07350015%2E2012%2E693850

Teks penuh

Gambar

Garis besar

Dokumen terkait

The proposed test procedure is based on finite- sample pivots that are valid without any parametric assumptions about the specific distribution of the disturbances in the multi-

Response of output, inflation, and interest rate factor (first, second, third row, respectively) to a contractionary monetary shock: median and 80% HPD intervals (first

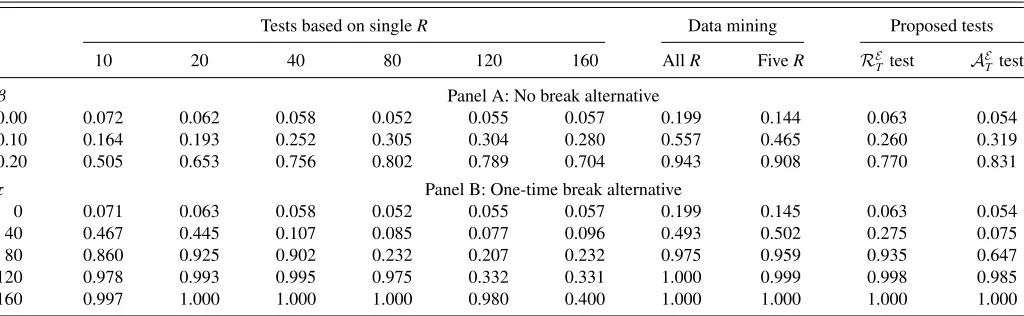

One way to study the finite sample performance of the new forecast rationality tests is to use the bootstrap reality check of White ( 2000 ) or the refinement proposed by Hansen (

mission process between the crude oil and wholesale markets, and to compare the outcome of the testing procedure under dif- ferent temporal aggregation of the time series for

We focus on the characteristics and dynamics of bear market rallies and bull market corrections, including, for example, the probability of transition from a bear market rally into

This section also provides the main theoretical results on the limiting behavior of linear combinations of sample moment conditions and presents an easy-to-implement rank test

Standard segregation indices measure the distance between the distribution of a minority population across units and a counterfactual situation of evenness in which the proportion

Applying our approach to S&P500 index daily returns and option data, we show that one- and two- factor SVS models provide a better fit for both the historical and the