MEMPERKUAT STRUKTUR BISNIS

UNTUK PERTUMBUHAN

restrukturisasi korporasi untuk optimalisasi strategi fokus

pada bisnis inti, pengembangan usaha yang intensif di segmen

zona transisi dan perairan semakin memperkuat pilar usaha

yang akan menjadi tumpuan bagi kinerja yang lebih kokoh

di masa mendatang. Struktur bisnis yang lebih kuat akan

membawa energi baru bagi seluruh elemen di perusahaan

sehingga kami siap mengantisipasi setiap tantangan bisnis yang

semakin dinamis dan mampu memberikan nilai tambah yang

lebih besar bagi

stakeholders

maupun

shareholders

.

Concerning the long-term strategies of the Company,

strengthening business structure is a strategic step for delivering

high and sustainable growth performance. In addition to

Dengan kinerja konsolidasi yang solid dan juga didukung oleh peningkatan kompetensi usaha dan sumber

daya manusia, pengembangan keahlian dan teknologi, perluasan pangsa pasar dan optimalisasi aset

operasional, sejak lima tahun terakhir pendapatan usaha Perseroan terus tumbuh rata-rata 22% per

tahunnya (CAGR). Kinerja tinggi tersebut terutama dikontribusi oleh pendapatan dari kelompok Jasa Hulu

Migas Terintegrasi yang merupakan bisnis inti Perseroan.

Langkah strategis Perseroan untuk terus mengembangkan dan memperkuat kompetensi inti di segmen

zona transisi dan perairan, telah menghasilkan pertumbuhan pendapatan usaha yang mengesankan.

Pendapatan usaha unit bisnis ini mengalami kenaikan signifikan dibandingkan tahun sebelumnya.

2010: TAHUN PERTUMBUHAN DENGAN

MEMPERKUAT STRUKTUR USAHA

Borrowing the solid consolidated performance and higher competence of our business and human

resources, development of skill and technology, enlarged market share and optimalization of operational

assets, operating revenues of the Company in the last five years booked Compound Annual Growth Rate

(CAGR) of 22%. The higher performance was translated from the revenue contribution of the Integrated

Upstream Oil & Gas Services which serves as the core business of the Company.

The strategic steps of the Company to keep developing and strengthening the core competence at

transition zone and marine segment, resulted in an impressive operating revenue growth. Operating

revenue from the business unit considerably rose compared to those of previous years.

Consolidated operating revenues rose 15% to IDR 4.21 trillion of which Integrated Upstream Oil and Gas business group made the biggest contribution.

Rp3,68 triliun

Total Aset Konsolidasi tercatat Rp3,68 triliun, sebagian besar terdiri dari Aset Tetap yang dipergunakan untuk operasional Perseroan. IDR3.68 trillionConsolidated asset value reached IDR3.68 trillion, which was mostly derived from Fixed Assets used for Company’s operation.

9 Penghargaan

Kualitas Jasa

Kinerja operasional Perseroan membanggakan dengan kompetensi yang telah teruji selama lebih dari 40 tahun terus memberikan reputasi yang terpercaya diantaranya 9 pengakuan dan penghargaan dari para klien terkemuka atas kualitas operasi Perseroan.9 Service Quality Awards

IKHTISAR UTAMA

HIGHLIGHTS

Ikhtisar Operasi | Operational Highlights 7

Peta Operasi Jasa Hulu Migas Terintegrasi | Operational Map of Integrated Upstream Oil and Gas Services 8 Peta Operasi Jasa Hilir Migas | Operational Map of Downstream Oil and Gas Services 10 Peta Operasi Jasa Penunjang Hulu Migas | Operational Map of Upstream Oil and Gas Support Services 10

Peristiwa Penting 2010 | Significant Events 2010 12

Penghargaan 2010 | Award 2010 14

Ringkasan Aksi Korporasi 2010 | Summary of Corporate Action 2010 16

Ikhtisar Kinerja Saham | Stock Performance Highlights 19

Kebijakan Dividen | Dividend Policy 24

INFORMASI PERSEROAN

CORPORATE INFORMATION

Sekilas Perseroan | Corporate Overview 26

Sejarah Singkat Perseroan | Corporate Brief History 27

Komposisi Pemegang Saham | Composition of Shareholders 32

Visi dan Misi | Vision and Mission 33

Strategi Jangka Panjang | Long Term Strategy 34

Struktur Korporasi | Corporate Structure 35

Bidang Usaha Perseroan, Anak Perusahaan dan Afiliasi | Business Line of Corporate, Subsidiaries

and Affiliate 36

Struktur Organisasi Perseroan | Corporate Organization Structure 39

LAPORAN MANAJEMEN

MANAGEMENT REPORT

Laporan Komisaris Utama | President Commissioner’s Report 40

Laporan Direktur Utama | President Director’s Report 50

Tanggung Jawab Laporan Tahunan 2010 | Responsibility of Annual Report 2010 63

LAPORAN TATA KELOLA

PERUSAHAAN

CORPORATE GOVERNANCE

REPORT

Komitmen GCG | GCG Commitment 65

Tujuan Penerapan GCG | Objectives of GCG Implementation 65

Pengukuran Implementasi GCG | Measurement of GCG Implementation 66

Struktur dan Hubungan Tata Kelola | Structure and Relation in Good Governance 67 Rapat Umum Pemegang Saham | General Meeting of Shareholders (GMS) 68

Dewan Komisaris | Board of Commissioners 70

Direksi | Board of Directors 73

Komite Audit | Audit Committee 78

Komite Nominasi dan Remunerasi | Nomination and Remuneration Committee 83 Remunerasi Dewan Komisaris dan Direksi | Remuneration of Board of Commissioners and Directors 86

Sekretaris Perusahaan | Corporate Secretary 87

Lembaga dan Profesi Penunjang Pasar Modal | Capital Market Support Institution and Professionals 94

Mekanisme GCG | Mechanism of GCG 95

Sistem dan Prosedur Perseroan | Corporate System and Procedure 98

Pengendalian Risiko Perseroan | Corporate Risk Management 101

Pengawasan dan Pengendalian Internal | Internal Supervision and Control 108

Perkara Hukum Perseroan | Company's Legal Affair 110

MANAGEMENT’S DISCUSSION

AND ANALYSIS

LAPORAN KEBERLANJUTAN

SUSTAINABILITY REPORT

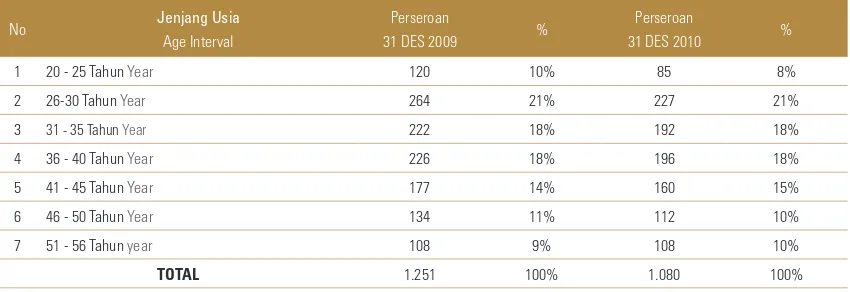

Laporan Sumber Daya Manusia | Human Resources Report 158

Laporan Tanggung Jawab Sosial Perusahaan | Corporate Social Responsibility Report 172

Laporan K3LL | Health Safety and Environment Report 188

INFORMASI TAMBAHAN

ADDITIONAL INFORMATION

Profil Dewan Komisaris | Profile of the Board of Commissionners 196

Profil Direksi | Profile of the Board of Directors 201

Profil Komite Audit | Profile of Audit Committee 206

Profil Komite Nominasi dan Remunerasi | Profile of Nomination and Remuneration Committee 208

Profil Sekretaris Perusahaan | Profile of Corporate Secretary 209

Jaringan Perseroan | Office Network 210

Referensi Terhadap Ketentuan Bapepam-LK mengenai Format Laporan Tahunan | Reference to the

Bapepam-LK Regulation on the Annual Report Format 211

LAPORAN KEUANGAN

KONSOLIDASI TAHUN 2010

2010 CONSOLIDATED

FINANCIAL STATEMENTS

Laporan Keuangan Konsolidasi Tahun 2010 | 2010 Consolidated Financial Statements 223

Laporan Tahunan 2010 ini kami rancang secara khusus agar pembaca dapat memahami lebih baik lagi tentang perkembangan usaha kami.

URAIAN 2006* 2007* 2008* 2009* 2010 DESCRIPTION

LAPORAN LABA RUGI STATEMENTS OF INCOME

Pendapatan Usaha 1.877.981 2.103.690 2.543.193 3.662.331 4.210.786 Operating Revenues

Laba Kotor 348.637 398.745 394.874 543.028 409.875 Gross Profit

Laba Usaha 115.331 144.354 180.387 276.287 134.103 Income from Operations

Depresiasi 89.310 121.016 150.688 203.311 278.286 Depreciation

EBITDA 204.641 265.370 331.075 479.598 412.389 EBITDA

Beban Keuangan 38.732 42.392 58.987 92.958 79.597 Financing Cost

Laba Bersih 83.033 100.140 133.722 466.233 63.906 Net Income

Jumlah Saham Beredar

(ribu lembar) 5.838.500 5.838.500 7.298.500 7.298.500 7.298.500

Number of Shares Issued (thousand shares)

Laba Bersih per Saham Dasar (Rp) 14 17 19 65 9 Basic Earnings per Share (IDR)

NERACA BALANCE SHEETS

Aset Lancar 835.284 994.492 1.619.482 2.548.026 2.040.659 Current Assets

Aset Tetap - bersih 702.095 836.185 1.294.400 1.413.322 1.386.723 Property & Equipment - net

Jumlah Aset 1.808.610 2.159.405 3.317.816 4.207.629 3.678.566 Total Assets

Kewajiban Lancar 736.231 918.095 1.163.382 1.660.411 1.271.960 Current Liabilities

Kewajiban Tidak Lancar 178.588 277.169 522.342 622.965 456.448 Non - Current Liabilities

Jumlah Kewajiban 914.819 1.195.264 1.685.724 2.283.376 1.728.408 Total Liabilities

Hutang Berbunga 296.762 591.871 917.461 983.803 829.075 Interest Bearing Debt

Ekuitas 879.408 948.901 1.613.833 1.909.678 1.937.289 Equity

Modal Kerja - bersih 99.053 76.397 456.100 887.615 768.699 Working Capital - net

Pengeluaran Modal 92.438 156.916 577.558 241.046 179.597 Capital Expenditure

LAPORAN ARUS KAS STATEMENTS OF CASH FLOWS

Kas Bersih dari Kegiatan Operasi 78.849 (142.145) 35.972 288.389 34.030 Net Cash from Operating Activities

Kas Bersih untuk Kegiatan Investasi (29.307) (126.713) (549.049) 320.030 (100.502) Net Cash used in Investments

Kas Bersih untuk Kegiatan Pendanaan 12.038 218.748 807.249 114.663 (333.163) Net Cash from Financing Activities

RASIO KEUANGAN FINANCIAL RATIO

Margin Laba Operasi 6% 7% 7% 8% 3% Operating Profit Margin

Margin Laba Bersih 4% 5% 5% 13% 2% Net Profit Margin

Margin EBITDA 11% 13% 13% 13% 10% EBITDA Margin

Rasio Lancar 113% 108% 139% 153% 160% Current Ratio

Perputaran Total Aset 104% 97% 77% 87% 114% Total Asset Turnover

Imbal Hasil Aset 5% 5% 4% 11% 2% Return on Asset

Imbal Hasil Ekuitas 9% 11% 8% 24% 3% Return on Equity

Hutang/Ekuitas 0,34 0,62 0,57 0,52 0,43 Debt to Equity

Hutang/Total Aset 0,16 0,27 0,28 0,23 0,23 Debt to Total Asset

Hutang/EBITDA 1,45 2,23 2,77 2,05 2,01 Debt to EBITDA

EBITDA/Beban Bunga 5,28 6,26 5,61 5,16 5,18 EBITDA to interest expense

Total Kewajiban/Ekuitas 1,04 1,26 1,04 1,20 0,89 Total Liabilities to Equity

Total Kewajiban/Aset 0,51 0,55 0,51 0,54 0,47 Total Liabilities to Assets

Dalam jutaan Rupiah, kecuali disebutkan lain

* Disajikan kembali * Restated

In millions IDR, unless otherwise stated

10

09 08 07 06

10

09 08 07 06

10

09 08 07 06

63 4.211

3.662 2.543 2.104 1.878

64

466 134 100 83

134

276 180 144 115

IKHTISAR OPERASIONAL

Operational Highlights

Pendapatan Usaha

Operating Revenues

Jumlah Aset

Total Assets

Laba Usaha

Operating Income

Jumlah Kewajiban

Total Liabilites

Laba Bersih

Net Income

Jumlah Ekuitas

Total Equity

Jasa Hulu Migas Terintegrasi

Integrated Upstream Oil & Gas Services

Jasa Hilir Migas

Downstream Oil & Gas Services

Jasa Penunjang Hulu Migas

Upstream Oil & Gas Support Services

Kontribusi Pendapatan Usaha 2010

Operating Revenue Contribution 2010

Dalam miliar Rupiah In billions IDR

Dalam miliar Rupiah In billions IDR

Dalam miliar Rupiah In billions IDR

Dalam miliar Rupiah In billions IDR

Dalam miliar Rupiah In billions IDR

Dalam miliar Rupiah In billions IDR

06 07 08 09 10

4%

52%

44% 862.810 765.592 249.579

1.073.089 805.880 224.721 1.676.040 570.514 297.359 2.275.854 1.060.517 325.960 2.193.709 1.859.959 157.118

10

09 08 07 06

10

09 08 07 06

10

09 08 07 06

3.679

4.208 3.318 2.159 1.809

1.728

2.283 1.686 1.195 915

1.937

East Kalimantan

South Kalimantan Central Kalimantan

West Kalimantan

West Java

East Java Nanggroe Aceh Darussalam

North Sumatera

West Sumatera Riau

Jambi

Lampung South Sumatera

G E O S C I E N C E S E R V I C E S (GSC) O I L F I E L D S E R V I C E S (OFS) O I L F I E L D S E R V I C E S (OFS)

O I L F I E L D S E R V I C E S (OFS)

O I L F I E L D S E R V I C E S (OFS) D R I L L I N G S E R V I C E S (EDS) G E O S C I E N C E S E R V I C E S (GSC)

G E O S C I E N C E S E R V I C E S (GSC)

Central Java

G E O S C I E N C E S E R V I C E S (GSC)

PETA OPERASI JASA HULU MIGAS TERINTEGRASI

Operational Map of Integrated Upstream Oil and Gas Services

G E O S C I E N C E S E R V I C E S (GSC)

Client: PT Total E&P Indonesie Project: 3D Transition Zone Seismic

Data Acquisition Services Area: Central Tunu, East

Kalimantan

Client: JOB Pertamina - Talisman Project: 3D Land Seismic Data

Acquisition Services Area: Prabumulih, South Sumatera

Client: PT Pertamina EP Project: 3D Land Seismic Data

Acquisition Services Area: Muara Enim, Palembang,

South Sumatera

Client: PT Pertamina EP Project: 2D Land Seismic Data

Acquisition Services Area: Bandar Jaya Lampung,

North Lampung

Client: PT Pertamina EP

Project: Hydraulic Workover Unit Services

Area: Cirebon, West Java Client: PT Pertamina Gas

Project: Installation/insertion of oil pipe

Area: Tempino, Plaju, South Sumatera

Client: Chevron Indonesia Company, Bermuda Project: Hydraulic Workover Unit

Equipment and Services

Area: Balikpapan, East Kalimantan

Client: Pertamina Hulu Energy ONWJ Ltd., USA Project: Hydraulic Workover Unit

Services and Vessels

Area: Kep. Seribu North Jakarta

Client: Lundin Rangkas BV, Belanda Project: 2D Land Seismic Data

Acquisition Services Area: Rangkas, West Java D R I L L I N G S E R V I C E S (EDS)

Client: KSO Pertamina EP- Benakat Barat Petroleum Project: Drilling Rig 550 HP Services

Area: Pendopo, South Sumatera

Client: PT Pertamina EP

Project: Perforating, Data Processing (EWLPP) services Area: Karang Ampel, West Java

G E O S C I E N C E S E R V I C E S (GSC) Client: JOB Pertamina - Medco

Simenggaris Project: 2D Land Seismic Data

Acquisition Services Area: Simenggaris, East

Southeast Sulawesi South Sulawesi

West Papua North Sulawesi

Peta Operasi Major Projects Divisi Geoscience Services (

GSC

)

Peta Operasi Major Projects Divisi Drilling Services (

EDS

)

Peta Operasi Major Projects Divisi Oilfield Services (

OFS

)

O I L F I E L D S E R V I C E S (OFS)D R I L L I N G S E R V I C E S (EDS)

G E O S C I E N C E S E R V I C E S (GSC) G E O S C I E N C E S E R V I C E S (GSC)

Client: Chevron West Papua Ltd., Bermuda

Project: 2D Transition Zone Seismic Data Acquisition Services Area: Karas dan Kaimana, West

Papua Client: Murphy South Barito Ltd.,

Bahama Project: 2D Land Seismic Data

Acquisition Services Area: Banjar Baru, East Kalimantan

Client: Virginia Indonesia Company LLC, USA

Project: Modular rig 1500 HP services Area: Badak, East Kalimantan

D R I L L I N G S E R V I C E S (EDS)

Client: Elnusa Bangkanai Energy Ltd., British Virgin Islands Project: Land Drilling Rig 2000 HP

services Area: Bangkanai, Central

Kalimantan

Client: Chevron Makassar Ltd, Bermuda

South Kalimantan

PETA OPERASI JASA PENUNJANG HULU MIGAS

Operational Map of Upstream Oil and Gas Support Services

Core Activities: Oil & Gas Data Management and Storage Services

Location: BSD Tangerang, Klayan-Cirebon, Prabumulih SIGMA CIPTA UTAMA

PETA OPERASI JASA HILIR MIGAS

Operational Map of Downstream Oil and Gas Services

East Kalimantan

Central Kalimantan West Kalimantan

West Java

East Java Nanggroe Aceh Darussalam

North Sumatra

Riau

Jambi

Lampung South Sumatra

Central Java RITEL BAHAN BAKAR

Business Unit: Kelola SPBU Client: Swasta

Location: Bintaro, Tendean, Fatmawati Ancol, Sunter,Cisalam, Cikampek,Labuan

TRADING

Business Unit: Trading Chemical Client: Exxon Mobil Location: Cepu DEPOT

Business Unit: Mobil Bunker Agent

Client: Ritel

Location: Tj. Mas - Semarang

TRADING

Business Unit: Trading Chemical Client: Elnusa Location: Benakat TRANSPORTATION

Business Unit: Trans. pola All In Klien Client: Pertamina Location: Depot Kertapati DEPOT

Business Unit: Depot sistem VHS

Client: PT Lontar Papyrus

Location: Jambi

DEPOT

Business Unit: Depot sistem VHS

Client: PT TImah

Location: Binyu dan Muntok

TRANSPORTATION Business Unit: Trans. pola All In Client: Pertamina Location: Depot Dumai

TRANSPORTATION Business Unit: Trans. pola All In Client: Pertamina Location: Depot Medan

TRANSPORTATION

Business Unit: Trans. pola Cost & Fee & APMS Client: Pertamina

Location: Depot Pontianak TRADING

Business Unit: Trading Industrial Fuel Client: Hutama Karya Location: Sabang

DEPOT

Business Unit: Depot sistem VHS

Client: PT Arutmin

Location: Senakin

TRADING

Business Unit: Trading Chemical Client: TAC PTM PAN Petalahn Location: Lepas pantai Kep. Natuna

TRADING

Business Unit: Trading BBM Industri Client: Holcim Location: Cikampek

TRADING

Core Activities: Pipe Threading Service and Fabrication

Location: Batam

Core Activities: Oil and Gas Exploration and Production Data Processing and Storage

Location: Jakarta PATRA NUSA DATA ELNUSA FABRIKASI KONSTRUKSI

Southeast Sulawesi

South Sulawesi

West Papua North Sulawesi

TRANSPORTATION Business Unit: Trans. pola All In Client: Pertamina Location: TT. Manggis TRANSPORTATION

Business Unit: Trans. pola Cost & Fee &APMS Client: Pertamina

Location: Depot Banjarmasin TRANSPORTATION

Business Unit: Trans. pola Cost & Fee Client: Pertamina Location: Depot Makassar

TRADING

Business Unit: Trading BBM Industri Client: Nippon Suisan Location: Ambon

TRADING

Business Unit: Trading BBM Client: Tri Kusuma Graha Location: Merauke

Transportasi

Depot

Trading

Ritel Bahan Bakar

TRADINGBusiness Unit: Trading BBM Industri Client: Elnusa

Location: Samarinda

TRANSPORTATION

Business Unit: Trans. pola Cost & Fee &APMS Client: Pertamina

Location: Depot Balikpapan

TRANSPORTATION

Business Unit: Trans. pola Cost & Fee Client: Pertamina Location: Depot Bitung

TRADING

Februari

February

Melalui Divisi Drilling Services, Perseroan mendapatkan penghargaan 1st winner of Housekeeping Rig (Modular Rig) dari VICO.Through Drilling Services Division, the Company won 1st Winner of Housekeeping Rig (Modular Rig) from VICO.

Maret

March

KSO Pertamina EP - Patina Group Ltd memberikan penghargaan atas Excellent Safety Performance 267.264 man hours without LTI kepada Perseroan melalui Divisi Drilling Services.

KSO Pertamina EP-Patina Group Ltd awarded the Company the Excellent Safety Performance over 267,264 man hours without LTI through Drilling Services Division.

31

Perseroan mendapat fasilitas kredit dari The Bank of Tokyo Mitsubishi UFJ Ltd (BTMU) senilai USD22,5 juta. The Company earned a credit facility of USD22.5 million from The Bank of Tokyo Mitsubishi UFJ Ltd (BTMU).

April

April

Kinerja saham ELSA pada posisi puncak sepanjang tahun 2010 pada level 650 dengan korelasi aktivitas rilis pemberitaan mengenai kinerja Perseroan 2009 (Audit) dan 1Q-2010 serta berita target penyelesaian transaksi saham ELSA oleh salah satu pemegang saham mayoritas. Performance of ELSA stock occupied peak position in 2010 at level of 650, correlated with news releases on the Company’s performance in 2009 (Audited) and 1Q-2010, also news on completion target of ELSA-stock transaction by one of the major shareholders.

Mei

May

12

Perseroan menandatangani konfirmasi penyelesaian transaksi dengan Eurorich Group Limited, untuk divestasi 25% saham milik Perseroan di dalam Elnusa Tristar Ramba Ltd. The Company signed confirmation on completion of transaction with Eurorich Group Limited, to divest 25% shares held by the Company in Elnusa Tristar Ramba Ltd.

12

Perseroan berhasil masuk jajaran Top 100 Emiten Terbaik versi Majalah Investor, tepatnya pada urutan ke 16. The Company was ranked 16 in the list of Investor Managazine’s Top 100 Best Listed Companies.

Juni

June

21

Perseroan mengadakan Rapat Umum Pemegang Saham Tahunan, juga terdapat keputusan mengenai susunan pengurus Perseroan yang baru. The Company held the Annual General Meeting of Shareholder with decision of new composition of the management.

Juli

July

5

Pergantian Pemegang Saham Mayoritas dan Pengendali, dari sebelumnya PT Tri Daya Esta kepada PT Benakat Petroleum Energy Tbk. yang memiliki 37,15% saham Perseroan.

The change of Majority and Controlling Shareholder, from PT Tri Daya Esta to PT Benakat Petroleum Energy Tbk dominating 37.15% shares.

30

Saham ELSA berhasil

mempertahankan untuk tetap berada dalam index LQ 45 periode Agustus

2010-Januari 2011. Indeks ini menunjukkan likuiditas perdagangan saham yang cukup tinggi dan diminati investor.

ELSA stock succeeded to secure its position in LQ 45 index in the period of August 2010-January 2011. The index represents high stock trading liquidity and attractive for investors.

Petrochina International Jabung, Ltd. Excellent HSE performance 4.987.071 man hours without LTI. Petrochina International Jabung, Ltd awarded the Excellent HSE Performance over 4,987,071 man hours without LTI.

Agustus

August

Perseroan memperkuat sinergi dengan Pertamina Hulu untuk mengusung Indonesia Incorporated ke pasar internasional.

The Company strengthened synergy with Pertamina Hulu to promote Indonesia Incorporated to international market.

September

September

Perseroan melalui Divisi Geoscience Services berhasil memperoleh kontrak Proyek Transition Seismic Acquisition di area Blok Papua Barat. The Company through Geoscience Services succeeded to obtain Transition Seismic Acquisition project at West Papua Block.

20

22

Elnusa meraih Annual Report Award (ARA) 2009 sebagai Pemenang Pertama kategori Perusahaan private, non-keuangan, listed. Elnusa won Annual Report Award (ARA) 2009 as the first winner in Category of private, non-financial, listed company.

Oktober

October

05

Perseroan mengadakan Vendor Relationship Event sekaligus melakukan Peluncuran ELSA e-Proc. The Company held a Vendor Relationship Event as well as launching of ELSA e-Proc.

November

November

04

Perseroan melalui Divisi Oilfield Services mendapat 3 (tiga) penghargaan dari Total EP Indonesie atas Elnusa Samudra-1 Slickline Boat, Elnusa Samudra-2 Snubbing Barge dan Snubbing Rig #16. The Company through Oilfield Services Division received 3 (three) awards from Total EP Indonesie for Elnusa Samudra-1 Slickline Boat, Elnusa Samudra-2 Snubbing Barge and Snubbing Rig #16.

11

Perseroan menandatangani perjanjian jual beli saham dengan Salamander Energy Group Limited dalam rangka penjualan 100% saham Perseroan di Elnusa Bangkanai Energy Ltd.

The Company signed sell and purchase agreement with Salamander Energy Group Limited in the divestment of 100% shares of the Company in Elnusa Bangkanai Energy Ltd.

24

Tim “Drilling for Water” berhasil menuntaskan pemboran titik pertama di daerah Kalasan

Yogyakarta, dan selanjutnya membantu tersedianya air bersih berkelanjutan dalam tugas kemanusiaan di kawasan pasca letusan Merapi.

Drilling for Water team succeded to complete the drilling on first spot in Kalasan area Yogyakarta, and further helped provide sustainable clean water in humanitarian act in the post-Merapi explosion areas.

Desember

December

08

Perseroan melakukan Public Expose untuk memaparkan kinerja dan prospek bisnis ke depan. The Company conducted Public Expose to convey the business performance and prospect in the future.

09

Perseroan meraih penghargaan “ Terpercaya” dalam Corporate Governance Perception Index (CGPI) 2009 yang diselenggarakan oleh Indonesian Institute for Corporate Governance (IICG) dan Majalah SWA.

The Company was recognized as "Trusted” in Corporate Governance Perception Index (CGPI) 2009 held by Indonesian Institute for Corporate Governance (IICG) and SWA Magazine.

15

PT Patra Nusa Data (PND) salah satu anak perusahaan Perseroan, meluncurkan produk Inameta Platinum dengan akses informasi berbasis web, menggunakan teknologi Geographic Information System (GIS).

PT Patra Nusa Data (PND), a subsidiary of the Company, launched Inameta Platinum product offering access to web-based information using Geographic Information System (GIS) technology.

22

Peresmian operasional Warehouse ELSA Utama di Sentul City yang memiliki konsep warehouse terpadu.

The operational inauguration of the Main ELSA Warehourse in Sentul City, which promotes integrated warehouse.

Aksi Hijau Perseroan untuk tahun 2011 dicanangkan dengan program “Derma 2011 Pohon”

The Company’s Green Campaign for 2011 was launched under “Derma 2011 Tree” program.

24

PENGHARGAAN 2010

Awards 2010

1st Winner of Housekeeping Rig (Rig EMR#001)

Dari: VICO

1st Winner of Housekeeping Rig (Rig EMR#001) From: VICO

Excellent HSE Performance 267.264 man hours without LTI

Dari: KSO Pertamina EP – Patina Group

Excellent HSE Performance 267,264 man hours without LTI From: KSO Pertamina EP – Patina Group

Pengelolaan K3LL dengan 1.500 pekerja untuk > 5 juta jam kerja Dari: Pertamina Rengas Dengklok

Excellent HSE Performance with 1,500 employees for > 5 million man hours

From: Pertamina Rengas Dengklok

Excellent HSE Performance 645.687 man hours without LTI

Dari: Pasir Petroleum Resources Ltd.

Excellent HSE Performance 645,687 man hours without LTI From: Pasir Petroleum Resources Ltd.

Excellent HSE performance 1.000.000 man hours without LTI

Dari: Ranhill Jambi PTE

Excellent HSE performance 4.987.071 man hours without LTI

Dari: Petrochina International Jabung Ltd

Excellent HSE performance 4,987,071 man hours without LTI From: Petrochina International Jabung Ltd

Juara 1 Annual Report Award kategori private, non keuangan,

listing company

Dari: Bapepam-LK dan Bursa Efek Indonesia

1stWinner of Annual Report Award for category of Private, Non-Financial, Listed Company

From: Bapepam-LK and Indonesia Stock Exchange

1.000 days no LTI ELSA-1 Slickline Boat

Dari: Total E&P Indonesie

1,000 days no LTI ELSA-1 Slickline Boat From: Total E&P Indonesie

1.000 days no LTI ELSA-2 Snubbing Barge

Dari: Total E&P Indonesie

1,000 days no LTI ELSA-2 Snubbing Barge From: Total E&P Indonesie

3.000 days no LTI Rig # 16 Snubbing Unit

Dari: Total E&P Indonesie

3,000 days no LTI Rig # 16 Snubbing Unit From: Total E&P Indonesie

“Perusahaan Terpercaya” dalam Corporate Governance Perception Index 2010

Dari: Indonesian Institute for Corporate Governance (IICG) dan Majalah SWA

RINGKASAN AKSI KORPORASI

Summary of Corporate Action

Divestasi atas 25% kepemilikan saham

Perseroan di Elnusa Tristar Ramba Ltd.

Divestment of 25% Company's share

ownership on Elnusa Tristar Ramba Ltd.

Divestasi atas 100% kepemilikan saham

Perseroan di Elnusa Bangkanai Energy.

Divestment of 100% Company's share

ownership on Elnusa Bangkanai Energy.

25%

100%

Sejalan dengan strategi Perseroan untuk meningkatkan profitabilitas dan pertumbuhan dengan fokus di Jasa

Hulu Migas Terintegrasi serta melakukan pengembangan bisnis yang lebih bersinergi dengan bisnis utama,

secara konsisten Perseroan melanjutkan aksi korporasi dalam rangka

“re-arranging business portfolio”.

Setelah tahun lalu melakukan penjualan saham Perseroan pada perusahaan afiliasi yang bergerak dalam layanan direktori dan contact center, maka tahun ini Perseroan melakukan divestasi atas saham Perseroan yang terdapat dalam anak perusahaan dan afiliasi yang berada dalam kelompok usaha Asset Based, sebagai berikut:

1. Divestasi kepemilikan saham Perseroan pada Elnusa Tristar Ramba Ltd (ETRL)

• ETRL adalah perusahaan ailiasi Perseroan yang melakukan kegiatan usaha pengelolaan dan pengoperasian lapangan produksi minyak di TAC Blok Ramba, Sumatera.

• Perseroanmemiliki25%sahamETRL,bersama-sama dengan Tristar Global Holding Co., yang memiliki 75% saham ETRL, merefleksikan kepemilikan 60% working interest di lapangan minyak Ramba tersebut.

• Pada tanggal 10 Mei 2010, Perseroan telah menandatangani perjanjian Jual Beli 25% saham Perseroan dalam ETRL dengan Eurorich Group Limited. Pembayaran atas penjualan saham tersebut telah selesai dilakukan pada tanggal 11 Mei 2010 sebesar USD 1 juta. Penandatanganan Surat Konfirmasi Penyelesaian juga telah dilakukan pada tanggal 12 Mei 2010.

• Dana hasil penjualan saham ETRL akan dipergunakan Perseroan untuk memperkuat kompetensi inti Perseroan yaitu dibidang Jasa Hulu Migas Terintegrasi.

2. Divestasi kepemilikan saham Perseroan pada Elnusa Bangkanai Energy Ltd (EBE)

• EBE adalah anak perusahaan Perseroan yang melakukan kegiatan usaha pengelolaan dan pengoperasian lapangan eksplorasi gas di PSC Blok Bangkanai, Kalimantan.

• Perseroan memiliki 100% saham EBE, yang merefleksikan kepemilikan 80% working interest di lapangan gas Bangkanai yang diakuisisi pada tahun 2003 dengan jangka waktu kepemilikan dan operatorship selama 30 tahun.

• Pada tanggal 11 November 2010, Perseroan telah menandatangani Perjanjian Jual Beli untuk divestasi atau pelepasan 100% kepemilikan saham Perseroan dalam EBE dengan Salamander Energy Group Limited.

After the release of the Company's ownership in the affiliate that operated in directory and contact center services, the Company again divested its shares in the Asset-Based subsdiaries and affiliates:

1. Divestment of Company’s share ownership in Elnusa Tristar Ramba Ltd (ETRL)

• ETRL is an afiliate of the Company that runs management and operation of oil production field in TAC Ramba Block, Sumatera.

• TheCompanyheld25%ofETRLsharesalong with Tristar Global Holding Co owned 75%, reflecting the 60% ownership of working interest in Ramba’s oil field.

• OnMay10,2010,theCompanysignedasale and purchase agreement of 25% shares of the Company in ETRL with Eurorich Group Limited. The stock sale was fully paid off on May 11, 2010, for USD1 million. The Confirmation Letter on transaction completion was signed on May 12, 2010.

• The proceeds from ETRL’s stock sale will be used to strengthen core competence of the Company in Integrated Upstream Oil & Gas Services.

2. Divestment of Company's share ownership in Elnusa Bangkanai Energy Ltd (EBE)

• EBEisasubsidiaryoftheCompanyoperatingin management and operation of gas exploration field in PSC Bangkanai Block, Kalimantan.

• The Company owned 100% of EBE’s shares, reflecting 80% ownership of working interest in Bangkanai’s gas field which was acquired in 2003, with ownership and operatorship period of 30 years.

• Dana hasil penjualan saham EBE yang senilai USD 11,2 juta juga dipergunakan Perseroan untuk memperkuat kompetensi inti Perseroan yaitu dibidang Jasa Hulu Migas Terintegrasi. • Namun, untuk dapat memberikan akses yang

lebih mudah bagi Perseroan untuk melakukan kegiatan bisnis inti di lapangan tersebut, Perseroan memutuskan untuk mempertahankan 11% kepemilikan working interest di Lapangan Bangkanai, melalui perusahaan afiliasi (anak perusahaan PT Elnusa Patra Ritel) yaitu Elnusa Chariot International Ltd. Sehingga pasca divestasi Perseroan, komposisi pemegang working interest Lapangan Bangkanai adalah EBE (69%), Bangkanai Petroleum (L) Berhad (15%), Elnusa Chariot International Ltd. (11%) dan Mitra Energia Bangkanai (5%).

Dengan dilepasnya 2 (dua) portofolio Perseroan di

Asset Based tersebut, semakin memantapkan langkah Perseroan untuk terus fokus di Jasa Hulu Migas Terintegrasi. Ditambah dengan pengalokasian dana hasil penjualan saham tersebut juga dipergunakan untuk memperkuat kompetensi dan kapasitas di bisnis inti. Namun begitu, Perseroan tidak menutup kemungkinan untuk melakukan diversifikasi bisnis melalui kepemilikan working interest lapangan migas. Hanya saja porsi kepemilikannya tidak sebagai mayoritas dan bukan sebagai operator, namun sebagai strategi untuk kepentingan sinergi dengan kegiatan jasa hulu migas yang merupakan bisnis inti Perseroan.

TRANSAKSI MATERIAL

Sebagaimana diatur dalam ketentuan Bapepam-LK IX. E.2 tentang Transaksi Material dan Perubahan Kegiatan Usaha Utama, selama tahun 2010 Perseroan tidak memiliki dan melakukan aksi korporasi yang termasuk dalam transaksi material.

TRANSAKSI AFILIASI DAN BENTURAN

KEPENTINGAN

Sebagaimana diatur dalam ketentuan Bapepam-LK IX. E.1 tentang Transaksi Afiliasi dan Benturan Kepentingan Transaksi Tertentu, selama tahun 2010 Perseroan tidak memiliki dan melakukan aksi korporasi yang termasuk dalam transaksi afiliasi maupun benturan kepentingan.

RINGKASAN AKSI KORPORASI

SUMMARY OF CORPORATE ACTION

• TheUSD11.2millionproceedsgeneratedfrom the EBE’s stock sale was used to strengthen the core competence of the Company in Integrated Upstream Oil and Gas Services.

• However, to provide easier access for the Company in operating the core business activities in the field, the Company decided to maintain 11% ownership of working interest in Bangkanai Field through its affiliate (subsidiary of PT Elnusa Patra Ritel), namely Chariot International Ltd. Post divestment action, the composition of the working interest holders at Bangkanai Oilfield is EBE (69%), Bangkanai Petroleum (L) Berhad (15%), Chariot International Ltd. (11%) and Mitra Energia Bangkanai (5%).

Following the divestment of these two Asset-Based portfolios, the Company is becoming more confident to focus on Integrated Upstream Oil and Gas Services. Ini addition, the proceeds from the stock sale will be used to strengthen the competence and capacity of core business. Still, the Company saves a room for business diversification by owning working interest in oil and gas fields. Yet, not as the major shareholders or operator but as strategy for synergy purpose with upstream oil and gas services which is the Company’s core business.

MATERIAL TRANSACTION

According to regulation in Bapepam-LK IX. E.2. concerning Material Transaction and Change of Core Business, the Company in 2010 did not have and conduct any corporate actions that were counted as material transaction.

AFFILIATION TRANSACTION AND CONFLICT

OF INTEREST

Tanggal Date

Tindakan Korporasi Corporate Action

Modal Dasar (miliar) Equity (billion)

Modal Ditempatkan & Disetor Penuh (miliar) Issued and Fully Paid Up

Capital (billion)

Nilai Nominal Per Lembar Saham Nominal Value per

Stock

Jumlah Saham Beredar Total Share

Issued

Pre Corporate Action Rp750 Rp583,85 Rp500 1.167.700.000

09 - 10 - 2007 Peningkatan Modal Dasar Equity Increase

Rp2.250 Rp583,85 Rp500 1.167.700.000

09 - 10 - 2007 Pemecahan Nilai Nominal Saham (Stock Split) 1:5

1:5 Stock Split

Rp2.250 Rp583,85 Rp100 5.838.500.000

06 - 02 - 2008 Initial Public Offering (IPO) 20% dari Modal Dasar atau sebanyak 1.460.000.000 lembar saham, dan mencatatkan (listing) semua saham Perseroan yang beredar sebanyak 7.298.500.000 lembar saham di Bursa Efek Indonesia dengan kode perdagangan “ELSA”

Initial Public Offering (IPO) 20% of Equity

Rp2.250 Rp729,85 Rp100 7.298.500.000

13 - 10 - 2008 s.d/to 12 - 01 - 2009

Pembelian Kembali Saham - (Buyback) sebanyak 99.738.000 lembar saham Buyback

Rp2.250 Rp729,85 Rp100 7.298.500.000

KRONOLOGI PENCATATAN SAHAM STOCK LISTING CHRONOLOGY

KINERJA SAHAM

Setelah mampu menghadapi krisis ekonomi global dengan baik pada tahun 2009, perekonomian Indonesia terus tumbuh secara mengesankan. Berbagai pencapaian positif mampu diraih perekonomian Indonesia pada tahun 2010 antara lain terjaganya stabilitas keuangan, menguatnya nilai tukar Rupiah dan cukup tingginya pertumbuhan ekonomi yang mencapai 6,1%.

Kondisi perekonomian Indonesia yang kuat turut mendorong kenaikan kinerja saham-saham Bursa Efek Indonesia. Indeks Harga Saham Gabungan (IHSG) mampu membukukan kenaikan tertinggi di Asia Pasifik atau naik sebesar 46,1% (year on year) mencapai Rp3.703 pada akhir tahun 2010. IHSG tercatat menjadi salah satu indeks dengan kinerja paling baik di dunia. Saham-saham pertambangan bergerak searah dengan IHSG dan menunjukkan tren meningkat sepanjang tahun 2010. Sektor pertambangan, dimana saham Perseroan (ELSA) dikategorikan, telah mencatat kenaikan 48,59% dan menjadi salah satu penopang kinerja IHSG di tahun

STOCK PERFORMANCE

Successfully riding out global economic crisis in 2009, Indonesia has seen remarkable economic growth. Indonesian economy recorded a series of positive achievements in 2010, among which were financial stability, stronger IDR exchange rate and excellent economic growth reached 6.1%.

The resilient economy of Indonesia was translated into the increased performances of the shares traded at Indonesia Stock Exchange. Jakarta Composite Index (JCI) proved to have the highest increase in Asia Pasific or rose by 46.1% (year-on-year) to IDR3,703 in the end of 2010. JCI was one of the world’s best-performing index.

Mining stocks moved in line with of JCI and confirmed an increasing trend during 2010. Mining sector where the Company’s stock (ELSA) was classified, rose 48.59% and became one of the drivers supporting the index in 2010. Yet, positive

2010. Akan tetapi, momentum positif kenaikan IHSG dan saham-saham sektor pertambangan tidak diikuti oleh kinerja saham ELSA, walaupun kinerja saham ELSA sempat lebih tinggi dibandingkan dengan kinerja IHSG sepanjang kuartal II-2010.

ELSA menutup tahun 2010 pada level Rp325 atau mengalami penurunan sebesar 8,45% dibandingkan harga penutupan tahun 2009. Kisaran harga selama setahun berada diantara Rp285-650. Periode kuartal II-2010 (April-Juni 2010) merupakan periode volume transaksi saham Perseroan paling tinggi dalam setahun, mencapai 94,95 juta lembar saham per hari. Tingginya likuiditas perdagangan saham ELSA pada kuartal II-2010 seiring dengan informasi kinerja 2009 (Audit) dan kuartal I 2010 serta pelepasan 37,15% salah satu pemegang saham mayoritas Perseroan.

Kapitalisasi pasar saham ELSA mengalami penurunan sebesar 7,2% menjadi Rp2,37 triliun pada kuartal IV-2010 seiring dengan melemahnya harga saham ELSA di pasar, yang diantaranya disebabkan karena belum optimalnya pencapaian kinerja keuangan Perseroan di kuartal IV tersebut. Akan tetapi, dengan komunikasi yang baik dari Perseroan mengenai antisipasi, program perbaikan dan prospek usaha dan keuangan kedepan, para pelaku pasar modal tetap memiliki ekspektasi tinggi dan tetap menilai positif prospek usaha Perseroan. Hal ini terlihat dari mulai stabilnya harga saham ELSA di kuartal IV-2010 yang diiringi oleh naiknya volume transaksi rata-rata tahun 2010 menjadi 47,89 juta lembar per hari atau naik sebesar 8,23% dibandingkan dengan volume transaksi rata-rata tahun 2009 yang sebesar 44,24 juta lembar per hari.

ELSA 325 IHSG 3703.51 Mining Sector Index 3274.61

80.00%

60.00%

40.00%

20.00%

0.00%

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

momentum of the increasing index and mining stocks did not happen at ELSA’s performance although ELSA once went higher than JCI’s performance during second quarter of 2010.

ELSA ended the year of 2010 at the level of IDR325 or slipped by 8.45% compared the closing level in 2009. The price for one-year period was in the range of IDR285-650. In the second quarter of 2010 (April-June 2010) , the Company recorded the highest transaction volume in a year amounting 94.95 million shares per day. The high liquidity in ELSA’s trading activity in the second quarter of 2010 was due to the information of Company's performance 2009(Audited) and first quarter of 2010, also the transaction of 37.15% shares by one of the Company’s majority shareholders.

Market capitalization of ELSA stocks declined by 7.2% to IDR2.37 trillion in fourth quarter of 2010 due to weakening ELSA’s stock price, one of which was caused by the drop of financial performance of the Company in the fourth quarter. Yet, following better communication for anticipation, improvement program and the prospect of business and financial condition carried out by the Company, the market players still had high expectation and valued the Company’s business prospect positively. This was indicated from the stable price of ELSA stocks in fourth quarter of 2010 along with average increase in transaction volume in 2010 to 47.89 million shares per day or rose by 8.23% compare to average transaction volume in 2009 which was 44.24 million shares per day.

Berdasarkan kinerja dan likuiditas saham, ELSA telah masuk ke dalam indeks LQ45 empat kali berturut-turut selama periode Februari 2009 hingga Juni 2011, Jakarta Islamic Index, Kompas 100 dan MSCI Index pada bulan Mei 2010. Hal ini merupakan respon dari semakin meningkatnya kepercayaan dan ekspektasi investor terhadap kinerja ELSA. Bahkan, analis-analis di pasar saham memberikan rekomendasi dan keyakinan bagi pelaku pasar untuk mengoleksi saham ELSA. 76% analis yang meng-cover

saham ELSA memberikan rating “Beli”.

Tertinggi

Highest

(IDR)

Terendah

Lowest

(IDR)

Penutupan

Closing

(IDR)

Volume Rata-rata Harian (Lembar)

Daily Average Volume (Shares)

Kapitalisasi Pasar

Market Capitalization (Shares)

(IDR)

Kuartal I - 08 550 260 370 75.667.691 2.700.445.000.000 Quarter I - 08

Kuartal II- 08 445 280 345 33.661.802 2.517.982.500.000 Quarter II- 08

Kuartal III- 08 355 150 200 11.102.595 1.459.700.000.000 Quarter III- 08

Kuartal IV - 08 165 106 117 11.004.535 853.924.500.000 Quarter IV - 08

Kuartal I - 09 177 114 174 25.770.720 1.252.584.588.000 Quarter I - 09

Kuartal II- 09 420 172 340 113.552.226 2.447.579.080.000 Quarter II- 09

Kuartal III- 09 385 300 355 23.063.331 2,555,560,510,000 Quarter III- 09

Kuartal IV - 09 360 280 355 12.122.410 2,555,560,510,000 Quarter IV - 09

Kuartal I - 10 510 310 470 43,490,508 3,430,295,000,000 Quarter I - 10

Kuartal II- 10 650 380 395 94,945,895 2,882,907,500,000 Quarter II- 10

Kuartal III- 10 400 285 340 31,146,542 2,481,490,000,000 Quarter III- 10

Kuartal IV - 10 370 305 325 21,319,911 2,372,012,500,000 Quarter IV - 10

HARGA SAHAM PER TRIWULAN TAHUN 2008-2010 STOCK PRICE PER QUARTER 2008-2010

REKOMENDASI ANALIS TERHADAP SAHAM ELSA ANALYST'S RECOMMENDATION

BeliBuy

NetralNeutral

Volume

HargaPrice

24%

76%

Based on stock performance and liquidity, ELSA has been listed in LQ45 Index four times consecutively for the period of February 2009 until June 2011, Jakarta Islamic Index, Kompas 100 and MSCI Indices since May 2010. This is positive response from the increasing investors' confidence and expectation on ELSA performance. In fact, market analysts recommended and ensured the market to buy on ELSA stock. About 76% of analysts covering ELSA stock gave ‘buy’ rating.

Nama Name

Jabatan Position

Jumlah Saham yang dimiliki Total Share ownership

%

Waluyo Komisaris Utama President Commissioner Tidak ada None 0%

Surat Indrijarso Komisaris Independen Independent Commissioner Tidak ada None 0%

Soehandjono Komisaris Independen Independent Commissioner Tidak ada None 0%

Erry Firmansyah Komisaris Commissioner 1.600.000 lembar 1.600.000 shares 0,02%

Achmad Luthfi Komisaris Commissioner Tidak ada None 0%

Suharyanto Direktur Utama President Director Tidak ada None 0%

Santun Nainggolan Direktur Keuangan Director of Finance Tidak ada None 0%

Suryadi Oemar Direktur Operasi Director of Operation Tidak ada None 0%

M. Jauzi Arif Direktur Pengembangan Usaha Director of Business Development 864.500 lembar 864.500 shares 0,01%

Lucy Sycilia Direktur SDM dan Umum Director of Human Resources and General Affairs 598.000 lembar 598.000 shares 0,01% Stock Ownerships by Board of Commissioners and Directors

Referring to the provisions of Indonesia Stock Exchange No. III.3.4 and III.3.5, the Company is required to report the registration of shareholders of the Company’s Board of Commissioners and Directors. Below is the list of stock ownership of Board of Commissioners and Directors as per December 31, 2010:

In line with information disclosure to Indonesia Stock Exchange (IDX), there was a change in one of majority and controlling shareholders (the owner of 37.15% shares of the Company), from PT Tri Daya Esta to PT Benakat Petroleum Energy Tbk. The takeover transaction was completed on July 5, 2010 through IDX negotiation market.

Kepemilikan Saham Dewan Komisaris dan Direksi

Sesuai dengan ketentuan Bursa Efek Indonesia No. III.3.4 dan III. 3.5 Perseroan berkewajiban melaporkan registrasi pemegang saham Dewan Komisaris dan Direksi Perseroan. Berikut adalah kepemilikan saham Dewan Komisaris dan Direksi Perseroan per 31 Desember 2010:

KOMPOSISI PEMEGANG SAHAM COMPOSITION OF SHAREHOLDERS

Komposisi pemegang saham Perseroan Per 31 Desember 2010

Composition of shareholders as of December 31, 2010:

Pemegang Saham Jumlah Pemegang Saham

Number of Shareholders

Jumlah Saham Total Shares

% Kepemilikan % Ownership

Shareholders

Kepemilikan Saham 5% atau Lebih Holding 5% or More Ownership

PT Pertamina (Persero) 1 3.000.000.000 41,10 PT Pertamina (Persero)

PT Benakat Petroleum Energy Tbk 1 2.711.565.890 37,15 PT Benakat Petroleum Energy Tbk

Kepemilikan Saham di bawah 5% Share Ownership Below 5%

Saham Treasury* 1 99.738.000 1,37 Treasury Stock*

Dewan Komisaris dan Direksi Perseroan 3 3.062.500 0,04 Board of Commissioners and Directors

Masyarakat (masing-masing <5%) 8.869 1.484.133.610 20,33 Public (each <5%)

Jumlah Total 8.875 7.298.500.000 100,00 Total

* Saham Treasury berasal dari saham program buyback.

* Treasury Stocks is derived from buyback program stocks.

Sesuai dengan keterbukaan informasi Perseroan kepada Bursa Efek Indonesia (BEI), telah terjadi perubahan pada salah satu pemegang saham mayoritas (pemegang 37,15% saham Perseroan) dan pengendali yaitu dari semula PT Tri Daya Esta menjadi PT Benakat Petroleum Energy Tbk. Transaksi pengalihan saham Perseroan tersebut seluruhnya selesai dilakukan pada tanggal 5 Juli 2010 melalui pasar negosiasi BEI.

Jan-10

Mar-10

Jun-10

Sep-10

Dec-10

Bank & Asuransi Bank & Insurance

Koperasi & Yayasan Cooperative Union & Foundation

Perseroan Terbatas Limited Liabilities

Dana Pensiun Pension Fund

Badan Usaha Asing Foreign Company

Reksadana Mutual Fund

Individu Domestik Domestic Individuals

Individu Asing Foreign Individuals

Although individual ownership in ELSA stocks declined by 7% in December 2010 compared to same period last year, in overall the percentage of individual ownership in ELSA stocks was still the highest or dominated almost 72% of the composition of less-than-5% ownership as per December 2010. Individual ownership has somehow sustained the liquidity of ELSA trading at the market.

From institution side, in the end of fourth quarter of 2010 the ownership composition of foreign institutions significantly jumped by 800% to 12% against the figure of the same period last year, which was only 1.35% from total composition of less-then-5% ownership as per December 2009. This indicated better and improved confidence of the foreign investors in ELSA. Meanwhile, as per December 31, 2010, pension fund owned 2.5%, mutual fund 1.7%, cooperatives and foundations 0.2%, limited company 10.7% and bank & insurance 0.8%.

In general, all mentioned above showed big attention from market players to ELSA stocks during the year of 2010. The market players were also quite responsive to the information from the Company particularly regarding the sustainable contracts of Integrated Upstream Oil and Gas Services, corporate actions including divestment of subsidiaries and distribution of interim dividend, as well as corporate strategies to strengthen core competence in Integrated Upstream Oil and Gas Services especially in Transition zone and Marine seismic and acquisition. The positive response from the market at the end gave influence to the stock price, transaction volume and composition of ELSA shareholders.

Meskipun kepemilikan saham ELSA oleh individu mengalami penurunan sebesar 7% di bulan Desember 2010 dibandingkan periode yang sama tahun lalu, akan tetapi secara keseluruhan prosentase kepemilikan saham ELSA oleh individu masih yang terbesar atau menguasai hampir 72% komposisi pemegang saham dibawah 5% per Desember 2010. Kepemilikan oleh individu ini mendorong kenaikan likuiditas perdagangan saham ELSA di pasar.

Dari sisi institusi, pada akhir kuartal-IV 2010 komposisi kepemilikan institusi asing mengalami kenaikan yang sangat signifikan yakni naik 800% menjadi 12% dibandingkan periode yang sama tahun sebelumnya yang hanya menguasai 1,35% dari total komposisi pemegang saham dibawah 5% per Desember 2009. Hal ini menandakan bahwa kepercayaan investor asing terhadap ELSA semakin membaik dan terus mengalami peningkatan. Sementara itu, per 31 Desember 2010, kepemilikan dana pensiun sebesar 2,5%, reksadana 1,7%, koperasi dan yayasan 0,2%, perseroan terbatas 10,7% dan bank & asuransi 0,8%.

Secara umum, semua hal tersebut di atas menggambarkan bahwa perhatian pelaku pasar modal selama periode 2010 terhadap saham ELSA cukup tinggi. Pelaku pasar juga terbukti cukup responsif terutama terhadap informasi yang disampaikan Perseroan khususnya mengenai perolehan kontrak-kontrak Jasa Hulu Migas Terintegrasi yang berkelanjutan, aksi korporasi berupa divestasi anak perusahaan dan pembagian dividen interim, hingga strategi Perseroan untuk terus memperkuat kompetensi inti di bidang Jasa Hulu Migas Terintegrasi khususnya di Transition Zone

dan Marine seismic and acquisition. Respon pasar yang positif tersebut pada akhirnya turut serta memberikan pengaruh kepada harga saham, volume transaksi serta komposisi pemegang saham ELSA.

Sedangkan komposisi kepemilikan saham masing-masing < 5% adalah sebagai berikut:

Perseroan merencanakan dan berusaha untuk membagikan dividen dalam bentuk uang tunai sekurang-kurangnya sekali dalam setahun. Besarnya dividen dikaitkan dengan keuntungan Perseroan pada tahun buku yang bersangkutan, dengan tidak mengabaikan tingkat kesehatan Perseroan dan tanpa mengurangi hak dari Rapat Umum Pemegang Saham Perseroan untuk menentukan lain sesuai dengan ketentuan Anggaran Dasar Perseroan.

Dengan mengindahkan ketentuan-ketentuan di atas, Perseroan merencanakan dan berusaha untuk mempertahankan rasio pembayaran dividen sekitar 20% dari laba bersih konsolidasi Perseroan untuk setiap tahunnya.

Penentuan jumlah dan pembayaran dividen tersebut, akan bergantung pada rekomendasi dari Direksi Perseroan, namun tidak terdapat kepastian bahwa Perseroan akan dapat membayarkan dividen pada tahun ini ataupun pada tahun-tahun mendatang. Keputusan Direksi dalam memberikan rekomendasi pembayaran dividen tergantung pada:

•Rencana pengembangan Perseroan dan belanja modal; •Pertimbangan kebijakan pada sektor industri yang

sejenis;

•Kondisi arus kas dan kebutuhan modal kerja Perseroan; •Kebijakan struktur permodalan Perseroan;

•Laba bersih.

Seluruh saham biasa atas nama yang telah ditempatkan dan disetor penuh mempunyai hak yang sama dan sederajat termasuk hak atas pembagian dividen. Dividen yang diterima pemegang saham yang berkebangsaan non-Indonesia akan terkena pajak di Indonesia.

The Company plans and exerts to distribute cash dividend at least once in a year. The dividend percentage strongly relates to the Company’s profit of current book year, by paying attention to the condition of the Company and without reducing the rights of General Meeting of Shareholders to detemine other decision than those stated in the Company’s Article of Assocation.

Regarding the above-mentioned provisions, the Company plans and will maintain its dividend payout ratio at 20% of consolidated net income of the Company annually.

The percentage and dividend payment will be calculated based on recommendation of Company’s Directors, however there is no guarantee that the Company will be able to pay dividend this year or years ahead. In making a dividend payout recommendation, Directors shall consider to: •Company's development plan and capital

expenditure;

• Consideration against applicable policies of similar industries;

• Company’s cash flow and needs of working capital; • Company’s policy on capital structure;

• Net income.

The entire issued and fully-paid ordinary preferred shares offers same and equivalent rights including rights for dividend.

For dividend recieve by non-Indonesian shareholders will be subject to tax in Indonesia.

KEBIJAKAN DIVIDEN

Dividend Policy

Tahun Buku

Book Year

Tanggal RUPST

AGMS Date

Laba Bersih (Rp)

Net Income (Rp)

Tanggal Pembayaran

Payment Date

Jumlah Dividen (Rp)

Total Dividend (Rp)

Dividen per Lembar Saham (Rp)

Dividend per Share (Rp)

Rasio Pembayaran Dividen)1

Dividend Payout Ratio1

2007 15 Mei 2008 Rp100.140.357.333 25 Juni 2008 Rp20.028.071.466 Rp2,74 20,00%

2008 6 Mei 2009 Rp133.772.000.000 25 Juni 2009 Rp26.754.400.000 Rp3,72 20,00%

2009 21 Juni 2009 Rp466.233.000.000 Terbagi dalam 2 tahap: Rp179.969.050.000 Rp25,00 38,60 %

26 Januari 2010)2 Rp143.975.240.000)3 Rp 20,00

16 Agustus 2010 Rp35.993.810.000 Rp5,00

(1) Rasio Pembayaran Dividen (Dividend Payout Ratio) dihitung dari jumlah dividen dibandingkan dengan Jumlah Laba Bersih tahun berjalan.

(2) Merupakan Dividen Interim Tahun 2009, yang diputuskan oleh Rapat Direksi dan Dewan Komisaris tanggal 10 Desember 2009. Besaran dividen berdasarkan jumlah Laba Bersih Perseroan yang diperoleh dalam periode 9 bulan yang berakhir pada tanggal 30 September 2009 sebesar Rp492,544,000,000.

(3) Jumlah Dividen Interim tersebut diperhitungkan dalam pembayaran Dividen final tahun buku 2009.

(1) Dividend Payout Ratio is calculated based on total dividend compared to the Net Income of the Current Year.

(2) Interim dividend paid in 2009, was determined at a Meeting between Directors and Board of Commissioners on December 10, 2009. The dividend percentage was based on Company’s Net Income raised in 9 months ended on September 30, 2009 amounting IDR492,544,000,000.

(3) Interim Dividend was calculated based on Final Dividend of the year book of 2009.

Kronologi Pembayaran Dividen Saham

Perseroan membayar dividen tunai atas saham seperti yang diputuskan oleh Rapat Umum Pemegang Saham Tahunan (RUPST), sebagai berikut:

Chronology of Dividend Payment

SEKILAS PERSEROAN

Corporate Overview

PT Elnusa Tbk Graha Elnusa

Jl. T.B. Simatupang Kav. 1 B Jakarta 12560

Telp: +62 21 78830850 Fax: +62 21 78830883 Email: corporate@elnusa.co.id

Website: www.elnusa.co.id

• Kami merupakan satu-satunya perusahaan nasional yang

memiliki kompetensi terpadu di bidang jasa hulu migas dengan konsep one stop service dan fokus pada kegiatan seismic services, drilling services, dan oilfield services.

• Kami memiliki pengalaman lebih dari 40 tahun dalam industri

migas serta memiliki bisnis pendukung yang kuat di Anak Perusahaan terutama di jasa hilir migas yang telah teruji kompetensinya guna mendukung bisnis inti.

• Kami memiliki reputasi rekam jejak yang membanggakan,

ditunjukkan dengan kualitas kinerja memenuhi standar ISO 90001:2008 dan OHSAS 18001:2007 yang telah diakui oleh perusahaan-perusahaan migas nasional maupun multinasional yang menjadi pelanggan kami.

• Kami memiliki basis pelanggan yang terdiversiikasi dengan

beberapa perusahaan migas nasional maupun internasional sebagai loyal customer dengan wilayah operasi hampir di seluruh wilayah Indonesia dan beberapa wilayah di negara lain.

• Kamiadalahpemimpindiindustriterpadujasahulumigasyang

terbiasa menjalin aliansi strategis dengan profesional dunia sehingga berbudaya professional setara dengan pelaku bisnis migas global.

• Kami merupakan bagian dari keluarga besar Pertamina yang

merupakan perusahaan migas nasional terbesar dan mendapat dukungan dari network pemegang saham lain, regulator dan juga institusi keuangan.

• KamimerupakanperusahaanTerbukadantelahtercatatdiBursa

Efek Indonesia (BEI) sejak 6 Februari 2008 dengan kode transaksi perdagangan “ELSA" dengan praktek tata kelola (Terpercaya) yang diakui oleh IICG.

• Kami melakukan secara konsisten peningkatan kompetensi

sumber daya manusia, kepedulian lingkungan hidup dan implementasi tanggung jawab sosial untuk menjadikan generasi masa depan yang lebih baik.

• We are the only national company having integrated competence in upstream oil and gas services with one-stop service concept, and focusing on seismic services, drilling services, and oilfield services.

• Weareconirmedonmorethan40yearsofexperienceinoil and gas industry, strongly supported by Subsidiaries, particularly engaged in downstream oil and gas services and having been proven for the competence to support the core business.

• Wehavereputableandsatisfyingrecord,asindicatedfrom our performance which has been widely recognized with ISO 90001:2008 and OHSAS 18001:2007 and recognized by both national and multinational companies.

• We also have diversiied customer base consisting of national and international companies as our loyal customers, with widespread operational areas in Indonesia and other countries.

• We are a leading company in integrated upstream oil and gas services and accustomed to strategic alliances with world class professionals, which builds our professional culture equal to the global players in oil and gas.

• We are part of Pertamina’s family, the largest national oil and gas company, and attains big support from other shareholders’ network, regulators and financial institutions.

• We are a public-listed company whose stocks have been listed at Indonesia Stock Exchange since 6 February 2008 under “ELSA” ticker with trusted Governance and accountability.

SEJARAH SINGKAT PERSEROAN

Corporate Brief History

Perseroan didirikan di Jakarta dengan nama PT Electronika Nusantara berdasarkan Akta Pendirian No. 18 tanggal 25 Januari 1969 jo Akta Perubahan Anggaran Dasar No.10 tanggal 13 Februari 1969 di hadapan Notaris Tan Thong Kie SH, yang kemudian diumumkan dalam Berita Negara Republik Indonesia No. 35, Tambahan No. 58 tanggal 2 Mei 1969.

Perseroan mengawali kiprahnya sebagai pendukung operasi perusahaan induk, yaitu PT Pertamina (Persero), terutama dalam memberikan pelayanan–termasuk pemeliharaan dan perbaikan, di bidang peralatan komunikasi elektronik, peralatan navigasi dan sistem radar yang digunakan oleh kapal-kapal milik Pertamina maupun kapal-kapal minyak asing yang memiliki perjanjian kerjasama dengan BUMN Migas.

Seiring perkembangan tantangan dan peluang yang dimiliki, maka pada tahun 1972 Perseroan mulai masuk kedalam industri seismik dengan membentuk divisi

The Company was established under the name PT Electronika Nusantara based on notarial Deed of Incorporation No. 18 dated 25 January 1969 jo Deed of Amandment to Act of Article of Association No. 10 dated 13 February 1969 in front of Notary Tan Thong Kie SH, which was later announced in State Gazette No. 35, Annex No. 58 dated 2 May 1969.

The Company began its operation as the supporting activity of its parent, PT Pertamina (Persero), particularly in providing services-including maintanance and repair, in electronic communication equipment, navigation tools, and radar system used by Pertamina’s vessels as well as foreign oil vessels having agreement with state oil and gas company.

seismic data processing. Untuk melengkapi kompetensi yang telah dibangun, maka pada tahun-tahun berikutnya Perseroan mendirikan perusahaan workover hydraulic

dan mengakuisisi perusahaan drilling. Perseroan juga membangun kompetensi lain yang berhubungan erat dengan kompetensi awal yaitu dengan membentuk dan mengakuisisi beberapa perusahaan penunjang migas dan juga hilir migas serta perusahaan dibidang telematika untuk menyempurnakan struktur bisnis yang dijalankan.

Dalam rangka meningkatkan nilai Perseroan serta memperkuat usaha yang berkelanjutan, Perseroan masuk ke asset based dengan mengakuisisi lapangan eksplorasi gas di Bangkanai, Kalimantan pada tahun 2003. 4 tahun kemudian, Perseroan kembali mengakuisisi lapangan produksi migas di Ramba, Sumatera. Sehingga pada akhir tahun 2006, Perseroan secara total memiliki 14 anak perusahaan dan 2 perusahaan afiliasi.

Sejalan dengan strategi untuk mengoptimalisasikan struktur bisnis dan kinerja Perseroan, pada tahun 2007 Perseroan melakukan restrukturisasi korporasi dan aktivitas bisnis dengan tujuan memposisikan diri sebagai perusahaan Migas pertama di Indonesia yang mampu menawarkan Jasa Hulu Migas Terintegrasi (Integrated Oil & Gas Services) dengan konsep “one-stop services” di bidang pelayanan jasa hulu Migas (integrated upstream services) sebagai bisnis inti dari Perseroan. Empat anak perusahaan yang menjadi tulang punggung bisnis jasa migas digabung ke dalam induk, disamping penggabungan horisontal yang mengukuhkan penunjang bisnis utama.

Pada tahun 2008, setelah dinyatakan efektif menjadi Perusahaan Terbuka, Perseroan juga melakukan Penawaran Umum Perdana dan mencatatkan sahamnya di Bursa Efek Indonesia. Profesionalisme, transparansi, pengelolaan perusahaan dengan etika bisnis yang bersih terpercaya, menjadi keniscayaan yang memotivasi Perseroan untuk siap menjawab tantangan dan peluang bisnis migas di tanah air bahkan mancanegara. Perseroan juga semakin mengukuhkan diri untuk terus memberikan jasa hulu migas yang berkualitas.

Re-engineering business portfolio dengan melakukan divestasi beberapa anak perusahaan dan afiliasi yang memiliki bisnis diluar jasa migas juga dilakukan untuk lebih menfokuskan sumber daya kedalam bisnis inti. Kini, Perseroan memimpin industri jasa terintegrasi di bidang hulu migas, dengan layanan terbaik bagi pelanggannya yaitu perusahaan-perusahaan migas nasional dan multinasional.

To build a comprehensive competence, the Company in the following years set up a workover hydraulic company and acquired a drilling company. The Company also developed other competence strongly related to initial competence, by establishing and acquiring several supporting oil and gas companies and downstream oil and gas companies as well as telematics companies to run better business structure.

To improve Company’s values also strengthen a sustainable business, the Company entered asset-based industry by acquiring a gas field in Bangkanai, Kalimantan, in 2003. About four years later, the Company again conducted an acquisition on an oil and gas field in Ramba, Sumatra. Then in the and of 2006, the Company had a total of 14 subsidiaries and two affiliates.

Considering strategy of optimizing business structure and performance of the Company, in 2007 the Company conducted corporate and business activity restructuring aiming at securing the position of the first Indonesia’s integrated oil and gas company that served one-stop services in Integrated Upstream Oil & Gas Services, which was the core business of the Company. Four subsidiaries that served as the backbone of the Company’s oil and gas service business were then merged into the holding, adding to the horizontal merger to strengthen the core business support.

In 2008, following the effective statement to be a Public Company, the Company conducted the Initial Public Offering and listed its shares in Indonesia Stock Exchange. Professionalism, transparency, managing the Company with business ethics that are clean and trustable, have motivated the Company to be ready for the challenges and opportunities in the country and beyond.

The Company also settled itself for providing the qualified upstream oil and gas services. Re-engineering business portfolio through divestment of shares in subsidiaries and affiliates engaging in the businesses beyond oil and gas services, was taken to direct resources to focus on upstream oil and gas business. Now, the Company leads the integrated upstream oil and gas services, by offering best services to the dedicated clients, namely the national and multinational oil and gas companies.