LAPORAN

TAHUNAN

ANNUAL

REPORT

2015

Pe ru sa h a a n An d a m e m a h a m i p e n t in g n ya

inovasi bagi pertum buhan yang keberlanjutan,

sejalan dengan upaya peningkatan kom petensi

in t in ya d a la m se g m e n u sa h a h u lu se rt a

p ersiap an revitalisasi segm en hilir. Perusahaan

An d a t e t a p b e rfo ku s p a d a u p a ya m e n ja g a

t in g ka t p ro d u kt ivit a s ya n g t in g g i m e la lu i

p e n in g ka t a n e fe kt ivit a s d a n e fisie n si p ro se s

p ro d u ksi, d e m i m e m a st ika n ke b e rla n ju t a n

p e n cip t a a n n ila i b a g i p a ra p e m a n g ku

kep en tin g an .

INNOVATING GROWTH

REVITALIZING

SUSTAINABILITY

Pe n g e m b a n g a n b ib it u n g g u l sa w it m e la lu i ke rja sa m a dengan ASD Costa Rica, m enghasilkan 4 (em pat) varietas bibit unggul (Spring, Them ba, CR Ovane dan CR Suprem e) d en g a n keu n g g u la n u sia t a n a m a n m en g h a silka n ya n g relatif m uda - 2 (dua) tahun dibandingkan 3 (tahun) untuk t a n a m a n n o rm a l - d a n p o t e n si ke m a m p u a n vo lu m e produksi buah sawit 40 ton Tandan Buah Segar (TBS) per hektar per tahun, lebih tinggi dari produksi norm al 25-30 ton TBS per hektar per tahun. Keem pat varietas bibit unggul in i t e la h m e m p e ro le h p e rse t u ju a n Pe m e rin t a h u n t u k program penanam an baru dan re-planting, dan ditargetkan untuk penjualan bagi perkebunan rakyat um um m aupun perusahaan perkebunan skala m enengah dan besar.

Th e d evelo p m en t o f p rem iu m p a lm seed s t h ro u g h t h e ven t u re co o p era t io n w it h ASD Co st a Rica , p ro d u cin g 4 (four) prem ium seed varieties (Spring, Them ba, CR Ovane a n d CR Su p rem e) fea t u rin g rela t ively sh o rt er im m a t u re period - 2 (two) years instead of the norm al 3 (three) years - with the potential palm production volum e of 40 tons of Fresh Fruit Bunches (FFB) per hectare per year, higher than the norm al p rod uction of 25-30 tons of FFB p er hectare per year. The four prem ium seed varieties have obtained the Governm ent approval for new planting and re-planting p ro g ra m s, a n d h a ve b een t a rg et ed fo r sa le t o o il p a lm sm allholders as well as to m id-size and big com panies.

Ke rja sa m a d e n g a n Ya ya sa n Ba krie Am a n a h - se b u a h ya ya sa n so sia l d a la m Ke lo m p o k Usa h a Ba krie - d a la m p e n g e lo la a n d a n a u n t u k ke p e n t in g a n so sia l m e la lu i Pro g ra m ‘Pa yro ll ZIS’ ya n g m elib a t ka n ka rya w a n d a la m pengum pulan dana sosial secara rutin m elalui pem otongan gaji secara sukarela.

Cooperation with the Bakrie Am anah Foundation - a social fo u n d at io n in t h e Bakrie Bu sin ess Gro u p - in m an ag in g so cia l fu n d s t h ro u g h t h e ‘Pa yro ll ZIS’p ro g ra m in vo lvin g e m p lo ye e s in t h e co lle ct io n o f so cia l fu n d s t h ro u g h voluntary salary cut on a regular b asis.

INOVASI

INNOVATION

INOVASI BENIH UNGGUL

SAWIT

Innovation on Prem ium Palm Seeds

INOVASI PENGUM PULAN

DANA SOSIAL

Pe n g e m b a n g a n p ro g ra m ‘b a n k sa m p a h ’ b a g i sisw a Sekolah Dasar yang dikelola di bawah yayasan pendidikan b in a a n p eru sa h a a n , ya n g m elib a t ka n p a ra sisw a d a la m up aya p em ilahan sam p ah yang b ernilai ekonom is untuk disalurkan m elalui sekolah serta dikonversikan sebagai dana tabungan bagi kebutuhan sekolah siswa.

The developm ent of the ‘trash bank’ program for students o f Ele m e n t a ry Sch o o ls ru n b y co m p a n y-s u p p o rt e d ed ucational found ations, involving stud ents in the efforts t o t a ke a d va n t a g e o f e co n o m ic-va lu e d w a st e t o b e d istrib uted throug h the schools and to b e converted as savings of funds for the students’ school needs.

Penerap an kurikulum b erb asis ling kung an (Ad iw iyata) d i Sekolah Dasar Bakrie Utam a Sungai Aur yang berlokasi di Kecam atan Sungai Aur - Pasam an Barat (dalam lingkungan Perkebunan Unit Usaha Sum bar/BPP).

Th e im p le m e n t a t io n o f e n viro n m e n t -b a se cu rricu lu m (Ad iw iyata) at the Bakrie Utam a Sung ai Aur Elem entary School located in the Sungai Aur District of West Pasam an (in the Plantation area of Sum b ar / BPP Unit).

Pe n g e m b a n g a n d a n p e n g e lo la a n M in ia t u r Hu t a n Konservasi seluas 17 Ha di tengah perkebunan sawit di Unit AGW, b ert u ju a n u n t u k m en ja g a sert a m en g em b a n g ka n ke a n e ka ra g a m a n h a ya t i ya n g a d a , m e la lu i u p a ya p e n a n a m a n b ib it t a n a m a n la n g ka m e la lu i ke rja sa m a dengan lem baga terkait, juga bertujuan untuk m em elihara ekosistem yang ada, serta perlindungan dan pem eliharaan flora dan fauna yang terdapat di lokasi.

The developm ent and m anagem ent of a 17 Ha Miniature Conservation Park in the m iddle of the palm plantation of th e AGW Un it, aim ed at p reservin g an d d evelo p in g th e availab le b iod iversities, through the p lanting of seed s of endangered species in cooperation with related institutions; also aim ed at m aintaining current ecosystem s, as well as to protect and m aintain the prevailing flora and fauna on lo cat io n .

INOVASI PENGELOLAAN

SAM PAH

Innovation on Trash Managem ent

INOVASI PENDIDIKAN

BERBASIS WAWASAN

LINGKUNGAN

Innovation on Environm entally-Based Ed u cat io n

INOVASI KONSERVASI

LINGKUNGAN

Ikhtisar Keuangan

Report of the Board of Directors

Diskusi dan Analisa

Net Profit for the Year from Discontinued OperationsUse of Proceeds from Rights Issue Perubahan Kepemilikan Saham (Investasi / Ekspansi / Divestasi / Penggabungan/Peleburan Usaha / Akuisisi)

Changes in Share Ownership

(Investment / Expansion / Divestment / Merger / Aquisition)

Transaksi Benturan Kep entingan

Changes in Law s and Regulations

Perub ahan Stand ar Akuntansi

Rapat Um um Pem egang Saham General M eeting of Shareholders M anagement of Corporate Social and Environmental Responsibilities

Peng em b ang an Ketenag akerjaan serta Penerap an Kesehatan, Keselam atan dan Keam anan Kerja Employment Development and Implementation of Occupational Health, Safety and Security

Perlind ung an Konsum en Consumer Protection

Perlind ung an Ling kung an Environmental Protection

Data Perusahaan

Corporate Data

Profil Kom isaris

Profile of the Board of Commissioners

Profil Direksi

Profile of the Board of Directors

Kom isaris d an Direktur Entitas Anak dan Perusahaan Asosiasi

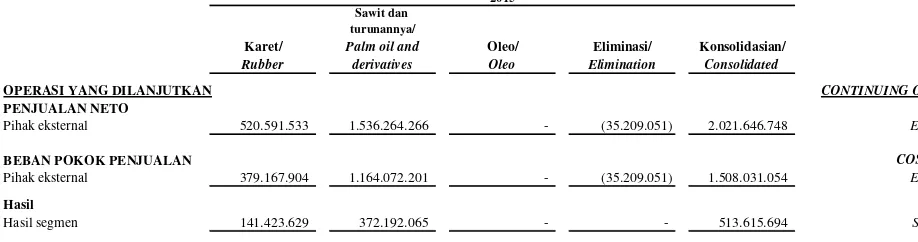

2.021.646.748 2.636.703.408 2.076.486.069 2.485.429.887 3.646.109.970

1.508.031.054 1.906.053.721 1.485.599.280 1.736.764.096 2.213.587.101

513.615.694 730.649.687 590.886.789 748.665.791 1.432.522.869

(1.391.246.384) (506.829.808) (3.043.733.871) (970.138.364) 907.504.303

333.393.831 (1.940.798) 477.691.368 25.289.743 (319.685.719)

(1.057.852.553) (508.770.606) (2.566.042.503) (944.848.621) 587.818.584

540.318.460 (174.173.396) (200.676.538) (122.750.156) 157.682.069

(517.534.093) (682.944.002) (2.766.719.041) (1.067.598.777) 745.500.653

(514.569.643) (623.581.202) (2.762.792.133) (1.065.265.036) 744.889.699

(2.964.450) (59.362.800) (3.926.908) (2.333.741) 610.954

(763.647.528) (725.117.291) (3.047.203.419) (1.098.540.855) 667.631.265

(760.683.078) (665.754.491) (3.040.527.764) (1.095.903.882) 667.020.311

(2.964.450) (59.362.800) (6.675.655) (2.636.973) 610.954

IKHTISAR KEUANGAN

Financial Highlights

Penjualan neto

Net sales

Beban pokok penjualan

Cost of sales

Laba bruto

Gross profit

Laba (rugi) sebelum m anfaat (b eb an) p ajak p enghasilan

Incom e (loss) before incom e tax b enefit (exp ense)

Manfaat (beban) pajak penghasilan - neto

Incom e tax benefit expense - net

Laba (rugi) neto tahun berjalan dari operasi yang dilanjutkan

Net incom e (loss) for the year from continuing op erations

Laba (rugi) neto tahun berjalan dari operasi yang dihentikan

Incom e (loss) net for the year from d iscontinuing op erations

Laba (rugi) neto tahun berjalan

Net incom e (loss) for the year

Laba (rugi) neto tahun berjalan yang dapat diatribusikan kepada pem ilik entitas induk

Net incom e (loss) for theyear attributable to owners of the parent

Laba (rugi) neto tahun berjalan yang dapat diatribusikan kepada kepentingan non pengendali

Net incom e (loss) for the year attrib utab le to non-controlling in t erest s

Total (rugi) pendapatan kom p rehensif tahun b erjalan

Total com prehensive incom e (loss) for the current year

Total (rugi) pendapatan

kom prehensif tahun berjalan yang dapat diatribusikan kepada pem ilik entitas induk

Com prehensive incom e (loss) for the current year attributable to owners of the parent

Total (rugi) pendapatan

kom prehensif tahun berjalan yang dapat diatribusikan kepada kepentingan non pengendali

Total com prehensive incom e (loss) for the current year attributable to non-controlling interests

Angka pada tabel dan grafik m enggunakan notasi Indonesia (dalam ribuan rupiah, kecuali disebutkan lain)

Num erical notations in all tables and graphs are in Indonesian (in thousands IDR, except stated otherwise)

Ura ia n

Descrip t io n

2015

2014* 2013* 2012 2011- - - - 1.668.642

302.472.184 302.472.184 302.535.339 302.535.339 305.708.697

16.926.616.869 17.450.389.476 18.020.640.490 18.983.332.052 18.702.295.203

13.569.811.257 13.329.936.336 13.175.070.059 11.068.929.244 9.644.732.756

3.356.805.612 4.120.453.140 4.845.570.431 7.914.402.808 9.057.562.447

(6.492.421.059) (5.102.238.942) (2.899.502.046) 787.482.797 (2.074.241.065)

(3,06%) (3,91%)* (15,35%)* (5,61%) 3,98%

(15,42%) (16,57%)* (62,89%)* (13,46%) 8,22%

18,49% 33,73% 54,41% 126,24% 39,77%

404,25% 323,51%* 271,90%* 139,86% 106,48%

80,17% 76,39%* 73,11%* 58,31% 51,57%

0,43x 0,84x 1,03x 1,06x 2,39x

37,91 21,75 15,54 17,01 32,04

21% 27% 22% 25% 34%

0,12 0,15 0,12 0,13 0,19

25,41% 27,71% 28,46% 30,12% 39,29%

13.720.471.386 13.720.471.386 13.720.471.386 13.720.470.842 13.686.738.842

(37,72) (49,78) (201,36) (77,69) 54,80

0 0 0 4,51 4,40

686.023.569.300 686.023.569.300 686.023.569.300 1,276,003,788,306 3,900,720,569,970 Angka pada tabel dan grafik m enggunakan notasi Indonesia

(dalam ribuan rupiah, kecuali disebutkan lain)

Num erical notations in all tables and graphs are in Indonesian (in thousands IDR, except stated otherwise)

Ura ia n

Descrip t io n

2015

2014* 2013* 2012 2011Rasio Keuangan / Financial Ratio

Inform asi Keuangan Lainnya / Other Financial Inform ation

Inform asi Saham

* disajikan kem bali | restated

Investasi p ad a entitas asosiasi

Investm ents in associates

Investasi pada entitas lain

Investm ents in other entities

Jum lah aset

Total assets

Jum lah liab ilitas

Total liab ilities

Ekuitas neto

Equity - net

Modal kerja bersih

Net working capital

Tingkat pengem balian aset

Return on assets

Tingkat p engem b alian ekuitas

Return on equity

Rasio lancar

Current ratio

Rasio kewajiban terhadap ekuitas

Liab ilities to Eq uity Ratio

Rasio kewajiban terhadap aset

Liab ilities to assets ratio

EBITDA terhadap beban bunga

EBITDA to interest Expenses

Tingkat p erp utaran p ersed iaan

Inventory turnover

Tingkat perputaran aset tetap

Assets turnover

Tingkat perputaran jum lah aset

Total assets turnover

Marjin laba kotor

Gross profit m argin

Jumlah saham beredar (lembar saham)

Outstanding shares (share of stock)

Laba (rugi) neto per saham dasar (Rp)

Basic earnings (loss) p er share (IDR)

Dividen per saham (Rp)

Dividend per share (IDR)

Nilai kapitalisasi pasar (Rp)

Market capitalization value (IDR)

IKHTISAR SAHAM DAN EFEK LAINNYA

Shares and Securities Highlights

Kinerja Saham| Share Perform ance

(Rupiah) 2015 2014 ( IDR)

Harga tertinggi 50 82 Highest p rice

Harga terend ah 50 50 Lowest price

Harga pada akhir tahun 50 50 Year-end price

Rugi neto per saham dasar (37,50) (45,44) Basic loss per share

Pem b u kaan Teren d ah Tert in g g i Pen u t u p an Pem b u kaan Teren d ah Tert in g g i Pen u t u p an

Op en Lo w est Hig h est Clo se Op en Lo w est Hig h est Clo se

Triwulan I 50 50 50 50 50 50 82 50 1st Quarter

Triwulan II 50 50 50 50 50 50 57 50 2nd Quarter

Triwulan III 50 50 50 50 50 50 50 50 3rd Quarter

Triwulan IV 50 50 50 50 50 50 54 50 4th Quarter

Harga Saham | Share Price

(Rupiah) 2015 2014 (IDR)

IDX : UNSP Pasar Reguler Pasar Negosiasi Pasar Reguler Pasar Negosiasi

Frekuensi (x) Vo lu m e Vo lu m e Frekuensi (x) Vo lu m e Vo lu m e

Triwulan I 5.161 340.605.100 426.743.825 31.314 2.932.907.600 558.554.725 1st Quarter

Triwulan II 1.248 5.995.300 685.487.900 21.541 212.395.800 341.109.772 2nd Quarter

Triwulan III 1.177 1.222.200 519.926.492 1.862 48.925.200 215.377.900 3rd Quarter

Triwulan IV 1.435 4.192.300 332.665.550 7.187 419.931.900 720.939.025 4th Quarter Peredaran Saham | Share Distribution

(unit) 2015 2014 (unit)

Harga dan Volume Saham BSP Selama Tahun 2015

Price and Volum e Perform ance of BSP Shares During 2015

Harga Penutupan Saham (Rp) Closing Price (IDR)

Volum e Saham BSP

BSP Shares Volum e

(u n it )

Jan - Mar Apr - Jun Jul - Sep Oct - Dec

180.000.000 160.000.000 140.000.000 120.000.000 100.000.000 80.000.000 60.000.000 40.000.000 20.000.000 0 70

1990 20.958.630 10.054.899 - 37.000 -

-1991 30.741.819 15.185.189 200 37.000 7.400.000 73,59%

1992 32.325.516 11.758.727 275 37.000 10.175.000 67,00%

1993 37.947.393 15.796.846 275 37.000 10.175.000 86,53%

1994 51.588.016 24.185.623 285 37.100 10.545.000 66,75%

1995 71.984.448 33.346.431 350 37.100 12.950.000 53,54%

1996 100.331.884 43.147.436 400 74.000 14.800.000 44,38%

1997 135.160.976 50.369.091 75 207.200 15.540.000 36,00%

1998 166.769.962 50.469.411 75 207.200 15.540.000 30,85%

1999 38.323.862 (6.445.287) - 207.200 -

-2000 (155.326.414) (193.650.277) - 248.640 -

-2001 (225.869.471) (70.543.056) - 248.640 -

-2002 (149.914.301) 75.955.170 - 248.640 -

-2003 (67.347.562) 80.425.611 - 248.640 -

-2004* 8.641.491 95.916.193 - 2.331.000 -

-2005 110.371.065 115.715.575 6 2.331.000 13.986.000 14,58%

2006 262.289.585 172.897.520 9 2.331.000 20.979.000 18,13%

2007 433.899.857 206.575.272 15 3.787.875 34.965.000 20,22%

2008 543.073.253 173.569.364 17 3.787.997 64.395.948 31,17%

2009 761.819.508 252.783.327 9 3.787.997 34.037.072 19,61%

2010 1.528.053.050 805.630.446 3,8 13.553.773 50.292.114 19,90%

2011 2.212.742.843 744.889.699 4,4 13.686.739 60.199.906 7,47%

2012 1.084.981.063 (1.067.598.777) 4,555 13.720.471 62.500.000 8,39%

2013 (1.677.811.070) (2.766.719.041) - 13.720.471 -

-2014 (2.301.100.710)* (682.944.002)* - 13.720.471 -

-2015 (2.815.670.353) (517.534.093) - 13.720.471 -

-* setelah perubahan kebijakan akuntansi dan penyajian kembali laporan keuangan ||||| after change in accounting policy and restatement of financial statements Dividen| Dividends

Tahun Saldo Laba Ditahan Laba (Rugi) Bersih Dividen Tunai Jumlah Saham Dividen Dibayar Payout Ratio (Defisit)

Year Retained Earnings Net Profit (Loss) Cash Dividend Total Share Dividend Payment Payout Ratio (Deficit)

(Rp | IDR 000) (Rp | IDR 000) (Rp | IDR) (000 saham | shares) (Rp | IDR 000) (%)

Penawaran Saham Perdana 06-01-1990 11.100.000 11,10 Initial Pub lic Offering

Pencatatan Perusahaan 02-02-1996 37.000.000 37,00 Com p any Listing

Pem ecahan Nilai Nom inal Saham (@ Rp 500) 26-08-1996 74.000.000 37,00 Stock Split (@ IDR 500)

Saham Bonus 16-09-1996 207.200.000 103,60 Bonus Shares

Saham Divid en 23-08-1999 248.640.000 124,32 Divid end Shares

Pem ecahan Nilai Nom inal Saham (@ Rp 100) 18-10-2004 994.560.000 124,32 Stock Split (@ IDR 100)

Penawaran Um um Terbatas I 10-11-2004 2.331.000.000 233,10 1st Rights Issue (8:7)

Penawaran Um um Terbatas II 29-08-2007 3.787.875.000 378,79 2nd Rights Issue (8:5)

Pem belian Kem bali Saham (6.100.000) 17-11-2008 3.781.775.000 378,18 Share Buyback (6,100,000)

Penawaran Um um Terbatas III 02-02-2010 13.553.772.676 1.355,38 3rd Rights Issue (2:5)

Konversi Waran 31-12-2013 13.720.471.386 1.372,05 Warrant Conversion

Kronologi Pencatatan Saham | Share Listing Chronology

Catatan ||||| Notes: sudah termasuk saham konversi w aran ||||| includes shares from converted w arrants

IDX : UNSP Tanggal Saham Terakumulasi Nominal Terakumulasi

Obligasi| Bond

Perusahaan Anda sudah tidak m em iliki obligasi yang m asih beredar sejak tahun 2014.

Your Com pany did not have anym ore bonds traded in the m arket since 2014.

1. 1 Septem ber 2010 4.288.888,89

2. 1 Maret 2011 436.854,00

3. 1 Septem ber 2011 3.996.000,00

4. 1 Maret 2012 3.062.360,00

5. 1 Septem ber 2012 3.078.360,00

6. 1 Maret 2013 3.178.360,00

7. 1 Septem ber 2013 3.178.360,00

8. 1 Maret 2014 3.178.360,00

9. 1 Septem ber 2014

-10. 1 Maret 2015

-11. 1 Septem ber 2015

-Pembayaran Bunga Wesel Bayar| Paym ent of Equity-Linked Notes Interests

Tanggal | Date Jum lah | Am ount (USD)

SGX-ST 18 Februari 2010 100.000.000 8% p.a. / 7 years

Efek Lainnya

|

Other Securities:

Wesel Bayar| Equity-Linked Notes

Bu rsa Tanggal Pencatatan Jum lah (USD) Bunga / Jangka Waktu

Stock Exchange Listing Date Am ount (USD) Interest / Period

Komposisi Pemegang Saham| Shareholders’ Com position per 31/12/2015

Ju m lah Jumlah

Lem bar Saham Nominal (Rp 000) % Num ber of Shares Total (IDR 000)

Pem egang Saham Sh a reh o ld ers

Ha iya n t o 906.765.500 90.676.550 6,61

Credit Suisse AG, Singapore Branch

S/A Long Haul Holdings Ltd (MOU Facility) 430.000.000 43.000.000 3,13

PT Asuransi Jiwa Sinarm as MSIG 339.661.000 33.966.100 2,48

Meivel Hold ings Corp oration 320.396.500 32.039.650 2,34

PT Raja Dana Indonesia 305.000.000 30.500.000 2,22

Credit Suisse AG Singapore Trust/AC

Clien ts-2023904000 240.928.500 24.092.850 1,76

Reksa Dana Penyertaan Terbatas

Syailendra Multi Strategy Fund II 194.280.500 19.428.050 1,42

Reksadana HPAM Prem ium 1 180.000.000 18.000.000 1,31

PT Bakrie Kim ia Investam a 170.379.984 17.037.998 1,24

DBS Bank Ltd SG - PB Clients 157.732.000 15.873.200 1,16

Citibank New York SA Dim ensional

Em erging Market Value Fund 111.492.900 11.149.290 0,81

PT Petrom ine Energy Trading 77.275.000 7.727.500 0,56

PT Bakrie Capital Indonesia 17.314.530 1.731.453 0,13

Dana Pensiun Bakrie 4.500.000 450.000 0,03

PT Bakrie & Brothers Tbk 2.463.471 246.347 0,02

Koperasi Karyawan PT Bakrie Sum atera Plantations Tbk 1.087.500 108.750 0,01

PT Bakrie Investisindo 940.800 94.080 0,01

Masyarakat 10.259.253.201 1.025.925.321 74,76

Operational Excellence

Driven by Standardization

Pencap aian Keunggulan Op erasional m elalui Stand arisasiGREAT

RENCANA STRATEGIS

RENCANA STRATEGIS

Strategic Intent

Go! and Reach Extraordinary Achievement through Transformation

VISION

“To Be the Num ber One and Most Adm ired

Integ rated Ag ro-Business Com pany in Indonesia”

M ISSION “Nurture and Sustain the Wealth of Our Com m unity by Extracting the Optim um Value Creation through Environm entally Friend ly Op eration and Leveraging CORE Expertise in Multi

Crops and Global Op erat io n s” WHAT BUSINESS

ARE WE IN:

Integ rated Sustainab le

Agro-Business and Related Services

CORE VALUES • BSP is Our Hom e

• Initiative and Em powerm ent

with Accountab ility • Sense of Mission • Adaptive to and

Driving Change

Strateg y

Resu lt

FOCUS STRATEGIES: OLEO 1 . Develop & Sustain Operational

Exellen ce

2 . Nurture the Right Organization and Talent Pool

3 . Extend Strategic Sourcing Partners & Alt ern at ives

4 . Deliver Prom ised Service Rate

5 . Consistently Com ply with Industry Standard 6 . Partner with Reputable Funding Resources

(in line with Long Range Financial Road Map) 7 . Retain and Acquire Global Brand Endorser(s) FOCUS STRATEGIES: PALM & RUBBER

1 . Develop Right Land with Suitable Clim ate 2 . Nurture the Right Organization

and Talent Pool

3 . Build & Maintain Right Infrastructure 4 . Attain High Yield and Lowest

Com petitive Cost Position

5. Partner with Reputable Funding Resources 6 . Leverage and Expand Sizeable

Land Bank

Nomor Satu

Mencapai posisi sebagai perusahaan terbesar di Indonesia, berdasarkan ukuran total pendapatan.

Paling Dikagumi

Menjadi perusahaan yang ingin ditiru perusahaan lain, berkem bang dengan sistem dan kinerja operasional yang sem purna, serta m enjadi tolok ukur bagi industri, yang m em iliki tingkat ROE yang tinggi, Rating Perusahaan serta People Management yang baik.

Terintegrasi

Mem iliki lingkup usaha terbentang dari industri hulu (m elalui pengem bangan riset dan pengelolaan kebun) serta industri hilir (dengan pengem bangan operasi pem rosesan dasar m enjadi pem rosesan lebih lanjut).

Sektor Agrobisnis

Ruang lingkup usaha m eliputi aneka kom oditas serta produk turunannya.

Di Indonesia

Meskip u n akan t u m b u h secara g lo b al, n am u n fo ku s u t am a ad alah u n t u k m en ja d i p eru sa h a a n n o m o r sa t u d i sekt o r a g ro b isn is ya n g b ero p era si d i Ind onesia.

Visi dan Misi Perusahaan Anda telah disetujui oleh Direksi dan Dewan Kom isaris pada tahun 2010.

Your Com pany’s Vision and Mission have been approved by the Board of Directors and Board of Com m issioners in 2010.

Menjadi Perusahaan Agrobisnis

Terintegrasi Nomor Satu dan Paling

Dikagumi di Indonesia

VISI

vision

To be the Number One and M ost Admired Integrated Agro-Business Company in Indonesia

Number One

Reaching the position as the largest com pany in Indonesia, based on the revenue size.

M ost Admired

Being a com pany that others would like to em ulate, growing by excellent o p e ra t io n a l syst e m s a n d perform ance, as well as becom ing the industry standards, with high ROE, as w ell as g o o d Co m p an y Rat in g an d People Managem ent.

Integrated

Co ve rin g b u sin e ss lin e s fro m t h e upstream industry (through research d e ve lo p m e n t a n d p la n t a t io n m a n a g e m e n t ) t o t h e d o w n st re a m in d u st ry (w it h t h e d evelo p m en t o f b a sic p ro ce ssin g in t o a d va n ce processing operations).

Agro-Business

The scope of business covers m ulti-com m odities and derivatives.

In Indonesia

M engembangkan dan M enjaga

Kesinambungan

Perusahaan Anda m em bina m anfaat ekonom is bagi kom unitas internal dan eksternal. Kom unitas internal m encakup karyawan dan keluarga m e re ka , se rt a in ve st o r. Ko m u n it a s e kst e rn a l m e n ca ku p se lu ru h pem angku kepentingan yang m engem bangkan hubungan ekonom is yang saling m enguntungkan dengan Perusahaan Anda.

Nilai Optimal

Perusahaan Anda m em peroleh nilai tam bah ekonom is dalam sem ua p ro ses ran t ai n ilai g u n a m en cap ai ekst raksi p en cip t aan n ilai yan g op tim al.

Ramah Lingkungan

Pe ru sa h a a n An d a m e m a t u h i best pract ices in d u st ri d a la m h a l lingkungan dan sosial. Indikator yang relevan digunakan seperti ISPO dan RSPO Com pliance, CSR Rating, EHS Rating, dan ISO 14001.

Keahlian Kunci

Perusahaan Anda m em iliki Sum ber Daya Manusia, proses bisnis, sistem dan teknologi yang unggul; serta terus m engadakan penelitian dan p engem b angan untuk m eningkatkan hasil d ari keb un d an fasilitas p e m ro se sa n ya n g d im iliki d e n g a n d id u ku n g o le h know ledge management yang baik.

M ulti Tanaman dan Operasi Global

Perusahaan Anda m engem bangkan agrobisnis m ulti kom oditas dan

Nurture and Sustain the Wealth of Our Com m unity by Extracting the Optim um Value Creation through Environm entally Friendly Operations and Leveraging Core Exp e rt ise in Mu lt i-Cro p s a n d Glo b a l Op erat io n s

MISI

m ission

Mengembangkan dan Menjaga

Kesinambungan Kesejahteraan

Komunitas dengan Melakukan

Ekstraksi Penciptaan Nilai Optimal

melalui Kegiatan Operasional yang

Ramah Lingkungan dan

Memanfaatkan Keahlian Kunci

dalam Operasi Multi Tanaman

dan Operasi Global

Nurture and Sustain

Yo u r Co m p a n y n u rt u re s e co n o m ic benefits for both internal and external com m unities. The internal com m unity includes em ployees and their fam ilies, a s w e ll a s in ve st o rs. Th e e xt e rn a l com m unity com prises all stakeholders having m utual econom ic relations with Your Com pany.Optimum Value

Your Com p any g ains econom ic value a d d ed in every p ro cess o f t h e va lu e ch a in t o ext ra ct t h e o p t im u m va lu e creation.

Environment-Friendly

Yo u r Co m p a n y co m p lie s w it h t h e in d u st ry’s b e st p ra ct ice s in b o t h e n viro n m e n t a l a n d so cia l issu e s. Releva n t in d ica t o rs u sed in clu d e t h e ISPO and RSPO Com pliance, CSR Rating, EHS Rating, and ISO 14001.Core Expertise

Yo u r Co m p a n y h a s excellen t Hu m a n Resources, business processes, system s and applied technologies; and persists to conduct research and developm ent a ct ivit ie s t o e n h a n ce t h e yie ld s o f current estates and processing facilities, su p p o rt e d b y g o o d kn o w le d g e m anagem ent.

M ult i-Crops and Global

Operations

SERTIFIKASI

Certifications

SERTIFIKASI SISTEM

Stand ar

ISO 9001:2008

ISO 14001:2004

SM K3

RSPO

SCCS

ISPO

SJH

(Sistem Jaminan Halal)

SNI 06-1903-2000 Standard Indonesia Rub b er

SNI ISO 9001:2008

OHSAS 18001:2007

PROPER SERTIFIKASI

PRODUK

SERTIFIKASI KETENAGAKERJAAN

PROGRAM LINGKUNGAN

Unit Tang g al Tang g al

Dikeluarkan Berakhir

JOP 19/05/2015 18/05/2018

GLP 29/02/2012 05/01/2015

Corporate Jakarta 20/02/2012 19/02/2015

Kisaran 15/09/2015 30/04/2018

AMM/AGW 02/08/2012 01/08/2015

SNP 15/10/2012 14/10/2015

FSC Tanjung Morawa 29/04/2014 24/04/2017

HIM 10/06/2011 09/06/2017

HIM 10/03/2014 09/03/2017

Kisaran 30/04/2014 21/04/2017

JOP 19/05/2015 18/05/2018

Corporate Jakarta 20/02/2012 19/02/2015

AMM/AGW 02/08/2012 02/08/2015

BPP Pasam an 03/12/2012 25/10/2015

SNP 15/10/2012 14/10/2015

AM 09/12/2013**

Kisaran 31/08/2015 30/08/2018

Kisaran 03/11/2015 02/11/2020

AMM/AGW 28/08/2012 27/08/2017

Kisaran 03/11/2015 02/11/2020

AMM/AGW 28/08/2012 27/08/2017

AMM/AGW 16/01/2014 15/01/2019

Kisaran 17/06/2015 16/06/2020

BPP Pasam an 17/06/2015 17/06/2020

Kisaran 17/07/2013 16/07/2015

GLP 17/07/2013 16/07/2015

AMM/AGW 17/07/2013 16/07/2015

Kisaran 23/09/2013 10/09/2017

Kisaran 15/09/2015 30/04/2018

HIM 10/07/2013 24/06/2017

JOP Factory 05/03/2014 04/03/2017

JOP 23/04/2011 04/2017

Kisaran 12/04/2012 15/01/2015

SNP 15/10/2012 14/10/2015

AMM/AGW 03/11/2014 06/04/2017

HIM 10/06/2011 09/06/2017

Kisaran Biru 20/11/2015

UPSTREAM WILAYAH 2 Ad hika And rayud ha Bakrie

DIRECTOR IN CHARGE Ad hika And rayud ha Bakrie

STRUKTUR ORGANISASI

AREA JAMBI 1 Zulsony Id ial

AREA JAMBI 2

Toga Sim am ora Udijanto Eko SantosaAREA KALSEL AREA SUMUT 2

Dedy Pranoto

AREA BENGKULU 1

Bangar Siagian AREA BENGKULU 2Ed ison Sem b iring AREA LAMPUNGDwi Hartono

PROCUREMENT Bam bang S. Laksanawan

AGRONOMY INSPECTORATE RUBBER

M. Idris

TANJUNG MORAWA PLANT Ahm ad Sahnan Matondang

DOWNSTREAM DEVELOPMENT Tutik Herlina Mahendratto

FINANCE & REPORTING DOWNSTREAM Raharyanto Susilo

PROJECT & ENGINEERING Soeseno Soep arm an*

SEED GARDEN

Taufiq Tarigan R. Atok HendrayantoJV ASD

KALTENG IGI Bam bang S. Laksanawan

FINANCE & REPORTING BUSDEV & SIP Wawan Sulistyawan

FINANCIAL ACCOUNTING & REPORTING Lam b as Sitom p ul

MANAGEMENT ACCOUNTING & CONTROL

Ku rn iaw an

Organizational Structure

INVESTOR RELATION TBD

STRATEGIC INVESTMENT PORTFOLIO Gatot S.Harsono

UPSTREAM 1 UPSTREAM 2

UPSTREAM

* diklasifikasikan sebagai aset yang tersedia untuk dijual

classified as assets held for sale

AREA OPERASI

Area of Operations

Kuala Tanjung: Oleochemical Complex

Lokasi | Location : Kuala Tanjung Luas Area | Area :

Manufacturing and Facilities : 113,4Ha

Tanjung M oraw a: Fatty Acid Plant FSC

Lokasi | Location : Tanjung Morawa Luas Area | Area :

Manufacturing and Facilities : 7Ha

Sumbar| West Sumatra BPP, CCI

Lokasi | Location :

• BPP Pasam an • CCI Pesisir Selatan Luas Lahan | Field Area :

• Sawit | Palm 10.773Ha • Plasm a Sawit | Palm Plasm a 6.304Ha

Sumut 2| North Sumatra 2 GLP

Lokasi | Location : Labuhan Batu Luas Lahan | Field Area :

• Sawit | Palm 7.728Ha

Bengkulu 1 AM

Lokasi | Location :

• AM Ketahun Luas Lahan | Field Area :

• Karet | Rubber 2.610Ha

Bengkulu 2 JOP

Lokasi | Location :

• JOP Bengkulu Utara Luas Lahan | Field Area :

• Karet | Rubber 2.298Ha

Lampung HIM

Lokasi | Location : Tulang Bawang Luas Lahan | Field Area :

• Karet | Rubber 3.529Ha

DOWNSTREAM

Sumut 1| North Sumatra 1 BSP

Lokasi | Location : Asah an Luas Lahan | Field Area :

• Sawit | Palm 9.897Ha • Karet | Rubber 10.858Ha

Jambi 1 AGW/AM M

Lokasi | Location :

• AGW/AMM Tanjung Jabung Barat Luas Lahan | Field Area :

• Sawit | Palm 4.418Ha • Plasm a Sawit | Palm Plasm a 7.701Ha

Jambi 2 SNP

Lokasi | Location :

• SNP Muaro Jam bi Luas Lahan | Field Area :

• Sawit | Palm 7.039Ha

Kalsel| South Kalimantan M IB

Lokasi | Location : Banjar Baru Luas Lahan | Field Area :

• Sawit | Palm 6.054Ha

EM AL, JAW *

Luas Lahan | Field Area :

AIRPL

GFII ARBV

Solegna

AI

100,00% 100,00% 75,00% 100,00%

25,00%

BSPF BPP AM M SNP GLP ASD BRBE

M IB CCI Fordway AM

BSPN

HIM AGW BSPL

Bookwise

NAM

DAIP FSC SIP DSIP

SM AP DAP

99,60%

0,40%

BSEP

IKP

85,00%

JOP

M M R

95,31%

M M L

62,50%

4,69% 37,50%

M M M PBJ TSP PP EM AL JAW

99,99% 99,99% 99,99% 95,00% 99,99% 99,99% 99,95% 99,99% 100,00%

99,99% 99,99% 13,15% 100,00% 99,88% 99,99% 99,94% 99,99% 100,00%

100,00% 96,55% 100,00% 99,76% 99,93% 85,00% 99,99% 99,99% 100,00% 50,00% 70,00% 100,00% 99,99%

BSP

STRUKTUR USAHA

Business Structure

Tahun Operasi

Ko m ersia l Persentase Kep em ilikan Year of Percentage of Ownership

Entitas anak Lo kasi Kegiatan Usaha Utam a Co m m ercial 2015 2014

Su b sid iaries Do m icile Princip al Activities Op erat io n (%) (%)

Kepemilikan saham secara langsung | Direct Ow nership

Agri International Resources Pte. Ltd. Singapura Perusahaan investasi 2007 100,00 100,00 (AIRPL) Singapore Investment company

Agri Resources B.V. (ARBV) Belanda Perusahaan investasi 2007 25,00 25,00

Netherlands Investment company

BSP Finance B.V. (BSPF) Belanda Jasa keuangan 2006 100,00 100,00

Netherlands Financial services

PT Agro M itra M adani (AM M ) Jambi Pengolahan minyak kelapa saw it 2004 85,00 85,00

Oil palm processing

PT Agrow iyana (AGW) Jambi Perkebunan kelapa saw it 1998 99,93 99,93

Oil palm plantations

PT Bakrie Pasaman Plantations (BPP) Sumatera Barat Perkebunan kelapa saw it 1998 99,76 99,76

West Sumatra dan pengolahan minyak kelapa saw it

Oil palm plantations and processing

PT Bakrie Rekin Bio Energy (BRBE) Batam Produksi Bio-diesel - 70,00 70,00

Bio-diesel production

PT Grahadura Leidongprima (GLP) Sumatera Utara Perkebunan dan pengolahan 2000 99,99 99,99

North Sumatra kelapa saw it

Oil palm plantations and processing

PT Huma Indah M ekar (HIM ) Lampung Perkebunan dan pengolahan karet 1992 96,55 96,55

Rubber plantations and processing

PT Nibung Arthamulia (NAM ) Palembang Pengolahan dan perdagangan hasil 2002 99,99 99,99 perkebunan karet

Processing and trading of rubber plantations crop

PT Sumbertama Nusapertiw i (SNP) Jambi Perkebunan dan pengolahan 2005 99,99 99,99 kelapa saw it

Oil palm plantations and processing

BSP Netherlands Finance B.V. (BSPN) Belanda Perusahaan investasi 2010 100,00 100,00

Netherlands Investment company

BSP Liberia B.V. (BSPL) Belanda Perusahaan investasi - 100,00 100,00

Netherlands Investment company

PT ASD-Bakrie Oil Palm Seed Indonesia Sumatera Utara Produksi, pemrosesan, distribusi 2011 50,00 50,00

North Sumatra dan penjualan benih

Production, processing, distribution and sale of seeds

Kepemilikan saham secara tidak langsung | Indirect Ow nership

M elalui Agri International Resources Pte. Ltd. ||||| through Agri International Resources Pte. Ltd.

Agri Resources B.V. (ARBV) Belanda Perusahaan investasi 2007 75,00 75,00

Netherlands Investment company

Agri International Finance B.V. (AI) Belanda Jasa keuangan 2007 100,00 100,00

Netherlands Financial services

M elalui PT Nibung Arthamulia ||||| through PT Nibung Arthamulia

Bookwise Investment Ltd. (Bookwise) Kep. Virgin Britania Raya Jasa keuangan 2009 100,00 100,00

British Virgin Islands Financial services

PT Domas Saw itinti Perdana (DSIP) Sumatera Utara Pengolahan minyak inti saw it - 99,99 99,99

North Sumatra Palm kernel oil processing

PT Flora Saw ita Chemindo (FSC) Sumatera Utara Pengolahan fatty acid 2008 99,99 99,99

North Sumatra Fatty Acid manufacturing

PT Sarana Industama Perkasa (SIP) Sumatera Utara Pengelolaan kaw asan industri - 99,94 99,94

North Sumatra Industrial estate management

PT Domas Agrointi Perkasa (DAIP) Sumatera Utara Pengolahan olein - 99,88 99,88

North Sumatra Olein processing

PT Domas Agrointi Prima (DAP) Sumatera Utara Produksi fatty alcohol 2011 100,00 100,00

Tahun Operasi

Ko m ersia l Persentase Kep em ilikan Year of Percentage of Ownership

Entitas Anak Lo kasi Kegiatan Usaha Utam a Co m m ercial 2015 2014

Su b sid iaries Do m icile Princip al Activities Op eratio n (%) (%)

Notes:

(-) Belum beroperasi ||||| Non-operating

Kepemilikan saham secara tidak langsung | Indirect Ow nership M elalui PT Domas Agrointi Prima ||||| through PT Domas Agrointi Prima

PT Saw itmas Agro Perkasa (SM AP) Sumatera Utara Industri oleokimia - 99,60 99,60

North Sumatra Processing industry oleochemical

M elalui PT Grahadura Leidongprima ||||| through PT Grahadura Leidongprima

Fordways Management Ltd. (Fordway) Kep. Virgin Britania Raya Jasa keuangan 2009 100,00 100,00

British Virgin Islands Financial services

PT Citalaras Cipta Indonesia (CCI) Sumatera Barat Perkebunan kelapa saw it 2010 99,99 99,99

West Sumatra Oil palm plantations

PT M onrad Intan Barakat (M IB) Kalimantan Selatan Perkebunan kelapa saw it - 99,95 99,95

South Kalimantan Oil palm plantations

PT Julang Oca Permana (JOP) Bengkulu Perkebunan karet 2004 99,99 99,99

Rubber plantations

M elalui PT Julang Oca Permana ||||| through PT Julang Oca Permana

PT Inti Kemitraan Perdana (IKP) Bengkulu Perkebunan karet - 85,00 85,00

Rubber plantations

M elalui Agri Resources B.V. ||||| through Agri Resources B.V.

Great Four International M auritius Perusahaan investasi 2000 100,00 100,00 Investments Co. Ltd. (GFII) Investment company

Solegna B.V. (Solegna) Belanda Perusahaan investasi 2006 100,00 100,00

The Netherlands Investment company

M elalui Great Four International Investment Co. Ltd. ||||| through Great Four International Investment Co. Ltd.

PT Eramitra Agrolestari (EM AL) Jambi Perkebunan kelapa saw it 1997 99,99 99,99

Oil palm plantations

PT Jambi Agrow ijaya (JAW) Jambi Perkebunan kelapa saw it 1999 99,99 99,99

Oil palm plantations

M elalui Solegna B.V. ||||| through Solegna B.V.

PT M ultrada M ulti M aju (M M M ) Sumatera Selatan Perkebunan kelapa saw it 1997 99,99 99,99

South Sumatra Oil palm plantations

PT Padang Bolak Jaya (PBJ) Sumatera Selatan Perkebunan kelapa saw it 1998 99,99 99,99

South Sumatra Oil palm plantations

PT Perjapin Prima (PP) Sumatera Selatan Perkebunan kelapa saw it 1997 95,00 95,00

South Sumatra Oil palm plantations

PT Trimitra Sumberperkasa (TSP) Sumatera Selatan Perkebunan kelapa saw it 2000 99,99 99,99

South Sumatra Oil palm plantations

M elalui PT Huma Indah M ekar ||||| through PT Huma Indah M ekar

PT Air M uring (AM ) Bengkulu Perkebunan dan pengolahan karet 1998 99,99 99,99

SAMBUTAN DEWAN KOMISARIS

Message from the BOC

Soedjai Kartasasmita

Kom isaris Utam a & Kom isaris Independen

Pem egang Saham Yang Terhorm at

Ba g i in d u st ri p e rke b u n a n , t a h u n 2 0 1 5 m e ru p a ka n t a h u n ya n g d ilip u t i b erb a g a i t a n t a n g a n b esa r ya n g b elum p ernah d ialam i seb elum nya sep anjang sejarah industri ini. Merupakan kondisi yang serba sulit, nam un kita patut bersyukur dengan adanya dukungan tenaga kerja yang berdedikasi serta sum ber daya m anusia yang kom peten dan inovatif guna m endapatkan solusi atas berbagai ham batan yang dihadapi di bidang finansial serta di lapangan.

Terdapat em pat hal yang m enjadi tantangan utam a di t a h u n 2 0 1 5 . Pe rt a m a , m e la m b a t n ya p e rt u m b u h a n ekonom i d unia; ked ua, kem arau yang leb ih p anjang yan g d iseb ab kan o leh efek El Nin o yan g leb ih b erat d ib and ing kan d i m asa lam p au; ketig a, jatuhnya nilai Rupiah; serta keem pat, tren penurunan harga m inyak b um i. Pad a kenyataannya, keem p at tantang an b esar yang terjad i d alam satu m asa sep erti d i tahun 2015

Dear Sharehold ers,

The year 2015 was for the plantation industry a year full of m ajor challeng es never exp erienced b efore in the ind ustry’s history. It was a really d ifficult situation, but thanks to the highly dedicated workforce supported by com petent and innovative personnel, solutions could b e found for p rob lem s arising in the financial sector and in the fields as well.

There w ere four m ajor challeng es in 2015. First, the slowing down of the world’s econom y; second, a longer drought caused by El Nino m ore severe this tim e than in the past; third, the decrease of the value of Rupiah; and fourth, the downward trend of the price of crude o il. As a m a t t e r o f fa ct , t h e fo u r b ig ch a lle n g e s appearing in the sam e year like in 2015 have never been experienced before in the plantation industry’s history.

Kita patut bersyukur dengan adanya dukungan

tenaga kerja yang berdedikasi serta sumber daya

manusia yang kompeten dan inovatif guna

mendapatkan solusi atas berbagai hambatan yang

dihadapi di bidang finansial serta di lapangan

The slow ing d ow n of the w orld ’s econom ic g row th, particularly in China and India, two largest im porting co u n t rie s fo r p la n t a t io n p ro d u ct s, h a ve le d t o a d rastically d ecreasing d em and which resulted in over supply of palm products, which eventually caused the decrease of CPO prices down to the lowest level in the la st five ye a rs, i.e . USD 5 0 3 .1 6 p e r m e t ric t o n b y Novem b er 2015.

The extrem ely dry clim ate throughout the year caused by El Nino w as another m ajor p rod uction constraint for the p lantation ind ustry in 2015, and further led to the decrease in production levels in the first quarter of 2016.

In term s of Indonesia’s dom estic econom ic condition, the decline of Rupiah to US Dollar exchange rate did not only triggered the rise of production costs, but also fostered great financial burdens for Your Com pany.

The sharp decrease of world oil prices down to the level lo w e r t h a n USD 5 0 p e r b a rre l h a d sig n ifica n t ly contributed to the decrease of CPO prices, pertaining to the positive correlation between the prices of those co m m o d it ies.

Performance of the Board of Directors

We are grateful that Your Com pany was able to cope with the uneasy challenges throughout the year 2015, ensuring current and future business sustainability. We see that the Board of Directors and Your Com p any’s em ployees had done their utm ost for the best interest of Your Com pany. Your Com pany’s Board of Directors also ensured com pliance to environm ental regulations, a s sh o w n b y t h e co m p le t io n o f RSPO a n d ISPO ce rt ifica t io n s in a n u m b e r o f e st a t e s w it h in Yo u r Co m p an y o p eratio n al areas. Hen ce, Yo u r Co m p an y’s reputation was not tarnished by incidents jeopardizing the Indonesian palm industry, such as forest and peat soil fires in various areas in Sum atra and Kalim antan.

Pertaining to the decrease of palm and rubber prices and the slow econom ic g row th in various countries, the Board of Directors took the right poisition to rem ain

Perlam b atan p ertum b uhan ekonom i d unia, terutam a yang dialam i China dan India, dua negara pengim por t e rb e s a r h a s il p e rke b u n a n , t e la h m e n ye b a b ka n p e n u ru n a n p e rm in t a a n ya n g cu ku p d ra st is ya n g m engakibatkan penum pukan persediaan produk sawit, yang pada akhirnya berdam pak pada penurunan harga CPO sam pai pada titik terendah dalam 5 tahun terakhir ini, yaitu m encap ai USD 503,16 p er m etrik ton p ad a Novem b er 2015.

Iklim kem arau p anjang yang terjad i sep anjang tahun akibat El Nino, m erupakan ham batan lain bagi produksi in d u s t ri p e rke b u n a n p a d a t a h u n 2 0 1 5 , s e rt a berdam pak pada rendahnya produksi kuartal pertam a tahun 2016.

Sem entara dari sisi kondisi perekonom ian dalam negeri Indonesia, jatuhnya nilai tukar Rupiah atas m ata uang Do la r Am e rika se la in m e m icu p e n in g ka t a n b ia ya p rod uksi, juga m em b erikan d am p ak yang b esar b agi beban keuangan Perusahaan Anda.

Pen u ru n a n t a ja m h a rg a m in ya k b u m i d u n ia sa m p a i p ad a titik yang leb ih rend ah d ari USD 50 p er b arrel, t u ru t m e m b e rika n ko n t rib u si ya n g sig n ifika n p a d a penurunan harga m inyak sawit, terkait adanya korelasi positif di antara harga kedua kom oditi tersebut.

Kinerja Direksi

Rasa syukur kam i atas kem am puan Perusahaan Anda u n t u k m e n g h a d a p i t a n t a n g a n ya n g t id a k m u d a h sep a n ja n g t a h u n 2015 d em i m en ja g a keb erla n ju t a n usahanya saat ini dan di m asa m endatang. Kam i m enilai b ah w a Direksi d an p ara karyaw an Peru sah aan An d a telah m em berikan upaya terbaiknya dem i kepentingan Perusahaan Anda. Direksi Perusahaan Anda tetap patuh p ad a kaid ah-kaid ah lingkungan d engan d ip erolehnya sertifikasi RSPO d an ISPO p ad a sejum lah p erkeb unan d i lin g ku n g a n Pe ru sa h a a n An d a . De n g a n d e m ikia n n a m a b a ik Pe ru sa h a a n An d a t id a k t e rce m a r o le h kejadian-kejadian yang dapat m erusak reputasi industri kelap a saw it In d o n esia sep erti keb akaran h u tan d an lahan gam b ut d i b erb agai kawasan d i Sum atera d an Kalim an t an .

cautious and alert towards possible new developm ents which could offer opportunities apart from challenges.

The efforts to increase purchases of fresh fruit bunches (FFB) from palm farm ers as well as latex from rubber farm ers were part of the strategic breakthroughs in Your Com pany’s efforts to cope with production lim itations. The results have b een p ositive for Your Com p any, in b o t h so cial an d fin an cial t erm s, as can b e o b served through the contribution to Your Com pany significant gross incom e and gross profit in 2015.

An o t h e r b re a kt h ro u g h co n d u ct e d b y t h e Bo a rd o f Dire ct o rs h a d b e e n t h e a t t e m p t t o a cce le ra t e t h e certification for the 4 new prem ium palm varieties (DxP Sp rin g , DxP Th em b a , DxP CR Su p rem e a n d DxP CR Ova n e ) p ro d u ce d b y t h e se e d g a rd e n o f t h e jo in t venture com pany ASD-BSP JV. Co. in Kisaran. Th ose new varieties are superior in various aspects: short im m ature period – 2 (two) years instead of 3 (three) years – and p otentially high p rod uctivity levels. It is good for the reputation of Your Com pany that those 4 varieties have been approved by the Governm ent for application in n e w p la n t in g o r re p la n t in g p ro g ra m m e s. It is t h e intention of Your Com pany that those 4 varieties will be offered for sale to oil palm sm allholders as well as to m id-size and big com panies.

Th e va st ra n g e o f b rea kt h ro u g h s co n d u ct ed b y t h e Board of Directors, including the efforts for effectiveness a n d efficien cy en h a n cem en t in t h e p la n t a t io n s a n d p ro ce ssin g p la n t s, a s w e ll a s t h e fo cu s o n h u m a n resources com petency developm ent, have helped Your

m enghadapi segala kem ungkinan perkem bangan baru ya n g d a p a t m e m b a w a p e lu a n g d ib a lik b e rb a g a i tantangan yang dihadapi.

Up a ya m en in g ka t ka n p em b elia n t a n d a n b u a h seg a r (TBS) dari petani sawit m aupun lateks dari petani karet m e ru p a ka n b a g ia n d a ri t e ro b o sa n st ra t e g is d a la m upaya Perusahaan Anda untuk m engatasi keterbatasan p rod uksi. Hal ini telah m em b erikan hasil p ositif b ag i Perusahaan Anda, baik sosial m aupun finansial, seperti dapat dilihat dari kontribusinya pada pendapatan dan laba kotor Perusahaan Anda yang cukup signifikan di tahun 2015.

Pa d a b id a n g la in , t ero b o sa n ya n g d ila ku ka n Direksi adalah upaya m em percepat perolehan sertifikasi untuk 4 varietas kelapa sawit baru (DxP Spring, DxP Them ba, DxP CR Sup rem e d an DxP CR Ovane) yang d ihasilkan oleh kebun bibit m ilik usaha patungan ASD-BSP JV. Co. di Kisaran. Em pat varietas baru ini m em iliki kelebihan d a la m b eb era p a a sp ek: u sia t a n a m a n m en g h a silka n yang relatif m uda - 2 (dua) tahun dari sebelum nya 3 (tiga) tahun – d an p otensi tingkat p rod uktivitas yang tinggi. Merupakan reputasi yang baik bagi Perusahaan And a b ahw a keem p at varietas b ib it ung g ul ini telah m em peroleh persetujuan Pem erintah untuk penerapan d a la m p ro g ra m p e n a n a m a n b a ru d a n rep lant ing. Perusahaan Anda m enargetkan 4 varietas baru ini untuk p e n ju a la n b a g i p e rke b u n a n ra kya t u m u m m a u p u n perusahaan perkebunan skala m enengah dan besar.

Berb agai terob osan yang d ilakukan Direksi, term asuk u p a ya p e n in g ka t a n e fe kt ivit a s d a n e fis ie n s i d i perkebunan dan pabrik pengolahan, serta fokus pada u p a ya p e n g e m b a n g a n ko m p e t e n si su m b e r d a ya m a n u sia , m em b u a t kin erja o p era sio n a l Peru sa h a a n

Terobosan lain yang dilakukan Direksi adalah upaya

mempercepat perolehan sertifikasi untuk 4 varietas

kelapa sawit baru - DxP Spring, DxP Themba, DxP CR

Supreme dan DxP CR Ovane.

Com pany to show operational perform ance which are not too far from the expectation, am idst the intensity of the current challenges. Nevertheless, a num ber of constraints in 2015 have also hind ered the Board of Directors’ efforts to m anifest the revitalization of the Oleochem icals seg m ent.

Another im p ortant achievem ent was an outstand ing perform ance in the developm ent of social relations with lo ca l co m m u n it ies, b o t h in t h e en viro n m en t a l a n d ed u ca t io n a l sect o rs, w h ich even t u a lly b en efit s b o t h p a rt ie s . Th is ca n b e s e e n b y Yo u r Co m p a n y accom plishm ent in 2015 to receive the CSR Award 2014 in 3 p ro g ram cat eg o ries, n am ely t h e en viro n m en t al m an ag em en t act ivit ies in Jam b i Un it , t h e Ad iw iyat a school program with environm entally-based curriculum in Su m b a r Un it , a n d t h e e m p lo ye e co o p e ra t ive s program in Jakarta Unit.

Changes in the Board of Commissioners Yo u r Co m p an y An n u al GMS h eld o n Ju n e 25, 2015 ap p o in t ed Ad ika Nu rag a Bakrie as Co m m issio n er t o replace Eddy Soeparno who resigned in 2015 due to an external assignm ent.

As such, b ased on the d ecision of the Annual GMS, Yo u r Co m p a n y Bo a rd o f Co m m issio n e rs re m a in s m anned by 6 (six) Com m issioners, including 3 (three) Independent Com m issioners, as follows:

Soedjai Kartasasm ita, Independent Com m issioner and Presid ent Com m issioner

Bobby Gafur S. Um ar, Com m isioner and Vice President Co m m issio n er

Bungaran Saragih, Ind ep end ent Com m issioner Anton Ap riyantono, Ind ep end ent Com m issioner Anindya Novyan Bakrie, Com m issioner

Adika Nuraga Bakrie, Com m issioner

Performance of the Supporting Committees In perform ing the task and responsibilities in 2015, Your Com pany Board of Com m issioners had been supported b y t h e Au d it Co m m it t e e w h ich e n s u re d t h e effectiveness of the internal control system (includ ing t h e p re p a ra t io n s fo r t h e im p le m e n t a t io n o f t h e En t e r p r is e Re s o u r ce Pr o g r a m ) a s w e ll a s t h e effectiveness of the internal and external auditors’ task p e rfo rm a n ce ; t h e No m in a t io n a n d Re m u n e ra t io n Co m m it t ee w h ich m o n it o red t h e d evelo p m en t a n d

Anda tidak terlalu jauh dari harapan, di tengah besarnya t a n t a n g a n ya n g d ih a d a p i. Wa la u d ia ku i, b e rb a g a i h a m b a t a n ya n g t e rja d i p a d a t a h u n 2 0 1 5 ju g a m e n ye b a b ka n Dire ksi b e lu m d a p a t m e re a lisa sika n revitalisasi segm en Oleokim ia.

Hal p en tin g lain n ya ad alah kin erja yan g san g at b aik dalam pem binaan hubungan sosial dengan m asyarakat se t e m p a t , b a ik d a la m b id a n g lin g ku n g a n m a u p u n p e n d id ika n , ya n g p a d a a kh irn ya m e m b e rika n keu n t u n g a n b a g i ked u a b ela h p ih a k. Terb u kt i p a d a tahun 2015 Perusahan Anda m endapatkan CSR Award 2014 d alam 3 kateg o ri p ro g ram n ya, yaitu keg iatan pengelolaan lingkungan di Unit Jam bi, layanan sekolah berbasis lingkungan (Adiwiyata) di Unit Sum bar, serta program koperasi karyawan di Unit Jakarta.

Perubahan Susunan Komisaris

RUPS Tahunan Perusahaan Anda yang diadakan pada tanggal 25 Juni 2015 m enyetujui pengangkatan Adika Nuraga Bakrie sebagai Kom isaris untuk m enggantikan Ed d y So ep a rn o ya n g t ela h m en g u n d u rka n d iri p a d a t a h u n 2 0 1 5 t e r ka it d e n g a n p e n u g a s a n d i lu a r Perusahaan And a.

De n g a n d e m ikia n , b e rd a sa rka n ke p u t u sa n RUPS Ta h u n a n t erseb u t , Peru sa h a a n An d a t et a p m em iliki 6 (e n a m ) Ko m isa ris, t e rm a su k 3 (t ig a ) Ko m isa ris Independen, dengan susunan sebagai berikut: So e d ja i Ka rt a sa sm it a , Ko m isa ris In d e p e n d e n d a n Kom isaris Utam a

Bob b y Gafur S. Um ar, Kom isaris d an Wakil Kom isaris Ut a m a

Bungaran Saragih, Kom isaris Independen Anton Apriyantono, Kom isaris Independen Anindya Novyan Bakrie, Kom isaris

Adika Nuraga Bakrie, Kom isaris

Kinerja Komite Pendukung Dew an Komisaris

Atas nam a Dewan Kom isaris

On behalf of the Board of Com m issioners

Soedjai Kartasasmita

Kom isaris Utam a & Kom isaris Independen

President Com m issioner & Independent Com m issioner

sam pai proses pem antauan); Kom ite Manajem en Risiko yang telah m em astikan terlaksananya penerapan sistem

Ent erprise Risk M anagement; Ko m it e In vest a si ya n g t ela h m ela ksa n a ka n p en g a w a sa n a t a s im p lem en t a si keb ija ka n , st ra t eg i d a n p ro g ra m in vest a si fin a n sia l, terutam a terkait perlunya restrukturisasi keuangan serta u p a ya m e m b a n g u n h u b u n g a n d e n g a n m it ra ke rja p o t e n sia l u n t u k se g m e n Ole o kim ia ; se rt a Ko m it e Ling kung an & Hub ung an Sosial yang telah b erp eran penting dalam m elaksanakan upaya untuk m em perkuat jaring an kom unikasi sosial yang telah ad a, terutam a terkait dengan kondisi yang penuh gejolak (ekonom i, sosial dan lingkungan) di tahun 2015.

Apresiasi

Dalam kesem patan ini, Dewan Kom isaris m engucapkan t erim a ka sih a t a s d u ku n g a n d a n kep erca ya a n ya n g tinggi yang diberikan oleh para pem egang saham dan pem angku kepentingan, sehingga Direksi dapat bekerja d e n g a n b a ik d a la m m e n g h a d a p i t a n t a n g a n ya n g d ih a d a p i d i t a h u n 2 0 1 5 . De w a n Ko m isa ris ju g a m en ya m p a ika n t erim a ka sih kep a d a Ed d y So ep a rn o untuk seg ala kontrib usi yang telah d ib erikan selam a m enjabat sebagai Kom isaris Perusahaan Anda sam pai tahun 2015.

Akh ir ka t a , De w a n Ko m isa ris ju g a m e n ya m p a ika n a p r e s ia s i ya n g t in g g i ke p a d a Dir e ks i a t a s ke p e m im p in a n n ya ; ju g a ke p a d a se lu ru h st a f d a n karyawan, serta tenaga kerja di perkebunan, atas segala kerja kerasnya dalam upaya peningkatan efisiensi dan e fe kt ivit a s d e m i m e n ja g a ke b e rla n ju t a n u s a h a p eru sa h a a n .

im p le m e n t a t io n o f re la t e d syst e m s (in clu d in g t h e co m p e t e n cy crit e ria fo rm u la t io n p ro ce ss u p t o t h e m onitoring process); the Risk Managem ent Com m ittee w hich ensured the ap p lication of the Enterp rise Risk Managem ent system ; the Investm ent Com m ittee which m o n it o red t h e im p lem en t a t io n o f fin a n cia l p o licies, strategies and investm ent program s, particularly with regard s to the need for financial restructuring as well as efforts to estab lish relations with p otential b usiness partners in the Oleochem icals segm ent; as well as the En viro n m en t a n d So cia l Rela t io n s Co m m it t ee w h ich p la ye d im p o rt a n t ro le s in st re n g t h e n in g t h e so cia l co m m u n ica t io n n e t w o rk, e sp e cia lly in re g a rd s o f u n ce r t a in co n d it io n s (e co n o m ic, s o cia l a n d environm ental) in 2015.

Appreciation

In conclusion, the Board of Com m issioners extend their gratitude for the support and trust of the shareholders and stakeholders, which m ade it possible for the Board o f Dire ct o rs t o p e rfo rm w e ll in co p in g w it h t h e challenges in 2015. The Board of Com m issioners also wish to express their warm gratitude to Eddy Soeparno for all contrib utions d uring his term of office as Your Com pany Com m issioner until 2015.

LAPORAN DIREKSI

Report of the Board of Directors

Para Pem angku Kepentingan yang kam i horm ati,

Tahun 2015 m erupakan tahun yang penuh tantangan b ag i in d u st ri p erkeb u n an saw it d an karet , t eru t am a karen a b eb erap a fakt o r ekst ern al yan g t erjad i d ilu ar ke n d a li. Iklim ya n g ku ra n g b e rsa h a b a t m e ru p a ka n fa kt o r ya n g p a lin g d o m in a n d i t a h u n 2015. Ha l in i terkait dengan adanya fenom ena El Nino yang m em icu t erja d in ya m u sim kem a ra u b erkep a n ja n g a n h in g g a m engakibatkan penurunan tingkat produktivitas yang cukup signifikan terhadap industri perkebunan kelapa sawit sekitar 20%. Penurunan tingkat produktivitas ini m akin diperlem ah lagi dengan adanya kebakaran hutan d an lah an d alam skala yan g cu ku p lu as d i b erb ag ai wilayah Sum atera dan Kalim antan. Tebalnya kabut asap dalam kurun waktu yang panjang telah m engganggu p roses p enyerb ukan b unga tanam an hingga sem akin m e m p e rle m a h t in g ka t p ro d u kt ivit a s in d u s t ri perkebunan sawit term asuk Perusahaan Anda. Alhasil, p a so ka n m in ya k sa w it d a ri In d o n esia d a n Ma la ysia d ip e rkira ka n a ka n le b ih re n d a h d i t a h u n 2 0 1 6 d ib and ingkan tahun seb elum nya.

Faktor eksternal lain adalah m elem ahnya pertum buhan eko n o m i g lo b a l seb a g a i a kib a t p erla m b a t a n t in g ka t p ert u m b u h a n eko n o m i Ch in a ya n g h a n ya m en ca p a i 6 ,9 % d i t a h u n 2 0 1 5 . Akib a t p e le m a h a n e ko n o m i

Dear Stakehold ers,

The year 2015 was a year full of challenges for palm and rubber plantations industry, particularly due to a n u m b e r o f u n co n t ro lla b le e xt e rn a l fa ct o rs. No n -supportive clim ate had been the m ost dom inant factor in 2015. This was related to the El Nino effects which led t o a p ro lo n g ed d ry sea so n ca u sin g a sig n ifica n t decrease in the productivity level, down by around 20%. The decreasing productivity level was futher weakened b y the occurrence of forest and land fires at a relatively large scale in various areas in Sum atra and Kalim antan. The presence of thick haze during a lengthy tim e span h ave cau sed d ist u rb an ces fo r t h e p o llen at io n o f t h e trees, lowering further the productivity level of the palm p la n t a t io n s in d u s t ry, in clu d in g Yo u r Co m p a n y. Subsequently, the palm oil supply from Indonesia and Malaysia is projected to be lower in 2016 com pared to the previous year.

Another external factor was the weakening of the global eco n o m y a ffect ed b y t h e slo w in g d o w n o f Ch in a ’s eco n o m ic g ro w t h ra t e w h ich o n ly rea ch ed 6.9% in 2015. Du e t o t h e w ea ken in g o f t h e w o rld ’s seco n d

Dengan kesungguhan dan kerja keras seluruh

karyawan, walaupun dihadapkan pada berbagai

tantangan, pada tahun 2015 Perusahaan Anda

berhasil mempertahankan volume produksi sawit dan

karet dari perkebunan inti sesuai rencana kerja

com m od ities includ ing p alm and rub b er exp erienced sharp decreases. In addition to the lower dem and for palm and rubber com m odities, the plunging of world oil prices in 2015 also put further pressures on prices o f in d u st ria l co m m o d iit ies b a sed o n o t h er n a t u ra l-resources, such as palm and rubber, down to the lowest level. The low price of oil in 2015 affected the dem and fo r CPO a s se ve ra l Eu ro p e a n , Am e rica n a n d Asia n countries w hich have used veg etab le oil fuel for the autom otive industry sector during the past few years, have begun to return to the consum ption of fossil fuel w hich is currently m uch cheap er. A sim ilar case also hap p ens for the rub b er ind ustry, where the d ecrease of oil prices are projected to boost the production of oil-b ased synthetic rub b er.

Me a n w h ile , t h e d e va lu a t io n o f t h e Ch in e se Yu a n currency had been considered to lead to uncertainties for the global financial sector, sparking the attem pt of the banking sector to retighten their policies. This had also ind irectly affected the reactivation p rocess of Your Com p any’s Oleochem icals segm ent.

Ne ve rt h e le ss, w e co n sid e r e ve ry ch a lle n g e a s a n opportunity for self-im provem ent to ensure sustainable b u sin e ss g ro w t h . We b e lie ve t h a t t h e su p p ly a n d d e m a n d o f w o rld co m m o d it ie s in clu d in g CPO a n d ru b b er w ill so o n fin d a n ew eq u ilib riu m w h ich w ill eventually accelerate the rebound of CPO and rubber p rices to higher levels. An im p roved world econom ic st a b ilit y in t h e co m in g ye a rs is e xp e ct e d t o h e lp accelerate this process.

Therefore in dealing with the various external challenges w e co n t in u e t o fo cu s o n t h e o p t im iza t io n o f t h e u t iliza t io n o f o u r reso u rces, p a rt icu la rly in p rem iu m p a lm s e e d s d e ve lo p m e n t a n d s o cia l re la t io n s im p ro ve m e n t . Wit h t h e co n ce rt e d e ffo rt s o f a ll em ployees, Your Com pany had been able to m aintain the hom egrown palm and rubber production volum e w ithin the w ork p lan; w hile the 23.33% d ecrease in net sales over the previous year was due to the effects of the decrease in com m odity prices and the decrease in third-party purchases.

Your Com pany values the im portance of strengthening social relations, p articularly in a p eriod like this where the vast range of external challenges to the econom ic ko m o d it i d u n ia t e rm a su k sa w it d a n ka re t m e ro so t

cukup tajam . Selain pelem ahan perm intaan kom oditas sawit dan karet ini, penurunan harga m inyak dunia yang t a ja m d i t a h u n 2 0 1 5 ju g a t u ru t m e n e ka n h a rg a kom oditas industri berbasis sum ber daya alam lainnya, sep erti saw it d an karet, hing g a ke ting kat terend ah. Re n d a h n ya h a rg a m in ya k b u m i d i t a h u n 2 0 1 5 m e m p e n g a ru h i p o la p e rm in t a a n a ka n CPO d a ri sejum lah negara Eropa, Am erika dan Asia yang dalam beberapa tahun terakhir banyak m enggunakan bahan bakar nabati untuk kebutuhan sektor industri otom otif, kin i m u la i kem b a li m en g a lih ka n ko n su m si ke b a h a n b akar b erb asis m inyak b um i yang jauh leb ih m urah. Hal yang sam a juga terjadi pada industri karet, di m ana turunnya harga m inyak diperkirakan akan m endorong produksi karet sintetis yang berbasis m inyak bum i.

Di sisi lain, devaluasi m ata uang Yuan China dipandang m em iliki dam pak terhadap ketidakpastian bagi sektor keuangan gloabl, sehingga m em icu sektor perbankan u n t u k m e m p e rke t a t ke b ija ka n n ya ke m b a li. Ha l in i se ca ra t id a k la n g su n g ju g a b e rp e n g a ru h t e rh a d a p proses reaktivasi segm en Oleokim ia Perusahaan Anda.

Na m u n d e m ikia n b a g i ka m i s e t ia p t a n t a n g a n m erupakan peluang untuk terus m em benahi diri untuk m em elihara p ertum b uhan usaha yang b erkelanjutan. Kam i m eyakini b ahw a p asokan d an p erm intaan atas kom oditas dunia term asuk CPO dan karet akan segera m enem ukan titik keseim bangan baru yang ada akhirnya akan m endorong percepatan pem ulihan harga CPO dan karet ke tingkat yang lebih tinggi. Stabilitas ekonom i dunia yang lebih baik di tahun m endatang diharapkan dapat m em percepat realisasi proses ini.

Oleh karen an ya kam i m en yikap i b erb ag ai tan tan g an p rod uksi sawit d an karet d ari p erkeb unan inti sesuai rencana kerja; sem entara p enurunan p enjualan neto se b e sa r 2 3 ,3 3 % d ib a n d in g ka n t a h u n se b e lu m n ya t e rja d i ka re n a p e n g a ru h o le h p e n u ru n a n h a rg a kom oditi dan penurunan volum e pem belian dari pihak ket ig a.

conditions in general m ight have the potentials to spark s o cia l co n flict s . Re g a r d in g t h e co m m u n it y e m p o w e rm e n t e ffo rt s , in 2 0 1 5 Yo u r Co m p a n y continued to to provide full attention to econom ic and educational enhancem ent for the local societies within t h e co rp o ra t e o p era t io n a l a rea s, a s a fo rm o f Yo u r Com pany’s awareness of the needs of the stakeholders.

Strategic Policies

In consid eration of the challenging external factors in 2015, Your Com pany m anagem ent applied a num ber of strategic m oves, covering short-term , m id d le-term and long-term plans. Am ong these strategic m oves are r e vit a liza t io n o f fin a n cia l s t r u ct u r e t h r o u g h com m unications and negotiations with creditors; while o n n o n -fin a n cia l sid e , Yo u r Co m p a n y fo cu se d t h e attention to hum an resources through the com petency developm ent program s, in both technical and soft skills

A st ra t eg ic o p era t io n a l m o ve co n d u ct ed b y Yo u r Co m p a n y is t o

carefully set a production volum e target for each production m ill.

perekonom ian secara um um berpotensi m em icu konfliksosial. Terkait pem berdayaan m asyarakat, selam a tahun 2015 Perusahaan And a tetap m em b erikan p erhatian p enuh p ad a keg iatan p erekonom ian d an p end id ikan u n t u k m a s ya r a ka t d i s e kit a r a r e a o p e r a s io n a l p e ru sa h a a n , se b a g a i sa la h sa t u b e n t u k ke p e d u lia n Perusahaan Anda bagi para pem angku kepentingan.

Kebijakan Strategis

Den g an m em p erh atikan fakto r-fakto r ekstern al yan g penuh tantangan di tahun 2015 tersebut, m anajem en Perusahaan Anda telah m enerapkan beberapa langkah-langkah strategis, baik rencana strategis jangka pendek, jangka m enengah m aupun jangka panjang. Langkah-la n g ka h st ra t e g is t e rse b u t d ia n t a ra n ya re vit a lisa si st ru kt u r ke u a n g a n d e n g a n m e la ku ka n se ra n g ka ia n ko m u n ika si d a n n e g o sia si d e n g a n p a ra kre d it u r; sed ang kan d ari sisi non keuang an, Perusahaan And a

Langkah strategis operasional yang dilakukan

Perusahaan Anda adalah menetapkan target

volume produksi yang ingin dicapai dengan

cermat di setiap pabrik yang dimiliki

to enhance leadership capabilities, in order to develop future lead ers.

Pa lm t re e s p la n t e d o n a 4 5 ,8 6 7 Ha o f la n d h a ve co n t r ib u t e d s a le s t h r e e t im e s la r g e r t h a n t h e co n t rib u t io n o f ru b b e r sa le s w it h t h e ru b b e r t re e s planted on a 15,613 Ha of land. In consequences, the decrease in Your Com pany palm sales had significantly affected the EBITDA value. In consideration of this, a strategic operational m ove conducted by Your Com pany was to carefully set a production volum e target for each production plant. Maintenance of the plant m achinery a n d e q u ip m e n t is t h e re fo re d e e m e d o f u t m o s t im portance to ensure the sm ooth run of the production process, in addition to regular developm ent program s m e n it ik b e ra t ka n p e rh a t ia n n ya p a d a su m b e r d a ya

m a n u s ia ya n g d im ilikin ya d e n g a n m e n g a d a ka n program pengem bangan kom petensi, baik dalam segi t e kn is m a u p u n so f t sk i l l s u n t u k m e n in g ka t ka n ka p a b ilit a s ke p e m im p in a n , d e m i m e n cip t a ka n pem im pin m asa depan (future leader).