Directory UMM :Data Elmu:jurnal:J-a:Journal of Economics and Business:Vol53.Issue1.2001:

Teks penuh

Gambar

Dokumen terkait

The nine projects that were put on hold were from firms that expected total IT spending to either remain the same or to decrease (Table 8).. The projects that were most

Abstract: This study examines the relation between stock prices and accounting earnings and book values in six Asian countries: Indonesia, South Korea, Malaysia, the

In Lindh and Malmberg (1998) age structure induced changes in the saving rate trigger an inflationary process unless the loan rate of interest is accommodating the changing

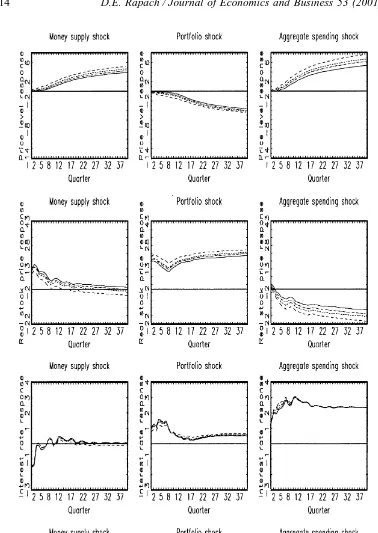

While the world real interest rate is potentially an important mechanism for transmit- ting international shocks to small open economies, much of the recent quantitative research

Based on “simple and intuitive financial theory” (Mukherjee and Naka, 1995; Chen et al., 1986), we hypothesize a relationship between the Singapore stock market and

I use a dynamic model with an optimizing representative agent to explore the role that transaction costs might play in engendering a relationship between real stock returns and

We show that splitting an order into multiple deliveries can reduce the average cycle stock and thus the total cost, especially if the cost of despatching an order (which includes

That is, subjects may form their values for a good differently in a hypothetical market than in a market in which real money is ‘on the line.’ However, given a value has been