 30 years ago in 1972 and went public once they owned 24 supermarkets. Hero used the money to pay back bank loans and launch an aggressive campaign of expansion but only with supermarkets. Last year Hero opened its first ever hypermarkets - one outside Surabaya, Indonesia's second-largest city, and another outside Jakarta.

Makro is also expanding, with about two or three new outlets a year. Its president director, Simon Collins, said that from the very beginning, the aim has been to join forces and grow together with Indonesia's small-to-medium-scale businesses.

Makro has many domestic small and medium-sized businesses as its suppliers though Hero has for long been using this style of win-win alliance to cut down on distribution and networking costs, particularly with fresh produce.

Tesco