CHAPTER 1

1. INTRODUCTION

1.1: Background to the study

Banking activities were sufficiently important in Babylonia in the second millennium B.C. that

Written standards of practice were considered necessary. These standards were part of the Code of Hammurabi – the earliest known formal laws. Obviously, these primitive banking

Transactions were very different in many ways to their modern-day

counterparts. Deposits were not of money but of cattle, grain or other crops and eventually precious metals. Nevertheless, some of the basic concepts underlying today’s banking system were present in these ancient

arrangements. A wide range of deposits was accepted, loans were made, and borrowers paid interest to lenders.1

Similar banking type arrangements could also be found in ancient Egypt. These arrangements stemmed from the requirement that grain harvests be stored in centralized state warehouses.

Depositors could use written orders for the withdrawal of a certain quantity of grain as a means of payment. This system worked so well that it continued to exist even after private banks dealing in coinage and precious metals were established2.

We can trace modern-day banking to practices in the Medieval Italian cities of Florence, Venice, and Genoa. The Italian bankers made loans to princes,

1 Davies, G. (1994) “A History of Money from Ancient Times to the Present Day”, Cardiff, UK, University of Wales

Press.

both to finance wars and their lavish lifestyles, and to merchants engaged in international trade. In fact, these early banks tended to be set up by trading families as a part of their more general business activities. The Bardi and Peruzzi families were dominant in Florence in the 14th century and

established branches in other Parts of Europe to facilitate their trading activities3. Both these banks extended substantial loans to Edward III of

England to finance the 100 years war against France. But Edward defaulted, and the banks failed.

Perhaps the most famous of the medieval Italian banks was the Medici bank, set up by Giovanni Medici in 13974. The Medici had a long history as money

changers, but it was Giovanni who moved the business from a green-covered table in the market place into the hall of a palace he had built for himself. He expanded the scope of the business and established branches of the bank as far north as London. While the Medici bank extended the usual loans to merchants and royals, it also enjoyed the distinction of being the main banker for the Pope. Papal business earned higher profits for the bank than any of its other activities and was the main driving force behind the

establishment of branches in other Italian cities and across Europe.

Much of the international business of the medieval banks was carried out through the use of bills of exchange. At the simplest level, this involved a creditor providing local currency to the debtor in return for a bill stating that a certain amount of another currency was payable at a future date – often at the next big international fair. Because of the church prohibition on directly charging interest, the connection between banking and trade was essential. The bankers would take deposits in one city, make a loan to someone

transporting goods to another city, and then take repayment at the

destination. The repayment was usually in a different currency, so it could easily incorporate what is essentially an interest payment, circumventing the

3 Hoggson, N. F. (1926) “Banking Through the Ages”, New York, Dodd, Mead & Company.

church prohibitions. For example, a Florentine bank would lend 1000 florins in Florence requiring repayment of 40,000 pence in three months in the bank’s London office. In London, the bank would then loan out the 40,000 pence to be repaid in Florence at a rate of 36 pence per florin in three

months. In six months, the bank makes 11.1 percent – that’s an annual rate of 23.4 percent.

It is also interesting to note that a double-entry bookkeeping system was used by these medieval bankers and that payments could be executed purely by book transfer5.

During the 17th and 18th centuries the Dutch and British improved upon Italian banking techniques. A key development often credited to the London goldsmiths around this time was the adoption of fractional reserve banking6.

By the middle of the 17th century, the civil war had resulted in the demise of the goldsmiths’ traditional business of making objects of gold and silver. Forced to find a way to make a living, and having the means to safely store precious metal, they turned to accepting deposits of precious metals for safekeeping. The goldsmith would then issue a receipt for the deposit. At first, these receipts circulated as a form of money. But eventually, the goldsmiths realized that since not all of the depositors would demand their gold and silver simultaneously, they could issue more receipts than they had metal in their vault.

Banks became an integral part of the US economy from the beginning of the Republic. Five years after the Declaration of Independence, the first

chartered bank was established in

Philadelphia in 17817, and by 1794, there were seventeen more. At first,

bank charters could only be obtained through an act of legislation. But, in 1838, New York adopted the Free Banking

5 Goldthwaite (1995) op. cit.

6 Davies (1994) op. cit.

Act, which allowed anyone to engage in banking business as long as they met certain legal specifications. As free banking quickly spread to other states, problems associated with the system soon became apparent. For example, banks incorporated under these state laws had the right to issue their own bank notes. This led to a multiplicity of notes – many of which proved to be worthless in the all too common event of a bank failure. With the Civil War came legislation that provided for a federally chartered system of banks.

This legislation allowed national banks to issue notes and placed a tax on state issued bank notes.

These national bank notes came with a federal guarantee, which protected the note-holder if the bank failed. This new legislation also brought all banks under federal supervision. In essence it laid the foundations of the present-day system.

1.2. Area of the study

Somaliland bank (baanka soomaaliland) Thus, the president of that time appointed a board of directors consisted of governor (gudoomiyaha baanka), and director general to direct the activities of the bank, and succeeds partially its task of opening the bank, which

means only three regions are opened out of six regions, while the three remaining regions are not opened. In 1997 the administration are replaced and nominated new governor, and two director generals, which one holds two positions both vice-governor and director general.

After short period of the stabilization of the central bank, the president of that time (Mr. Egal) has suggested the former Somali currency should be replaced to a new Somaliland shilling8. This task was appointed to the central

bank to issue a new currency and it was its first assignment. The central bank sets the design, symbols, nodes, and all its features and then proposed to the parliament and they approved in june-3-1994. Lastly the central bank declared the bid and the British company named (Harrison and sons limited) wins the contract and they signed the contract of printing the new currency in June -9-1994 to the British company and the currency (Somaliland

shillings) received in 12-june-1994 and the central bank had declared in 20-october-1994 for the replacement of the former Somali shillings.

Unfortunately, the central bank had completed this task partially, which means only three regions ( Hargeisa, Borame and Ber-bera) had being replaced their previous money out of the six while the other regions

remained unchanged and use their previous money. Furthermore, in 2002 had its second task when forgery money enters to the market and the central bank printed a new money with slight modification of adding silver wire in order, to know whether its forgery or not.

In 2011 the president (siilaanyo) suggested to replace again in former Somali for the rest three regions and it achieved only Togdheer region and printed a new paper money and former Somali had been burned. The current president of Somaliland has tried many times to replace the previous Somali shillings which is commonly used in eastern regions of the country, but nothing had being achieved yet for this trials, because of lack of adequate capital to collect and change it. The government paid 10 billion only the replacement of former Somali currency in Togdheer which is highly cost and it does not have this ability and capacity to print a new currency.

It’s very interesting to know, that the role of the central bank in the

regulation of the financial market is completely passive, and the hawala and money changers regulated the market as they want and their expectations. Though, the central banks have the highest authority for the regulation of the money market and keep the prestige of the money and setup the rates. According to the words of DE KOCK,9 ‘’the privilege of note-issue was almost

everywhere associated with the origin and development of central bank’’ the role of bank is absolutely inactive, due to, the currency both Somaliland shilling and dollar is the hands of the businesses and hawala and there is a lack of collaboration between the government, businesses, and the bank. However, the price stability and exchange stability were the traditional objective of central banking and its banks duty creating strong relationship for the concerned bodies in order to establish and setup a fixed rate of

exchange and keeping of the currency’s privilege by revaluation and play his role for the financial market.

Somaliland bank (BAANKA SOOMAALILAND) has the highest financial

authority and is responsible for managing the expansion (supply of money to the market and issuance of new money if shortage of money takes place) and contraction of the volume of the money (if inflation arises and when supply of the money is too high to the market). Thus, Somaliland has a unique currency (Somaliland shilling) and firstly, was issued in 1994, while the Somaliland president at that time (Mr. Egal) has suggested the former Somali currency should be replaced by a new Somaliland shilling.

This duty was assigned in the central bank in order to establish and prepare all features that the currency needed to have in terms of design, quantity, symbols, and appearance. After long discussion and brainstorming, the bank succeeded the execution of this job. In June- 3- 1994 sends to the parliament and they are approved. It’s very interesting to know that the central bank

were not have a capital to finance and it had signed a contract by a business man named (Mr. ibrahim dhere) for the payment of the hard currency and he will take the replaced former Somali shilling. Furthermore, when the money received the bid has been declared and British company (Harrison and sons limited) wins the tender and in june-9-1994 the contract has been signed together and the order being placed. After a short period the Harrison finished the issuance of the money and it reaches to the country in

12-october-1994. The quantities that have been issued were only 5 billion, and in 20-october-1994 had being declared its replacement. Fortunately

completed this heavy duty partially, which means only three regions ( maroodi-jeex, awdal and saaxil) have been collected their previous currency and replaced by a new Somaliland shilling, while the other three regions remained unchanged and used their previous money. The Somali shilling which were used at that time are collected and putted in the hands of the business men and therefore, the bank notes were issued with

denominations of 5,10,10, 20,50,100,500,1000,1nd 5000 shillings and coins’ of 1 shilling , with dates ranging from 1994 to 2011. Currently only the

500sh, 1000sh, and 5000shillings notes are in circulation and the coins and other remaining notes are not currently minted or circulated.

For the first time, the Somaliland shilling enters to the market the exchange rate ( SICIRKA SARIFKA) were $100=5000 shillings and it was very expensive and the two neighbor countries Ethiopia and Djibouti argues its highly

revaluated , on the other hand, the $1=5000 of Somali shillings. But, after a time the exchange rate was progressively increased to 4200 shillings which is 60% in a ratio. From time to time the Somaliland currency becomes

devaluated due to the lack of control of the central bank and the

notes that are absolutely out of the circulation or extremely reduced their usage.

Sample of Paper notes that are not currently in the

circulation

The central bank provides exchange services for various currencies at the official government rate, but most people prefer the better. Although, unofficial rates provided by the remittance agents (XAWILAADAHA) and money changers (SARIFLAYAASHA) found on the streets of the main cities. In November 2000 the official exchange of the Somaliland central bank was 4500 shillings for 41 US dollar. Unofficial exchange rates at the time

fluctuated between 4000 to 5000 shillings per dollar, and in December 2008, the official exchange rate had fallen to 7500 shillings per US dollar.

embargo and money changers whom setup any rates they want as central bank employee reported and most of families lived in the country are

receive their livelihood from their relatives lived in abroad in dollar. Actually the money changers set up the rates due to their expectations of increment sand decrements of dollar and Somaliland shilling. For occasion, at the end of the month when the salaries are given to the employee of international agencies in dollar and the Diaspora remitted abroad to their relatives in dollar they decrease the exchange rate of dollar against Somaliland shilling revaluating the Somaliland currency in order to gain a large amount of dollar amount in few amount of Somali land shilling.

Somaliland exchange market ( suuqa sarifka lacagta ee somaaliland)

All the above mentioned reasons has greatly affected the value of

The former and current governors of the central bank have tried many times to capture the control of the financial market, but nothing had become

fruitful for this trials and it had become null and void.

1.3. Statement of the problem

In his well-known 2007 article, michiel hendric De cock, states that the

central bank ‘’is the organ of government that undertakes the major financial operations of government and by its conduct of these operations and by other means, influences the behavior of financial institution so as to support the economy policy of the government’’10. Therefore, the Somaliland central

bank has the highest authority of undertaking all financial operations and regulating the exchange market, unlike this, the central bank fails for doing this task and money changers and few business men those both the two currencies shilling and the dollar are their hands regulates the market.

Since, the Somaliland community is mainly depends on the money that their relatives remitted from the abroad and livestock, it’s important to know the impact of the floating rate to their livelihood. Although it is undoubtedly clear that the intervention of the central bank is highly needed, still it is feasible that the floating exchange rate and fixed exchange rate have an impact for the society.

It is arguable that the passive role of the central bank in the financial market will create classes for the society, because of the instability of the money market and incompatibility of the goods and services. However, the central

bank should create a strong relationship for the money changers, business, and ministry of finance in order to establish the regulations of the market. As result, it is important to look for a system which can re-establish the power of central bank and the privilege of the Somali land shillings. In order to scrutinize how the role of the central bank can be re-established, this thesis will answer for the following research questions:

What are the causes of the fluctuations and devaluations of Somaliland shillings?

Does floating exchange and fixed exchange rate have a negative impact for the exchange and value of the money?

How we can re-establish the central bank’s authority of regulating financial market?

Do money changers and hawala changers have an impact for the exchange?

What role the community plays the fluctuations of the Somaliland

shilling?

1.4. Objectives of the study

1.4.1. General objectives

1.4.2. Specific objectives.

To know how the Somaliland central bank works

To identify the role central bank plays in the financial market, and

The main causes of the devaluation of Somaliland currency

against foreign currency.

to know the causes of the fluctuations of the shilling

the impact of the fluctuation for the value of the shilling and the

community

to highlight and create active central bank to regulate financial

and exchange market

to obtain a bachelor degree of accounting

1.4.3. Significance of the study

This study focuses on the causes the devaluations of Somaliland shilling. It specifically focuses on the exchange rates and its impact of the economy and the society. In addition to, it will explore the affects of the money changers and the Xawaala changers for the devaluation of the Somaliland shillings against the dollar. Furthermore, the study seeks logical solutions for the excessive fluctuations in the shilling through strengthen the role of the central bank.

With view of this, this thesis will assist:

Central bank board

Government,

Businesses, Community, and

It also helps from the board of the bank to realize that the fluctuations and the loss value of the currency can be resolved through the

enhancement and the effective of the central bank and creating strong relations for all the concerned bodies.

It will also further provide for researchers, academics and student reliable data about the role of the central bank of the devaluation and fluctuations of Somaliland shillings

1.5. Scope of the study

The study uses the Somaliland central bank as a case study. It examines the causes of the fluctuations and devaluations of Somaliland shillings. With regard to the causes of the fluctuations the study will only address the

passive role of the central bank as the primary causes which caused the loss value of the shillings and put the market in the hands of the money

changers. The study will not be tasked to examine the other related causes of the fluctuation and devaluation of the shilling. On other hand, the thesis examines the possibilities of a controlling the financial market through

activating the role of the central bank and its structure. With regard to this, it will examine the compatibility between the bank, money changers,

government institutions, and the business men and creating strong relationships for them.

1.5.1. Limitation of the study

The passive role of the central bank as the main causes of the fluctuation and devaluation of the Somaliland shillings.

With regard to the other sources and the roots of the causes of the devaluation and the fluctuations, this study will not be tasked to address other causes.

On other hand, the constraints of the study faces are lack of relevant,

accurate and sufficient information.

1.6. Research methodology

This study will be analytic. It will consist of an analysis on both the primary and secondary sources. The primary data source will be

face to face approach interview,

Focus group discussion;

In addition, the study will try to conduct through phone interview and

distribute a questionnaire.

Then the information that has been received will be analyzed and incorporated to this analytical study.

The secondary sources will be gathered from the related books, magazines, articles and Google and is mainly is used to cover the historical background of the study.

CHAPTER TWO

LITERATURE REVIEW

2. Theoretical framework

2.1. Introduction

In this chapter the researcher will explain and describe the concepts that are relevant in the field of central bank and exchange and necessary to facilitate a comprehensive analysis and understanding of the research. In particular, the frame of reference which was used in this study will be presented.

2.2. Central banking

A central bank is a public institution that manages a state’s currency, money supply, interest rates. Somaliland central bank also usually oversees the commercial banking system of their respective countries. In contrast to a commercial, a central bank possesses a monopoly on increasing the country’s monetary base. And usually also prints the national currency, which usually as the nation’s tender.

rates, setting the reserve requirement, and acting as a lender of the last resort to the banking sector during times of bank insolvency and financial crises. Central banks usually also have supervisory powers, intended to prevent bank runs and to reduce the risk that commercial banks and other financial institutions engage in reckless (out of control) or fraudulent

behavior. Central banks in most developed countries are institutionally designed to be independent from political interference.

Somaliland bank is planned to be independent for the political interference like the political parties, government institutions and the commercial sector.

2.2.1. Naming of the central bank

There is no standard terminology for the name of a central bank, but many countries use the ‘’bank of country’’ form. Some are styled ‘’national’’ banks such as ‘’national bank of Ukraine’’; but the term national bank is more often used by privately owned commercial banks, especially in the United States. In some cases, central banks may incorporate the word ‘’central’’ (for

example European central bank; but the central bank of India is a government owned commercial bank and not a central bank.

Other central banks are known as a monetary authority such as the monitory authority of Singapore and many countries have state owned banks or other quasi-government entities that have entirely separate functions, such as financing imports and exports.

Similarly, as the article 4 of the Somaliland banking laws11 stated, Somaliland

uses the term of central bank in order to indicate both the monetary authority and leading banking entity

2.2.2. Functions of the central bank

. Central banks are charged with the responsibility of keeping the physical reserves of the country (e.g. gold) and regulating the amount of money in circulation and the credit supplied to the economy.

They are the sole suppliers of banknotes (the issue of coins is not always the sole right of the central bank). Central banks are responsible for monetary policy which keeps the national currency as stable as possible. They represent the national interest in relations with the International

Monetary Fund, the World Bank and other international financial institutions. Two of the four central banks in this study have banking supervision

central banks to neglect the impact of monetary policy on the health of the banking system, which itself could have an impact on the nation’s banking system and therefore the entire economy.

2.2.3. Monetary policy

Central banks implement a country’s chosen monetary policy. At the most basic level, this involves establishing what form of currency the country may have, whether a fiat currency, gold backed currency (disallowance for the countries with membership of the international monetary fund), currency board or currency union. When a country has its own national currency, this involves the issue of some form of standardized currency, which is

essentially a form of promissory note (a promise to exchange the note for money under certain circumstances). Historically, this was often a promise to exchange the money for precious metals in some fixed amount. Now, when many currencies are fiat money, the ‘promise to pay’’ consists of the

promises to accept that currency to pay for taxes.

A central bank may use another country’s currency either directly (in a

Somaliland bank has not backed the foreign currency and the money

changers hold the currencies due to the passive role of the bank. The holding of foreign currencies can be backed and hold through using banks control mechanism and other active measures undertaken by the monetary authority.

2.2.3.1. Goals of monetary policy

There is motive behind the each countries monetary policy. But in the

common, the monetary policy enhances the employment rate it controls the frictional unemployment (the time period between the jobs when a worker is searching for, or transitioning from one job to another) and the structural unemployment. It also sets price stability and promotes the economic growth by encouraging the capital investment and lowering the interest rate in order the firms can loan money to invest in their capital stock and pay less interest for it. It keeps the economy from overheating and avoids market bubbles. It makes:

Financial market stability

Foreign exchange market stability

However, the Somaliland bank has its own monitory policy and it fails the stabilization of the exchange rate and these causes by the

devaluation of the shilling against the dollar.

2.2.4. Currency issuance

Similar to the commercial banks, central banks hold assets (government bonds, foreign exchange and other financial assets) and incur liabilities (currency outstanding). Central banks create money by issuing interest-free currency notes and selling them to the public in exchange for

interest-bearing assets such as government bonds. When a central bank wishes to purchase more bonds than earlier respective national governments make available, they may purchase private bonds or assets denominated in foreign currencies.

Since Somaliland bank is non-interest bearing still offers a loan to the

government and makes receipts and collections of some money such as the employee income tax, and all deductions that is necessary to be made and usually charges a fees. Then, the central bank remitted this income for the accounts of the government institutions. This income, derived from the power to issue currency is called seigniorage , and usually belongs to the central government

2.2.5. Limits on policy effects

once in an open market. Robert Mundell’s ‘’impossible trinity’’ is the most famous formulation of these limited powers, and postulates that is

impossible to target monetary policy, the exchange rate (through a fixed rate) and maintain free capital movement, this essentially means that central banks may target interest rates or exchange rates with credibility, but not both at once. In most famous case of policy failure, Black Wednesday, George Soros arbitraged the pound sterling’s relationship to the EUC (after making $2 billion himself and forcing the UK to spend over $8 billion

defending the pound), and forced it to abandon its policy. Since then he has been a harsh critic of clumsy bank policies and argued that no one should be able to do what he did.

The most complex relationships are those between the yen and US dollar, and between the euro and its neighbors. The situation in Cuba is so

exceptional as to require the Cuban peso to be dealt with simply as an exception, since the dollar were ubiquitous in Cube’s markets its

legislations in 1991, but were officially removed from the circulation in 2004 and replaced by the convertible peso.

According to this the US dollar is every were in Somaliland markets. It needs a legislation prohibiting the dollar in the hands of the money changers and the community. The central bank should propose a law prohibiting the dollar in the market to the parliaments to approve it.

2.2.6. Policy instrument

While capital adequacy is important, it is defined and regulated by the bank for international settlements, and central banks in practice generally do not apply stricter rules.

To enable open market operations, a central bank must hold foreign exchange reserves (usually in the form of government bonds) and official gold reserves. It will often have some influence over any official or mandated exchange rates: some exchange rates are managed, some are market based (free float) and many are somewhere in between managed and dirty float). By far the most visible and obvious power of many modern central banks is to influence market exchange rates. Although the mechanism differs from country to another, most use a similar mechanism based on a central bank’s ability to create as much fiat money as required.

2.2.7. Open market operation

Through open market operations, a central bank influences the money supply in an economy directly. Each time it buys securities, exchanging money for the security, it raises the money supply. Conversely, selling of security lowers the money supply. Buying of securities thus amounts to printing new money while lowering supply of the specific security.

All of these interventions can also influence the foreign exchange market and thus the exchange rate. For example the People's Bank of China and the Bank of Japan have on occasion bought several hundred billions of U.S. Treasuries, presumably in order to stop the decline of the U.S. dollar versus the renminbi and the yen.

2.2.8. Capital requirements

All banks required to hold a certain percentage of their assets as capital, a rate which may establish by the central bank or the banking or the banking supervisor. For international banks, including the 55 members’ central banks of the bank for international settlement, the threshold is 8% of risk adjusted assets, whereby certain assets (such as government bond) are considered to have lower risk and are either partially or fully excluded from total assets for the purposes of calculating capital adequacy. Partly due to concerns about asset inflation and repurchases agreements, capital requirement may be considered more effective than reserve requirement in preventing indefinite lending; when at the threshold, a bank cannot extend another loan without acquiring further capital on its balance sheet.

2.2.9. Reserve requirement

banks. Such legal reserve requirements were introduced in the 19th century as an attempt to reduce the risk of banks overextending themselves and suffering from bank runs, as this could lead to knock-on effects on other overextended banks.

As the early 20th century gold standard was undermined by inflation and the late 20th century fiat dollar hegemony evolved, and as banks proliferated and engaged in more complex transactions and were able to profit from dealings globally on a moment's notice, these practices became mandatory, if only to ensure that there was some limit on the ballooning of money

supply. Such limits have become harder to enforce. The People's Bank of China retains (and uses) more powers over reserves because the yuan that it manages is a non-convertible currency. Loan activity by banks plays a

fundamental role in determining the money supply. The central-bank money after aggregate settlement – "final money" – can take only one of two forms:

physical cash, which is rarely used in wholesale financial markets,

central-bank money which is rarely used by the people

The currency component of the money supply is far smaller than the deposit component. Currency, bank reserves and institutional loan agreements together make up the monetary base, called M1, M2 and M3. The Federal Reserve Bank stopped publishing M3 and counting it as part of the money supply in 2006.

Central banks often have requirements for the quality of assets that may be held by financial institutions; these requirements may act as a limit on the amount of risk and leverage created by the financial system. These

counterparties only when security of a certain quality is pledged as

collateral.

2.2.10. Exchange requirements

To influence the money supply, some central banks may require that some or all foreign exchange receipts (generally from exports) be exchanged for the local currency. The rate that is used to purchase local currency may be market-based or arbitrarily set by the bank. This tool is generally used in countries with non-convertible currencies or partially convertible currencies. The recipient of the local currency may be allowed to freely dispose of the funds, required to hold the funds with the central bank for some period of time, or allowed to use the funds subject to certain restrictions. In other cases, the ability to hold or use the foreign exchange may be otherwise limited.

In this method, money supply is increased by the central bank when it purchases the foreign currency by issuing (selling) the local currency. The central bank may subsequently reduce the money supply by various means, including selling bonds or foreign exchange interventions.

2.2.11. Banking supervision and other activities

In some countries a central bank through its subsidiaries controls and

out by a government department such as the UK Treasury, or an independent government agency (for example, UK's Financial Services Authority). It

examines the banks' balance sheets and behavior and policies toward

consumers. Apart from refinancing, it also provides banks with services such as transfer of funds, bank notes and coins or foreign currency. Thus it is often described as the "bank of banks".

Many countries such as the United States will monitor and control the banking sector through different agencies and for different purposes,

although there is usually significant cooperation between the agencies. For example, money center banks, deposit-taking institutions, and other types of financial institutions may be subject to different (and occasionally

overlapping) regulation. Some types of banking regulation may be delegated to other levels of government, such as state or provincial governments. Any cartel of banks is particularly closely watched and controlled. Most

countries control bank mergers and are wary of concentration in this industry due to the danger of groupthink and runaway lending bubbles based on a

single point of failure, the credit culture of the few large banks.

2.2.12. The independence of the central bank

Advocates of central bank independence argue that a central bank which is too susceptible to political direction or pressure may encourage economic cycles ("boom and bust"), as politicians may be tempted to boost economic activity in advance of an election, to the detriment of the long-term health of the economy and the country. In this context, independence is usually

defined as the central bank's operational and management independence from the government.

The literature on central bank independence has defined a number of types of independence.

Legal independence

The independence of the central bank is enshrined in law. This type of

independence is limited in a democratic state; in almost all cases the central bank is accountable at some level to government officials, either through a government minister or directly to a legislature. Even defining degrees of legal independence has proven to be a challenge since legislation typically provides only a framework within which the government and the central bank work out their relationship.

Goal independence

The central bank has the right to set its own policy goals, whether inflation targeting, control of the money supply, or maintaining a fixed exchange rate. While this type of independence is more common, many central banks prefer to announce their policy goals in partnership with the appropriate

setting process and thereby increases the credibility of the goals chosen by providing assurance that they will not be changed without notice. In addition, the setting of common goals by the central bank and the government helps to avoid situations where monetary and fiscal policy are in conflict; a policy combination that is clearly sub-optimal.

Operational independence

The central bank has the independence to determine the best way of achieving its policy goals, including the types of instruments used and the timing of their use. This is the most common form of central bank

independence. The granting of independence to the Bank of England in 1997 was, in fact, the granting of operational independence; the inflation target continued to be announced in the Chancellor's annual budget speech to Parliament.

Management independence

The central bank has the authority to run its own operations (appointing staff, setting budgets, and so on.) without excessive involvement of the government. The other forms of independence are not possible unless the central bank has a significant degree of management independence. One of the most common statistical indicators used in the literature as a proxy for central bank independence is the "turn-over-rate" of central bank governors. If a government is in the habit of appointing and replacing the governor frequently, it clearly has the capacity to micro-manage the central bank through its choice of governors.

from the central bank. Recently, both the Bank of England (1997) and the European Central Bank have been made independent and follow a set of published inflation targets so that markets know what to expect. Even the

People's Bank of China has been accorded great latitude due to the difficulty of problems it faces, though in the People's Republic of China the official role of the bank remains that of a national bank rather than a central bank,

underlined by the official refusal to "unpeg" the yuan or to revalue it "under pressure". The People's Bank of China's independence can thus be read more as independence from the USA which rules the financial markets, than from the Communist Party of China which rules the country. The fact that the Communist Party is not elected also relieves the pressure to please people, increasing its independence.

Governments generally have some degree of influence over even

"independent" central banks; the aim of independence is primarily to prevent short-term interference. For example, the chairman of the U.S. Federal

Reserve Bank is appointed by the President of the U.S. (all nominees for this post are recommended by the owners of the Federal Reserve, as are all the board members), his choice must be confirmed by the Congress, and he must appear and testify before congress twice a year.

International organizations such as the World Bank, the Bank for

section. An independent central bank will score higher in the review than one that is not independent.

2.3. Conceptual framework

2.3.1. Exchange rates

In finance, an exchange rate (also known as the foreign-exchange rate, forex rate or FX rate) between two currencies is the rate at which one currency will be exchanged for another. It is also regarded as the value of one country’s currency in terms of another currency. For example, an interbank exchange rate of 91 Japanese yen (JPY, ¥) to the United States dollar (US$) means that ¥91 will be exchanged for each US$1 or that US$1 will be exchanged for each ¥91. Exchange rates are determined in the foreign exchange market, which is open to a wide range of different types of buyers and sellers where currency trading is continuous: 24 hours a day except weekends, i.e. trading from 20:15 GMT on Sunday until 22:00 GMT Friday. The spot exchange rate refers to the current exchange rate. The forward exchange rate refers to an exchange rate that is quoted and traded today but for delivery and payment on a specific future date.

The quoted rates will incorporate an allowance for a dealer's margin (or profit) in trading, or else the margin may be recovered in the form of a "commission" or in some other way. Different rates may also be quoted for cash (usually notes only), a documentary form (such as traveller's cheques) or electronically (such as a credit card purchase). The higher rate on

documentary transactions is due to the additional time and cost of clearing the document, while the cash is available for resale immediately. Some dealers on the other hand prefer documentary transactions because of the security concerns with cash

2.3.1.1. Exchange control

exchange control is one of the important devices to control international trade and payments. It aims at equilibrium foreign receipt and payments, not through such market forces as fixed or flexible exchange rate but through direct and indirect control of foreign exchange rate. Prof. Ellsworth defines exchange control (exchange controls deals with the balance of payments difficulties, disregards market forces and substitute for them the arbitrary decisions of government officials. Imports and other international payments are no longer determined solely by international price comparisons, but also by considerations of national need. The exchange control system has the following main features: 1. it involves complete government control over the foreign exchange market 2. All foreign currencies are required to be surrendered to the central bank 3.the central bank fixes the official exchange rate 4. Only specified bank and licensed dealers can deal in foreign exchange 5. The central bank acts as a discriminating monopolist by charging low rates of exchange for the purchase of essential imports and high rates for

2.3.2. Retail exchange market

People may need to exchange currencies in a number of situations. For example, people intending to travel to another country may buy foreign currency in a bank in their home country, where they may buy foreign currency cash, traveler’s cheques or a travel-card. From a local money changer they can only buy foreign cash. At the destination, the traveler can buy local currency at the airport, either from a dealer or through an ATM. They can also buy local currency at their hotel, a local money changer, through an ATM, or at a bank branch. When they purchase goods in a store and they do not have local currency, they can use a credit card, which will convert to the purchaser's home currency at its prevailing exchange rate. If they have traveler’s cheques or a travel card in the local currency, no

currency exchange is necessary. Then, if a traveler has any foreign currency left over on their return home, may want to sell it, which they may do at their local bank or money changer. The exchange rate as well as fees and charges can vary significantly on each of these transactions, and the exchange rate can vary from one day to the next.

There are variations in the quoted buying and selling rates for a currency between foreign exchange dealers and forms of exchange, and these

variations can be significant. For example, consumer exchange rates used by

Visa and MasterCard offer the most favorable exchange rates available, according to a Currency Exchange Study conducted by CardHub.com.[3] This

studied consumer banks in the U.S., and Travelex, showed that the credit card networks save travelers about 8% relative to banks and roughly 15% relative to airport companies.

Each country, through varying mechanisms, manages the value of its currency. As part of this function, it determines the exchange rate regime

that will apply to its currency. For example, the currency may be free-floating, pegged or fixed, or a hybrid.

If a currency is free-floating, its exchange rate is allowed to vary against that of other currencies and is determined by the market forces of supply and demand. Exchange rates for such currencies are likely to change almost constantly as quoted on financial markets, mainly by banks, around the world.

A movable or adjustable peg system is a system of fixed exchange rates, but with a provision for the devaluation of a currency. For example, between 1994 and 2005, the Chinese yuan renminbi (RMB) was pegged to the United States dollar at RMB 8.2768 to $1. China was not the only country to do this; from the end of World War II until 1967, Western European countries all maintained fixed exchange rates with the US dollar based on the Bretton Woods system. But that system had to be abandoned due to market

pressures and speculations in the 1970s in favor of floating, market-based regimes.

Still, some governments keep their currency within a narrow range. As a result currencies become over-valued or under-valued, causing trade deficits or surpluses

2.3.4. Fluctuations in exchange markets

valuable whenever demand for it is greater than the available supply. It will become less valuable whenever demand is less than available supply (this does not mean people no longer want money, it just means they prefer holding their wealth in some other form, possibly another currency). Increased demand for a currency can be due to either an increased transaction demand for money or an increased speculative demand for money. The transaction demand is highly correlated to a country's level of business activity, gross domestic product (GDP), and employment levels. The more people that are unemployed, the less the public as a whole will spend on goods and services. Central banks typically have little difficulty adjusting the available money supply to accommodate changes in the demand for money due to business transactions.

Speculative demand is much harder for central banks to accommodate, which they influence by adjusting interest rates. A speculator may buy a currency if the return (that is the interest rate) is high enough. In general, the higher a country's interest rates, the greater will be the demand for that currency. It has been argued that such speculation can undermine real

economic growth, in particular since large currency speculators may

deliberately create downward pressure on a currency by shorting in order to force that central bank to buy their own currency to keep it stable. (When that happens, the speculator can buy the currency back after it depreciates, close out their position, and thereby take a profit.

For carrier companies shipping goods from one nation to another, exchange rates can often impact them severely. Therefore, most carriers have a CAF

charge to account for these fluctuations.

The "real exchange rate" (RER) is the purchasing power of a currency relative to another. It is based on the GDP deflator measurement of the price level in the domestic and foreign countries (, which is arbitrarily set equal to 1 in a given base year. Therefore, the level of the RER is arbitrarily set depending on which year is chosen as the base year for the GDP deflator of two

countries. The changes of the RER are instead informative on the evolution over time of the relative price of a unit of GDP in the foreign country in terms of GDP units of the domestic country. If all goods were freely tradable, and foreign and domestic residents purchased identical baskets of goods,

purchasing power parity (PPP) would hold for the GDP deflators of the two countries, and the RER would be constant and equal to one

If one's monetary income stays the same, but the price level increases, the purchasing power of that income falls. Inflation does not always imply falling purchasing power of one's money income since it may rise faster than the price level. A higher real income means a higher purchasing power since real income refers to the income adjusted for inflation

2.3.6. Asset market model

The expansion in trading of financial assets (stocks and bonds) has reshaped the way analysts and traders look at currencies. Economic variables such as

economic growth, inflation and productivity are no longer the only drivers of currency movements. The proportion of foreign exchange transactions

The asset market approach views currencies as asset prices traded in an efficient financial market. Consequently, currencies are increasingly

demonstrating a strong correlation with other markets, particularly equities. Like the stock exchange, money can be made (or lost) on the foreign

exchange market by investors and speculators buying and selling at the right (or wrong) times. Currencies can be traded at spot and foreign exchange options markets. The spot market represents current exchange rates, whereas options are derivatives of exchange rates.

2.3.7. Manipulation of exchange rates

Countries may gain an advantage in international trade if they manipulate the value of their currency by artificially keeping its value low, typically by the national central bank engaging in open market operations. It is argued that the People's Republic of China has succeeded in doing this over a long period of time.

In 2010, other nations, including Japan and Brazil, attempted to devalue their currency in the hopes of subsidizing cheap exports and bolstering their ailing economies. A low exchange rate lowers the price of a country's goods for consumers in other countries but raises the price of goods, especially imported goods, for consumers in the manipulating country.

2.3.8. The central bank and the Somaliland market of

exchange rate.

the exchange rate by Two ways, not all, but sometimes when inflation or deflation occur in Somaliland currency, those are first, is when inflation occur or the currency’s value decrease, the central bank dump more unit of Somaliland shilling currency to the market of exchange rate, and collect the foreign currency from the market. Second is when deflation occurs or the currency’s value increase, the central bank collects the unit of Somaliland currency form the market and dump the foreign currency to the market, these two ways ate the most role of the central bank to keep the reliability of home currency to overthrow the heavy hanging exchange rate.

The real perception of this two form are from how good or bad of the Somaliland economic activities are e.g., the livestock and their product are the backbone of Somaliland economic and above 60% of Somaliland currency for local community is from livestock.

So, the more of livestock production of Somaliland is the less float of our currency, this cause balance payment and stable economic activity.

2.3.9. The affect of the fluctuation exchange rate in the

live hood opportunities in Somaliland

From the outset, the elimination of the dual exchange rate of SL,SHL against the US Dollar would, from the monetary point of view, seem a sound policy decision that the government ought to have taken at a much earlier stage. After all, one can say, the government used to lose a lot of revenues as a result of its application of the unrealistically fixed rate level of SL,SH 2500 for every dollar collectible as tax duty.

of lower tariff, On the other hand, traders may complain that by inflating the value of tariff rates, the government wants to put them out of business.

In spite of this scenario, in which we expect both the government and the businessmen to use this tariff affair for the sole purpose of promoting their own respective interests, one is bound to seriously ask what impact the new measures will have on other people.

Well, there is no doubt that the new government policy, if not carefully redesigned, will have disastrous consequences for the livelihoods of the majority of people who have already been burdened by the continued ban on Somaliland livestock exports to Saudi Arabia. While it has been wrong in the first place not to establish the market value as the Somaliland Shilling’s actual exchange rate, we still do not see any reasons as to why the government shouldn’t introduce the single rate currency coupled with a reduction in tariff rates. Unless the government and the traders are still keen on destroying the livelihoods of their own people, we think that a remedy for the problem would lie in lowering the tariff rates to a level where the amounts to be levied become equal to what people used to pay before last Tuesday. (2008)

CHAPTER THREE

3.1. Overview

In this section the research findings are presented. First, the demographic of the respondents is given. Second, the questionnaire distributed and

interviews are conducted.

For this study the researcher has distributed questionnaires with a sample of 21 individuals that there weren’t any questionnaire was returned out of the 21, this indicated that (100%) questionnaires were collected.

This part is the fundamental section of the research paper and it’s the analysis of the questionnaire distributed, interview of the officials and the judgment of the researcher will come under this part

3.2. Demographic profile of the respondents

The demographic profiles of the respondents in the sample size are discussed here based on the data obtained from both sample employees in central bank, money changers and interviewed sample officials during the field survey is presented. The demographic profile is including: gender, marital status, education, age, department and position.

3.2.1. Gender

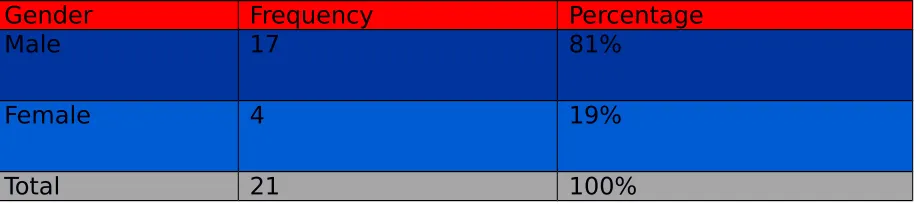

Gender Frequency Percentage

Male 17 81%

Female 4 19%

Total 21 100%

Table 3.1 above shows the gender distribution of the respondents. 81% (17) of the respondents are male, while the remaining 19% (4) are female. The variation in the gender distribution is very large. This can be attributed to the culture of the country where in more males are work outside the home than females. Also the most males are educated and they get the opportunity of work than females.

3.2.2. Marital status

Table 3.2 descriptive statistics of the marital status of the respondents Marital status

Frequency Percentage

Married 16 76%

Single

5 24%

Total 21 100%

Table 3.2 above depicts the marital status of the respondents. 76% (16) of the respondents are married, while the remaining 24% (5) are single. The disparity in married is very large. This can be attributed to the culture that people to be married early, while few people married not early age

3.2.3. Educational background

Educational background frequency Percentage

University

5 24%

Secondary

9 43%

Primary 7 33%

Total 21 100%

Table 3.3 shows the educational background of the respondents. 24% (5) of the respondents are university degree level, 43% (9) were secondary level, while the 33% (7) had primary level. Over all, the educational level of the respondents was high. This means the central banks employees are educated and mostly they are university and secondary level.

3.2.4. Age group

Table 3.4 descriptive statistics of the age group of the respondents

Age group Frequency Percentage

Bellow 25 2 10%

25_30 0%

31-35 4 19%

35-40 3 14%

41-50 10 47%

Above 50 2 10%

Total 21 100%

and above. This shows that most of the workers are old workers and are in a position to respond the questions because their related experience of this topic and lack retirement plan and pension policy and every one will stay his position until his death and no opportunity available in the new job seekers to enter the work environment.

3.2.5. Department

figure3.5The figure 3.5 above depicts the departments of the respondents. Overall, there is 4 departments with finance department having the highest percentage and number of employee responded 42% (9), following the audit having 38% (8) respondents, human resource have 10% (2) and lastly loan department which have 10% (2) employee responded.

3.2.6. Position

Table 3.6 descriptive statistics of the respondents in positio

Position Frequency Percentage

finance department 42%(9)finance department 42%(9)

loan department 10% (2)loan department 10% (2)

human resource department 10% (2)human resource department 10% (2)

Blue collar worker 3 14%

Office worker

14 67%

Middle level manager

4 19%

Total

21 100%

The table 3.6 above shows the position of the respondents. Office worker has the highest frequency of 14 out of 21 making up 67% of the total respondents. Next, is the middle manager with frequency rate of 19% (4), followed by the blue collar worker with a frequency of 3 (14%). This means that the majority of bank employees are educated and they have the skills and ability to run the office tasks

3.3 analysis of the questionnaire

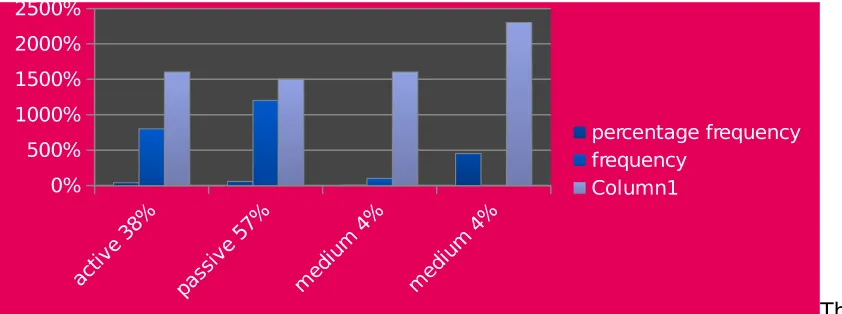

Figure 3.7 analysis of the role of the central bank in the regulating in exchange market

0% 500% 1000% 1500% 2000% 2500%

percentage frequency frequency

Column1

The central bank has highest authority of the regulating in the financial market and setting stable exchange rate

According to the above figure 3.7, a show that 38% of the employee respondents replied the role of the central bank is active, 57% of them replied that the central bank is passive, while the remaining 4% of the respondents replied is medium. It’s obvious that the central bank’s role in the financial and exchange market is passive and is necessary to exercise its authority to regulate the market of exchange.

3.3.1.

Do you believe that the society plays a role in the

fluctuations and instability of the shillings? Do they feel

ownership?

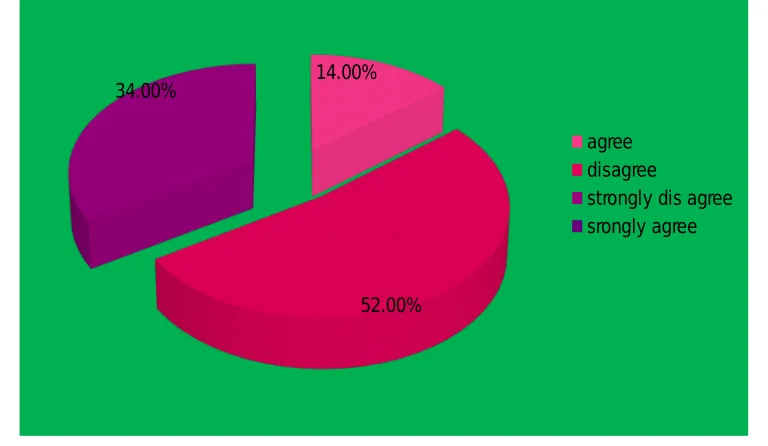

It’s not only the central bank‘s responsibility for conservation of the currency. But also it is the society’s responsibility for safeguarding for their domestic currency in every country and people must feel ownership of the currency. But Somali Landers do not believe that.

52.00%

29.00%

19.00%

do you believe that the society plays a role in the flactuation and instability of the shilling

agree disagree strongly agree strongly disagree

Figure 3.8 shows that the 52% of the employee respondents agrees that the society plays a role in the fluctuation and instability of the exchange, 29% of the respondents disagree; while the remaining 19% replied strongly agree. Therefore, some officials that interviewed in this issue during the data collection discover that the society plays a role and they do not feel the ownership of the shillings and prefer a foreign currency. This shows that the character of ownership is missing and people don’t feel so. Every currency its people gives the privilege and stability and make a value for it and unless the Somali Landers do so it never possible to make stable the rate and value of the shilling.

3.3.2. What are the constraints reduces the role of the

central bank to control the exchange rate?

The table &Figure 3.9 .In the question of what constrains that reduce the role of central bank to effectively control the fluctuations of exchange rate, the answers of the official bankers that I distribute the questioner were 19% ticked that the exchange rate traders break the rule and not obeyed the rule and regulations that bank imposed or as legally has to perform, while 10% of the respondent elected that there is lack of effective communication between central and exchange market, and the rest 71% get answered there is lack of effective implementation from the central bank to perfume his duty but there are rule regulations. This indicates that the implementation of the central bank to control the exchange market is weak and the central bank does not use the effective mechanisms that he can control the market and the money changers get the opportunity to exercise their limited power on exchange market as they like. The below chart show this answers.

Value Frequency Percentage

the rule

3.3.3. Does the fixed exchange rate participated for the

devaluation of the shillings

prefer floating exchange rate in order to enhance and encourage their domestic production and tackle foreign importers.

Value Frequency Percentage

Agree 3 14%

Disagree 11 52%

Strongly disagree 7 34%

Total 21 100%

Table 3.10

14.00%

52.00% 34.00%

does the fixed exchange rate participated in the devaluation of the shilling

agree disagree

strongly dis agree srongly agree

Figure 3.10 source primary data

3.3.4. How did the central bank controls when inflation

occurs

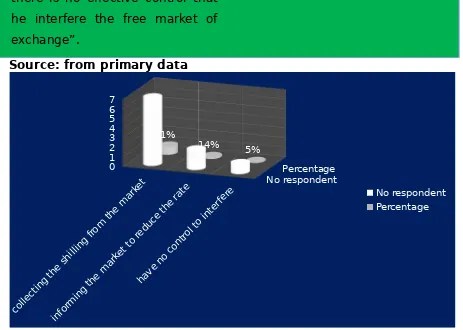

the bank have as functionally to control the exchange rate but that there is no effective control that he interfere the free market of exchange.

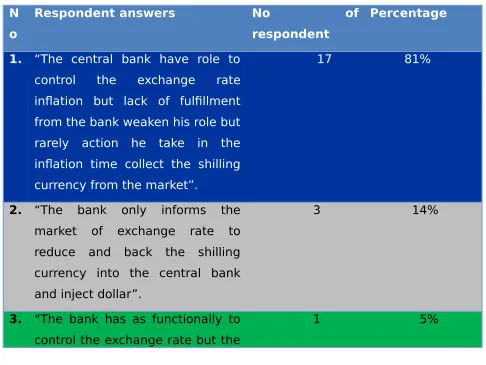

Table 3.11. Show the answers open ended question of “how the central bank control when inflation occur”

N o

Respondent answers No of

respondent

Percentage

1. “The central bank have role to control the exchange rate inflation but lack of fulfillment from the bank weaken his role but rarely action he take in the inflation time collect the shilling currency from the market”.

17 81%

2. “The bank only informs the market of exchange rate to reduce and back the shilling currency into the central bank and inject dollar”.

3 14%

3. “The bank has as functionally to control the exchange rate but the

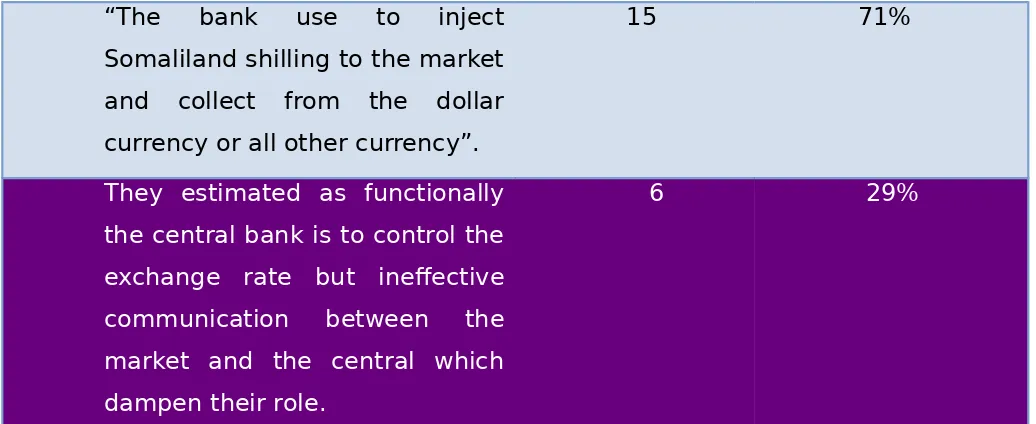

3.3.6. How the central bank controls when deflations occur

the face verse the previous question in the deflation time the respondent answered the that bank use to inject Somaliland shilling to the market and collect from the dollar currency or all other currency 71% believe that, while the 29% estimated as functionally the central bank is to control the exchange rate but the ineffective communication between the market and them dampen their role. This means that the role of the central bank is passive, because functionally is the central banks task to control foreign currency and not allowed to go through the hands of the exchange men and the market. It’s the responsibility of the bank at the time deflation occur to inject shilling to the market and also printing paper money if there is a shortage money .

Figure3.12. Show the answer of the question “when deflations occur how the central bank controls”.

Table 3.12

“The bank use to inject Somaliland shilling to the market and collect from the dollar currency or all other currency”.

15 71%

They estimated as functionally the central bank is to control the exchange rate but ineffective communication between the market and the central which dampen their role.

6 29%

71.00% 29.00%

Percentage

collecting the doller and in-jecting the shillings

there is a in effective communication

Figure 3.12

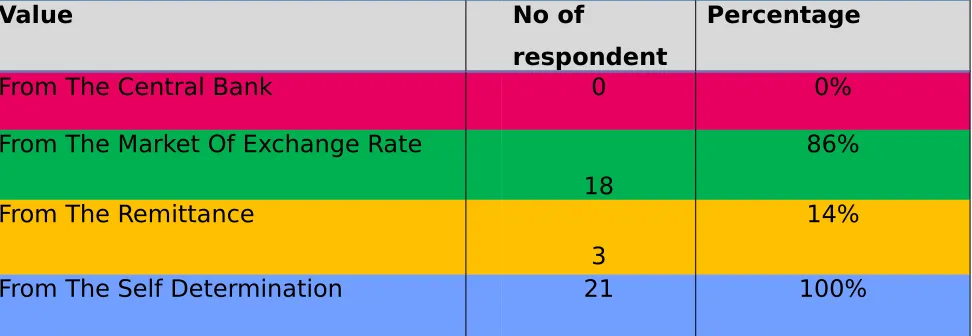

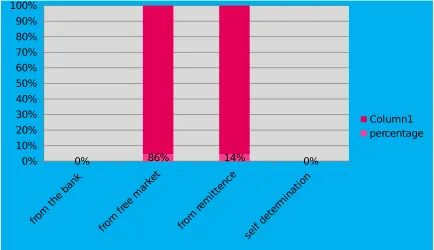

3.3.7. Where do you get the determination rate that you

make exchange?

Table3.13. Table and chart that shows where determine the rate exchange.

Value No of

respondent

Percentage

From The Central Bank 0 0%

From The Market Of Exchange Rate

18

86% From The Remittance

3

14%

from

3.3.8. What service do you made

Table 3.14, Descriptive analysis of the services which money traders perform

Value Frequency Percentage

Figure 3.14 source: computed from primary data

3.3.9. Did the central bank get involved in your business?

Figure 3.14, descriptive analysis of whether the central bank involved the moneychangers business

YES ; 10.00%

NO ; 90.00%

did the central bank get involved in your business

Source: computed from the primary data

As indicated in figure 3.14, the question of did the central bank involved and interfere the money exchangers businesses. 90% of the respondents replied NO, while the remaining 10% replied YES. This shows that the role of the central bank in the exchange market is passive and he have not any

3.3.10. How the fluctuation of the exchange rate effect to

your business

Table and figure 3.15. Descriptive analysis of the How the fluctuation of the exchange rate effect to your business

Table3.15effect of fluctuations’ in the exchange rate traders

Value No of respondent Percentage

1. Small effect 13 62%

2. Middle effect 5 24%

3. Great effect 3 14%

.

Figure3.15

small effect middle effect great effect 0

2 4 6 8 10 12 14 16 18 20

Effect of Flunctuation in the Exchange Rate Traders

The question of how the fluctuations of exchange rate affect the exchange traders 62% of the respondent ticked it has small affect and 24% answered that the fluctuations have middle affect to them, while the remaining 14% believe the affect of the fluctuations to their business is great affect. This means that the fluctuation of the shilling does not affect the moneychangers because they maintained their compatibility of the rate change and they gat their charge every time.

3.3.11.

What are the causes of the devaluation of

the shilling?

The first time the Somaliland shilling enters to the market was 1994. At this time the shilling was have a high value comparing to the foreign countries. But, it’s the responsibility of the bank to maintain and safeguard the value of the domestic currency. Unfortunately the bank losses this responsibility and the currency depreciated due to many factors. However the central bank should exercise his authority to keep the value of the currency and its one of the main tasks appointed for the central bank for the monetary policy of the country.

Table 3.16 descriptive analysis of the causes of the depression of the shilling

Value Frequency Percentage

First civil war 8 38%

Excessive printing money

4 19%

Absence of the role of the central bank

9

The figure 3.16 above indicates that analysis of the causes of the

allowance for the bank and searching a profit for it and will set any rate that he will get a return

CHAPTER FOUR

4. Conclusion & Recommendation

4.1. Introduction

In this chapter the researcher tries to summarize the above major findings of the study focusing the main theme of the paper. At the end, the study drawn a conclusion based on the analysis of the available data.

Finally on the basis of the conclusion, the researcher recommends some points that enable to minimize and prevent the problems of stabilization of exchange rate in Central Bank of Somaliland.

4.1. Conclusion

The objective of the study was to assess the role of the central bank on exchange rate and devaluation of the shilling. Reviewing the importance role of the central bank on exchange rate and identifying the current role of the central bank.