Directory UMM :Data Elmu:jurnal:I:International Review of Economics And Finance:Vol8.Issue4.Nov1999:

Bebas

20

0

0

Teks penuh

Gambar

+2

Dokumen terkait

This paper derives optimal perfect hedging portfolios in the presence of transaction costs within the binomial model of stock returns, for a market maker that establishes bid and

We identify two major sources of the asymmetric return cross-correlation among stock returns: (1) the difference in the sensitivity of stock returns to economic factors, and (2)

Fig. CER for all IPOs, thin-trading IPOs, and heavy-trading IPOs. Cumulative excess returns for 250 trading days surrounding lock-up expiration date for a sample of companies

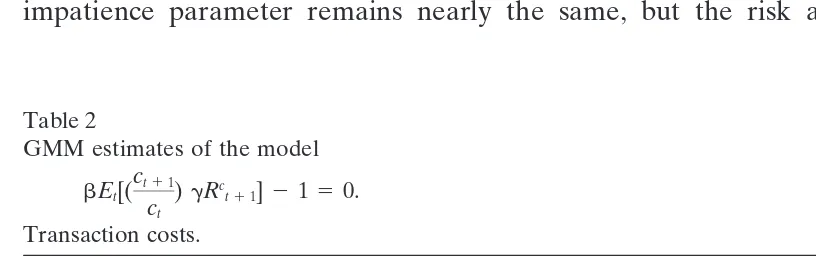

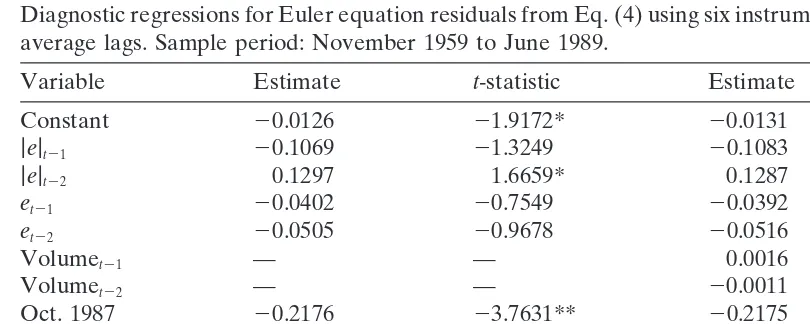

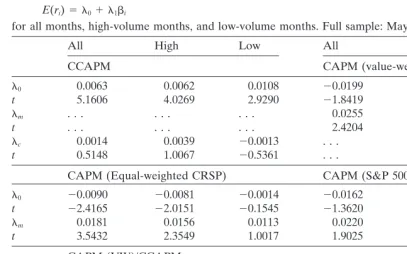

Again, following Fama (1990) we first run regressions of stock returns on the variables proxying for expected stock returns of the following form (Table 3). 1100, Table IV) the