INTERNET BANKING USING INTENTION: A MODEL MODIFICATION BASED ON QUALITY AND RISK CHARACTERISTICS

Mujilan1 and

Sumiyana2

Abstract

This study modifies the Internet Banking (IB) Using Intention Model based on quality and risk. This study also gives the alternative model by dimension modification especially in the quality. The result of this study indicates the two types of quality impact to the intention. If we apply 11 dimensions of quality, there is a strong direct effect of the IB service quality to the intention. But if we apply the general perception of quality, the effect of IB service quality to the intention will be indirect via the mediating of user satisfactions. Risk has a low negative impact to the intention if the users recognize the IB service quality and satisfy which the services. It means that quality and satisfaction plays an important role to reduce perceived risk and build intention in the internet banking context. This modified model can be used to explain the characteristics of users in their perception of internet banking.

Keywords:internet banking, service quality, perceived risk, user

satisfaction, intention to use, internet users, quality dimensions, general perceived quality.

INTRODUCTION

The internet banking using has grown as a consequence of internet and technology

growth in the world. The success model of internet banking (IB) had the own

characteristics that difference in some way from others technology success models like

web portals or e-commerce (Bauer et al., 2005). Consequently, there is a need to develop

an internet banking success model to explain the IB characteristics.

Researchers still focused on internet banking quality (eq. Bauer et al., 2005; Ma et

al., 2011) and some studies focused on internet banking risk (eq. Wong et al., 2009;

Aslam et al., 2011). In their studied, Ma et al. (2011) suggested that the internet banking

service quality should be extended to how user’s perception of internet banking service

quality affected the satisfaction and intention behavioral. This study modifies the internet

banking model to extend Ma’s internet banking service quality and to integrate which

1

Mujilan is an education staff in Accounting Department, Faculty of Economics, Widya Mandala Madiun University; email: [email protected]

2

Sumiyana is accounting professor in Faculty of Economics and Business, Gadjah Mada

DeLone & McLean technology success model validated by Wang (2008). We also

investigate perceived risk on using internet banking (Aslam et al., 2011) to complete the

internet banking model.

To modify the model, we approach from the human’s rational judgment in the

decision making process. Two basic factors are considered as cost and benefit.

Consequently, the model will include this two factors called internet banking quality and

risk. Operationally, we use Internet Banking Service Quality (Ma et al. 2011) and

Perceived Risk (Aslam et al., 2011). The SEM by Amos 18 is applied to test the model.

This study focuses on integrating four factors to modify the model. The factors are

quality, satisfaction, risk, and intention. The path directions are investigated and

explained. We collect instrument to measure this four factors from some literatures and

simplify the item numbers to reduce the response bias. We hope this study will contribute

to the information system literature by support the intention of using internet banking

model and understanding of how the effect direction of each factors. Also, we hope to give

the simplified instrument related to the model.

This study is a general view of the internet banking model. A specific characteristic

(eq. respondents, IB providers) may need in the future study. The context of this study is

individual perception (not a company) and be done in the developing country. This study

has assumptions, first, the respondents use rational consideration in decision making to

use internet banking. Second, individuals use their IB to operate their saving account.

Third, this IB is used in developing country or in the early phase of internet using

(Gounaris and Dimitriadis, 2003). Forth, the distance from the user’s home to the

conventional banking office doesn’t affect the decision in using IB.

LITERATURE REVIEW

Internet Banking Service Quality

Service quality is become the great differentiator, the most powerful competitive

weapon most service organization possess (Berry et al., 1988; Jayawardhena, 2004).

Quality from customer’s view is conformance to specification (Berry et al., 1988). The

customer’s retention and interest is very depended on services quality delivered (Hamadi,

2010).

Quality has been viewed by Garvin (1987) as a product quality. In the information

systems there was service quality (SERVQUAL) which five dimensions (Parasuraman et

al., 1991; Kettiger & Lee, 1997). The context of service quality was used by Gounaris &

of e-banking. Jayawardhena (2004) studied in internet banking quality measurement.

Yaya et al. (2011) used E-S-QUAL (modification from SERVQUAL by Parasuraman et al.,

2005) to evaluate online banking.

Ma et al. (2011) tried to identify the internet banking quality dimensions from former

literatures. They used 11 quality dimensions. They applied the dimensions as variables in

the regression. The dimensions were: reliability, convenience, efficiency, comfort,

serviceability, security, privacy, assurance, reputation, product differentiation and

customization, and customer service.

Reliability: if it delivers the services as it’s promised (Ma et al., 2011). Reliability is

the ability to perform the desired service dependably, accurately, and consistently (Berry

et al., 1988; Parasuraman et al., 1985; McKinney et al., 2002; Kenova & Jonasson, 2006).

Convenience: if it enables customers to access banking at all times and places (Ma et

al., 2011). Wolfinbarger & Gilly (2001) used convenience in the context of saving time and

effort, including physical and mental effort.

Efficiency: Ma et al. (2011) used efficiency in the context of speed download and

response time. Efficiency also be used as the site is simple to use, structured properly,

requires minimum of information to be input by the customer (Kenova & Jonasson, 2006;

Parasuraman et al., 2005). Then, efficiency is described as ease and speed of accessing

and using the site (Parasuraman et al., 2005). Comfort: Hong et al. (2011) referred to

psychology that comfort was a feeling at ease. Operationally, the comfort if the user feel

comfort with the change in upgrade system. Ma et al. (2011) used this context to cap that

the user comfort with internet banking.

Serviceability: is innovation ability to confirm the users need (Ma et al., 2011).

Garvin (1987) defined serviceability as speed, courtesy, competence, and easy of repair.

Security: is defined as financial security, refer to the fact that user has perception if their

bank information is secure and no one else can access their account (Hamadi, 2010).

Privacy:is the user level perceptions that their personal information is protected (Hamadi,

2010). In other word privacy is the state level if the site safe and protecting the user

information (Parasuraman et al., 2005). Privacy is related to the secure of private and

secret information (Ma et al., 2011).

Assurance: can be understood as the employee knowledge, courteous, and the

ability to make users feel confidence (Kettinger & Lee, 1997). It can be related to the

clearance and trustfully of the information (Kenova & Jonasson, 2006). Reputation: Ma et

al. (2011) took a marketing context that reputation was associated which brand equity, or

relations in their function. Credibility was obtained from trustworthiness, believability, and

honesty (Parasuraman et al., 1985).

Product differentiation and customization: Ma et al. (2011) used it as the

adoption of website to the better setting according to individual user requirements. Swaid

& Wigant (2009) used it as a user perception of the individualized attention and

differentiated services that were tailored to meet individual’s need and preferences. Cruz

& Gallego (2004) said that the personalization systems could be categorized as

customization (user personalization) and based on user profile (adaptive and proactive

configuration). Customer services: The online customer service may hide from users.

This will be a relation to the emotion and feeling of the users because no human

interaction. Parasuraman et al. (2005) used contact dimensions to explain the assistance

via telephone or online representatives.

User Satisfaction

Satisfied customers may pass on positive comments about the firm and its offering

and recommend the company to others (Zeng et al., 2009). In the online shopping

context, McKinney et al. (2002) define satisfaction as an affective state representing an

emotional- reaction to the entire web site search experience. Based on McKinney et al.

(2002) we define user satisfaction of internet banking as an affective state representing an

emotional reaction to the internet banking site experience.

Perceived Risk

Wong et al. (2009) in the online shopping context defined perceived risk as

customer perceptions to the risk of internet transaction. This study uses operational

definition of perceived risk in internet banking as user perceptions of the risk when

adopting internet banking.

There are some barriers in internet banking adoption perceived by the active

internet users, especially in the developing countries (Aslam et al., 2011). This barrier can

reduce the intention to adopt the internet banking. In their studied, Aslam et al. (2011)

categorized two major barriers: psychological barriers, and technical barriers. In the

psychological barriers there were low perceived value and high perceived risk. This

perceived risk included economic risk, functional risk, social risk, and psychological risk.

The second major barrier was technical barrier included lack of security and privacy, lack

of knowledge, and access to internet.

In this study, we adopt perceived risk from Aslam’s high perceived risk. So there will

be economic risk, functional risk, social risk, and psychological risk. Economic risk

operating difficulty and chances of incomplete transactions due to internet speed failure.

Social risk is related to the culture that in the developing countries have soft and

collectivist culture where concern for social value. Unlike traditional banking, using online

banking is perceived to hinder the social relationship during the transaction based on

interpersonal interaction at the physical services. Psychological risk is about psychological

inconvenience while switching from conventional banking habits to the online banking

system and to learn new technology impedes the adoption process.

Intention to Use

Wang (2008) applied Intention to Reuse when modify DeLone & MacLean Model

(2003). DeLone & McLean (2003) suggested that Intention to Use may be a worthwhile

alternative measure in intention to reuse context. Based on the marketing literature, Wang

(2008) defined Intention to Reuse as the favorable attitude of the customer toward an

e-commerce system that results in repeat used/purchased behavior. Based on Wang

(2008), we raise an operational definition of internet banking Intention to Use as favorable

attitude of the internet user towards an internet banking system that result in use behavior.

This concept can be applied when we investigate the IB users or potential users.

Variable Relationships

Wang (2008) indicated that quality in the information system had positive direct

effect to the user satisfaction. Zeng et al. (2009) gave the same indication; they said that

fulfillment/reliability had direct effect to the overall satisfaction. This fulfillment variable is a

part of the quality dimension, and overall satisfaction is close to the user satisfaction. In

the internet banking context the quality will have a positive impact to the user satisfaction.

This is alike direction in the other web context. It’s predicted if internet banking can

provide the quality which match to the user’s expectation, they will feel that their need is

complied, further they will be satisfied with the internet banking services.

In the e-commerce and online shopping context, user satisfaction had an effect to

the intention (Wang, 2008; Zeng et al., 2009). We think internet banking characteristic is

closely to e-commerce context. Satisfaction is a symbol that user expectation complied

and they feel comfort in using internet banking. This satisfaction affect emotionally than

users will not reluctant to use internet banking. Implicitly this says that quality has impact

to the intention via user satisfaction.

If Wang’s and Zeng’s research show the indirect effect from quality to the intention,

Hamadi (2010) gave the evidence in the internet banking context that perceived quality

had stronger direct effect to the commitment than via mediation of satisfaction. We think

intention to revisit the bank site. The explanation of this direction is customers do business

via bank website if they think internet banking has good quality although they do not be

satisfied at all components.

Wong et al. (2009) found that perceived risk had negative direct effect to the

willingness to use e-banking. In other way Zeng et al. (2009) said that variable

security/privacy which indicators of risk perceptions on using online transactions had

effect to the repurchase intention. The willingness to use e-banking or repurchase

intention are closely to the intention to use in this study. It seems clear that perceived risk

has negative impact to the intention. Ones who perceive higher risk in the internet banking

will lower the intention to use. May they choose to visit the physic bank or use the other

usual facilities used.

Other evidence related to the risk is that risk can be reduced by raise some quality

in dimensions (Chen & Chang, 2005; Lee et al., 2010). Chen & Chang (2005) gave the

explanation, “Theoretically, if service quality cues in an advertisement indicate the service

will be performed at a high level, the associated risk should be reduced. If customers feel

a service firm is reliable (for example, possessing adequate and up-to-date equipment),

responsive to their particular requests, reassuring, and empathic in caring for them as an

individual, then the risk of patronizing that service should be reduced.” This explanation

indicated that quality has negative direct effect to the perceived risk.

Because quality has direct impact to the satisfaction and perceived risk, so that will

be an implicit hypothesis that satisfaction give a negative direct effect to the perceived

risk. This direction is an implication from the indirect effect of quality to the perceived risk

via user satisfaction.

H1: Internet Banking Service Quality has a positive impact to the user satisfaction.

H2: User satisfaction has a positive impact to the Intention to Use

H3: Internet Banking Service Quality has a positive impact to the Intention to Use.

H4: Perceived Risk has a negative impact to the Intention to Use

H5: Internet Banking Service Quality has a negative impact to the Perceived Risk.

H6. Internet Banking Service Quality has a negative impact to the Perceived Risk.

RESEARCH METHOD

Sampling and data collection

The respondents were internet users in Indonesia conducted by paper and online

media. First, post mails were sent to 15 Catholic Universities (island of Java, Sumatra,

department to the lectures in scope. The questioners are also sent to accounting

department of 10 companies in Java. Second, the online survey was conducted to fulfill

the questioner on the web. Post’s mail invitations were sent to 16 companies in Java.

Online invitations were sent privately via e-mail, facebook, and tokobagus. Overall 1831

paper and online questioners were sent. Responses were 429 (23.4%) questioners back

or fulfilled. The data was checked and found 2 double IP, 6 un-complete, 14 un-seriously.

Used data is 407 (22%).

Instruments

Questioner in 7 point Likert-scale was applied. The variable indicators were

collected from some literatures which 73 items available. We used 44 items (see

appendix) to reduce response bias because of so many questions. The items reducing

were based on judgment: properly to the internet banking, same dimensions, clearly

statement specification. Confirmatory factor analysis was applied by SPSS-dimension

reduction and scale reliability. Loading factor were in range of 0.60 - 0.95. Sixth indicator

of perceived risk (ris06) was dropped because consist in cross loading. Cronbach’s alpha

for variables and quality dimensions were in range 0.72 – 0.93. So the instruments were

valid and reliable according to the data characteristic in this study.

Data and Model Testing

The models were tested by SEM which Amos 18 software. Measurement model for

confirmatory factor analysis, normality, and outliers were accessed to understanding the

data and model characteristic. Model fit is accessed by Goodness-of-Fit Index (GOF

Index) included absolute measures, incremental fit measures, and parsimony measures

(Hair et al., 2010: p. 716).

RESULT, ANALYSIS, and DISCUSSION

Demography

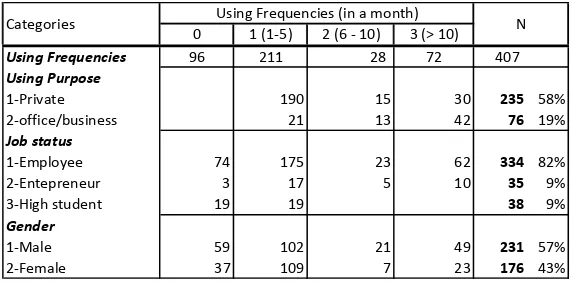

The demography data is shown in the table 1. Using frequencies indicate the

prediction of IB using every month. The dominant users are in the level 1 (1 till 5 times).

The purpose of IB using is dominant for private need. The respondent is dominant from

employee in the universities or companies. The respondents were male 57% and female

Table 1: demography

0 1 (1‐5) 2 (6 ‐ 10) 3 (> 10)

Using Frequencies 96 211 28 72 407

Using Purpose

1‐Private 190 15 30 235 58%

2‐office/business 21 13 42 76 19%

Job status

1‐Employee 74 175 23 62 334 82%

2‐Entepreneur 3 17 5 10 35 9%

3‐High student 19 19 38 9%

Gender

1‐Male 59 102 21 49 231 57%

2‐Female 37 109 7 23 176 43%

N Categories Using Frequencies (in a month)

Data Examining

Normality test for the data model shows t value out of range + 2.58. It significance

<0.5 or indicated non-normal distributed. There is explanation about the normality on

Likert-scale. Clason & Dormody said it was difficult to see how normally distributed data

can arise in a single Likert-type item. The data will frequently be skewed. Further,

Norman (2010) said that parametric statistics could be used with Likert data, with small

sample size, with unequal variance, and with non-normal distributions, with no fear of

coming to the wrong conclusion. Another consideration on Likert-type was a large sample

size could be assumed had a normal distribution. For sample sizes of 200 or more, the

effect of non-normality may be negligible; the researcher could be less concerned about

nonnormal variables (Hair et al., 2010: 71).

Measurement models are applied in the two categorizes: first, measuring the quality

which it’s dimensions. Second, is measuring the satisfaction, perceived risk, and intention.

Quality measurement model indicated that loading factor is greater than 0.5.

Measurement model for satisfaction, risk, and intention resulted loading factor was greater

than 0.6. This value indicates a good convergent validity. The discriminant validity is

accessed from correlation matrices. All indicators show higher correlation values to the

own variable compared to other variables. It indicates good discriminant validity.

In these measurement models there are a correlation or affection among error term

or indicators suggested by Amos modification model. Not all of these suggestion were

used because insignificant or to avoid a more complex path models. Example, the

intention to visit website (int01) reduced risk of computer cost (ris01) but arise the

was intention to increase the using IB in the future (int03) would reduce the risk of

difficulty to learn the interface (ris07).

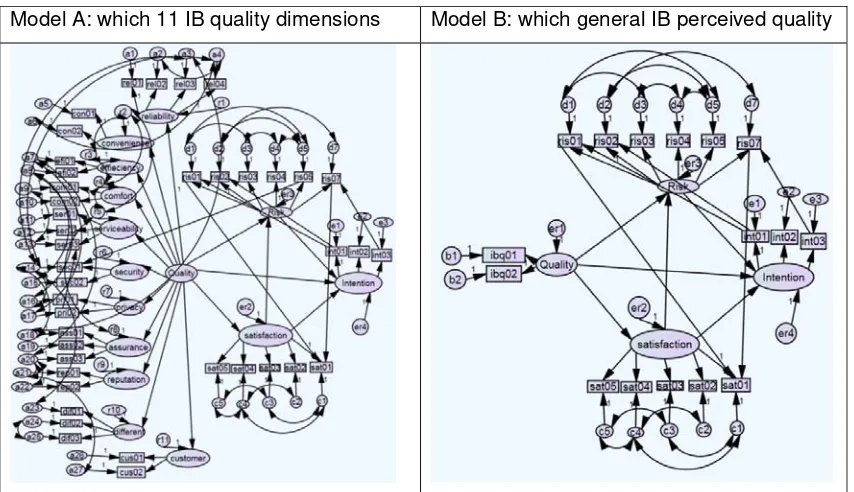

Structural Equation Model (A)

Fit indices of Model A can be seen at table 2. The Model A has χ2 value 3353.130

sig 0.000. It significance of χ2 indicates not a good fit model, but we can see the ratio χ2/df

(3353.130/721 = 4.651), ratio < 5 indicated that model is fit. RMSEA also support this fit

which mediocre category, value 0.095. Furthermore, GFI (0.726), AGFI (0.672) and PGFI

(0.608), it values are greater than 0.6 or indicate a good fit. CFI (0.816) is near to 0.9.

Generally can be concluded that model is good but hasn’t perfected.

Comparison Model (B)

In the instrument we have two indicators that measure the internet banking service

quality in general. The indicators were used by Ma et al. (2011) to test the antecedent of

quality variable. Model B or Model Alternative uses the way which this two quality

indicators to replace 11 dimensions of quality. The result of Model B can be seen at table

2 column B. Although the Model B show better fit which less χ2 ratio, less RMSEA, greater

GFI, and greater CFI, but we recommend the Model A to used in the future because it has

Figure 1: Testing Models for intention to use internet banking

Model A: which 11 IB quality dimensions Model B: which general IB perceived quality

Table 2: Comparison of GOF Models

GOF Index Standard Mod. A Mod. B (alt)

N 407 407

Absolut Fit Indices

Chi‐Square (X2) 3353.130 312.420

Degree of freedom 721.000 82.000

Probability P > 0.05 .000 .000

Rasio X2/df < 2 ; 5 4.651 3.810

RMSEA < 0.05; 0.08; 0.1 .095 .083

GFI >0.6 .726 .915

AGFI >0.6 .672 .860

PGFI >0.6 .608 .552

RMR <0.08 .089 .065

Incremental / Relative Fit Indices

NFI > 0.9 .778 .940

NNFI / TLI ‐‐>1 .791 .934

RFI >0.9 .748 .912

IFI >0.9 .817 .955

CFI ** >0.9 .816 .955

Parsimony Fit Indices

PRATIO .879 .683

PNFI 0 – 1 .684 .642

Table 3: Comparison of Standardized regression weight

Endogen Exogen Coeff. CR Sig. Coeff. CR Sig.

Satisfaction <‐‐‐ Quality H1 + .840 13.508 *** .858 18.757 *** Intention <‐‐‐ satisfaction H2 + .242 3.242 *** .419 4.518 ***

Intention <‐‐‐ Quality H3 + .551 6.793 *** .333 3.608 ***

Intention <‐‐‐ Risk H4 ‐ ‐.081 ‐2.005 ** ‐.077 ‐1.793 *

Risk <‐‐‐ Quality H5 ‐ .101 .958 .120 .995

Risk <‐‐‐ satisfaction H6 ‐ ‐.452 ‐4.253 *** ‐.468 ‐3.889 ***

*** sig. 1%; ** sig. 5%; * sig. 10%

Hyphotheses/ Predictions

Variables Mod A Model B (alt)

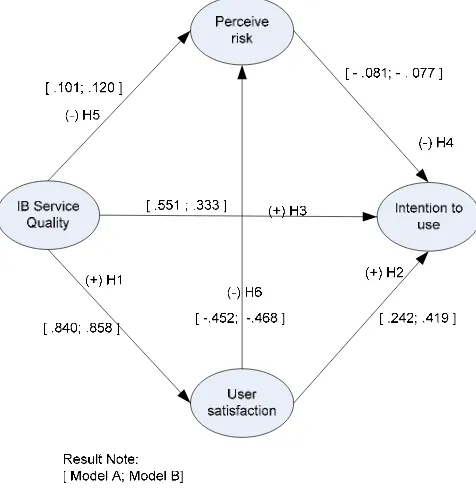

The score of standardized regression weight in table 3 were drawn in the path

diagram as shown in figure 2. This comparison data from the table or the figure will be

used to conclude the hypotheses. The main consideration is result from the Model A.

Table 3 indicates only one hypothesis unsupported, it is H5 which predict a negative

impact from the quality to the risk. We can see that the result is positive insignificance

(coeff. 0.101; CR = 0.958).

Hypothesis 1 predicts that IB service quality has a positive impact to the user

satisfaction. Model A show coefficient 0.840 sig 1%.. So it can be concluded that

hypothesis 1 is supported. Hypothesis 2 predicts that user satisfaction has a positive

impact to the intention to use. The coefficient of this link in Model A is 0.242 at

Figure 2: standardized regression weight (compared model A, B)

Hypothesis 3 predicts that quality has a direct positive impact to the intention. The

result shows that all models have a positive direct impact from quality to the intention

(0.551; 0.333) sig. 1%. So, hypothesis 3 is supported. Hypothesis 4 predicts that

perceived risk has a negative impact to the intention to use. The result supports this

hypothesis. The impact values are -0.081, -0.077. Hypothesis 6 predicts that user

satisfaction had a negative or reducing perceived risk. The result of all model indicate a

negative impact (-0.452; -0.468), the hypothesis 6 is supported.

Discussion

The link between quality and risk shows in-significance result and contra prediction.

The hypothesis predicts that quality will reduce risk, but the result shows the quality hasn’t

power to reduce the perceived risk. In this case we can see the role of user satisfaction in

reducing risk. When the quality has no power to reduce risk, the user satisfaction does.

User satisfaction play an important role by mediates the link between quality and risk.

Users reduce their risk perception only if the quality makes them be satisfied. Other

researches (eq. Chen & Chang, 2005; Lee et al., 2010) saw the direct effect of quality to

Even though risk has a negative impact or reduce the intention, but this impact is

lower than impact of quality or satisfaction. This indicates that in the user’s perception of

quality and satisfaction is more important than the risk.

The impact of quality to the intention has a differ value by Model A and B. Model A

shows higher value than B in the direct effect of quality to intention. But, when there is a

mediating of user satisfaction, Model B shows higher value of the path user satisfaction to

the intention. This can be explained that when users know the specification of quality (by

11 quality dimensions) that will be direct impact to the intention. But if users only be asked

by the general perception of quality (2 quality indicators), they need satisfy first so the

intention will arise. The mediating effect of satisfaction has an important role when users

only know the general perception of quality.

CONCLUSSIONS AND LIMITATIONS

The model of internet banking using intention is modified by the rational

consideration in decision making approach which in this study uses the quality and risk.

The model has four variables: internet banking service quality, user satisfaction, perceived

risk, and intention to use. The model which eleven dimensions of quality was applied in

model A. Then, model B used the general perception of quality by two items of indicator.

The two models have a good fit, but have a little different in the effect of quality to the

intention. Users who know the specific quality feel the direct impact to the intention, but if

users only know the general perception of quality that the satisfaction will have an

important role. Perceived risk has a negative impact to the intention, but this impact is

lower power than the quality and satisfaction. Perceived risk can be reduced by raising the

quality, but if users feel be satisfied first by the quality offered. So, there is a mediating

effect of user satisfaction.

The decisions by the result of this study must be considered by the limitations. First,

this study is individual perceptions by self reporting from a survey and dominant from an

employee. Second, the internet users are in the category of earlier level of adoption.

Future researches can be done in the context of another user area, specific IB provider,

user using frequencies characteristics, and IB using for companies adoption. Researcher

can investigate deeper to the dimensions of quality. We suggest that the instrument in this

study can be considered to be applied because more simple by the item size. We suggest

References

Aslam, H.D., Khan, M. and Tanveer, A. (2011), Perceive Barriers Towards Adoption Of Internet Banking Among Non-Metropolitan Internet Users of Pakistan, International

Business & Economics Research Journal. Vol. 10, No. 4, pp. 45-55

Bauer, H.H., Hammerschmidt, M. and Falk, T. (2005). Measuring the quality of e-banking portals. International Journal of Bank. Vol. 23 No 2, pp. 153-175.

Berry, L.L., Parasuraman , A. and Zeithaml, V.A. (1988), The Service-Quality Puzzle,

Business Horizons, Sept – Oct 1988, pp. 35-43.

Chen, T. and Chang, H. (2005), Reducing Consumer’s Perceived Risk Through Banking Service Quality Cues in Taiwan, Journal of Business and Psychology, Vol. 19, No. 4, pp. 521-540.

Clason, D.L. and Dormody, T.J. (1994), Analyzing Data Measured by Individual Likert-Type Items. Journal of Agriculture Education, Vol. 35, No. 4, pp. 31-35.

Cruz, P.P.P. and Gallego, P.DM. (2004), Flow in eBank Satisfaction Measure,

Documentos de Trabajo “Nuevas Tendencias En Direccion de Empresas” DT 06/04,

pp. 1-10.

Garvin, D.A. (1987), Competing on the eight dimension of quality, Harvard Business

Review, Nov – Dec, pp. 101-109.

Gounaris, S. and Dimitriadis, S. (2003), “Assessing service quality on the web: evidence from business-to-consumer portals”, Journal of Services Marketing, Vol. 17 No. 5, pp. 529-48.

Hair, J.F.JR., Black, W.C., Babin, B.J. and Anderson, R.E. (2010), Multivariate Data

Anaysis, 7th edn, Pearson Prentice Hall.

Hamadi, C. (2010), The Impact of Quality of Online Banking on Customer Commitment,

Communications of the IBIMA, Vol. 2010, pp. 1-8.

Jayawardhena, C. (2004), Measurement of Service Quality in Internet Banking: The Development of an Instrument, Journal of Marketing Management, 20, pp. 185-207.

Kenova, V. and Jonasson, P. (2006), Quality Online Banking Services, Bachelor Thesis within Business Administration, Jonkoping International Business School.

Kettinger, W.J. and Lee, C.C. (1997), Pragmatic Perspectives on the Measurement of Information Systems Service Quality, MIS Quarterly, June, pp. 223-240.

Lee, A.T., Liou, S.N., Lee, A.P. and Cheng, YC. (2010), The Effects of On-line Banking Service Quality on Perceived Risk and Behavioral Intent, EABR & ETLC Conference

Proceedings, Dublin, Ireland, p. 266.

Ma, Z., Ma, L., Heilongjiang, and Zhao, J. (2011), Evidence on E-Banking Quality in the China Commercial Bank Sector, Global Journal of Business Research, Vol. 5. No. 1, pp. 73-83.

McKinney, V., Yoon, K., Zahedi, F.M. (2002), The Measurement of Web-Customer Satisfaction: An Expectation and Disconfirmation Approach, Information Systems

Research, Vol. 13, No. 3, Sept., pp. 296-315.

Norman, G. (2010), Likert scales, levels of measurement and the “laws” of statistics, Adv.

Parasuraman, A., Zeithaml, V. A. and Berry, L. L. (1985), A Conceptual Model of Service Quality and Its Implications for Future Research, Journal of Marketing, Vol. 49, Fall, pp. 41-50.

Parasuraman, A., Zeithaml, V.A. and Malhotra, A. (2005), “E-S-QUAL: a multiple-item scale for assessing electronic service quality”, Journal of Service Research, Vol. 7, No. 3, pp. 1-21.

Parasuraman, A; Berry, L.L. and Zeithaml, V.A. (1991), Refinement and Reassessment of the SERVQUAL Scale, Journal of Retailing, Vol. 67, No. 4, Winter, pp. 420-450.

Swaid, S.I. and Wigand, R.T. (2009), Measuring the Quality of E-Service: Scale Development and Initial Validation, Journal of Electronic Commerce Research, Vol. 10, No. 1, pp. 13-28.

Wang, YS. (2008), Assessing e-commerce systems success: a respecification and validation of the DeLone and McLean model of IS success, Information Systems

Journal, 18, pp. 529-557.

Wolfinbarger, M. and Gilly, M.C. (2001), Shopping Online for Freedom, Control, and Fun,

California Management Review, Vol. 43, No. 2, Winter, pp. 34-55.

Wong, D.H., Loh, C., Yap K.B. and Bak, R. (2009), To Trust or Not to Trust: the Consumer’s Dilemma with E-Banking, Journal of Internet Business. Issue 6, pp. 1-27.

Yaya, L.H.P., Marimon, F. and Casadesus, M. (2011), Customer’s loyalty and perception of ISO 9001 in online banking, Industrial Management & Data Systems, Vol. 111, No. 8, pp. 1194-1213.

Yee, B.Y. and Faziharudean (2010), Factor Affecting Customer Loyalty of Using Internet Banking in Malaysia, Journal of Electronic Banking System, Vol. 2010, pp. 1-21.

Zeng, F., Hu, Z., Chen, R. and Yang, Z. (2009), Determinants of Online Service Satisfaction and Their Impacts on Behavioral Intentions, Total Quality Management,

Appendix: Instrument of this Study

No State items Dimensions References

RELIABILITY (1)

1 Internet banking (IB) provides accurate information and

continuously recorded my financial data.

Accurate Ma et al. (2011)

2 Internet Banking performs the service correctly since

the first time of using.

Rely on Zeng et al. (2011)

3 Internet Banking transaction are always accurate Accurate Zeng et al. (2011)

4 Internet Banking delivered the process/transaction

within the time promised.

Consistence Zeng et al. (2009)

CONVENIENCE (2)

1 I think I can access IB anytime and anywhere, and

save time as compared to conventional banking.

Anywhere anytime

Ma et al. (2011)

2 Internet banking is having the time saving of not having

to go to the bank office.

Saving time Wolfinbarger & Gilly

(2001)

EFFICIENCY (3)

1 It’s quick to make transaction on my bank website. Quick

transaction

1 I feel comfortable with the changes resulting from the

upgrades of the systems.

Comfort with change

Hong et al. (2011)

2 In the upgrades, the use ob buttons, radio buttons, and

combo boxes is consistent with my understanding.

Consistency with user knowledge

Hong et al. (2011)

SERVICEABILITY (5)

1 Internet banking has search function that make easy to

find information.

Service Leelapongprasut et

al. (2005)

2 The structure of menus and buttons are attractive,

easy to find, easy to use, and functionally good.

Service Leelapongprasut et

al. (2005)

3 If there were a trouble, the banking officer gives

assistance quickly to solve the problems.

Repair Leelapongprasut et

al. (2005)

SECURITY (6)

1 I feel safe in my online transaction and secure in

providing sensitive information for my online transaction.

Feel secure Ma et al. (2011)

2 My bank communicates its security policies on its

website

Financial security

Ma et al. (2011)

PRIVACY (7)

1 I think my internet banking companies keep customers

information private and confidential.

Information safety

Ma et al. (2011)

2 I trust that my bank website protect and didn’t used the

personal information inappropriately.

1 I have confidence in the bank’s services confidence Kenova &

Jonnasson (2006); Kettinger & Lee (1997)

2 I think, internet banking has courteous in deliver

services and information.

courteous Kettinger & Lee

(1997)

3 Bank officer has knowledge about internet banking so

can give good explanation about internet banking.

Have the knowledge

Kettinger & Lee (1997)

REPUTATION (9)

good services. services (2010)

2 Internet banking has a reputation for being fair in its

relationship with its users.

1 IB website gives a personal attention for personal or

private setting.

Personal attention

Swaid & Wigand (2009)

2 IB website enables me to order the service in a way

that meets my needs.

Order specific needs

Swaid & Wigand (2009)

3 IB website understands my specific needs. Understand

specific needs.

Swaid & Wigand (2009)

CUSTOMER SERVICE (11)

1 The site provides ways to contact and advisor at the

bank

Provide the way to contact

Hamadi (2010)

2 I can communicate with someone from the bank (eq.

by e-mail) if I have problems with my account.

Interactivity Hamadi (2010)

ONLINE BANKING QUALITY

1 I believe that my internet banking service provide good

quality.

Quality perception

Ma et al. (2011)

2 The internet banking service quality matches with my

expectation.

1 I feel be satisfied with internet banking systems. System

satisfaction

Wang (2008)

2 I think that internet banking is of high quality Quality

satisfaction

Wang (2008)

3 I feel satisfied with the bank because implementing

internet banking.

Satisfaction with company

Zeng et al. (2009)

4 I feel be satisfied with internet based transaction Transaction

satisfaction

Zeng et al. (2009)

5 I am very satisfied with the internet banking service

delivered by bank.

Service satisfaction

Zeng et al. (2009)

PERCEIVED RISK

1 Exactly to use internet banking need computer cost, so

make me unwilling to use it.

Economic risk Aslam et al. (2011)

2 I think that using internet banking make extra

associated cost (eq. internet cost, etc).

Economic risk Aslam et al. (2011)

3 I fear of loss personal service and one-to-one

relationship with banker if I use internet banking.

Social risk Aslam et al. (2011)

4 I fear of incomplete transaction when I use internet

banking

Functional risk Aslam et al. (2011)

5 I think, using internet banking to make transaction is

high financial risk.

Economic risk Aslam et al. (2011)

6 I feel inconvenience of adopting new technology Psychological

risk

Aslam et al. (2011)

7 It is time taking and difficult to learn internet banking

interface

Psychological risk

Aslam et al. (2011)

INTENTION TO USE

1 I will visit internet banking website if I need banking

services.

Intention to visit

Wang (2008)

2 I will use internet banking to make baking transaction in

the future

Intention to do business

Wang (2008)

3 I will use internet banking services more frequently in

the future.

Increasing business