CRRF Capital Replacement Reserve Fund DBSA Development Bank of South Africa DoRA Division of Revenue Act. HSDG Human Settlement Development Grant HSRC Human Science Research Council IDP Integrated Development Plan IDZ Industrial Development Zone. MIG Municipal Infrastructure Subsidy MMC Member of the Mayor's Committee MPRA Municipal Property Rates Act MSA Municipal Systems Act.

SMME Small Micro and Medium Enterprises USDG Urban Development Grant WSA Water Services Authority.

ANNUAL BUDGET

EXECUTIVE MAYOR’S REPORT

One of the biggest challenges we still face as a city is the ever-increasing cost of maintaining our existing infrastructure. The city will undertake a needs analysis to formulate a Master Plan for the implementation of CCTV cameras in BCMM. Our city has established partnerships with seven international cities, the last one being the City of Oldenburg in Germany.

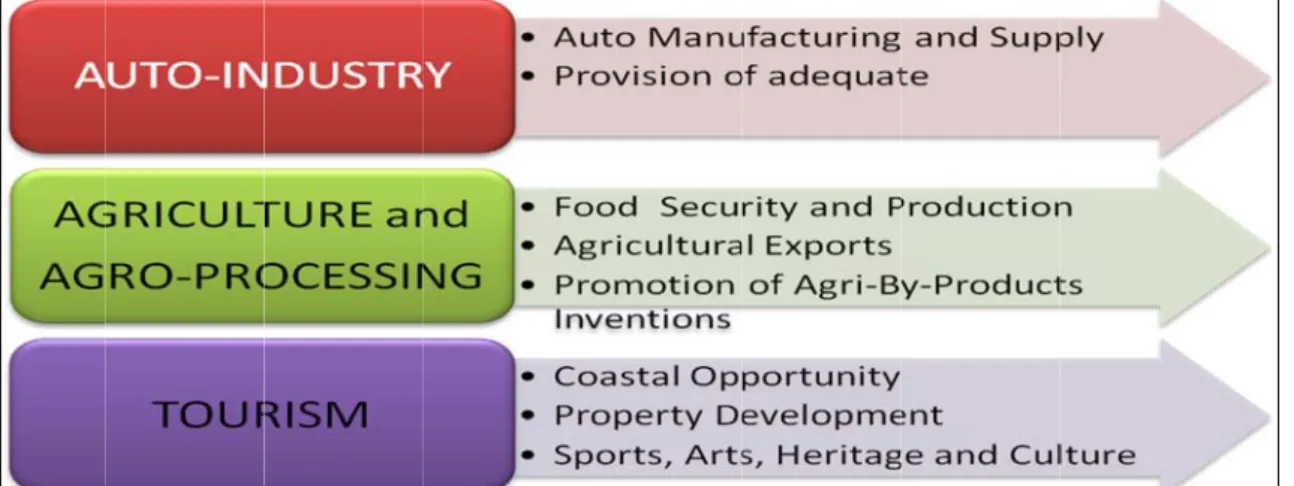

Through our international twinning, we are keen to facilitate business-to-business partnerships between our Metro and these Cities.

COUNCIL RESOLUTIONS

Page | 7 3 The Buffalo City Metropolitan Municipal Council, acting in terms of 75A of the Act on Local Government: Municipal Systems (Act 32 of 2000), approves and accepts with effect from 1 July 2013 the rates for other services as set out in Annex F. 6 That in terms of Section 24(2)(c)(iii) of the Municipal Financial Management Act, 56 of 2003, the measurable performance objectives for capital and operating expenditure per vote for each year of the medium-term income and expenditure framework as set out in Supporting Table SA7 is approved. 7 That in terms of Section 24(2)(c)(iv) of the Municipal Financial Management Act, 56 f 2003, the amendments to the Integrated Development Plan as set out in the Budget Chapter 17 are approved, which have been agreed to the Special IDP and Organization Performance Management Portfolio Committee meeting held on 15 May 2013.

9 Council notes that the MTREF budget for 2013/14, which has been presented for adoption, is structured in relation to the then Buffalo City Municipality's votes and functions.

EXECUTIVE SUMMARY

Implementation of a General Valuation every four years in terms of the Municipal Property Tax Act. Other expenses consist of various line items related to the daily operations of the municipality. The justification is that ownership and the net assets of the municipality belong to the community.

The municipality has increased its cash reserves, which is part of the city's strategic financial sustainability. The city's expected cash position was discussed as part of the budgeted cash flow statement. This trend will need to be carefully monitored and managed in the implementation of the budget.

OPERATING REVENUE FRAMEWORK

OPERATING EXPENDITURE FRAMEWORK

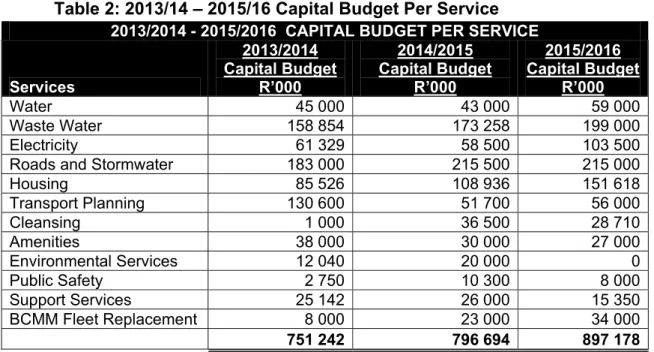

CAPITAL EXPENDITURE FRAMEWORK

The budget management committee has been set up in accordance with § 53 of the MFMA and municipal budget reporting regulations. In relation to the municipality's poor policy, registered households are entitled to 6 kℓ water, 50 kwh electricity. Long-term investments primarily consist of the sinking funds for repayment of future loans.

Details of the City's strategy regarding asset management, repairs and maintenance are contained in SA34C.

ANNUAL BUDGET TABLES

SUPPORTING DOCUMENTATION

OVERVIEW OF THE ANNUAL BUDGET PROCESS

OVERVIEW OF ALIGNMENT OF ANNUAL BUDGET WITH IDP

Capital charges for operating expenses are a measure of the cost of borrowing relative to operating expenses. The liquidity ratio measures the municipality's ability to use cash and cash equivalents to repay or immediately withdraw its current liabilities. The capacity of existing treatment works is insufficient to meet current and future water demands.

The objective of the draft Budget Implementation and Management Policy (Rental Policy) is to effectively and efficiently manage budget transfers to ensure optimal service delivery. Revision of the spatial plan to bring human resources closer to economic and employment opportunities. BCMM will work to improve this allocation in the 2014/15 MTREF to ensure the continued health of municipal infrastructure.

As far as the borrowing and investment policy of the municipality is concerned, the borrowings are withdrawn only after the expenses for the specific project have been completed. For the purposes of cash-backed reserves and the reconciliation of the accumulated surplus, a provision equal to one month's operating expenses has been provided. It should be noted that although this may be considered prudent, the desired cash levels should be 60 days to ensure the ongoing liquidity of the municipality.

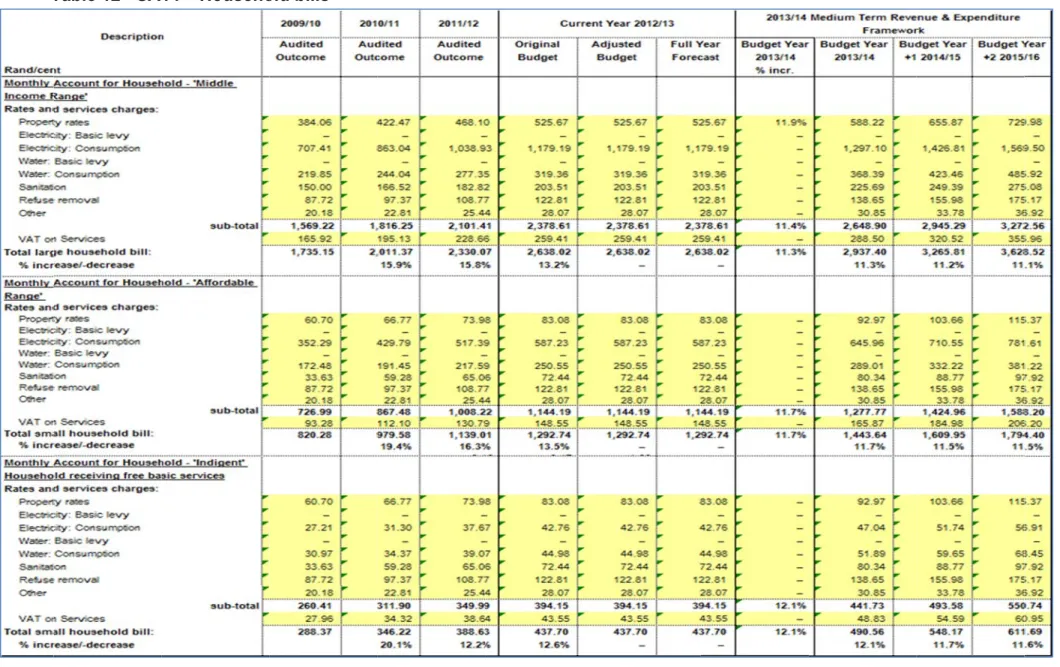

Any poor collection performance could put upward pressure on the City's ability to meet its creditor obligations. The table above shows that the growth percentage is a total of 5.7, 5.1 and 5.0 percent for the individual business years of MTREF 2013/14. This measure is intended to analyze the baseline assumed collection rate for the MTREF to determine the adequacy and credibility of the budget assumptions contained in the budget.

According to Article 53(1)(c)(ii), the mayor of a municipality must take all reasonable steps to ensure that the service implementation plan and budget of the municipality are submitted within 28 days of the approval of the budget is approved by the mayor. In terms of the City's Supply Chain Management Policy, no contracts will be awarded outside the medium-term revenue and expenditure framework (three years) unless MFMA Article 33 is complied with. The following three tables detail the city's investment program, first for new assets, then for asset renewal, and finally for asset repair and maintenance.

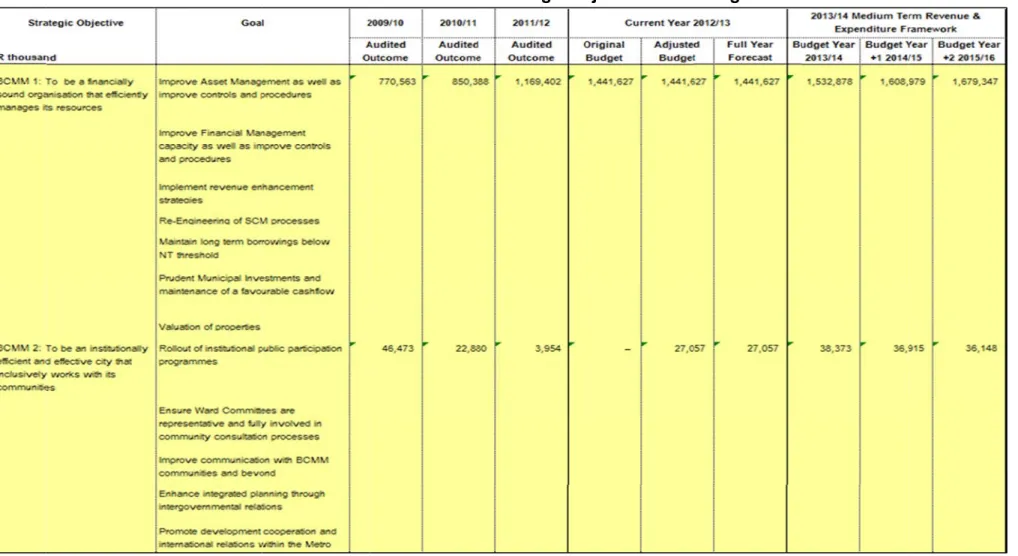

MEASURABLE PERFORMANCE OBJECTIVES AND INDICTORS

OVERVIEW OF BUDGET-RELATED POLICIES

The City's budgeting process is guided and governed by relevant legislation, frameworks, strategies and related policies. This policy is available and can be viewed on Buffalo City Metropolitan Municipality's website: www.buffalocity.gov.za. A long-term loan policy has been developed in accordance with the Municipal Finance and Management Act No.

56 of 2003 and the Municipal Budgeting and Reporting Regulations on Debt Disclosure The policy was approved by Council on 4 June 2010. The Draft Asset Management Policy provides guidance on the management of immovable assets (infrastructure, community facilities, public amenities, investment property and associated land and intangible assets). The purpose of this policy is that the municipality must implement prevailing accounting standards; and apply asset management practice in a consistent manner and in accordance with legal requirements and recognized good accounting practice.

The objective of the Capital Infrastructure Investment Policy Project is to create and maintain an asset in a healthy state in order to ensure a return on the city's investment. The draft financing and reserves policy aims to ensure that the Municipality has sufficient and cost-effective financing in order to achieve its long-term objectives through the implementation of medium-term operating and capital budgets. The Draft Policy for Long-Term Financial Planning includes the development, implementation and evaluation of a plan for the provision of basic municipal services and capital assets.

OVERVIEW OF BUDGET ASSUMPTIONS

Stricter controls of the Credit Control Policy are enforced, the collection of arrears will be used as a source of additional cash inflow for the funding of future capital infrastructure projects. It is assumed that own source income will increase at a rate influenced by the consumer receivables collection rate, tariff/tariff prices, real growth rate of the City, household formation growth rate and the poor household change rate. The focus will be to strengthen the link between policy priorities and expenditure in order to ensure the achievement of the national, provincial and local objectives.

In this regard, repairs and maintenance were budgeted at 7% of total revenue above MTREF and an average of 10% of total revenue for each service. Ho h covers is do info. from c ailed analys etail of boron. urrent finan sis of the rows C. expenses of the vices 4 MTREF is developing .. the wing replaced for and in the war due to obligations. Usually, unless there are special circumstances, the municipality is obliged to return unspent conditional grant funds to the national revenue fund at the end of the financial year.

As part of the planning strategy, it should be managed aggressively as part of the medium term planning. 2.6.8 Nationa against the mu informa perform table es funding Table 4 . ves.. to notice ering the fu F has bee ments of t ersus cash. A 'positive' cash position for each year of the MTREF will generally be a minimum requirement, subject to the planned use of these funds such as cash back-up of reserves and working capital requirements. If the municipality's forecast cash position is negative, for any year of the medium-term budget, it is very unlikely that the budget will meet MFMA requirements or be sustainable and may indicate a risk of non-compliance with section 45 of the MFMA which deals with the refund. of short-term debt at the end of the financial year.

Regardless of annual liquidity, an assessment should be made of the municipality's ability to meet monthly payments as and when they fall due. As part of MTREF 2013/14, the municipalities' improvement in liquidity causes the ratio to move upwards to 3.9 and then to 5.3 and 6.9 for the outermost years. A requirement of the detailed capital budget (since MFMA Circular 28, which was issued in December 2005) is to categorize each capital project as a new asset or a renewal/rehabilitation project.

The detailed SDBIP document is at a draft stage and will be finalized following approval by the 2013/14 MTREF in May 2013 in accordance with MFMA, Section 53(1)(c).

OVERVIEW OF BUDGET FUNDING

EXPENDITURE ON GRANTS AND RECONCILIATIONS OF UNSPENT FUNDS 98

MONTHLY TARGETS FOR REVENUE, EXPENDITURE AND CASH FLOW

ANNUAL BUDGET AND SDBIPs – INTERNAL DEPARTMENTS

ANNUAL BUDGET AND SDBIPs – MUNICIPAL ENTITIES AND OTHER

CAPITAL EXPENDITURE DETAILS

Page | 116 Table 62 - SA34b - Capital expenditures for renewal of existing assets by asset categories (continued).

LEGISLATION COMPLIANCE STATUS

The remuneration of councilors is determined by the Minister of Cooperative Governance and Traditional Affairs in accordance with the Remuneration of Public Office Holders Act, 1998 (Act 20 of 1998).

OTHER SUPPORTING DOCUMENTS

CITY MANAGER’S QUALITY CERTIFICATE