A Model of Portfolio Investment Management of

The Islamic Endowment Funds

Using System Dynamics Methodology

Dian Masyita ([email protected])

The Faculty of Economics, Padjadjaran University, Bandung, Indonesia

Abstract

This research tries to find out the potency of endowment funds as an innovation financial instrument, especially cash waqf, to alleviate the poverty in Indonesia. This research also tries to offer a design of the endowment funds management system in a system dynamics model. Using the system dynamics methodology, we try to know the structure of the endowment funds management system and simulate the behaviour of endowment funds.

Cash Waqf, a special charitable endowment fund, is expected to become one of the alternative instruments for the poverty alleviation programs in Indonesia. These programs require huge amount of fund that cannot be provided thoroughly by the government. Therefore, initiation of new sources of fund for such a program is inevitable. In the Islamic sosio-economic concept, there is a source of social fund that is economically and politically free of charge, namely cash waqf (wakaf tunai). In this concept, Nadzir (cash waqf fund manager) collects the fund from Waqif (cash waqf payer) and invest the money in the real sector (mainly Small & Medium-sized Ventures) and in any syariah-based investment opportunities.

Nadzir will then allocate all profits and returns gained from the investments to any poverty alleviation programs to enhance the quality of poor people’s life, such as free education and health service, cheap basic food, etc. Nadzir is obliged to maintain the amount of fund in such a way that it does not go below the initial amount. Therefore, Nadzir not only should be highly capable, butalso needs a financial institution, which has been proven to be experienced, highly capable and effective in helping SMEs development efforts, since such a microfinancing program is considered as the most vital portfolio in the poverty alleviation program. Therefore, it’s necessary to design an instrument which is able to control the endowment funds management especially cash waqf.

Keywords: the endowment funds, cash waqf, portfolio investment, poverty alleviation, system dynamics

1. Preface

In the end 2005, the Indonesian poverty rate has been still discouraging. The poverty indices are still higher than those of the previous years. The economic crisis beginning in 1997, does not end until now. In addition, the Tsunami Disasters destroyed two provinces in Indonesia i.e Nanggroe Aceh Darussalam and North Sumatra in the end of the year 2004. Based on the Statistics Central Bureau (BPS)’s data, there are about 40 million Indonesian people who are under the poverty line.

Indonesia has come into debt trap made by the Indonesian government and the private sectors. Large amount of debt has weakened Indonesian economy for the past seven years. Meanwhile, the government has been confronted with the deficit budget almost every year since 1997, which means that the government may find it difficult to cover its routine expenditures1.

1

Baswir, Revrisond, Indonesian Foreign Debt, satunet column, 2000.

Those regular balance sheet items require so large amount of fund that government cannot provide adequate fund for other strategic needs, such as good education, appropriate health, poverty, and SME’s development. Mismanagement of debts is the largest of all factors that make Indonesia go into crisis. Consequently, all of citizens and their offsprings have to carry the heavy burden of that debt.

2. Problem Identification

Waqif donates his/her money as waqf

fund to Mauquf’alaih (a person who is entitled to get benefit from waqf fund) through Nadzir (a person/an institution being in charge for managing waqf fund and distributing returns of waqf investment). Only gains of the invested waqf fund will be delivered to Mauquf’alaih2.

The principal of funds keep being invested in potential investment opportunities. In relation to its role as waqf fund investment manager, Nadzir on behalf of Waqf Institution may allocate some waqf funds to financial portfolio and finance SMEs’ businesses on the basis of profit-loss sharing system.

The larger the investment returns, the more fund can be allocated to poverty alleviation program. In some countries, waqf fund management has reduced poverty effectively and enhanced people’s welfare, by providing additional fund for education & health development programs, cheap houses & public facilities development programs, and so forth.

3. Objectives of Research

This research is expected to be able to find out the potency of an Islamic innovation financial instrument, especially cash waqf, to alleviate the poverty in Indonesia. This research also tries to offer a design of the endowment fund management system in a system dynamics model. Using the system dynamics methodology, we try to know the structure of cash waqf system and simulate the behaviour of it.

On the next part of this paper, we will discuss definition, law, and history of a special endowments fund, cash waqf, to recognize the concept and its potential benefit.

4. Problem Definition : Cash Waqf Previously, waqf of building and land are the most popular forms of waqf. Nowadays, cash waqf has become increasingly well-known, particularly because of its flexibility, which allows distribution of the waqf’s potential benefit to be benefited by the poor anywhere3.

Cash waqf was firstly introduced in Ottoman era in Egypt. Professor Mannan then sosialized cash waqf in Bangladesh through Social Investment Bank Limited (SIBL). SIBL issues Cash Waqf Certificate to collect funds

2

Utomo, Setiawan Budi, Fiqh on Waqf and Cash Waqf, Presentation in Monthly Discussion for Cash Waqf Implementation in Indonesia, MUI Commission of Economy. 2001

3

Mannan, M.A.Abdul, Cash Waqf Certificate- an Innovation in Islamic Financial Instrument: Global Opportunities for Developing Social Capital Market in the 21stCentury

Voluntary Sector Banking”, Presentation at the Third Harvard University Forum on Islamic Finance, October 1, 1999

from the rich and distributes gains of the managed funds to the poor4.

Like those of Bangladesh, most of Indonesian people are poor. Characteristic of communities in both countries are also similar. Therefore, effectiveness of cash waqf certificate program to help reduce poverty in Bangladesh gives hope that analogous program can be successfully implemented in Indonesia. Therefore, Fatwa Commission, Board of Indonesian Moslem Scholars (MUI),responded the necessity of cash waqf program in Indonesia by issuing a fatwa (dated on 11 May 2002) about cash waqf .

5. Research Metodology

This research used system dynamics methodology to capture dynamic phenomenon of a system, in which variables change simultaneously as time moves5. System Dynamics is a method of dealing with questions

about the dynamic tendencies of complex systems, that is, the behavioral patterns they generate over time6.

System dynamics is a powerful tool in the creation of feedback theories. Since its beginnings, the founders of the field have developed a series of guidelines for the model building process (Randers 1980; Richardson and Pugh 1981; Roberts et al. 1983; Wolstenholme 1990; Sterman 2000) and a series of tests to build confidence in the models created (Forrester and Senge 1980; Sterman 2000)7.

In 2000, I carried out a survey on possible implementation of cash waqf in Jakarta and West Java, Indonesia. The survey concluded that most people did not trust any existing government institution to manage cash waqf fund and control its investment activities, especially because cash waqf management will involve large amount of endowment funds8. Most of them also recommend that if a special purpose institution is established to manage cash waqf fund, it has to be highly capable of detecting any potential dishonesty and assessing performance of cash waqf fund manager, i.e. nadzir. Therefore, it’s

4 Mannan, M.A.Abdul, Cash Waqf, Enrichment of Family

Heritage Generation to Generation, Social Investment Bank

Publication Series no. 1, 1st edition, 1998

5

Tasrif, Muhammad, System Thinking & Dynamics Modeling,ITB 1996

6 Meadows, Donella H., “The Unavoidable A Priori”, MIT

Press 1980.

7

Sterman, John. Business Dynamics: system thinking & modeling for a complex world, Mc Graw-Hill, 2000.

8Masyita, Dian, Preliminary Implementation Model Design

necessary to design an instrument which is able to control the cash waqf management.

Based on the survey’s result, using exclusively designed computer program then simulated with system dynamics methodology, some scenarios of cash waqf implemention to formulate some policy concepts applicable in Indonesia. The computer program was designed to help the policy makers (1) estimate cash waqf potential in alleviating poverty in Indonesia, (2) supervise performance of nadzir or waqf fund management institution, and (3) identify appropriate policies conducive to poverty alleviation programs. Since there was no similar study preceding the research, some assumptions were applied. The ability of three national TV corporations (RCTI, SCTV, and Indosiar) to collect donation amounting 2 billions Rupiah in two nights in 2000 and the other charity programs to collect donation in 2001-2005 were used as an assumption basis of amount of fund could be gathered by cash waqf management institution9. This research also used data supplied by Biro

Pusat Statistik Republik of Indonesia (National

Beaurau for Statistics), BKKBN Republic of Indonesia (National Coordinating Agency for Family Planning) and Islamic Financial Institution.

5.1 Limitation of Research

This research put more emphasived on financial management especially raising and investing of cash waqf funds. The duties of Nazir, as a cash waqf fund manager, are to increase the cash waqf funds and invest those funds in profitable portfolios. As we know, the poverty alleviation problems are complicated. However, they need multidiscipline knowledge to formulate and figure out the solutions. With this research we want to try to make an early design of poverty alleviation in the financial viewpoint using system dynamics modeling.

6. General Description of System

Conceptualization

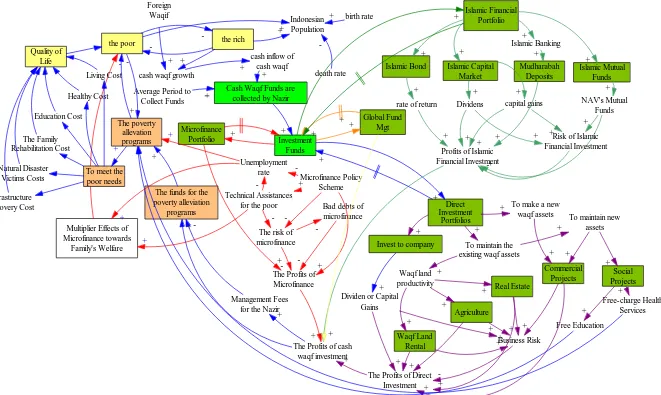

The system conceptualization involves establishing model boundary, identifying causal relationships and policy framework10. In this research the model boundary includes all relevant factors that are considered important in the problem context. The model comprises six interrelated components in the cash waqf management as shown as Figure 1.

9

PIRAC (Public Interest Research and Advocacy Center), “Rate of giving of Indonesian Community”.. Based on survey from Agustus 2000 to Agustus 2001.

10

Sushil (1993), System Dynamics “A Practical Approach for Managerial Problems”,Wiley Eastern Limited.

THE POOR THE RICH

CASH WAQF FUNDS

INVESTMENT PORTFOLIOS

+ INVESTMENT

PROFITS

AVAILABLE FUNDS FOR THE POVERTY

PROGRAMS +

+ -+

+

(-) loop 1

(+) loop 2

+ (+) loop 3

(-) loop 4

-

-Figure 1. A Macro-view of Model

A general system of cash waqf model, derived from a macro-view of model above, consists of six sectors i.e:

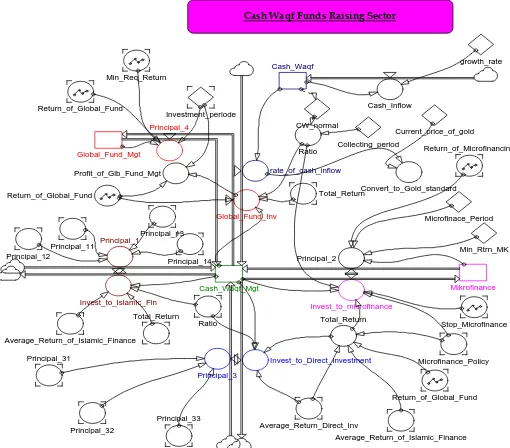

1). The cash waqf fund raising sectors

Cash Waqf Funds Raising Sector

Principal_32

Total_Return

growth_rate Cash_Waqf

Min_Req_Return

Cash_Inflow Return_of_Global_Fund

Investment_periode

CW_normal

Principal_4

Current_price_of_gold Collecting_period

Principal_3 Principal_1

Principal_11 Principal_12

Principal_14 Principal_13

Principal_33 Principal_31

Ratio

Global_Fund_Inv

Invest_to_Islamic_Fin

Convert_to_Gold_standard

Cash_Waqf_Mgt Mikrofinance Global_Fund_Mgt

Return_of_Global_Fund Total_Return

Invest_to_Direct_Investment

Invest_to_microfinance

Ratio Return_of_Microfinancing

rate_of_cash_inflow Profit_of_Glb_Fund_Mgt

Return_of_Global_Fund

Microfinace_Period

Min_Rtrn_MK Principal_2

Total_Return

Stop_Microfinance

Average_Return_of_Islamic_Finance

Microfinance_Policy

Average_Return_Direct_Inv

Average_Return_of_Islamic_Finance

2) The Islamic financial portfolios sectors,

Islamic Financial Portfolio Sector

Investment_periode Return_Islamic_Finance

Invest_to_Islamic_Fin

Principal_14

Invest_to_Islamic_Fin

Principal_12 Islamic_Mutual_Funds

Invest_to_Mutual_Funds

Min_Req_Return Return_Islamic_Mutual_Fund

Profit_of_Islamic_Bonds

Return_of_Islamic_Bonds

Invest_to_Islamic_Bond Islamic_Bonds

Principal_13

urn_Islamic_Finance Min_Req_Return

Invest_to_JII Islamic_Capital_Market

Profit_of_Islamic_Cap_Mrkt

Invest_to_Mudharabah_Deposits

Principal_11 Return_Islamic_Finance

Profit_of_Islamic_Mutual_Funds

Investment_periode Invest_to_Islamic_Fin

Return_of_Deposit

Profit_of_Islamic_Deposits Profit_of_Islamic_Bonds

Mudarabah_Deposits

Profit_of_Islamic_Finance

Investment_periode Average_Return_of_Islamic_Finance

Profit_of_Islamic_Deposits Return_of_Islamic_Stocks

Return_Islamic_Finance Return_of_Islamic_Bonds Return_of_Islamic_Bonds Profit_of_Islamic_Mutual_Funds

Return_Islamic_Mutual_Fund

Return_of_Deposit

Return_of_Islamic_Stocks

Figure 2. The Interrelationship Among Variables in the General System

Islamic Financial Portfolio

Microfinance Portfolio

The Profits of Microfinance The risk of microfinance

Microfinance Policy Scheme

Bad debts of microfinance Unemployment

rate

Technical Assistances for the poor

+

-+

-+

-Indonesian Population

birth rate +

the rich the poor

death rate cash waqf growth

cash inflow of cash waqf

Cash Waqf Funds are collected by Nazir Average Period to

Collect Funds

Investment Funds

-+ +

+

+

+

Direct Investment

Portfolios + +

The Profits of cash waqf investment Management Fees

for the Nazir The funds for the

poverty alleviation programs

-+ +

+ +

+

-+

Islamic Capital Market

Islamic Banking

Islamic Mutual Funds

Dividens capital gains

Mudharabah Deposits

NAV's Mutual Funds +

+

+

+ +

+

+ Islamic Bond

+

rate of return +

Profits of Islamic Financial Investment

+ +

+ +

+

Risk of Islamic Financial Investment

-+ +

+

+

Invest to company To maintain the

existing waqf assets

To make a new waqf assets

+ +

+

Dividen or Capital Gains

+

Waqf land productivity

To maintain new assets

Agriculture

Real Estate +

+

+

+

Business Risk

Social Projects Commercial

Projects

Free Education

Free-charge Health Services

Waqf Land Rental

+

+ +

+

+

The Profits of Direct Investment

+

+ +

+

++

+ +

+

-+

+ The poverty

allevation programs

-+ +

Global Fund Mgt +

Foreign Waqif

+

+

+

+

Multiplier Effects of Microfinance towards

Family's Welfare

-+

+ +

To meet the poor needs Living Cost

Healthy Cost

Education Cost

The Family Rehabilitation Cost

Natural Disaster Victims Costs

Infrastructure Recovery Cost

Quality of Life

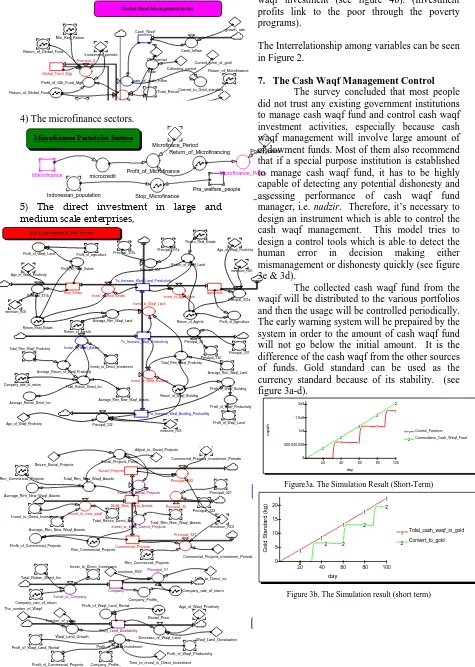

3) The global fund management sectors,

Global Fund Management Sector

Total_Return

4) The microfinance sectors.

Microfinance Portofolio Sectors

Mikrofinance microcredit Profit_of_Microfinance

Indonesian_population Stop_Microfinance

The survey concluded that most people did not trust any existing government institutions to manage cash waqf fund and control cash waqf investment activities, especially because cash waqf management will involve large amount of endowment funds. Most of them also recommend that if a special purpose institution is established to manage cash waqf fund, it has to be highly capable of detecting any potential dishonesty and assessing performance of cash waqf fund manager, i.e. nadzir. Therefore, it’s necessary to design an instrument which is able to control the cash waqf management. This model tries to design a control tools which is able to detect the human error in decision making either mismanagement or dishonesty quickly (see figure 3e & 3d).

5) The direct investment in large and medium scale enterprises,

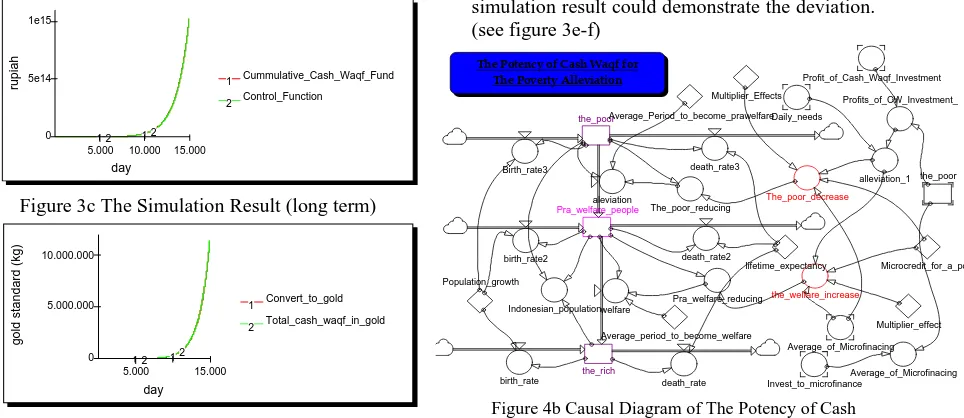

6) The distribution sectors of the profits of cash waqf investment (see figure 4b). (Investment profits link to the poor through the poverty programs).

The Interrelationship among variables can be seen in Figure 2.

7. The Cash Waqf Management Control

Direct Investment to Real Sectors

Return_Real_Estate

Principal_331a Age_of_Waqf_Prodctvty Principal_331b

Profit_of_Waqf_Land

The collected cash waqf fund from the waqif will be distributed to the various portfolios and then the usage will be controlled periodically. The early warning system will be prepaired by the system in order to the amount of cash waqf fund will not go below the initial amount. It is the difference of the cash waqf from the other sources of funds. Gold standard can be used as the currency standard because of its stability. (see figure 3a-d).

day

Figure3a. The Simulation Result (Short-Term)

day

Gold St

andard (kg) Total_cash_waqf_in_gold

1

Figure 3b. The Simulation result (short term)

day

rupiah 1 Cummulative_Cash_Waqf_Fund

Control_Function 2

5.000 10.000 15.000

0 5e14 1e15

1 2 1 2

Figure 3c The Simulation Result (long term)

day

gold standard (kg)

Convert_to_gold

Figure 3d The Simulation Result (long term)

da

Figure 3e. The Simulation Result (short term) if any of mismanagements or dishonesty occur

day

2.000 6.000 10.000 0

Figure 3f. The Simulation Result (long term) if any of mismanagements or dishonesty occur

8. The Potency of Cash Waqf for the

Poverty Alleviation Programs

It can be concluded from the system that the larger the amount of cash waqf collected, the larger the amount of fund can be invested in highly cost-effective profit sharing-based portfolios, and the larger the amount of return can be distributed to poor people. The more fund allocated to finance microbusiness, the sooner poverty in Indonesia can be alleviated. (see Figure 4a).

The waqif and public can control or monitor the cash flow of cash waqf investment. If mismanagement and dishonesty occurred, the

simulation result could demonstrate the deviation. (see figure 3e-f)

The Potency of Cash Waqf for The Poverty Alleviation

Pra_welfare_people

Figure 4b Causal Diagram of The Potency of Cash Waqf Simulation using Powersim

Profits of Cash Waqf Investment Distribution

Enter_to_pra_welfare

Figure 4b Causal Diagram of Simulation using Powersim

9. The Simulation Result

assumption basis of amount of fund could be gathered by cash waqf management institution.

It was then assumed that the cash waqf institution could obtain 20 millions Rupiah a day in form of cash waqf from various components of Indonesian people. The study also assumed that the gathered fund would grow 25% annually and it would be invested in Islamic financial products with profit sharing- based various rate of return.

Using the above assumption and data supplied by Biro Pusat Statistik (National

Beaurau for Statistics), BKKBN (National Coordinating Agency for Family Planning) and

syariah financial institution in Indonesia, the computer-based data process resulted. Such an amount of fund is expected to be available for the poverty alleviation efforts in Indonesia, especially through microfinance distribution program. If this plan can be implemented smoothly and if those assisted micro enterprises can get well run maximum of 8 years after being financed, it will take approximately 12500 days (35 years) to eliminate poverty and 22400 days (63 years) to increase quality of live for Indonesian population. (see figure 5a-b) Poor people, in this study, are those with very low quality of life. In other words, poor people are not only those who cannot feed once a day, but also those who cannot afford proper health and education services.

Time

the_poor 1

the_poor 2

Pra_welfare_people 3

Pra_welfare_people 4

the_rich 5

the_rich 6

Indonesian_populatio 7

Indonesian_populatio 8

5,000 10,000 15,000 20,000 25,000 30,000 0

50,000,000 100,000,000 150,000,000 200,000,000

1 2 3 4

5 6 7 8

1 2 3 4

5 6 7 8

1 2 3 4

5 6 7 8

1 2 34

56 7 8

1 2 3 4 5 6 7 8

Figure 6a. Simulation Result (based on Rp 50 million in a day compare with Rp 20 million in a day)

10. Conclusions

This work is an attempt to provide Board of Indonesian Waqf and policy makers in Indonesia with a “microworld” in which they can experiment with their policy options, prior to adoption. This helps them test their mental models regarding the solutions they see for the problems associated with portfolio of Islamic endowment funds investment management. The model could be used a basis for other cycle model of donation funds. We would expect that expanding our model to include all players in the endowment funds and donation funds such as Zakat, infaq, shadaqah etc. and linking it with a macroeconomic model, would probably reinforce the cyclical behaviour.

List of References

day

popul

at

ion the_rich

1 the_poor 2

Pra_welfare_people 3

Indonesian_population 4

5,000 10,000 15,000 20,000 25,000 30,000 0

50,000,000 100,000,000 150,000,000 200,000,000

1 2 3 4

1

2 3 4

1

2 3 4

1

2 3 4

1

2 3 4

1. Baswir, Revrisond (2000), Indonesian Foreign Debt, satunet column.

2. Mannan, M.A.Abdul, (1998) Cash Waqf, Enrichment of Family Heritage Generation to Generation, Social Investment Bank Publication Series no. 1, 1st edition.

3. Mannan, M.A.Abdul, (October 1, 1999), Cash Waqf Certificate- an Innovation in Islamic Financial Instrument: Global Opportunities for Developing Social Capital Market in the 21stCentury Voluntary Sector Banking”, Presentation at the Third Harvard University Forum on Islamic Finance.

Figure 5a. The Simulation Result (based on Rp 20 million a day)

4. Mannan, M.A.Abdul, (1999) Lesson of Experience of Social Investment Bank in Family Empowerment Micro-credit for Poverty Allevation: A Paradigm shift in Micro-financ”, Social Investment Bank Publication Series no. 10.

day

p

o

p

ulation The_poor_decrease

1

the_welfare_increase 2

5.000 15.000 25.000

0 100.000.000 200.000.000 300.000.000 400.000.000 500.000.000

1 2 1 2 1 2 1 2 1

2 5. Masyita, Dian, (2001), Preliminary Implementation

Model Design of Cash Waqf Certificate as Alternative Instrument for Poverty Alleviation in Indonesia using System Dynamics Methodologi, Thesis, ITB. 6. PIRAC (Public Interest Research and Advocacy Center),

“Rate of giving of Indonesian Community”. Based on survey from Agustus 2000 to Agustus 2001. Figure 5b. The Simulation Result (based on Rp 20 million a day) 7. Sterman, John. (2000), Business Dynamics: system

thinking & modeling for a complex world, Mc Graw-Hill

Based on the study result above and various scenarios proposed, if the gathered fund through cash waqf certificate increase i.e. Rp 50 million in a day , it will take approximately 11000 days (30 years) to eliminate poverty and 21000 days (57 years) to increase quality of live for Indonesian population. (see figure 6a)

8. Sushil, (1993), System Dynamics- A Practical Approach for Managerial Problems, Wiley Eastern Limited, India.

9. Tasrif, Muhammad, (1996), System Thinking & Dynamics Modeling.