Virutex-Ilko S.A.

Jon E. Martı´nez

UNIVERSIDAD ADOLFOIBAN˜ EZRodrigo K. Ba´ez

UNIVERSIDAD ADOLFOIBAN˜ EZFernando P. Salinas

UNIVERSIDAD ADOLFOIBAN˜ EZThis case presents the inspiring success story of a family company that organization, the granting of manufacturing licenses, or investment in manufacturing facilities, either alone or with local partners. Export to was founded by a European immigrant in Chile in the 1930s to produce

steel wool. The company has captured a dominant share of the domestic countries within the Latin America region is a strategy that is being adopted by many Latin American enterprises. The Virutex-Ilko case market for household cleaning products plus a broad line of products for

the kitchen including baking molds, kitchen tools, and nonelectric food illustrates many of the reasons for this trend. There is, of course, the problem of declining profit margins in developed country markets. But, processors, such as strainers and graters. As with many Latin American

family firms, Virutex-Ilko confronted a succession crisis with the passing there is also the opportunity for access to economies that have overcome periods of crisis and stagnation, and that are opening to global competition. of its founder. But under the firm leadership of the founder’s eldest son,

supported by a strengthened board of directors, the company not only It is precisely the Latin American enterprises that are poised to take advantage of these opportunities because of geographic proximity, linguistic maintained its market position in Chile but also began exporting

bakingw-are to the United States and eventually to the more demanding markets and cultural affinity, and in-depth knowledge of business practices. The Virutex-Ilko case provides an opportunity to design an entry strategy into of Europe. The 1980s were not a “lost decade” for Virutex-Ilko. The case

documents the steps taken by new management to serve its customers in these new markets. In which countries do the greatest opportunities lie? With what kinds of products and in what market niches does the company the developed countries of North America and Europe with tailor-made

products under private brand labels, providing high levels of service and have a competitive advantage? Through what sorts of channels and manu-facturing arrangements can it best realize this advantage? J BUSN RES quality at low prices. By 1991. nearly two-thirds of the company’s Ilko

2000. 50.83–95. 2000 Elsevier Science Inc. All rights reserved. line of kitchen products were being exported to these northern markets.

In that same year, profitability began to erode as the Chilean inflation rate outstripped devaluation of the peso against the dollar. As is repeatedly seen in cases of Latin American business enterprise, a political decision

E

arly in March 1992, Toma´s Mu¨nzer, President ofViru-to overvalue the currency had disastrous effects upon the export business.

tex-Ilko S.A., was pondering the firm’s international

As the case opens in 1992, Tomas Munzer, eldest son of the company’s

expansion strategy. The company, family owned, was

founder, faced the decision of whether to change the strategy in developed

the absolute leader in the Chilean market of home cleaning

country markets from that of cost leadership to one of product

differentia-products, cookware and nonelectric food-processing devices,

tion through distinctive design and brand recognition or to concentrate

with almost US$11 million of annual sales and a labor force

on new export markets in the developing countries of Latin America. To

of 340 employees.

explore the latter option, he hired Christian Salamovich to conduct a

The firm had begun its internationalization process in

study of six countries in South America. The case contains rich data on

1982. After some stumbling, it succeeded in introducing its

the markets, distribution channels, and competition for the Ilko product

products in the markets of developed countries. After almost

line in Argentina, Bolivia, Mexico, Paraguay, Peru, and Uruguay. Not

10 years of international operations, exports of bakeware and

only did Mr. Munzer have to decide which countries were more attractive,

kitchen tools to the United States and Europe accounted for

he also had to decide how to penetrate the markets of those that he

almost 14% of the company’s total sales. However, the

profit-selected. The case presents a broad array of options including export to

ability of these operations had been perceptibly affected by

distributors or commission agents, establishment of an independent sales

the sharp decline in the real exchange rate of Chile’s currency. A new market seemed to offer interesting opportunities to

Address correspondence to J. E. Martinez, Universidad Adolfo Ibanez, Av.

Presidente Erazuriz 3485, Las Condea, Santiago, Chile. Virutex-Ilko. The Latin American market, after several years

Journal of Business Research 50, 83–95 (2000)

2000 Elsevier Science Inc. All rights reserved. ISSN 0148-2963/00/$–see front matter

of economic crisis and protectionism, was now exhibiting In 1980, Mr. Mu¨nzer died, leaving as heirs his wife Ilse and his two young sons. Toma´s and Roberto, the children, increasing dynamism. The firm’s board of directors and

man-agement would have to decide whether they would continue 22 and 18 years old, respectively, were both students. The family considered three options: to sell the business, to put focusing their efforts on the penetration of developed

coun-tries, or if they should address the Latin American market as one of the sons in charge despite of lack of experience, or to hire an external manager. They chose the latter, hiring a gen-well. If they chose this second alternative, they would have

to decide on the markets to penetrate, the entry strategy to use eral manager for operational and financial-administrative man-agement, while also constituting a board of directors that and whether they should apply the same marketing program

everywhere or adapt to each country situation. included the three family members and two family friends, one of whom had broad experience in international trading.

History of the Company

Virutex-Ilko in 1992

The firm’s history dates back to 1937, when Herbert Mu¨nzer,

a Jewish immigrant who in Germany had been a housewares The decisions adopted by the Board of Directors enabled the firm to continue its progress despite the serious recession of dealer, decided to take up residence in Chile. Early in the

1940s, he created a small business to import the same kind 1982 to 1985. Over a five-year period, Toma´s Mu¨nzer held several jobs in the company’s commercial and procurement of products. The main product, steel wool, was imported from

the United States, but due to the Second World War the areas. He took up the presidency in September 1984. A short time later another professional manager, Ciro Sa´nchez, joined firm had to start manufacturing in Chile. The firm ordered

machines required for the manufacturing of steel wool, looms the firm as financial manager, and in 1989 he assumed the vice-presidency.

for metal netting manufacturing, and weaving machines to

produce steel wool pads. The Virutex brand name was used The explosive growth of the firm in years 1986 and 1987 generated a second dilemma: how to face the challenge of for all the products they manufactured.

The firm began to develop and grow, with new products growth while simultaneously improving on production and quality. Continued growth was hindered by a patriarchal man-constantly being added to the Virutex line. In 1953, the firm

entered the new business of manufacturing kitchen tools with agement style. In 1988, with the help of outside advisors, the firm began a process of cultural change and organizational matrices brought from Germany. Later, the acquired

knowl-edge made it possible to begin domestic construction of matri- development. These changes consisted of improved communi-cations in all areas increased participation to all employees ces and to launch a variety of products, such as coffee filters, fly

swatters, dish covers, tin-plated strainers, spoons, eggbeaters, and the encouragement toward creativity, commitment, au-tonomy, and teamwork. Internal ceremonies and rites were pastry wheels, skimming spoons, potato presses, and grape

squashers. These items, originally manufactured under the established during this process, and the company’s “credo” was developed. (see Figure 1).

brand “Ideal”, inaugurated the current Ilko line. All the firm’s

products were sold to large wholesale dealers, mainly Gilde- In 1992, the Virutex line held 55% of the household clean-ing products market. Its main rivals were Manlac, Metaltex, meister and Duncan Fox, who purchased the factory’s entire

output and placed it in the retail market. Calegri, 3M, and Fibro Chile. Each of these competitors manu-factured only some of the products in the lines manumanu-factured Herbert Mu¨nzer regularly traveled to Europe and the

United States, bringing back new product and process ideas, and sold by Virutex.

In the kitchen tools, bakeware and nonelectric food-pro-which he later adapted and developed for the Chilean market.

In that way, the firm introduced new kitchen cleaning prod- cessing devices market, the Ilko line, with 150 products, held almost 60% of the Chilean market. Its rivals were imported ucts, such as Mago Pads, with and without soap and, later,

the Bonobril line, consisting of plastic foam adhered to an products and small local manufacturers. In 1991, Ilko’s sales in Chile represented 22% of the firm’s total sales. Almost all abrasive material.

After a six-year feasibility study, in 1970, Mr. Herbert of the firm’s exports, amounting in 1991 to 14% of the overall income, were Ilko products (Income statements for 1985– Mu¨nzer decided to import presses, equipment, and matrices

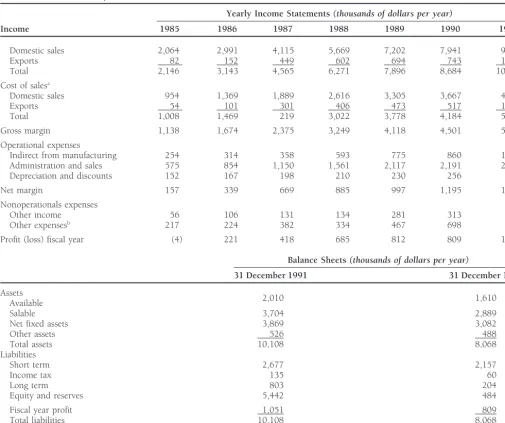

to manufacture the current Ilko products. Thus began the 1991 and balance sheets for the periods ending December 31, 1990 and 1991 are presented in Table 1).

manufacturing of bakeware, roasting pans, serving dishes,

kitchen graters, toasters, corkscrews, can openers, knife sharp- Virutex-Ilko executives ascribed success in the Chilean market to the firm’s strong concern for the quality of its eners, pliers, and other devices. The Ilko line was oriented

mainly at leading quality products, and great concern was products and to a clear focus on the end consumer and on distribution channels. One of the firm’s main assets was its shown for design and external appearance. This strategy

re-sulted in the company’s products gaining the image of im- knowledge and experience in merchandising. In 1981, due to the failure of one of its major dealers, the firm decided to ported articles at a time when Chilean consumers were

individu-85

Virutex-Ilko S.A. J Busn Res

2000:50:83–95

sons, the options of developing new businesses in Chile and expanding current businesses to foreign markets had been taken under consideration. After the founder died, his son Toma´s, supported by Pablo Wald, one of the firm’s directors, took the first steps in that direction. These actions occurred before Toma´s had assumed the presidency.

In those years, the country was suddenly flooded with imported products similar to those manufactured and sold by Virutex. Between 1981 and 1985, Ilko halted a part of its own production and imported some products. In the process the firm acquired detailed knowledge about the products sold in developed markets, identified the major suppliers and their weaknesses, and searched for opportunities in international markets, obtaining access to a valuable network of contacts. In 1982, the first attempts to export Ilko products were made. The reasons behind this first international expansion were: to take advantage of unused capacity; to diversify mar-kets; to avoid devaluation loss; and to soften the impact of the domestic market decline in the years after 1981. Further-more, the larger product volume would allow the firm to achieve some economies of scale. The challenge of being a manufactured products exporter and the status that this im-plied in a country that traditionally exported only basic raw materials (copper, cellulose, fish meal, etc.) strengthened top

Figure 1. Virutex-Ilko’s credo (by Toma´s Mu¨nzer).

management’s resolve to sell abroad.

However, persuading the rest of the management team of the feasibility of the mission abroad was not easy. Virutex-als in the sales area looked after the distribution to large Ilko products were, on the whole, difficult to sell in external customers and the exhibition of products at points of sale. A markets because shipping costs reduced their competitiveness. marketing unit was created in 1983, and in turn new advertis- To reduce the impact of shipping costs, innovative packing ing operations were designed, more importance was assigned techniques were used. For example, springforms were packed to packaging, labeling and product exhibiting, and the first one inside the other. Such innovations enabled Virutex prod-“merchandisers” were hired. Little by little, a professional ucts to compete even in the distant Mexican market. sales staff was developed at the national level. In 1991, the However, the first attempts were clumsy; a desire to sell structuring of the marketing management area was completed abroad was all that the firm had. Virutex management made with the addition of two new executive positions and a staff contacts with potential customers through ProChile, a govern-of product managers and sales representatives (an organization ment export promotion agency, but these contacts did not chart is shown in Figure 2). produce sales. Company managers attended specialized shows In 1992, the firm marketed its Virutex and Ilko products without a product catalog or price lists. They knew nothing through the following distribution channels: supermarket about cubical contents or shipping requirements. “In brief, chains, 62%; distributors and wholesalers, 30%; department there was a total ignorance of all that was required for ex-stores, 3%; other channels, 5%. porting,” recalled Toma´s Mu¨nzer. “Everything failed. We had Early in 1992, the firm entered the business of plastic neither a plan nor clear targets to achieve. But there was one brushes and brooms as a complement to the household clean- virtue: perseverance.”

ing products group of the Virutex line. These products, im- Virutex managers learned from these mistakes. They at-ported from Brazil under the brand name “Clap”, were mar- tended courses, prepared special catalogs, and produced sam-keted through the same channels used by Virutex products. ples that were seen everywhere. They traveled constantly to houseware shows abroad, particularly in the United States, acquiring firsthand information on what was happening in

The Internationalization Process

the industry. They located importers that marketed productssimilar to those manufactured by the firm and who might be In 1982, possibilities for sustained growth for Virutex had

interested in beginning a long-term commercial relationship. been limited by the small size of the Chilean market, the

Through these efforts, they began to generate a network large share that the firm had already achieved, and the low

Table 1. 1985–1991 Yearly Income Statements and 1990 and 1991 Balance Sheets

Yearly Income Statements(thousands of dollars per year)

Income 1985 1986 1987 1988 1989 1990 1991

Domestic sales 2,064 2,991 4,115 5,669 7,202 7,941 9,375

Exports 82 152 449 602 694 743 1,500

Total 2,146 3,143 4,565 6,271 7,896 8,684 10,875

Cost of salesa

Domestic sales 954 1,369 1,889 2,616 3,305 3,667 4,380

Exports 54 101 301 406 473 517 1,065

Total 1,008 1,469 219 3,022 3,778 4,184 5,445

Gross margin 1,138 1,674 2,375 3,249 4,118 4,501 5,430

Operational expenses

Indirect from manufacturing 254 314 358 593 775 860 1,073

Administration and sales 575 854 1,150 1,561 2,117 2,191 2,640

Depreciation and discounts 152 167 198 210 230 256 308

Net margin 157 339 669 885 997 1,195 1,410

Nonoperationals expenses

Other income 56 106 131 134 281 313 390

Other expensesb 217 224 382 334 467 698 749

Profit (loss) fiscal year (4) 221 418 685 812 809 1,051

Balance Sheets(thousands of dollars per year)

31 December 1991 31 December 1990

Assets

2,010 1,610

Available

Salable 3,704 2,889

Net fixed assets 3,869 3,082

Other assets 526 488

Total assets 10,108 8,068

Liabilities

Short term 2,677 2,157

Income tax 135 60

Long term 803 204

Equity and reserves 5,442 484

Fiscal year profit 1,051 809

Total liabilities 10,108 8,068

Source: Virutex-Ilko management.

aDirect labor cost accounts for 16%. bIncome tax included in other expenses.

In 1984, they placed their first exports in American and Cana- bakeware was also done with nonelectrical food-processing devices. Whereas the competitors’ strategy was rigid and dian markets, with customers whose basic concern was price.

As the firm gained experience, it began to offer products at unadaptable, ours was the opposite and this helped make it possible for Virutex-Ilko to enter these markets. higher prices that were tailored to customer specifications.

Toma´s Mu¨nzer commented:

Later, the firm looked for potential European importers at the trade shows and thus generated the first orders. Manage-We did everything in successive approaches. In bakeware,

we were competitive both in price and quality; besides, we ment thought that it would be easy, but they made several mistakes. In the first place, they did not analyze the European were flexible, with a great capacity to adapt to customers’

requirements in product design, appearance, packaging, market, nor did they inquire into the consumer needs and characteristics to ascertain if they were different than those quantity, etc. We appealed to the customer’s pride by using

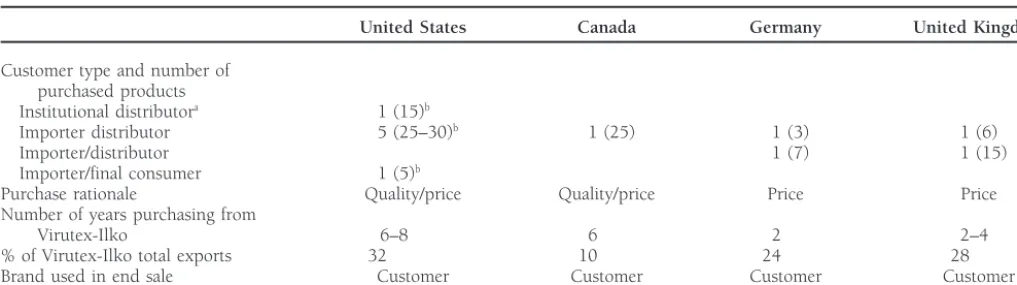

Table 2. Virutex-Ilko Customers in External Market

United States Canada Germany United Kingdom

Customer type and number of purchased products

Institutional distributora 1 (15)b

Importer distributor 5 (25–30)b 1 (25) 1 (3) 1 (6)

Importer/distributor 1 (7) 1 (15)

Importer/final consumer 1 (5)b

Purchase rationale Quality/price Quality/price Price Price

Number of years purchasing from

Virutex-Ilko 6–8 6 2 2–4

% of Virutex-Ilko total exports 32 10 24 28

Brand used in end sale Customer Customer Customer Customer

Source: Virutex-Ilko marketing management estimates.

aSales to hotel chains and others.

bIn parentheses, the number of different products sold to each customer.

for kitchen products, their greater knowledge about their use. 80% of that market. The leader was Kaiser, a company that manufactured the whole variety of springforms. Other major Neither was any consideration given to the importance that

design had for this consumer, nor of the sales seasonality of competitors were Zenker, a manufacturer that also sold metal strainers, and Doctor Oetcker. With combined annual sales certain products.

Nevertheless, there were many good ideas as well. There of US$200 million, the German manufacturers had little flexi-bility in their policies regarding international markets. They were periodic visits to customers, through which excellent

communication and empathy as well as first-rate service was were strong in Europe but weaker in North America (informa-tion on competitors in the bakeware industry in developed established. For instance, the firm offered toll-free telephone

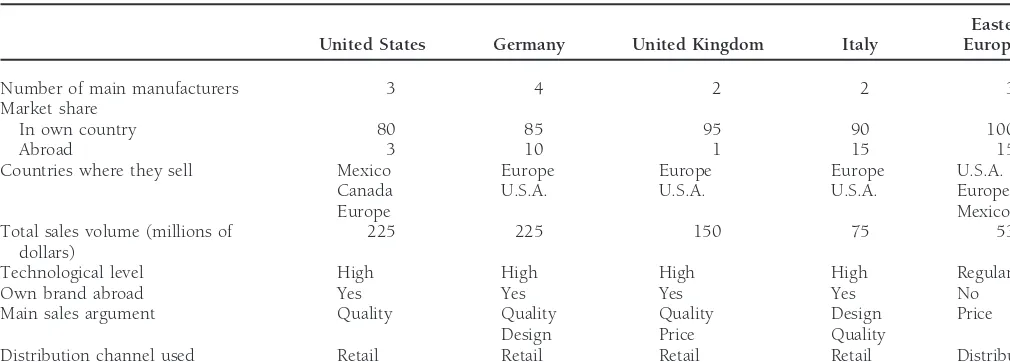

service for all U.S. customers, so that they could request any countries is shown in Table 3).

Two large English manufacturers had a share of almost kind of information without cost. Every difficulty was solved,

every suggestion was welcomed. Promises were fulfilled. 95% in their home market, with an annual billing of some US$150 millions. In the European market, though in a lesser proportion, some German, Dutch, Austrian, English, and

The Market in Developed Countries

Swiss importers competed alongside French and U.S.manu-facturers. There were almost no products from the Far East Virutex-Ilko had succeeded at competing in the bakeware

to be found in Europe. market in countries with long cooking traditions and had

In the North American market, products and designs were gained twelfth place in the world bakeware market in terms

different, resembling those in the Anglo-Saxon world. There of volume. The customary way of life in Germany and Austria

were three major U.S. manufacturers that collectively had a was centered in the kitchen, where ovens were kept burning

market share of about 80% and total sales of more than during the cold winters. In traditional celebrations, such as

US$200 million. These producers (Ekco, G. & S. and Chicago Christmas Day and Holy Week, most families baked cookies,

Metallic) had begun to lose market share as a result of signifi-sweets, and cakes that were typical of those festivities.

cant volumes of some items being imported from low-cost, Virutex-Ilko customers were importer-distributors who

manufacturing-oriented competitors in Taiwan, Hong-Kong, sold to small, specialized gourmet shops; distributors who

and Korea that competed on the basis of price. sold to supermarkets; importer-dealers who served customers

In addition to bakeware, company management believed in the institutional-professional market;

manufacturer-distrib-that there were great future prospects in nonelectrical food utors who sold complementary products to those produced in

processors, such as strainers, potato presses, vegetable sieves, house; and customers who sold directly to the final consumer

graters, etc., where Virutex-Ilko ranked sixth in the world (information on the firm’s customers in developed countries

market. The undisputed leader in this market was an Italian is contained in Table 2).

manufacturer, Metaltex, which had subsidiaries in Belgium, Internationally, there were some 80 or 90 significant

manu-Switzerland, and Germany, and a major distributor network factures of bakeware, kitchen tools, and nonelectrical food

in the United States. Its leadership was based not only in processing devices. Most of them had headquarters and

oper-product design and variety but also on costs, both in the mass ated in developed countries. Every year, they could be found

and upscale market. Its annual sales were US$75 million, and at the major houseware trade shows.

it had captured 87% of the European market, 9% in the United In Europe, the strongest bakeware industry was in

89

Virutex-Ilko S.A. J Busn Res

2000:50:83–95

Table 3. Bakingware Market Competitors

Eastern

United States Germany United Kingdom Italy European

Number of main manufacturers 3 4 2 2 3

Market share

In own country 80 85 95 90 100

Abroad 3 10 1 15 15

Countries where they sell Mexico Europe Europe Europe U.S.A.

Canada U.S.A. U.S.A. U.S.A. Europe

Europe Mexico

Total sales volume (millions of 225 225 150 75 53

dollars)

Technological level High High High High Regular

Own brand abroad Yes Yes Yes Yes No

Main sales argument Quality Quality Quality Design Price

Design Price Quality

Distribution channel used Retail Retail Retail Retail Distributor

Source: Virutex-Ilko management estimate.

Other competitors were from Eastern European countries such mature markets would require a substantial investment of as Czechoslovakia, Poland, and former East Germany. China financial resources. The firm had been imitating the design also was showing an increased presence in this industry. of products in developed markets, to later adapt them for use With respect to technology, the leaders in these industries in Chile, and exports consisted of products made to customer were the Germans in bakeware and the Italians in nonelectrical specifications. To obtain better margins in developed markets food processors, both superior to the level of technology in required therefore, the investment of resources, energy and Virutex-Ilko. Since 1989, the firm consistently integrated pro- creativity in the design variable. It was not an easy job, because cess improvements and invested in new equipment. Neverthe- Chile did not have an industrial design tradition.

less, it still had a relatively low level of automation. From the outset of internationalization, Virutex manage-ment had considered the alternative of establishing an alliance with a European or North American company. This had not

The Strategic Dilemma

been pursued because of differences in business vision with By mid-1991, after several years of successfully exporting to potential partners, but the idea had not been discarded. In markets in developed countries, profitability began to decrease the words of Toma´s Mu¨nzer:

with the increasing overvaluation of the Chilean peso. Export

Today’s efforts are directed to moving from a price market margins, which traditionally had been half the margins

en-to a design market and en-to bring off associations with manu-joyed in the domestic market, had fallen to 25%, and the firm

facturers or dealers interested in having a supplier who had been working at full capacity for the last three years.

Furthermore it was necessary to add investments in technology is reliable not only for its product quality but also for and the training of human resources to continue competing performance and service. The challenge is to be creative, in international markets. The President commented: to develop new products, and to offer a more attractive and more varied range of products. To do this we must Ten years ago, exporting was a challenge. We wanted to

improve the speed of innovation at competitive costs. demonstrate that we could penetrate the northern markets

and stay there. Whereas today, we want to improve our Regarding the second option, it appeared that there was a profitability, which has been affected by the exchange rate. great difference between the markets of developed and devel-We think that there are basically two options to achieve oping countries. In America, the level of competition posed that improvement. One is to support our products with a by Mexico to its Northern neighbors seemed to be very differ-brand of our own, because until now we have exported ent than from Mexico to the South. Latin America appeared to only with private labels, and to innovate in design. The present interesting opportunities for Virutex-Ilko, particularly second option is to penetrate markets with higher margins, considering the increasing openness of several major econo-fewer competitors and greater opportunities for applying mies in the region and the improvement of their macroeco-what we have learned in Chile and in the Northern markets.

nomic position after what had been called the “lost decade”. In recent years, the firm had made a few occasional sales in With relation to the first strategic option, Virutex-Ilko’s

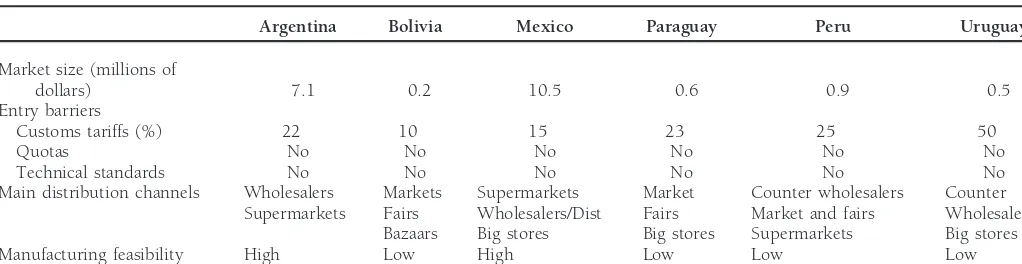

Table 4. Latin American Market

Argentina Bolivia Mexico Paraguay Peru Uruguay

Market size (millions of

dollars) 7.1 0.2 10.5 0.6 0.9 0.5

Entry barriers

Customs tariffs (%) 22 10 15 23 25 50

Quotas No No No No No No

Technical standards No No No No No No

Main distribution channels Wholesalers Markets Supermarkets Market Counter wholesalers Counter

Supermarkets Fairs Wholesalers/Dist Fairs Market and fairs Wholesalers

Bazaars Big stores Big stores Supermarkets Big stores

Manufacturing feasibility High Low High Low Low Low

Source: Virutex-Ilko marketing management estimates.

In mid-1991, the firm created a unit to study the Latin Because of the Argentine preference for salty meals such as pizza and other doughs, molds were as important or more American market and to analyze export or investment

possibil-ities in the region. Christian Salamovich, a multinational exec- than the springforms for pastry (cakes, pies, etc.), that pre-vailed in Chile. Some salty meals required mold shapes that utive with extensive marketing experience in Latin America,

was hired to take charge of that unit. He was to report directly were different than those used in sweet doughs. Besides, Ar-gentines used higher and larger springforms than Chileans. to Juan Eduardo Rodrı´guez, the marketing manager (refer to

organization chart in Figure 2), who had fostered the idea of The same was true with other kitchen tools, such as ladles and palette knives.

penetrating this region.

In the second semester of 1991, Mr. Salamovich began his There were three local springform brands of poor quality analysis of Latin American countries. As a first step, it was whose prices were one-third less than those of Ilko products. decided that only the markets of Argentina, Bolivia, Paraguay, Imported baking molds were few, brought mainly from the Peru, and Uruguay would be studied. He visited each of United States and, in lesser quantities from Germany and these countries, where he examined distribution channels and Brazil. In general, the prices for these imports were higher competitors, and met with suppliers and potential importers than Ilko’s, and the products were poorly distributed. In and distributors. Mexico also was included in this study, but kitchen tools, such as ladles and palette knives, there were the information was provided by Fernando Bihan, the exports two Argentine brands in stainless steel, a more durable mate-manager, for developed countries, since with the creation of rial than the superchromium plated rolled steel that Ilko man-a North Americman-an Free Trman-ade Agreement, this country fell ufactured for the Chilean market. They were strong brands under his jurisdiction. A summary of data on these six coun- and had suitable distribution. Besides these, there were many tries may be found in Tables 4 and 5. stainless steel imports from the Far East, Brazil, and other

countries, but all of them were of very poor quality. In nonelectric food-processing products, such as strainers

The Latin American Market

and potato presses, there were few reliable local producers.Their quality was poor, and they had a reduced variety of

Argentina

products in contrast with the wide range of the Ilko product Virutex-lko’s marketing management believed that the size of

line. However, it was possible to find inexpensive imported the Argentine market for Ilko’s product line was a little over

products from the Far East as well as imported products of US$7 million. Tariffs for these imported products were 22%,

convenient design and price from the United States and Brazil. and there were neither quotas nor technical standards.

Approximately 70% of the retail sales of these products

Bolivia

were made through some 3,000 bazaars throughout the

coun-try, where many of them carried a wide stock. These bazaars Bolivia was the smallest market in the region, with an esti-mated volume of only US$150,000 per year. Apparently, ov-were served by large wholesalers, who provided typical

whole-sale functions. The remaining 30% was sold by supermarket ens were used very little in Bolivia, so demand for bakeware was quite small. Bolivian import duty was 10%, and there chains that, though less developed than in Chile, had lately

exhibited growth and dynamism. Several Chilean supermarket were neither quotas nor technical standards imposed on these products. Supermarkets had little significance and accounted chains, such as Jumbo and Unimarc, had substantial

invest-ments in Argentina, and others, such as Almac and Ekono, for about 10% of sales of bakeware products. The remainder was sold in public market, fairs, and small bazaars.

91

Virutex-Ilko

S.A.

J

Busn

Res

2000:50:83–95

Table 5. Competitors in Latin America

Bakingware Kitchenware Non-electrical food-processors

Country Local Imported Local Imported Local Imported

Argentina Poor quality Germany, U.S.A., Brazil Strong competition stain- East: stainless steel, cheap Few suppliers, reliable, East, U.S.A., Brazil Lower price Scarce, expensive less steel, good distri- Chile: super chromium poor quality Design, price

bution plated

Bolivia None Scarce None East: stainless steel, cheap None East, Brazil, U.S.A.

Brazil: stainless steel, cheap Irregular supplying Argentina: stainless steel, Quality, price

cheap

Mexico Poor quality U.S.A., Germany Two very strong firms U.S.A., East Two very strong firms. Italy

Lower price Scarce, expensive with good quality chro- High ranking: expensive and Good quality Good and expensive Very good appearance mium-plated and stain- stainless steel Chromium-plated product

less steel products Very competitive

Quite competitive

Paraguay None Brazil, U.S.A. None East: stainless steel, cheap Very small East, Brazil, U.S.A.

Brazil: stainless steel, cheap Irregular supplying Quality, price Peru Poor quality Brazil, U.S.A. Poor quality Brazil: stainless steel, cheap Poor quality East, Colombia, Brazil,

Lower price Scarce, expensive Small variety Venezuela

Irregular supplying, price

Uruguay Poor quality Brazil Poor quality Argentina: stainless steel, Poor quality Brazil, East

Lower price Competitive cheap Small variety Irregular supplying,

Brazil: stainless steel, cheap price

East: stainless steel, cheap

Ilko strengths Quality Design Variety

Competitive price Variety Quality

Variety Competitive price Competitive price

There were no local suppliers of baking molds, and im- significance was increasing. On the other hand, there were seven or eight large department stores in Asuncion alone. ported products were scarce. There were also no local kitchen

There were no local competitors in bakeware products, tool manufacturers, though there were low-priced imported

though springforms were imported from Brazil and the United stainless steel products from the Far East, Brazil, and

Argen-States. There were no Paraguayan manufacturers of kitchen tina. As for nonelectrical food-processing products, such as

tools, and products found in the market came, as in the strainers, the only ones to be found were imported from the

case of Bolivia, from the Far East, Brazil, and Argentina. These Far East, Brazil, and the United States, which competed in

products were stainless steel devices of poor quality and low quality and prices, but whose supply was irregular.

prices. In strainers and other nonelectrical items, there was little local production and, as in Bolivia, the market was supplied

Mexico

with Far Eastern, Brazilian, and U.S. products that were compet-The Mexican market was the largest among those analyzed,

itive in quality and price but with irregular distribution. with an estimated US$10.5 million per year. Nevertheless, in

relative terms, this was not a very large market, because Mexico

Peru

was a country where apparently there was little habit of baking

The size of Peruvian market was estimated at some meals in general and pastry in particular. Typical Mexican

US$900,000 per year. Its tariff level was 25%, and, as in the foods included many salty and seasoned products. This market

previously described markets, there was no imposition of did not have quotas or technical standards or restraints, and

quotas or technical standards, but certification by an interna-there was a 15% import tariff.

tional firm was required for quality control on all imports The most important channel, by far, were supermarket

before they left the country of origin. Supermarkets accounted chains, which accounted for 65% of national level sales and

for approximately 25% of sales of this kind of product. Because which were predominant in the Federal District, the country’s

of the current economic crisis, supermarkets only accepted capital. Wholesalers, very important for serving bazaars and

goods on consignment. Wholesalers, many of Japanese origin, shops, contributed approximately 30% of sales. Department

were very important, accounting for 40–50% of sales. Markets stores sold the remaining 5% but were significant because of

and fairs were supplied mainly by these wholesalers. It was the status and publicity of having one’s products displayed

believed that this informal market accounted for almost 50% there.

of these product’s total retail sales. The remaining sales were The competitors were quite diverse. In bakeware products,

made by large retail outlets that were confronting severe pay-local suppliers exhibited poor quality, though prices were

ment problems. quite convenient. Imported products were few, but of

excel-Local suppliers of bakeware exhibited poor quality, though lent appearance and high prices, and they came from the

their prices were lower than those of Ilko products. Some United States and Germany. In kitchen tools, there were two

imported items came from Brazil and the United States, but very strong Mexican manufacturers, with good quality both

their prices were high. There were no local manufacturers of in chromium-plated and stainless steel utensils that were very

quality kitchen tools, and channels stocked themselves with expensive. In strainers and other nonelectrical products, there low-priced imports of stainless steel that came from Brazil were also two very strong local suppliers, with good quality and the Far East. Quality and variety of strainers and other and very competitive prices in tin-plated products. Imports nonelectrical items of Peruvian manufacture were poor, and came mainly from Italy, from the world’s largest exporter, and imports were irregularly received from the Far East, Colombia, they were products high in quality and in price. Brazil, and Venezuela but at moderate prices.

Paraguay

Uruguay

This was a small market, with approximately US$600,000 This was a small market, with estimated sales a little over annual sales for products in the Ilko line. Tariffs were 23%, US$1 million for Ilko line products. It had the highest regional and there were neither quotas nor technical standards. It import duty (50%), but this was expected to decrease in appeared that Paraguayans did not use ovens much for prepar- negotiating rounds anticipated for July 1992. There were no ing meals either. There was significant demand among the quotas or technical standards.

Paraguayan population for kitchen tools, strainers, and other In Uruguay, there were three supermarket chains that ac-nonelectrical food processors. counted for approximately 40–50% of retail sales. The re-The main channels for these products were public markets maining sales were made in bazaars that acted as counter and fairs, particularly in lines such as strainers, kitchen tools, wholesalers. These were few but very significant.

93

Virutex-Ilko S.A. J Busn Res

2000:50:83–95

from Argentina, Brazil, and the Far East at reasonable prices. He had been in the business for forty years in the Mexican capital, where he was the second most important distributor. Small variety and poor quality were characteristic of strainers

and other nonelectrical items, while imports at very reasonable In Paraguay, Mr. Salamovich had chosen an imported/ distributor who operated in bazaar and hardware store items prices came irregularly from Brazil and the Far East.

and who had strength in distributing to supermarkets and market places as well. It was a business that was in the process

Entry and Operating Strategy

of being transformed into a firm, not yet completelyprofes-sional. It had conducted some operations with Virutex-Ilko

for Latin America

before September 1991. In Peru, Mr. Salamovich selected an Once the decision to enter Latin American markets had been

importer/distributor who knew quite a lot about the Ilko line made, the firm would have to decide how to penetrate these

because he was a mechanical engineer. He did not perform markets. One approach would be to export products

manufac-any manufacturing activity, only commercial activities such as tured in Chile and to distribute them in each market through

importing Cristal D’Arques. He had also operated occasionally importers, distributors or commission agents. These were also

with Virutex-Ilko before September 1991. the options of distribution through a sales organization of

Finally, in Uruguay, he had selected an importer/distributor their own or subcontracting a local firm. Another approach

who, besides importing large quantities of merchandise from would be to manufacture these products in each market, which

the Far East, manufactured plastic items such as shower cur-could be done by granting manufacturing licenses, directly

tains and inexpensive handbags. It was a medium-size family investing in facilities of their own or investing jointly with

business, quite well organized and very professional. The man-some local firm. Asked about how he envisioned the firm

agement team consisted of two brothers and their mother, operations in Latin America five years ahead, Toma´s Mu¨nzer

who took responsibility for sales. They were well accepted in commented:

the distribution channels, especially in supermarkets. Like the selected distributors in Bolivia, Paraguay, and Peru, they had We should have at least one or two small manufacturing

subsidiaries operating. I believe that in the long term, this operated with Virutex-Ilko before September 1991.

Another issue that troubled Virutex-Ilko executives was business has a weak exporting position in this region. These

investments should be made in association with people the marketing policy for their products in these markets. The original idea was to sell the entire range of products in all that have a good knowledge of these markets.

markets, and to implement a marketing program much like Juan Eduardo Rodrı´guez and Christian Salamovich

sup-the one sup-they had so successfully carried out in Chile. This ported the idea of initially appointing an importer or

distribu-included the use of their own brands, full distribution coverage tor for each country, except in very large countries, like Brazil,

and presence throughout the country, strong emphasis on or in countries with very different regions, like Bolivia, where

merchandising and salesmen training, sustained personal con-there would have to be more than one.

tact with customers, unique advertising strategies, etc. How-In his report, Mr. Salamovich presented the candidates he

ever, once Mr. Salamovich’s report was analyzed, they asked had preselected after visiting each country. In Argentina, he

themselves if the differences among Latin American markets had chosen a manufacturing firm that produced and imported

would make it necessary to somehow adapt the general plan. plastic items, with yearly sales of US$20 million, and whose

customers were mostly the large wholesalers all over the

coun-Teaching Note

try. This firm also sold 20% to supermarket chains and the

remainder directly to the 500 biggest bazaars in Argentina.

Case Purpose and Teaching Objectives

Virutex-Ilko was this firm’s representative in Chile.The purpose of the Virutex-Ilko is to develop abilities in In Bolivia, Mr. Salamovich preselected three

dealers/im-the design of entry strategies into new export markets. This porters for the zones of Santa Cruz, La Paz, and Cochabamba,

requires an evaluation of the countries in which the greatest respectively. The latter was a wholesaler who had been buying

opportunities, as well as an understanding of the kinds of small quantities of Ilko products for years and would be

products the market niches in which the company has a maintained for the sake of tradition. The one in Santa Cruz,

competitive advantage. recently appointed, was an importer of items to be sold in the

The teaching objectives include the following: bazaars. After many difficulties, they had hopes of appointing a

dealer in La Paz during the coming months, probably the 1. Understanding the factors involved in a decision to same one that represented the Argentine plastic manufacturer export or manufacture overseas.

selected by Mr. Salamovich to sell Virutex-Ilko products in 2. Appreciating the characteristics of Latin American mar-Argentina. In Mexico, Fernando Bihan had chosen a distribu- kets, the opportunities and risks that they present. tor/importer who distributed to supermarkets and had four 3. Evaluating the distribution channels and manufacturing stores or bazaars that operated both as retailers and as whole- arrangements through which a Latin American company

WHY WAS THE GERMAN MARKET MORE DEMANDING? HOW DID

Suggested Questions for Discussion

THE COMPANY RESPOND TO THOSE DEMANDS?

1. How did the company come to dominate the household

• Way of life centered in the kitchen; ovens kept burning cleaning and kitchenware markets in Chile?

during cold winters. 2. What was the company Credo and why was it

devel-• Tradition of baking pastries typical of Christmas and oped?

Holy Week festivities. 3. Why did it seek to enter the developed country markets

• Company responded by tailoring product to customer of North America and Europe? How successful was it?

specifications. Why? What was its strategy?

4. Why was the German market more demanding? How WHAT COUNTRIES OFFER THE GREATEST COMPETITION IN BAKING

did the company respond to those demands? WARE? IN NONELECTRICAL FOOD PROCESSORS? HOW DOES

VIRU-5. What countries offer the greatest competition in baking TEX-ILKO COMPETE?

ware? In nonelectrical food processors? How does

Viru-• Germany offered greatest competition in high end-of-tex-Ilko compete?

scale baking ware and Italy the same in nonelectrical 6. What strategic problem does the company face in 1992?

food processors. What are its major alternatives?

• Therefore, it is necessary to compete with price and 7. How would you assess the possibility of competing on

flexibility rather than with design and quality. design and brand image in North America and Europe?

8. Should the company seek to expand to other markets WHAT STRATEGIC PROBLEM DOES THE COMPANY FACE IN 1992? in Latin American? Why or why not? WHAT ARE ITS MAJOR ALTERNATIVES?

• Virutex-Ilko is seeing its margin reduced from 50% of

Case Analysis

domestic sales to only 25% due to increased pricecom-HOW DID THE COMPANY COME TO DOMINATE THE HOUSEHOLD petition in those markets and loss of competitiveness CLEANING AND KITCHENWARE MARKETS IN CHILE? from an increasingly overvalued peso.

• It can either change its strategy in the developed country • The founder brought his skills and market knowledge

markets, emphasizing design and quality, using its own with him from Germany.

brand name or it can basically abandon those markets • He took considerable risks in importing new machinery.

to low cost competitors from the Far East and enter the • He constantly added new products.

emerging markets of Latin America. • He traveled to the United States and Europe, bringing

back new product and process ideas. HOW WOULD YOU ASSESS THE POSSIBILITY OF COMPETING ON • There was a marked concern for product quality. DESIGN AND BRAND IMAGE IN NORTH AMERICA AND EUROPE? • There was a clear focus on the end consumer.

• This will be very difficult. There is no design tradition • Knowledge and experience in merchandising.

in Chile. The European markets in particular are very • Success in penetrating supermarket chains.

demanding.

WHAT WAS THE COMPANY CREDO AND WHY WAS IT DEVELOPED? • The company does not have the resources to create a

brand image. • Growth could not be achieved with a patriarchal-type

organization. SHOULD THE COMPANY SEEK TO EXPAND TO OTHER MARKETS • A process of organizational development and cultural IN LATIN AMERICAN? WHY OR WHY NOT?

change was begun.

Yes:

• The company needed creativity, commitment,

auton-omy, and teamwork. • There is no alternative since it is being pushed out of the developed country markets by new lower-cost producers

WHY DID IT SEEK TO ENTER THE DEVELOPED COUNTRY MARKETS

from the Far East

OF NORTH AMERICA AND EUROPE? HOW SUCCESSFUL WAS IT?

• Latin American countries were poor markets in the

WHY? WHAT WAS ITS STRATEGY?

1980s, but they have gotten their macro-economic act • The Chilean market was becoming saturated. together.

• Softening of Chilean market after 1981. • Increasingly open economies means lowered tariff barri-• There was unused capacity. ers and greater opportunities to compete on a level play-• Need for hard currency (historic losses due to devalua- ing ground.

95

Virutex-Ilko S.A. J Busn Res

2000:50:83–95

tween the low price local manufacturers and the high WHAT SHOULD THE COMPANY DO, AND WHY?

price imports.

• Changing the strategy in the northern countries would • Chile has a transportation advantage in South America

require financial resources and design skills that the (with respect to the United States, Germany, etc.)

company does not now have. It could be argued that

No: the company can acquire these from a strategic partner in the U.S. or Europe. However, current customers buyers • These are very small markets without a baking tradition.

probably don’t want to see a change in strategy since • We are not competitive with products from the Far East

they rely upon the company to produce under their or Brazil.

labels.

WHAT COUNTRIES ARE MOST ATTRACTIVE? WHY? Countries • A strong argument thus can be made for going into the may be evaluated along various criteria of attractiveness: total Latin American markets with a product that is much size of market; intensity of rivalry by local companies and higher quality than local manufacturers but priced below competing imports; tariff barriers; geographic proximity (and other imports. One competitive advantage is consistency lower transportation costs); ease of entry in distribution chan- and regularity, since the supplies from the Far East, nels; and baking traditions. Germany, or the United States appear to be irregular.

WHAT PRODUCT AND MARKET SEGMENTS OFFER GREATEST

OP-HOW SHOULD THE STRATEGY BE IMPLEMENTED? PORTUNITY? WHY?

• Implementation could occur by stages, beginning with • There is less competition in baking wares.

the naming of an exclusive distributor in each country • Furthermore, the competition is clearly segmented: high

(or geographic region). It appears that this process is well price imports and low price local manufactures.

under way with the preselection of certain candidates. • The company has an opportunity to target segments that

• An interesting discussion could occur around the issue seek both quality and reasonable price.

of strategic alliances in moving from export to local

WHY DOES THE COMPANY WANT TO USE EXCLUSIVE DISTRIBUTORS? manufacture. Advantages: fewer resources required and

local expertise provided. Disadvantages: loss of control • Commitment and motivation