Company in Brief

.05

Visi, Misi dan Filosoi Perusahaan

Vision, Mission and Company Philosophy

.06

Peristiwa Penting Perseroan dan Anak Perusahaan 2010

Signiicant Events of the Company and Subsidiaries 2010

Message from the President Commissioner

.17

Proil Dewan Komisaris

Proile of the Board of Commissioners

.20

Laporan Direktur Utama

Report from the President Director

.29

Proil Direksi

Proile of Corporate Advisor

.33

Analisis dan Pembahasan Manajemen

Management Discussion and Analysis

.90

Dewan Komisaris dan DireksiStatement of Responsibility of the Board of Commissioners and the Board of Directors

.95

Laporan Keuangan Konsolidasi

PT Bhakti Investama Tbk (the Company) was established in Surabaya on November 2nd, 1989 to operate in the capital market. Initially, its activities were limited to stock brokerage business. Through times, the business lourished and the Company moved to Jakarta in February 1990.

Within four years, the Company has ventured into a full range of capital market businesses, including broker dealer, investment manager, underwriter, loan origination and syndication, and research services. In a relatively short period, the Company has expanded to inancial advisory, providing corporations with services and advices in mergers and acquisitions. Additionally, the Company has also managed several types of mutual funds.

Following its consolidation, the Company earned the approval of the bourse authority to go public through an Initial Public Ofering (IPO) and listed its shares on the Jakarta Stock Exchange and Surabaya Stock Exchange. The IPO proceed amounted to Rp86.1 billion from 123 million shares priced at Rp700 per share.

In 1999, the Company began transforming itself into an investment company through several corporate actions such as restructuring, merger, acquisition and direct investment. As of 2010, the Company owned 2 (two) strategic business arms: PT Global Mediacom Tbk that runs its media businesses and PT Bhakti Capital Indonesia Tbk that provides inancial services.

The Company also had a number of investment portofolios, including a 20% stake in PT MNC Sky Vision, 99.9% ownership in PT Global Transport Services, and other investment portfolio.

PT Bhakti Investama Tbk (Perseroan) didirikan di Surabaya pada tanggal 2 November 1989 untuk bergerak di pasar modal. Awalnya, Perseroan bergerak secara terbatas di bidang perdagangan efek (brokerage). Seiring Dengan berkembangnya waktu dan kegiatan, Perseroan memindahkan kantor pusatnya ke Jakarta pada bulan Februari 1990.

Dalam kurun waktu empat tahun setelah itu, aktivitas Perseroan berkembang mencakup seluruh aspek kegiatan pasar modal yaitu: perantara dan perdagangan efek, manajer investasi, penjamin emisi efek, originasi & sindikasi pinjaman, serta jasa riset. Dalam waktu yang relatif singkat, Perseroan memperluas usaha ke bidang penasihat keuangan

(inancial advisory) dengan memberikan jasa dan nasihat ke perusahaan tentang penggabungan usaha dan akuisisi. Selain itu, Perseroan juga mengelola beberapa jenis produk reksa dana.

Setelah dianggap layak, pada tahun 1997, Perseroan memperoleh persetujuan dari otoritas untuk go public

melalui Penawaran Umum Perdana dan mencatatkan sahamnya di Bursa Efek Jakarta dan Bursa Efek Surabaya. Dalam IPO tersebut Perseroan menawarkan 123 juta lembar saham pada harga Rp700,- per saham dan berhasil menghimpun dana sebesar Rp86,1 miliar.

Pada tahun 1999, Perseroan mulai mentransformasikan diri sebagai perusahaan investasi. Program tersebut dilakukan melalui berbagai aksi korporasi, antara lain restrukturisasi, penggabungan usaha, akuisisi dan investasi langsung. Sampai 2010, Perseroan memiliki 2 (dua) lengan bisnis strategis; yaitu PT Global Mediacom Tbk yang bergerak di sektor Media dan PT Bhakti Capital Indonesia Tbk yang bergerak di bidang Jasa Keuangan.

Since last year, the Company has been conducting series of activities to diversify its businesses into the natural resources sector, especially in oil, gas and coal mining. The Company is hoping to make this new venture as its third business pillar in addition to media and inancial services.

In order to realize its mission and vision, the Company has designed several corporate strategies that include:

1. Focusing on content and advertising based media and subscriber based media through MNC Group.

2. Developing and maintaining long-term growth in inancial services using both the strategies of organic growth and synergic achievement through acquisitions conducted by PT Bhakti Capital Indonesia Tbk.

3. Realizing and developing our third business pillar in the natural resources industry, particularly in coal mining, oil and gas.

4. Expanding into other prospective sectors with high growth rates and returns.

As an investment company, the Company remains prudent in making investment decision, focusing on projects which are fundamentally prospective as either intermediate or long-term investments and has undergone a comprehensive and thorough due diligence process.

For its portfolio investments, the Company uses well-proven approaches in selecting either debt or equity-based investments. For short-term returns, the Company directs its investment toward marketable securities; while for long-term investment it will join forces with strategic investors to acquire companies with strong cash low and promising capital appreciation for long-term gains.

Sejak tahun lalu perusahaan telah melakukan serangkaian kegiatan terkait rencana diversiikasi ke sektor sumber daya alam, khususnya pertambangan batubara, minyak dan gas. Perusahaan bertekad menjadikan bisnis baru ini sebagai pilar bisnisnya yang ketiga selain media dan jasa keuangan.

Dalam rangka mewujudkan misi dan visinya, Perseroan senantiasa menerapkan strategi korporasi yang telah ditetapkan sebelumnya, yakni:

1. Fokus pada usaha media berbasis konten dan iklan serta media berbasis langganan melalui MNC Grup. 2. Mengembangkan dan mempertahankan pertumbuhan

jangka panjang di bidang jasa keuangan melalui strategi pertumbuhan organik dan pencapaian sinergi melalui akuisisi oleh PT Bhakti Capital Indonesia Tbk. 3. Merealisasikan dan mengembangkan bisnis di pilar

ketiga, yakni di bidang sumber daya alam, khususnya di bidang pertambangan batubara, minyak dan gas. 4. Ekspansi pada bidang investasi lain yang memiliki

prospek usaha dan tingkat pertumbuhan yang tinggi.

Sebagai perusahaan investasi, Perseroan senantiasa seksama dalam membuat keputusan investasi, dengan fokus pada proyek-proyek yang secara fundamental sangat menjanjikan baik berupa investasi jangka menengah maupun jangka panjang dan yang telah melewati proses uji tuntas yang menyeluruh.

Menjadi perusahaan investasi yang terkemuka, baik di dalam negeri, maupun di luar negeri, khususnya di kawasan Asia Pasiik.

To become a leading investment company, both domestically as well as internationally, particularly in Asia Paciic region.

Mission :

To consistently improve the welfare of and added values for the shareholders, investors, business partners, employees, and other stakeholders.

Misi :

Secara konsisten meningkatkan kesejahteraan dan nilai tambah bagi para pemegang saham, investor, mitra bisnis, karyawan serta seluruh pemangku kepentingan lainnya.

Visi :

Kemampuan dalam melihat peluang yang ada.

Integritas :

Kemampuan dalam membangun kepercayaan di antara investor dan komunitas bisnis.

Persistence :

Kekuatan untuk mengejar kesempatan dalam keadaan yang sulit.

Vision :

The ability in envisaging opportunities.

Integrity :

The ability to build trust among investors and business communities.

Persistence :

The strength to pursue and seize opportunities in times of diiculties.

Filosoi Perusahaan

Peristiwa Penting Perseroan

/ Signiicant Events of the Company

April /

April

• Perseroan menyelenggarakan Rapat Umum Pemegang Saham Luar Biasa dimana salah satu agendanya adalah pemaparan rencana Perseroan untuk melakukan ekspansi dan/atau investasi di bidang pertambangan batubara, minyak dan gas bumi.

• The Company held an extraordinary shareholders meeting, during which the management disclosed its plan to diversify into coal mining and oil/gas businesses.

Mei /

May

• Perseroan menandatangani dokumen transaksi dengan perusahaan yang telah mengakuisisi delapan konsesi batubara di Sumatera Selatan.

• Perseroan membagikan saham bonus dengan rasio 1:3, yaitu pemegang 1 (satu) lembar saham akan memperoleh 3 (tiga) saham bonus.

• The Company has signed a transaction document with a company which had acquired eight coal concessions in South Sumatera.

• The Company issued bonus shares with a ratio of 1:3, giving every holder of existing 1 (one) share to receive 3 (three) new shares.

Juni /

June

• Perseroan menyelenggarakan Rapat Umum Pemegang Saham Tahunan.

• Perseroan memperpanjang jangka waktu Tanda Bukti Utang Konversi selama 1 (satu) tahun hingga 2011.

• The Company held the Annual General Meeting of Shareholders.

• The Company rolled over its convertible bond for a year to 2011.

Desember /

December

• Perseroan mengurangi kepemilikan sahamnya di Citra Marga Nusaphala Persada menjadi 3,6%.

• Perseroan melaksanakan MESOP Tahap I sejumlah 173.670.533 lembar saham dengan harga pelaksanaan sebesar Rp117,-.

• The Company reduced its share ownership in Citra Marga Nusaphala Persada to 3.6%.

Peristiwa Penting Anak-Anak Perusahaan

/ Signiicant Events of the Subsidiaries

Media /

Media

Januari /

January

• Media Nusantara Citra (MNC) melalui Linktone Ltd mengakuisisi 50,01% saham Letang Game Ltd, perusahaan China dengan spesialisasi pada mobile games dan PC online games.

• Media Nusantara Citra (MNC), through its subsidiary Linktone Ltd, acquired 50.01% share of Letang Game Ltd, a China-based company that specializes in mobile games and PC online games.

Maret /

March

• MNC bersama Linktone mengakuisisi 75% saham Innoform Media Pte Ltd senilai SGD 9,75 juta.

• MNC together with Linktone acquired 75% share in Innoform Media Pte Ltd for SGD 9.75 million.

Juni /

June

• Indovision memenangkan penghargaan Indonesia’s Most Admired Companies (IMAC).

• Indovision won the Indonesia’s Most Admirer Company (IMAC) award.

Agustus /

August

• Indovision meraih Top Brand Awards 2010, yang ketiga kalinya dalam tiga tahun berturut-turut sejak 2008.

• Indovision received the Top Brand Award 2010, the third in a row since 2008.

Oktober /

October

• Televisi Pendidikan Indonesia (TPI) resmi berganti nama menjadi MNC TV.

• Televisi Pendidikan Indonesia (TPI) oicially changed name to MNC TV.

Desember /

December

• Global Mediacom (Mediacom) membagikan dividen senilai Rp5,- per lembar dengan jumlah total sekitar Rp68 miliar

• Mediacom menandatangani kerjasama dengan Rakuten, sebuah perusahaan internet terkemuka dari Jepang untuk meluncurkan sebuah pusat perbelanjaan on-line dengan nama “Rakuten Belanja On-line”.

• MNC membagikan dividen senilai Rp7,- per lembar saham dengan jumlah total sekitar Rp93 miliar

• Global Mediacom (Mediacom) distributed a total dividend of approximately Rp 68 billion or Rp5 per share.

• Mediacom signed an agreement with Rakuten, a leading Japanese internet company, to launch an online shopping center to be named “Rakuten Belanja On-line”.

Peristiwa Penting Anak-Anak Perusahaan

/ Signiicant Events of the Subsidiaries

Jasa Keuangan /

Financial Services

Januari /

January

• MNC Securities meluncurkan fasilitas online trading dengan nama Bhakti Online Brokerage (BOB).

• MNC Securities membuka kantor cabangnya yang ke-15 di Jakarta.

• MNC Securities launched the online trading platform under the name of Bhakti Online Brokerage (BOB).

• MNC Securities commenced operation of its 15th branch oice in Jakarta.

Maret /

March

• MNC Securities membuka kantor cabangnya yang ke-16 di Jakarta.

• MNC Securities opened its 16th branch oice in Jakarta.

Juni /

June

• MNC Asset Management melalui produk BIG DANA LANCAR meraih penghargaan “Best Mutual Fund” untuk kategori reksa dana Pasar Uang periode 1 tahun versi Majalah Investor.

• MNC Asset Management melalui produk BIG DANA MUAMALLAH meraih penghargaan “Best Mutual Fund” untuk kategori reksa dana Pendapatan Tetap Syariah periode 1 tahun versi Majalah Investor.

• BIG DANA LANCAR, a money market fund managed by MNC Asset Management won “The Best Mutual Fund” award for its outstanding performance in the category of money market fund for 1 year period by Investor Magazine.

• BIG DANA MUAMALLAH, a sharia mutual fund managed by MNC Asset Management was awarded “The Best Mutual Fund” for its outstanding performance in the category of sharia ixed-income fund for 1 year period by Investor Magazine.

Agustus /

August

• MNC Securities membuka kantor cabangnya yang ke-17 di Jakarta

• MNC Finance melakukan pembelian kembali (buy back) Obligasi II Tahun 2007 senilai Rp12 miliar.

• MNC Securities oicially opened up its 17th branch oice in Jakarta

• MNC Finance conducted the buyback of Bond II Year 2007 worth Rp12 billion.

November /

November

• Bhakti Capital Indonesia mengakuisisi UOB Life-Sun Assurance dan merubah namanya menjadi MNC Life Assurance.

• MNC Finance menjalin kerjasama pembiayaan channeling

dengan Bank Sinarmas Syariah.

• MNC Finance melakukan pembelian kembali (buy back) Obligasi Bhakti Finance II Tahun 2007 senilai Rp55 miliar.

• Bhakti Capital Indonesia acquired UOB Life-Sun Assurance and renamed it to MNC Life.

• MNC Finance established a channeling-inancing partnership with Bank Sinarmas Syariah.

• MNC Finance conducted the buyback of Bhakti Finance Bond II Year 2007 worth Rp55 billion.

Desember /

December

• MNC Finance melunasi sisa Obligasi II Tahun 2007 sejumlah Rp83 miliar.

• Bhakti Finance dan Bhakti Asset Management melakukan pergantian nama masing-masing menjadi MNC Finance dan MNC Asset Management.

• Bhakti Capital Indonesia membagikan dividen senilai Rp2,- per lembar saham dengan jumlah total sekitar Rp2,5 miliar

• Bhakti Securities melakukan perubahan nama menjadi MNC Securities, efektif bulan Januari 2011.

• MNC Finance pay of the remaining Bond II Year 2007 with a total amount of Rp83 billion.

• Bhakti Finance and Bhakti Asset Management changed their name to MNC Finance and MNC Asset Management respectively.

• Bhakti Capital Indonesia distributed a total dividend of approximately Rp2.5 billion or Rp2 per share.

Dalam miliar Rupiah, kecuali disebutkan lain In billion Rupiah, unless otherwise stated

URAIAN

2010

2009

2008

2007

2006

DESCRIPTION

Pendapatan Usaha 6.832 5.466 5.943 4.849 657 Total Revenue

Laba Usaha 1.561 726 638 1.114 210 Operating Income

Laba (Rugi) Bersih 258 (48) (355) 695 230 Net Income (Loss)

EBITDA 2.120 1.200 1.258 1.596 320 EBITDA

Jumlah Aset 16.603 17.109 17,765 19.742 10.614 Total Assets

Jumlah Kewajiban 6.844 6.731 7.325 8.966 6.298 Total Liabilities

Jumlah Ekuitas 5.574 4.832 4.845 6.005 1.873 Total Stockholders’ Equity

Laba (Rugi) Bersih per Saham Dasar

(dalam Rupiah penuh)

9 (2)* (49) 119 52 Basic Earning (Loss) per Share (in full Rupiah amount)

Laba (Rugi) Bersih per Saham Dilusian

(dalam Rupiah penuh)

7 - - 110 43 Diluted Earning (Loss) per Share (in full Rupiah amount)

RASIO KEUANGAN UTAMA KEY FINANCIAL RATIO

Laba (Rugi) Bersih /

Pendapatan Usaha 3,78% -0,88% -5,98% 14,34% 34,93% Net Income (Loss) / Total Revenue

Laba (Rugi) Bersih /

Jumlah Aset 1,56% -0,28% -2,00% 3,52% 2,16% Net Income (Loss) / Total Assets

Laba (Rugi) Bersih /

Jumlah Ekuitas 4,64% -0,99% -7,33% 11,58% 12,25% Net Income (Loss) / Total Stockholders’ Equity

Jumlah Kewajiban /

Jumlah Ekuitas 122,78% 139,29% 151,17% 149,30% 336,26%

Total Liabilities / Total Stockholders’ Equity

Jumlah Kewajiban /

Jumlah Aset 41,22% 39,34% 41,23% 45,42% 59,34% Total Liabilities / Total Assets

EBITDA /

Jumlah Pendapatan Usaha 31,03% 21,96% 21,17% 32,92% 48,73% EBITDA / Total Revenue

DIVIDEN DIVIDEND

Dividen Tunai per Saham

(dalam Rupiah penuh) - - 5 5

-Cash Dividend per Share (in full Rupiah amount)

* Disajikan kembali untuk mencerminkan pengaruh pembagian saham bonus tahun 2010

PENDAPATAN USAHA

Dalam Miliar Rupiah

Revenues

In Billion Rupiah06

657

4,849

5,943

5,466

6,832

07 08 09 10

06

6,298

8,966

7,325

6,731 6,844

07 08 09 10

jUMlAH kEwAjibAN

Dalam Miliar Rupiah

Total Liabilities

In Billion Rupiah230

695

(355)

(48)

258

06 07 08 09 10

lAbA (RUgi) bERSiH

Dalam Miliar Rupiah

Net Income (Loss)

In Billion Rupiah06

10,614

19,742

17,765

17,109

16,603

07 08 09 10

jUMlAH ASET

Dalam Miliar Rupiah

Total Assets

In Billion Rupiah06

320

1,596

1,258

1,200

2,120

07 08 09 10

EbiTDA

Dalam Miliar Rupiah

EBITDA

In Billion Rupiah06

1,873

6,005

4,845 4,832

5,574

07 08 09 10

jUMlAH EkUiTAS

Dalam Miliar Rupiah

Jumlah Saham Beredar

(dalam lembar saham) 29.848.162.845 7.236.933.545 7.236.933.545 7.236.259.371 4.803.305.032

Number of Outstanding Shares (in share)

Nominal

(dalam Rupiah penuh) 100 100 100 100 100

Nominal Value (in full Rupiah)

Harga Saham Stock Price

Tertinggi(Rp) 1.020 290 1080 1590 670 Highest (Rp)

Terendah (Rp) 90 135 166 480 90 Lowest (Rp)

Penutupan (Rp) 163 199 199 1050 480 Closing (Rp)

Kapitalisasi Pasar

(dalam miliar rupiah) 4.865,25 1.440,15 1.440,15 7.598,07 2.305,59

Market Capitalization (in billion Rupiah)

Pergerakan Harga Saham 2010

Stock Price Movement 2010

1200

1000

800

600

400

200

0

Kronologis Pencatatan Saham Perseroan

Share Listing Chronology

Keterangan

Saham Yang Ditawarkan /

Share Ofered

Waran Yang Ditawarkan / Warrant

Ofered

Jumlah Saham /

Total Number of Shares

Tanggal Efektif dari Bapepam-LK/ Persetujuan RUPSLB/

Date of Efective Statement from Bapepam-LK/ Extraordinary Shareholders

Meeting Approval

Tanggal Pencatatan BEI /

Listing Date IDX

Remark

BEJ / JSX BES / SSX

Penawaran Umum Perdana 123.000.000 - 428.000.000 28 Oct 97 24 Nov 97 24 Nov 97 Initial Public Ofering

Pemecahan Saham 428.000.000 - 856.000.000 6 Aug 99 8 Sep 00 8 Sep 99 Stock Split

Pemecahan Saham 1.284.000.000 - 2.140.000.000 5 Jan 00 8 Sep 00 8 Feb 00 Stock Split

Pemecahan Tanpa HMETD 107.000.000 - 2.247.000.000 27 Sep 99 4 Jul 00 4 Jul 00 Non-Preemptive Rights

Penawaran Umum Terbatas I 253.597.938 347.500.000 2.500.597.938 22 Jun 01 20 Jul 01 20 Jul 00 Right Issue I

Penawaran Umum Terbatas II 706.000.250 875.209.278 3.206.598.188 17 Sep 02 16 Oct 02 16 Oct 02 Right Issue II

Penawaran Umum Terbatas III 847.644.020 565.096.278 5.227.242.032 4 Jun 04 28 Jun 04 21Jun 04 Right Issue III

Penawaran Umum Terbatas IV 1.829.534.711 - 7.056.776.743 27 Jun 07 28 Jun 07 12 Jul 07 Right Issue IV

Komposisi Pemegang Saham pada akhir bulan Desember 2010

Shareholders Composition as of December 2010 Pemegang Saham

Shareholders Kepemilikan Saham Share Ownership %

Di Atas 5% / Above 5%

PT Bhakti Panjiwira 6.703.864.112 22,45%

Hary Tanoesoedibjo 5.111.398.000 17,12%

UOB Kay Hian Private Limited 1.797.000.000 6,02%

ABN Amro Nominees Singapore 1.785.484.000 5,98%

UBS AG Singapore 1.600.000.000 5,36%

Sub Total 16.997.746.112 56,93%

Masyarakat (di bawah 5%) / Public (below 5%) 12.642.428.733 42,37% Modal Saham yang diperoleh kembali/Treasury Stock 207.988.000 0,70%

Grand Total 29.848.162.845 100,00%

Komposisi saham yang dimiliki oleh Komisaris dan Direksi atas nama pribadi per Desember 2010

Share ownership composition by the Board of Commissioners and Directors as of 31st December 2010

Pemegang Saham

Shareholders

Jabatan

Title

Kepemilikan Saham

Share Ownership %

Hary Tanoesoedibjo Direktur UtamaPresident Director 5.111.398.000 17,12%

Liliana Tanaja KomisarisCommissioner 72.114.000 0,24%

Ratna Endang Soelistyawati Komisaris UtamaPresident Commissioner 35.141.000 0,12%

Darma Putra DirekturDirector 4.383.500 0,01%

Hary Djaja DirekturDirector 3.362.500 0,01%

Bambang Rudijanto Tanoesoedibjo KomisarisCommissioner 1.753.500 0,01%

Antonius Z. Tonbeng Komisaris IndependenIndependent Commissioner 350.500 0,00%

RATNA ENDANG SOELISTYAWATI Komisaris Utama

President Commissioner

The key factor of our

successful performance

in 2010 was the synergy

between the Company and

its subsidiaries.

Greetings,

On behalf of the Board of Commissioners of PT Bhakti Investama Tbk, let us irst praise God Almighty for all of His blessings which enabled the Company to have better and satisfactory performance in 2010.

The performance of the Company deserved the highest commendation, considering the global economic condition which was still below our expectations. Even though the world economic growth rose to 4.2% in 2010 from around 2.2% in 2009, it was still lower than 2007 growth of 5.2%.

The moderate world economic growth was due to many developed countries were still coping with the negative impacts of the global economic crisis which started in 2008 and peaked in 2009. For instance, USA was reforming its inancial sector by ratifying the Dodd-Frank Wall Street Reform and Consumer Protection Act in 2010, which will be imposed this year. On the other hand, Asia Paciic nations – particularly China and India with their Gross Domestic Products (GDP) of 10 and 8.9% respectively – once again became the locomotives of the world economic growth. Indonesia, with its 6.1% growth or well above the global growth, and other Asian nations also contributed to the world economic growth.

Consumption remains the driving force of national economic growth in 2010, in addition, economic growth was also contributed by exports which climbed by 7% year-on-year, despite the steady strengthening of the Rupiah against the US Dollar, as the world demands for Indonesian products have increased.

In 2010, the Indonesian Balance of Payments registered a signiicant surplus, due to the upsurge of capital inlows in the forms of both portfolio and direct investments. Such performance has generated positive perception from international economists, in addition to the high yield of investments in the country.

Salam sejahtera,

Atas nama Dewan Komisaris PT Bhakti Investama Tbk, izinkan saya dalam Laporan Tahunan 2010 ini menghaturkan puji dan syukur kepada Tuhan atas segala karuniaNya sehingga Perseroan dapat menunjukkan kinerja yang semakin baik dan amat memuaskan.

Kinerja Perseroan tersebut patut dihargai mengingat kondisi ekonomi global dan nasional belum sebaik seperti yang kita harapkan. Memang laju pertumbuhan perekonomian dunia meningkat menjadi 4,2% pada 2010 dari sekitar 2,2% pada 2009. Namun laju pertumbuhan tahun 2010 tersebut masih lebih rendah daripada angka pada 2007 sebesar 5,2%.

Pertumbuhan ekonomi global yang moderat tersebut terjadi karena negara maju masih mengatasi dampak negatif krisis keuangan global yang muncul pada akhir 2008 dan memuncak pada 2009. Amerika Serikat misalnya sedang melakukan reformasi di bidang keuangan dengan mengesahkan UU Dodd-Frank pada 2010 dan akan mulai memberlakukannya tahun ini. Di sisi lain, Negara kawasan Asia Pasiik terutama China dan India, dengan pertumbuhan produk domestik bruto masing-masing 10% dan 8,9%, kembali menjadi motor pertumbuhan ekonomi dunia. Indonesia dan Negara Asia lain juga mendukung pertumbuhan ekonomi global. Perekonomian Indonesia tumbuh 6,1%, jauh di atas pertumbuhan global.

Sumber pertumbuhan ekonomi nasional pada 2010 tetap konsumsi seperti pada tahun-tahun sebelumnya. Selain itu pertumbuhan ekonomi juga disumbang oleh ekspor, yang meningkat 7% dari angka pada 2009 meskipun nilai tukar Rupiah terus membaik terhadap USD. Hal ini terjadi karena permintaan dunia atas produk Indonesia yang masih kuat.

The perception then attracted many foreign investors to invest their funds in Indonesian capital market, as indicated by the 46% growth of Jakarta Composite Index (JCI) from 2,534 points on the year-end closing of 2009 to 3,703 points in 2010. The increasing JCI has placed the Indonesian Stock Exchange among the best performing bourses in Asia Paciic.

Aside from the macro economic factors, we believe that the achievement of the Company in 2010 was the fruit of the hard work and efectiveness of the management in implementing strategies to broaden the business scope. They managed to sharpen the core businesses – focusing on inancial services, set up a comprehensive strategy to venture to the natural resources sector, and maintain the development of the media sector through MNC Group. We also fully support every steps taken by the Board of Directors to pursue a strategy of expansion to productive business sectors.

We believe that every decisions made by the Board of Directors in expanding the Company either through organic or inorganic ways with a series of acquisitions has undergone a long process supported by comprehensive reviews including risk managements. Therefore, we are hoping to expand and optimize our current achievements for the growth of our business in the coming years.

The key factor of our successful performance in 2010 was the synergy between the Company and its subsidiaries. Hence, the Board of Commissioners gives the highest appreciation for the hard work and outstanding team work which have been shown by the management and employees in creating added values for the entire stakeholders.

Ditambah dengan masih tingginya imbal hasil investasi dari aset domestik, persepsi positif tersebut tampaknya telah mendorong pemodal portofolio asing berinvestasi di pasar modal Indonesia. Indikasinya adalah kenaikan Indeks Harga Saham Gabungan (IHSG) sebesar 46% dari 2.534 poin pada akhir 2009 menjadi 3.703 poin pada akhir 2010. Kenaikan IHSG membuat Bursa Efek Indonesia menjadi salah satu bursa dengan kinerja terbaik di Asia Pasiik.

Di luar faktor makro ekonomi nasional tersebut, kami percaya bahwa pencapaian Perseroan pada 2010 adalah hasil kerja keras manajemen dan efektiitas mereka dalam menerapkan strategi untuk melebarkan sayap bisnis seperti mempertajam core business dengan fokus ke jasa keuangan dan mempersiapkan ekspansi bisnis di natural resources, di samping pengembangan di bidang media melalui MNC Group. Kami juga mendukung sepenuhnya langkah Direksi Perseroan yang telah mengambil langkah-langkah untuk melakukan strategi ekspansi di sektor-sektor bisnis yang dianggap produktif

Kami percaya setiap keputusan Direksi untuk mengembangkan Perseroan baik secara organik maupun non-organik dengan serangkaian akuisisi telah melewati proses panjang yang didukung dengan berbagai kajian termasuk kajian resiko. Karena itulah kami berharap pencapaian yang sudah dilakukan saat ini bisa dikembangkan dan dioptimalkan untuk pertumbuhan bisnis Perseroan yang lebih baik di tahun-tahun mendatang.

Kami juga melihat kunci sukses dari pencapaian kinerja pada 2010 adalah sinergi yang dihasilkan dari kerjasama antara Perseroan dengan anak-anak perusahaan. Untuk ini Dewan Komisaris memberikan penghargaan setinggi-tingginya terhadap kerja keras dan kerjasama tim yang baik, yang ditunjukkan jajaran manajemen dan karyawan Perseroan sehingga menciptakan nilai tambah yang lebih besar bagi para pemegang saham dan seluruh pemangku kepentingan.

DEwAN KOMISARIS DAN/ATAU MELALUI RAPAT UMUM PEMEGANG SAHAM.

Moreover, we appreciate the eforts of the Board of Directors in implementing Good Corporate Governance in 2010. Every business decisions were conducted in transparent manner. Every business strategy was communicated openly to the Board of Commissioners and/or through the General Meeting of Shareholders. Everyone in the Company from upper to lower management has a good understanding of the scope and responsibility of their work.

We foresee that the improvement of global economic condition in 2011 will generate a substantial foreign capital inlow to Indonesia, which correlates with the commitment of several companies to gather fresh fund through Initial Public Oferings (IPOs) or rights issue on the capital market. It will surely provide an opportunity for the Company, particularly through its subsidiaries in the inancial service sector. We also realize, however, the potentials of growth would not come into existence without challenges. The increased crude oil price will adversely afect various business and national economy.

The Board of Commissioners once again gives the highest commendation for the hard, smart, and solid team works which have been contributed by the management and employees in advancing the Company and created added values for the entire shareholders and stakeholders.

Lebih dari itu, kami menghargai upaya Direksi yang telah menerapkan Tata Kelola Perusahaan dengan baik pada 2010. Setiap pengambilan keputusan bisnis Perseroan dilakukan secara transparan. Strategi bisnis sejauh ini selalu dikomunikasikan kepada Dewan Komisaris dan/atau melalui Rapat Umum Pemegang Saham. Setiap pihak di Perseroan mulai dari manajemen sampai ke level rendah telah memahami dengan baik ranah pekerjaan dan tanggung jawab mereka masing-masing.

Kami memperkirakan bahwa semakin baiknya kondisi ekonomi global pada 2011 akan mendorong arus modal asing lebih deras lagi masuk ke Indonesia. Hal ini terkait dengan komitmen beberapa perusahaan untuk menggalang dana di pasar modal baik melalui penawaran saham perdana

(initial public ofering/IPO)maupun right issue. Hal ini jelas memberi peluang usaha bagi Perseroan, khususnya melalui anak perusahaan di bidang jasa keuangan. Namun kami sadar bahwa potensi pertumbuhan tersebut bukannya tanpa tantangan. Kenaikan harga minyak mentah dunia secara otomatis akan berdampak besar pada berbagai kegiatan bisnis dan perekonomian nasional.

Sekali lagi, Dewan Komisaris memberikan penghargaan setinggi-tingginya atas kerja keras, kerja cerdas dan kerja tim yang solid yang ditunjukkan jajaran manajemen dan karyawan Perseroan dalam memajukan Perseroan dan memberikan nilai lebih demi kepentingan para pemegang saham dan pemangku kepentingan.

RATNA ENDANG SOELISTYAWATI

Ratna Endang Soelistyawati was born in Surabaya in 1961. After inishing her 6th semester (3rd year) at the Civil Engineering of Petra University, Surabaya in 1984, she advanced her education to Qualifying Year for a Master program in Civil Engineering at Carleton University, Ottawa, Canada, and earned her degree in Master of Engineering in 1987.

Before chairing the Board Of Commissioners of the Company in 2009, she was a Commissioner from 1995-2009. She has also held several important positions, including President Commissioner of PT Solobhakti Trading & Contractor since 2002, Commissioner of PT Prasasti Mitra since 1994 until February 28th 2007, BPR Bangil Adyatama since 1998, PT Cipta Karya Bhakti since 1987, and BPR Rajekwesi since 2001.

4. Posma Lumban Tobing,

Komisaris Independen

/

Independent Commissioner

5. Antonius Z. Tonbeng,

Komisaris Independen

/

Independent Commissioner

3

5

1

4

2

RATNA ENDANG SOELISTyAwATI

Komisaris Utama President Commissioner

Ratna Endang Soelistyawati lahir di Surabaya pada tahun 1961. Setelah menyelesaikan semester 6 (tingkat 3) Fakultas Teknik Sipil Universitas Petra tahun 1984, beliau melanjutkan pendidikannya ke Qualifying year untuk program Master di bidang Teknik Sipil di Carleton University, Ottawa, Kanada, dan meraih gelar Master of Engineering pada tahun 1987.

Bambang Rudijanto Tanoesoedibjo lahir di Surabaya pada tahun 1964 dan memperoleh gelar Bachelor of Commerce dari Carleton University, Ottawa, Kanada pada tahun 1987 dan kemudian gelar Master of Business Administration dari University of San Francisco, USA pada tahun 1989. Beliau menjabat Komisaris Perseroan sejak 2002. Saat ini beliau juga menduduki beberapa posisi penting baik di Grup Bhakti maupun Grup MNC, di antaranya adalah Direktur Utama PT MNC Sky Vision sejak 2004, wakil Komisaris Utama PT Global Mediacom Tbk dan PT Rajawali Citra Televisi Indonesia (RCTI) sejak 2002, Komisaris PT Media Nusantara Citra Tbk sejak 2004, dan Komisaris Utama PT MNC Asset Management (dahulu “PT Bhakti Asset Management”). Selain itu, beliau juga menjabat sebagai Komisaris Utama PT Dos Ni Roha sejak 2007.

Liliana Tanaja, yang lahir di Surabaya, mendapatkan berbagai diploma di bidang studi yang berhubungan dengan bidang kecantikan dan fesyen di Ottawa, Kanada selama periode 1987-1989. Beberapa diantaranya adalah Diploma Professional Cosmetician, Diploma Professional Nail Technician, dan Diploma Colour Consultant dari Versailles Academy of Make-up Arts & Aesthetics (1986-1988), Diploma Hat Making & Accessories, Diploma Fashion Design dari L’Academic des Couturies Canadiens, serta Diploma Fashion Merchandising and Marketing dari ICS Canadian Limited (1988-1989).

Selain menjabat Komisaris sejak Juni 2009, beliau juga menjabat Pemimpin Umum Majalah HighEnd sejak 2008, Komisaris PT Star Media Nusantara dan Ketua Umum yayasan Pendidikan Bagi Bangsa sejak 2007, Direktur PT Media Persahabatan Indonesia sejak 2004, Pemimpin Umum Tabloid Genie dan Mom&Kiddie, serta Ketua Jalinan Kasih RCTI. Selain itu beliau juga merupakan pendiri Miss Indonesia.

Bambang Rudijanto Tanoesoedibjo was born in Surabaya in 1964 and earned his Bachelor degree in Commerce from Carleton University, Ottawa, Canada in 1987 and Master of Business Administration degree from University of San Francisco, USA in 1989. He has been assigned as one of the Commissioners of the Company since 2002, as well as several other important positions in Bhakti Group and MNC Group, including the President Director of PT MNC Sky Vision since 2004, Vice President Commissioner of PT Global Mediacom Tbk and PT Rajawali Citra Televisi Indonesia (RCTI) since 2002, Commissioner of PT Media Nusantara Citra Tbk since 2004, and President Commissioner of MNC Asset Management (previously known as PT Bhakti Asset Management). Additionally, he has also been serving as the President Commissioner of PT Dos Ni Roha since 2007.

Liliana Tanaja was born in Surabaya. She earned diplomas in several studies related to fashion and beauty care in Ottawa, Canada, in 1987-1989, including Diploma in Professional Cosmetician, Diploma in Professional Nail Technician, and Diploma in Color Consultant from Versailles Academy of Make-up Arts & Esthetics (1986- 1988), Diploma in Hat Making & Accessories, Diploma in Fashion Designer from L’Academic des Couturies Canadiens, and Diploma in Fashion Merchandising as well as Marketing from ICS Canadian Limited (1988-1989).

Aside from serving as one of the Commissioners of the Company since June 2009, she also holds several positions in the ailiated companies – the Chairwoman of HighEnd Magazine since 2008, a Commissioner of PT Star Media Nusantara, the Chairwoman of Yayasan Pendidikan Bagi Bangsa (Education for the Nation Foundation) since 2007, Director of PT Media Persahabatan Indonesia since 2004, Chairwoman of Genie and Mom&Kiddie tabloids, as well as Chairwoman of Jalinan Kasih RCTI. She is also the founder of Miss Indonesia Beauty Pageant.

Commissioner

LILIANA TANAJA

Komisaris

Posma Lumban Tobing, lahir di Tarutung, Sumatera Utara pada tahun 1948 dan lulus AKABRI Kepolisian pada tahun 1970. Beliau menyelesaikan pendidikan lanjutan tingkat doctoral di PTIK pada tahun 1981 dan SESKOAL pada tahun 1985 dan LEMHANAS KSA VIII pada tahun 2001. Beliau juga pernah mengikuti beberapa kursus kepemimpinan seperti Suspadnas di Lemhanas, Susgatisospol dan Suspospol di Sesko ABRI, Kursus Para, dll. Beliau menjabat sebagai Komisaris Perseroan sejak 2006. Selain itu beliau juga menjadi anggota Dewan Komisaris di beberapa perusahaan terailiasi seperti PT MNC Skyvision sejak 2004, PT Media Nusantara Citra Network sejak 2006, PT Sun Televisi Network serta Komisaris Utama PT Rajawali Citra Televisi Indonesia sejak 2009. Sebelumnya beliau pernah menjalani karir di Kepolisian RI dengan pangkat terakhir Komisaris Jenderal Polisi pada tahun 2003 dan telah menerima bintang jasa seperti STL Bhayangkara Pratama. Beliau pernah bertugas sebagai anggota DPR/MPR RI dengan jabatan terakhir Ketua Fraksi TNI/POLRI DPR-RI MPR-RI dan wakil Ketua MPR RI periode 1999-2004. Beliau juga pernah menjadi Ketua Komisi VII pada 2001-2003.

Lahir di Makassar, Antonius Z Tonbeng memperoleh Sarjana Muda Ekonomi pada tahun 1975 dari Universitas Hasanuddin di Makassar dan lulus Sarjana Akuntansi dari Universitas Katolik Parahyangan Bandung pada tahun 1981. Beliau menjabat sebagai Komisaris Perseroan sejak Juni 2009. Beliau juga memegang posisi sebagai Komisaris pada PT Asindo Husada Bhakti sejak 2003 dan PT MNC Asset Management (dahulu “PT Bhakti Asset Management”) sejak 2004. Sebelumnya, beliau menjabat sebagai Direktur PT Bhakti Capital Indonesia Tbk (2004-2006) dan PT Global Land Development Tbk (2006-2008).

Posma Lumban Tobing was born in Tarutung, North Sumatera in 1948. He graduated from the Armed Forces’ Police Academy (AKABRI Kepolisian) in 1970. He inished his advanced study equivalent to doctoral degree from the Police Institute of Higher Education (PTIK) in 1981. He graduated from SESKOAL in 1985 and LEMHANAS KSA VIII in 2001. In addition, he had also undertaken several leadership courses on military and defense, such as Suspadnas at Lemhanas, Susgatisospol and Suspospol at Sesko ABRI, Para School, etc. He has been an Independent Commissioner of the Company since 2006. Furthermore, he was also appointed as a member of the Board Of Commissioners in the ailiated companies, including PT MNC Skyvision since 2004, PT Media Nusantara Citra Network since 2006, PT Sun Televisi Network, as well as the President Commissioner of PT Rajawali Citra Televisi Indonesia (RCTI) since 2009. He has spent his career with the Indonesian Police and ultimately ranked as a General Commissioner in 2003 with several honorary prizes like the STL Bhayangkara Pratama. Posma had also served as a legislator in the People’s Consultative Assembly (MPR) as the Head of the Army/Police Faction, Vice Chairman of MPR during the period of 1999-2004 and Chairman of Commission VII of the House of Representatives (DPR) from 2001-2003.

Born in Makassar, Antonius Z Tonbeng obtained his Diploma degree in Economics from Makassar’s Hasanuddin University in 1975 and Bachelor degree in Accounting from Parahyangan Catholic University of Bandung in 1981. He was appointed as a Commissioner of the Company since June 2009. He has also been serving as a Commissioner of PT Asindo Husada Bhakti since 2003 and PT MNC Asset Management (previously known as PT Bhakti Asset Management) since 2004. Previously, he was a member of the Board of Directors of PT Bhakti Capital Indonesia Tbk (2004-2006) and PT Global Land Development Tbk (2006- 2008).

Independent Commissioner

ANTONIUS Z. TONBENG

Komisaris Independen

HARY TANOESOEDIBJO Direktur Utama

President Director

The Company consolidated

revenues rose sharply by

25%, from Rp 5.47 trillion

in 2009 to Rp 6.83 trillion in

2010, which is the highest

igure in the Company’s

history.

PENDAPATAN USAHA

KONSOLIDASI

PERSEROAN NAIK

TAJAM, 25%, DARI

RP5,47 TRILIUN PADA

2009 MENJADI

Honorable shareholders,

First of all – allow me on behalf of the Board Directors to praise God Almighty for His blessing upon us that we are able to continue to improve the Company’s performance. We recorded 2010 as Year of Growth and Business Expansion.

In line with that, we are proud to report that in 2010 the Company’s consolidated revenue rose sharply by 25%, from Rp5.47 trillion in 2009 to Rp6.83 trillion, which is the highest igure in the Company’s history. Moreover, after implementing the cost eiciency program, the 2010 operating income soared 115% to Rp1.56 trillion compared to 2009 achievement of Rp726 billion.

Undoubtedly our success could not have been accomplished without the support from our shareholders and stakeholders. In addition, the global economic recovery, which began since 2009 and continued to lourish in 2010, has enhanced the Company’s performance. The global economic recovery, as seen from the world economic growth, has increased the demand for goods and services, which are partially supplied by Indonesia. Indonesian export, underpinned by investment and consumption, has accelerated the economical growth which inevitably boosted the Gross Domestic Product to around 6% in 2010. Indonesia, as we all know, together with other Asia Paciic countries, will become one of the world economy backbones.

Pemegang saham yang terhormat,

Pertama-tama – atas nama Dewan Direksi – izinkan saya mengucapkan puji syukur kepada Tuhan yang Maha Esa karena hanya atas karunia-Nya kita mampu terus meningkatkan kinerja Perseroan. Kami mencatat 2010 sebagai Tahun Pertumbuhan dan Ekspansi Bisnis.

Sejalan dengan itu, dengan bangga kami sampaikan bahwa pada tahun 2010 pendapatan usaha konsolidasi Perseroan naik tajam, yaitu sebesar 25%, dari Rp5,47 triliun pada tahun 2009 menjadi Rp6,83 triliun, yang merupakan angka tertinggi sepanjang sejarah Perseroan. Ditunjang dengan keberhasilan program eisiensi biaya yang kami jalankan, laba usaha tahun 2010 meningkat lebih tinggi lagi, yakni 115% menjadi Rp1,56 triliun dibandingkan dengan capaian 2009 sebesar Rp726 miliar.

Tentu saja keberhasilan kami tidak akan tercapai tanpa dukungan para pemegang saham dan seluruh pemangku kepentingan. Selain itu, pemulihan ekonomi global, yang berlangsung sejak 2009 dan berlanjut pada 2010, turut memberi pengaruh positif pada kinerja Perseroan. Pemulihan ekonomi global, seperti terlihat dari pertumbuhan ekonomi dunia, telah meningkatkan permintaan akan barang dan jasa, yang sebagian dipasok oleh Indonesia. Ekspor Indonesia, didukung oleh konsumsi dan investasi, telah mempercepat roda pembangunan sehingga produk domestik bruto tumbuh sekitar 6% pada 2010. Indonesia seperti kita ketahui, bersama negara-negara Asia Pasiik lain, akan menjadi salah satu motor perekonomian dunia.

Pada tahun 2010, laba usaha

meningkat :

In 2010, Operating

income soared by

115

%

lAbA USAHA

726

miliar

1,56

triliun

Honorable shareholders,

The global economic recovery and robust economic growth has in turn pushed the conidence of investors to invest in Indonesian capital market as seen from the spike in the composite stock price index (CSPI) from 2.534 points to 3,703 points at the end of 2010. In line with the improvements of stock market conditions, the performance of our subsidiaries in inancial services sector has risen sharply.

Our inancial Services Sector, through PT Bhakti Capital Indonesia Tbk (Bhakti Capital), was able to beneit from good momentum in 2010, where various strategies and business development to strengthen its core business have been implemented. Bhakti Capital recorded revenues of Rp291 billion in 2010 which increased by 50% compared to 2009 revenue of Rp194 billion.

Through Bhakti Capital, the Company has penetrated the insurance business by acquiring 99.9% share in UOB Life. As the majority shareholder of UOB Life, the Company has changed its name to MNC Life Assurance. We have embarked to the insurance business to beneit from a very promising market of the insurance industry in Indonesia. It is evidenced by the facts that Indonesia, with a total population of 240 million people, has a low penetration rate of insurance products which is estimated at only around 1.82%. We certainly hope the acquisition and operation of MNC Life Assurance will fortify the Company’s objective to become an integrated inancial services company.

Apart from that, the Company through MNC Securities has introduced an online trading platform called the Bhakti Online Brokerage (BOB) in order to increase the volume of transactions. In the investment manager sector, MNC Asset Management has increased its exposure in the mutual fund industry, by successfully expanding the investor base, especially the MNC Dana Lancar, a money market mutual fund which could be an alternative to bank deposits. In the multi-inance sector, MNC Finance has expanded and increased the number of its branches throughout Indonesia.

Pemegang saham yang terhormat,

Pemulihan ekonomi global dan mantapnya pertumbuhan ekonomi nasional pada gilirannya telah meningkatkan keyakinan para pemodal untuk berinvestasi di pasar modal Indonesia, seperti terlihat dari lonjakan indeks harga saham gabungan (IHSG) dari 2.534 poin menjadi 3.703 poin pada akhir 2010. Sejalan dengan membaiknya kondisi bursa saham tersebut, kinerja anak perusahaan Perseroan di bidang jasa keuangan meningkat tajam.

Sektor Jasa Keuangan kami, yang dikelola oleh PT Bhakti Capital Indonesia Tbk (Bhakti Capital), telah memanfaatkan momentum bagus pada tahun 2010 dengan menerapkan berbagai strategi dan pengembangan usaha untuk memperkuat core business di bidang jasa keuangan. Bhakti Capital mampu membukukan pendapatan tahun 2010 sebesar Rp291 miliar, meningkat 50% dibandingkan tahun 2009 sebesar Rp194 miliar.

Melalui Bhakti Capital, Perseroan telah merambah ke bisnis asuransi dengan mengakuisisi 99,9% saham UOB Life. Sebagai pemegang saham mayoritas UOB Life, Perseroan telah mengubah nama perusahaan asuransi ini menjadi MNC Life Assurance. Langkah diversiikasi ini kami lakukan untuk memanfaatkan potensi pasar industri asuransi di Indonesia yang masih sangat menjanjikan. Dengan jumlah penduduk Indonesia sekitar 240 juta orang, tingkat penetrasi produk asuransi diperkirakan baru sekitar 1,82 persen. Akuisisi dan pengoperasian MNC Life Assurance ini kami harapkan akan mendukung pencapaian sasaran Perseroan menjadi perusahaan jasa keuangan terintegrasi.

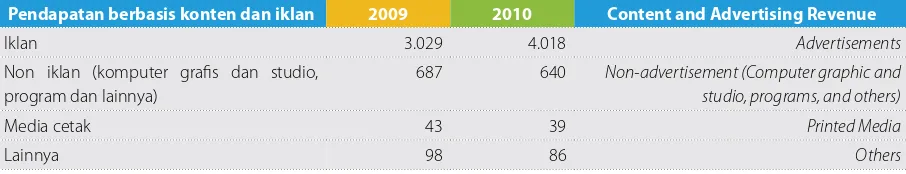

In absolute terms, PT Global Mediacom Tbk. (“Mediacom”) which represents the media sector contributes revenue through content & advertising based media, and subscriber based media, with the total revenue of Rp6.33 trillion, representing a 26% increase from Rp5.03 trillion in 2009.

During the irst quarter of 2010 Linktone Ltd (Linktone) which is part of PT Media Nusantara Citra Tbk (MNC) – a subsidiary of Mediacom (MNC Group) – has acquired 75% share of Innoform Group, a Singapore-based company with regional oices in Malaysia and Hong Kong. InnoForm Group is a DVD manufacturer and the holder of the DVD distribution rights and educational products such as movies and music entertainment.

InnoForm Group is the majority shareholder of Alliance Entertainment and holds license of Warner Home Video, New Line International, 20th Century Fox Entertainment and other independent ilm studio. InnoForm Group shall be utilized to expand MNC Group’s content distribution and procurements.

In addition, Linktone has acquired a controlling interest in Letang Game Ltd (Letang), a Chinese company specializing in development of mobile games and PC Online Games by utilizing innovative content and leading technologies. The combination of Letang’s expertise with Linktone’s broad distribution capabilities is expected to improve Linktone’s position in expanding its business both domestically and to international markets.

Another achievement in the media business is the partnership establishment between MNC Group and Rakuten, Inc. - a leading Internet company from Japan. In this partnership the two companies will form a joint venture that will launch the brand “Rakuten Belanja On-line”, an online shopping center and

Secara absolut, bisnis media yang diwakili PT Global Mediacom Tbk. (“Mediacom”) menyumbang pendapatan dari media berbasis konten dan iklan serta media berbasis pelanggan yang secara keseluruhan membukukan pendapatan pada tahun 2010 sebesar Rp6,33 triliun, meningkat sebesar 26% dibandingkan tahun 2009 sebesar Rp5,03 triliun.

Pada kuartal pertama 2010, Linktone Ltd (Linktone) yang yang merupakan bagian dari PT Media Nusantara Citra Tbk (MNC) – anak perusahaan Mediacom (MNC Group) - telah mengakuisisi 75% saham InnoForm Group, perusahaan yang berkantor pusat di Singapura dan memiliki kantor regional di Malaysia dan Hongkong. InnoForm Group adalah perusahaan pembuat dan pemegang hak distribusi DVD produk-produk edukasi dan hiburan seperti ilm dan musik.

InnoForm Group adalah pemegang saham mayoritas Alliance Entertainment, pemegang lisensi video dari warner Home Video, New Line International, 20th Century Fox

Entertainment dan studio ilm independen lain. InnoForm Group akan diutilisasi untuk memperluas distribusi dan pembelian content.

Selain itu, Linktone telah mengakuisisi mayoritas saham pada Letang Game Ltd (Letang), sebuah perusahaan Cina dengan spesialisasi pada mobile games dan PC Online Games dengan memanfaatkan konten inovatif dan teknologi terdepan. Kombinasi antara keahlian Letang dengan distribusi Linktone yang sangat luas diharapkan dapat meningkatkan posisi Linktone dalam pertumbuhannya di dalam dan luar negeri.

Pencapaian lain pada bisnis media adalah terjalinnya kerjasama antara MNC Grup dan Rakuten, Inc - perusahaan internet terkemuka dari Jepang. Dalam kerja sama ini kedua perusahaan akan membentuk usaha patungan yang akan meluncurkan merk “Rakuten Belanja On-line”, pusat

PADA TAHUN MENDATANG, PERSEROAN AKAN BERDIRI DI ATAS TIGA PILAR BISNIS yAITU

MEDIA, JASA KEUANGAN DAN NATURAL RESOURCES.

expected to surpass other online shopping sites to become the number one shopping site. This collaboration is to exploit the promising potential of e-commerce business. As a country with a population of 240 million, the fourth largest in the world, and 33 million Internet users, the largest in ASEAN, Indonesia has the potential for tremendous growth in e-commerce business.

In order to accelerate its business growth in the future, in 2010 the Company decided to enter into new ventures in coal mining, oil and gas.

The Company signed the transaction documents to own the majority share in PT Bhakti Coal Resources (BCR), which has acquired eight Mining Rights (Ijin Usaha Pertambangan (IUP)) covering more than 92,000 hectares in Musi Banyuasin Regency, South Sumatra. The realization of this acquisition will make the Company the majority shareholder of BCR.

Therefore in the upcoming year, the Company will stand on three business pillars, namely Media, Financial Services and Natural Resources, where the Company’s performance will continue to grow in the future. Meanwhile, in the eforts to increase public awareness and to enhance credibility, the Company has changed the names of all the inancial services subsidiaries with MNC brand.

perbelanjaan online yang diharapkan akan menjadi nomor satu di Indonesia menggeser media shopping online yang ada. Kerjasama ini adalah untuk memanfaatkan potensi bisnis e-commerce yang menjanjikan. Sebagai negara dengan populasi 240 juta, keempat terbesar di dunia, dan populasi pengguna internet 33 juta, terbesar di ASEAN, Indonesia memiliki potensi pertumbuhan yang luar biasa dalam bisnis e-commerce.

Untuk mempercepat pertumbuhan usaha di masa depan, pada tahun 2010 Perseroan memutuskan untuk masuk ke bidang usaha baru yaitu bisnis pertambangan batu bara, minyak dan gas.

Perseroan telah menandatangani dokumen transaksi untuk memiliki mayoritas saham PT Bhakti Coal Resources (BCR) yang telah mengakuisisi delapan Ijin Usaha Pertambangan (IUP) seluas lebih dari 92.000 ha di Kabupaten Musi Banyuasin, Sumatera Selatan. Realisasi akuisisi tersebut akan membuat Perseroan menjadi pemegang saham mayoritas BCR.

Dengan demikian, pada tahun mendatang, Perseroan akan berdiri di atas tiga pilar bisnis yaitu Media, Jasa Keuangan dan Natural Resources, yang mendukung pertumbuhan kinerja Perseroan di masa depan. Sementara itu, untuk meningkatkan awareness masyarakat dan kepercayaan publik, Perseroan telah mengubah nama semua perusahaan di bidang jasa keuangan dengan nama-nama yang menggunakan nama merek MNC.

PERSEROAN TELAH MENGUBAH NAMA SEMUA PERUSAHAAN DI BIDANG JASA

KEUANGAN DENGAN NAMA-NAMA yANG MENGGUNAKAN NAMA MEREK MNC.

To support future expansion plans, the Company has conducted a series of activities to strengthen the inancial structure; for example the Company received approval from shareholders at the Extraordinary General Meeting of Shareholders dated 15 April 2010 to raise capital without preemptive rights. In May 2010, the Company made its capitalization of share premium by issuing bonus shares, in which each holder of 1 (one) share will receive 3 (three) Bonus Shares with the total value of Rp2.83 trillion.

To ensure that the Company’s goals and objectives are achieved, we continuously improve the personal quality and morale of our human resources through variuos training programs and outdoor activities such as outings and outbound.

Realizing the demands in business industry and the Company’s status as a public company, the Company has given its full commitment to implement Good Corporate Governance (GCG) in business processes and all aspects of corporate management. The Company is also applying the principles of GCG in all levels of the organization in a well planned, focused and measurable eforts.

In addition, the Company’s management with the support from all elements of the organization ranging from the General Meeting of Shareholders, the Board of Commissioners, Board of Directors, and all the employees, committed to continuously build the system, structure, also management and organizational culture based on the values of transparency, accountability, responsibility, independence , and equality / fairness.

Untuk mendukung rencana ekspansi ke depan, Perseroan telah melakukan serangkaian kegiatan yang memperkuat struktur keuangan, antara lain Perseroan telah mendapat persetujuan dari pemegang saham dalam Rapat Umum Pemegang Saham Luar Biasa pada tanggal 15 April 2010 untuk menambah modal Tanpa Hak Memesan Efek Terlebih Dahulu. Pada bulan Mei 2010, Perseroan juga melakukan kapitalisasi atas agio saham dengan menerbitkan saham bonus, di mana setiap pemegang 1 (satu) saham akan memperoleh sebanyak 3 (tiga) Saham Bonus dengan nilai mencapai Rp2,83 triliun.

Untuk memastikan bahwa sasaran dan tujuan Perusahaan tercapai, kami terus meningkatkan kualitas pribadi dan semangat kerja karyawan melalui berbagai program pelatihan serta kegiatan luar ruangan seperti outing dan outbond.

Menyadari tuntutan dunia usaha dan status Perseroan sebagai perusahaan publik, maka Perseroan telah memberikan komitmen penuh untuk menerapkan tata kelola perusahaan yang baik (GCG) dalam proses bisnis dan seluruh aspek pengelolaan perusahaan. Perseroan juga menerapkan prinsip-prinsip GCG pada semua organ dan jenjang di perseroan secara terencana, terarah dan terukur.

Based on the above-mentioned commitments, until the end of 2010 the Company has made various eforts, such as:

1. Forming several committees in the Board of Commissioners, namely: Audit Committee, Nomination and Remuneration Committee, Financial Planning and Business Risk Committee, and Good Corporate Governance Committee.

2. Socializing GCG.

In accordance with their functions and responsibilities, the management continuously attempted to couple our achieved proitability with Good Corporate Governance. To ensure the implementation of GCG, the Company has appointed Independent Commissioners. As the executors of every policy, the Board of Directors continuously takes the interests of shareholders and stakeholders into account and complies with the applicable regulatory requirements.

In the management side, the Company has strengthened the Internal Audit Group, to ensure that the Company’s internal control system and its business units work properly. The duties of Internal Audit Group are not only to evaluate the condition of internal controls, but also responsible in improving the adequacy and efectiveness of internal control systems itself.

In performing its duties, the Internal Audit Group refers to the Internal Audit Charter (aligned with the Bapepam-LK regulation) which gives authorities to Internal Audit Group to conduct a broad audit for all business units within the Group Company.

Berdasarkan komitmen di atas, Perseroan sampai akhir 2010 telah melakukan berbagai upaya, seperti:

1. Pembentukan beberapa Komite di Dewan Komisaris, yaitu: Komite Audit, Komite Nominasi dan Remunerasi, Komite Perencanaan Keuangan dan Risiko Usaha, serta Komite GCG.

2. Sosialisasi GCG.

Sesuai dengan fungsi dan tanggung jawabnya, manajemen berupaya agar proitabilitas yang telah dicapai Perseroan diiringi dengan tata kelola perusahaan yang baik. Untuk memastikan terlaksananya prinsip GCG, perusahaan juga telah mengangkat Komisaris Independen. Direksi selaku eksekutor dalam setiap kebijakan senantiasa berorientasi pada kepentingan pemegang saham dan pemangku kepentingan dan memperhatikan serta patuh pada ketentuan perundangan yang berlaku.

Di sisi Manajemen, Perseroan telah memperkuat Grup Internal Audit, yang bertujuan untuk memastikan bahwa kondisi sistem pengendalian internal di Perseroan beserta unit-unit usahanya berjalan dengan baik. Tugas dari grup Internal Audit tidak hanya mengevaluasi kondisi pengendalian internal (internal control), tetapi juga bertanggung jawab dalam meningkatkan kecukupan dan efektiitas dari sistem pengendalian internal (internal control system) tersebut.

Prospects in 2011

We enter 2011 with optimism that the trend of world economic recovery will continue. Accordingly, the Company has determined to utilize the existing investment resources, increase public and investor conidence, continuously monitor the new emerging potentials and taking strategic steps to enhance business growth.

Going forward, the Company will implement these following strategies:

1. Focusing in content and advertising based media, and subscriber based media through MNC Group.

2. Developing and maintaining long-term growth in inancial services both with organic growth strategy and synergic achievement via acquisition through Bhakti Capital.

3. Developing and implementing our third pillar business in the natural resources industry, especially in coal mining, oil and gas.

4. Expanding into other investment areas with lucrative business potentials and high growth rates.

Prospek 2011

Memasuki tahun 2011, kami optimis bahwa pemulihan perekonomian dunia akan terus berlanjut. Sejalan dengan itu, Perseroan bertekad untuk memanfaatkan sumber daya investasi yang ada, meningkatkan kepercayaan publik maupun investor, terus menerus mengidentiikasi potensi bisnis yang ada dan mengambil langkah-langkah strategis untuk meningkatkan pertumbuhan usaha.

Ke depan Perseroan akan menerapkan strategi sebagai berikut:

1. Fokus pada kegiatan usaha media berbasis konten dan iklan serta media berbasis langganan melalui MNC Grup. 2. Mengembangkan serta mempertahankan pertumbuhan jangka panjang di bidang jasa keuangan baik dengan strategi pertumbuhan organik dan pencapaian sinergi melalui akuisisi oleh Bhakti Capital .

3. Merealisasikan dan mengembangkan bisnis di pilar ketiga, yakni di bidang sumber daya alam, khususnya di bidang pertambangan batubara, minyak dan gas. 4. Melakukan ekspansi pada bidang investasi lain yang

memiliki prospek usaha dan tingkat pertumbuhan yang tinggi.

PERSEROAN TELAH MEMPERKUAT GROUP INTERNAL AUDIT, yANG BERTUJUAN UNTUK

MEMASTIKAN BAHwA KONDISI SISTEM PENGENDALIAN INTERNAL DI PERSEROAN

BESERTA UNIT-UNIT USAHANyA BERJALAN DENGAN BAIK.

With the aforementioned strategies, we expect in 2011 the Company will be able to do the following:

1. Media

Strengthening our current media business to increase its contribution to the Company.

2. Financial Services

Continue to develop inancial services business to become a “inancial services supermarket” that ofers a variety of quality inancial services ranging from investment products, mutual funds, insurance, stocks and bonds.

3. Developing the natural resources business to be able to give optimum revenue contribution to the Company in the future.

Finally, on behalf of the Board of Directors, I would like to give our highest appreciation to all parties who have supported our eforts, and made our Company a leading investment company in Indonesia. I on behalf of the Board of Directors would also like to express our appreciation to the shareholders, all employees of the Company and the Board of Commissioners who have supported the growth of the Company. With a strategy of continuous business expansion, we have great conidence that the Company will achieve better results in the future.

Melalui strategi tersebut di atas, kami berharap pada 2011 kami akan mampu melakukan hal-hal berikut:

1. Media

Memperkuat bisnis media yang telah berjalan dengan baik agar dapat memberikan kontribusi yang lebih besar. 2. Jasa Keuangan

Terus mengembangkan bisnis jasa keuangan sehingga menjadi “supermarket inancial services”

yang menawarkan berbagai layanan keuangan yang berkualitas mulai dari produk investasi, reksa dana, asuransi, saham, dan obligasi.

3. Mengembangkan bisnis di bidang sumber daya alam sehingga ke depan mampu memberikan kontribusi pendapatan yang optimal bagi Perseroan.

Akhir kata, atas nama Direksi, saya menyampaikan penghargaan yang setinggi-tingginya kepada semua pihak yang berkepentingan, yang telah mendukung usaha kami dan telah menjadikan Perseroan kami sebagai perusahaan investasi terkemuka di Indonesia. Saya atas nama Direksi, juga ingin menyampaikan penghargaan kepada para pemegang saham yang telah mendukung pertumbuhan Perseroan dan terhadap seluruh karyawan Perseroan dan Dewan Komisaris. Dengan strategi untuk terus melakukan ekspansi bisnis, kami memiliki keyakinan yang sangat besar bahwa Perseroan akan mencapai hasil yang lebih baik lagi di masa depan.

HARY TANOESOEDIBJO

Hary Tanoesoedibjo, whom was born in Surabaya in 1965, founded the Bhakti Group in 1989. He completed his study and received honorary degree of Bachelor of Commerce in Corporate Finance from Carleton University, Ottawa, Canada in 1988. He earned his Master of Business Administration degree in Portfolio Management from the same university in 1989.

In addition of being the Group President and CEO of the Company, he also holds various important positions in Bhakti Group and MNC Group. He is the President Commissioner of PT Bhakti Capital Indonesia Tbk since 1999, Group President and CEO of PT Global Mediacom Tbk since 2002, Group CEO of PT Media Nusantara Citra Tbk since 2004, President Director of PT Rajawali Citra Televisi Indonesia, Chairman of Linktone Ltd since 2008, and President Commissioner of PT MNC Sky Vision since 2006.

Many of the enterprises under his leadership have seen exceptional succeses. They have reached leading positions in Indonesia or even becoming a model for other player in the industry.

He has led several mergers and acquisitions as well as many complicated corporate restructurings, including the restructuring of PT Bhakti Capital Indonesia Tbk, Global Mediacom, MNC, RCTI and MNC TV (previously known as TPI). He also established Seputar Indonesia Newspaper. He is also a lecturer in several educational institution as well as becoming a speaker in seminars on capital market, corporate inance, investment and strategic management.

Hary Tanoesoedibjo, lahir di Surabaya pada tahun 1965, mendirikan Bhakti Group pada tahun 1989. Beliau menyelesaikan studinya dengan meraih gelar kehormatan Bachelor of Commerce di bidang Corporate Finance dari Carleton University, Ottawa, Kanada pada tahun 1988 dan Master of Business Administration bidang Manajemen Portofolio dari universitas yang sama pada tahun 1989.

Saat ini beliau menjabat sebagai Group President dan CEO PT Bhakti Investama Tbk. Selain itu beliau juga memangku berbagai jabatan penting di Bhakti Group dan MNC Group, di antaranya adalah Komisaris Utama PT Bhakti Capital Indonesia Tbk sejak 1999, Group President dan CEO PT Global Mediacom Tbk (Mediacom) sejak 2002, Group CEO PT Media Nusantara Citra Tbk sejak 2004, Direktur Utama PT Rajawali Citra Televisi Indonesia, dan Chairman Linktone Ltd sejak 2008, Komisaris Utama PT MNC Sky Vision sejak 2006.

Perusahaan-perusahaan yang dipimpin oleh beliau berkembang dengan sukses. Perusahaan-perusahaan tersebut menjadi perusahaan terdepan di Indonesia dan menjadi model bagi perusahan-perusahaan lain di industrinya.

Beliau telah berhasil memimpin berbagai akuisisi dan restrukturisasi penting, termasuk tapi tidak terbatas pada restrukturisasi PT Bhakti Capital Indonesia Tbk, Mediacom, MNC, RCTI dan MNC TV (dahulu “TPI”). Beliau adalah pendiri media cetak Seputar Indonesia. Beliau juga mengajar di berbagai lembaga pendidikan dan kursus serta pembicara pada berbagai seminar tentang pasar modal, corporate inance, investment maupun strategic management.

HARy TANOESOEDIBJO

Direktur Utama

HARy DJAJA

Direktur

Directors

DARMA PUTRA

Direktur

Director

Darma Putra was Born in 1966 in Medan and earned his bachelor degree from the Oregon State University, USA in 1988 and his MBA Degree in Finance from The University of Minnesota, USA in 1990.

He started his career in inance industy as Research Analyst at PT Sun Hung Kai Securities Indonesia (1990-1991), and as Financial Planning Executive at Bumi Raya Utama Group (1991-1997), before joining PT. Marga Mandalasakti (1997-1998) as the Chief Financial Oicer. He served as Finance Director at PT. Kurnia Kapuas Utama, Tbk. (1998-1999) and the Vice President Director of PT. Marga Mandalasakti (1999-2001) and inally President Director of PT. Marga Mandalasakti (2001-2008).

He was appointed as Director of the Company since April 2008. Currently, he also assumed some important positions in the Bhakti Group such as President Director of PT Bhakti Capital Indonesia Tbk, as well as Commissioner in PT MNC Securities (previously “PT Bhakti Securities”), PT MNC Finance (previously “PT Bhakti Finance”) and PT MNC Life Assurance in November 2010.

Hary Djaja was born in 1959 in Kediri and graduated from the University of Airlangga, Surabaya in 1982. He was appointed as Director of the Company since 1989. He had been appointed as President Director of PT Bhakti Capital Indonesia Tbk from 1999-2002. Currently he also serves as Commissioner of several of the Company’s subsidiaries such as PT Bhakti Capital Indonesia Tbk since 2002, PT MNC Asset Management (previously “PT Bhakti Asset Management”) since 2002, PT MNC SkyVision (2006-2009), President Commissioner of PT MNC Finance (previously “PT Bhakti Finance”) since 2008 as well as President Director of PT Global Transport Services.

Darma Putra lahir di Medan pada tahun 1966 dan memperoleh gelar sarjananya dari Oregon State University, Amerika Serikat pada 1988 dan gelar MBA di bidang Finance dari the University of Minnesota, Amerika Serikat pada 1990.

Beliau memulai karir di industri keuangan sebagai Analis Riset di PT Sun Hung Kai Securities Indonesia (1990-1991), dan Financial Planning Executive di Bumi Raya Utama Group (1991-1997), sebelum bergabung PT. Marga Mandalasakti (1997-1998) sebagai Chief Financial Oicer. Dia juga menjabat Direktur Keuangan di PT. Kurnia Kapuas Utama, Tbk. (1998-1999) dan wakil Direktur Utama PT. Marga Mandalasakti (1999-2001) dan akhirnya Direktur Utama PT. Marga Mandalasakti (2001-2008).

Beliau menjabat sebagai Direktur Perseroan sejak April 2008. Beliau juga dipercaya memangku sejumlah jabatan di kelompok usaha Bhakti Group, di antaranya Direktur Utama PT Bhakti Capital Indonesia Tbk, dan Komisaris di beberapa Anak Perusahaan, seperti PT MNC Securities (dahulu “PT Bhakti Securities”), PT MNC Finance (dahulu “PT Bhakti Finance”). dan PT MNC Life Assurance.

DRS. wIDODO BUDIDARMO Penasihat Perusahaan

Corporate Advisor

Widodo Budidarmo was born in Surabaya in 1927. After completing his post-graduate study at the Police Institute of Higher Education (PTIK), he continued his studies at the US Coast Guard Oicer Candidate School and Police Administration Studies, US. He had served many important position such as:

1. Chief of Indonesian Police (1974-1978)

2. Indonesian Ambassador to Canada (1979-1983)

3. President Commissioner of state-owned printing company PERUM PERURI (1985-1987)

4. President Commissioner of the state-controlled Bank Rakyat Indonesia (1987-1995)

He has been appointed as a Corporate Advisor since 1997. Lahir di Surabaya pada tahun 1927. Setelah menyelesaikan

studi paska sarjananya di Perguruan Tinggi Ilmu Kepolisian, Jakarta, beliau melanjutkan studinya ke US Coast Guard Oicer Candidate School and Police Administration Studies, AS. Beliau telah menduduki berbagai posisi penting sebagai:

1. Kepala Polisi Republik Indonesia (1974-1978) 2. Duta Besar Indonesia untuk Kanada (1979-1983) 3. Komisaris Utama, PERUM PERURI (1985-1987)

4. Komisaris Utama, Bank Rakyat Indonesia (1987-1995)