Statistik Asuransi Gempa

Bumi Indonesia 2009

[Indonesian Earthquake Insurance Statistic 2009]

Sesuai dengan tujuan pendiriannya, MAIPARK

selalu berusaha melakukan inovasi dalam

memberikan pelayanan terbaik bagi industri

asuransi Indonesia dalam hal ilmu dan statistik

mengenai risiko bencana.

Inovasi

terus

kami

lakukan

untuk

menyempurnakan laporan statistik ini, sehingga

menjadi lebih akurat, rinci dan komperhensif.

Berikut kami sajikan laporan Statistik Asuransi

Gempa Bumi Indonesia 2009

–

2010 yang

mencakup :

o

Inovasi terhadap sistem dan proses

pengolahan data statistik.

o

Peta Kejadian Gempa Bumi Indonesia.

o

Peta

Exposure

Gempa Bumi Indonesia.

o

Penggolongan tersendiri atas risiko multi

lokasi, dalam laporan profile risiko dan

klaim.

o

Analisa asuransi gempa terkait kondisi

makro ekonomi.

o

Tabel, peta dan grafik yang kreatif.

Dengan semangat ”Go Green”, dan laporan

tersebut disajikan dalam bentuk soft copy dan

tidak lagi diproduksi dalam bentuk hard copy.

Usaha

yang

kami

lakukan

dalam

menyempurnakan laporan statistik ini tidak akan

berarti apa - apa tanpa dukungan dari seluruh

perusahaan asuransi. Data yang lengkap dan

akurat akan sangat menentukan kualitas dari

hasil statistik ini.

In line with the intention of MAIPARK

establishment, MAIPARK keeps on innovating to

provide the best services

for the Indonesia’s

insurance industry in terms of science and

statistics on Catastrophe risks. We keep on doing

innovation to make this statistics report more

accurate, detailed and comprehensive. Herewith,

we present Indonesian Earthquake Statistical

Report of 2009 - 2010 which include:

o

Inovation of the system and statistical

o

Separate classification of multi-location

risks in Risk and Loss Profile report.

o

Analysis of earthquake insurance related

presented in soft copy rather than hard copy.

Kami berharap laporan statistik ini dapat

memberikan

manfaat

tidak

hanya

bagi

perusahaan asuransi yang menangani asuransi

gempa bumi, namun juga berguna bagi industri

Asuransi Umum di Indonesia.

We hope that this statistic report is useful for both

insurance

companies

having

earthquake

business and general insurance industry in

Indonesia.

Salam Inovasi MAIPARK !!

Daftar Isi / Contents

F.Pertumbuhan

Incurred Claim

... 15

Exposure Asuransi Gempa Bumi Indonesia

...

Tabel 2.1.Exposure Per Cresta Zone ... 15

Tabel 2.2.Exposure Per Okupasi ... 17

Tabel 2.3.Exposure Per Interest ... 19

Tabel 2.4.Exposure Per Provinsi ... 21

Gross Premium Asuransi Gempa Bumi

Indonesia

...

Tabel 3.1.Gross Premium Per Cresta Zone . 22

Tabel 3.2.Gross Premium Per Okupasi ... 24

Tabel 3.3.Gross Premium Per Provinsi ... 26

Jumlah Risiko Asuransi Gempa Bumi

Indonesia

...

Tabel 4.1.Jumlah Risiko Per Cresta Zone ... 27

Tabel 4.2.Jumlah Risiko Per Okupasi ... 29

Klaim Asuransi Gempa Bumi Indonesia

...

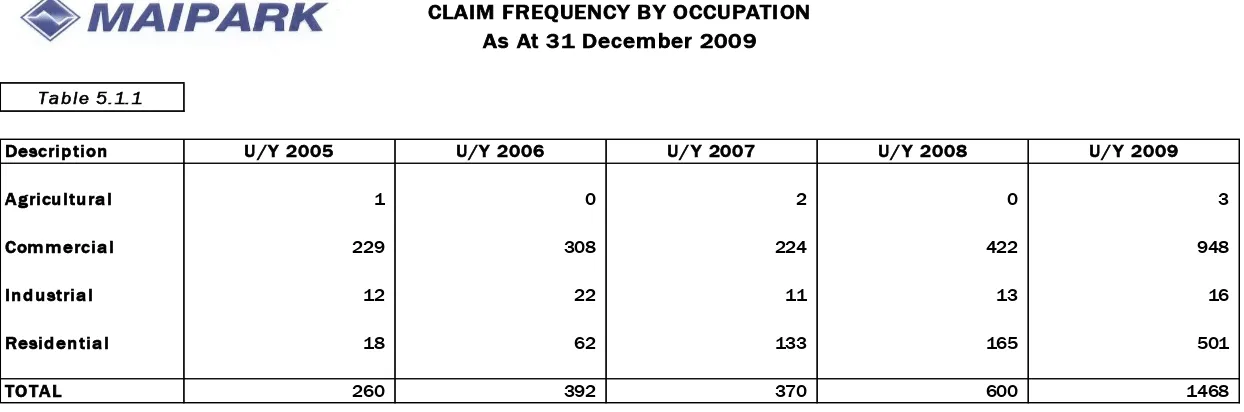

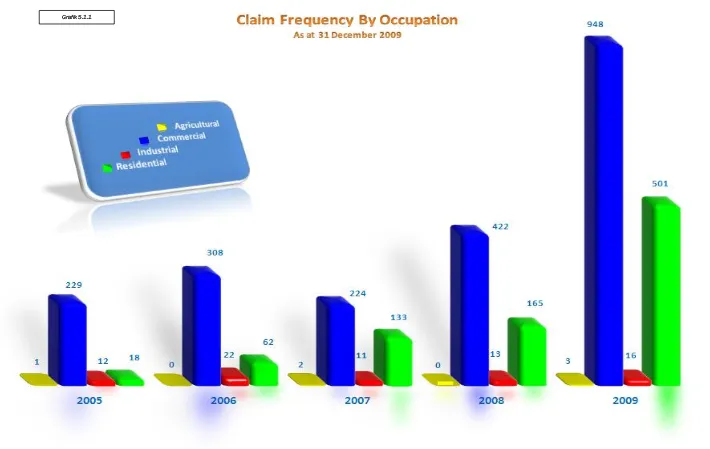

Tabel 5.1.1.Klaim Frekwensi Per Okupasi .... 31

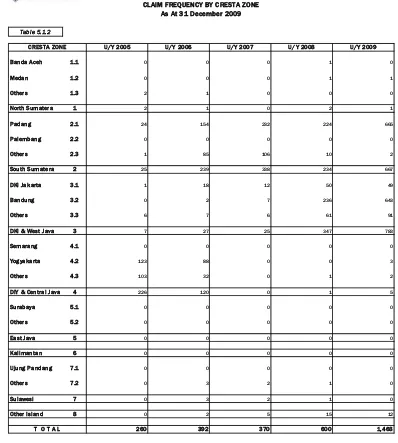

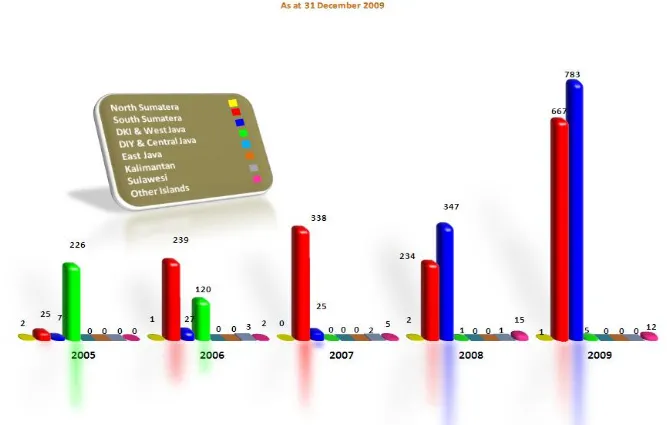

Tabel 5.1.2.Klaim Frekwensi Per Cresta Zone

... 33

Tabel 5.2.1.Jumlah Klaim Per Okupasi ... 35

Kata Pengantar ... i

Table of Contents ... iii

Statistical Information ... iv

Summary of Indonesia Earthquake

Insurance 2009

...

A.Introduction ... 1

B.Market Structure ... 1

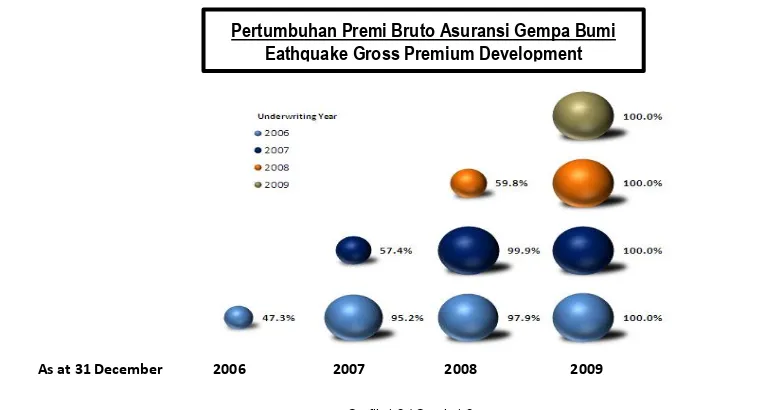

C.Growth of Gross Premium ... 2

D.Number of Risks ... 6

F.Growth of Incurred Claim ... 15

Indonesia Earthquake Insurance Exposure

....

Table 2.1.Exposure By Cresta Zone ... 15

Table 2.2.Exposure By Occupation ... 17

Table 2.3.Exposure By Interest ... 19

Table 2.4.Exposure By Province ... 21

Indonesia Earthquake Insurance Gross

Premium

...

Table 3.1.Gross Premium By Cresta Zone .. 22

Table 3.2.Gross Premium By Occupation .... 24

Table 3.3.Gross Premium By Province ... 26

Indonesia Earthquake Insurance Number of

Risks

...

Table 4.1.Number of Risk By Cresta Zone .. 27

Table 4.2.Number of Risk By Occupation... 29

Indonesia Earthquake Insurance Claim

...

Table 5.1.1.Claim Frequency By Occupation 31

Table 5.1.2. Claim Frequency By Cresta Zone

... 33

Tabel 5.2.2.Jumlah Klaim Per Cresta Zone .. 37

Table 5.2.2.Claim Amount By Cresta Zone .. 37

Risk and Loss Profile

...

Risks and Loss Profile Underwriting Year

2009

...

Agricultural Occupation ... 44

Commercial Occupation ... 45

Industrial Occupation ... 46

Residential Occupation ... 47

Risks and Loss Profile Underwriting Year

2008

...

Agricultural Occupation ... 48

Commercial Occupation ... 49

Industrial Occupation ... 50

Residential Occupation ... 51

Risks and Loss Profile Underwriting Year

2007

...

Agricultural Occupation ... 52

Commercial Occupation ... 53

Industrial Occupation ... 54

Residential Occupation ... 55

Commercial Occupation ... 57

Okupasi Industrial ... 58

Okupasi Residential ... 59

Peta.7.1 Distribusi Kejadian Gempa di

Indonesia 2004 - 2009 ... 60

Daftar Istilah ...

Lampiran

1.

Tarif Asuransi Gempa Bumi Indonesia ...

2.

Skala First Loss ...

3.

Tabel Jangka Waktu Pertanggungan

Kurang dari satu tahun ...

4.

Tabel Indemnitas ...

Okupasi Commercial ... 57

Industrial Occupation ... 58

Residential Occupation ... 59

Map 7.1 Indonesia Earthquake Distribution of

occurrences 2004-2009 ... 60

Glossaries ...

Attachments

1.

Indonesia Earthquake Insurance Tariff ....

2.

First Loss Scale ...

3.

Short Period Table

less

than one year

period

...

1.

Statistik dibuat berdasarkan Underwriting

pertanggungan seluruh risiko pada

lokasi yang sama untuk

masing-masing

perusahaan

asuransi.

Definisi setiap risiko atau setiap

lokasi ditentukan oleh perusahaan

asuransi atau penerbit polis sesuai

dengan

interpretasi

perusahaan

asuransi dalam

underwriting

polis

kebakaran.

2.3. Besarnya Limit Sesi atas setiap

risiko (

any one risk

) untuk gabungan

kerugian fisik dan gangguan usaha

insurance company. The definition of

anyone risk or any location is

combined material and business

interruption damage are as follows:

2.3.1

For West Java, Banten and DKI

: 5% (five percent) of the total

sum insured, a maximum of

USD 2,500,000.00 (two million

five hundred thousand U.S.

Dollars) for any one risk, each

insurance company or policy

issuer

perusahaan asuransi atau

2.5.

Bilamana risiko ditutup secara

ko-asuransi, jumlah maksimum sesi dari

semua Anggota ko-asuransi adalah

sesuai dengan ketentuan yang diatur

selain polis ko-asuransi tersebut

pada obyek pertanggungan yang

sama, perusahaan asuransi tetap

dapat mensesikan risiko dimaksud,

dengan catatan jumlah seluruh sesi

perusahaan asuransi bersangkutan

tidak melebihi ketentuan yang diatur

pada butir 2.3.

3.

Tarif Premi

3.1. Penutupan dengan menggunakan

Full Value Basis mengaplikasikan

Tarif Premi Standar Gempa Bumi

Indonesia (lampiran 1)

3.2. Penutupan dengan First Loss / Sub

Limit Basis mengaplikasikan standar

First Loss Scale (lampiran 2)

3.3. Perhitungan premi untuk penutupan

kurang dari 12 (dua belas) bulan

diberlakukan skala premi jangka

pendek (lampiran 3)

3.4. Untuk perhitungan premi Bussiness

Interruption diberlakukan Indemnity

2.5

For coinsurance policies, maximum

cession from all members of

coinsurance is stipulated in item 2.3

above. Each ceding company cedes

proportionally depending on its

share.

In the even there are other policies

on the same risk beside that

coinsurance policy, insurer still can

cede such risks subject to the

maximum limit set out in item 2.3

3.

Premium Tariff

3.1.

For the coverage of Full Value Basis,

Indonesian earthquake rate standard

is applied (attachment 1).

3.2.

The coverage First Loss / Sub Limit

Basis uses standard First Loss Scale

(attachment 2).

3.3.

Premium calculation for short period

coverage is based on Short Period

Scale (attachment 3).

3.4.

Premium calculation for business

interruption is based on Indemnity

Period Scale (attachment 4)

4.

Insured Objects

4.1.1. Kerusakan Fisik :

4.2 Penutupan sebagaimana dimaksud

pada butir 4.1. adalah yang ditutup

secara langsung (direct business)

termasuk ko-asuransi. Penutupan

tidak

langsung

(indirect

business/Reasuransi) tidak dapat

disesikan.

5.

Pelaporan Bordero.

Pelaporan

bordero

dilakukan

setiap

bulannya untuk semua risiko yang ditutup

pada bulan yang bersangkutan dan sudah

harus diterima selambat-lambatnya pada

akhir bulan berikutnya.

6.

Untuk kasus “Multi Location Risk” yang

mengalami kesulitan dalam memberikan

detail harga pertanggungan perlokasi

maka dengan persetujuan AAUI pensesian

risiko dan perhitungan premi dilakukan

pada zona-zona tertentu.

7.

Untuk menggambarkan premi dan harga

pertanggungan yang sebenarnya dalam

penutupan

asuransi

gempa

bumi

berdasarkan ko-asuransi, diharapkan agar

seluruh anggota ko-asuransi mensesikan

risiko gempa bumi tersebut.

Indirect businesses cannot be

ceded.

5.

Bordereaux Report.

Bordereaux reports is submitted on a

monthly basis for all risk underwritten in the

month concerned and should be received

by the end of the following month.

6.

In the case of Multi Location Risks with no

details of sum insured provided per

location, the risk cession and its premium

calculation specified zones after approved

by AAUI.

A.

Pendahuluan.

Tingkat Pendapatan Domestik Bruto (PDB)

Indonesia di tahun 2009 ini tercatat sebesar Rp.

5.613,40. Hal ini menunjukan telah terjadi

peningkatan

sebesar

13,31%

dibanding

Pendapatan Domestik Bruto di tahun 2008 yang

sebesar

Rp.

4.954,26

triliun.

Kenaikan

Pendapatan Domestik Bruto ditahun ini lebih

rendah jika dibanding dengan kenaikan pada

tahun 2008 yang mencapai 25,19%

Tingkat Pendapatan Domestik Bruto (PDB)

Indonesia dalam lima tahun terakhir dapat dilihat

pada grafik 1.1 dibawah ini

B.

Struktur Pasar.

Per 31 Desember 2009, seperti yang dilaporkan

oleh Bapepam LK

–

Departemen Keuangan

dalam laporan

Indonesian Insurance Directory

2009

,

jumlah

perusahaan

asuransi

dan

reasuransi umum di Indonesia adalah 93

perusahaan. Dengan rincian 89 perusahaan

asuransi umum dan 4 perusahaan reasuransi

umum. Dari ke 89 perusahan asuransi umum ini,

A.

Introduction

The Gross Domestic Product (GDP) of Indonesia

in the year 2009 is reported in amount of Rp.

5.613,40 trillion. It increases for about 13,31%

from Rp. 4.954,26 trillion of the Gross Domestic

Product (GDP) in 2008. However this increase is

still lower compared to the increased of 25,19%

in 2008.

The level of Gross Domestic Product of

Indonesia for the last five years is shown in graph

1.1 below.

B.

Market Structure.

On 31 December 2009, as reported by Bapepam

LK- Ministry of Finance, in the report Based on

the report of Indonesia Insurance Directory, the

member of general insurance and reinsurance in

Indonesia is 93 companies, comprising of 89

general insurance companies and 4 reinsurance

companies. Out of these 89 general insurance

companies

Pendapatan Domestik Bruto (PDB)

Gross Domestik Product (GDP)

Grafik 1.1 / Graph 1.1

Ikhtisar Kegiatan Usaha Asuransi Gempa Bumi Indonesia Tahun 2009

Summary of Indonesian Earthquake Insurance Business Activities in 2009

20 diantaranya adalah perusahaan patungan.

Sedangkan 69 sisanya adalah perusahan swasta

nasional. Dari 4 perusahaan reasuransi umum,

kesemuanya

adalah

perusahaan

swasta

nasional.

C.

Pertumbuhan Premi Bruto

Sampai dengan posisi per 31 Desember 2009,

pendapatan premi bruto asuransi gempa bumi

terlihat menunjukan pertumbuhan yang positif.

Hal ini terlihat pada pendapatan premi

underwriting 2009 ditahun pertama yang sebesar

Rp. 1.126 milliar. Angka ini lebih besar 4,45%

dibandingkan dengan premi underwriting 2008

ditahun pertamanya yg sebesar Rp. 1.078 milliar.

Pendapatan premi bruto asuransi gempa bumi

per 31 Desember 2009 untuk tahun underwriting

2006 adalah sebesar Rp. 1.734 Milliar. Premi

Bruto untuk tahun underwriting 2007 tercatat

sebesar Rp. 1.792 Milliar, sedangkan tahun

underwriting 2008 adalah Rp. 1.803 milliar.

Tabel

1.1

dan grafik

1.2 berikut

ini

menggambarkan pertumbuhan premi bruto dari

tahun ke tahun.

20 general insurance companies are joint venture

and the remaining is private national companies.

4 reinsurance companies are private national

companies.

C.

Gross Premium Growth

As per 31 December 2009, the gross premium of

earthquake insurance shows positive growth. We

could see this from the premium of underwriting

year 2009 in the first year development, which is

Rp. 1.126 billion. This is 4,45% higher than the

premium of underwriting year 2008 in the first

year of its development, which is Rp. 1.078.

The gross premium of earthquake per 31

December 2009 for underwriting year 2006,

2007, 2008 are Rp. 1.734 billion, Rp. 1.792

billion, Rp. 1.803 billion respectively.

Table 1.1 and graph 1.2 below show gross

premium development from year to year.

Grafik 1.2 / Graph 1.2

Pertumbuhan Premi Bruto Asuransi Gempa Bumi

Eathquake Gross Premium Development

Kontribusi terbesar premi asuransi gempa bumi

yang tercatat sampai dengan 31 Desember 2009

pada

tahun

underwriting

2009

masih

menunjukkan tingginya tingkat pendapatan premi

yang diperoleh dari okupasi industri, dengan

rasio pendapatan sebesar 68% dari total premi.

Diikuti oleh okupasi komersil dengan ratio

sebesar 22% dan residensil sebesar 9%.

Sedangkan okupasi agrikultur menyumbang

hanya sebesar 1%.

Table 1.2 berikut ini menyajikan rincian premi

bruto berdasarkan okupasi.

Penyebaran premi untuk tahun underwriting

2009, per 31 December 2009, memperlihatkan

risiko gempa bumi yang tetap tinggi pada zona 3

(DKI Jakarta dan Jawa Barat). Hal ini

menguatkan bahwasannya zona 3 sebagai zona

pusat ekonomi dan bisnis di Indonesia. Tingkat

rasio pada zona 3 untuk underwriting 2009

tercatat sejumlah Rp. 595,02 Billion atau sebesar

53% dari total premi.

Distribusi

premi

asuransi

gempa

bumi

berdasarkan cresta zone dapat dilihat pada tabel

1.3 berikut ini.

The

highest

concentration

premium

of

earthquake distribution for underwriting year

2009 is in zone 3 (DKI Jakarta and West Java).

This is no surprise because zone 3 is the central

economy and business in Indonesia. The

premium income for zone 3 for underwriting 2009

is Rp. 595,02 billion or 53% of the total premium.

Distribution of earthquake insurance premium is

shown in table 1.3 below.

Dalam Miliar Rupiah

In Billion Rupiah

Sumatera Wilayah Utara /

North Sumatera

94.23

5%

92.17

5%

63.83

4%

49.06

4%

Sumatera Wilayah Selatan /

South Sumatera

208.61

12%

176.08

10%

203.89

11%

131.30

12%

DKI & Jawa Barat / DKI & West Java

792.90

46%

818.29

46%

928.63

51%

595.03

53%

DIY & Jawa Tengah /

DIY & Central Java

148.95

9%

144.90

8%

107.60

6%

49.51

4%

Jawa Wilayah Timur / East Java

209.29

12%

285.12

16%

265.86

15%

182.88

16%

Kalimantan /

Kalimantan

178.62

10%

156.87

9%

107.80

6%

52.88

5%

Sulawesi /

Sulawesi

59.32

3%

64.81

4%

67.35

4%

22.79

2%

Wilayah Lainnya /

Other Island

42.47

2%

54.30

3%

58.63

3%

42.73

4%

Total

1,734.39

1,792.55

1,803.59

1,126.17

Zona Cresta /

Cresta Zone

2009

2008

2007

2006

Tahun Underwriting / Underwriting Year

Premi Bruto Berdasarkan Zona Cresta

Gross Premium By Cresta Zone

Per / As At 31 Dec 2009

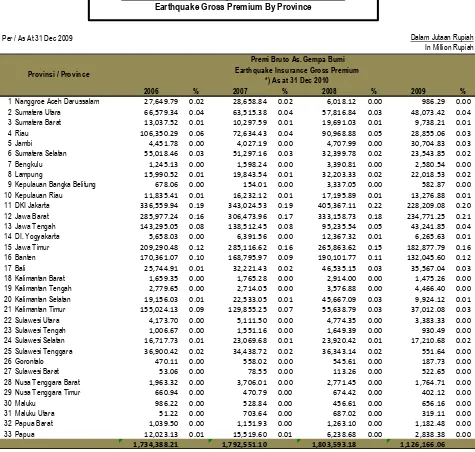

Tabel 1.4 dibawah ini menyajikan kontribusi

pendapatan premi asuransi gempa bumi yang

dibagi berdasarkan provinsi, catatan per tanggal

31 Desember 2009.

This following table 1.4 shows earthquake

insurance premium contribution by province, as

at 31 December 2009.

Premi Bruto Asuransi Gempa Bumi Berdasarkan Provinsi

Earthquake Gross Premium By Province

Tabel 1.4 / Table 1.4

D.

Jumlah Risiko

Seiring dengan pertumbuhan jumlah premi bruto

yang terus meningkat, jumlah risiko asuransi

gempa bumi juga terus meningkat. Tercatat

sampai dengan 31 Desember 2009, jumlah risiko

gempa bumi untuk tahun underwriting 2006

adalah 71.115 risiko, di tahun underwriting 2007,

jumlah tersebut naik sebesar 13% menjadi

80.607 risiko. Untuk tahun underwriting 2008

jumlah risiko naik cukup signifikan, dengan

kenaikan sebesar 24% dibanding dengan tahun

underwriting 2007. Sedangkan untuk tahun

underwriting 2009, jumlah risiko tercatat

sebanyak 56,004 risiko. Angka ini akan terus

bertambah, karena pensesian masih terus

berlangsung.

Table dibawah ini menyajikan jumlah risiko,

namun tidak termasuk risiko multilokasi yg tidak

lengkap datanya, dimana kami kesulitan

memisahkannya untuk menjadi satu risiko.

.

D.

Number of Risks

The gross premium of earthquake insurance

grows as well as the number of earthquake risk.

As at 31 December 2009, it is recorded that

earthquake risks for underwriting year 2006 is

71.115 risks. In underwriting year 2007 these are

80.607 risks or increased by 13%. For

underwriting year 2008, the number of risks

increased significantly by 24% compared to

underwriting year 2007. In the meantime, the

number of risk for underwriting year 2009 is

56.004 risks and will keep increasing since the

cession still continues.

The following table shows earthquake number of

risks, excluding undefined multi location risks as

we see it difficult to separate them into single

*) Tidak termasuk risiko multilokasi yang tidak terdefinisi secara lengkap / excluding undefined multilocation risks

E.

Pertumbuhan

Incurred Claim

Yang dimaksud dengan

Incurred claim

adalah

klaim dibayar ditambah dengan klaim yang masih

dalam proses penyelesaian.

Tahun 2009 ini adalah tahun yang teramat berat

bagi bangsa ini. Berbagai bencana gempa bumi

terjadi,

seperti

gempa

Padang,

gempa

Tasikmalaya, dan gempa Papua.

Di awal tahun 2009, sebuah gempa besar

menghantam Manokwari, Provinsi Papua Barat.

Empat orang dinyatakan meninggal dunia, lebih

dari 66 orang luka, dan lebih dari 500 rumah

pukul 05.33.40 yang berlokasi pada 95 km barat

Manokwari pada kedalaman 10 km.

Tasikmalaya, namun hingga ke Cianjur, Garut,

Sukabumi, Bandung, Bogor dan Ciamis.

Sejumlah desa bahkan habis tertimpa longsor

akibat gempa. Badan Penanggulangan Bencana

Nasional (BNPB) mencatat setidaknya 10.000

unit rumah rusak berat. Data ini belum termasuk

kerusakan ratusan fasilitas umum seperti

sekolah, tempat Ibadah, dan kantor.

E.

Growth of Incurred Claim

It is claim paid plus outstanding claims.

Pada tanggal 30 September 2009, gempa

berkekuatan 7,6 skala richter menghantam

wilayah Sumatera Barat dan sekitarnya. Gempa

menyebabkan kerusakan parah di beberapa

wilayah di Sumatera Barat seperti Kabupaten

Padang Pariaman, Kota Padang, Kabupaten

Pesisir Selatan, Kota Pariaman, Kota Bukittinggi,

Kota Padangpanjang, Kabupaten Agam, Kota

Solok, dan Kabupaten Pasaman Barat.

Provinsi Sumatera Barat secara geografis berada

di antara pertemuan dua lempeng benua besar

(lempeng Eurasia dan lempeng Indo-Australia)

dan patahan (sesar) Semangko. Di dekat

pertemuan kedua lempeng terdapat patahan

Mentawai. Ketiganya merupakan daerah seismik

aktif. Menurut catatan ahli, gempa wilayah

Sumatera Barat memiliki siklus 200 tahunan.

Gempa besar yang pada awal abad ke-21 telah

memasuki masa berulangnya siklus.

Bencana gempa ini sendiri merupakan akibat

dua gempa yang terjadi kurang dari 24 jam pada

lokasi yang relatif berdekatan. Pada hari Rabu 30

September terjadi gempa berkekuatan 7,6 pada

Skala Richter dengan pusat gempa (episentrum)

57 km di barat daya Kota Pariaman (00,84 LS

99,65 BT) pada kedalaman (hiposentrum) 71 km.

Pada hari Kamis 1 Oktober terjadi lagi gempa

kedua dengan kekuatan 6,8 Skala Richter, kali ini

berpusat di 46 km tenggara Kota Sungai penuh

pada pukul 08.52 WIB dengan kedalaman 24 km.

Gempa pertama terjadi pada daerah patahan

Mentawai (di bawah laut) sementara gempa

kedua terjadi pada patahan Semangko di

daratan.

Menurut

data

Satkorlak

Penanggulangan

Bencana, sedikitnya 1.117 orang tewas akibat

gempa ini yang tersebar di 3 kota dan 4

kabupaten di Sumatera Barat, korban luka berat

mencapai 1.214 orang, luka ringan 1.688 orang,

korban hilang 1 orang. Sedangkan 135.448

rumah rusak berat, 65.380 rumah rusak sedang,

& 78.604 rumah rusak ringan. Jumlah

On September 30, 2009, an earthquake

measuring 7.6 Richter scale hit West Sumatra

and the surrounding regions. The earthquake

caused severe damages in several areas in West

Sumatera like Padang Pariaman Regency, Kota

Padang, Pesisir Selatan District, Pariaman,

Bukittinggi, Padangpanjang, Agam District,

Solok, and West Pasaman district.

West Sumatra Province is geographically located

between the confluence of two major continental

plates (the Eurasian plate and the

Indo-Australian plate) and fracture (fault) Semangko.

Near, by there is plate Mentawai. All are active

seismic areas. According to the experts study,

the earthquake region of West Sumatra has a

cycle of 200 years. Large earthquake in the early

21st century has entered a period of recurrence

of the cycle.

The earthquake itself was the result of two

earthquakes that occurred less than 24 hours at

a location relatively close together. On

Wednesday, September 30, an earthquake

measuring 7.6 on the Richter Scale with

epicenter of the earthquake (epicenter) 57 km to

the southwest city of Pariaman (00,84 LS 99.65

BT) at a depth (hiposentrum) 71 km. On

Thursday, October 1 occurred again with a force

of 6.8 earthquakes on the Richter scale, centered

at 46 km southeast of Sungai Penuh at 8:52 pm

with a depth of 24 km. The first earthquake

occurred in the Mentawai fault area (under the

sea) while the second quake occurred on the

fault Semangko on the mainland.

kerugian ekonomi gempa ini, seperti yang

dilaporkan oleh wakil gubernur Sumatera Barat

berdasarkan verifikasi final adalah sebesar Rp.

21.580 milliar.

Kerugian asuransi atas gempa pariaman ini

dipastikan akan sangat besar. Menurut catatan

per 31 Desember 2009, jumlah

incurred claim

akibat gempa ini telah mencapai Rp. 835,33

milliar. Kerugian asuransi ini jauh lebih besar dari

kerugian gempa bumi Yogyakarta 2006 lalu,

yang per 31 Desember 2009 ini, tercatat hanya

Rp. 336,43 milliar. Diperkirakan angka ini akan

terus bertambah, karena masih banyak klaim

yang masih dalam penilaian.

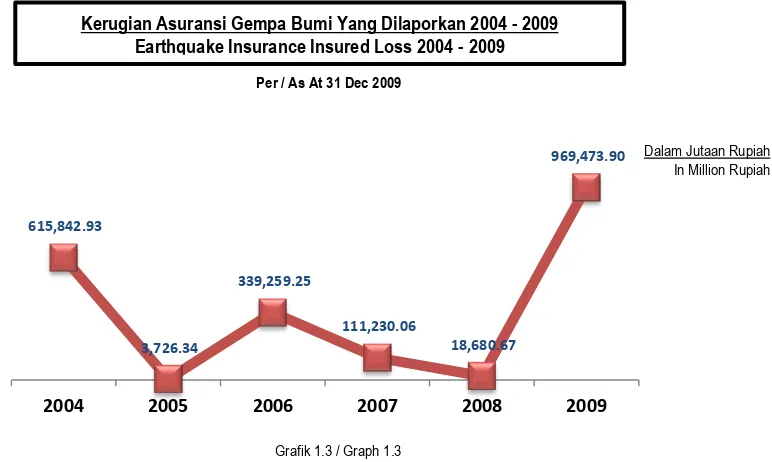

Berdasarkan data per tanggal 31 Desember

2009, Besar kerugian asuransi akibat bencana

alam di tahun ini sebesar Rp. 969.473,90 milliar.

Ini adalah kerugian asuransi terbesar sepanjang

Maipark berdiri di tahun 2004.

Grafik dibawah ini menunjukkan jumlah kerugian

asuransi gempa bumi yang dilaporkan sepanjang

tahun 2004 hingga 2009 ini.

damaged.

Economic

loss

of

Pariaman

earthquake, as reported on final verification

report by deputy governor of West Sumatera

greater than the loss of Yogyakarta earthquake in

2006, as at 31 December 2009, accounted for

only Rp. 336.43 billion. It is estimated that this

figure will continue to grow, because there are

still many claims revisions.

Based on data as of December 31, 2009, the big

insured loss from natural disasters this year

amounted to Rp. 969,473.90 billion. It is the

biggest insured loss since the establishment of

Maipark in 2004.

The graphic below tells us about earthquake

insured loss reported for 2004 - 2009.

Grafik 1.3 / Graph 1.3

Kerugian Asuransi Gempa Bumi Yang Dilaporkan 2004 - 2009

Earthquake Insurance Insured Loss 2004 - 2009

Tabel dibawah ini menampilkan

incurred claim

sepanjang tahun 2009

Below table shows incurred claim during this

2009.

Tanggal Peristiwa

Kerugian ( Dalam Rupiah )

Nama / Name

Jenis / Type

Date of Occurance

Loss ( In Rupiah )

Manokwari

Earthquake

4-Jan-09

2,952,454,937

Palu

Earthquake

2-Mar-09

2,800,000

Padang

Earthquake

16-Apr-09

226,140,075

Padang

Earthquake

16-Aug-09

51,125,960,170

T asikmalaya

Earthquake

2-Sep-09

47,928,196,253

Nusa Dua

Earthquake

19-Sep-09

921,078,296

Pariaman

Earthquake

30-Sep-09

835,328,242,563

Kepahyang

Earthquake

1-Oct-09

259,440,505

Ujung Kulon

Earthquake

16-Oct-09

119,586,208

Bima

Earthquake

9-Nov-09

30,610,000,000

Kejadian / Event

Incurred Claim 2009

Tabel 1.9 / Table 1.9

Table dibawah ini menyajikan pertumbuhan klaim

dari semua event 2004

–

2009.

This following table shows claim development for

all claim events during period of 2004

–

2010.

Tanggal Peristiwa Ac eh Earthquake 26-Dec -04 612,226,619,221 612,531,185,533 Cilegon Earthquake 15-Jan-05 780,267,740 816,431,678

T anjung Karang Earthquake 12-May-06 33,575,300 33,575,300

Sibolga Earthquake 19-May-06 7,612,000

Yogyakarta Earthquake 27-May-06 255,920,900,053 336,432,968,532 Pangandaran Earthquake 17-Jul-06 2,418,989,460 2,428,124,860 Jakarta Earthquake 19-Jul-06 257,918,125 242,903,125

Wonosari Earthquake 22-Sep-06 97,589,358 97,589,358

Pandeglang Earthquake 24-Dec -06 16,477,760 16,477,760

Manado Earthquake 21-Jan-07 428,830,661 503,894,784

Denpasar Earthquake 8-Oc t-07 32,543,000 82,035,138

Painan Earthquake 24-Oc t-07 12,906,700 12,906,700

Dompu Earthquake 25-Nov-07 15,000,000 4,090,000

Ac eh Earthquake 21-Dec -08 53,980,575

Manokwari Earthquake 4-Jan-09 2,952,454,937

Ujung Kulon Earthquake 16-Oc t-09 119,586,208

Bima Earthquake 9-Nov-09 30,610,000,000

Pertumbuhan

Incured Claim

Semua Kejadian 2004 - 2010

Earthquake Insurance Incurred Claim All Event 2004 - 2010

T a b l e 2.1

In IDR

Amount in % Amount in % Amount in % Amount in % Amount in % Banda Aceh 1.1 19,558,587,948,251.30 22,564,931,471,192.40 21,797,820,935,187.80 1,243,747,474,310.66 541,801,271,791.60 Medan 1.2 28,137,089,340,559.10 37,614,766,828,547.20 40,266,507,995,498.80 36,995,562,334,792.40 23,497,696,785,028.40 Others 1.3 9,665,997,686,081.70 20,642,457,483,500.10 16,783,167,146,596.80 13,927,347,583,764.80 17,249,945,888,727.10 North Sumatera 1 57,361,674,974,892.10 4% 80,822,155,783,239.70 5% 78,847,496,077,283.30 5% 52,166,657,392,867.90 4% 41,289,443,945,547.10 4% P adang 2.1 5,246,554,344,258.29 5,115,117,625,752.85 4,477,993,314,008.37 11,088,612,547,802.00 3,457,683,179,085.15 P alembang 2.2 26,044,328,687,045.10 31,747,488,493,919.80 29,393,829,655,798.90 9,586,687,440,609.30 5,468,360,367,296.80 Others 2.3 85,078,633,101,277.70 165,420,150,966,639.00 127,834,745,802,912.00 143,080,928,230,813.00 110,441,449,860,189.00 South Sumatera 2 116,369,516,132,581.00 7% 202,282,757,086,311.00 13% 161,706,568,772,719.00 11% 163,756,228,219,224.00 12% 119,367,493,406,571.00 13% DKI Jak arta 3.1 512,361,820,196,686.00 270,398,212,403,235.00 266,177,961,883,188.00 294,637,264,369,306.00 174,221,426,377,178.00 Bandung 3.2 26,489,234,747,708.70 38,355,364,127,409.50 33,073,241,404,495.30 37,339,001,488,740.70 4,226,055,690,620.00 Others 3.3 411,216,138,270,203.00 372,674,463,760,529.00 371,863,520,056,450.00 376,560,648,704,834.00 306,909,259,397,916.00 DKI & West Java 3 950,067,193,214,598.00 61% 681,428,040,291,173.00 45% 671,114,723,344,134.00 45% 708,536,914,562,881.00 50% 485,356,741,465,714.00 51% Semarang 4.1 17,931,045,050,876.00 27,427,342,751,182.10 26,449,310,136,141.20 22,329,092,094,361.80 1,090,302,251,452.25 Yogyak arta 4.2 3,796,006,609,950.96 4,141,815,844,451.76 5,890,628,514,880.09 9,541,735,392,861.68 4,757,990,052,720.60 Others 4.3 55,524,224,651,423.30 96,469,108,290,950.60 88,693,096,139,362.90 54,149,574,122,106.70 36,344,039,501,683.10 DIY & Central Java 4 77,251,276,312,250.30 5% 128,038,266,886,584.00 8% 121,033,034,790,384.00 8% 86,020,401,609,330.20 6% 42,192,331,805,856.00 4% Surabaya 5.1 42,691,740,623,228.50 39,281,785,113,920.20 39,806,257,961,459.00 55,173,144,407,002.00 33,140,876,789,122.10 Others 5.2 112,581,066,670,440.00 143,980,015,300,594.00 189,942,623,294,877.00 164,414,222,136,876.00 124,239,673,677,181.00 E ast Java 5 155,272,807,293,668.00 10% 183,261,800,414,514.00 12% 229,748,881,256,336.00 15% 219,587,366,543,878.00 16% 157,380,550,466,303.00 17% Kalimantan 6 126,317,167,129,982.00 8% 153,509,017,473,083.00 10% 133,020,937,447,058.00 9% 85,660,523,369,080.00 6% 46,908,775,362,275.70 5% U jung P andang 7.1 6,185,748,726,847.72 9,734,930,202,012.80 13,580,572,116,708.90 11,858,126,298,351.80 9,348,935,598,947.54 Others 7.2 43,578,771,491,006.90 44,005,956,587,199.10 40,276,571,198,793.20 42,194,179,568,638.70 10,520,214,616,535.10 Sulawesi 7 49,764,520,217,854.70 3% 53,740,886,789,211.90 4% 53,857,143,315,502.10 4% 54,052,305,866,990.50 4% 19,869,150,215,482.70 2% Other Island 8 24,906,824,288,087.00 2% 35,475,436,048,023.50 2% 42,708,408,542,586.30 3% 44,134,631,987,544.50 3% 34,118,623,292,109.20 4%

1,557,310,979,563,910.00

100% 1,518,558,360,772,140.00 100% 1,492,037,193,546,000.00 100% 1,413,915,029,551,800.00 100% 946,483,109,959,859.00 100%

NATIONAL AGGREGATE EXPOSURES BY CRESTA As At 31 December 2009

U /Y 2008

T O T A L

U /Y 2007

U /Y 2005 U /Y 2006 U /Y 2009

Ta b l e 2.2

In IDR

Description U /Y 2005 In % U /Y 2006 In % U /Y 2007 In % U /Y 2008 In % U /Y 2009 In % Agricultural 61,942,135,248,115.50 4% 9,840,296,069,672.66 1% 10,216,620,816,116.90 1% 16,025,171,749,587.00 1% 8,338,738,969,501.26 1% Commercial 260,980,311,341,982.00 17% 348,748,832,792,887.00 23% 304,117,991,663,755.00 20% 348,668,162,180,442.00 25% 197,303,283,938,017.00 21% Industrial 928,999,162,765,924.00 60% 1,100,101,277,227,930.00 72% 1,067,695,381,512,080.00 72% 903,846,597,402,321.00 64% 661,202,559,621,438.00 70% Residential 305,389,370,207,893.00 20% 59,867,954,681,651.70 4% 110,007,199,554,049.00 7% 145,375,098,219,447.00 10% 79,638,527,430,902.50 8% TOTAL 1,557,310,979,563,910.00 100% 1,518,558,360,772,140.00 100% 1,492,037,193,546,000.00 100% 1,413,915,029,551,800.00 100% 946,483,109,959,859.00 100%

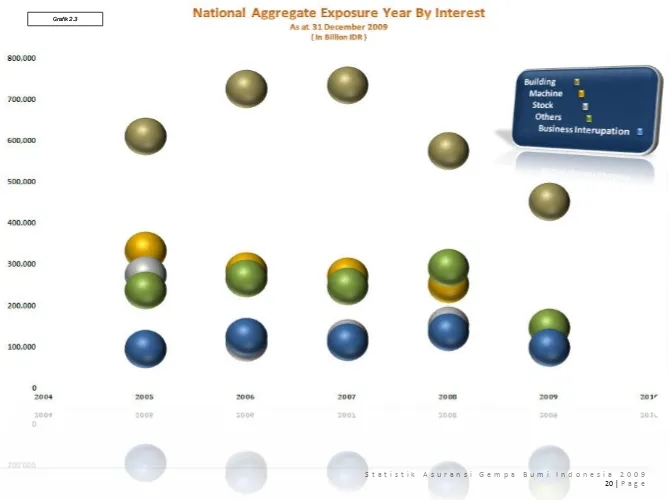

Ta b l e 2.3

In IDR

Description

U /Y 2005

U /Y 2006

U /Y 2007

U /Y 2008

U /Y 2009

Building

611,861,631,011,181.00

727,455,323,232,449.00

736,242,851,910,110.00

577,468,015,660,992.00

453,573,040,517,034.00

Machinery

334,317,430,934,478.00

285,910,590,803,287.00

272,395,523,967,001.00

253,272,388,118,646.00

146,611,985,761,144.00

Stock

276,065,895,579,831.00

111,804,961,583,085.00

122,830,495,226,567.00

153,589,718,386,021.00

98,199,282,713,536.00

Others

239,120,244,536,531.00

267,095,822,076,663.00

248,205,135,610,190.00

293,050,408,893,822.00

147,760,392,679,351.00

SU B TOTAL

1,461,365,202,062,020.00

1,392,266,697,695,480.00

1,379,674,006,713,870.00

1,277,380,531,059,480.00

846,144,701,671,066.00

Business Interruption

95,945,777,501,893.80

126,291,663,076,656.00

112,363,186,832,136.00

136,534,498,492,316.00

100,338,408,288,793.00

T O T A L

1,557,310,979,563,910.00

1,518,558,360,772,140.00

1,492,037,193,546,000.00

1,413,915,029,551,800.00

946,483,109,959,859.00

In IDR

Amount in % Amount in % Amount in % Amount in %

1 Nanggroe Aceh Darussalam 23,222,469,030,663 1.53% 24,972,224,260,762 1.67% 4,574,682,657,827 0.32% 782,365,429,802 0.08% 2 Sumatera Utara 57,599,686,752,577 3.79% 53,875,271,816,521 3.61% 47,591,974,735,041 3.37% 40,507,078,515,746 4.28% 3 Sumatera Barat 11,803,237,469,684 0.78% 8,992,716,716,874 0.60% 16,303,250,037,684 1.15% 7,767,706,269,350 0.82% 4 Riau 106,250,386,674,915 7.00% 68,958,266,404,896 4.62% 68,137,306,748,043 4.82% 27,762,414,804,006 2.93% 5 Jambi 4,357,669,826,183 0.29% 3,622,773,662,240 0.24% 4,185,096,088,953 0.30% 28,589,990,611,256 3.02% 6 Sumatera Selatan 50,170,938,429,080 3.30% 46,176,884,371,846 3.09% 27,211,971,305,340 1.92% 20,172,454,290,478 2.13% 7 Bengkulu 1,090,793,435,087 0.07% 1,227,599,398,637 0.08% 2,673,025,232,884 0.19% 1,737,517,134,516 0.18% 8 Lampung 15,158,238,620,892 1.00% 17,128,769,552,469 1.15% 27,343,348,285,755 1.93% 19,364,713,305,527 2.05% 9 Kepulauan Bangka Belitung 926,110,341,839 0.06% 149,313,067,118 0.01% 2,477,887,610,958 0.18% 547,824,551,103 0.06% 10 Kepulauan Riau 12,525,382,288,631 0.82% 15,450,245,598,639 1.04% 15,424,342,909,608 1.09% 13,424,872,440,335 1.42% 11 DKI Jakarta 270,398,212,403,235 17.81% 266,177,961,883,188 17.84% 294,637,264,369,306 20.84% 174,221,426,377,178 18.41% 12 Jawa Barat 256,788,556,957,487 16.91% 261,142,622,874,084 17.50% 261,612,191,175,470 18.50% 200,147,184,887,907 21.15% 13 Jawa Tengah 123,535,065,522,968 8.14% 114,707,453,791,809 7.69% 75,548,464,334,883 5.34% 37,122,245,896,025 3.92% 14 DI. Yogyakarta 4,503,201,363,617 0.30% 6,325,580,998,575 0.42% 10,471,937,274,448 0.74% 5,070,085,909,831 0.54% 15 Jawa Timur 183,261,800,414,514 12.07% 229,748,881,256,336 15.40% 219,587,366,543,878 15.53% 157,380,550,466,303 16.63% 16 Banten 154,241,270,930,452 10.16% 143,794,138,586,862 9.64% 152,287,459,018,104 10.77% 110,988,130,200,629 11.73% 17 Bali 22,095,799,557,558 1.46% 25,469,732,730,428 1.71% 34,386,793,860,389 2.43% 28,258,367,074,155 2.99% 18 Kalimantan Barat 1,755,343,725,658 0.12% 1,823,275,121,773 0.12% 2,568,186,902,395 0.18% 1,380,476,888,062 0.15% 19 Kalimantan Tengah 2,840,199,371,595 0.19% 2,747,177,576,000 0.18% 3,351,976,232,714 0.24% 4,073,009,044,169 0.43% 20 Kalimantan Selatan 16,425,535,541,263 1.08% 19,051,779,243,047 1.28% 34,182,207,541,635 2.42% 8,553,864,295,883 0.90% 21 Kalimantan Timur 132,487,938,834,567 8.72% 109,398,705,506,239 7.33% 45,558,152,692,335 3.22% 32,901,425,134,161 3.48% 22 Sulawesi Utara 4,044,025,703,653 0.27% 4,336,122,366,985 0.29% 3,769,435,935,249 0.27% 2,817,088,276,743 0.30% 23 Sulawesi Tengah 932,489,065,038 0.06% 1,389,415,978,487 0.09% 1,331,354,197,536 0.09% 783,701,010,841 0.08% 24 Sulawesi Selatan 14,258,541,449,464 0.94% 18,864,248,655,904 1.26% 18,025,425,788,216 1.27% 14,762,918,538,062 1.56% 25 Sulawesi Tenggara 34,044,852,282,949 2.24% 28,717,770,322,555 1.92% 30,341,023,803,838 2.15% 871,831,789,452 0.09% 26 Gorontalo 415,250,424,999 0.03% 474,303,802,854 0.03% 459,556,664,246 0.03% 176,177,289,895 0.02% 27 Sulawesi Barat 45,727,863,109 0.00% 75,282,188,717 0.01% 125,509,477,905 0.01% 457,433,310,490 0.05% 28 Nusa Tenggara Barat 1,688,945,797,799 0.11% 3,019,349,262,762 0.20% 2,016,032,579,217 0.14% 1,524,933,791,000 0.16% 29 Nusa Tenggara Timur 579,335,645,653 0.04% 417,028,971,049 0.03% 575,507,995,224 0.04% 348,267,026,135 0.04% 30 Maluku 847,060,371,383 0.06% 423,345,235,688 0.03% 361,246,408,670 0.03% 514,701,876,544 0.05% 31 Maluku Utara 46,800,369,415 0.00% 598,536,891,829 0.04% 513,301,830,627 0.04% 243,123,108,233 0.03% 32 Papua Barat 923,962,125,328 0.06% 956,628,512,641 0.06% 1,050,735,881,379 0.07% 979,122,470,498 0.10% 33 Papua 9,293,532,180,887 0.61% 11,823,786,938,190 0.79% 5,231,013,432,039 0.37% 2,250,107,945,545 0.24%

1,518,558,360,772,140

1,492,037,193,546,000 1,413,915,029,551,800 946,483,109,959,859

NATIONAL AGGREGATE EXPOSURES PER PROVINCE

As At 31 December 2009

U/Y 2009

T O T A L

U/Y 2008 U/Y 2006 U/Y 2007

Tabl e 2 . 4

T a b l e 3.1

In IDR

A mou nt in % A mou nt in % A mou nt in % A mou nt in % A mou nt in % Band a A ceh 1.1 1,442,695,025.82 26,900,882,950.15 25,875,083,013.44 1,534,840,500.84 692,056,546.09 Med an 1.2 47,324,344,212.47 43,735,534,092.80 48,450,713,093.63 45,391,628,497.52 27,661,861,213.03 Others 1.3 10,685,128,215.06 23,592,711,393.87 17,848,428,643.70 16,908,491,388.07 20,705,794,186.22 North Su matera 1 59,452,167,453.35 3% 94,229,128,436.82 5% 92,174,224,750.78 5% 63,834,960,386.43 4% 49,059,711,945.34 4% P ad ang 2.1 5,915,742,165.67 5,820,893,038.13 4,957,806,707.07 13,484,664,445.59 4,292,800,450.18 P alemb ang 2.2 24,200,965,654.40 34,150,601,060.36 31,862,238,825.03 11,387,279,189.22 6,157,316,833.35 Others 2.3 66,501,280,533.21 168,635,685,608.90 139,264,245,209.03 179,022,813,019.94 120,850,653,403.10 Sou th Su matera 2 96,617,988,353.29 5% 208,607,179,707.39 12% 176,084,290,741.13 10% 203,894,756,654.75 11% 131,300,770,686.63 12% DKI Jak arta 3.1 742,448,593,077.71 336,559,935,840.51 343,024,525,676.84 405,367,106,444.63 228,209,077,857.04 Band u ng 3.2 47,570,832,732.21 44,477,233,600.54 40,049,648,774.34 49,301,390,699.51 5,297,822,559.44 Others 3.3 502,335,524,089.81 411,861,074,162.27 435,220,281,600.06 473,959,105,477.43 361,519,027,020.01 DKI & West Java 3 1,292,354,949,899.73 68% 792,898,243,603.32 46% 818,294,456,051.24 46% 928,627,602,621.57 51% 595,025,927,436.49 53% Semarang 4.1 37,844,947,865.56 32,224,969,152.00 32,534,702,391.59 28,531,679,785.67 1,256,578,250.39 Yogyak arta 4.2 4,724,013,608.48 5,259,170,776.14 5,877,053,252.65 11,016,722,289.41 5,888,909,387.08 Others 4.3 23,571,849,348.65 111,468,942,721.90 106,492,249,853.08 68,054,460,951.00 42,361,993,058.42 DIY & Central Java 4 66,140,810,822.69 3% 148,953,082,650.03 9% 144,904,005,497.32 8% 107,602,863,026.09 6% 49,507,480,695.89 4% Su rab aya 5.1 57,987,665,454.16 46,218,862,733.85 49,778,971,284.14 65,879,117,582.56 39,158,088,838.49 Others 5.2 144,683,362,869.68 163,071,615,132.76 235,337,649,107.11 199,984,498,465.95 143,719,705,693.19 E ast Java 5 202,671,028,323.84 11% 209,290,477,866.61 12% 285,116,620,391.25 16% 265,863,616,048.51 15% 182,877,794,531.68 16% Kalimantan 6 85,751,921,895.05 4% 178,619,161,748.68 10% 156,867,631,637.02 9% 107,796,769,319.78 6% 52,877,854,016.97 5% U ju ng P and ang 7.1 24,012,146,214.11 11,612,489,587.73 16,805,966,746.55 16,502,092,118.06 10,823,293,561.63 Others 7.2 43,431,243,217.23 47,709,200,997.85 48,001,669,232.14 50,844,079,005.54 11,963,228,599.47 Su lawesi 7 67,443,389,431.35 4% 59,321,690,585.58 3% 64,807,635,978.69 4% 67,346,171,123.60 4% 22,786,522,161.10 2% Other Island 8 36,776,236,376.64 2% 42,469,250,284.99 2% 54,302,239,532.26 3% 58,626,440,326.56 3% 42,729,995,281.38 4%

1,907,208,492,555.94

1,734,388,214,883.42 1,792,551,104,579.69 1,803,593,179,507.28 1,126,166,056,755.48 T O T A L

CRE STA Z ONE U /Y 2009

NATIONAL GROSS PREMIUM INCOME BY CRESTA ZONE As At 31 December 2009

U /Y 2007

Ta b l e 3.2

In IDR

Description

U/Y 2005

In %

U/Y 2006

In %

U/Y 2007

In %

U/Y 2008

In %

U/Y 2009

In %

Agricultural

90,000,687,106.34

4.72%

10,320,755,425.88

0.60%

9,959,498,689.24

0.56%

17,316,518,971.41

0.96%

9,390,083,378.64

0.83%

Commercial

498,746,757,143.75

26.15%

427,602,684,321.90

24.65%

382,423,458,733.07

21.33%

441,838,266,503.01

24.50%

244,473,909,717.96

21.71%

Industrial

889,616,514,714.16

46.64%

1,219,152,631,538.73

70.29%

1,256,954,204,205.92

70.12%

1,145,631,250,704.99

63.52%

767,458,544,941.91

68.15%

Residential

428,844,533,591.68

22.49%

77,312,143,596.91

4.46%

143,213,942,951.48

7.99%

198,807,143,327.89

11.02%

104,843,518,716.98

9.31%

TOTAL

1,907,208,492,555.93

1,734,388,214,883.42

1,792,551,104,579.71

1,803,593,179,507.30

1,126,166,056,755.49

In IDR

Amount in % Amount in % Amount in % Amount in %

1 Nanggroe Aceh Darussalam 27,649,788,917.10 1.59% 28,658,844,407.01 1.60% 6,018,115,544.05 0.33% 986,291,496.78 0.09% 2 Sumatera Utara 66,579,339,519.72 3.84% 63,515,380,343.76 3.54% 57,816,844,842.38 3.21% 48,073,420,448.56 4.27% 3 Sumatera Barat 13,037,516,281.91 0.75% 10,297,594,862.47 0.57% 19,691,025,587.05 1.09% 9,738,213,337.28 0.86% 4 Riau 106,350,289,691.26 6.13% 72,634,430,707.09 4.05% 90,968,881,176.96 5.04% 28,855,060,408.98 2.56% 5 Jambi 4,451,784,631.41 0.26% 4,027,193,017.80 0.22% 4,707,988,291.14 0.26% 30,704,826,531.80 2.73% 6 Sumatera Selatan 55,018,463,978.14 3.17% 51,297,160,581.41 2.86% 32,399,775,939.07 1.80% 23,543,848,627.75 2.09% 7 Bengkulu 1,245,133,959.10 0.07% 1,598,242,093.78 0.09% 3,390,814,727.25 0.19% 2,580,540,004.96 0.23% 8 Lampung 15,990,519,515.20 0.92% 19,843,539,280.63 1.11% 32,203,330,649.15 1.79% 22,018,528,130.91 1.96% 9 Kepulauan Bangka Belitung 678,063,867.99 0.04% 154,009,605.20 0.01% 3,337,046,985.34 0.19% 582,870,145.60 0.05% 10 Kepulauan Riau 11,835,407,782.38 0.68% 16,232,120,592.75 0.91% 17,195,893,298.79 0.95% 13,276,883,499.34 1.18% 11 DKI Jakarta 336,559,935,840.51 19.41% 343,024,525,676.84 19.14% 405,367,106,444.63 22.48% 228,209,077,857.04 20.26% 12 Jawa Barat 285,977,239,376.61 16.49% 306,473,957,404.90 17.10% 333,158,726,023.25 18.47% 234,771,247,129.56 20.85% 13 Jawa Tengah 143,295,051,805.81 8.26% 138,512,447,712.79 7.73% 95,235,540,560.77 5.28% 43,241,851,104.13 3.84% 14 DI. Yogyakarta 5,658,030,844.22 0.33% 6,391,557,784.53 0.36% 12,367,322,465.31 0.69% 6,265,629,591.76 0.56% 15 Jawa Timur 209,290,477,866.61 12.07% 285,116,620,391.25 15.91% 265,863,616,048.51 14.74% 182,877,794,531.68 16.24% 16 Banten 170,361,068,386.21 9.82% 168,795,972,969.49 9.42% 190,101,770,153.69 10.54% 132,045,602,449.89 11.73% 17 Bali 25,744,911,402.82 1.48% 32,221,430,862.19 1.80% 46,535,151,728.39 2.58% 35,567,040,756.07 3.16% 18 Kalimantan Barat 1,659,352,606.17 0.10% 1,765,278,536.95 0.10% 2,914,003,594.84 0.16% 1,475,261,112.44 0.13% 19 Kalimantan Tengah 2,779,654,555.53 0.16% 2,714,045,205.49 0.15% 3,576,879,669.84 0.20% 4,466,399,145.67 0.40% 20 Kalimantan Selatan 19,156,026,288.61 1.10% 22,533,052,927.72 1.26% 45,667,092,609.28 2.53% 9,924,117,363.68 0.88% 21 Kalimantan Timur 155,024,128,298.37 8.94% 129,855,254,966.87 7.24% 55,638,793,445.82 3.08% 37,012,076,395.18 3.29% 22 Sulawesi Utara 4,173,700,913.48 0.24% 5,111,502,494.62 0.29% 4,774,347,563.95 0.26% 3,383,327,151.29 0.30% 23 Sulawesi Tengah 1,006,671,453.84 0.06% 1,551,161,208.75 0.09% 1,649,386,637.62 0.09% 930,494,082.23 0.08% 24 Sulawesi Selatan 16,717,729,565.16 0.96% 23,069,679,622.97 1.29% 23,920,422,822.59 1.33% 17,210,682,393.94 1.53% 25 Sulawesi Tenggara 36,900,421,496.63 2.13% 34,438,719,842.94 1.92% 36,343,138,610.78 2.02% 551,639,022.88 0.05% 26 Gorontalo 470,108,981.96 0.03% 558,018,128.04 0.03% 545,614,739.22 0.03% 187,731,787.19 0.02% 27 Sulawesi Barat 53,058,174.52 0.00% 78,554,681.37 0.00% 113,260,749.44 0.01% 522,647,723.57 0.05% 28 Nusa Tenggara Barat 1,963,324,282.82 0.11% 3,706,010,978.81 0.21% 2,771,452,454.59 0.15% 1,764,711,010.32 0.16% 29 Nusa Tenggara Timur 660,936,009.28 0.04% 470,786,558.82 0.03% 674,419,775.98 0.04% 402,116,764.70 0.04% 30 Maluku 986,219,504.74 0.06% 528,835,496.63 0.03% 456,610,792.43 0.03% 656,160,724.83 0.06% 31 Maluku Utara 51,224,416.91 0.00% 703,643,802.96 0.04% 687,023,343.99 0.04% 319,112,721.78 0.03% 32 Papua Barat 1,039,504,431.46 0.06% 1,151,930,854.70 0.06% 1,263,102,712.88 0.07% 1,182,478,013.18 0.11% 33 Papua 12,023,130,236.97 0.69% 15,519,600,978.13 0.87% 6,238,679,518.29 0.35% 2,838,375,290.50 0.25%

1,734,388,214,883

1,792,551,104,580 1,803,593,179,507 1,126,166,056,755 T O T A L

Tabl e 3 . 4

Province

NATIONAL GROSS PREMIUM INCOME BY PROVINCE

As At 31 December 2009

T a b l e 4.1

U / Y 2005 U / Y 2006 U / Y 2007 U / Y 2008 U / Y 2009

B a n d a A ceh 1.1 218 300 434 479 265

Med a n 1.2 4,761 2,857 2,911 3,897 2,156

Oth ers 1.3 1,544 1,063 1,224 2,060 950

North Su ma tera 1 6,523 4,220 4,569 6,436 3,371

P a d a n g 2.1 2,933 2,018 2,707 3,514 2,265

P a lemb a n g 2.2 1,203 814 1,091 1,226 504

Oth ers 2.3 6,011 4,989 5,585 8,652 3,678

Sou th Su ma tera 2 10,147 7,821 9,383 13,392 6,447

DKI Ja k a rta 3.1 22,184 22,309 24,054 24,693 15,145

B a n d u n g 3.2 3,313 3,008 3,579 4,372 724

Oth ers 3.3 15,017 13,098 14,198 17,722 12,658

DKI & West Ja va 3 40,514 38,415 41,831 46,787 28,527

Sema ra n g 4.1 1,757 1,563 1,890 2,291 307

Y ogya k a rta 4.2 936 1,376 1,669 1,738 1,098

Oth ers 4.3 3,121 2,971 3,654 5,576 3,795

DIY & Cen tra l Ja va 4 5,814 5,910 7,213 9,605 5,200

Su ra b a ya 5.1 3,584 2,875 3,258 3,877 2,068

Oth ers 5.2 4,567 3,143 3,618 5,140 2,842

E a st Ja va 5 8,151 6,018 6,876 9,017 4,910

Ka lima n ta n 6 2,798 1,831 2,040 3,385 1,290

U ju n g P a n d a n g 7.1 1,070 759 867 1,076 546

Oth ers 7.2 2,386 1,445 2,156 3,178 999

Su la wesi 7 3,456 2,204 3,023 4,254 1,545

Oth er Isla n d 8 4,887 4,696 5,672 6,795 4,714

82,290 71,115 80,607 99,671 56,004

*) Figure above excluding undefined multi location risks

T O T A L

NUMBER OF RISKS BY CRESTA ZONE

As At 31 December 2009

Ta ble 4.2

In IDR

Description

U/Y 2005

In %

U/Y 2006

In %

U/Y 2007

In %

U/Y 2008

In %

U/Y 2009

In %

Agricultural

607

1%

464

1%

413

1%

619

1%

281

1%

Commercial

46,379

56%

38,084

54%

38,175

47%

56,980

57%

29,934

53%

Industrial

17,911

22%

8,969

13%

11,395

14%

9,314

9%

6,108

11%

Residential

17,393

21%

23,598

33%

30,624

38%

32,758

33%

19,681

35%

TOTAL

82,290

71,115

80,607

99,671

56,004

*) Figure above excluding undefined multi location risks

T a b l e 5.1.1

Descrip tion

U /Y 2005

U /Y 2006

U /Y 2007

U /Y 2008

U /Y 2009

Agricultural

1

0

2

0

3

Commercial

229

308

224

422

948

Ind ustrial

12

22

11

13

16

Resid ential

18

62

133

165

501

TOTAL

260

392

370

600

1468

Ta b l e 5.1.2

U/Y 2005 U/Y 2006 U /Y 2007 U/Y 2008 U/Y 2009

Banda Aceh 1.1 0 0 0 1 0

Medan 1.2 0 0 0 1 1

Others 1.3 2 1 0 0 0

North Sumatera 1 2 1 0 2 1

Padang 2.1 24 154 232 224 665

Palembang 2.2 0 0 0 0 0

Others 2.3 1 85 106 10 2

South Sumatera 2 25 239 338 234 667

DKI Jak arta 3.1 1 18 12 50 49

Bandung 3.2 0 2 7 236 643

Others 3.3 6 7 6 61 91

DKI & West Java 3 7 27 25 347 783

Semarang 4.1 0 0 0 0 0

Yogyak arta 4.2 123 88 0 0 3

Others 4.3 103 32 0 1 2

DIY & Central Java 4 226 120 0 1 5

Surabaya 5.1 0 0 0 0 0

Others 5.2 0 0 0 0 0

East Java 5 0 0 0 0 0

Kalimantan 6 0 0 0 0 0

Ujung Pandang 7.1 0 0 0 0 0

Others 7.2 0 3 2 1 0

Sulawesi 7 0 3 2 1 0

Other Island 8 0 2 5 15 12

260 392 370 600 1,468

CLAIM FREQUENCY BY CRESTA ZONE

T O T A L CRESTA Z ONE

Ta ble 5.2.1

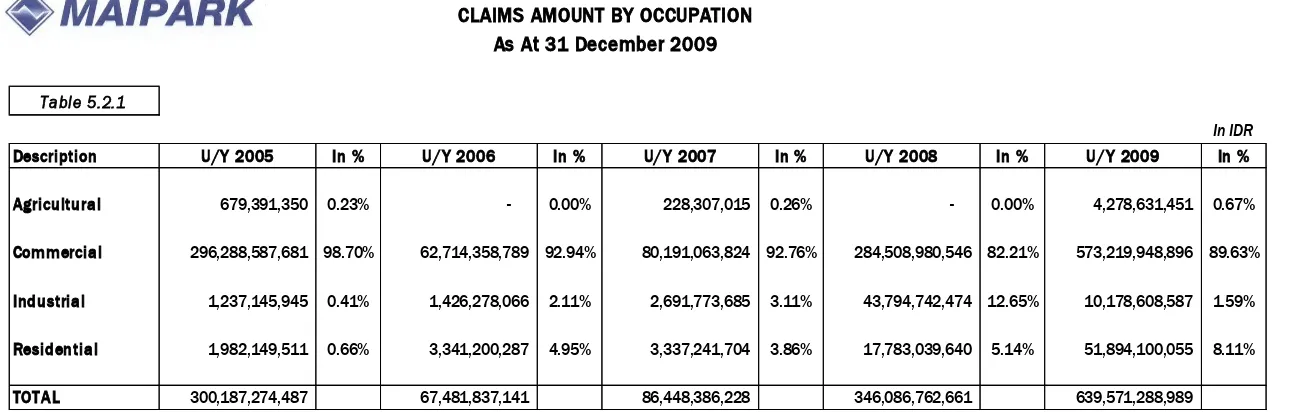

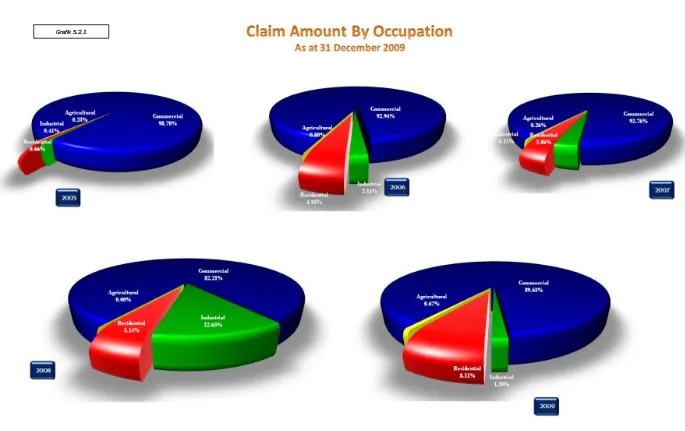

In IDR

Description

U/Y 2005

In %

U/Y 2006

In %

U/Y 2007

In %

U/Y 2008

In %

U/Y 2009

In %

Agricultural

679,391,350

0.23%

-

0.00%

228,307,015

0.26%

-

0.00%

4,278,631,451

0.67%

Commercial

296,288,587,681

98.70%

62,714,358,789

92.94%

80,191,063,824

92.76%

284,508,980,546

82.21%

573,219,948,896

89.63%

Industrial

1,237,145,945

0.41%

1,426,278,066

2.11%

2,691,773,685

3.11%

43,794,742,474

12.65%

10,178,608,587

1.59%

Residential

1,982,149,511

0.66%

3,341,200,287

4.95%

3,337,241,704

3.86%

17,783,039,640

5.14%

51,894,100,055

8.11%

TOTAL

300,187,274,487

67,481,837,141

86,448,386,228

346,086,762,661

639,571,288,989

T a b l e 5.2.2

In IDR

Amount in % Amount in % Amount in % Amount in % Amount in %

Banda Aceh 1.1 0.00 0.00 0.00 53,980,575.00 0.00

Medan 1.2 0.00 0.00 0.00 35,147,600.00 849,225,000.00

Others 1.3 693,471,350.00 38,868,000.00 0.00 0.00 0.00

North Sumatera 1 693,471,350.00 0.2% 38,868,000.00 0.1% 0.00 0.0% 89,128,175.00 0.0% 849,225,000.00 0.1%

Padang 2.1 520,815,384.91 12,392,323,221.48 71,975,480,730.66 121,274,954,417.79 347,743,173,179.89

Palembang 2.2 0.00 0.00 0.00 0.00 0.00

Others 2.3 28,044,000.00 13,301,235,769.69 7,256,181,339.40 382,359,613.75 438,045,436.44

South Sumatera 2 548,859,384.91 0.2% 25,693,558,991.17 38.1% 79,231,662,070.06 91.7% 121,657,314,031.54 35.2% 348,181,218,616.33 54.4%

DKI Jak arta 3.1 33,575,300.00 1,274,922,115.00 1,423,567,052.00 14,478,375,341.82 6,545,921,353.28

Bandung 3.2 0.00 29,532,220.00 3,123,678,404.89 184,466,649,426.00 188,842,309,358.76

Others 3.3 2,124,517,860.13 592,233,256.31 863,777,250.00 8,198,379,706.48 61,764,297,912.46

DKI & West Java 3 2,158,093,160.13 0.7% 1,896,687,591.31 2.8% 5,411,022,706.89 6.3% 207,143,404,474.30 59.9% 257,152,528,624.50 40.2%

Semarang 4.1 0.00 0.00 0.00 0.00 0.00

Yogyak arta 4.2 289,312,869,462.44 35,881,903,755.23 0.00 0.00 132,677,500.00

Others 4.3 7,473,981,129.57 3,689,214,185.00 0.00 25,000,000.00 77,500,000.00

DIY & Central Java 4 296,786,850,592.01 98.9% 39,571,117,940.23 58.6% 0.00 0.0% 25,000,000.00 0.0% 210,177,500.00 0.0%

Surabaya 5.1 0.00 0.00 0.00 0.00 0.00

Others 5.2 0.00 0.00 0.00 0.00 0.00

East Java 5 0.00 0.0% 0.00 0.0% 0.00 0.0% 0.00 0.0% 0.00 0.0%

Kalimantan 6 0.00 0.0% 0.00 0.0% 0.00 0.0% 0.00 0.0% 0.00 0.0%

U jung Pandang 7.1 0.00 0.00 0.00 0.00 0.00

Others 7.2 0.00 134,523,123.14 369,371,661.00 2,800,000.00 0.00

Sulawesi 7 0.00 0.0% 134,523,123.14 0.2% 369,371,661.00 0.4% 2,800,000.00 0.0% 0.00 0.0%

Other Island 8 0.00 0.0% 147,081,495.59 0.2% 1,436,329,790.00 1.7% 17,169,115,980.13 5.0% 33,178,139,248.48 5.2%

300,187,274,487.05

67,481,837,141.44 86,448,386,227.95 346,086,762,660.97 639,571,288,989.31 T O T A L

Claims Amount By Cresta Zone

As At 31 December 2009

UNDERWRITING YEAR : 2006 - 2009 DATA POS ITION FROM

1 0.00 50.00 32,529 32,529 10.58 10.58 11,494.74 11,494.74 0.18 0.18 93 93 3.29 3.29 2,387.27 2,387.27 0.21 0.21 20.77 20.77 2 50.00 100.00 17,262 49,791 5.62 16.20 1,507.56 13,002.30 0.02 0.20 125 218 4.42 7.70 3,983.19 6,370.45 0.35 0.56 264.21 48.99 3 100.00 200.00 31,115 80,906 10.12 26.32 5,100.13 18,102.43 0.08 0.28 268 486 9.47 17.17 6,477.55 12,848.00 0.57 1.13 127.01 70.97 4 200.00 300.00 24,811 105,717 8.07 34.39 6,979.77 25,082.20 0.11 0.39 357 843 12.61 29.79 16,469.12 29,317.12 1.45 2.57 235.95 116.88 5 300.00 500.00 33,975 139,692 11.05 45.44 15,552.04 40,634.24 0.24 0.63 452 1,295 15.97 45.76 40,492.44 69,809.56 3.55 6.13 260.37 171.80 6 500.00 750.00 35,073 174,765 11.41 56.85 25,661.46 66,295.71 0.40 1.03 377 1,672 13.32 59.08 64,244.11 134,053.67 5.64 11.76 250.35 202.21 7 750.00 1,000.00 19,443 194,208 6.33 63.18 19,805.01 86,100.72 0.31 1.33 1610 1,833 5.69 64.77 30,463.90 164,517.56 2.67 14.44 153.82 191.08 8 1,000.00 1,500.00 25,549 219,757 8.31 71.49 35,063.49 121,164.21 0.54 1.88 2110 2,044 7.46 72.23 39,080.62 203,598.18 3.43 17.87 111.46 168.03 9 1,500.00 2,000.00 13,210 232,967 4.30 75.79 26,209.28 147,373.49 0.41 2.28 1120 2,156 3.96 76.18 34,630.33 238,228.51 3.04 20.90 132.13 161.65 10 2,000.00 2,500.00 9,960 242,927 3.24 79.03 25,628.53 173,002.02 0.40 2.68 890 2,245 3.14 79.33 37,220.36 275,448.87 3.27 24.17 145.23 159.22 11 2,500.00 3,000.00 6,498 249,425 2.11 81.14 20,513.33 193,515.34 0.32 3.00 480 2,293 1.70 81.02 27,214.41 302,663.29 2.39 26.56 132.67 156.40 12 3,000.00 4,000.00 9,265 258,690 3.01 84.16 36,859.54 230,374.88 0.57 3.57 800 2,373 2.83 83.85 42,056.32 344,719.61 3.69 30.25 114.10 149.63 13 4,000.00 5,000.00 5,969 264,659 1.94 86.10 30,999.31 261,374.19 0.48 4.05 580 2,431 2.05 85.90 7,393.03 352,112.64 0.65 30.90 23.85 134.72 14 5,000.00 7,500.00 9,616 274,275 3.13 89.23 66,936.90 328,311.08 1.04 5.08 680 2,499 2.40 88.30 18,033.89 370,146.53 1.58 32.48 26.94 112.74 15 7,500.00 10,000.00 5,302 279,577 1.72 90.95 52,518.40 380,829.48 0.81 5.90 360 2,535 1.27 89.58 31,022.17 401,168.70 2.72 35.20 59.07 105.34 16 10,000.00 20,000.00 9,763 289,340 3.18 94.13 154,780.32 535,609.80 2.40 8.30 640 2,599 2.26 91.84 118,896.69 520,065.39 10.43 45.64 76.82 97.10 17 20,000.00 50,000.00 8,345 297,685 2.71 96.84 297,114.27 832,724.07 4.60 12.90 650 2,664 2.30 94.13 124,579.72 644,645.12 10.93 56.57 41.93 77.41 18 50,000.00 100,000.00 4,027 301,712 1.31 98.15 330,485.80 1,163,209.87 5.12 18.02 470 2,711 1.66 95.80 104,514.58 749,159.70 9.17 65.74 31.62 64.40 19 100,000.00 500,000.00 4,402 306,114 1.43 99.58 1,095,952.24 2,259,162.11 16.97 34.99 830 2,794 2.93 98.73 167,752.15 916,911.85 14.72 80.46 15.31 40.59 20 500,000.00 UP 1,283 307,397 0.42 100.00 3,148,077.51 5,407,239.62 48.76 83.75 190 2,813 0.67 99.40 43,001.890.00 959,913.74 3.77 84.23 1.37 17.75 1,049,458.93 6,456,698.56 16.25 100.00 17 2830 0.60 100.00 179,674.54 1,139,588.28 15.77 100.00 17.12 17.65