The development of an institution, focused on providing transparent, loyal and effective services in the residence of the !Kheis Municipal Area. To promote economic development to the advantage of the communities within the boundaries of the !Kheis Municipality. This will be done by creating and maintaining an effective administration and a safe environment to attract tourists and investors to the area."

DRAFT ANNUAL BUDGET

Mayor’s Report

The municipality in partnership with the Department of Energy is keen to develop Solar Power Plants in the !Kheis area, as we believe that this venture can ensure employment opportunities in the area. The budget that is submitted here today is another step closer to realizing the strategic goals of the municipality which include, among other things, institutional development and transformation, service delivery to all our communities, the financial viability and sustainability of the municipality as well as good administration and public participation. I would like to thank all the role players, stakeholders and every citizen of !Kheis Municipality who participated in the drafting of this IDP and Budget, through a process of public participation, ward committees, workshops, one-on-one engagement and individual input.

Council resolutions

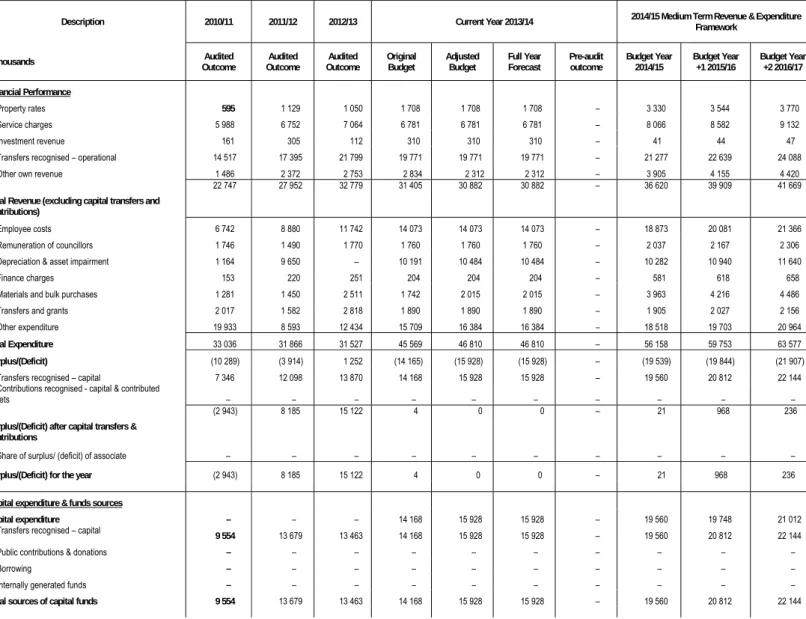

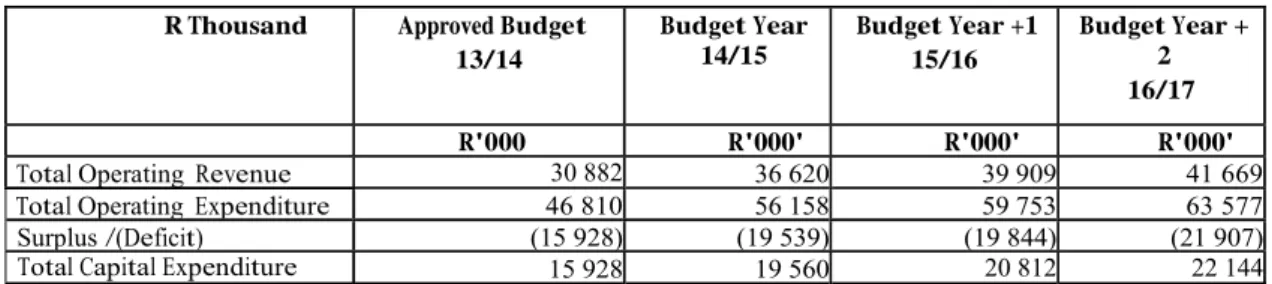

Executive Summary

Operational expenditure increased by 19.9% in the financial year 2014/15 compared to the figures of the approved adjustment budget 2013/14. These two projects were already approved by MIG before the end of the 2013/14 financial year. Loans are not expected to contribute to financing capital expenditures in any of the MTREF years.

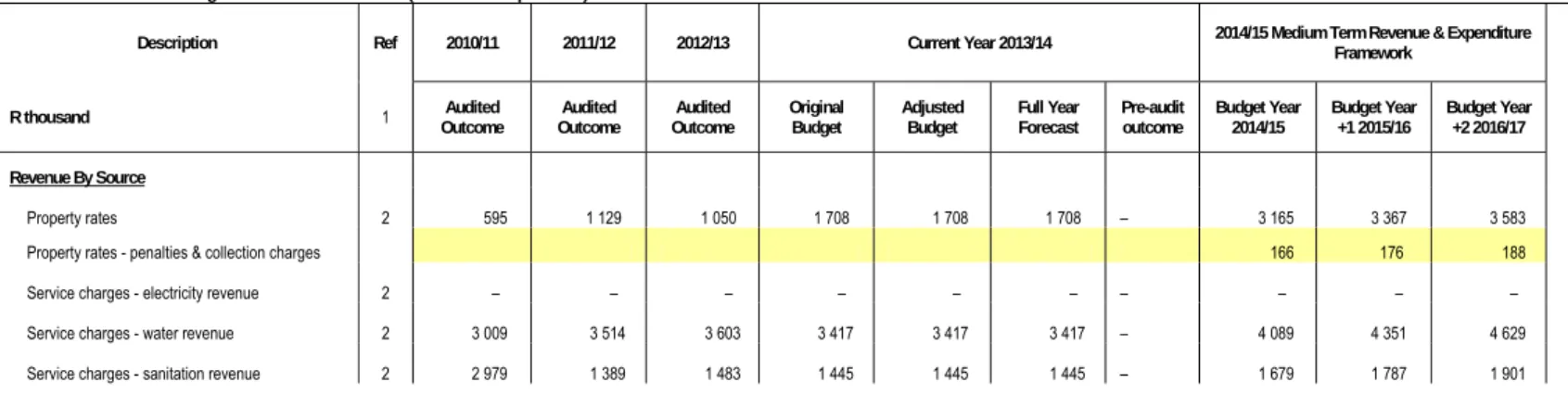

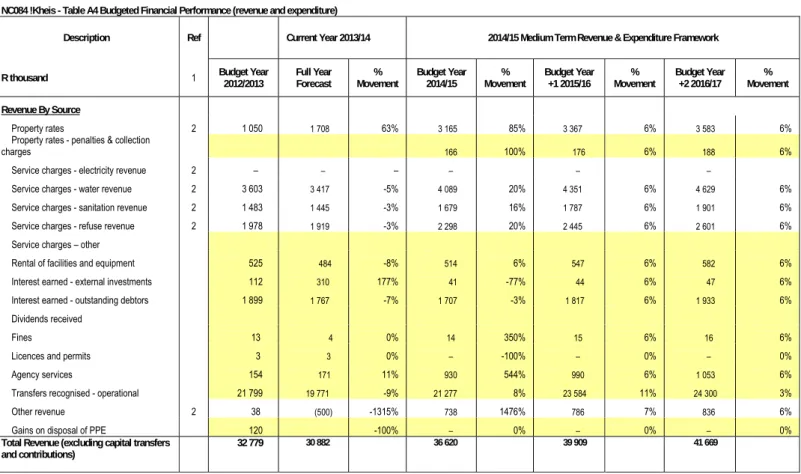

Operating Revenue Framework

Revenues from rates and service charges make up a significant percentage of the revenue curve for the municipality. However, the Department was presented with evidence to confirm that the water security planning process is underway in each of the supply systems. !Kheis Municipality will take ownership of the water safety plan, an improvement plan should be drawn up to mitigate the dangers.

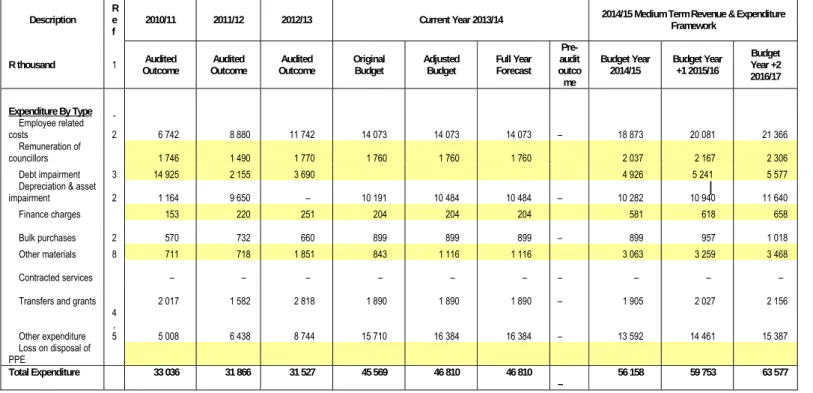

Operating Expenditure Framework

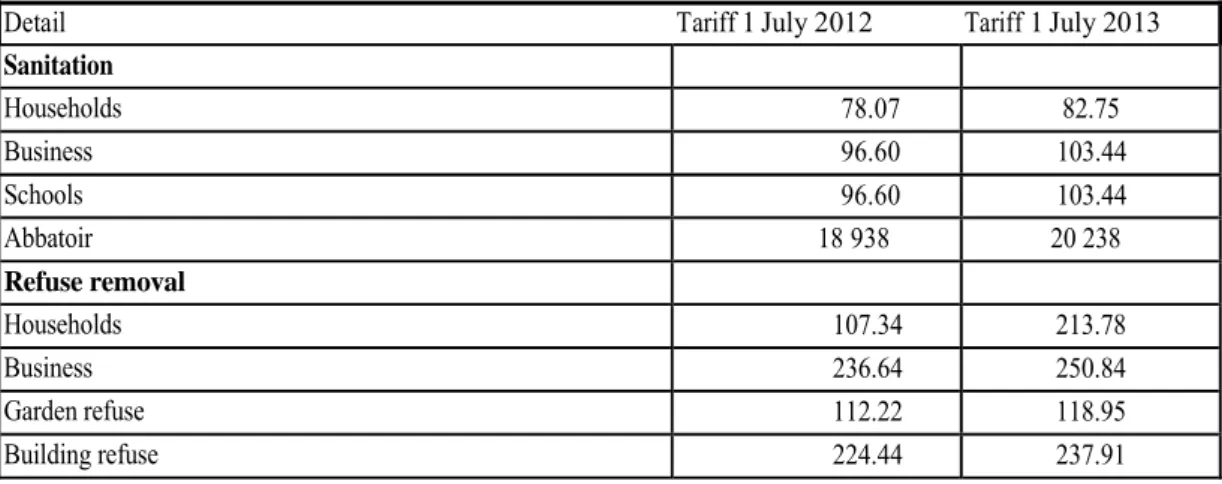

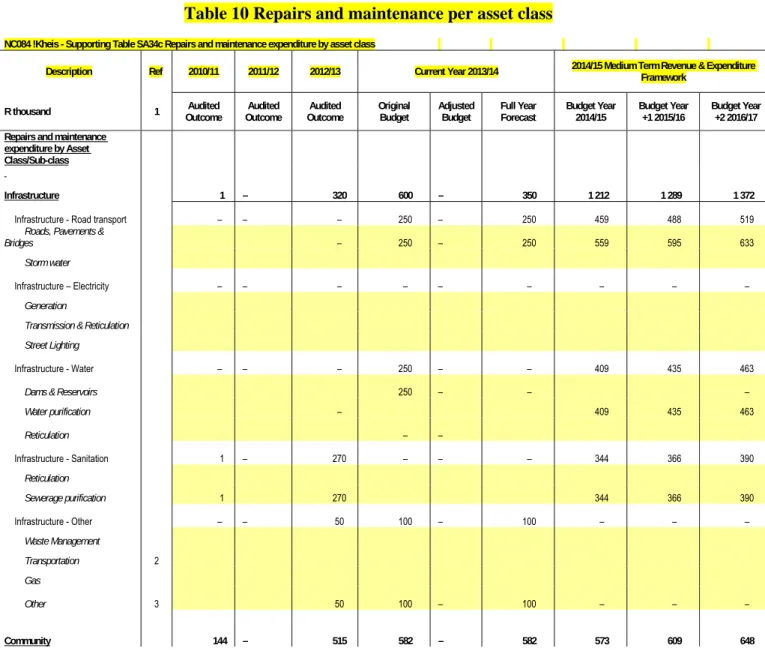

Other expenses consist of various line items related to the daily operations of the municipality. In accordance with the municipality's repair and maintenance plan, this group of expenses has been prioritized to ensure sustainability of the municipality's infrastructure. To receive these free services, households must register in terms of the municipality's Needy Policy.

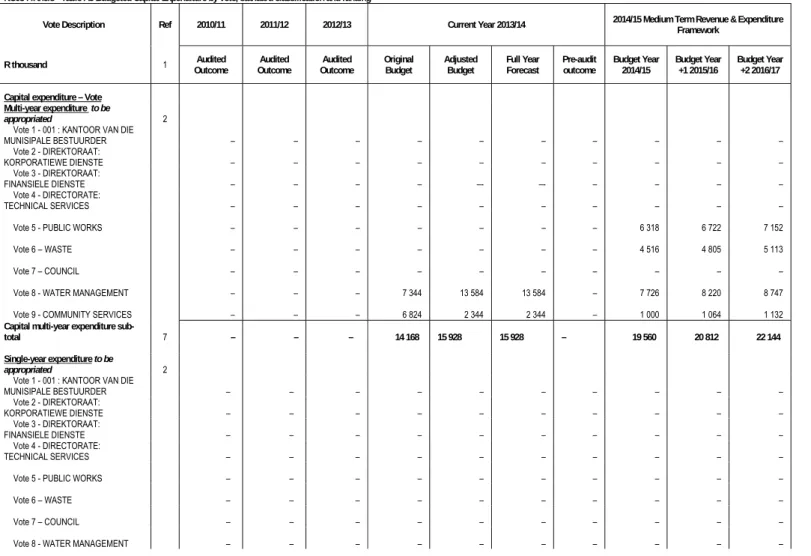

Capital expenditure

The social package costs of the registered indigent households are largely funded by the national government through the local government's fair share received in terms of the annual Division of Revenue Act. For 2014/15, an amount of R18.5 million has been earmarked for infrastructure development, representing 99% of the total capital budget. In recent years, this amount is R20.8 million and R22.1 million respectively for each of the financial years.

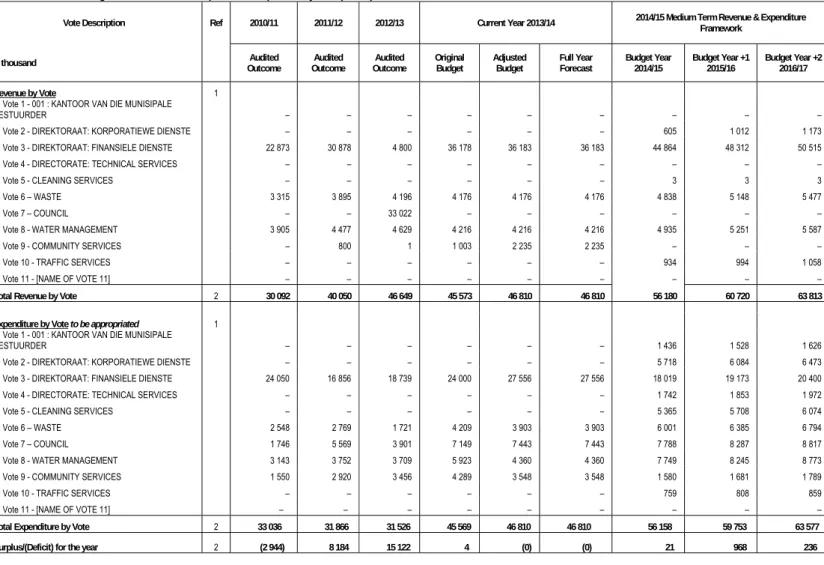

Drafted Annual Budget Tables (A1 – A10)

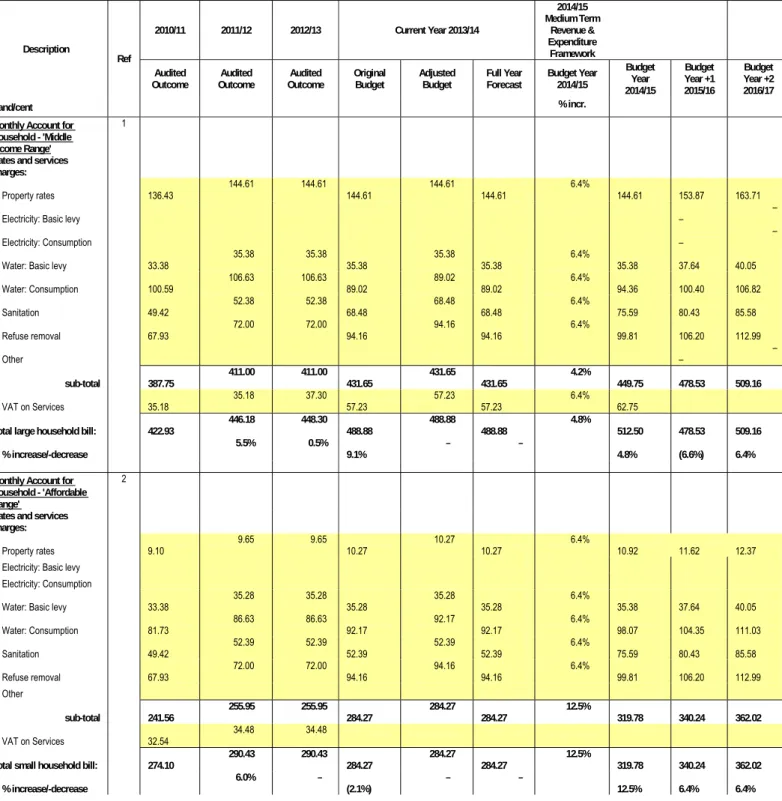

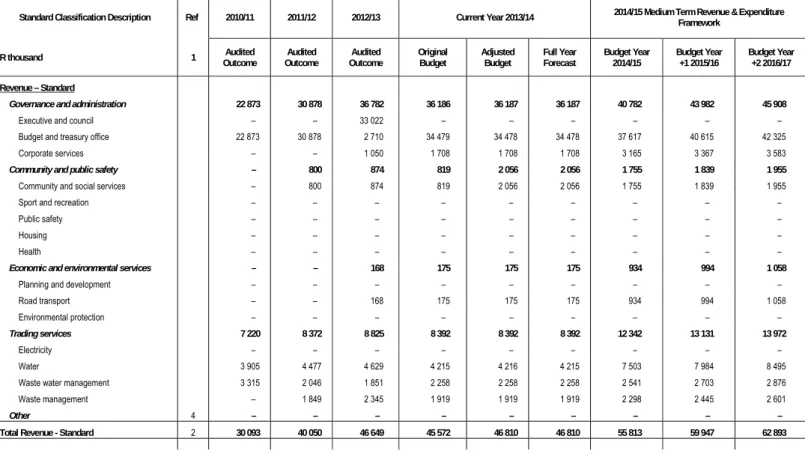

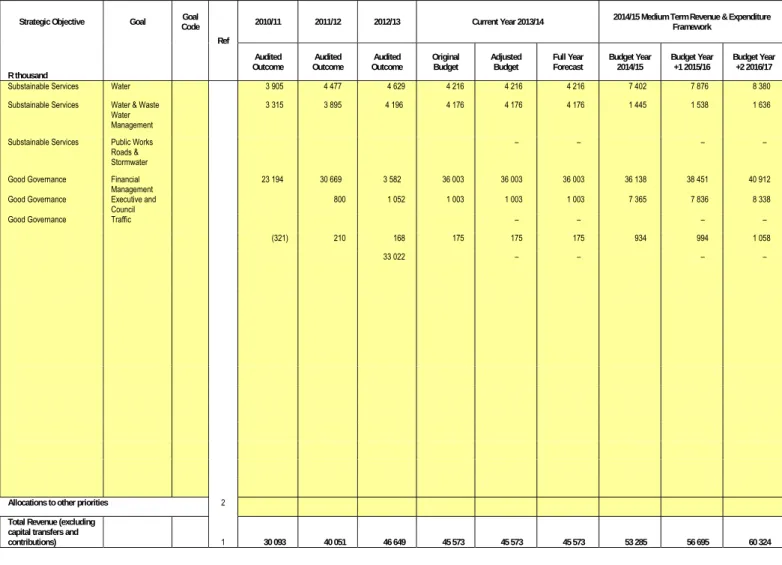

This table provides an insight into the budget-planned performance of the business according to the organizational structure of the municipality. The rationale is that the ownership and net assets of the municipality belong to the community. For example, the assumption of the collection rate will affect the cash position of the municipality and consequently.

SUPPORTING DOCUMENTATION

Overview of the annual budget process

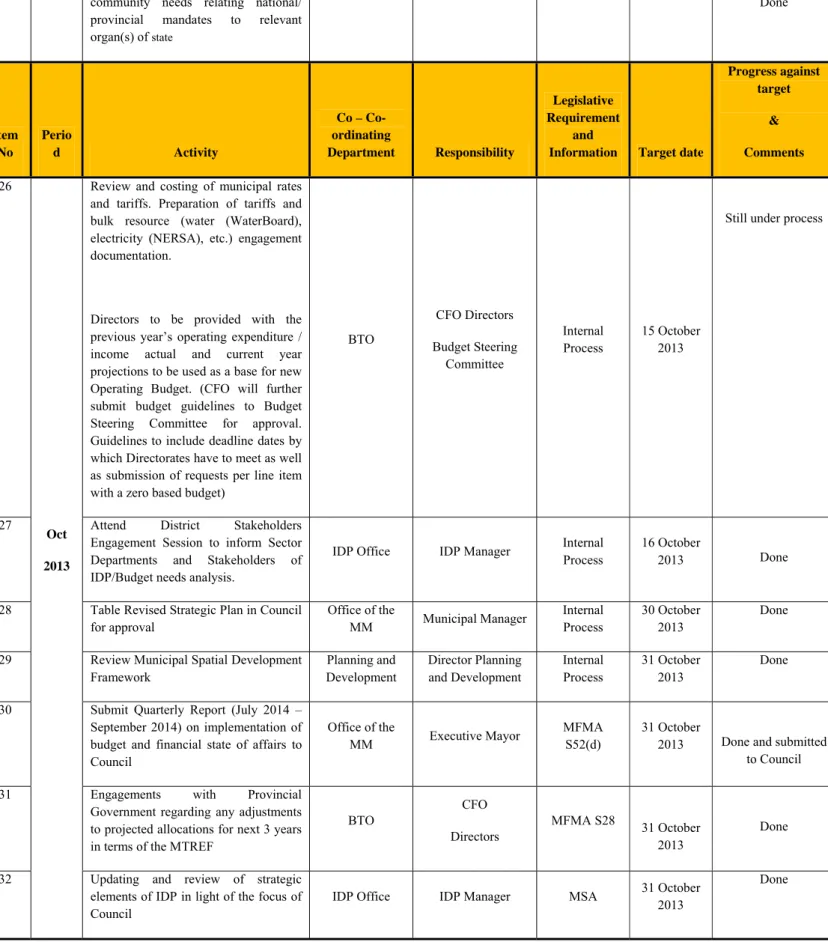

Draft 2014/15 IDP and Budget Process Timetable outlining the steps and timelines for preparing the 2014/14 IDP, budget and two outer annual budgets and SDBIP. 10 Complete logistical processes related to each of the IDP and budget meetings and submit a related business plan to management. 32 Update and review strategic elements of IDP in light of Board focus.

SDBIP within 28 days of budget approval and submit hard and electronic copy to NT and PT. IDP and Budget Steering Committee - Oversee alignment of the planning process with the district framework. Copies of the IDP and budget will be posted on the website for people and service providers to download.

It started in September 2011 following the presentation of the IDP process plan and budget timeline for the 2014/15 MTREF in August. 5 in compiling the 2014/14 MTREF, each department/function had to review the business planning process, including setting priorities and objectives following the mid-year performance review against the departmental service delivery plan and the implementation of the 2013/2014 budget. The Draft Service Delivery and Budget Implementation Plan (SDBIP) with the Draft Performance Agreements will be submitted to the Mayor after the approval of the Draft IDP and Budget; and the final SDBIP will be presented to Council for approval with Performance Agreements on 30 May 2014 with the final IDP and budget.

5As part of the compilation of the MTREF 2014/15, extensive financial modeling has been performed to ensure long-term affordability and financial sustainability.

Overview of alignment of annual budget with IDP

Improve capacity within the municipality and establish effective systems to manage and provide sustainable services to the community of !Kheis Municipality by December 2014. Restructuring of human resources in the municipality, including staff training and appointment of additional staff. Upgrading the administrative and financial system, including training on the use of these systems.

Provision of necessary agricultural infrastructure and improved animal husbandry Potential establishment of agro-industries to add value to agricultural products Determining mining opportunities in the area. Provide all residents of the municipality of !Kheis with access to quality health and emergency services by June 2015. Lack of sufficient and Providing adequate and effective access to communication. Upgrading existing communications networks and systems.

However, it was envisaged that more community priorities could be added. In accordance with the MSA, the IDP represents a unified, inclusive strategic plan for the municipality. It provides direction for the municipal IDP, related sector plans and strategies, and the allocation of resources from the municipality and other service delivery partners.

The 2014/15 MTREF has therefore been directly informed by the IDP review process and the following tables provide a reconciliation between the IDP's strategic objectives and operating income, operating expenditure and capital expenditure.

Measurable performance objectives and indicators

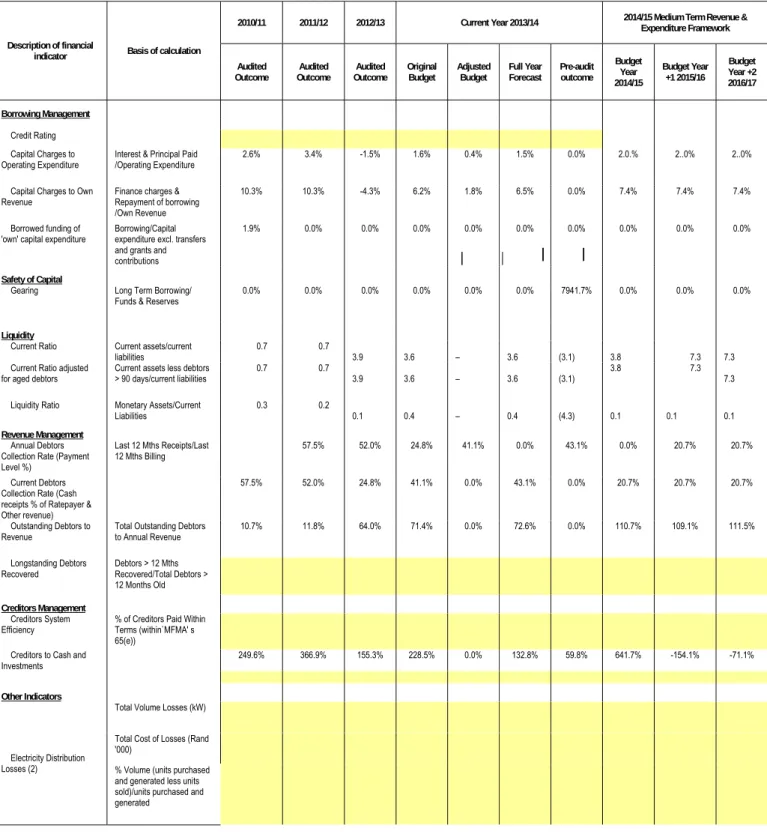

The information is not available at this stage and will be included after approval of the SDBIP. The debt-to-asset ratio is a measure of long-term borrowing as a percentage of the municipality's total asset base. This ratio remains negligible due to the minimal amount of borrowing that the municipality has.

Capital cost of operating expenses is a measure of the cost of borrowing in relation to operating expenses. This is below the benchmark ratio due to the excessive provision for bad debts which we are yet to review. The liquidity ratio is a measure of the ability of the municipality to use cash and cash equivalents to immediately eliminate or settle its current liabilities.

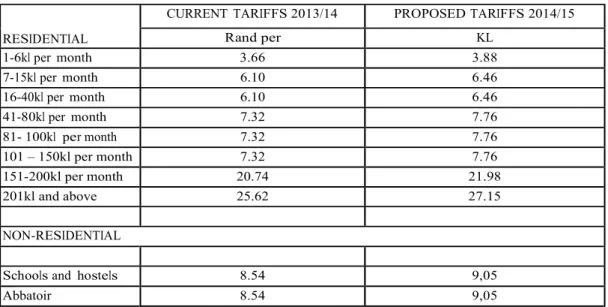

The intent of the strategy is to streamline the revenue value chain by ensuring accurate billing, customer service, credit checking and collections. In terms of the council's poverty policy (attached as Annex 4), registered households are entitled to 6kl of water, free sanitation and free waste disposal equivalent to once a week, as well as a discount on their property rates. The council is the Water Service Authority for the entire council in terms of the Water Services Act, 1997 and acts as a water service provider.

Approximately 90% of the municipality's bulk water needs are directly supplied by Boegoeberg water in the form of purified water.

Overview of budget related‐policies

Its objective is to empower senior managers with an effective financial and budgetary change and control system to ensure optimal service delivery within the legislative framework of the MFMA and the municipal system of delegations. The Council will consider the amended policy in due course and will consult extensively on the changes. The current regulations are available on the municipal website www.!kheis.gov.za.

The municipality's Cash Management and Investment Policy, as approved by the council, will also be reviewed. The purpose of the policy is to ensure that the municipality's excess cash and investments, where appropriate, are adequately managed, particularly funds set aside for cash backing of certain reserves. The policy describes the minimum cash and cash equivalents required at any given time and introduces timeframes for achieving certain benchmarks.

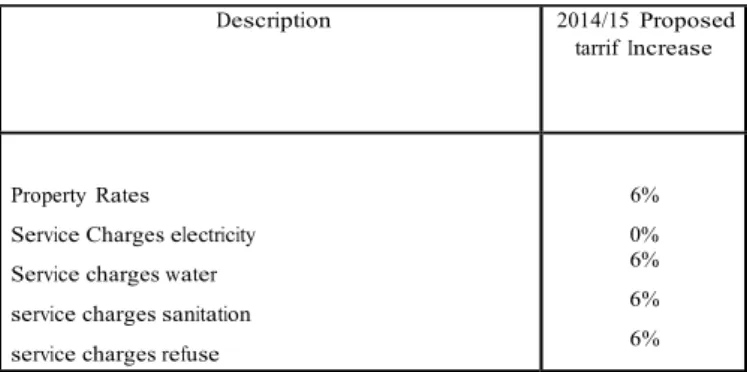

The municipality's tariff policy (available at www.!kheis.gov.za) provides a broad framework within which the municipality can set fair, transparent and affordable tariffs that also promote sustainable services. The Financial Code policy has directly influenced the composition of the MTREF 2014/15, with an emphasis on affordability and long-term sustainability. Although we are busy reviewing the policy, its content has been important in the preparation of the MTREF.

The results of the financial planning are brought to the Council and then translated into recommendations for budgetary guidelines that inform the composition of the next MTREF.

Overview of budget assumptions

As a result, the 2013/14 MTREF is based on all loans undertaken using fixed interest rates for amortization style loans that require both regular principal and interest payments. It is also assumed that current economic conditions, and relatively controlled inflationary conditions, will continue for the forecast term. Integration of service delivery between national, provincial and local government is of critical importance to ensure focused service delivery and in this regard various measures have been implemented to align IDPs, provincial and national strategies around priority spatial interventions.

In order to achieve these priorities, integration mechanisms have been established that ensure comprehensive planning and implementation of various development programs. Emphasis will be placed on strengthening the link between policy priorities and spending to ensure national, provincial and local targets are met. The spend rate is estimated to be at least 90% for operational expenditure and 100% for the capital program for MTREF 2014/15, the performance of which has been factored into the cash flow budget.

Overview of budget funding

Revenue to be generated from property tax is R3.1 million in the 2014/15 financial year and rises to R3.3 million by 2015/16 which represents 6% of the operating revenue base of the municipality. With the implementation of the Municipal Property Tax Act, the rating base changed significantly. Capital grants and receipts equal 100% of the total funding source representing R14.4 million for the 2014/15 financial year.

What is the forecasted cash and investments available at the end of the budget year. A deficit is indicative of non-compliance with section 18 of the MFMA requirement that the municipality's budget must be 'funded'. In terms of the municipality's Loans and Investments Policy, loans are only deducted once the expenses have been incurred against the relevant project.

Any under-performance in terms of collections may put increasing pressure on the municipality's ability to meet its financial obligations. The forecast of the municipality's cash position was discussed as part of the budgeted cash flow statement. This measure aims to analyze the assumed base rate of collection for the MTREF to determine the relevance and reliability of the budget assumptions contained in the budget.

Details of the municipality's asset management and repair and maintenance strategy can be found in Table 48 of MBRR SA34C.

Expenditure on grants and reconciliation of unspent funds

Councillor and employee benefits

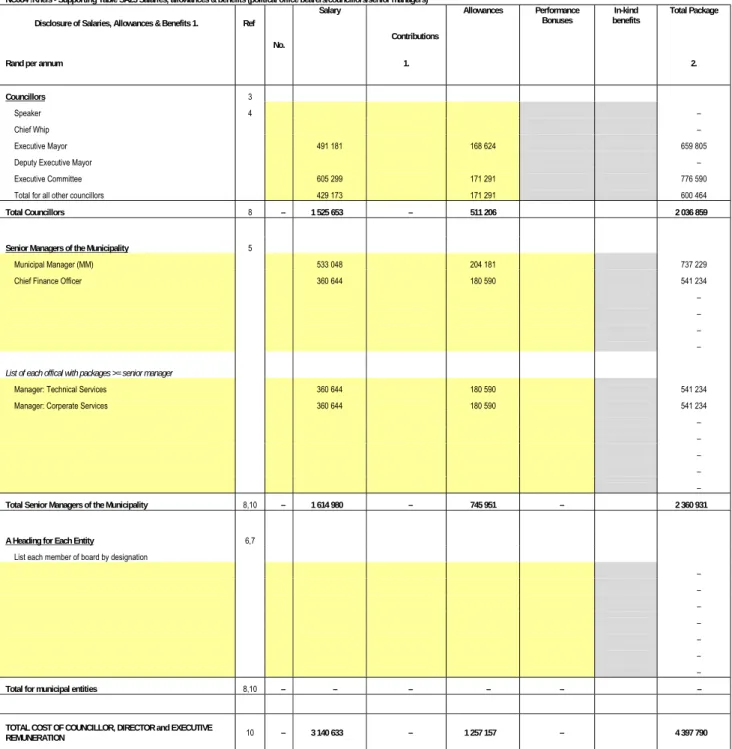

NC084 !Kheis - Support Table SA23 Salaries, Allowances and Benefits (Political Office Holders/Council Members/Senior Managers) Disclosure of Salaries, Allowances and Benefits 1.

Contracts having future budgetary implications

Capital expenditure details

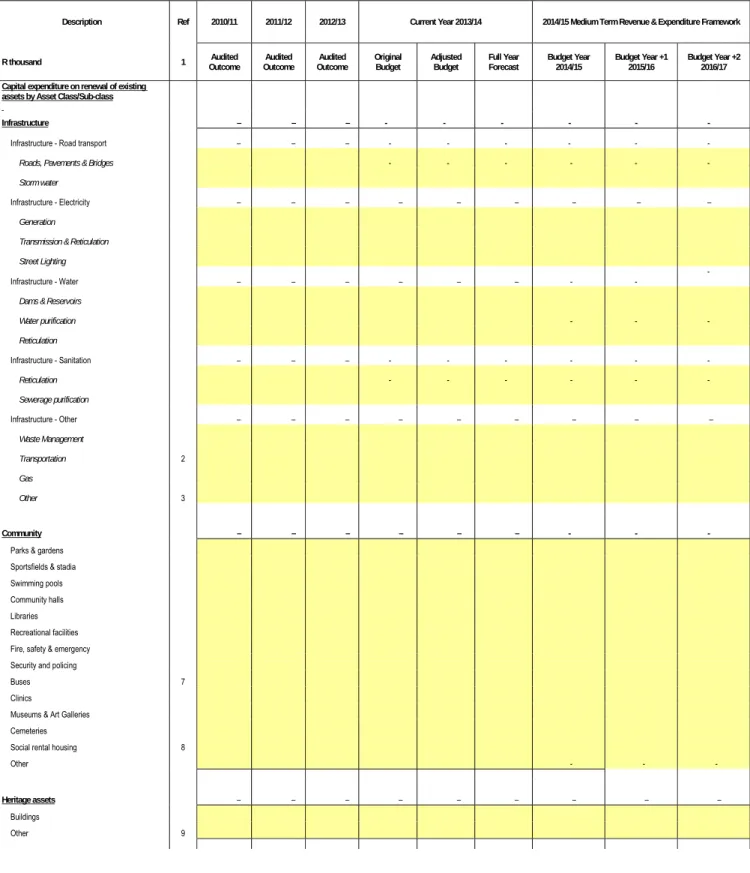

NC084 !Kheis - Supporting table SA34b Capital expenditure for renewal of existing assets by asset category.

Legislation compliance status

Other supporting documents

Municipal manager’s quality certificate