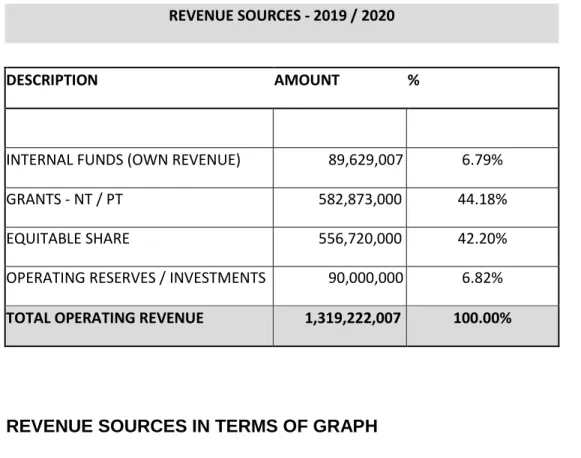

I do this in my role as Executive Mayor and carry out my fiduciary responsibility as the guardian of the District's finances. An assessment was made of the flood damage and estimated to be more than R200 million in the entire District, hence the Council declared a state of disaster in the District on 30 April 2019. The municipality is still grant dependent; own income is 6 percent of the total budgeted operating income and it is R89.6 million.

The projected staff-related cost allocation for the 2019/20 financial year totals R287.8 million, which equates to 39.3 percent of total operating expenditure. Vacancies have been significantly rationalized downwards as part of the county councils' cost reclassification and cash management strategy. This is in line with the Treasury requirement of 8% of total operating costs.

With this, we get rid of expensive future replacement costs and increase the public's trust in the management of the municipality. That is why we are bringing to this house and to the people of the district today a realistic plan to stimulate economic growth in our district. The district budgeted an amount of R28.6 million as part of the implementation of the Agri-Park program.

That the attached IDP, budget and budget related policies regarding 2019/2020 be adopted.

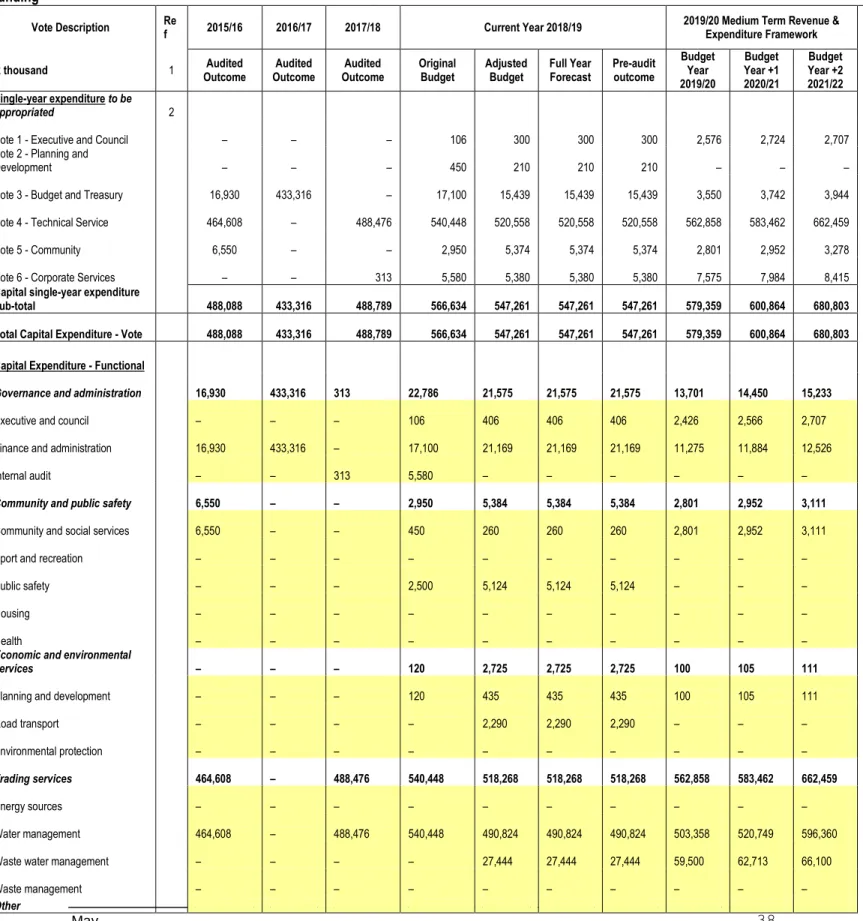

EXPENDITURE ALLOCATIONS

OPERATING EXPENDITURE 2019- 2020

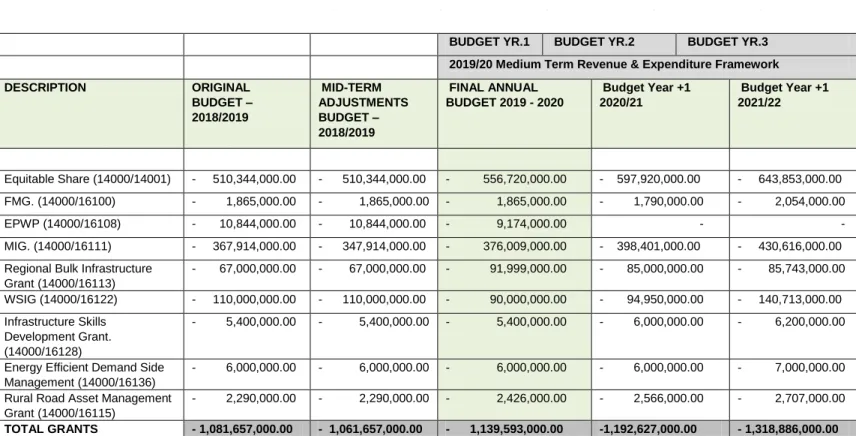

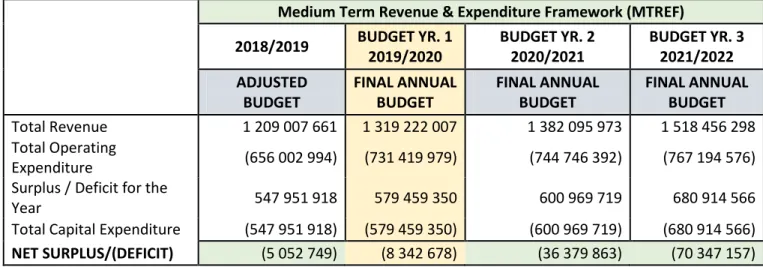

26 Total operating expenditure for the 2019/20 financial year was allocated at 731 million and amounts to a percentage increase of 8 per cent from the 2018/19 adjusted budget. As much as the municipality is experiencing pressure from key departments and a rising growth in personnel costs together with the necessary provisions to be made instead of depreciation and repairs and maintenance, year-on-year growth in the district municipality's budget over the MTREF is less than 10%. The capital budget of R579 million for 2019/20 has increased by 5% from the 2018/19 adjustment budget apart from the fact that the Municipal Infrastructure Grant has been reduced by R20m by the National Treasury during the mid-term.

This increase is primarily due to an increase in DORA's funding resources, particularly MIG and RBIG. In an attempt to speed up service delivery, the municipality tried to obtain a DBSA loan, but it was not approved due to excessive liabilities and depleted reserves. The council and senior managers must continue to be 'grant hunters' to fund these projects.

Also, part of the capital budget will be financed from revenue-generating projects, including the implementation of a revenue-enhancing strategy and Equitable Share. Also, the Council of the District Municipality of Alfred Nzo has approved the cost-cutting measures as part of compliance with Circular 82 - Cost Control Measures issued by National Treasury, as well as Cost Control Regulations as published by Government Gazette No. 16022018, as a result of items such as catering, accommodation costs, and travel and conference expenses have been drastically reduced. Senior Managers have the responsibility to manage their own budgets in consultation with the Chairs of Standing Committees and Standing Committees as appropriate.

Allocations per line mail is carried out by the departments themselves, as long as they do not exceed the allocated amounts per table. The municipality opted for early adoption of mScoa in the 2015/16 financial year in preparation for budget implementation and this has been achieved through the acquisition of mSCOA compliant consolidated financial management system (Munsoft) which is already fully operational by the municipality. The MTREF budget preparation is prepared in accordance with the new requirements of the mSCOA regulations.

The municipality has complied with all versions of mSCOA as introduced by National Treasury. The draft IDP and budget have been submitted to National Treasury on the mSCOA format of seven segments. The final budget will also be submitted to National Treasury in mSCOA format.

REVENUE SOURCES - 2019/2020

Conventional Water Meter & Prepaid Water Meter Maintenance

To ensure that the installed prepaid water meters are maintained and kept in good working order, the maintenance of these meters is crucial. We expect an increase in the maintenance of water meters in the future. The maintenance process required proper procedures to be followed to ensure that if the Auditor General (AG) needed information, everything would be available. Possible materials used; the labeling and storage of each meter removed; recording of the replaced prepaid meter number; fill in the warranty form if necessary, register GPS coordinates; register Time and date of action, link consumer user interface units.

The district municipality intends to carry out a water meter audit in the financial years 19/20 and 2020/2021. The meter audit will be carried out to identify all faulty meters to either repair or replace them for all consumers who do not have working water meters. 31 In the same way as all other rural municipalities, our district municipality is largely dependent on grants to finance both operations and capital expenditure, without which it could cease to exist.

The implementation of revenue improvement strategy is essential to ensure an increase in ANDM's internal revenue.

Sale of Water and Impact of Tariff Increases

This is based primarily on the 6 percent CPI inflation projected by the National Treasury. Due to the prevailing economic conditions, an increase above the current rate of inflation would negatively impact the consumer's ability to service their debts.

Operating Expenditure Framework

The budgeted allocation for staff-related costs for the financial year 2019/20 totals R287 million and remuneration for councilors totals R11.7 million, which is equivalent to 39 per cent of total operating costs. Salary increases have been incorporated into this budget with a percentage increase of 6.5 percent for the 2019/20 fiscal year as per SALGA Bargaining Council Circular No. 35. In the last two years of the MTREF, an annual increase of 5.4 percent has been included (CPI plus 1%).

The costs associated with the remuneration of councilors are determined by the Minister of Co-operative Governance and Traditional Affairs in accordance with the Public Office Remuneration Act, 1998 (Act 20 of 1998). The composition of the district municipality budget takes into account the most recent proclamation in this regard and a provision of 6.5 percent has therefore been made to cover such costs. This is in line with the continuing capital infrastructure program conducted annually by the district municipality.

EXPENDITURE ALLOCATIONS - 2019/ 2020

The district municipality has made a forecast of 54 million lek in the 2019/20 budget for repairs and maintenance. This is slightly less than the National Treasury's requirement of 8% of total operating cost, provision to be made from Total Property, Plant and Equipment (PPE) in accordance with MFMA circular number 55. However, this is a slight increase of R4 million from the provision made in the medium term adjustment budget (R58 million) against the initial budget.

As part of a review of the local government infrastructure grant framework, the Treasury announced in the 2016 Revenue Bill that the rules under the Municipal Infrastructure Grant (MIG) framework will be changed to allow funds to be used for infrastructure renewal and replacement in the future . Financial costs mainly consist of long-term loan interest repayments (cost of capital). A total budget of R562 million has been allocated for infrastructure development for 2019/20, which equates to 97 per cent of the total capital budget of internally funded projects involving ANDM.

The Municipality's forecasted cash position was discussed as part of the budgeted cash flow statement. A "positive" cash position for each year of the MTREF will generally be a minimum requirement, subject to the planned use of these funds such as cash back-up of reserves and working capital requirements. The purpose of this measure is to understand how the municipality has used the available cash and investments as identified in the budgeted cash flow statement.

The detailed reconciliation of monetarily secured reserves/surpluses will be specified in the budget proposal. As part of the 2019/2020 MTREF, municipalities increase their cash position, causing the ratio to move upwards and then increase slightly for recent years. It should be noted that a surplus does not necessarily mean that the budget is financed from a cash flow perspective, so the first two measures in the table are critical.

This measure should be considered important within the context of the funding measures criteria, because a trend indicating that insufficient funds are being committed to asset repair may also indicate that the overall budget is not reliable and/or sustainable over the period medium and long-term, because the budget income is not being protected. A detailed capital budget requirement (since MFMA Circular 28 which was issued in December 2005) is to categorize each capital project as a new asset or a renovation/rehabilitation project. This following table meets the requirements of Circular 42 of the MFMA, which deals with the financing of the municipal budget in accordance with articles 18 and 19 of the MFPA.

The table seeks to answer three key questions about the use and availability of cash: What cash and projected investments are available at the end of the budget year. The lack (applications > cash and investments) is an indication of non-compliance with Article 18 of the MFMA requirement that the municipal budget must be "financed".