Directory UMM :Journals:Journal Of Public Economics:Vol79.Issue1.Jan2001:

Teks penuh

Gambar

Dokumen terkait

They present new theoretical findings on the economic consequences of estate taxation, new simulation findings on the importance of bequests and other intergenerational transfers

Hence, earnings inequality, the transmission of earnings inequality across generations, the number and spacing of children, assortative mating, heterogeneous rates of return,

Those with substantial unrealized capital gains, for whom the benefits of ‘basis step-up at death’ under the income tax are greatest, are less likely to make large inter vivos

However, in a model of endogenous growth, either a small tax on capital income, whose proceeds are wasted, increases growth and welfare or a small marginal subsidy to

This paper examines the impact of US income and payroll taxes on the decision of wage-and-salary employees to become self-employed. I exploit variations in the tax treatment of wage

In weed-free cauliflower plots, the model esti- mated sufficiently well total biomass production, leaf area growth, plant height and the size of the marketable organ (FigC.

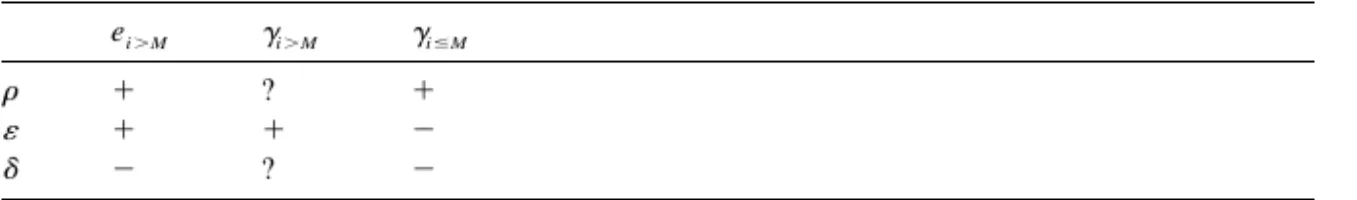

Here, tax structure refers to the mix of taxes on physical capital income, labor income and consumption which satisfy an exogenously given government budget constraint.. The

It concludes that when environmental tax revenues are used to reduce payroll taxes, and if wage-price inflation is prevented, significant reductions in pollution, small gains