07350015%2E2012%2E634342

Teks penuh

Gambar

Garis besar

Dokumen terkait

The test statistic designed for testing conditional stochastic dominance is easily adapted to testing inequality restrictions on other conditional moments, possibly indexed by

The proposed test procedure is based on finite- sample pivots that are valid without any parametric assumptions about the specific distribution of the disturbances in the multi-

While Finkelstein and McGarry ( 2006 ) found no positive correlation between risk and coverage in the long-term care insurance (LTCI) market, our test reveals evidence of

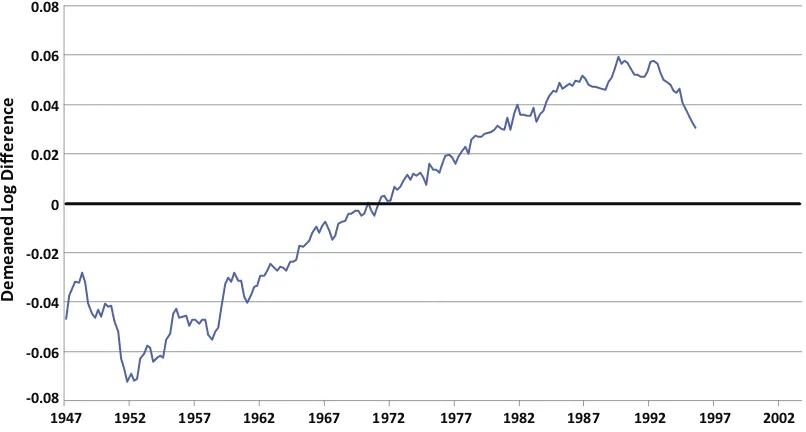

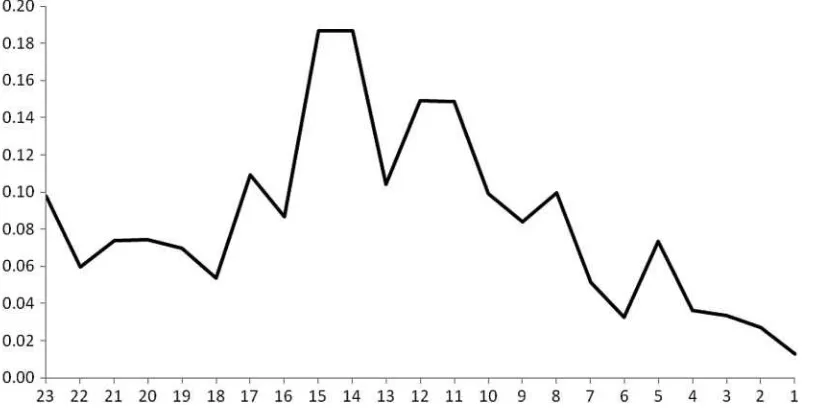

The line labeled test for bias before break point shows the p -values for tests using subsamples that begin in 1971 and end at the date shown on the horizontal axis.. The line

Three programs rewarded high-performing California schools and their teachers: the Governors Performance Award Program (GPAP), the School Site Employee Performance Bonus (SEPB), and

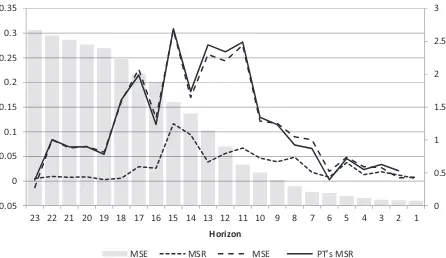

We also consider size-adjusted power. Apart from the Cauchy case, the size distortions when fixed- b critical values are used were small for all of the tests except the MR/S test.

This section also provides the main theoretical results on the limiting behavior of linear combinations of sample moment conditions and presents an easy-to-implement rank test

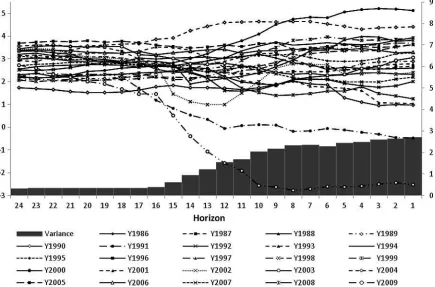

We propose a method to estimate the intraday volatility of a stock by integrating the instantaneous conditional return variance per unit time obtained from the