Previously, the municipality has never carried out such a coordinated process or placed economic development at the center of the planning process. This three-year project will ease congestion in the area and is expected to be completed by April 2016. The second phase of the 55 km Western Aqueduct pipeline is underway and will pick up speed with the construction of the Northern Aqueduct starting soon.

BUDGET RELATED RESOLUTIONS

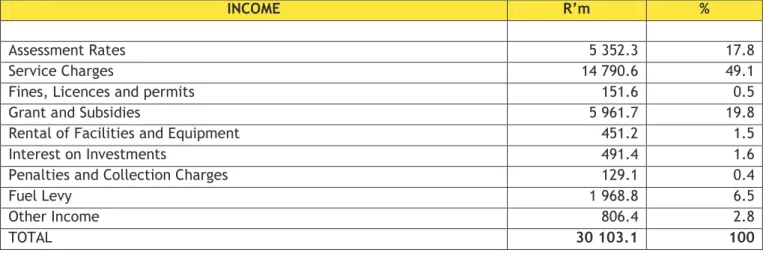

ESTIMATES OF INCOME AND EXPENDITURE

RECAPITULATION: VALUATION OF RATEABLE PROPERTY

Based on the amended Rates Policy adopted by the Council on 29 January 2014, the municipality can levy different rates for different categories of real estate.

EXEMPTIONS, REBATES AND REDUCTIONS

- RESIDENTIAL PROPERTY

- PUBLIC BENEFIT ORGANISATIONS

- LIFE RIGHTS SCHEMES AND RETIREMENT VILLAGES

- SCHOOLS NOT FOR GAIN

- BED AND BREAKFAST UNDERTAKINGS

- GUEST HOUSE UNDERTAKINGS

- BACK–PACKER LODGES, HOLIDAY ACCOMODATION AND STUDENT ACCOMMODATION

- NATURAL AND OTHER DISASTERS

- VACANT LAND

- NATURE RESERVES AND CONVERSATION AREAS

- ECONOMIC DEVELOPMENT

- SPECIAL RATING AREAS

Upon application and approval, a 25% discount is granted to a property let for the purpose of holiday accommodation for a reward. iii). The discount will be allocated in accordance with the completion and transfer of units within the development in accordance with the rates policy. i) That the Special Assessment Areas as shown in Appendix A be and are hereby defined. ii) That in relation to Special Assessment Areas, additional rates, as shown in Appendix A, be adopted and imposed in respect of each category of property within the boundaries of the special classification area.

PHASING IN OF RATES

Developments which are included in the Council approved Development node will receive a rebate as approved by Council on the application and will be limited to. The discount will be allocated in accordance with the completion and transfer of units within the development in accordance with the rates policy. i) That the Special Assessment Areas as shown in Appendix A be and are hereby defined. ii) That in relation to Special Assessment Areas, additional rates, as shown in Appendix A, be adopted and imposed in respect of each category of property within the boundaries of the special classification area. a) 100% in the first year b) 75% in the second year c) 50% in the third year d) 25% in the fourth year.

DATE OF OPERATION OF DETERMINATION OF RATES That this determination comes into operation on 1 July 2014

FINAL DATE FOR PAYMENT OF RATES

ADMINISTRATION CHARGE ON ARREAR RATES

OTHER TARIFFS AND CHARGES

DOMESTIC WATER DEBT RELIEF PROGRAM

ELECTRICITY DEBT RECOVERY USING THE 80/20% OR 50/50% PREPAYMENT SYSTEM

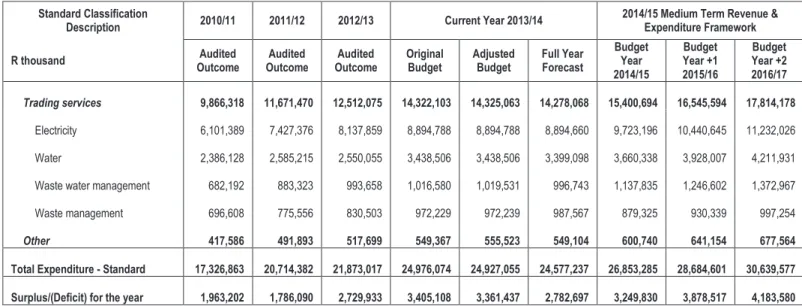

CAPITAL EXPENDITURE ESTIMATE

BORROWINGS TO FINANCE THE CAPITAL BUDGET

HOUSING/HOSTELS DEFICIT

NEW FUNCTIONS/ SERVICES

MEASURABLE PERFORMANCE OBJECTIVES

INTEGRATED DEVELOPMENT PLAN (IDP)

PARTICULARS OF INVESTMENTS

REMUNERATION OF COUNCILLORS AND SENIOR OFFICIALS

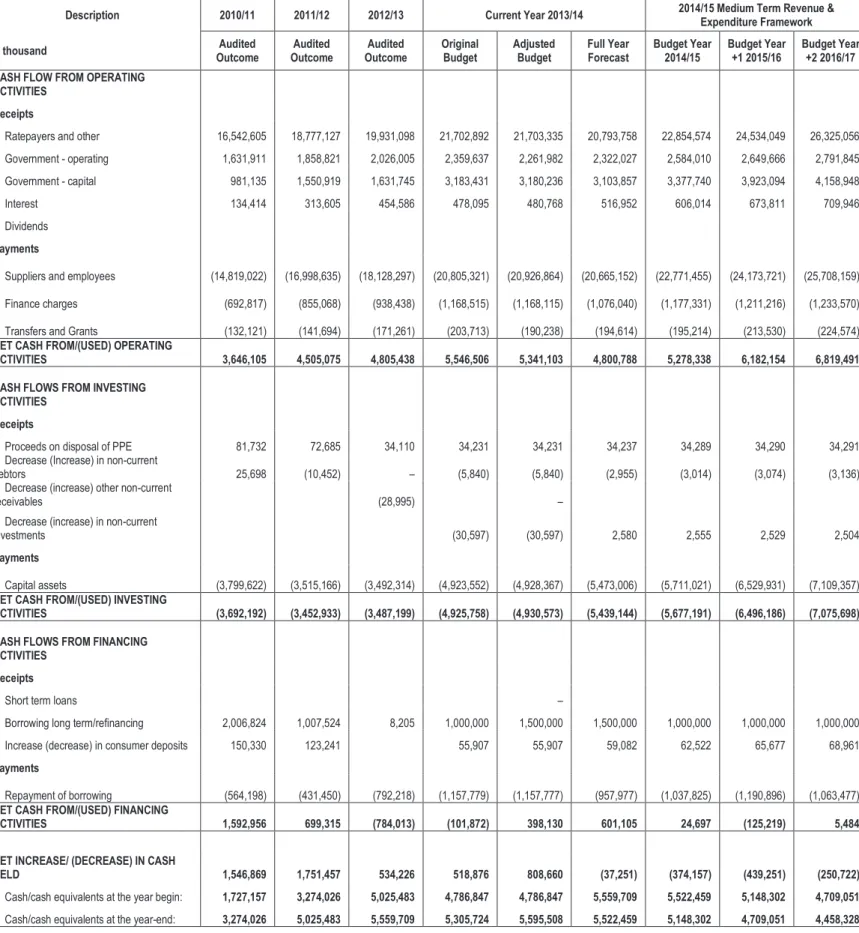

Spending plans had to be revised and resources re-prioritized to ensure key objectives were met. Loans should be sustainable and affordable and used only for capital projects - Basic growth in interest rates should be ensured to ensure the sustainability of free basic services - Balancing capital expenditure for social, economic, rehabilitation and support.

OVERVIEW OF THE 2014/15 MTREF

Zero tolerance towards theft of electricity and water and non-payment of bills.

STRATEGIC PRIORITIES FOR THE 2014/2015 YEAR

KEY ISSUES

Climate change has been identified as one of the most pressing challenges of our time. While Bridge City development has progressed significantly, the ability of this development to grow is limited by the current M35 transport hub. The development of the half diamond hub will greatly aid Bridge City's ability to develop further.

PAST AND CURRENT PERFORMANCE, ACHIEVEMENTS AND CHALLENGES

SERVICE DELIVERY

The Inner City is the heart of the business and tourism area within the province. The regeneration of the Inner City includes the redevelopment of the Warwick area and various other projects related to the city centre.

INSTITUTIONAL TRANSFORMATION

As part of the municipality's program to clear backlogs in the provision of basic services and provide temporary services to informal settlements and transit camps, container-based sanitation facilities are being rolled out. In addition, there is an increased budget allocation to accelerate the provision of ablution facilities in informal settlements in the medium term.

FINANCIAL PERFORMANCE (2012/13 AND 2013/14): PARENT MUNICIPALITY

OPERATING BUDGET

This year's results show that spending was 47% of the planned operating expenditure of R24.8 billion. To date, approximately R3.2 billion has been received from all sources, representing 57.3% of the budgeted amount.

ALIGNMENT WITH NATIONAL AND PROVINCIAL PRIORITIES

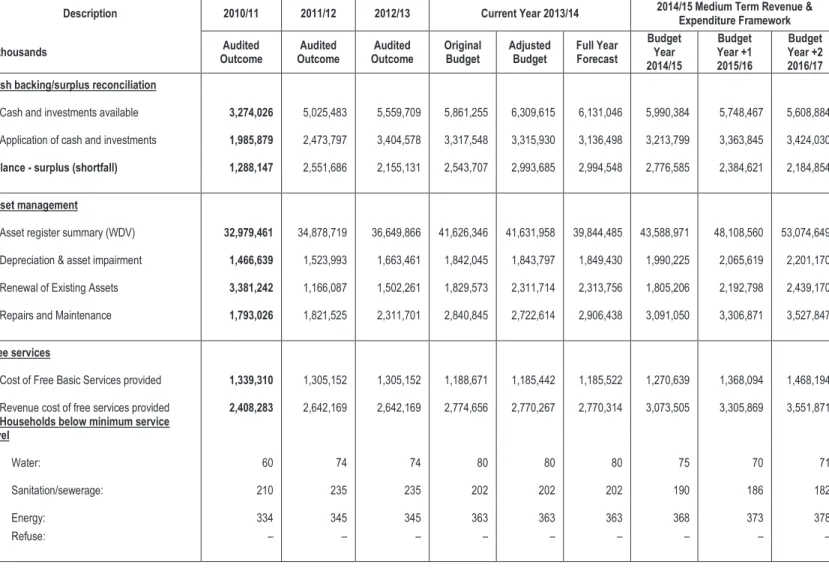

Capital expenditure at the end of December 2013 was approximately R2.1 billion, 38.8% of the planned amount. Capital projects were accelerated to address backlogs in the provision of basic services, necessitating a change in capital budget priorities.

FINANCIAL STRATEGY, ONGOING VIABILITY AND SUSTAINABILITY

THE MUNICIPAL INFRASTRUCTURE INVESTMENT FRAMEWORK

The operating expenses necessary to ensure that the provided infrastructure is operated and maintained correctly. To what extent can income be raised to cover these operating expenses within the municipal fiscal framework.

MUNICIPAL SERVICE FINANCIAL MODELLING FOR ETHEKWINI

However, this must be done in such a way that the municipality, which is at the forefront of infrastructure provision, remains financially viable and has the capacity to operate and maintain this infrastructure. The framework also considers the monitoring systems needed to assess progress in infrastructure delivery, as well as processes to ensure that systems and management capacity are in place in municipalities to manage infrastructure, with an emphasis on a municipal infrastructure asset management strategy.

INFRASTRUCTURE DELIVERY MANAGEMENT SYSTEMS (IDMS)

The municipality is committed to ensuring that all backlogs in the provision of infrastructure are removed. Doing so will improve infrastructure delivery, fully align with National Treasury's infrastructure alignment model developed through their Infrastructure Delivery Improvement Program and additionally benefit from the assistance of National Treasury resources.

MUNICIPAL ENTITIES

SOURCES OF FUNDING

Expenditure on repairs and maintenance is R3.4 billion for 2014/15, representing 11.4% of the total operating budget. Financial expenses consist primarily of interest repayments on long-term loans (cost of capital) and amount to 3.9% of operating expenses.

CAPITAL BUDGET

The multi-year salary and collective agreement for the period 1 July 2012 to 30 June 2015 has been taken into account. The latest executive order to this effect has been taken into account when preparing the municipality's budget.

INFRASTRUCTURE EXPENDITURE TRENDS

Replacement of obsolete solid waste fleet: R 37.8 million New office space in Germany: R 16.3 million Lovu landfill and infrastructure works R 9 million Buffelsrot landfill: R 8 million. Security costs for asset protection: R 39.3 million Provision for 5 years VIP pit latrine cleanup: R 21.9 million per annum Water consumption at ablution blocks: R 26.8 million.

MAJOR ITEMS OF EXPENDITURE ITEM/DESCRIPTION

HUMAN SETTLEMENTS AND INFRASTRUCTURE

CORPORATE AND HUMAN RESOURCES

SUSTAINABLE DEVELOPMENT AND CITY ENTERPRISES

GOVERNANCE

This table makes it easy to see the planned operational performance in relation to the organizational structure of the city. The rationale is that the ownership and net assets of the municipality belong to the community.

OVERVIEW

The capital budget is then allocated accordingly to cover the highest priority projects in IDPs. The city decided to use financial modeling techniques, based on the MSFM, to estimate the allocation of the capital budget.

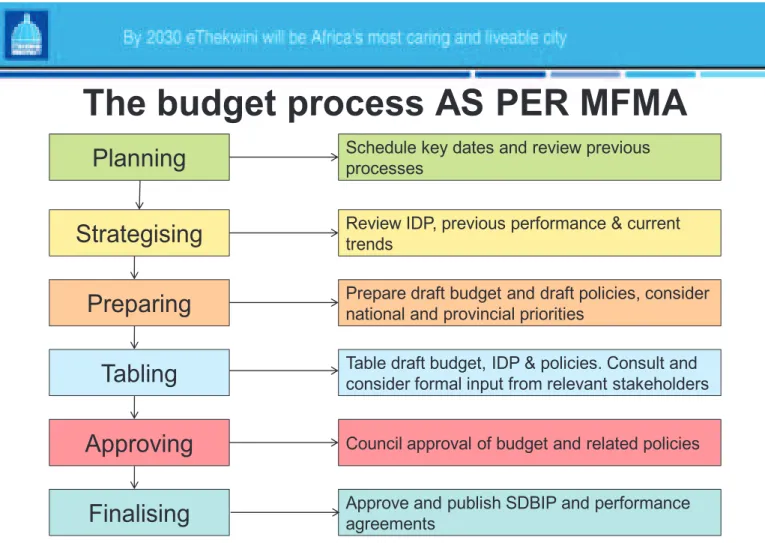

The budget process AS PER MFMA

POLITICAL OVERSIGHT OF THE BUDGET PROCESS

The key to strengthening the link between priorities and spending plans lies in increasing political oversight of the budget process. Political oversight of the budget process allows the Government, and in particular, the municipality, to manage the tension between competing policy priorities and fiscal realities.

PROCESS FOR CONSULTATIONS WITH EACH GROUP OF STAKEHOLDERS AND OUTCOMES

Strengthening the link between government priorities and spending plans is not an end in itself, but the goal should be the improved delivery of services designed to improve the quality of life for all people in the city. Section 53(1)(a) of the MFMA provides that the mayor of a municipality must provide political guidance on the budget process and the priorities that must guide the preparation of the budget.

SCHEDULE OF KEY DEADLINES RELATING TO BUDGET PROCESS

The integrated development planning process further provides a strategic environment for the management and direction of overall planning, development and decision-making in the municipality. The IDP is the result of planning processes and spans a five-year period that correlates with the mandate of political leaders.

KEY NATIONAL AND PROVINCIAL GUIDING DOCUMENTS

There were 5 priorities in the 2014 presidential SONA, which were mainly focused on education, health, fighting crime and corruption, rural development and land reform, and creating decent work, which are the pillars of the national development plan. In response to the province's state title, the municipality has contributed tremendously to infrastructure provision and infrastructure revolution, especially roads, cargo and port, skills improvement, economic development, poverty alleviation, provision of housing and suitable human settlement pattern, improvement of health and healthy lifestyle, climate change mitigation, support of informal traders and job creation.

DEVELOPMENT CHALLENGES

So, against this background, it is clear that the municipality really has a direct role to play in facilitating and managing long-term planning and development processes that consider the issue of sustainability. The municipality has revised its Long Term Development Framework (LTDF) to ensure that sustainability in all its aspects is embedded in the municipality and affects IDPs.

MUNICIPAL STRATEGIC PRIORITY AREAS

All operating and capital programs in the 2014/15 medium-term budget were assessed through a prioritization mechanism developed to ensure alignment with the development strategy of the municipality. The IDP formed the basis of the priorities identified in the strategic plan and all resources were focused on achieving the priorities.

IDP OVERVIEW AND KEY AMENDMENTS

The IDP is an all-encompassing plan that forms the framework for development in a municipality. It aims to coordinate the work of local and other spheres of government in coherent plans to improve the quality of life for all the people living in the area.

IDP REVIEW PROCESS AND STAKEHOLDER PARTICPATION

LINK BETWEEN THE IDP AND THE BUDGET

More importantly, the Performance Management System (PMS) provides the municipality with the ability to monitor and evaluate individual and organizational performance in meeting our IDP results and vision. Like last year, our IDP continues to be the strategic driver of both our budget and performance management system.

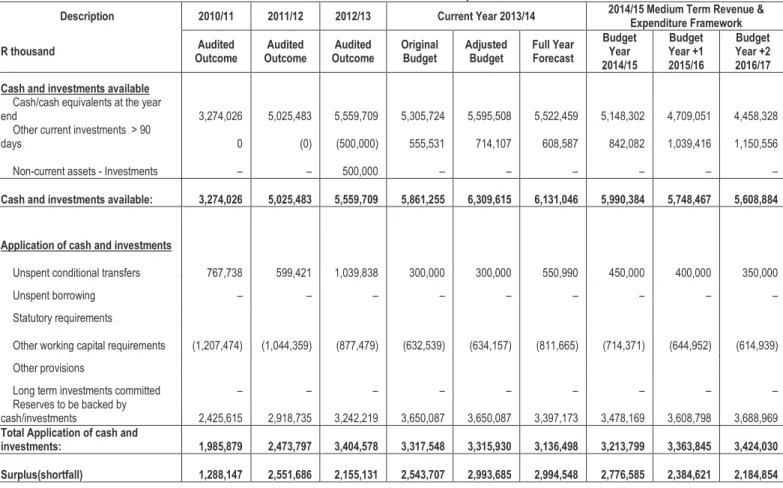

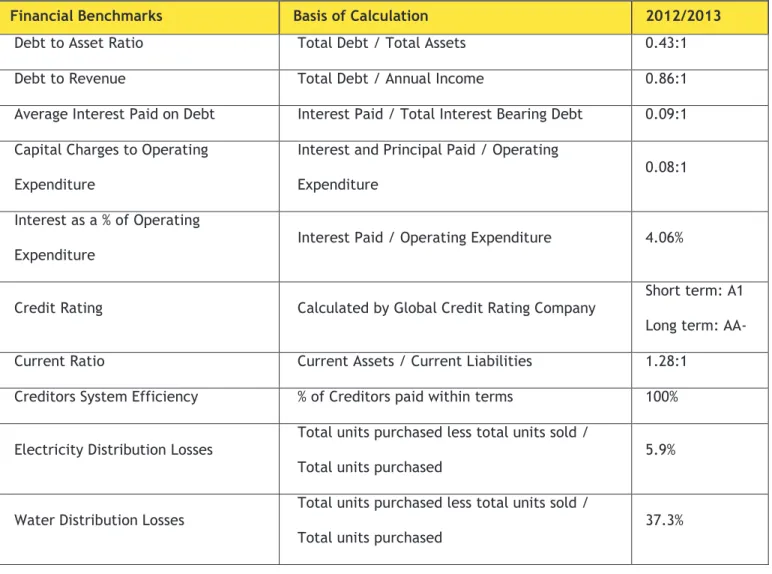

KEY FINANCIAL RATIOS / INDICATORS

The ratio measures short-term liquidity, i.e. the extent to which current liabilities can be paid from current assets. The short term (A1+) and long term credit rating of AA - received by the city is the highest given to any municipality in South Africa.

FREE AND SUBSIDISED BASIC SERVICES

Capital expenditure to operating expenditure (the measure of borrowing costs relative to operating expenditure) compares favorably with the acceptable norm of around 10%. The ratio of 1.28:1 is favorable, as it is above the norm of 1:1 that is normally set for municipalities.

DRINKING WATER QUALITY AND WASTE WATER MANAGEMENT

The MFMA and the Municipal Budget and Reporting Regulations require that budget-related policies be reviewed, and where applicable, updated on an annual basis. The main purpose of budget-related policies is to govern and guide the budget process and inform medium-term projections.

ASSESSMENT RATES POLICY

Wastewater treatment works operated by the Municipality are authorized to discharge treatment effluents into rivers and the marine environment. Below are the budget policies which have been approved by the Council, or have been reviewed/amended and/or are currently being reviewed/amended in accordance with the National Guidelines and other legislation.

CREDIT CONTROL AND DEBT COLLECTION POLICY

The Green Drop regulatory program was established by the Department of Water Affairs to certify the wastewater systems of all municipalities and water service providers. The MTREF includes a budgetary provision for the upgrades and maintenance of water network and sewage treatment works to ensure that the systems are capable of performing to acceptable standards.

TARIFF POLICY

WATER POLICY

SUPPLY CHAIN MANAGEMENT POLICIES

INVESTMENT / CASH MANAGEMENT AND BORROWING POLICIES

In order to give department heads more flexibility in managing budgets, Virements budget procedures are in place to audit budgets (within votes - ie Output Unit) through the Virements budget. In order to ensure compliance with Section 28 of the MFMA and the Municipal Budget and Reporting Regulations, procedures have been established regarding the transfer of funds and budget adjustment reporting.

ASSET MANAGEMENT PLAN

ACCOUNTING POLICY

FUNDING AND RESERVES POLICY

BUDGET POLICY

KEY FINANCIAL ASSUMPTIONS

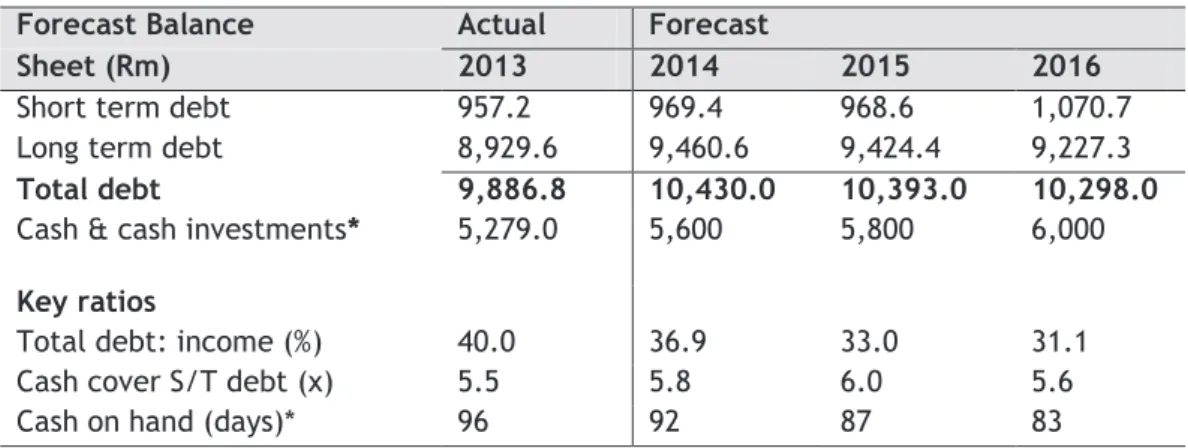

CREDIT RATING OUTLOOK

The 2013/14 capital budget of R5.4 billion is funded with R3.1 billion from government grants, R0.8 billion from internally generated funds and R1.5 billion in external borrowing. The graph below shows the total capital budget since 2007 and indicates its funding sources. Cash in excess of immediate needs is invested in short-term money market instruments in terms of a strict investment policy which stipulates that cash holdings are placed only between the big four South African banks and Investec.

PRICE MOVEMENTS ON SPECIFICS

Amortization Provisions must be cash backed each year, subject to the National Treasury Standard for Days Cash on Hand of 90 days.

TIMING OF REVENUE COLLECTION

AVERAGE SALARY INCREASES

CHANGING DEMAND CHARACTERISTICS (DEMAND FOR SERVICES)

ABILITY OF THE MUNICIPALITY TO SPEND AND DELIVER ON THE PROGRAMS

COST OF SERVICE DELIVERY VS AFFORDABILITY

LOAN DEBT AND INVESTMENTS

Investments for the municipality are made in compliance with and compliance with the Regulation on Municipal Investments of the MFPP, the Council's Investment Policy and other relevant legislation. Investments are made taking into account the risk profile, the liquidity needs of the city and the return on investment.

SOURCES OF FUNDING

- Costs Savings and Productivity Improvement Initiatives

- SUPPLY CHAIN MANAGEMENT

- ENERGY OFFICE

A contract register database is being used to track all payments over R200,000. The first phase of automating the contract register has been completed, as the contract register is now in the JDE accounting system. An Energy Management Steering Committee (EMSC) will be constituted with membership representing each of the entities responsible for major energy use within the municipality.

INVESTMENTS – CASH BACKED

The PSEE project will be governed by a multi-stakeholder steering committee led by the Department of Energy. Indirect social benefits such as job creation/maintenance and skills development related to energy efficiency services.

COLLECTION RATES FOR EACH REVENUE SOURCE

The bad debt provision of approximately R 2.7 billion will not be fully written off. Government debt of about R 135 million (more than 90 days), mainly consists of Ingonyama Trust properties.

LEVELS OF RATES, SERVICE CHARGES AND OTHER FEES AND CHARGES

CONSOLIDATED BUDGET

DETAILED

UHD%DVHG0DQDJHPHQW 6WUDWHJLF3URMHFWV 9RWH&RPPXQLW\DQG(PHUJHQF\6HUYLFHV 'HSXW\&LW\0DQDJHU. 9RWH2IILFHRIWKH&LW\0DQLW\DQG EXGVSHUVRQ ,QYHVWLJDWLRQV /HJDO6HUYLFHV 3HUIRUPDQFH0DQDJHPHQW 0HWURSROLWDQ3ROLFH 5LVN0DQDJHPHQW.

BUDGET SUPPORTING TABLES

BUDGET RELATED CHARTS