Full Terms & Conditions of access and use can be found at

http://www.tandfonline.com/action/journalInformation?journalCode=vjeb20

Download by: [Universitas Maritim Raja Ali Haji] Date: 11 January 2016, At: 22:25

Journal of Education for Business

ISSN: 0883-2323 (Print) 1940-3356 (Online) Journal homepage: http://www.tandfonline.com/loi/vjeb20

Ethics Education in Accounting Curricula: Does

it Influence Recruiters' Hiring Decisions of

Entry-Level Accountants?

Kevin Breaux , Michael Chiasson , Shawn Mauldin & Teresa Whitney

To cite this article: Kevin Breaux , Michael Chiasson , Shawn Mauldin & Teresa Whitney (2009) Ethics Education in Accounting Curricula: Does it Influence Recruiters' Hiring Decisions of Entry-Level Accountants?, Journal of Education for Business, 85:1, 1-6, DOI: 10.1080/08832320903217358

To link to this article: http://dx.doi.org/10.1080/08832320903217358

Published online: 07 Aug 2010.

Submit your article to this journal

Article views: 153

View related articles

CopyrightC Heldref Publications ISSN: 0883-2323

DOI: 10.1080/08832320903217358

Ethics Education in Accounting Curricula: Does it

Influence Recruiters’ Hiring Decisions of

Entry-Level Accountants?

Kevin Breaux, Michael Chiasson, Shawn Mauldin, and Teresa Whitney

Nicholls State University, Thibodaux, Louisiana, USA

Recently, the National Association of State Boards of Accountancy (NASBA) has focused its attention on mandating specific ethics coursework within the 150-hr requirement for eligibility to sit for the uniform CPA examination. This push for ethics education heightened attention toward ethics in the accounting curriculum and is the basis for the present study. The primary objective of the present research study is to test the hypothesis that ethical coverage in account-ing programs is an important factor in recruitaccount-ing decisions for entry-level accountaccount-ing positions. The research was conducted in two phases. The first phase employed an experimental design to test whether ethical coverage in accounting programs is an important factor in recruiting decisions for entry-level accounting positions. The second phase employed a survey, allowing recruiters to self-report which criteria they value most in recruiting for entry-level accountant positions. The results from both phases suggest that ethical coverage in accounting programs in not an important factor in recruiting decisions for entry-level accounting positions.

Keywords: Accounting, Curriculum, Education, Ethics, Recruiting

The lack of ethics coursework in business and accounting curricula is well documented. According to MacLean and Litzky (2003), less than 25% of the top 50 business schools require a stand-alone ethics course. In a survey that Willen (2004) conducted, only 33% of accredited business schools require an ethics course. Many schools claim to integrate ethics throughout the curriculum. However, integration prob-ably results in a hodgepodge of topics that may bring into question the legitimacy of solid ethics coverage. The recent scandals of Enron, WorldCom, and Arthur Andersen have raised the awareness of the lack of ethics coverage in busi-ness and accounting curricula. As a result of the collapse of these organizations and the lack of definitive ethics coverage in business and accounting curricula, the National Associ-ation of State Boards of Accountancy (NASBA) responded with a movement to implement specific ethics requirements in accounting curricula. This movement resulted in a resur-gence of the debate as to the value and method of delivery of ethics in accounting curricula.

Correspondence should be addressed to Kevin Breaux, Nicholls State University, Accounting and Information Systems, P.O. Box 2015, Thibodaux, Louisiana 70310, USA. E-mail: Kevin.Breaux@nicholls.edu

Even before the Sarbanes-Oxley Act was enacted in July 2002, many accounting firms were requiring ethics training for their employees (Dipiazza, 2002). Most State Boards of Accountancy require ethics as a part of the Continuing Pro-fessional Education (CPE) requirement to maintain a CPA license. Considering the movement by NASBA, the contin-ued interest in ethics by accounting firms, and the ethics CPE requirement, it would seem that ethics education in ac-counting curricula would be an important factor in recruiters’ hiring decisions of entry-level accountants. Also, if ethics is important, do recruiters distinguish between separate ethics courses and integration of ethics into the curriculum? In ac-cordance, the purpose of the present article is to address these questions. The NASBA’s Push for Ethics section of the present article presents a history of NASBA as it relates to its movement toward requiring specific coursework in ethics.

NASBA’S PUSH FOR ETHICS

The idea of professional ethics dates back to the early 19th century and has since evolved (Baker, 1999). In the early 1800s, professional ethics was the expected behavior of a gentleman. Over time, professional ethics began to take form

2 K. BREAUX ET AL.

as codes and regulations. Every profession—from account-ing to medicine—has codes of ethics. These codes are es-tablished by professional organizations to give the public added confidence. Because these codes are present, the pub-lic expects strict adherence to these rules and guidelines. It is obvious why the medical profession needs codes of ethics: the lives of practitioners’ patients depend on their decisions. Although the importance of professional ethics in account-ing may not be as transparent, ethics in accountaccount-ing is also important.

Just as patients rely on doctors, the public relies on in-formation produced and validated through the work of ac-countants. Accounting professionals have a specific skill set that includes knowledge of tax laws, accounting principles, and auditing standards. The general public does not possess this knowledge, and this difference creates the public’s re-liance on accounting information. Also, accountants have access to information, such as client files, which the general public does not. The accounting profession provides infor-mation used by investors, stock market analysts, and share-holders. The effects of unethical behavior by accountants can cause catastrophic events that extend from the corporation to its shareholders, as was seen with WorldCom, Enron, and Arthur Andersen. Therefore, it is pertinent that accountants follow the codes of ethics and other regulations established by professional accounting organizations such as the Amer-ican Institute of Certified Public Accountants (AICPA).

NASBA is responsible for setting policies regarding re-quirements for eligibility to sit for the uniform CPA examina-tion. Recently, NASBA has focused its attention on detailing specific courses for candidates to take to satisfy the 150-hr requirement. In February 2005, NASBA issued an exposure draft on rules 5–1 and 5–2. The exposure draft contained pro-visions requiring candidates to complete 3 semester credit hours (SCHs) in ethical and professional responsibilities of CPAs and 3 SCHs in ethical foundations and applications in business to meet the minimum educational requirement to sit for the uniform CPA examination. The exposure draft was available for response until August 2005, and as expected, drew much attention from both opponents and proponents.

NASBA (2005) stated that the change to require ethics was necessary because:

The content of the 150-hr program is critical in assuring the necessary educational preparation of applicants. The ad-equacy of this preparation is continually challenged by the rapid rate of change experienced in business. Due to glob-alization, technological innovation, and other faced-paced changes, there is a need for a broader set of transferable skills and content knowledge than in the past. (p. Rules -5–7)

The AICPA (2005) responded by stating that the exposure draft would not achieve the desired benefits and that it would create significant and costly practical problems for colleges and universities, resulting in negative consequences

for students, public accounting firms, taxpayers, and the State Boards of Accountancy.

Although many educators agree that ethics should be em-phasized in business and accounting curricula, most believe that this mandate to require specific courses and hours with-out any evidence to support these requirements would lead to negative consequences. NASBA appears to agree; on Oc-tober 28, 2005, the NASBA Board of Directors approved the recommendation of the NASBA Education Committee to not move forward with the current form of the proposed rules. A joint panel will be developed to further review and discuss Rules 5–1 and 5–2. NASBA’s decision to review the ethics requirements further underscores the importance of this research.

METHOD

Research Problem and Hypothesis

Due to NASBA’s recent attempts to mandate specific ethics coursework in accounting curricula, the debate on the mer-its of requiring additional ethics education has increased. The proposed mandate to complete 3 SCHs in ethical and professional responsibilities of CPAs and 3 SCHs in eth-ical foundations and applications in business would have affected the requirements to sit for the uniform CPA ex-amination and therefore the courses universities must offer. Additional ethics courses would add additional costs to ac-counting programs and to universities that are already facing budget problems and faculty shortages. These costs would ultimately be passed on to students. For additional ethics ed-ucation to have merit, it would have to add value at some level. One level would certainly be entry into the profession. Determining whether CPA firm recruiters of entry-level accountants consider ethics coursework in their recruiting decisions is important because it provides NASBA with rel-evant feedback from the profession. Therefore, the purpose of the present study is to empirically investigate the effect of ethics coursework on the recruitment of entry-level ac-countants. Specifically, the research was designed to test the following hypothesis:

Hypothesis 1: Ethical coverage in accounting programs is an important factor in recruiting decisions for entry-level accounting positions.

Research Instrument

The present research used four different research instruments. The first three research instruments (Appendixes A and B) listed typical criteria found in an applicant for an entry-level accounting position and asked recruiters to indicate how ac-tively they would recruit the applicant based on the listed criteria. The criteria used to describe the applicant included age, professional appearance, eligibility to sit for the uniform

CPA examination, good communication skills, involvement in extracurricular activities, overall GPA, accounting GPA, as well as energy, motivation and enthusiasm. These crite-ria were used because of their extensive use in recruitment studies that indicated their importance to the success of ac-counting students once they join the acac-counting profession (Accounting Education Change Commission, 1990; Baker & McGregor, 2000; Paseward et al., 1988; Hardin & Stocks, 1995). However, there is a lack of research on the importance of ethics education in recruitment studies. By addressing the importance of ethics coverage in curricula with respect to recruiting, the present study attempts to extend the litera-ture on what criteria are important to recruiters of entry-level accountants.

Using the aforementioned criteria, three different versions of the research instrument were developed and administered to participants in the present study. The different versions were developed to empirically test whether ethical coverage was an important factor in recruiting decisions. This ma-nipulation addressed the preference for ethical coverage in the curriculum of the applicant. The manipulations were as follows:

Research Instrument 1(RI1): The student’s coursework

con-tains no ethical content (Appendix A).

(RI2): The student’s coursework integrates ethics throughout

the curriculum (Appendix B).

(RI3): The student’s coursework contains specific courses in

ethics.

In this series of research instruments, recruiters were asked to indicate how actively they would recruit the recent grad-uate with the listed criteria. The recruiters were asked to use a Likert-type scale ranging from 0 (not very actively) to 10 (very actively) to indicate how actively their firm would recruit the hypothetical applicant.

RI4 used the same criteria asRI1–3, but simply listed the

criteria believed to be useful in recruiting decisions. Each recruiter was asked to rank the characteristics in order of importance using a Likert-type scale ranging from 1 (most important criterion) to 9 (least important criterion). The instrument also asked recruiters to list other criteria that they consider when interviewing a candidate for an entry-level accounting position.

Each of the four research instruments also contained a sec-tion on firm demographics. The firm demographic quessec-tions asked participants to indicate the number of CPA’s employed by the firm and to classify the firm as local, regional, or na-tional.

Sample Selection

To test the hypothesis, the research instruments were mailed to CPA firm recruiters in a four-state area including Al-abama, Louisiana, Mississippi, and Texas. The contact infor-mation was taken from the Web sites of the State Boards of

Accountancy for the states. When individual contact infor-mation was available, the research instrument was addressed to an individual CPA at the firm. When individual contact information was not available, the research instrument was addressed to the recruiter of a listed firm. There was no du-plication in the CPA firms receiving the instruments unless the CPA firm had multiple locations in one state. The experi-ment allowed instruexperi-ments to be sent to different locations of a single CPA firm in one state or multistate region. A total of 400 research instruments were mailed, with 100 of each in-strument being evenly distributed over the four-state region. The data collected from the first three research instruments allowed the hypothesis to be tested. The nature of the research dictated a two-phase study. The first phase determined if ethics coursework affects recruiting decisions. The second phase used the data collected from the fourth instrument to determine whether recruiters would self-report that ethics coursework affects their recruiting decisions.

Phase One

The first phase of the study used an experimental behavioral design to test the hypothesis.RI1, 2, 3were sent to 100

partic-ipants, respectively. The instrument responses were analyzed to determine if ethics in accounting programs is an important factor to accounting recruiters in their hiring decisions for an entry-level accounting position. When recruiters were found to value ethics coursework, further analysis was performed to ascertain if a certain delivery method for ethics coursework is preferred-integrated ethics or specific ethics coursework. The data were further analyzed on the differences or similarities in responses based on firm size.

Phase Two

The second phase of the research study determined whether recruiters self-report that ethics is an important criterion in making recruiting decisions.RI4was mailed to 100

partici-pants. The responses were analyzed to determine which cri-teria recruiters value the most. These results were used in conjunction with the results from the experimental behav-ioral design used in the first phase of the study, to determine whether ethics coursework is important to recruiters.

DATA ANALYSIS

Phase One

Phase one tested the hypothesis that ethical coverage in ac-counting programs is an important factor in recruiting de-cisions for entry-level accounting positions. To test the hy-pothesis, analysis of variance (ANOVA) was used because of its appropriateness in situations in which the independent variable (ethics manipulation) is set at a certain level and the dependent variable (ranking) is obtained at each of these levels (Parasuraman et al., 2004).

4 K. BREAUX ET AL.

TABLE 1

Analysis of Variance Results, Phase 1: Ethics Manipulation

Source FValue Prob>F

Ethics 2.452 0.091

Of the 300 research instruments sent, 98 usable instru-ments were returned for a response rate of 32.7%. In each of these research instruments, participants indicated how ac-tively their firm would recruit the student with the given characteristics. This level of recruitment was indicated on a Likert-type scale ranging from and was used as the dependent variable in the ANOVA model. The independent variable in the ANOVA model was the ethics manipulation.

The results of the ANOVA illustrated in Table 1 indicate that there is no difference among the means of the ethics manipulation (F =2.452,p =.091). These results do not lend support to the hypothesis because no difference exists among the means of the manipulations (contains no ethical content, integrates ethics throughout curriculum, contains specific courses in ethics). Therefore, the ANOVA results suggest that ethical coverage in accounting programs is not an important factor in recruiting decisions for entry-level accounting positions.

An additional ANOVA test was used to determine whether Ethics Manipulation×Firm Size explained the variance in the level of recruitment. Firm size was self-reported by the respondents on the research instrument. Each respondent in-dicated the number of CPAs employed by his or her firm, and this number was used as a proxy for firm size. The level of recruitment, presented as a slash on a Likert-type scale rang-ing from, was used as the dependent variable in the ANOVA model, and the firm size was used as the independent vari-able. The results of the ANOVA illustrated in Table 2 indicate that there is no difference among the means of the ethics ma-nipulation with respect to firm size (F=1.337,p=.156). Therefore, firm size does not affect the preference for ethics coursework in recruiting decisions.

Phase Two

Phase two was designed to ascertain which criteria recruiters self-report as important. Phase two usedRI4, which asked

recruiters to rank nine criteria for entry-level accounting ap-plicants by importance. Of the 100 research instruments sent,

TABLE 2

Analysis of Variance Results, Phase 1: Ethics Manipulation and Firm Size Interaction

Source FValue Prob>F

Ethics×Size 1.337 0.156

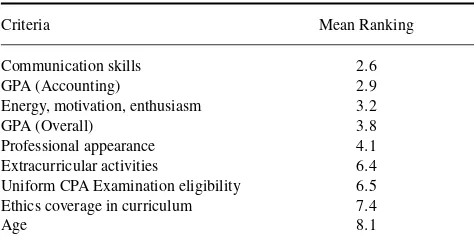

TABLE 3

Analysis of Mean Ranking, Phase 2

Criteria Mean Ranking

Communication skills 2.6

GPA (Accounting) 2.9

Energy, motivation, enthusiasm 3.2

GPA (Overall) 3.8

Professional appearance 4.1

Extracurricular activities 6.4

Uniform CPA Examination eligibility 6.5 Ethics coverage in curriculum 7.4

Age 8.1

19 usable instruments were returned for a response rate of 19%. Each recruiter ranked the most important criterion as 1 while the least important criterion was ranked as 9. To an-alyze these data, the mean ranking was computed for each criterion. The mean ranking for all categories was calculated and are shown in Table 3. The criteria are presented in or-der of importance based on the means as reported by survey respondents.

As evidenced by the mean ranking, ethics coverage in curriculum ranks low in importance in recruiting decisions. Ethics coverage only ranked in the top 5 criteria in 15.8% of the useable surveys. Thus, recruiters self report that ethics coverage is not important in recruiting decisions. With ethics having a mean ranking of 7.4, only age was indicated as being less important than ethics coverage when recruiting for entry-level accounting positions. The results of phase two lend additional support to the findings of phase one that ethics coursework is not an important criterion in recruiting for entry-level accounting positions.

RI4 also asked recruiters to list additional criteria that

were important in recruiting decisions. These criteria indicate other characteristics that recruiters value as important and may be useful in future research studies. Table 4 shows the additional criteria frequently listed by recruiters.

CONCLUSION

If recruiters do not value ethics coursework as this study sug-gests, should colleges and universities offer these courses? Phase one indicated that recruiters do not value ethics in the accounting curriculum when recruiting for entry-level ac-counting positions. Phase two lends support to the results

TABLE 4

of phase one and indicated additional criteria which re-cruiters consider important. Therefore, NASBA’s push for ethics coursework should be evaluated to determine which delivery method of ethics coursework would be most ben-eficial to students, colleges, and the profession as a whole. If specific courses in ethics would not make students more desirable to recruiters, the model used by many schools of integrating ethics in the accounting programs should suffice for ethics education for entry-level accountants. The present research study does not suggest that ethics is not important but rather provides guidance to NASBA as the organization pushes for ethics coursework in accounting curricula. Al-though ethics is important to the profession, it may be to the students’ and profession’s benefit to educate accountants on ethics through CPE courses and internal firm ethics training. More research should be performed to examine whether the profession values on-the-job ethics training more than ethics coursework in college curricula.

REFERENCES

AICPA. (2005). Accounting Education Change Commission. 1990. Ob-jectives of Education for Accountants: Position Statement Number

One.Issues in Accounting Education(Fall): pamphlet. Retrieved July

22, 2008, from http://www.nasba.org/nasbaweb/NASBAWeb.nsf/PS/955 11CC8CE69334A862571B900755B3F/$file/AICPA%20Framework.pdf Baker, R. (1999). Codes of ethics: Some history. Perspectives on

the Professions. Retrieved July 22, 2008, from http://www.iit.edu/

departments/csep/perspective/pers19 1fall99 2.html

Baker, W. M., & McGregor, C. C. (2000). Empirically assessing the impor-tance of characteristics of accounting students.Journal of Education for

Business,75, 149–157.

Dipiazza, S. A. (2002). Ethics in Action.Executive Excellence,19, 15–16. Hardin, J. R., & Stocks, M. H. (1995). The effect of AACSB Accreditation on

the recruitment of entry-level accountants.Issue in Accounting Education, 10, 83–95.

NASBA. (2005). Retrieved July 22, 2008, from http://www.nasba.org/ nasbaweb/NASBAWeb.nsf/PS/264D55C613B9747D862571B900755C7 F?OpenDocument

MacLean, T., & Litzky, B. (2003). Task force report on in-tegrating ethics and business in society in the U.S. manage-ment curriculum. Retrieved July 22, 2008, from http://www.cba.k-state.edu/department/ethics/docs/TaskForceSummaryJune03.pdf Paseward, W. R., Strawser, J. R., & Wilkerson, J. E., Jr. (1988).

Empir-ical evidence on the association between characteristics of graduating accounting students and recruiting decisions of accounting employers.

Issues in Accounting Education,3, 388–401.

Parasuraman, A., Grewal, D., & Krishnan, R. (2004).Marketing research. Boston: Houghton Mifflin Company.

Willen, L. (2004). Kellogg denies guilt as B-schools evade alumni lapses. Bloomberg Press Wire. Retrieved July 22, 2008, from www.cba.k-state.edu/departments/ethics/docs/bloombergpress.htm

6 K. BREAUX ET AL.

APPENDIX A—RECRUITER SURVEY

Assume that your firm is recruiting an entry-level accountant. During the interview process, you meet a student from an AACSB accredited accounting program who has the following criteria:

• The student is 23 years old.

• The student has a professional appearance.

• The student is eligible to sit for the CPA examination.

• The student demonstrates good communication skills.

• The student’s coursework contains no ethical content.

• The student is involved in several extracurricular activities.

• The student’s overall GPA is a 3.4 on a 4.0 scale.

• The student has a GPA of 3.6 in accounting courses.

• The student is energetic, motivated and enthusiastic.

How actively would your firm recruit the above student? Please indicate your answer by placing a slash on the line below.

0————1———2————3————4————5————6————7————8————9————10

Not Very Actively Very Actively

Firm Demographics

How many CPA’s does your firm employ?

Would you classify your firm as local, regional or national?

APPENDIX B—RECRUITER SURVEY

Assume that your firm is recruiting an entry-level accountant. During the interview process, you meet a student from an AACSB accredited accounting program who has the following criteria:

• The student is 23 years old.

• The student has a professional appearance.

• The student is eligible to sit for the CPA examination.

• The student demonstrates good communication skills.

• The student’s coursework integrates ethics throughout the curriculum.

• The student is involved in several extracurricular activities.

• The student’s overall GPA is a 3.4 on a 4.0 scale.

• The student has a GPA of 3.6 in accounting courses.

• The student is energetic, motivated and enthusiastic.

How actively would your firm recruit the above student? Please indicate your answer by placing a slash on the line below.

0————1———2————3————4————5————6————7————8————9————10

Not Very Actively Very Actively

Firm Demographics

How many CPA’s does your firm employ?

Would you classify your firm as local, regional or national?