JOURNAL OF

e

sian

Econon1ics

Full Length Articles

Arup Mrtra. Chandan Sharma, Mane-Ange Veganzones-Varoudakis,

Trade liberalization. technology transfer. and hrms productive

performance. The case of lndran manufacturing

Suyanto. Ruhul Salim. Harry Bloch, Which

ヲセイュウ@benefrt from

forergn direct Investment?

eューセイゥ」。ャ@evidence from Indonesian

manufacturing

16Kazunobu Hayakawa Kenmei Tsubota. Locatron chorce in

low-income countnes Evidence from Japanese rnvestments

in East Asia

30

Rashid Ameer, Frnancial constraints and corporate investment rn

Asian countries

44

Scimago Journal & Country Rank

Home

Journal Rankings

Country Rankings

Viz Tools

Help

About Us

Journal of Asian Economics

Country

Netherlands

35

H Index

Subject Area and

Category

Economics, Econometrics and Finance

Economics and Econometrics

Finance

Publisher

Elsevier BV

Publication type

Journals

ISSN

10490078

Coverage

1990-ongoing

Scope

The Journal of Asian Economics provides a forum for publication of increasingly growing

research in Asian economic studies and a unique forum for continental Asian economic

studies with focus on (i) special studies in adaptive innovation paradigms in Asian economic

regimes, (ii) studies relative to unique dimensions of Asian economic development paradigm,

as they are investigated by researchers, (iii) comparative studies of development paradigms in

other developing continents, Latin America and Africa, (iv) the emerging new pattern of

comparative advantages between Asian countries and the United States and North America.

(

source

)

Enter Journal Title, ISSN or Publisher Name

Quartiles

The set of journals have been ranked according to their SJR and divided into four equal groups, four quartiles. Q1 (green)

comprises the quarter of the journals with the highest values, Q2 (yellow) the second highest values, Q3 (orange) the third

highest values and Q4 (red) the lowest values.

Category

Year

Quartile

Economics and Econometrics

1997

Q3

Economics and Econometrics

1998

Q3

Economics and Econometrics

1999

Q4

Economics and Econometrics

2000

Q3

SJR

The SJR is a size-independent prestige indicator that

ranks journals by their 'average prestige per article'. It is

based on the idea that 'all citations are not created

equal'. SJR is a measure of scienti c in uence of

journals that accounts for both the number of citations

received by a journal and the importance or prestige of

Citations per document

This indicator counts the number of citations received

by documents from a journal and divides them by the

total number of documents published in that journal.

The chart shows the evolution of the average number of

times documents published in a journal in the past two,

three and four years have been cited in the current year.

1997 1999 2001 2003 2005 2007 2009 2011 2013 2015

Economics and Econometrics

the journals where such citations come from It

measures the scienti c in uence of the average article

in a journal, it expresses how central to the global

The two years line is equivalent to journal impact factor

™

(Thomson Reuters) metric.

Cites per document

Year

Value

Cites / Doc. (4 years)

1999

0.126

Cites / Doc. (4 years)

2000

0.250

Cites / Doc. (4 years)

2001

0.179

Cites / Doc. (4 years)

2002

0.327

Cites / Doc. (4 years)

2003

0.713

Cites / Doc. (4 years)

2004

0.718

Cites / Doc. (4 years)

2005

0.593

Cites / Doc. (4 years)

2006

0.754

Cites / Doc. (4 years)

2007

0.677

Cites / Doc. (4 years)

2008

0.758

Total Cites

Self-Cites

Evolution of the total number of citations and journal's

self-citations received by a journal's published

documents during the three previous years.

Journal Self-citation is de ned as the number of citation

from a journal citing article to articles published by the

same journal.

Cites

Year

Value

Self Cites

1999

2

External Cites per Doc

Cites per Doc

Evolution of the number of total citation per document

and external citation per document (i.e. journal

self-citations removed) received by a journal's published

documents during the three previous years. External

citations are calculated by subtracting the number of

self-citations from the total number of citations

received by the journal’s documents.

Cites

Year

Value

% International Collaboration

International Collaboration accounts for the articles that

have been produced by researchers from several

countries. The chart shows the ratio of a journal's

documents signed by researchers from more than one

country; that is including more than one country

address.

Year

International Collaboration

1999

13.79

Citable documents

Non-citable documents

Not every article in a journal is considered primary

research and therefore "citable", this chart shows the

ratio of a journal's articles including substantial

research (research articles, conference papers and

reviews) in three year windows vs. those documents

other than research articles, reviews and conference

papers.

Documents

Year

Value

Cited documents

Uncited documents

Ratio of a journal's items, grouped in three years

windows, that have been cited at least once vs. those

not cited during the following year.

Documents

Year

Value

Uncited documents

1999

83

Uncited documents

2000

70

Uncited documents

2001

64

Uncited documents

2002

54

←

Show this widget in

your own website

Just copy the code below

and paste within your html

code:

<a href="http://www.scimagojr.com/journalsearch.php?q=22736&tip=sid&exact=no" title="SCImago Journal & Country Rank"><img border="0" src="http://www.scimagojr.com/journal_img.php?id=22736" alt="SCImago Journal & Country Rank" /></a>

0.75 0.3 0.6 0.9 1.2 1.5 1.8

1999 2002 2005 2008 2011 2014

0 200 400

1999 2002 2005 2008 2011 2014

0 0.7 1.4 2.1

1999 2002 2005 2008 2011 2014

0 25 50

1999 2002 2005 2008 2011 2014

0 100 200

1999 2002 2005 2008 2011 2014

Developed by:

Powered by:

Follow us on

Editorial Board

Editor-in-Chief:

Michael G. Plummer

The Johns Hopkins University, School of Advanced International Studies, Bologna Center aウウッ」ゥセエ・@ Ed.itors:

R. Click. The Elliott School of lntemational Affairs, The George Washington University, Washington. USA M. Dt.ogey, Institute of Management, Trumpington. Cambridge. UK

K . Hamada, Department of Economics, Yale University. New Haven. USA F. Hsiao, Department of Economics, University of Colorado. Colorado, USA S.L. Husted, Economics Department, University of Pittsburgh. Pittsburgh, USA J . Riedel. School of Advanced International Studies Johns Hopkins University. Maryland, USA

S. Abe, Kyoto, Japan L.A. Winters, Brighton. UK

R. Baht. Atlanta. GA, USA J .R. Behrman, Philadelphia, PA. USA S. Bhuyan, New Brunswick . NJ, USA G.M. Bodnar. Washington DC, USA G. Capannelli, Manila. Philippines

C.C.·Y. Chu, Taipei. Taiwan W. Dobson, Toronto, ONT, Canada

D. Ely. San Diego, CA. USA D.J. Green. Manila. Philippines A.E. Harrison, Berkeley. CA. USA

H. H1ll, Canberra. Australia

G.C. Chow , Pr1nceton, NJ. USA J.M. Dowling. SMU. Singapore A. Heston, Philadelphia. PA. USA

G.H . Jefferson. Waltham . USA S.M. Khan, Bloomsburg. PA, USA

C.H. Lee. Honolulu. HI. USA

Executiw Editors:

M.M. Hutchison, Santa Cruz. CA. USA K. Kalirajan, Tokyo. Japan J.M. Kang. DeKalb, IL, USA

B.K. Kapur, Singapore M. Kishi, Tokyo, Japan A. Kose. Washington, D.C. USA R.F. Kosobud, Chicago, IL, USA S.Y. Kwack, Washington. DC, USA

S. La Croix, Hawaii, USA E. Leamer Los Angeles. CA. USA

K. Lee, Seoul, KQ(ea J. Menon, Manila. Philippines

M. Merva, Rome, Italy

Senior Editors:

J .M. Letiche, Berkeley, CA. USA K. Marwah , Ottawa, ONT, Canada

A. Nasution, Jakarta. 1ndone51a T. Ozawa. Fort Collins. CO. USA G. Papanek,Lexington. MA. USA H.T. Patrick, New York, NY, USA

Book Review Editors:

S . Bhuyan, Rutgers University M. Merva. John Cabot University

Founding Editor:

m Ndオ ョセ@

Rutgers University. New Brunswick. NJ , USA

Articles in Journal of Asian Economics abstracted in Asian Pacific Economic Literature.

C .-G . Moon, Seoul, KQ(ea E. Ogawa. Tokyo, Japan P. Petri, Waltham, MA, USA S. Pitayanon, Bangkok, Thailand M .G. Quibria, Newton, MA, USA

R. Ram, Normal, IL, USA E. Ramstetter, Kitakyushu, Japan S.E. Reynolds. Salt Lake City, UT, USA

S .C. Sharma, Carbondale, IL, USA C. Tuan, Shatin, NT, Hong Kong

J.P. Vere, HUHK, Hong Kong G. Wignaraja, Manila. Philippines

J.P. Winder, New York, USA

D.H. Perkins, Cambridge, MA. USA

Y. Sazanami , Tokyo. Japan A.M. Stem, Ann Arbor. MI. USA J .T.H. Tsao, Potomac, MD, USA

Also covered in the abstract and citation database Scopus®. Full text available on ScienceDirect®.

For a full and complete Guide for Authors, please go to: http://www.elsevier.com/locate/asieco

Journal

of Asian

Economics

Vol. 33

Aims and Scope:

The

journal of

Asian

Economics

provides a forum for publication of increasingly growing research in Asian economic studies

and a unique forum for continental Asian economic studies with focus on (i) special studies in adaptive innovation paradigms in Asian

economic regimes,

(ii)studies relative to unique dimensions of Asian economic development paradigm. as they are investigated by

researchers,

(iii)comparative studies of development paradigms in other developing continents. Latin America and Africa. (iv) the emerging

new pattern of comparative advantages between Asian countries and the United States and North America, and (v) the emerging economic

dimensions following the onecurrency based European Economic Community and the new economic reforms in the Soviet Union and in

Eastern European Countries.

Publication Information:

journal of

Asian

Economics

(ISSN 1049-0078). For

2014. Volumes

30C- 35Cis scheduled for publication.

Subscription prices are available upon request from the Publisher or from the Elsevier Customer Service Department nearest you or from

this journal's website (http:/fwww.elsevier.com/locatefasieco). Further information is available on this journal and other Elsevier products

through Elsevier's website (http:/fwww.elsevier.com). Subscriptions are accepted on a prepaid basis only and are entered on a calendar

year basis. Issues are sent by standard mail (surface within Eu rope, air delivery outside Europe). Priority rates are available upon request.

Oaims for missing issues should be made within six months of the date of dispatch.

Advertising

information: If you are interested in advertising or other commercial opportunities please e-mail Commercialsales@elsevier.com

and your inquiry will be passed to the correct person who will respond to you within 48 hours.

Author inquiries

For inquiries relating to the submission of articles (including electronic submission) please visit this journal's homepage at http://www.

elsevier.com/locate/asieco. For detailed instructions on the preparation of electronic artwork. please visit http:/fwww.elsevier.com/

artworkinstructions. Contact details for questions arising after acceptance of an article, especially those relating to proofs, will be

provided by the publisher. You can track accepted articles at http://www.elsevier.com/trackarticle. You can also check our Author FAQs at

http:lfwww.elsevier.com/authorFAQ and/or contact Customer Support via http://support.elsevier.com.

Orders,

claims, and journal inquiries: please contact the Elsevier Customer Service Department nearest you:

St. Louis: Elsevier Customer Service Department, 3251 Riverport Lane, Maryland Heights, MO 63043. USA; phone: (877) 8397126(toll

free within the USA

I; (

+ 1 )(314) 44788781 outside the USA); fax: ( + 1 )(314) 4478077; e-mail: journaiCustomerService-usa@elsevier.com

Oxford:

Elsevier Customer Service Department, The Boulevard, Langford Lane, Kidlington. Oxford OX5 1GB. UK; phone: (+44) (1865)

843434; fax: ( +44) (1865) 843970; e-mail: journalsCustomerServiceEMEA@elsevier.com

Tokyo: Elsevier Customer Service Department. 4F Higash i-Azabu, 1-Chome Bldg, 1-9-15 Higashi-Azabu. Minato-ku. Tokyo 1 06-0044,japan;

phone: (+81) (3) 5561 5037; fax : (+81 } (3) 5561 5047; e-mail: journalsCustomerServicejapan@elsevier.com

Singapore: Elsevier Customer Service Department, 3 Killiney Road. #08-01 Wins land House I. Singapore 239519; phone: (+65) 63490222;

fax: ( +65) 6733151

O;e-mail: joumalsCustomerServiceAPAC@elsevier.com

Funding

bodyagreements and poUdes

Elsevier has established agreements and developed policies to allow authors whose art.icles appear in journals published by Elsevier, to comply with

potential manuscript archiving requirements as specified as conditions of their grant awards. To learn more about existing agreements and policies

please visit http:lfwww.elsevier.com/fundingbodies

IUustration services

Elsevier's WebShop (http:flwebshop.elsevier.com/illustrationservices) offers lllusrration Services to authors preparing to submit a manuscript

but concerned about the quality of the images accompanying their article. Elsevier's expert illustrators can produce scientific. technical and

medical-style images. as well as a full range of charts. tables and graphs.lmage 'polishing' is also available, where our illustrators take your image(s)

and improve them to a professional standard. Please visit the website

tofind out more.

Language (Usage and Editing services)

Please write your text in good English (American or British usage is accepted, but not a mixture of these). Authors who feel their

English language manuscript may require editing to eliminate possible grammatical or spelling errors and to conform to correct

scientific English may wish to use the English Language Editing service available from Elsevier's WebShop http://webshop.elsevier.com/

languageediting/ or visit our customer support site http:/lsupport.elsevier.com for more information.

The American Committee on Asian Economic Studies (ACAES)

An Inter-university (Nonprofit) Program Founded in 1982

Executive Board: Life Members

Romeo M . Bautista, International Food Policy Research Institute; gイセッイケ@ C. Chow, Princeton University; M. Dutta, Rutgers University; H. Peter Gray, Rensselaer Polytechntc Institute at Troy, NY; Ricnard Hooley, University of Pittsburgh; F. Tomasson Januzi, University of Texas at Austin ; Gary H. Jefferson, Brandeis Umversity; Lawrence A. Klein, University of fYennsylvania; Richard F. Kosobud, University of Illinois at Chicago; Lawrence B. Krause, University of California at San Diego; Lawrence J . Lau, Stanford

University; Chung H. Lee, University of Hawaii at Manoa; Woo セ@ Lee, Bloomsburg University of Pennsytvania; John M. Letiche, University of California at Berkeley; Edward J. Lincoln, The Brookmgs Institution; Kanta Marwah, Csrleton University; James I. Nakarmura, Columbia University; Walter C. Neale, University of Tennessee; Gustav F. Papanek, Boston University; Hugh T. Patrick, Columbia University; Dwight H. Per1<ins, Harvard University; James Riedel, Johns Hopkins University; George Rosen, University of 1//inois at Chicago; Vernon W. Ruttan, University of Minnesota; Kazuo Sato, Rutgers University; Ryuzo Sato, New York University: T.N. Srinivasan, Yale University; Joseph J . Stem, Harvard University; Paul P. Streeten, Boston University; Vincent Su, The Ctty University of New York; Anthony M . t。セN@ Vanderbilt University; James T.H. Tsao, U.S. International Trade Commission; Yien-1 Tu, University of Arkansas at Fayetteville; Calla Wiemer. University of Hawaii at Manoa; Jang H. Yoo, Korea Institute for International Economtc Policy.

M. DUlTA, PRESIDENT AND CHIEF EXECUTIVE OFFICER, 1982-2002

Executive Board: Term Members (Term Ends Dec. 3, 2012)

Edna E. Ehrtich, Erlich International Consulting, New Yor1<, edna_ehrlich88@netzero.net; David Jay Green, Asian Development Bank, Manila, dgreen@adb.org; Frank Hsaio, University of Colorado at Boulder, hsiao@spot.colorado.edu; Steven L. Husted, University of Pittsburgh, husted1+@pltt.edu; Saleem Khan, Bloomsburg University, skhan@planetx.bloomu.edu; sオセ@ Y. Kwack, Howard University, skwack@howard. edu; Hiro l・・LセN@ Nagoya University, Nagoya, Japan, hlee@rieb.kobe-u.ac.jp; Gene Gruver, University of Pittsburgh. gruver+@pitt.edu; Balwant >:)ingh, Bucknell University, singh@bucknell.edu; Sumner LaCroix, Un/verstty of Hawaii, lacroix@hawaii.edu; Keun Lee, Seoul National University, klee1012@plaza .snu.ac.kr; Eric Ramstetter, International Centre for the Study of East Asian Development, ramst@lcsead .or.jp.

Board of Trustees: (2001-2012)

Jere Behrman, University of Pennsylvania, jbehrman@ssc.upenn.edu Members: Richard Kosobud, kosobud@uic.edu

Calla Weimer, cjweimer@hotmail .com

Richard Hooley, President and Chief Executive Officer, University of Pittsburgh, rhooley@pitt.edu

Jere Berrman, Vice President, ... James Riedel, Johns Hopkins University, jriedel@mail.jhuwash.jhu.edu

Executive Officers: (2007-2012):

Director: Michael G. Plummer,

The

Johns Hopkins University, SAIS-Bologna mplummer@jhubc.it; Vice-Director: Chung Lee, lchung@hawaii.edu; Assoc. Directors: Frank Hsiao, University of Colorado, frank.hsiao@colorado.edu; Richard Hooley, University of Pittsburgh , rhooley@pitt.edu; Steven L. Husted, University of Pittsburgh , husted1+@pitt.edu;Gary

H. Jefferson, Brandeis University jefferson@binah.cc.brandeis.edu; Treasurer: Stephen Husted, University of Pittsburgh, husted1+@pltt.eduNomination and Election Committee (2001- 2012)

James Tsao (Chair), George Washington University, tsao@erols.com; John Letiche, University of Cslifomia (Ber1<efey), jletiche@econ. ber1<eley.edu;

Banker.

C>

2014 Elsevier Inc.

This journal and the individual contributions contained in it are protected under copyright, and the following terms and conditions

apply to thei r use in addition

tothe terms of any Creative Commons or other user license that has been applied by the publisher to an

individual article:

Photocopying

Single photocopies of si ngle articles may be made for personal use

asallowed by national copyright laws. Permission is not required

for photocopying of articles published under the CC BY license nor for photocopying for non-commercial purposes in accordance with

any other user license applied by the publisher. Permission of the publisher and payment of a fee is required for all other photocopying,

including multiple or systematic copying. copying for advertising or promotional purposes. resale. and all forms of document delivery.

Special rates are ava ilable for educational institutions that wish to make photocopies for non-profit educational classroom use.

DerlvatJft Works

Users may reproduce tables of contents or prepare lists of articles including abstracts for internal circulation within their institutions or

companies. Other than for articles published under the CC BY license, permission of the publisher is required for resale or distribution

outside the subscribing institution or compa ny.

For any subscribed articles or articles published under a CC BY -NC-ND license, permission of the publisher is req uired for all other

derivative works, including com pilations and translations.

Storage or Usage

Except as outlined above or as set out in the relevant user license. no part of th is publication may

bereproduced. stored in a retrieval

system or transmitted in any form or by any means. electronic. mechanical. photocopying. recording or otherwise. without prior written

permission of the publisher.

Permissions

For information on how to seek permission visit www.elsevier.comfpermissions or call: ( +44) 1865 843830 (UK)

I (

+ 1) 215 239 3804

(USA).

Author rights

Author{s) may have additional rights in their articles as set out in their agreement with the publisher (more information at http:f/www.

elsevier.com/authorsrights).

Notke

No responsibility is assumed by the Publisher for any injury and/or damage to persons or property as

a

matter of products liability, negligence

or otherwise. or from any use or operation of any methods, products, instructions or ideas contained in the material herein. Because of rapid

advances in the medical sciences, in particular, independent verification of diagnoses and drug dosages should

bemade.

Which

firms

benefit

from

foreign

direct

investment?

Empirical

evidence

from

Indonesian

manufacturing

Suyanto

a,

Ruhul

Salim

b,*

,

Harry

Bloch

ba

FacultyofEconomics,UniversityofSurabaya,EastJava,Indonesia

b

CurtinBusinessSchool,CurtinUniversity,Perth,WA6845,Australia

1. Introduction

Thespillovereffectsofforeigndirectinvestment(FDI)havebeenamajorconcernforresearchersandpolicymakers

duringthelasttwodecades.AnumberofstudieshaveexaminedthespillovereffectsofFDIondomesticfirmproductivity

(Chakraborty&Nunnenkamp,2008;Haddad&Harrison,1993;Hu&Jefferson,2002;Javorcik,2004;Liang,2007;Negara& Firdausy,2011;Takii,2005,2011). Thesestudiesprovidesomeusefulinsightsregarding theevidenceof thespillover

benefitsand offersomerecommendationstomaximizethebenefits.However, mostexistingstudiesexcludetechnical

efficiencyandfocusmainlyontechnology,ignoringthattheFDIpresenceinhostcountriesistheimpetusforefficiency

improvementthroughcompetitionanddemonstrationeffects(Wang&Blomstrom,1992).AstudyofFDIspillovereffectson

firm-leveltechnicalefficiencyisimportanttoprovideevidenceastowhetherthelargeamountofFDIinflowsgenerate

positiveexternalitiestodomesticfirmsthroughefficiencyimprovement,thusindicatingwhetherthespilloverhypothesisis

justifiedinthecontextoftechnicalefficiency.SuchastudycanexploretowhatextentFDIcaninduceefficiencyspillovers,

andwhichfirmtypesreallybenefitfromthespillovers.

JournalofAsianEconomics33(2014)16–29

ARTICLE INFO

Articlehistory:

Received22November2012 Receivedinrevisedform8May2014 Accepted11May2014

Availableonline19May2014

JELclassification:

D24 D29 F23

Keywords:

Foreigndirectinvestment Spillovereffects Technicalefficiency Stochasticproductionfrontier Indonesia

ABSTRACT

Despitegrowingconcernregardingtheproductivitybenefitsofforeigndirectinvestment (FDI),veryfewstudieshavebeenconductedontheimpactofFDIonfirm-leveltechnical efficiency.Thisstudyhelpsfillthisgapbyempiricallyexaminingthespillovereffectsof FDIonthetechnicalefficiencyofIndonesianmanufacturingfirms.Apaneldatastochastic productionfrontier(SPF)methodisappliedto3318firmssurveyedovertheperiod1988– 2000. The results reveal evidence of positive FDI spillovers on technical efficiency. Interestingdifferencesemergehoweverwhenthesamplesaredividedintotwoefficiency levels.High-efficiencydomesticfirmsreceivenegativespillovers,ingeneral,while low-efficiencyfirmsgainpositivespillovers.Thesefindingsjustifythehypothesisofefficiency gaps,thatthelargeristheefficiencygapbetweendomesticandforeignfirmstheeasierthe formerextractsspilloverbenefitsfromthelatter.

ß2014ElsevierInc.Allrightsreserved.

*Correspondingauthorat:SchoolofEconomics&Finance,CurtinBusinessSchool,CurtinUniversity,WA6845,Australia.Tel.:+61892664577; fax:+6192663026.

E-mailaddress:Ruhul.Salim@cbs.curtin.edu.au(R.Salim).

ContentslistsavailableatScienceDirect

Journal

of

Asian

Economics

http://dx.doi.org/10.1016/j.asieco.2014.05.003

Amongthedevelopingeconomies,IndonesiaisparticularlysuccessfulinattractingFDI.NetFDIinflowstoIndonesiahave

risenmorethan30timessince1986,reachingarecordlevelofUS$8.3billionin2008(theCentralBankofIndonesia,2011).

However,thereisadearthofresearchonefficiencyspilloversinIndonesia.Mostempiricalstudiesexaminespillovereffects

undera frameworkofthelong-runequilibriumproductionfunction,whichassumesthatfirmsareproducingata full

efficiencylevel.Underthisframework,theFDIspilloversontechnicalefficiencyarenotcaptured.

Twopreviousstudiesbytheauthorsfocusontechnicalefficiencyusingastochasticproductionfrontierframeworkfor

individual Indonesian manufacturing industries. Suyanto, Salim, and Bloch (2009) examine the pharmaceutical and

chemicalindustries,whileSuyantoetal.(2012)examinetheelectronicandgarmentindustries.However, thereareno

studiesprovidingcomprehensiveresultsforthewholeIndonesianmanufacturingsectorusingastochasticframework.

AstudybyTemenggung(2007)examinesthewholeIndonesianmanufacturingsector.Ourcurrentresearchdiffersfrom

Temenggunginthreeimportantpoints.Firstly,Temenggungappliestheordinaryleastsquared(OLS)regressionmethodfor

paneldata,whichdoesn’tdistinguishbetweenfixedeffects(FE)andrandomeffects(FE).Secondly,theclassicalproduction

function,employedinTemenggung(2007),assumesthatallfirmsarefullyefficient,sothatthespillovereffectsofFDIreflect

technological progress. In contrast, the current paper employs the stochastic production frontier, which relaxes the

assumptionoffullefficiencyoffirms,sothatbothtechnologicalprogressandefficiencyimprovementareexamined.Thirdly,

wecalculatethescoresoftechnicalefficiencyofeachfirmandestimatesspillovereffectsseparatelyforhigh-efficiencyand

low-efficiencyfirms,providingausefulinsightintothedifferencesintheabilityofhigh-efficiencyandlow-efficiencyfirms

inabsorbingspillovereffectsfromFDI.

Thisstudycontributestotheexistingliteratureinseveralways.Firstly,itexaminesthespilloverhypothesisbyfocusing

ontechnicalefficiency,animportantaspectthatisoftenneglectedinthepreviousstudies.Theadoptionofastochastic

productionfrontierallowstheauthorstoinvestigatetheeffectsofFDIspilloversonfirm-leveltechnicalefficiency.Secondly,

thisstudycoversalongseriesofsurveyedfirms,whichincludesalsotheperiodoftheAsiancrisisonwards.Thirdly,this

study evaluates horizontal, backward, and forward spillovers of FDI. Most importantly, by examining the whole

manufacturing sector,it is possibletoidentifycharacteristics ofindustries that affect thesizeof thetechnology and

efficiencyspilloverstodomesticfirmsfromFDI.Inparticular,wefindevidencethatthesizeofthetechnologygapbetween

foreignanddomesticfirmsiscritical,withlargerefficiencygapsassociatedwithgreaterefficiencyspilloversfromFDI.

Weproceedbyreviewingtheconceptofspillovereffectsinthenextsection.Wethendiscussmethodologyanddata.

EmpiricalresultsarepresentedinSection4andtheconclusionsaregiveninthefinalsection.

2. FDI,spillovereffects,andtechnicalefficiency:theoreticalconceptandempiricalevidence

2.1. FDIandspillovereffects

Foreigndirectinvestmentisbelievedtoprovidehostcountrieswithdirectandindirectbenefits.Thedirectbenefitstake

theformsofnewinvestmentsthatboostnationalincome,increasetaxrevenues,andprovidenewemployment;whereasthe

indirectbenefitsareintheformsofexternalitiesthataregeneratedthroughnon-marketmechanismstorecipienteconomies

anddomesticfirmswithintheeconomies(Hymer,1960).TheseindirectbenefitsarecommonlyknownasFDIspillovers.

TheliteratureidentifiesatleastthreetypesofFDIspillovers.Theseareproductivityspillovers,market-accessspillovers,

and pecuniaryspillovers.Productivityspilloversaredefinedastheexternalities fromFDI thatleadtoincreasesinthe

productivityofdomesticfirms(Aitken&Harrison,1999).Market-accessspilloversexistwhenthepresenceofFDIgenerates

anopportunityfordomesticfirmstoaccessinternationalmarkets(Blomstrom&Kokko,1998).Pecuniaryspillovershappen

iftheexistenceofFDIaffectstheprofitfunctionsofdomesticfirmsthroughareductionincostsoranincreaseinrevenues

(Gorg&Strobl,2005).

OfthethreetypesofFDIspillovers,productivityspillovershavebeenaparticularconcernamongpolicymakersand

researchersinthelasttwodecades.VariousincentiveshavebeenprovidedbypolicymakerstoattractFDIandsubstantial

effortshavebeendevotedbyresearcherstoevaluatetheproductivityadvantage.However,theempiricalevidenceismixed

atbest.Somestudiesfindevidenceofpositiveproductivityspillovers(Caves,1974;Javorcik,2004;Kugler,2006;Schiff&

Wang,2008;Temenggung,2007),butothersdiscovernonexistentorevennegativespillovers(Aitken&Harrison,1999; Blalock&Gertler,2008;Djankov&Hoekman,2000).Thus,therelationshipbetweenFDIspilloversandfirmproductivity

remainsacontroversialissue.

2.2. Spillovereffectsandfirm-specificcharacteristics

Some researchersarguethat themixedevidenceintuitively impliesthat thespillover effects arenotan automatic

consequenceoftheforeignpresenceinaneconomy,rathertheydependsignificantlyonthecharacteristicsoffirmsinthe

industries(Gorg&Greenaway,2004;Lipsey&Sjoholm,2005;Smeets,2008).Oneimportantcharacteristicoffirmsisthe

technologygapbetweenforeignanddomesticfirms.InastudyonUKmanufacturingfirms,Griffith,Redding,andSimpson

(2002)findthatthewiderthetechnologygapthelargertheFDIspillovereffectsthatareobtainedbydomesticfirms.This

findingindicatesabenefitofbeinglessadvancedintermsoftechnology,whichsupportsthetheoreticalargumentinFindlay

(1978).AsimilarresultisdiscoveredalsobyCastellaniandZanfei(2003)forFranceandSpain,andbyPeriandUrban(2006)

forItalyandGermany.

Althoughthereisanadvantageinbeinglessadvanced,thetechnologygapshouldnotbetoowide(Wang&Blomstrom,

1992).Aminimumleveloftechnologyisrequiredfordomesticfirmstoabsorbthenewtechnologyfromforeignfirms.When

thegapistoowide,thelimitedkindabsorptivecapacityofdomesticfirmsmaynotpermitassimilationthenewtechnology

(Glass&Saggi,1998).

2.3. TechnicalefficiencygainsfromFDIspillovers

EarlierstudiesonFDIproductivityspilloversfocusontechnologyadvantages(Gorg&Greenaway,2004).Theknowledge

from foreignfirms is regarded synonymously withtechnological knowledge, as this is consistent with the useof a

conventionalproductionfunction.Managerialandorganizationalknowledgethatmayleadtoefficiencyspilloversarenot

portrayedsincefirmsareassumedtobeproducingatthelong-runequilibriumwithafullefficiencycapacity.Thus,the

productivityspilloversintheseearlystudiesareidenticallymeasuredastechnologyspillovers.

Morerecentstudiesfocusonbothefficiencyandtechnologyadvantages.Inthesestudies,knowledgeisdefinedbroadlyas

product,process,managerial,andorganizationalknowledge.Hence,productivityspilloversleadtobothtechnologyand

efficiencyadvantages.Unfortunately,studiesthatinvestigateefficiencyadvantagesarenotplentiful.InastudyonGreek

manufacturingfirms,DimelisandLauri(2002)examinetheeffectofforeignequitysharesonefficiencyandfindapositive

relationshipbetweenthesetwovariables.Also,GhaliandRezgui(2008)analyzetheTunisianmanufacturingsectorandfind

thathigherforeignshareincreasefirmefficiency.Addressingthesameissuebutemployingadifferentestimationmethod,

ourstudyinvestigatestheefficiencyspilloversinIndonesianmanufacturingfirms.WeextendthestudiesbyDimelisand

Lauri(2002)andGhaliandRezgui(2008)byfocusingonverticalspilloversaswellashorizontalspillovers.

3. Methodology,dataset,andvariables

3.1. Methodology

There are twocommonly used methods in measuringefficienciesand productivityat thefirm level, namelydata

envelopment analysis(DEA) and stochastic frontieranalysis (SFA).1 Eachof thetwo methods hasits advantages and

disadvantages,asexplainedbelow.Thechoicebetweenthesemethodsthusdependsontheobjectiveoftheresearch,the

typeoffirmsinthechosenindustry,andthenatureofthedata(Coelli,Rao,O‘Donnell,&Battese,2005;Olesen,Peterson,&

Lovell,1996).

DEAisalinearprogrammingmethodthatobservesproductionpossibilitiesusingthetechniqueofenvelopmentand

measuresefficiencyasthedistancetothefrontier(Banker,Charnes,&Cooper,1984;Charnes,Cooper,&Rhodes,1978).This

methodhastheprimaryadvantageofbeingofanon-parametricnatureandhastheabilitytohandlemultipleoutputsand

multipleinputs.2However,ithasthedisadvantageofproducingbiasedestimatesinthepresenceofmeasurementerrorand

otherstatisticalnoise,asthismethoddoesnotseparatethestochasticrandomnoisefromtheinefficiencyeffects(Schmidt,

1985).Hence,theestimationresultsunderthismethodtendtobeverysensitivetosmallchangesinthedata.

Alternatively,thestochasticfrontiermethodisaregression-basedmethodthatassumestwoseparateunobservederror

terms,onerepresentsefficiencyandtheotherrepresentsstatisticalnoise(Aigner,Lovell,&Schmidt,1977;Meeusen&van

denBroeck,1977).Ithasachiefadvantageintheabilitytomeasureefficiencyinthepresenceofstatisticalnoise.However,

thismethodisparametricandrequiresaspecificfunctionalformanddistributionalassumptionsfortheerrorterms(Coelli

etal.,2005).

InthisstudythestochasticfrontiermethodisappliedtoanalyzethespillovereffectsfromFDI.Theone-stagestochastic

productionfrontier(SPF)isusedtoestimateaproductionfrontierandatechnicalinefficiencyfunctionsimultaneously.As

pointed out by Kumbhakar,Ghosh, and McGuckin(1991) and Wangand Schmidt (2002),the one-stage approach is

preferable than thetwo-stage approach,as thelatter exhibitsat least twolimitations in estimation that can leadto

potentiallyseverebias.Thefirstlimitationisthattechnicalefficiencymightbecorrelatedwiththeproductioninputs,which

maycauseinconsistentestimatesoftheproductionfrontier.ThesecondlimitationistheOLSmethodinthesecondstageis

inappropriatesincetechnicalefficiencydistributionisassumedtobeone-sided.Consideringtheadvantages,thecurrent

studyadoptstheone-stageapproach,followingBatteseandCoelli(1995).

TheBattese–Coelliproductionfrontiercanbeexpressedasfollows:

yit¼ fðxit;t;

b

Þexpðv

ituitÞ (1)andtheinefficiencyfunctionmaybewrittenas:

uit¼zitdþwit (2)

1

ComprehensivereviewsofthetwomethodsareprovidedbyForsundetal.(1980),Bauer(1990),Bjureketal.(1990),Bravo-UretaandPinheiro(1993),

Greene(1993),Lovell(1993),andCoelli(1995).

2 Thenon-parametricnatureofDEAallowsformeasuringefficiencywithoutimposingaspecificfunctionalformandadistributionalassumptionondata.

Suyantoetal./JournalofAsianEconomics33(2014)16–29

whereyitdenotestheproductionoftheithfirm(i=1,2,...,N)inthetthtimeperiod(t=1,2,...,T),xitdenotesa(1k)vector

ofexplanatoryvariables,

b

representsthe(k1)vectorofparameterstobeestimated,expdenotesexponential,v

itisthetimespecificandstochasticerror,withiidN(0,

s

2v),anduitrepresentstechnicalinefficiency,whichisassumedasafunctionofa

(1j)vectorofobservablenon-stochastic explanatoryvariables,zit,anda(j1)vectorofunknownparameterstobe

estimated,

d

,andwitisanunobservablerandomvariable.TheparametersofEqs.(1)and(2)areestimatedusingthemaximumlikelihoodestimator(MLE)byfollowingthethree

stepsasexplainedinCoelli(1996).Withsimultaneousequationestimation,theMLEestimatesareunbiasedandefficient.

ThevarianceparametersoftheBattese-Coelli’smodelaredefinedas

s

2sBB

s

2v+s

2

uand

g

BBs

2u/s

2s.3g

isanimportantparametertodecidewhetherthereistechnicalinefficiencyornotinthemodel.Iftheestimatedvalueofg

isnotstatisticallysignificant,thereisnotechnicalinefficiencyandtheresultsobtainedfromestimatingEq.(1)byordinaryleastsquares(OLS)wouldbeefficient.Incontrast,iftheestimatedvalueof

g

isstatisticallysignificant,thenthereistechnicalinefficiencyandEqs.(1)and(2)shouldbeestimatedsimultaneously.

ThetechnicalefficiencyoftheithfirmcalculatedfromtheEqs.(1)and(2)istheratioofobservedoutputofthefirmtoits

potentialmaximumoutput,whichcanbewrittenas:

TEit¼

yit

yP

it

¼expðuitÞ (3)

FollowingBatteseandCoelli(1988),thebestestimatoroftheexp(uit)isitsconditionalexpectation,E[exp(uit)],so

technicalefficiencycanbewrittenas:

TEit¼E½expðuitÞ (4)

Ifitisassumedthattheproductionfrontiertakestheformofalog-linearproductionfunctionandtherearefourinput

variables(labour,capital,material,andenergy)intheproductionprocess,theempiricalmodelcanbeexpressedinnatural

logarithmsofvariablesas:

lnYit¼

b

oþb1

lnLitþb2

lnKitþb3

lnMitþb4

lnEitþþb5

Tþb6

lnFDlSectorþv

ituit (5)whereYisoutput,Lislabour,Kiscapital,Mismaterial,Eisenergy,Tisatime-trendvariablethatincreasesbyoneforeach

year,FDI_SectorisameasureofFDIhorizontalspilloversasexplainedinthenextsectionandtheothervariablesareas

previouslydefined.

TheinefficiencyeffectasafunctionofasetofFDIvariables,ayeardummy,anindustrydummy,andafirmdummycanbe

writtenas:

uit¼

d0

þd1

FDIFirmitþd2

FDISectorjtþd3

FDIFirmitFDISectorjtþd4

Yearþd5

Industryþd6

Firmþwit (6)whereFDI_Firmisadummyvariableforforeigndirectinvestmentthattakesavalueofzeroifafirmhasnoforeignownership

shareandtakesavalueofoneifaforeignfirmhasapositiveshare,FDI_Sectorisasdefinedabove,Yearisayeardummy

variable,IndustryisanindustrydummyandFirmisafirmdummy.TheinteractiontermofFDI_FirmFDI_Sectorisincluded

intheinefficiencyequationtoestimatewhetherforeignanddomesticfirmsbenefitequallyfromthepresenceofanew

foreignfirm.Apositive(negative)coefficientontheinteractiontermindicatesless(more)efficiencygainforforeignfirms

thanfordomesticfirms.

Eq.(6)isusedtoestimatetheintra-industryspillovers,whichcapturetheeffectsofforeignpresenceonthetechnical

efficiencyoffirmsinthesameindustry.Theinter-industryspilloversarecommonlyestimatedbyreplacingthe

horizontal-spillovervariable(FDI_Sector)withvertical-spillovervariables.Theinefficiencyfunctionfortheinter-industryspilloverscan

beexpressedas:

uit¼

d0

þd1

FDIFirmitþd2

FDIDownstreamSectorjtþd3

FDIFirmitFDIDownstreamSectorjtþd4

Yearþd5

Industryþ

d6

Firmþwit (7)or

uit¼

d0

þd1

FDIFirmitþd2

FDIUpstreamSectorjtþd3

FDIFirmitFDIUpstreamSectorjtþd4

Yearþd5

Industryþ

d6

Firmþwit (8)whereFDI_Downstream_Sector isaproxyfor spillovereffectsfromforeignfirmstoforeignand domesticsuppliersand

FDI_Upstream_Sectorisaproxyforspillovereffectsfromforeignfirmstoforeignanddomesticbuyers.

3

Thecompletederivationthelog-likelihoodfunctionoftheBattese-CoellimodelanditsrelatedvarianceparametersarediscussedinBatteseandCoelli (1993).

3.2. Dataanddatasetconstruction

Theprimarydataforourstudyaretheannualsurveysofmediumand largemanufacturingestablishments(Survey

TahunanStatistikIndustriorSI)conductedbytheIndonesianCentralBoardofStatistics(BadanPusatStatistikorBPS).These

annualsurveyscoverawiderangeofinformationfromeachsurveyedestablishment.Thebasicinformationincludesyearof

starting production, industrial classification, location, and the specific identification code. There is also information

regardingownership,whichincludesforeignanddomesticownership,andinformationrelatedtoproduction,suchasgross

output, number of workers in production and non-production, value of fixed capital, material usage, and energy

consumption.

Theannualsurveyshavebeenconductedsince1975andthemostrecentavailabledatarelatestotheyear2007.However,

thisstudyusesthedatafrom1988to2000.Theyear1988ischosenasastartingyearsinceitisthefirstyearthatthe

replacementvalueoffixedassets,whichisusedasameasureforcapital,isavailable.Theyear2000isselectedasthelastyear

becausetheBPSchangedthespecificidentificationcodein2001tothenewidentificationcode(KIPN)withoutprovidinga

concordancetabletotheprevioususedidentificationcode(PSID).Effortstomatchtheobservationsintheyears2001–2005

totheyears1988–2000usingoutputvaluesandlabourdonotyieldconsistentresults.Therefore,thelongestpossibleperiod

forthisstudyis1988–2000.

Inconstructingaconsistentdataset,severaladjustmentsareconducted.Theseincludeadjustmentforindustrialcode,

adjustmentforvariabledefinitions,cleaningfornoiseandtypologicalerrors,backcastingmissingvaluesofcapital,matching

firmsforabalancedpanel,andchoosingindustrieswithforeignfirms.Thebalancedpaneldataarepreferableinthisstudy

duetotwoadvantages:(1)itenablestracingthetechnicalefficiencyscoresofeachobservedfirmduringtheperiodofstudy;

(2)itremovestheinfluenceofafirmthatappearsonlyinoneortwoyears,whiletheperiodofestimationisfor13years.The

detailsofadjustmentsarepresentedinAppendix1.Aftertheadjustments,thefinalbalancedpanelofdataconsistsof3318

establishmentswith43,225observations.

Toshowtheinfluenceoftheconstructionofthebalancedpaneldataset,thedescriptivestatisticsoftherelatedvariables

arecalculatedforthebalancedpaneldataandfortheoriginaldatabeforetheadjustmentprocess.Theoriginaldataconsistof

establishmentsthatdonotreportcompleteinformationon output,labour,capital,material,orenergy.Thereforethese

establishmentsarenotincludedinthecalculationofthedescriptivestatisticsfororiginaldata.FollowingTakii(2005),(1)0.5

percentobservationswiththelowestvaluesofoutputand1.5percentobservationswiththehighestvaluesofoutputare

removed.Afterthesedeletions,thedescriptivestatisticsfortheoriginaltotaldata,aspresentedinTable1,consistsof24,188

establishmentsforanunbalancedpanelof238,628observations.

Table1showsthattheminimumvaluesofvariableslnY,lnL,lnK,lnM,lnEfortheoriginaldataarelowerifcomparedtothe

minimumvaluesofthosevariablesfromthebalancedpanel.Thismakessenseasthebalancedpaneldataremovessome

observations duringthe adjustment process. The maximum values of those variables are higher in theoriginal data

comparedtothoseinbalancedpaneldata.Themeanvaluesofthesefivevariablesarehigherinthebalancedpaneldata

comparedtothoseinoriginaldata,whilethestandarddeviationsofthesefivevariablesarelowerinbalancedpanelwhen

comparedtothoseinoriginaldata.

ForFDI_Firm,theminimumvalueiszeroandthemaximumvalueisonebothfororiginaldataandthebalancedpanel

data,becausethisvariableisadummyvariable.Further,theminimumvalueandthemaximumvalueofvariablesFDI_Sector,

Table1

Descriptivestatisticsfortheoriginaldataandthebalancedpaneldata.

Originaldataa

Balancedpaneldata

Min Max Mean SD Min Max Mean SD

ProductionFrontier

lnY 6.461 20.980 12.514 2.256 6.591 20.761 13.964 2.006

lnL 2.398 10.649 4.079 1.327 2.639 10.292 4.702 1.088

lnK 4.105 23.398 12.308 2.268 4.220 23.106 13.152 2.245

lnM 3.871 20.033 11.765 2.418 4.239 19.454 12.164 2.221

lnE 1.791 16.583 9.377 2.221 1.882 15.836 9.587 2.077

FDI_Sector 0 1.492 0.208 0.218 0 1.492 0.234 0.209

InefficiencyFunction

FDI_Firm 0 1 0.064 0.273 0 1 0.072 0.258

FDI_Sector 0 1.492 0.208 0.218 0 1.492 0.234 0.209

FDI_Downstream_Sector 0.002 5.443 0.176 0.212 0.002 5.443 0.176 0.204

FDI_Upstream_Sector 0 0.921 0.160 0.181 0 0.921 0.160 0.174

NumberofEstablishments 24,188 24,188 24,188 24,188 3318 3318 3318 3318 NumberofObservation 231,064 231,064 231,064 231,064 43,225 43,225 43,225 43,225

Source:Authors’calculationsfromtheannualsurveysoftheIndonesianCentralBoardofStatistics(BadanPusatStatistikorBPS).

Y=output,L=labour,K=capital,M=materialandE=energy.

aTheoriginaldatainthistableexclude:(1)theestablishmentsthatdonotreportinformationonoutput,labour,capital,material,orenergy;(2)1.5

percentobservationswiththelowestvaluesofoutputand1.5percentobservationsthehighestvaluesofoutput.

Suyantoetal./JournalofAsianEconomics33(2014)16–29

FDI_Backward,andFDI_Forwardarethesamefororiginaldataandforthebalancedpanel,asthecalculationofthese

inter-industryvariablesisbasedonallfirmsintheoriginaldataasinBlalockandGertler(2008).Themeanvaluesofthesethree

spillovervariablesarehigherinthebalancedpanelcomparedtothoseintheoriginaldata,whereasthestandarddeviations

arelowerinbalancedpanel.FromthedescriptivestatisticsinTable1,theauthorsconcludethatthereisnosubstantialbiasin

theadjustmentprocesssincethereisnosubstantialdifferenceinthemaximumvalue,minimumvalue,meanvalue,and

standarddeviation.

3.3. Measurementofvariables

Therearetwosetsofvariablesincludedinthisstudy:productionvariablesandinefficiencyvariables.Theproduction

variables consistofoutput,labour,capital,material,energy,time trendandFDI_Sector,whiletheinefficiencyvariables

includeFDIvariables(FDI_Firm,FDI_Sector,FDI_Upstream_Sector,andFDI_Downstream_Sector),ayeardummy,anindustry

dummy,andafirmdummy.TheprecisedefinitionofeachvariableisgiveninAppendix2.

Inthisstudy,grossoutputisusedasthemeasureforoutput(y).Itreferstothetotalvalueofoutputproducedbyafirm.

Thenumberofemployeesdirectlyandindirectlyengagedinproductionisusedforthemeasureoflabour(L).Asameasureof

capital(K),thisstudyusesthereplacementvalueofcapital,whilematerial(M)ismeasuredusingthetotalvalueofrawand

intermediatematerialsandenergy(E)ismeasuredasthesumofelectricityandfuelexpenses.

FDI_Firmismeasuredbyadummyofforeigndirectinvestment,whichtakesavalueofoneifafirmhasapositiveforeign

ownershipandtakesavalueofzeroifotherwise.AsameasurefortheFDIhorizontalspillovers,thisstudyusestheshareof

foreignfirmoutputtothetotaloutputatthefive-digitISICsectorallevel,whichisexpressedasinAitkenandHarrison

(1999):

FDISectorjt¼

P

i8i2jFDIFirmityit P

i8i2jyit

(9)

Eq.(9)capturestheeffectofFDIatthesectorallevelonproductivityatthefirmlevel.Itshowsthespillovereffectsof

foreignpresenceondomesticfirmsinthesamefive-digitISICindustry.

TwoalternativemeasuresofFDIspilloversinthisstudyaremeasuresofinter-industryspillovers.Thepresenceofforeign

firmsin certainfive-digit ISICindustriesmay createproductivityexternalities forfirmsin upstreamanddownstream

industries.Thisstudymeasurestheinter-industryspilloversbyusingvariablesthatreflecttheextentofbackwardand

forward linkages between industries. Following Javorcik(2004), themeasure for FDI spillovers fromforeign firmsin

industriesk(k6¼j)thatarebeingsuppliedbydomesticfirmsinindustriesjis:

FDIDownstreamSectorjt¼

X

kifk6¼j

ajk

FDISectorkt (10)where

a

jkistheproportionofsectorj’soutputsuppliedtosectork,whichistakenfromtheinput–output(IO)matrixoffour-digitindustries.4Similarly,themeasureforFDIspilloversfromforeignfirmsinindustriesmwhoseproductsarebought

bydomesticfirmsinindustriesnis:

FDIUpstreamSectormt¼

X

nifn6¼m

g

mnFDISectornt (11)where

g

mnistheproportionofinputspurchasedbyindustrynfromindustrymintotalinputsourcedbyindustryn,whichistakenfromtheinput–output(IO)matrixoffour-digitindustries.

Atime-trendvariableisincorporatedintheproductionfunctiontomeasuretechnicalchange.Thetime-trendvariable

takesavalueofonefortheyear1988,avalueoftwofortheyear1989,andsoon.Anindustrydummycaptureseffectsspecific

toaparticularindustryand hasa valueofoneforanindustry foranobservationofthatindustryand avalueofzero

otherwise.Asimilarprocedureisalsoappliedtothefirmdummyandyeardummyvariables.

4. Empiricalresults

Weestimatea stochasticfrontierestimationandfirsttestforconstantreturnstoscaletocheckwhethertheCobb–

Douglasproductionfrontierisbestsuitedtothedata.FollowingtheprocedureofjointrestrictiontestinBaltagi(2011,p.80),

thetestofconstantreturnstoscaleisconductedunderthenullhypothesisthatthesumoftheestimatedparameters(

b

i)in4Duringtheselectedperiodinthisstudy,therearefouravailableIOmatrixes,whichwerepublishedin1990,1993,1995,and2000.Thisstudyusesthese

fourinput-outputmatrixesforcalculatingthebackwardcoefficientajk.Thefollowingistheprocedureforobtainingvaluesofajk.Valuesofajkbeforeand

including1990aretakenfromthe1990IOmatrix.Valuesofajkfor1991and1992arelinearlyinterpolatedfromthe1990and1993IOmatrixes.Valuesof

ajkfor1993aretakenfromthe1993IOmatrix.Valuesofajkfor1994arecalculatedfromthelinearinterpolationofthe1993and1995IOmatrixes.Valuesof

ajkfor1995aretakenfromthe1995IOmatrix.Valuesofajkfrom1996to1999arelinearlyinterpolatedfromthe1995andthe2000IOmatrixes.Finally,

valuesofajkfor2000aretakenfromthe2000IOmatrix.

productionfrontierinEq.(5)isequaltoone.Theregressionsumofsquaresforunrestrictedmodel(RSSU)is39,631.63,

whereastheregressionsumofsquaredforrestrictedmodel(RSSR)is25,549.50.TheF-statisticsis392.52,suggestingthatthe

nullhypothesisisrejected.ThisresultconfirmsthattheCobb–Douglasproductionfrontierisnotthebestsuitedmodelfor

thestochasticfrontierestimation.Rather,asthesumofthecoefficients oftheinputvariablesis greaterthanone,the

unrestrictedmodelwithvariablereturnstoscaleisappropriateandisusedbelow

4.1. Intra-industryspillovers

Webeginwithestimationofintra-industryspillovers.UsingEqs.(5)and(6),theproductionfrontierandtheinefficiency

functionare estimatedsimultaneouslyfor observing theeffects offoreign investmenton theproduction frontierand

technicalefficiencyoffirms.Fortheinefficiencyfunction,thetechnicalefficiencyvariable(uit)isspecifiedasafunctionofa

foreignsharedummy(FDI_Firm),theshareofforeignfirms’outputsovertotaloutputsinthefour-digitindustry(FDI_Sector),

andaninteractingtermbetweenFDI_FirmandFDI_Sector.Whenforeigninvestmentincreasesthefirm’stechnicalefficiency,

thecoefficientofFDI_Firmisnegative.5Whentechnologyspillsoverfromfirmswithforeigndirectinvestmenttopurely

domesticfirmsinthesameindustry,thecoefficientofFDI_Sectorisnegative.Asfortheinteractionterm,thesignofthe

coefficientshowswhetherornotforeigndirectinvestmentaffectsthefirm’sabilitytobenefitfromspilloversoriginating

fromotherforeign-ownedfirmsinthesameindustry.

Weestimatefouralternativemodelsinordertotesttherobustnessoftheestimatedparameters.Inthefirstmodel,ayear

dummyandanindustrydummyareincludedintheinefficiencyequation.Theestimatedparametersarepresentedinthe

Model(1)columnofTable2.Theresultsfromtheproductionfrontiershowthatthefourinputvariablescontributepositively

andsignificantlytooutput,suggestingapositiveelasticityofeachinputonoutput.Thereisalsoapositiveandstatistically

significantcoefficientof thetime-trendvariableindicating that technicalchangecontributespositivelytooutput.The

positiveandstatisticallysignificantcoefficientofFDI_Sectorsuggestshorizontalspilloversfromintra-industryforeigndirect

investmentincreasetheproductionfrontierforallfirms.

Fromtheestimatesoftheinefficiencyfunction,whichisthemainfocusofthisstudy,thecoefficientofFDI_Firmis

negativeandhighlysignificant,indicatingthatforeigndirectinvestmentdecreasesthefirm’stechnicalinefficiency.This

suggeststhatfirmswithforeignownershipare,onaverage,moreefficientthanpurelydomesticfirms.Thisfindingconfirms

theargumentinCaves(1971)andDunning(1988)thatforeignfirmsaremorelikelytooperateontheproductionfrontier.

Furthermore,thenegativeand statisticallysignificantestimateofFDI_Sectorsuggeststhat knowledgespillsoverfrom

foreign-ownedfirmsincreasesthetechnicalefficiencyofallfirmsintheindustry.Thisresultisinlinewiththeargumentin

WangandBlomstrom(1992)andfindingsinGhaliandRezgui(2008).ThisresultisalsoconsistentwithfindingsinTakii (2005),Temenggung(2007)andBlalockandGertler(2008),whichusedifferentmethodsofanalysis.

Thepositivesignificantestimateofinteractingtermmeansthat,althoughtheforeign-ownedfirmsalsobenefitfromthe

presenceofotherforeigninvestmentintheindustry,thebenefitissmallerthanfordomesticfirms.Giventhattheestimated

coefficientofFDI_FirmandtheestimatedcoefficientofFDI_Sectorarenegativeandstatisticallysignificant,thepositive

coefficient of the interaction term means that uit/FDI_Firm=0.5763+0.0330FDI_Sector and that uit/FDI_Sector=

0.2224+0.0330FDI_Firm.AsbothFDI_FirmandFDI_Sectorareeachalwayslessthanorequaltoonebyconstruction,

theneteffectof FDI_Sectoris negativefor allforeignfirmsaswellasdomestic firms.However,themagnitudeofthe

improvementinefficiencyfromhavingforeignfirmsintheindustryisalwaysgreaterfordomesticfirmsthanforforeign

firms.

Inaddition,weconductjointsignificancetest(F-test)onthemagnitudeofspilloversforforeignestablishmentsinorder

tochecksignificanceofthedirecteffectandtheinteractingeffectofspilloversonforeignfirms.6Thevalueof

F-statisticis

calculatedfromthelog-likelihoodvalueoftheunrestrictedmodelandtheloglikelihoodvalueoftherestrictedmodel(when

boththecoefficientofFDI_SectorandthecoefficientofinteractingvariableFDI_FirmFDI_Sectorequaltozero).Thevalueof

loglikelihoodfortheunrestrictedmodelis7704.48,whereasthevalueofloglikelihoodfortherestrictedmodelis7643.00,

Sothat,theF-statisticis13.22,whichsuggeststhattheunrestrictedmodel(byincludingvariablesFDI_Sectorandinteracting

variableFDI_FirmFDI_Sector)isthecorrectmodelandthetwovariablesarejointlysignificantaffectingspilloverson

foreignestablishmentsat1%level.

Theestimatedcoefficientofyeardummyisnotstatisticallysignificant,suggestingthatonaveragethereisnosignificant

differenceintechnicalinefficiencyscoresoffirmsacrossthesampleyears.Thestatisticallysignificantestimatedcoefficient

ofindustrydummysuggeststhatthereisasignificantdifferenceininefficiencyscoresacrossfive-digitindustries.

Thehighlysignificantestimateofgammaimplicatesthatestimationofstochasticfrontiershouldincludeaninefficiency

effect. This finding provides the justification for the simultaneous estimation of stochastic production frontier and

inefficiencyequation.Inotherwords,themodelisappropriatelyrepresentingtheobservedfirms.

Inthesecondmodel,industrydummiesarereplacedbyfirmdummies,inordertocontrolforfirmheterogeneityacross

thesample.TheresultsaregivenintheModel(2)columnofTable2.Thesignandsignificanceofestimatesaresimilarto

5

Thedependentvariablefortheinefficiencyfunctionistechnicalinefficiency.ThenegativecoefficientofFDI_Firmindicatesthatforeigninvestment decreasesinefficiency,whichimpliesanincreaseinthefirm’sefficiency.

6 Wearegratefultooneofthereviewersforsuggestingthispoint.

Suyantoetal./JournalofAsianEconomics33(2014)16–29

thoseinthefirstmodel.Thenotabledifferenceisonlyinthemagnitudeoftheestimates.FocusingontheFDIvariables,the

magnitudesofcoefficientsaresmallerinthissecondmodelcompared tothose inthefirstmodel. Inotherwords,the

inclusionoffirmdummyandtheexclusionofindustrydummyinthesecondestimation(Model2)resultsinasmallereffect

ofFDIspilloversontechnicalinefficiency.Thisisnotsurprising.Firm-specificeffectsarelargelycapturedbythefirmdummy,

whichremovesapotentialsourceofbiasintheestimatesofothercoefficients.Notably,theresultsregardingthedirectionof

spillovereffectsarethesameasinthefirstmodel,asthecoefficientofFDI_Sectorisnegativeandstatisticallysignificantin

bothmodels.

Forthethirdmodel,onlyatimedummyisincludedasacontrollingvariableintheestimation.Theresultingestimates,

whicharepresentedintheModel(3)column,areverycomparablewiththeresultsinModel(1)andModel(2).Similar

findingsarealsoobservedinModel(4),whenthetimedummy,industrydummyandfirmdummyandareallexcludedfrom

estimation.TheresultsfromthesefourmodelsconfirmtherobustnessoftheestimatesofthepositivespilloversfromFDIon

thetechnicalefficiencyofdomesticfirms.

4.2. Inter-industryspillovers

Besidestheeffectsondomesticfirmsinthesameindustry,FDIcanalsogeneratespilloversondomesticfirmsinother

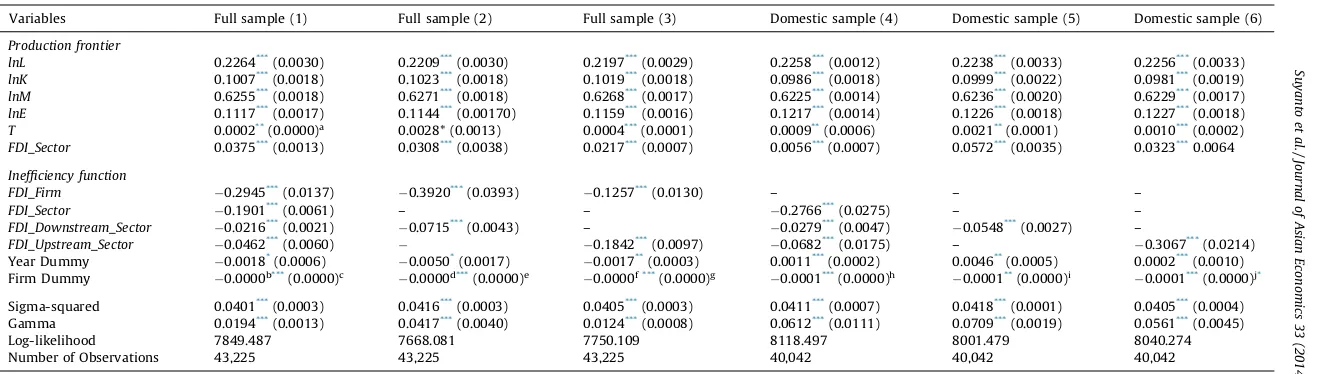

industries.Weestimatesixmodelsoftheinter-industryspillovers,andtheresultsofeachmodelarepresentedinTable3.

Thefirstthreemodelsareestimatedonthefullsampleandthelastthreemodelsareestimatedonthesub-sampleofonly

domesticfirms.Inthethreefull-samplemodels,thefirstmodelistocapturethesimultaneouseffectofthethreespillover

variablesontechnicalinefficiency.ThesecondandthethirdmodelfocusontheindividualeffectofeachoftheverticalFDI

spillovers(i.e.thedownstreamspilloverandtheupstreamspillover).Thesamestructureisalsoappliedtothesub-sampleof

onlydomesticfirms,withModel4capturesthesimultaneouseffectofthethreespillovervariables,Model5capturesthe

downstreameffectonly,andmodel6capturesonlytheupstreameffect.

In thefirstmodel (thefirst resultscolumnof Table3), thethree proxiesofspillover variables areincludedin the

estimations.Theresultsshowthatthehorizontalspillovervariable(FDI_Sector)hasanegativeandstatisticallysignificant

coefficient,suggestingthatanincreaseintheshareofforeignfirmoutputdecreasestechnicalinefficiencyacrossfirmsinthe

industry.Similarly,thespilloversfromFDIindownstreamindustriesalsodecreaseinefficiencyofsuppliers,asdemonstrated

bythenegativeandhighlysignificantcoefficientofthebackwardspillovervariable(FDI_Downstream_Sector).Inaddition,

the coefficientof the forwardspillover variable (FDI_Upstream_Sector) is negativeand highly significant,indicating a

negativerelationshipbetweenFDIinsupplierindustriesandtheindustry’sowntechnicalinefficiency.Althoughweemploy

adifferentmethodologyanduseadifferentdataset,thefindingsaresimilartothoseinLiang(2007).

Inthesecondandthethirdmodels(thesecondandthethirdcolumnsofTable3),theimpactsofbackwardspillover

variableandtheforwardspillovervariableareestimatedseparately.Ineachmodel,themagnitudeofthecoefficientofthe

includedspilloversvariableislargerthaninModel1,butneitherthesignnorthestatisticalsignificanceofthecoefficient

changes.Clearly,thereismulti-colinearityamongthespilloversvariablesthatmakestheidentificationofseparateeffects

Table2

Estimatingintra-industryspillovers.

Variables Model(1) Model(2) Model(3) Model(4)

Productionfrontier

lnL 0.2227***

(0.0033) 0.2256***

(0.0031) 0.2197***

(0.0030) 0.2167***

(0.0031)

lnK 0.1018***(0.0019) 0.1043***(0.0017) 0.1023***(0.0018) 0.1097***(0.0012)

lnM 0.6263***(0.0018) 0.6218***(0.0018) 0.6223***(0.0017) 0.6191***(0.0022)

lnE 0.1128***(0.0017) 0.1160***(0.0017) 0.1165***(0.0017) 0.1176***(0.0016)

T 0.0007*

(0.0005) 0.0039**

(0.0006) 0.0066***

(0.0028) 0.0012***

(0.0003)

FDI_Sector 0.1224***

(0.0055) 0.2044***

(0.0065) 0.2687***

(0.0096) 0.1577***

(0.0065)

Inefficiencyfunction

FDI_Firm 0.5763***

(0.0264) 0.1550***

(0.0018) 0.1960***

(0.0104) 0.2362***

(0.0092)

FDI_Sector 0.2224***

(0.0896) 0.2000***

(0.0149) 0.1780***

(0.0027) 0.1819***

(0.0034)

FDI_FirmFDI_Sector 0.0330***(0.0028) 0.0460***(0.0036) 0.1035**(0.0184) 0.0673***(0.0086)

YearDummy 0.0002(0.0031) 0.0010(0.0009) 0.0010(0.0019) – IndustryDummy 0.0039*

(0.0008) – – –

FirmDummy – 0.0001**

(0.0000)a

– –

Sigma-squared 0.0416***

(0.0010) 0.0416***

(0.0005) 0.0413***

(0.0003) 0.0418***

(0.0003) Gamma 0.0380***

(0.0038) 0.0224***

(0.0083) 0.0086***

(0.0002) 0.0151***

(0.0020) Log-likelihood 7704.484 7759.086 7618.974 7572.755 NumberofObservations 43,225 43,225 43,225 43,225

Source:Authors’calculations.

Notes:Y=output,L=labour,K=capital,M=material,E=energy,T=timetrend.Standarderrorsareinparentheses.

a

Theestimatedstandarderroris0.000009. * Significantatthe10%level.

** Significantatthe5%level. *** Significantatthe1%level.

Table 3

Estimating inter-industry spillovers.

Variables Full sample (1) Full sample (2) Full sample (3) Domestic sample (4) Domestic sample (5) Domestic sample (6)

Production frontier

lnL 0.2264***

(0.0030) 0.2209***

(0.0030) 0.2197***

(0.0029) 0.2258***

(0.0012) 0.2238***

(0.0033) 0.2256***

(0.0033)

lnK 0.1007***

(0.0018) 0.1023***

(0.0018) 0.1019***

(0.0018) 0.0986***

(0.0018) 0.0999***

(0.0022) 0.0981***

(0.0019)

lnM 0.6255***(0.0018) 0.6271***(0.0018) 0.6268***(0.0017) 0.6225***(0.0014) 0.6236***(0.0020) 0.6229***(0.0017)

lnE 0.1117***(0.0017) 0.1144***(0.00170) 0.1159***(0.0016) 0.1217***(0.0014) 0.1226***(0.0018) 0.1227***(0.0018)

T 0.0002**

(0.0000)a

0.0028* (0.0013) 0.0004***

(0.0001) 0.0009**

(0.0006) 0.0021**

(0.0001) 0.0010***

(0.0002)

FDI_Sector 0.0375***

(0.0013) 0.0308***

(0.0038) 0.0217***

(0.0007) 0.0056***

(0.0007) 0.0572***

(0.0035) 0.0323***

0.0064

Inefficiency function

FDI_Firm 0.2945***

(0.0137) 0.3920***

(0.0393) 0.1257***

(0.0130) – – –

FDI_Sector 0.1901***

(0.0061) – – 0.2766***

(0.0275) – –

FDI_Downstream_Sector 0.0216***(0.0021)

0.0715***(0.0043) –

0.0279***(0.0047)

0.0548***(0.0027) –

FDI_Upstream_Sector 0.0462***(0.0060)

0.1842***(0.0097)

0.0682***(0.0175) –

0.3067***(0.0214)

Year Dummy 0.0018*

(0.0006) 0.0050*

(0.0017) 0.0017**

(0.0003) 0.0011***

(0.0002) 0.0046**

(0.0005) 0.0002***

(0.0010) Firm Dummy 0.0000b***

(0.0000)c

0.0000d***

(0.0000)e

0.0000f***

(0.0000)g 0.0001*** (0.0000)h 0.0001** (0.0000)i 0.0001***

(0.0000)j*

Sigma-squared 0.0401***

(0.0003) 0.0416***

(0.0003) 0.0405***

(0.0003) 0.0411***

(0.0007) 0.0418***

(0.0001) 0.0405***

(0.0004) Gamma 0.0194***

(0.0013) 0.0417***

(0.0040) 0.0124***

(0.0008) 0.0612***

(0.0111) 0.0709***

(0.0019) 0.0561***

(0.0045) Log-likelihood 7849.487 7668.081 7750.109 8118.497 8001.479 8040.274 Number of Observations 43,225 43,225 43,225 40,042 40,042 40,042

Source: Authors’ calculations.

Notes:Y= output,L= labour,K= capital,M= material,E= energy,T= Time trend. Actual estimates area

0.00004,b 0.000034,c 0.0000017,d 0.000034,e 0.0000019,f 0.000034,g 0.0000014,h 0.0000024,i 0.000012,j

0.0000035. Standard errors are in parentheses. * Significant at the 10% level.

** Significant at the 5% level. *** Significant at the 1% level.

difficult.ThecoefficientoftheFDI_Downstream_Sectorbeingnegativeandstatisticallysignificantatthe1%levelinboth

Model1andModel2,indicatesarobustfindingthattheforeignentryinathree-digitindustrydecreasesthetechnical

inefficiencyofdomestic suppliers(i.e.positivebackwardspillovers).Similarly, thenegativeandstatisticallysignificant

coefficientoftheFDI_Upstream_SectorinbothModel1andModel3indicatesarobustfindingthatthepresenceofforeign

firmsinathree-digitindustrydecreasestheinefficiencyofdomesticbuyers(i.e.positiveforwardspillovers).

Toisolatethespillovereffectsononlydomesticfirms,weestimatetheModels1through3forthesub-sampleofonly

domesticfirms.TheestimationresultsarepresentedinthefourththroughsixthresultcolumnsinTable3.Theresultsare

similartothoseforthefullsampleoffirmsintermsofthesignsandsignificanceofthecoefficients.However,itisnotable

thatthecoefficientsforthespilloversvariablesinthedomesticfirmsamplearegenerallyoflargermagnitudethanthe

correspondingcoefficientsforthefullsample.ThisprovidesfurtherevidencetosupportthatfromtheresultsinTable2

showingthatspilloversfromforeignfirmsaremorebeneficialforpurelydomesticownedfirmsthanforfirmswithdirect

foreigninvestment.

GiventheresultsfromTable3,weconcludethatthespillovereffectsfromFDIdecreasetechnicalinefficiencyofdomestic

firms inupstreamand downstream industries.Thesefindings confirmtheargumentin Javorcik(2004) thata foreign

presenceinadomesticmarketmaygeneratenotonlyspillovereffectsondomesticfirmsinthesameindustrybutalso

providespilloverbenefitstodomesticfirmsintheupstreamanddownstreamindustries.

4.3. Spillovereffectsandtheleveloftechnicalefficiency

Sofar,theanalysispoolstogetherallfirmswithdifferentlevelsofefficiency.Ithasadvantageofshowingtheaverage

effectofFDIspilloversonafirm’stechnicalefficiency.However,ithasadisadvantageinthatthespillovereffectsareassumed

tobeuniformforallfirms.Thus,theanalysisdoesnotclearlydistinguishwhichfirmsgainthemostspillovereffectfromFDI.

Inthissection,theanalysisisextendedtoansweraquestionofwhetherthelevelofefficiencyinfluencestheabilityof

firmsinabsorbingspilloverbenefits.Thefirmsaredividedintotwogroups:firmswithahigh-efficiencylevelandthosewith

alow-efficiencylevel.Theproceduretogroupthefirmsisbysortingthefirmsfromtheonewiththehighesttechnical

efficiencyleveltothefirmwiththelowestefficiencylevel,andthenthesortedfirmsaredividedintotwo.Theupperhalfof

thedataiscategorizedasthehigh-efficiencyfirmsandthelowerhalfisthelow-efficiencyfirms.Theestimationresultsfor

thesetwogroupsoffirmsarepresentedinTable4.Weestimateresultsforthefullsampleoffirmsaswellasforthe

sub-sampleofonlydomesticfirms.

Startingfromthefullsampleestimations,thecoefficientofFDI_Firmisnegativeandstatisticallysignificantbothamong

high-efficiencyfirms(column1ofTable4)andamonglow-efficiencyfirms(column2),suggestingthatforeign-ownedfirms

have a higher technical efficiencylevel in both groups offirms. The positive and significantcoefficient ofFDI_Sector

demonstratesthatspilloversattheindustriallevelincreasetheinefficiencyofthefirms(i.e.anegativeefficiencyspillover).

Incontrast,thelow-efficiencyfirmsexperienceadecreaseintechnicalinefficiencywhenforeignfirmsaremoreimportantin

theindustry(i.e.apositiveefficiencyspillover),asindicatedbyanegativeandhighlysignificantcoefficientofFDI_Sector

(column2).

Table4

Estimatingintra-industryspilloversinhigh-efficiencyandlow-efficiencyfirms.

Variables Fullsample Domesticsample

High-efficiencyfirms(1) Low-efficiencyfirms(2) High-efficiencyfirms(3) Low-efficiencyfirms(4)

Productionfrontier

lnL 0.2049***(0.0047) 0.2258***(0.0040) 0.2372***(0.0018) 0.2012***(0.0038)

lnK 0.1080***(0.0032) 0.0985***(0.0024) 0.1025***(0.0024) 0.0911***(0.0021)

lnM 0.6038***

(0.0023) 0.6634***

(0.0027) 0.5883***

(0.0036) 0.6900***

(0.0026)

lnE 0.1316***

(0.0027) 0.0835***

(0.0023) 0.1429***

(0.0013) 0.0791***

(0.0018)

T 0.0021**

(0.0009) 0.0001**

(0.0000)b

0.0022***

(0.0004) 0.0064***

(0.0003)

FDI_Sector 0.0940***

(0.0058) 0.0492**

(0.0141) 0.0849***

(0.0032) 0.0727**

(0.0133)

Inefficiencyfunction

FDI_Firm 0.0617***(0.0088)

0.0096*(0.0063) – –

FDI_Sector 0.0742***(0.0062)

0.0556***(0.0035) 0.0657***(0.0038)

0.0660***(0.0115)

YearDummy 0.0020*

(0.0014) 0.0027***

(0.0007) 0.0029***

(0.0004) 0.0015***

(0.0001) FirmDummy 0.0001***

(0.0000)a

0.0001***

(0.0000)c

0.0001***

(0.0000)d

0.0000e**

(0.0000)f

Sigma-squared 0.0425***

(0.0004) 0.0382***

(0.0004) 0.0414***

(0.0005) 0.0341***

(0.0006) Gamma 0.0369***

(0.0043) 0.0151***

(0.0023) 0.0540***

(0.0036) 0.0746***

(0.0019) Log-likelihood 3493.823 4697.164 3597.36 5417.533 NumberofObservations 21,612 21,613 20,021 20,021

Source:Authors’calculations.

Notes:Y=output,L=labour,K=capital,M=material,E=energyandT=timetrendActualestimatesare:a

0.0000042,b

0.000037c

0.000005d

0.0000076,e

0.000018,f

0.0000066.Standarderrorsareinparentheses. * Significantatthe10%level.

** Significantatthe5%level. *** Significantatthe1%level.

ThecoefficientsofFDI_Sectorforthesub-sampleofonlydomesticfirms(columns3and4)areofthesamesignand

significanceasinthecorrespondingfullsampleestimation,butthemagnitudeofimpactissomewhatlowerinthedomestic

firmsub-sample.ThissuggeststhatFDIspillovershavesmallerimpactondomesticfirmsthanonforeignfirmsinindustries

withlargetechnologygaps.

TheresultsinTable4demonstratethatfirmswithdifferentefficiencylevelsmayreceivedifferenteffectsofFDIspillovers.

High-efficiencyfirmstend toobtainnegativespillover effects,while low-efficiencyfirmsexperience positive spillover

effects.Thesefindingsconfirmtheargumentthatthereisadvantagefrombeinglessadvancedintermsofefficiencyinterms

ofbenefittingfromspillovers(Glass&Saggi,1998;Wang&Blomstrom,1992)andareconsistentwiththeresultsinGriffith

etal.(2002),CastellaniandZanfei(2003),andPeriandUrban(2006).

5. Conclusion

ThisarticleempiricallyexaminesthespillovereffectsofFDIonfirmtechnicalefficiencyintheIndonesianmanufacturing

sectorfortheperiodbetween1988and2000.UsingtheframeworkofBatteseandCoelli’s(1995)stochasticproduction

frontier,wefindevidenceofapositivespillovereffectofFDItofirmsinthesameindustry(competitors),firmsinanupstream

industry(suppliers),andfirmsinadownstreamindustry(buyers).Thepositivespillovereffectis observedinboththe

estimationforthefullsampleoffirmsandtheestimationforthesub-sampleofonlydomesticfirms.Notably,theeffectson

domesticfirmsaregenerallymorepowerfulthan