10 (2000) 461 – 479

The early exercise premium in American put

option prices

Malin Engstro¨m, Lars Norde´n *

Department of Corporate Finance,School of Business,Stockholm Uni6ersity, S-106 91Stockholm, Sweden

Received 15 July 1999; accepted 18 February 2000

Abstract

This study estimates the value of the early exercise premium in American put option prices using Swedish equity options data. The value of the premium is found as the deviation of the American put price from European put-call parity, and in addition a theoretical estimate of the premium is computed. The empirically found premium is also used in a modified version of the control variate approach to value American puts. The results indicate a substantial value of the early exercise premium, where the premium derived from put-call parity is higher than the theoretical premium. The premium also increases with moneyness and time left to expiration, while the effect of interest rate and volatility depends on the moneyness of the option. The modified control variate technique works reasonably well relative to the theoretical models. In particular, for deep in-the-money options, this technique is superior. © 2000 Elsevier Science B.V. All rights reserved.

JEL classification:G10; G13

Keywords:Early exercise premium; American put options; Modified control variate technique www.elsevier.com/locate/econbase

1. Introduction

The equity options traded on the Swedish exchange for options and other derivative securities, OM, are American options. They provide the option holder with the right to exercise the contract any time prior to expiration. The privilege to

* Corresponding author. Tel.: +46-8-6747139; fax:+46-8-153054. E-mail address:[email protected] (L. Norde´n).

exercise early makes the prices of American options to include an early exercise premium compared to the prices of European options. Merton (1973a) shows that optimal early exercise never will occur for American call options written on non-dividend paying stocks. These calls could therefore be valued as if they were European, using, e.g. the Black and Scholes (1973) formula. When American call options on dividend paying stocks are concerned, early exercise might be optimal just before the ex-dividend instant. For an American put option on the other hand, early exercise may be optimal even if the underlying stock is not paying any dividends. In fact, an American put option should always be exercised early if it is sufficiently in-the-money.

The possibility of early exercise complicates the valuation of the American options, and several valuation approaches, both analytical approximations and numerical methods, have been developed. Examples of the first category are Roll (1977), Geske (1979) and Whaley (1981) for call options and Geske and Johnson (1984) and MacMillan (1986) for put options. In addition, Barone-Adesi and Whaley (1987) analyse both calls and puts. Examples of the second category are Brennan and Schwartz (1977), Boyle (1977) and Cox et al. (1979). Blomeyer and Johnson (1988) compare the accuracy of the Geske and Johnson (1984) American option pricing model to the Black and Scholes (1973) European model for valuing equity put options traded on the Chicago Board Options Exchange (CBOE). They find that both models undervalue options relative to market prices, but that the American model prices are much closer. They also reason that the difference between the deviation from market prices for the two models is an estimate of the early exercise premium. On average, this early exercise premium amounts to around 5% of the actual market price.

Zivney (1991) argues that the American option pricing models do not value the early exercise premium appropriately, and suggests that the value of early exercise ought to be established empirically. In order to measure the value of the premium, Zivney examines deviations from European put-call parity (henceforth PCP) of the American S&P 100 index options traded on the CBOE. A deviation from PCP can be regarded as an approximation of the value of the early exercise potential for either the call or the otherwise identical put, depending on which one of them is in-the-money. Zivney also suggests that American options could be valued using a modification of the control variate technique (see e.g. Hull and White (1988)). In the modification, an empirical early exercise premium should be added to the theoretical value of a European option to obtain the American option value.

simply to inefficiencies.1

In addition, McMurray and Yadav (1996) argue that the deviation only gives an estimate of the difference between the premiums for corresponding calls and puts rather than the individual premium for each option. This study contributes to the existing literature in a number of aspects. First, the value of the early exercise premium in American put option prices is determined empirically using Swedish equity option data. The premium is estimated using deviations from PCP, and the institutional setting in Sweden facilitates the empiri-cal analysis in that dividend payments occur only once a year, which is in contrast to four times a year in the US. The analysed period is the seven months following the dividend payments, and the call options should consequently never be exercised early according to theory. Hence, the call option prices do not include an early exercise premium, as in e.g. Zivney (1991), and the premium is attributed entirely to the put option. Using a dummy variable regression, the sensitivity of the early exercise premium to the pricing parameters; moneyness, time to expiration, interest rate and volatility is examined. For comparison, a theoretical measure of the premium is also calculated as the difference between theoretical values of American and European options. The American values are obtained using the model accord-ing to MacMillan (1986) and Barone-Adesi and Whaley (1987) (henceforth the BAW model) and the European values using the Black – Scholes model.

The second contribution of the paper is to use the empirically found premium in the modified control variate approach, suggested (but not used) by Zivney (1991), to value American puts. The accuracy of this pricing approach is examined by comparing the obtained option values with market prices and theoretical model values.2 The data set is therefore divided into two parts; an estimation period and

a subsequent evaluation period. The dummy regression coefficients from the estimation period are used to assess the early exercise premium for each put option during the out-of-sample evaluation period. This premium is then added to the corresponding Black – Scholes value to obtain an American put option value.

The results indicate a substantial value of the early exercise premium, where the average premium is higher for the PCP measure than for the theoretical measure. The premium also increases with the moneyness and the time left to expiration of the options, while the results concerning the effect of the interest rate and implied volatility depends on the moneyness of the options. On the whole, the modified control variate technique works reasonably well relative e.g. the BAW model. In particular, for the deep in-the-money options, the modified control variate tech-nique is superior to the theoretical models.

The remainder of the study is organised into five sections. The following section presents put-call parity and previous research of the early exercise premium. In section 3, the institutional setting and data of the study is presented while section

1However, Kamara and Miller (1995) find in their study of PCP for European options that the

violations are much less frequent and smaller than in studies of American options. This could imply that the major part of the deviations for American options could be attributed to the early exercise premium.

4 discusses the methodology. The fifth section presents the empirical results, and section 6 contains some concluding remarks.

2. Put-call parity and the early exercise premium in American options

A long position in a European put can be replicated using a portfolio consisting of a long position in a corresponding call, a short position in the stock and lending of the present value of the exercise price to the riskless interest rate. This portfolio will have the same payoff as a put on the expiration day, whatever the stock price might be. In the absence of dividends, taxes and transactions costs, the put price at time t is obtained from the PCP relationship:

p=c−S+Xe−r(T−t)

(1)

where p is the European put price, cis the European call price, Xis the common exercise price, S is the price of the underlying stock, (T−t) is the time left to expiration, andris the riskless rate of interest3. Since the traded and the replicated

put option have the same payoff, their values at time t must be the same in the absence of arbitrage possibilities. Merton (1973b) shows that PCP will not hold if there is a possibility that any of the options will be exercised early. The relationship between American put (P) and call (C) option prices is instead given by the following upper and lower bounds:

S−XBC−PBS−Xe−r(T−t) (2)

Several studies conduct tests of PCP. Examples are Stoll (1969), Evnine and Rudd (1985), and Brenner and Galai (1986). In these studies, PCP is tested using American options. Deviations are not uncommon, but the occurrence depends on the underlying security. An example is Brenner and Galai (1986) who analyse equity options traded on CBOE. They find significant deviations from PCP in cases where early exercise is likely. Kamara and Miller (1995), who analyse the European S&P 500 index options traded on the CBOE, find deviations much less frequent and smaller than those found in studies using American options. These deviations can not be explained by the early exercise possibility, and should therefore, be inter-preted as inefficiencies. However, Kamara and Miller find that the violations of PCP mostly reflect the liquidity risk, i.e. the risk of price adjustments from the placement of the order until execution. In their view, a liquidity risk premium could explain the mispricing of deep-out-of-the money options found in other studies. Zivney (1991) examines deviations from PCP, using daily data on the American S&P 100 index options, to find the value of the early exercise premium. The results of Zivney show that the value of early exercise is substantial, and that it seems to be larger for puts than for otherwise identical calls. This is in accordance with the fact that early exercise of a call written on the index is less likely than for a put

3Testing the PCP relationship itself is not the issue here, and transaction costs and taxes are therefore

option, since the index yields an almost continuous dividend stream. Furthermore, the premium is positively correlated with the riskless interest rate, the time left to expiration and the moneyness of the option.

de Roon and Veld (1996) use deviations from PCP for options written on the DAX index traded at the Amsterdam Stock Exchange, to infer the value of early exercise. The DAX is a performance index meaning that the dividends are rein-vested in the index. It is thus similar to a non-dividend paying stock, implying that the calls written on the index never should be exercised early. The problem that the deviation from PCP actually is an approximation of the difference between the premiums for puts and calls, respectively could thereby be disregarded. Using a relatively small sample of 175 daily observations, de Roon and Veld find an average early exercise premium equal to 51.3% of the put price. The premium is positively correlated with the moneyness of the option, the volatility of the index and the riskless interest rate.

The ideal way to establish the early exercise premium would be to calculate the difference between otherwise identical American and European options. Unfortu-nately, there exist very few markets with both types of options on the same underlying asset. Jorion and Stoughton (1989) exploit the fact that the European currency options, traded on the CBOE, are virtually identical to the American currency options traded on Philadelphia Stock Exchange (PHLX)4. Using daily

data, the authors find an average value of the early exercise premium of around 2% of the option price, but argues that the results could be affected by problems with non-synchronised prices between the two markets. A regression of the premium on the pricing parameters results in coefficients of the expected sign for call options, while for put options all the coefficients except for the volatility are of the expected sign, although not significant.

It is also possible to trade both European and American options on the FTSE-100 stock index on the options market in the UK. McMurray and Yadav (1996) as well as Unni and Yadav (1998) utilise this feature to estimate the early exercise premium directly5. McMurray and Yadav find evidence, using hourly data,

of significant early exercise premiums for both call and put options. The premiums are higher than both the deviations from PCP according to Zivney (1991) and the premiums predicted by the theoretical binomial model when the overall sample is analysed. Though, when only in-the-money puts are analysed, the average premium is higher for the binomial model. The early exercise premium is positively related to moneyness and time left to expiration. However, some cases of negative premiums are found, especially for out-of-the-money options, suggesting that European

4The CBOE European options were only traded for a few years, and they never attracted much

volume.

5Unfortunately, for pairs of European and American options on the FTSE 100 index, with the same

options sometimes could be overvalued relative American options. Unni and Yadav (1998) extend the analysis by using transactions data for a longer time period. Regression results show that the early exercise premium and the pricing parameters correspond as predicted by theory. Finally, using transactions data, Dawson (1994) compares the prices of American and European FTSE-100 index options by constructing butterfly spreads. The results suggest that both American and Eu-ropean options are frequently overpriced, depending on how the spreads are constructed. The conclusion is that this could be explained by an imperfect linkage between the prices of the two option types, rather than by a systematic overvalua-tion of the early exercise premium.

3. Institutional setting and data

Options on 27 individual stocks were listed on OM during the analysed period. The underlying stocks were in turn listed on the Stockholm Stock Exchange (StSE). The average daily trading volume for these options was around 51 000 contracts. Approximately 14 500 were put options whereas 36 500 were calls6. Comparisons

with CBOE shows that the average daily trading volume was around 305 000 equity option contracts at that time, of which around 90 000 were put options7. The

trading at the StSE, as well as the option trading at OM, normally takes place between 10:00 and 16:00 CET. Series of call and put option contracts with an initial time to expiration of 6 months are listed every three months. The option expiration day is the third Friday of the expiration month, but an equity option holder may exercise the contract until 17:00 on any trading day and until 18:00 on the expiration day8

. After receipt of exercise notices from the option holders, OM assigns the exercises randomly among the options writers. OM thus functions both as the exchange and the clearinghouse.

The data set used in the study consists of prices of put and call options during the sample period July 1, 1995 – February 1, 1996. Only the ten underlying stocks with the most frequently traded put options on the market at that time are used9.

Daily closing bid/ask quotes of the options are obtained from OM, whereas daily closing bid/ask quotes and transaction prices of the underlying stocks are obtained

6During the period in question, the average daily trading volume on the StSE for the underlying

stocks was SEK 2.6 billion for the on average 10 470 transactions per day. The market capitalisation for the 228 listed Swedish stocks at the end of year 1995 was SEK 1179 billion (which at that time was equal to $177 billion).

7Source, OM Factbook and Futures and Options World, February 1996, respectively.

8This section gives a description of the institutional setting that prevailed during the analysed period.

Since then, the trading hours and the last possible exercise times have been changed.

9The stocks are Astra A, Electrolux B, Ericsson B, Investor B, MoDo B, SCA B, Skandia, SEB A,

from the StSE. Dividends are paid only once a year and most dividend payouts occur around May. Hence, no dividend payments are made during the sample period. Finally, daily rates of the Swedish 1-month Treasury bills are used as a proxy for the riskless interest rate.

The sample period is divided into an estimation period: July 1 – December 31, 1995 and an evaluation period: January 1 – February 1, 1996. Since prices of both the put and the call in an option pair have to be used in the estimation period, only days for which non-zero quotes for both puts and calls exist are included in the sample. To avoid possibly disturbing effects of the trading immediately before expiration, options with less than a week left to expiration are omitted. After a screening procedure, observations that do not satisfy the American PCP boundary condition in Eq. (2) are excluded. In addition, observations are omitted if the option value according to the BAW model is less than SEK 0.01, the lowest tick size allowed at OM. The final estimation sample consists of 11 594 put-call pairs. Since only put options are included in the evaluation sample, the only restrictions for this sample is that the options should have at least a week left to expiration and the BAW model prices should not be less than SEK 0.01. The final evaluation sample consists of 2742 observations.

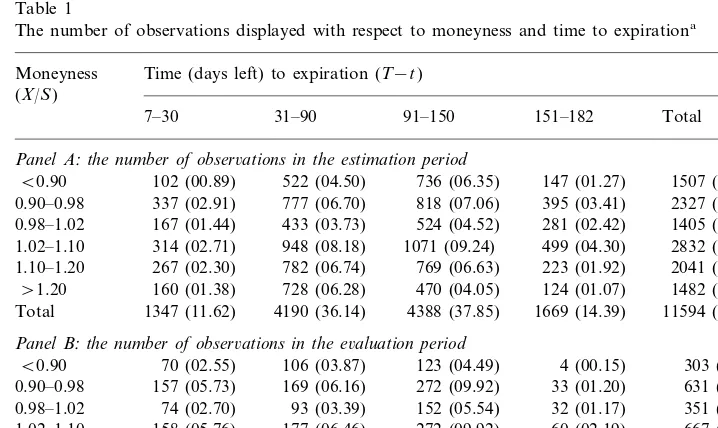

Table 1 offers a summary of the option data divided into subgroups with respect to moneyness and time to expiration. Panel A displays the data for the estimation period whereas Panel B contains data for the evaluation period. The observations are divided into six subgroups according to moneyness and four subgroups accord-ing to the number of days left to expiration. Moneyness is defined as the ratio of the exercise price to the stock price, where the average of the closing bid and ask quotes is used. In accordance with e.g. Jorion and Stoughton (1989), a put is defined to be at-the-money when its moneyness is between 0.98 and 1.02. For the estimation period, around one third of the puts are out-of-the-money while over 50% of the observations belong to the in-the-money groups. The dispersion of the options into different subgroups according to moneyness is roughly the same for the options in the evaluation period.

4. Methodology

However, the bid/ask quotes are only valid for a certain number of options, and in addition, several transactions may be executed within the spread. It is also possible that market markers do not price illiquid options as thoroughly as the more frequently traded ones. Nevertheless, the choice of bid/ask quotes instead of transaction prices is likely to improve the analysis.

4.1. Empirical and theoretical measures of the early exercise premium

The early exercise premium according to the deviations from PCP is estimated using the difference between the market value of the put, where the average of the closing bid/ask quotes is used, and the value of the put according to the PCP relationship given in Eq. (1). The average of the closing bid/ask quotes of the call and the underlying stock respectively is used in this computation. To establish the theoretical measure of the premium, the average of the same day’s closing bid/ask quotes of the option nearest-the-money is used to calculate the implied volatility for each day. In the calculation of the implied volatility, the BAW model and the closing transaction stock price are used. For each day in the sample, volatility

Table 1

The number of observations displayed with respect to moneyness and time to expirationa

Moneyness Time (days left) to expiration (T−t) (X/S)

Total

7–30 31–90 91–150 151–182

Panel A:the number of obser6ations in the estimation period

736 (06.35) 147 (01.27) 1507 (13.00) B0.90 102 (00.89) 522 (04.50) 0.98–1.02 167 (01.44) 433 (03.73) 524 (04.52) 281 (02.42)

314 (02.71) 948 (08.18)

1.02–1.10 1071 (09.24) 499 (04.30) 2832 (24.43)

1.10–1.20 267 (02.30) 782 (06.74) 769 (06.63) 223 (01.92) 2041 (17.60) \1.20 160 (01.38) 728 (06.28) 470 (04.05) 124 (01.07) 1482 (12.78)

4388 (37.85) 4190 (36.14)

1347 (11.62) 1669 (14.39)

Total 11594 (100.00)

Panel B:the number of obser6ations in the e6aluation period 70 (02.55) 106 (03.87)

B0.90 123 (04.49) 4 (00.15) 303 (11.05) 33 (01.20) 631 (23.01) 0.90–0.98 157 (05.73) 169 (06.16) 272 (09.92)

351 (12.80)

157 (05.73) 76 (02.77) 59 (02.15) 292 (10.65) \1.20

Total 742 (27.06) 773 (28.19) 1088 (39.68) 139 (05.07) 2742 (100.00)

aPanel A displays the number of observations that are included in the first part of the sample (July

estimates are made for the two different expiration days traded at that time. These estimates are then used to value both the American and the European options. Finally, the theoretical early exercise premium is calculated as the difference between the value given the BAW model and the value given the Black – Scholes model.

4.2. Dependence on option pricing parameters

Jorion and Stoughton (1990) issue proofs regarding the sensitivity of the early exercise premium to the pricing parameters. Their analysis focuses on foreign currency options but the proofs can be modified to hold also for equity options. The probability of early exercise is higher the more deep in-the-money the option is. When put options are concerned, the value of the early exercise premium is expected to increase as the ratio of the exercise price to the stock price increases. The time to expiration is also expected to have a positive effect on the premium, since the holder of a longer American option has all the possibilities the holder of a shorter option has, plus the additional possibilities coming from the extra time to expiration. Also the interest rate and the volatility of the underlying stock could affect the size of the premium. An increase in the interest rate leads to a reduction in the present value of the exercise amount of the option. Hence, the possibility to exercise early becomes more attractive, and the value of the early exercise premium is expected to increase with increases in the interest rate. The effect of the volatility is intuitively not as clear. A higher volatility would increase the likelihood that the stock price reaches a level low enough to trigger early exercise, but this exercise boundary level will simultaneously also be affected. The actual outcome depends on which effect dominates. In accordance with the proofs of Jorion and Stoughton (1990), the early exercise premium is hypothesised to be an increasing function of the volatility of the underlying security.

To investigate these hypotheses, the average early exercise premium is computed for all the subgroups according to moneyness and time to expiration mentioned above. It is then tested whether they are statistically different from each other. Furthermore, each estimate of the early exercise premium is regressed on the explanatory variables moneyness (X/S), the riskless interest rate (r), the time left to expiration measured in years (T−t) and the implied volatility (s). Furthermore,

dummy variables are used in the regression to take into account if the option is out, at or in-the-money, respectively.

4.3. The modified control 6ariate approach

two model values. After that, the value of the American option can be established by adding the theoretical premium to the known value of the European option. In the modified version of the control variate approach, the value of the early exercise premium, which is found through empirical analysis, is added to a theoretical value of the European option. In this study, the theoretical European option value is obtained according to the Black and Scholes (1973) formula, while the early exercise premium is determined using the regression coefficients for both the PCP and the BAW measure of the premium. The early exercise premium is determined by multiplying the appropriate coefficient with the value of the corre-sponding pricing parameter. Each estimate of the premium during the 1-month evaluation period is then added to the corresponding Black – Scholes value. The accuracy of the resulting American option values is examined by comparing them to market quotes and the values according to the BAW model and the Black – Sc-holes model, respectively.

5. Empirical results

5.1. The 6alue of the early exercise premium

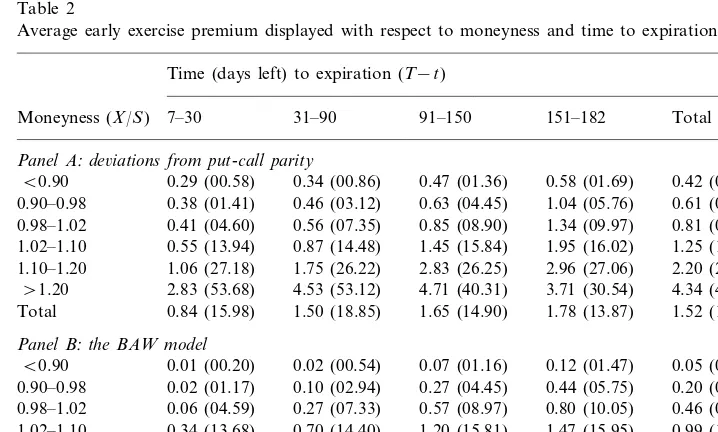

In Table 2, the average early exercise premium is presented with respect to moneyness and time to expiration of the options. Panel A displays the results for the PCP measure, whereas the results for the theoretical BAW measure are presented in Panel B. The table also reports the average market price for the options in each subgroup10

. If the entire sample is analysed, the mean value of the PCP premium is SEK 1.52, which equals 9.33% of the average put option price. The average premium is significantly different from zero at P-valuesB0.001 in all subgroups. The theoretical early exercise premium is on average SEK 1.06, or 6.65% of the average BAW option price, for the entire sample. The average theoretical premium is significantly different from zero in all subgroups, but appears to be lower than the corresponding PCP premium. Except for two subgroups, the deep and very deep in-the-money options with more than 150 days left to expiration, the differences are also statistically significant. The average option price is also lower in the theoretical panel for the majority of the subgroups. This could imply that some of the mispricing of the theoretical model might be explained by incorrect valuation of the early exercise premium.

The early exercise premium in out-of-the-money option prices reflects the possi-bility that the options may become in-the-money, and should, at least for deep out-of-the-money options, not be very high. However, the average PCP premium appears to be rather high compared to the BAW premium even in the group with deep out-of-the-money options with a month or less left to expiration. Perhaps the Kamara and Miller (1995) liquidity risk premium could explain this finding, given

the fact that deep out-of-the-money puts exhibit relatively low liquidity. The average BAW premium, on the other hand, is almost zero for these options.

The average premium that is found in this study is somewhat higher than the premium found in Blomeyer and Johnson (1988) and Jorion and Stoughton (1989). Jorion and Stoughton (1989), who use option prices from two different markets to compute the premium, argue that their results could be affected by the fact that the prices from the two markets are not synchronised. In some cases they even find the American option price to be below the corresponding European price. The results in this study could also be influenced by measurement problems, and the reported value of the empirical early exercise premium might be an over or underestimation of the actual value. The problems with non-synchronous data are hopefully minimised due to the screening procedure and the choice of data. Blomeyer and Johnson (1988) use transactions data free from the non-synchronous trading problem. However, assessing the early exercise premium is not their issue, and the premium implicit in their results is found using a completely different method than in other studies.

Although higher than in some of the previous studies, the early exercise premium found in this study is not unreasonably high. It is for instance very close to the premium found in Zivney (1991), even though the premium should be lower for

Table 2

Average early exercise premium displayed with respect to moneyness and time to expirationa

Time (days left) to expiration (T−t)

31–90 91–150 151–182 Total

Moneyness (X/S) 7–30

Panel A:de6iations from put-call parity 0.29 (00.58)

B0.90 0.34 (00.86) 0.47 (01.36) 0.58 (01.69) 0.42 (01.17) 0.38 (01.41)

0.90–0.98 0.46 (03.12) 0.63 (04.45) 1.04 (05.76) 0.61 (03.79) 0.81 (08.12) 1.34 (09.97)

0.85 (08.90) 0.98–1.02 0.41 (04.60) 0.56 (07.35)

1.02–1.10 0.55 (13.94) 0.87 (14.48) 1.45 (15.84) 1.95 (16.02) 1.25 (15.21) 1.06 (27.18) 1.75 (26.22)

1.10–1.20 2.83 (26.25) 2.96 (27.06) 2.20 (26.45)

4.71 (40.31)

4.53 (53.12) 4.34 (47.23)

2.83 (53.68) 3.71 (30.54)

\1.20

Total 0.84 (15.98) 1.50 (18.85) 1.65 (14.90) 1.78 (13.87) 1.52 (16.30) Panel B:the BAW model

B0.90 0.01 (00.20) 0.02 (00.54) 0.07 (01.16) 0.12 (01.47) 0.05 (00.91) 0.27 (04.45) 0.44 (05.75)

0.02 (01.17) 0.10 (02.94)

0.90–0.98 0.20 (03.69)

0.06 (04.59) 0.27 (07.33)

0.98–1.02 0.57 (08.97) 0.80 (10.05) 0.46 (08.16)

0.99 (15.13) 1.02–1.10 0.34 (13.68) 0.70 (14.40) 1.20 (15.81) 1.47 (15.95)

1.10–1.20 0.77 (26.52) 1.58 (25.81) 2.39 (25.79) 2.86 (26.73) 1.92 (25.99) 1.10 (51.49)

\1.20 2.82 (50.98) 3.68 (38.88) 3.62 (30.21) 2.97 (45.46) 1.24 (14.64) 1.34 (13.77) 1.06 (15.93) Total 0.37 (15.44) 0.99 (18.30)

aThe table presents the average early exercise put premium in SEK, according to deviations from PCP

index options than for equity options due to the lower probability of early exercise. The premium in Zivney (1991), which is found for one of the most widely traded options in the world, is around 10% for put options. Even though most studies find roughly similar values of the early exercise premium, the exception is the results of de Roon and Veld (1996), where the average premium is over 50% of the put option price. No other study finds a premium nearly as high as that, but the results could perhaps be explained by their rather small sample size.

The lower average premium for the theoretical measure compared to the PCP measure is to some extent in contrast to the results of McMurray and Yadav (1996). They find that a theoretical measure of the premium, computed using the binomial model, yields higher early exercise premiums for in-the-money puts than both the PCP measure and the direct measure. To examine if our results depend of the choice of theoretical model, the computations of the early exercise premium are repeated with the binomial model prices. However, the results (not reported, but available upon request) show that the average premiums for each subgroup are almost identical to those reported for the BAW measure.

In Table 2, the average premium increases with both moneyness and time to expiration for both measures. Using a two-way ANOVA, the hypothesis of equality between subgroups when it comes to the average early exercise premium is tested. A dummy variable regression with interaction terms shows that the difference in average premium between the subgroups is statistically significant at a P-valueB

0.001, for both the PCP and the BAW measure11

.

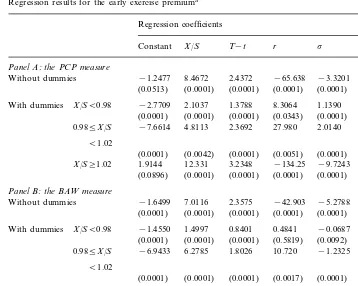

The regression results are presented in Table 3, with and without dummies for the moneyness of the options12. The results for the PCP measure of the premium, which

are displayed in Panel A, show that the early exercise premium as expected increases with moneyness and time to expiration. The coefficients are positive and highly statistically significant for all moneyness groups. The effect of the interest rate and volatility however, depends on the moneyness of the option. For at-the-money and out-of-the-at-the-money options, all coefficients are of the expected signs. For the in-the-money options, the coefficients for interest rate and volatility are both negative. They are also both highly statistically significant. The negative coefficient for volatility could possibly be explained with the increased value of the insurance element of the option associated with a higher volatility. This will in turn make early exercise less attractive. The negative interest rate relationship however, is hard to explain. The signs of the coefficients in the regression without dummies in Table 3 are the same as those for the in-the-money options. This is not surprising, since the average moneyness for all options is 1.05. The goodness of fit, as measured by regressionR2, is significantly higher for the dummy variable regression than for the

regression without dummies13

.

11The results are not reported but available upon request.

12The condition number, computed from the matrix including the explanatory variables, equals 1.39.

In Panel B, the regression results for the theoretical measure of the early exercise premium are displayed. Overall, the results are similar to those for the PCP measure. Also the theoretical premium increases with moneyness and time to expiration, and as in Panel A, the coefficients for interest rate and volatility are negative for the in-the-money options. However, the volatility coefficient is here significantly negative for all levels of moneyness, whereas the interest rate

coeffi-Table 3

Regression results for the early exercise premiuma

Regression coefficients

X/S T−t r s R2

Constant

Panel A:the PCP measure

−65.638 −3.3201 0.3611 Panel B:the BAW measure

−42.903 −5.2788 0.4923 With dummies X/SB0.98 −1.4550 1.4997 0.8401

(0.5819) (0.0092)

aPanel A shows the results of regressions of the early exercise premium according to the deviations

from PCP on the pricing parameters; moneyness (X/S), time to expiration (T−t), interest rate (r) and volatility (s). Panel B shows the corresponding results of regressions of the early exercise premium according to the BAW model. Each set of results is presented for the entire sample (regression without dummies) and for different subgroups according to moneyness (regression with dummies) respectively. The figures in parentheses are p-values associated with each regression coefficient. Correction for heteroscedasticity in the residuals is made according to White (1980).

13The null hypothesis, that the inclusion of the dummy variables in the regression does not improve

cient for out-of-the-money options is not significantly different from zero. No plausible explanation can be offered for these findings. Since there has to be a comparatively high volatility for a deep out-of-the-money option to become enough in-the-money to even be considered for early exercise, the negative coefficient for these options is unexpected. The BAW premium is not affected by possible problems with non-synchronised prices, except perhaps for the calculation of implied volatility. However, since the implied volatility for the option nearest-the-money is used to value all options, this should not affect the results for the entire sample. As in Panel A, the goodness of fit is significantly higher for the dummy variable regression than for the regression without dummies. Furthermore, the goodness of fit is higher for the theoretical measure than for the PCP measure14

. Although the expected correlations are found in most of the previous studies, also the results of Jorion and Stoughton (1989) show a negative volatility coefficient for the put options. The coefficients of their other variables are of the expected sign, but no coefficient is significantly different from zero. The authors propose that the negative volatility coefficient probably could be explained by a low variation in the independent variable, for the part of the sample with the highest premium. This is probably not the explanation for the results of this study, since the variation in volatility and interest rate is approximately the same in each moneyness group.

5.2. E6aluation of the modified control6ariate approach

The value of the early exercise premium and its dependence on the pricing parameters is established in the estimation period. The results are then used in the out-of-sample evaluation period to value American puts according to the modified control variate approach. Table 4 displays the number of put option values within the market bid/ask spread according to the PCP control variate approach (Panel A) and the BAW control variate approach (Panel B). For comparison, the number of put values that are within the bid/ask spread using the BAW and the Black – Sc-holes model are also displayed (Panel C and D, respectively).

The deep out-of-the-money options show similar results, regardless of the model used, but the number of PCP control variate values within the bid/ask spread is slightly higher than for the other models. For some of the time/moneyness subgroups the PCP control variate technique does not work very well. Even the Black – Scholes model works better in many cases. However, for the very deep-in-the-money options, Panel A of Table 4 shows a higher number of values within the bid/ask spread than any of the others. The results in Panel C show that the BAW model works best for at-the-money options. This is not surprising, since the implied volatility is found using these options. However, the BAW model does not, in relative terms, work very well for very deep-in-the-money options, and a possible explanation is that the theoretical models underestimate the early exercise premium for these options. The BAW control variate values, presented in Panel B, works

Table 4

The number of estimated option values within the market bid/ask spread, displayed with respect to moneyness and time to expirationa

Time (days left) to expiration (T−t)

31–90 91–150 151–182 Total

7–30 Moneyness

(X/S)

Panel A:option6aluation using the PCP control6ariate technique

60 (85.71) 81 (76.41) 97 (78.86) 0 (00.00) 238 (78.55) B0.90

0.98–1.02 56 (75.68) 71 (76.34) 218 (62.11)

162 (59.56) 39 (65.00)

94 (53.11) 407 (61.02)

1.02–1.10 112 (70.89)

127 (60.48) 1 (10.00)

1.10–1.20 82 (65.08) 91 (59.87) 301 (60.44)

34 (57.63) 0 (00.00)

47 (61.84) 213 (72.95)

132 (84.08) \1.20

Total 545 (73.45) 498 (64.42) 633 (58.18) 61 (43.88) 1,737 (63.35) Panel B:option6alution using the BAW control6ariate technique

51 (72.86) 79 (74.53) 104 (84.55) 0 (00.00) 234 (77.22) B0.90

212 (77.94) 16 (48.48)

128 (75.74) 460 (72.90)

0.90–0.98 104 (66.24)

72 (97.30) 90 (96.77) 131 (86.18) 25 (78.13) 318 (90.60) 0.98–1.02

1.10–1.20 88 (69.84) 98 (64.47) 310 (62.25)

35 (59.32) 0 (00.00)

57 (75.00) 201 (68.84)

\1.20 109 (69.43)

Total 559 (75.34) 600 (77.62) 800 (73.53) 82 (58.99) 2,041 (74.43) Panel C:option6aluation using the BAW model

102 (82.93)

B0.90 51 (72.86) 80 (75.47) 0 (00.00) 233 (76.90) 217 (79.78)

0.90–0.98 102 (64.97) 123 (72.78) 16 (48.48) 458 (72.58) 140 (92.11) 23 (71.88)

90 (96.77) 326 (92.88)

0.98–1.02 73 (98.65)

253 (93.01) 49 (81.67)

1.02–1.10 150 (94.94) 170 (96.04) 622 (93.25)

185 (88.10) 6 (60.00)

113 (74.34) 402 (80.72)

1.10–1.20 98 (77.78)

26 (34.21)

40 (25.48) 41 (69.49) 0 (00.00) 107 (36.64) \1.20

514 (69.27) 602 (77.88) 938 (86.21) 94 (67.63) 2,148 (78.34) Total

Panel D:option6aluation using the Black–Scholes model

97 (78.86) 2 (50.00)

B0.90 51 (72.86) 77 (72.64) 227 (74.92) 215 (79.04) 19 (57.58)

118 (69.82) 450 (71.32)

98 (62.42) 0.90–0.98

88 (94.62)

72 (97.30) 123 (80.92) 30 (93.75) 313 (89.17) 0.98–1.02

123 (69.49)

134 (84.81) 155 (56.99) 23 (38.33) 435 (65.22) 1.02–1.10

aPanel A and B show the number of control variate option values, according to PCP and BAW,

better for these options. Overall, the number of BAW control variate values within the bid/ask spread is rather close to the BAW model values.

The values according to the different pricing approaches are also compared to the average of the daily closing bid/ask quotes of the options. In Table 5, the root

Table 5

RMSE for the difference between estimated option values and actual option prices, displayed with respect to moneyness and time to expirationa

Time (days left) to expiration (T−t)

31–90

Moneyness (X/S) 7–30 91–150 151–182 Total

Panel A:option6aluation using the PCP control6ariate technique

0.2995 1.5234

0.3478 0.3942

B0.90 0.4016

0.90-0.98 0.5010 0.4364 0.7577 1.4788 0.6894

0.98-1.02 0.3862 0.4590 0.7493 1.1954 0.6787

0.9542 0.9001

0.8808 0.9014

1.02-1.10 0.9104

1.6613

1.10-1.20 1.3107 1.5288 1.8570 1.5271

\1.20 1.7931 2.4059 3.2445 – 2.3156 1.2303

1.2102

Total 1.1030 1.1830 1.1755

Panel B:option6aluation using the BAW control6ariate technique

0.3720 0.3841 1.0407

1.02-1.10 0.7406 0.7638 0.6427 1.0213 0.7396

1.10-1.20 1.2990 1.8979 1.6598 1.8689 1.6608

2.8229 3.9688

2.6782 –

\1.20 3.0188

1.2964

Total 1.4083 1.2608 1.0182 1.3014

Panel C:option6aluation using the BAW model

0.4030 1.0655 0.4161 0.4423 0.3667

B0.90

0.3667 0.5001 1.1269

0.90-0.98 0.4509 0.5107

0.98-1.02 0.0807 0.2590 0.3752 0.7976 0.3716

1.02-1.10 0.7191 0.6625 0.3985 0.6384 0.5835

1.3548 1.1537

1.2442

1.10-1.20 1.2163 1.6004

\1.20 3.2686 2.7594 2.9014 – 3.0704 0.8673

0.9464

Total 1.6383 1.1869 1.2316

Panel D:option6aluation using the Black–Scholes model

0.3819 0.4557 0.7529

\1.20 4.0104 4.5484 5.7399 – 4.5485 2.0265

Total 2.0640 1.9458 1.4588 1.9805

aPanel A and B show the RMSE for the difference between the control variate option value,

mean square error (RMSE) for the differences between theoretical values and average market quotes is presented for each pricing model. Panel A presents the RMSE for the PCP control variate approach whereas the results for the BAW control variate approach are reported in Panel B. The RMSE for values according to the BAW and the Black – Scholes model are displayed in Panel C and D.

Overall, the PCP control variate approach produces option values that minimise RMSE compared to the other approaches. The RMSE for all options in the evaluation sample is 1.18 for this approach, compared to 1.23 and 1.98 for the BAW and Black – Scholes model, respectively. Again, this result is mainly due to a relatively better performance of the PCP control variate approach for deep in-the-money options with a short time left to expiration. As in Table 4, the results for the deep out-of-the-money options are similar for the different models, with the PCP control variate approach being slightly superior. The RMSE results for the BAW control variate model are rather close to the actual BAW model results. Surpris-ingly though, for the at-the-money options it outperforms the BAW model when it comes to RMSE.

6. Concluding remarks

Using Swedish equity option data, this study analyses deviations from European put-call parity (PCP) to assess the early exercise premium in American put option prices. The empirically found early exercise premium is substantial and statistically significant, with an average value of SEK 1.52 for the entire sample. This corre-sponds to around 9% of the average market price for the put options. For comparison, a theoretical early exercise premium, computed as the difference between the values given by the BAW and the Black – Scholes model, is also analysed. The value of the theoretical premium, which is SEK 1.06 (roughly 7% of the BAW value) on average, is significantly lower than the premium according to the deviations from PCP. Since the average option price is lower for the theoretical model, this could imply that some of the mispricing of the theoretical model is explained by incorrect valuation of the early exercise premium.

As expected, the value of the premium, obtained from PCP, is found to increase with the moneyness of the options and with the time left to expiration. The effect of the volatility and the interest rate however, is not as clear. Regression results show that for out-of-the-money and at-the-money options, the effect is as hypothe-sised. For in-the-money options however, the relationship between premium and volatility is negative, and also the interest rate coefficient has a negative sign.

The comparatively high premium that is found in this study is interesting. The results of Engstro¨m et al. (2000) show that a large number of put options are not exercised when they should be. It appears that the Swedish option holders are more inclined to pay a premium for the right to exercise their contracts early, than to actually exercise the contracts.

Acknowledgements

This study has benefited from comments and suggestions from an anonymous referee, Niclas Hagelin and seminar participants at Stockholm University, the 1999 Workshop on Empirical Finance in Vasa, and the 12th Annual Australasian Banking and Finance Conference in Sydney. We would also like to thank Anders Stro¨mberg at OM Stockholm AB for his assistance. Financial support from

Bankforskningsinstitutet for the first author is greatly acknowledged.

References

Barone-Adesi, G., Whaley, R., 1987. Efficient analytic approximation of American option values. J. Financ. 42, 301 – 320.

Belsley, D., Kuh, E., Welsch, R., 1980. Regression Diagnostics, Identifying Influential Data and Sources Of Collinearity. Wiley, New York.

Black, F., Scholes, M., 1973. The pricing of options and corporate liabilities. J. Polit. Econ. 81, 637 – 657. Blomeyer, E., Johnson, H., 1988. An empirical examination of the pricing of American put options. J.

Financ. Quant. Anal. 23, 13 – 22.

Boyle, P., 1977. Options: a Monte Carlo approach. J. Financ. Econom. 4, 323 – 338.

Brennan, M., Schwartz, E., 1977. The valuation of American put options. J. Financ. 32, 449 – 462. Brenner, M., Galai, D., 1986. Implied interest rates. J. Business 59, 493 – 507.

Cox, J., Ross, S., Rubinstein, M., 1979. Option pricing: a simplified approach. J. Financia. Econom. 13, 145 – 166.

Dawson, P., 1994. Comparative pricing of American and European index options: an empirical analysis. J. Futures Markets 14, 363 – 378.

deRoon, F., Veld, C., 1996. Put-call parities and the value of early exercise for put options on a performance index. J. Futures Markets 16, 71 – 80.

Engstro¨m, M., Norde´n, L., Stro¨mberg, A., 2000. Early exercise of American put options: Investor rationality on the Swedish equity options market. J. Futures Markets 20, 167 – 188.

Evnine, J., Rudd, A., 1985. Index options: the early evidence. J. Financ. 40, 743 – 756.

Geske, R., 1979. A note on an analytical formula for unprotected American call options on stocks with known dividends. J. Financ. Econom. 7, 375 – 380.

Geske, R., Johnson, H., 1984. The American put valued analytically. J. Financ. 39, 1511 – 1524. Hull, J., White, A., 1988. The use of the control variate technique in option pricing. J. Financ. Quant.

Anal. 23, 237 – 251.

Jorion, P., Stoughton, N., 1989. An empirical investigation of the early exercise premium of foreign currency options. J. Futures Markets 9, 365 – 375.

Jorion, P., Stoughton, N., 1990. The valuation of the early exercise premium in the foreign currency options market. In: Khoury, S. (Ed.), Recent Developments in International Banking and Finance 3. Probus Publishing, pp. 159 – 190.

MacMillan, L., 1986. Analytic approximation for the American put option. Adv. Futures Options Res. 1, 119 – 139.

McMurray, L., Yadav, P., 1996. The Early Exercise Premium In American Option Prices: Direct Empirical Evidence, Chicago Board of Trade Eight Annual European Futures Research Symposium Proceedings.

Merton, R., 1973a. Theory of rational option pricing. Bell J. Econom. Manage. Sci. 4, 141 – 183. Merton, R., 1973b. The relationship between put and call option prices: comment. J. Financ. 28,

183 – 184.

Roll, R., 1977. An analytical valuation formula for unprotected American options on stocks with known dividends. J. Financ. Econom. 5, 251 – 258.

Stoll, H., 1969. The relationship between put and call option prices. J. Financ. 24, 801 – 824. Unni, S., Yadav, P., 1998. Market Value Of Early Exercise: Direct Empirical Evidence From American

Index Options, Discussion Paper no 5. Centre for Financial Markets Research, University of Strathclyde.

Whaley, R., 1981. On the valuation of American call options on stocks with known dividends. J. Financ. Econom. 9, 207 – 211.

White, H., 1980. A heteroscedasticity-consistent covariance matrix estimator and a direct test for heteroscedasticity. Econometrica 48, 817 – 838.

Zivney, T., 1991. The value of early exercise in option prices: an empirical investigation. J. Financ. Quant. Anal. 26, 129 – 138.