07350015%2E2013%2E747800

Teks penuh

Gambar

Garis besar

Dokumen terkait

Fiorentini and Sentana also suggest estimating additional shape parameters together with model parameters, which might improve the efficiency compared with using a prespecified

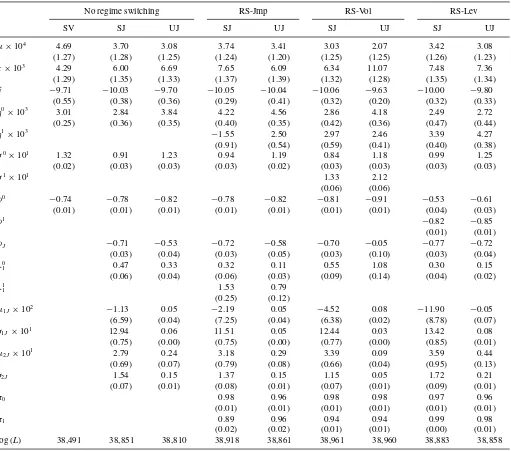

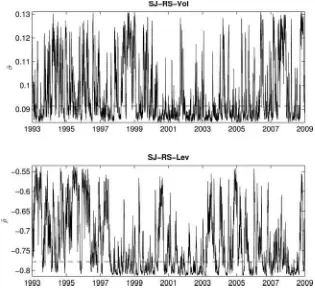

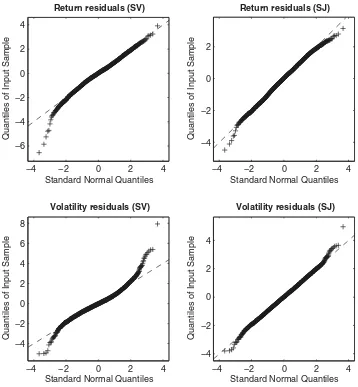

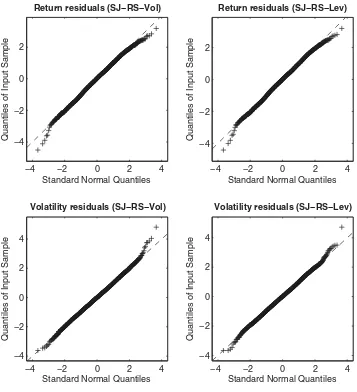

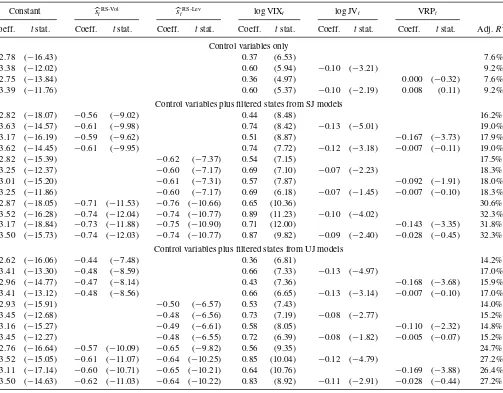

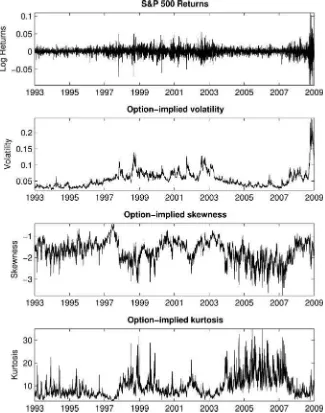

The empirical results with two realized volatility measures and daily returns for five stock indices show the feasibility of the realized BCSV model and demonstrate that the

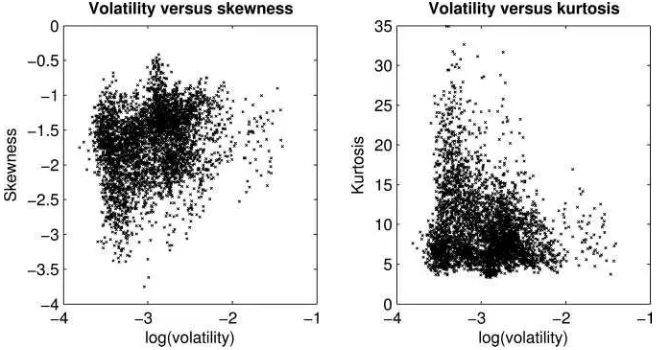

This is consistent with the idea that investors with favorable (unfavorable) expectations about future index movements will buy more call (put) options before price

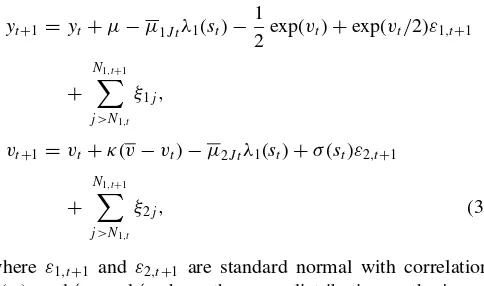

This article proposes a novel stochastic volatility (SV) model that draws from the existing literature on autoregressive SV models, aggregation of autoregressive processes, and

In the first part of the arti- cle, we propose a new reduced-form model in discrete time , the Leverage Heterogeneous Auto-Regressive with Continuous volatility and Jumps

"Indonesian Financial Crisis Prediction Using Combined Volatility and Markov Regime Switching Model Based on. Indicators of Real Interest Rate on

"Public information arrival and stock return volatility: Evidence from news sentiment and Markov Regime-Switching Approach", International Review of Economics & Finance, 2016

Dynamic Feedback Effect And Skewness In Non-Stationary Stochastic Volatility Model With Leverage Sujay K Mukhoti∗ Indian Institute of Management, Kozhikode IIMK PO, Kozhikode; Kerala-