ANNUAL BUDGET

M AYOR ’ S R EPORT

C OUNCIL R ESOLUTIONS

The Council of Bela-Bela Local Municipality, acting within the meaning of section 75A of the Local Government: Municipal Systems Act (Act 32 of 2000) approves the rates and rates set forth in Schedule 2 and shall take effect from 1 July 2016 on. That the municipality has no budget to attract long-term loans to finance the capital budget. That the accounting officer complies with all prescribed legal requirements regarding the submission of the budget document to the various institutions.

E XECUTIVE S UMMARY

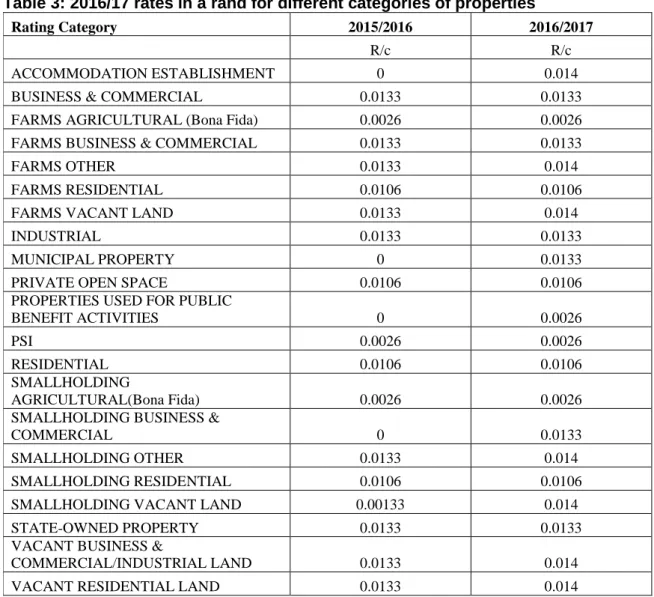

Pursuant to section 13 of the Municipal Property Tax Act, 2004 (Act No 6 of 2004)(MPRA) and sections 24 and 42 of the MFMA, new rates for property tax, electricity, water and any other taxes and similar rates may only be implemented from the beginning of the municipal fiscal year (July 1). Prior to the compilation of the 2016/2017 to 2018/2019 planning and budgeting process, a review of the municipality's service delivery priorities was conducted. In these difficult economic times, strong revenue management is fundamental to the financial sustainability of the municipality.

The municipality's Property Tax Policy approved in terms of the Municipal Property Tax Act, 2004 (Act 6 of 2004) (MPRA);. Both of these documents were used as a tool to determine the priority of the municipality's maintenance plan. The municipality expects to use contracted services in the 2016/2017 with spending of 6% of the total operating expenses of R388 million.

To receive these free services, households must apply in accordance with the municipal policy on the poor.

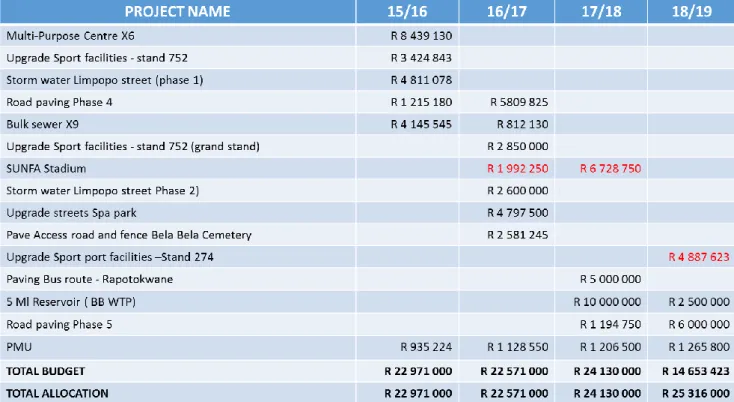

C APITAL EXPENDITURE

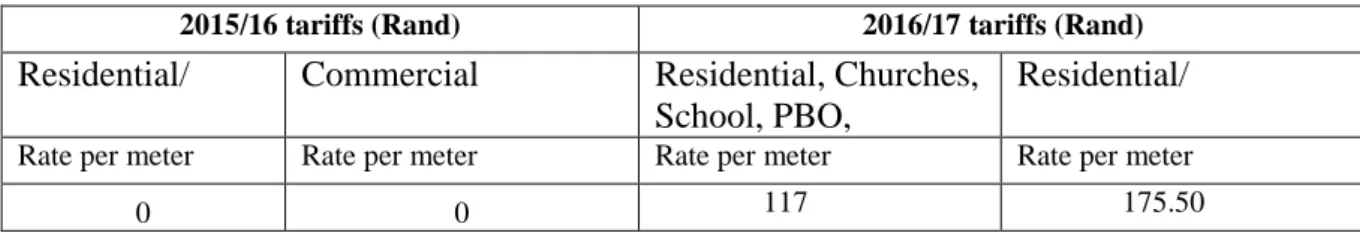

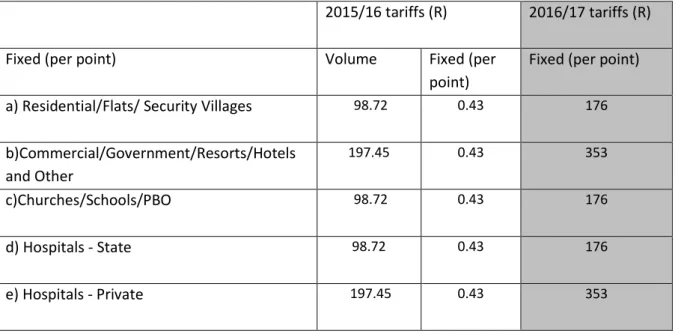

Regarding Circular 54, if a municipality's water rates are not fully cost-reflective, the municipality must develop a pricing strategy to gradually introduce the necessary rate increase in a way that spreads the impact to consumers over a period of time. This led the municipality to start the process of revising the rates in accordance with this request. The revision of the fees will enable the municipality to have adequate revenues to finance non-cash items in the future.

The council budgets a surplus of R44 million attributed to full budgeting for non-cash items. The expected cash surplus before non-cash items is R4 million as indicated in the reconciliation below. It is expected that the municipality will realize an operating surplus and a full budget for non-cash items in the final years of 2016/2017. As part of the budget documentation, there is a Draft Prioritization Model for Capital Assets Investment (attached as Appendix 1 to this report) against which all investment projects will be reviewed and prioritized to compete for available capital budget resources.

The municipality is continuing to build up a reserve that will be used to internally finance certain projects that play a crucial role in the provision of services. The table below shows a self-funded project of which R1.3 million will be spent in the financial period 2016/2017. For the 2016/2017 budget year, the furniture for the multi-purpose center is expected to cover 91% of the total in-house budget of R1.3 million, with the rest being used for protection and the emergency department.

Members of the public, interested parties, councilors and even officials were given the opportunity to submit comments on the budget. In accordance with Article 68 of the ZFMA, the municipal director and the administration must assist the mayor in this. All public participation comments that will be made in the month of April 2016 will be considered for implementation in the budget if necessary.

A NNUAL B UDGET T ABLES

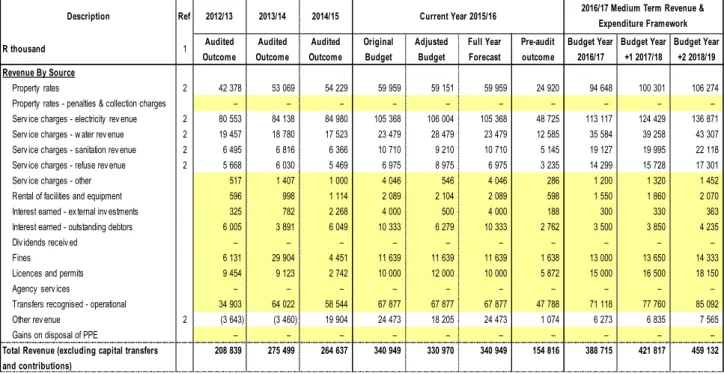

The table provides an overview of the amounts approved by the council for operational performance, funds allocated for capital expenditure, financial position, compliance with cash and funding and the commitment of the municipality to address the backlog in the delivery of basic services. The high increase is due to the allocation of R58 million (R30 million plus R28 million for MWIG and INEP respectively). However, these non-cash items will not significantly affect the revenues and expenses and the cash flows of the municipality.

This table facilitates insight into the budgeted operational performance in relation to the organizational structure of the municipality. This is due to the size of the department and its responsibility for service projects such as water, electricity and sanitation. The revenue to be generated from property rates is R94.6 million in the 2016/2017 financial year (excluding the lost revenue), which was increased from R59.1 million of the adjusted budget for 2015/2016.

For the 2016/17 financial year, service charges make up 47% of the total revenue base (excluding grants) and grow by less than 10% per year in the medium term. The reasoning is that the ownership and net assets of the municipality belong to the community; and. As an example, the collection rate assumption will affect the municipality's cash position and then inform the level of cash and cash equivalents at the end of the year.

These budget and planning assumptions form a critical link in determining the appropriateness and relevance of the budget as well as the determination of ratios and financial indicators. The cash position will continue to be managed through strict implementation of the credit control. Essentially, the table evaluates the funding levels of the budget by firstly forecasting the cash and investments at the end of the year and secondly reconciling the available funding with the liabilities/commitments that exist.

Non-compliance with section 18 of the MFMA is presumed because a deficit would indirectly indicate that the annual budget is not adequately funded. The municipal budget for repairs and maintenance is approximately 9% of operating expenditure for the 2016/17 financial year.

SUPPORTING DOCUMENTATION

O VERVIEW OF THE ANNUAL BUDGET PROCESS

There were no deviations from the key dates set out in the Budget Time Schedule which was tabled in the Council taking into account circular 78 which requires the Municipality to adopt the budget early compared to normal time frame.

IDP AND S ERVICE D ELIVERY AND B UDGET I MPLEMENTATION P LAN

Service Level Standard describes the expectation each department must meet in order to successfully achieve community service. Bela-Bela Local Municipal will continue to implement the service level standard in the fiscal year 2016/2017. How long does it take on average from completion to issuance of the first account. one month/three months or longer).

C OMMUNITY C ONSULTATION

O VERVIEW OF ALIGNMENT OF ANNUAL BUDGET WITH IDP

The constitution requires local government to link its management, budgeting and planning functions to its objectives. The legislation clearly states that a municipality must not only give effect to its IDP, but also conduct its affairs in a manner that is consistent with its IDP. The table below highlights the five final strategic IDP objectives for the 2016/2017 MTREF and further planning improvements that have directly informed this panel.

Community Consultation Forums on Tariffs, Poor Credit, Credit Control and Free Basic Electricity Revisit Community Needs, Consult and Assess Community Based Planning (CBP) Consultation Meetings. To ensure an integrated and focused service delivery between all spheres of government, it was important for the municipality to align its budget priorities with those of national and provincial governments. All spheres of government give high priority to infrastructure development, economic development and job creation, effective service delivery, poverty alleviation and building sound institutional arrangements.

F REE B ASIC S ERVICES : BASIC SOCIAL SERVICES PACKAGE FOR HOUSEHOLDS

P ROVIDING CLEAN WATER AND MANAGING WASTE WATER

M EASURABLE PERFORMANCE OBJECTIVES AND INDICATORS

Capital charges on debt proceeds Finance charges and repayment of borrowing / debt proceeds. Borrowed financing of 'own' capital expenditure Borrowing/Capital Expenditure ex cl. Long-term debtors Debtors recovered > 12 months recovered/Total debtors > Creditors management 12 months.

Debt Coverage (Total Operating Income - Operating Allowances)/Debt Service Payments due within financial year).

O VERVIEW OF BUDGET RELATED - POLICIES

O VERVIEW OF BUDGET ASSUMPTIONS

Section 17(3)(k) of the MFMA provides that as part of the budget decisions, the proposed cost to the municipality for the fiscal year of the salary, allowances and benefits of each political office holder, municipal officer, finance director and senior manager reporting to the town clerk must be made public. The focus will be on strengthening the link between policy priorities and expenditures in order to achieve national, provincial and local objectives. However, it is also important to bear in mind that some of these priorities are not directly linked to the powers and functions assigned to the municipality.

This following table meets the requirements of MFMA Circular 42, which deals with the financing of a municipal budget in accordance with §§ 18 and 19 of the MFMA. What are the forecasted cash and investments available at the end of the budget year. A deficit (application > cash and investments) is an expression of non-compliance with § 18 of the MFMA requirement that the municipality's budget must be 'financed'.

Usually, unless there are special circumstances, the municipality is required to return unspent contingent grant funds to the national revenue fund at the end of the fiscal year, unless the funds are committed to identifiable programs and/or projects; National Treasury requires the municipality to assess its financial sustainability through fourteen different measures that look at different aspects of the municipality's financial health. A 'positive' cash position for each year of the MTREF would generally be a minimum requirement, depending on the planned use of these funds, such as cash back from reserves and working capital requirements.

If the municipality's cash flow forecast is negative, for each year of the medium-term budget, the budget is very unlikely to meet the requirements of the MFMA or to be sustainable and may indicate a risk of non-compliance with Article 45 of the MFMA that it's about redemption. of short-term debt at the end of the financial year. This measure should be considered important within the context of the funding measures criteria, because a trend indicating that insufficient funds are being committed to asset repair may also indicate that the overall budget is not reliable and/or sustainable over the period medium and long-term, because the budget income is not being protected. A requirement of the detailed capital budget (since MFMA Circular 28 which was issued in December 2005) is to categorize each capital project as a new asset or a.

A LLOCATIONS AND GRANT MADE BY THE MUNICIPALITY

A declining or low level of renewal funding may indicate that a budget is not credible and/or sustainable and future income is not protected, similar to the justification for 'repairs and maintenance'.

E XPENDITURE ON ALLOCATION AND GRANT PROGRAMME

A NNUAL BUDGET AND SDBIP – I NTERNAL DEPARTMENTS

C ONTRACTS HAVING FUTURE BUDGETARY IMPLICATIONS

M ONTHLY TARGET FOR REVENUE , EXPENDITURE AND CASH FLOW

L EGISLATION COMPLIANCE STATUS

Q UALITY CERTIFICATION

AMENDED BUDGET RELATED POLICIES

TARIFFS