ANNUAL BUDGET

M AYOR ’ S R EPORT

C OUNCIL R ESOLUTIONS

Bela-Bela Local Municipality Council, acting in accordance with section 75A of the Local Government: Municipal Systems Act (Act 32 of 2000) approves and approves with effect from 1 July 2015 the rates set out in Schedule 2;. The Bela-Bela Local Municipality Council approves the revised draft organizational structure 2015/16, as set out in Appendix 3;. Bela-Bela Local Municipality Council approves the revised draft of the 2015/16 Performance Management Framework as set out in Appendix 4;.

The City Council for Bela-Bela Local Municipality approves the revised draft of the IDP for 2015/16 as set out in Appendix 5;. That the Accountant complies with all prescribed requirements in the legislation regarding the presentation of the budget document to the various institutions.

E XECUTIVE S UMMARY

Prior to preparing the planning and budgeting process for 2015/2016 to 2017/2018, an assessment of the priorities for the provision of municipal services was carried out. The municipality continues to hold community participation sessions under relevant legislation. In these difficult economic times, strong revenue management is fundamental to the financial sustainability of the municipality.

Council Property Pricing Policy approved under the Municipal Property Pricing Act, 2004 (Act 6 of 2004) (MPRA);. The municipality implements the directive from NERSA as part of the municipality's license agreement. Both of these documents were used as a tool to determine the priority of the municipality's maintenance plan.

In order to receive these free services, households must register in accordance with the municipality's poor policy.

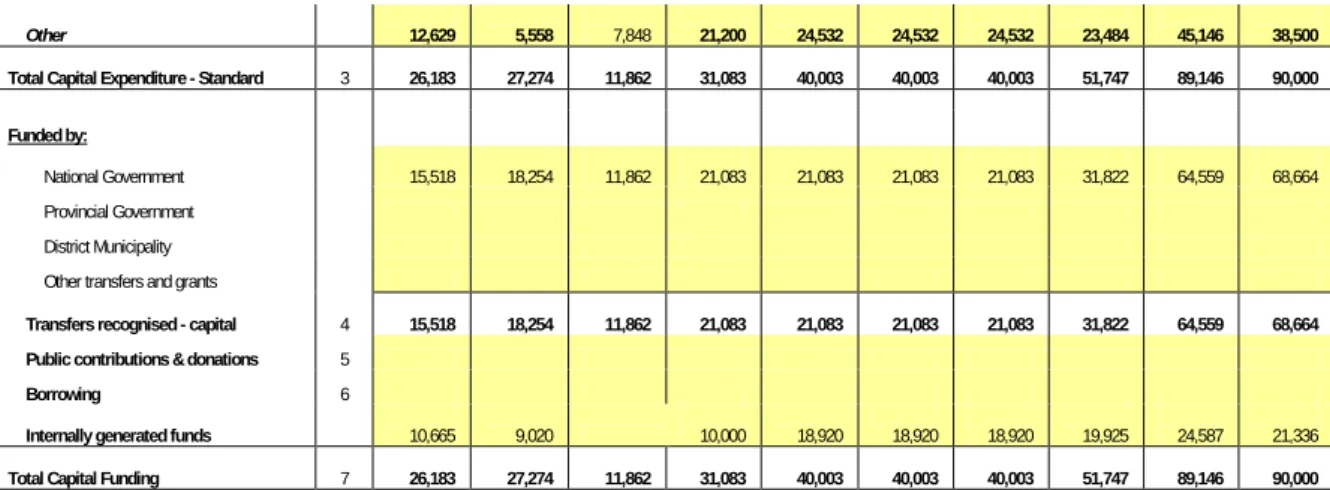

C APITAL EXPENDITURE

Excess fat was consistently trimmed from the overhead category, and very little fat, if any, now remains in the operating budget. As part of the budget documentation, there is a Draft Capital Investment Prioritization Model (attached as Appendix 1 to this report) against which all capital projects will be evaluated and prioritized to compete for available capital budget funding sources. R33.9 million of the capital budget belongs to the MIG and the remaining part of R17.8 million which is related to the projects financed by the municipality.

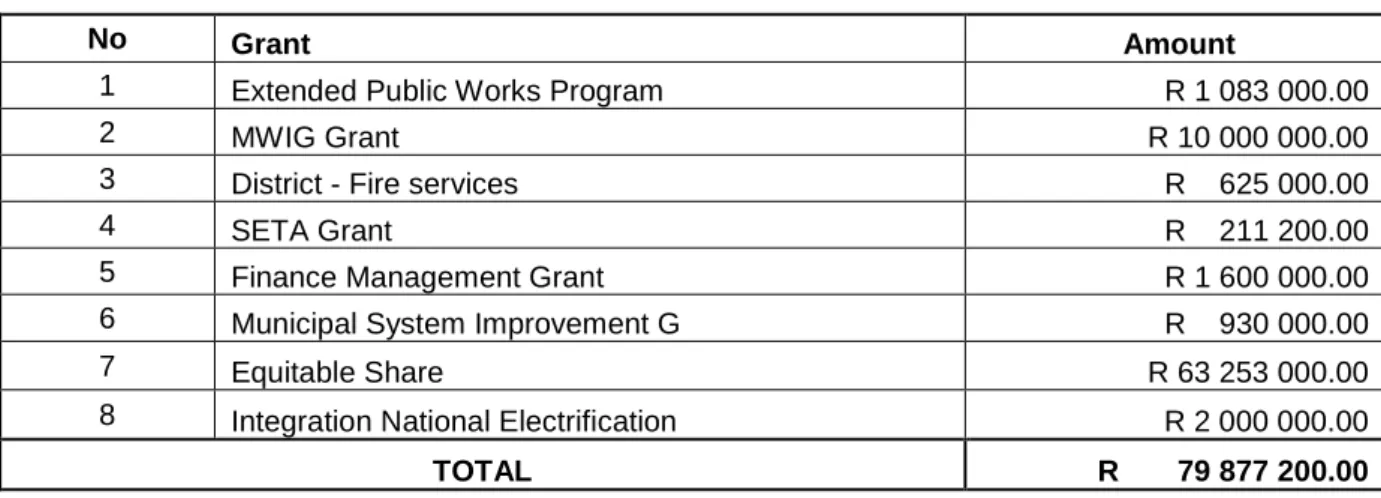

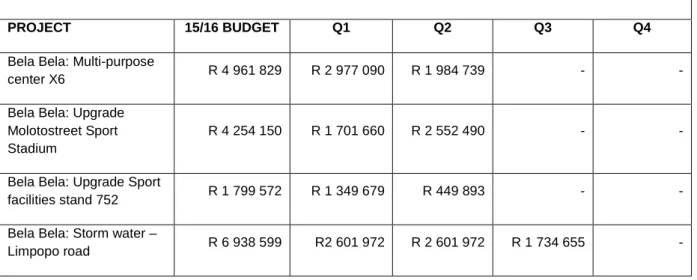

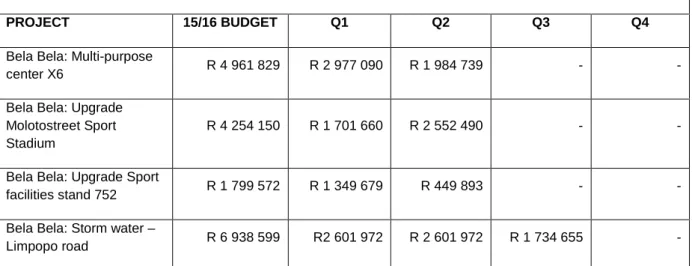

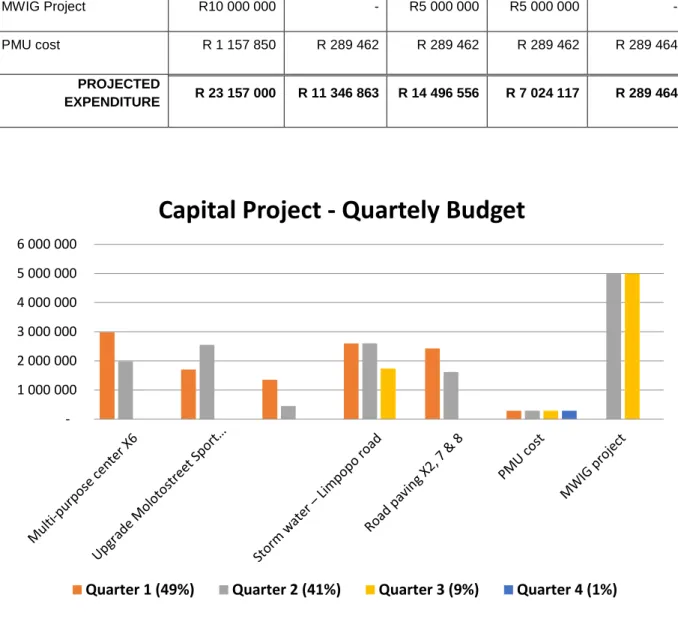

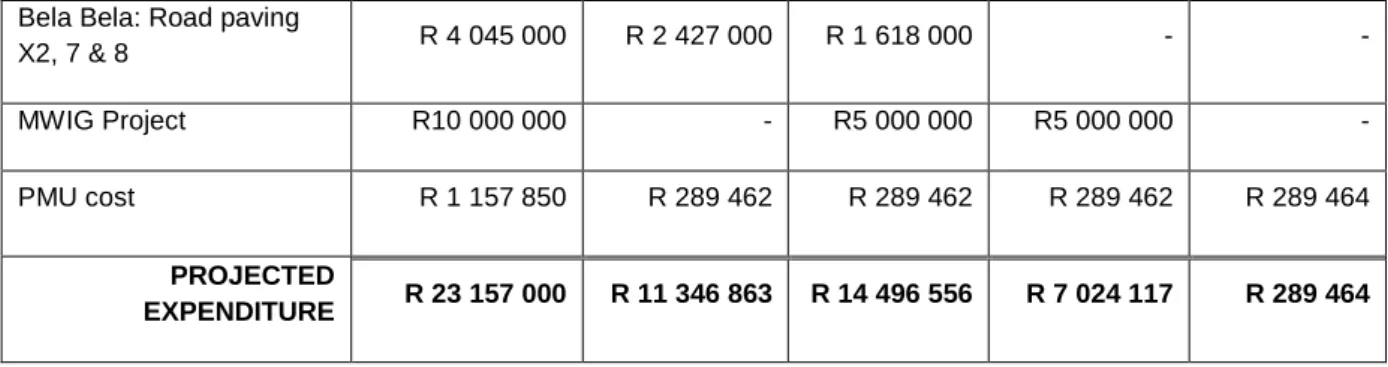

The projects depicted under the budget year 2015/2016 relate to projects planned for implementation during the 2015/2016 financial year. The available R33 157 000 Grant Funds for 2015/2016 will be distributed according to the Prioritization Model for Capital Asset Investment as indicated in the table below. For the budget year 2015/2016, it is expected that water infrastructure will cover 30% of the total budget of R, followed by stormwater - Limpopo with a coverage of 21% on budget and with PMU costs being the lowest with only up to 5% on the total budget.

Members of the public, stakeholders, councilors and even officials were given the opportunity to submit comments on the budget. Multipurpose Center X6 Stadium Upgrade Molotostreet Upgrade Sports Facilities stand 752 Stormwater - Limpopo Street Street Paving X costing 2, 7 and 8 PMU. The municipal manager and the administration must assist the Mayor in terms of Article 68 of the MFPP in this regard.

As depicted on table 4C above, it can be noted that, from R23 million budget amount;. 49% will be spent on the first quarter, followed by 41% on the second quarter, 9% on the third quarter and 1% on the last quarter. Based on current spending patterns as well as tenders already awarded, the projected capital expenditure for the 2014/2015 financial year is expected to be R.

A NNUAL B UDGET T ABLES

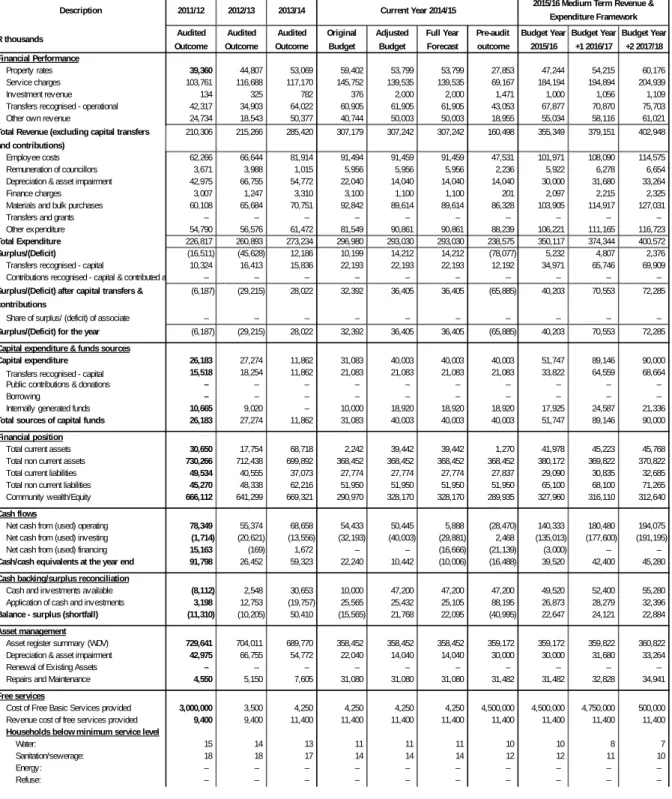

The table provides an overview of the amounts approved by the Council for operating performance, resources allocated for capital expenditure, financial position, cash and. This requires the simultaneous assessment of the Financial Performance Budget, Financial Position and Cash Flow, along with the Capital Budget. However, these non-cash items will not deeply affect the revenues and expenses as well as the cash flows of the municipality.

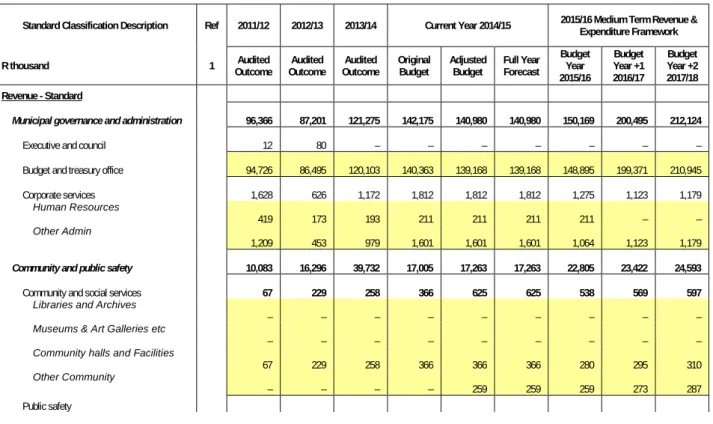

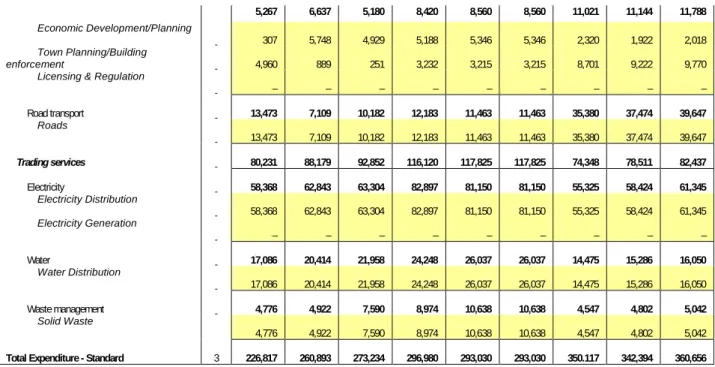

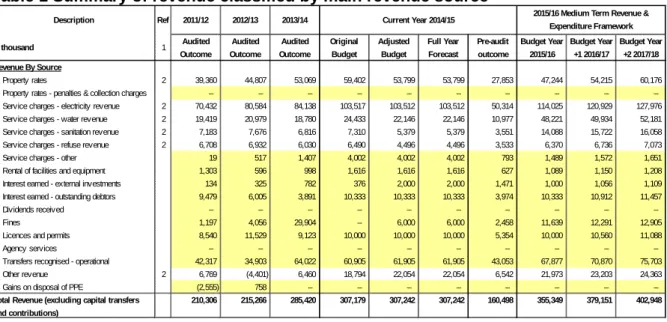

This table facilitates the view of the budgeted operational performance in relation to the organizational structure of the municipality. This is due to the size of the department as well as its responsibility over service delivery projects such as water, electricity and sanitation. The revenue to be generated from property rates is R45.2m in the 2015/16 financial year (before rebates are taken into account) and rises to R62.1m from 2017/18 representing an average of 21% of total revenue ( excluding grants).

Service charges relating to electricity, water, sanitation and refuse collection make up the largest component of the council's revenue basket, totaling R171m for the 2015/16 financial year and rising to R192.9m by 2016/17. For the 2015/16 financial year, service costs represent 62% of the total revenue base (excluding grants) and will increase by approximately 6% per annum over the medium term. The rationale is that the ownership and net assets of the municipality belong to the community.

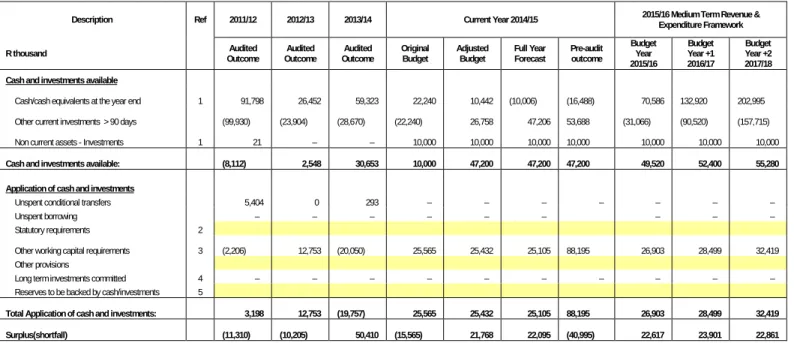

For example, the collection rate assumption will affect the municipality's liquidity and subsequently inform about the level of cash and cash equivalents at the end of the year. It shows the expected level of cash in-flow versus cash out-flow that is likely to result from the implementation of the budget. The liquidity position will continue to be managed by strict implementation of the credit control policy and cost containment measures.

Non-compliance with Article 18 of the MFMA is assumed because a shortfall would indirectly indicate that the annual budget is not properly funded. As stated in the previous reporting financial year, the Council has noted with concern the current level of allocation for asset renewal and maintenance.

SUPPORTING DOCUMENTATION

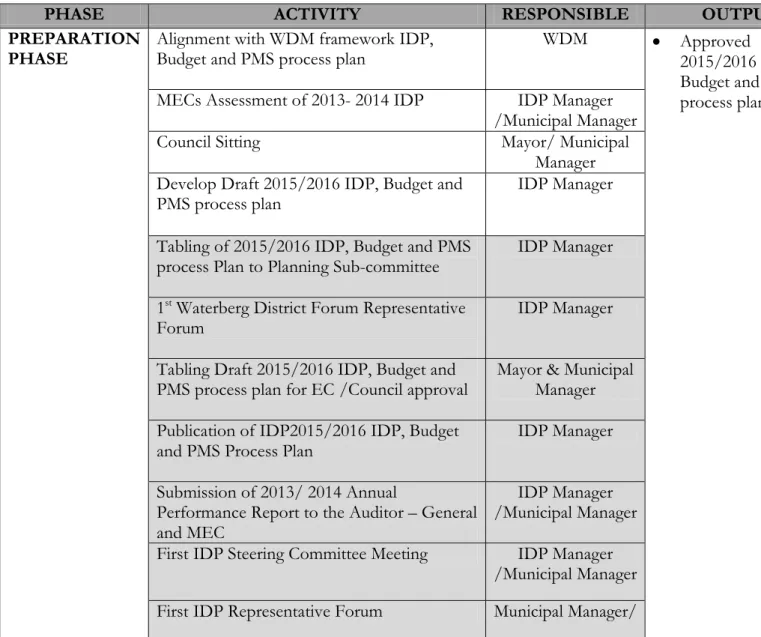

O VERVIEW OF THE ANNUAL BUDGET PROCESS

IDP AND S ERVICE D ELIVERY AND B UDGET I MPLEMENTATION P LAN

There were no deviations from key dates in the budget timetable submitted to the Council. How long does it take on average from completion to issuance of the first account. one month/three months or longer).

C OMMUNITY C ONSULTATION

O VERVIEW OF ALIGNMENT OF ANNUAL BUDGET WITH IDP

The municipal IDP offers a five-year strategic program of action aimed at defining short-term, medium-term and long-term strategic and budgetary priorities to create a development platform, which is related to the mandate of the political authorities. The IDP is therefore a key instrument that municipalities use to provide vision, leadership and direction to all those who have a role to play in the development of a municipal area. The IDP allows municipalities to make the best use of scarce resources and accelerate the provision of services.

Integrated development planning in the South African context includes an approach to planning that focuses on involving the municipality and the community to find the best solutions for sustainable development together. In addition, integrated development planning provides a strategic environment for managing and guiding all planning, development and decision-making in the municipality. It is important that the IOP developed by the municipality is in line with the national and provincial intention.

It should aim to coordinate the work of local and other spheres of government in a coherent plan to improve the quality of life of all the people living in that area. Applied to the Bela-Bela Local municipality, issues of national and provincial importance must be reflected in the IDP of the municipality. A clear understanding of such an intention is therefore essential to ensure that the municipality strategically meets the key national and provincial priorities.

The purpose of this review cycle was to develop and coordinate a coherent plan to improve the quality of life for all the people living in the area, which also reflects issues of national and provincial importance. One of the key objectives is therefore to ensure that there is alignment between national and provincial priorities, policies and strategies and the City's response to these requirements. In order to ensure integrated and focused service delivery between all spheres of government, it was important for the municipality to align its budget priorities with those of national and provincial government.

F REE B ASIC S ERVICES : BASIC SOCIAL SERVICES PACKAGE FOR INDIGENT HOUSEHOLDS

In all areas of government, high priority is given to infrastructure development, economic development and job creation, efficient services, poverty reduction and the establishment of sound institutional arrangements.

P ROVIDING CLEAN WATER AND MANAGING WASTE WATER

M EASURABLE PERFORMANCE OBJECTIVES AND INDICATORS

As time permits and the availability of information, these indicators will be compared with the indicators of other municipalities of similar type, size and function.

O VERVIEW OF BUDGET RELATED - POLICIES

The main policy changes include: the alignment with the changes to the Municipal Property Rates Act (MPRA).

O VERVIEW OF BUDGET ASSUMPTIONS

However, it is also important to bear in mind that some of these priorities are not directly linked to the powers and functions assigned to the municipality. What are the predicted cash and investments available at the end of the financial year. A shortfall (application > money and investments) indicates failure to comply with Article 18 of the MFMA requirement that the municipal budget must be 'financed'.

As a starting point, unless there are special circumstances, the municipality is obliged to return unused conditional grant funds to the national revenue fund at the end of the financial year. The municipality has indicated its intention to build up a cash-backed reserve in accordance with the recently approved reserve policy. Landskassen requires the municipality to assess its financial sustainability in relation to fourteen different measures that look at different aspects of the municipality's financial health.

The funding compliance metric essentially measures the extent to which the proposed budget meets the funding requirements of the MFMA. This metric is designed to analyze the underlying assumed collection rate for the MTREF to determine the relevance and credibility of the budget assumptions in the budget. The municipality has budgeted to spend 8.00% of the operating budget on repair and maintenance for the 2015/2016 financial year.

A requirement of the detailed capital budget (since MFMA Circular 28, which was issued in December 2005) is to categorize each capital project as a new asset or a renewal/rehabilitation project. Each of the above departments is led by a Senior Manager who is directly responsible to the municipal manager. However, changes in the new financial system are expected to improve the quality of the reports.

O VERVIEW OF BUDGET FUNDING ............................................................ E RROR ! B OOKMARK NOT DEFINED

C OUNCILLOR AND EMPLOYEE BENEFITS ................................................. E RROR ! B OOKMARK NOT DEFINED

C ONTRACTS HAVING FUTURE BUDGETARY IMPLICATIONS

C APITAL EXPENDITURE DETAILS ............................................................. E RROR ! B OOKMARK NOT DEFINED