Monthly Progress Report No. 22

Covering Project Activities During

Direktur Jenderal Bina Marga InspektoratJenderal, Kementrian PU Direktur Transportasi - Bappenas

Direktur Pengelolaan Kas Negara (PKN), KementrianKeuangan Direktur Bina Program, DitJen Bina Marga

Direktur Bina Teknik, DitJen Bina Marga Direktur Bina PelaksanaanWilayah I, DJBM

Biro PerencanaanzyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA&KLN, Kementrian PU Kasubdit Kawasan Strategis dan Andalan, KementrianDalam Negeri

.10. Kasubdit Pembiayaan dan KerjasarnaLuar Negeri,Dit. Bipran, DJBM 11. Kasubdit Wilayah I B, Direktorat Bina PelaksanaWilayah I, DJBM 12. Kasubdit Wilayah I C, Direktorat Bina PelaksanaWilayah I, DJBM 13. Kasubdit Wilayah I 0, Direktorat Bina PelaksanaWilayah I, DJBM

14. Kepala SNVT Pembinaan Administrasidan PelaksanaanPengendalianPHLN 15. PT. Perentiana Djaja

16. Yongma EngineeringCo, Ltd

17. PT. Epadascon Permata EngineeringConsultant 18. File

PT. PERENTJANAOJAJAin subconsultancy with • Yongina Engin eering Co. Ltd and i1PT. Epadascon Permata Engineering Consultant CTC Office: JI. CiniruVl1 No. 25, KebavoranBaru, Jakarta Selatan, :2:

Phone /Fax: (021)7229823

Should you have any comment or additional information that need to be incorporated in the Report, please feel free to get in touch with us.

This Report is reproduced in twenty (20) copies for distributionto all concemed authorities.

In compliance with the Terms of Reference of our Consultancy Contract, we submit herewith the Monthly Progress Report No.22 covering the month of October 2014.

Dear Sir,

....~

Submission of October 2014 Monthly Progress Report No.22; WINRIP Loan IBRD No. 8043-10

Subject

Attention: Ir. Agusta Ersada SinulinggaI MT

Officer In Charge PMUWINRIP Directorate General of Highways, MPW JI. Pafirnura 20 Kebayoran Baru Jakarta Selatan

Indonesia

Jakarta, November 14, 2014 Our Ref.No . :zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA03_02/CT NO/M -10.2014

MINISTRY OF PUBLIC WORKS

DIRECTORATE GENERAL OF HIGHWAYS

DIRECTORATE OF PLANNING Core Team Consultant for

Western Indonesia National Roads Improvement Project (WIN RIP) IBRD Loan No. 8043-10

Monthly Progress Report No. 22

Covering Project Activities During

Direktur Jenderal Bina Marga InspektoratJenderal, Kementrian PU Direktur Transportasi - Bappenas

Direktur Pengelolaan Kas Negara (PKN), KementrianKeuangan Direktur Bina Program, DitJen Bina Marga

Direktur Bina Teknik, DitJen Bina Marga Direktur Bina PelaksanaanWilayah I, DJBM

Biro PerencanaanzyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA&KLN, Kementrian PU Kasubdit Kawasan Strategis dan Andalan, KementrianDalam Negeri

.10. Kasubdit Pembiayaan dan KerjasarnaLuar Negeri,Dit. Bipran, DJBM 11. Kasubdit Wilayah I B, Direktorat Bina PelaksanaWilayah I, DJBM 12. Kasubdit Wilayah I C, Direktorat Bina PelaksanaWilayah I, DJBM 13. Kasubdit Wilayah I 0, Direktorat Bina PelaksanaWilayah I, DJBM

14. Kepala SNVT Pembinaan Administrasidan PelaksanaanPengendalianPHLN 15. PT. Perentiana Djaja

16. Yongma EngineeringCo, Ltd

17. PT. Epadascon Permata EngineeringConsultant 18. File

PT. PERENTJANAOJAJAin subconsultancy with • Yongina Engin eering Co. Ltd and i1PT. Epadascon Permata Engineering Consultant CTC Office: JI. CiniruVl1 No. 25, KebavoranBaru, Jakarta Selatan, :2:

Phone /Fax: (021)7229823

Should you have any comment or additional information that need to be incorporated in the Report, please feel free to get in touch with us.

This Report is reproduced in twenty (20) copies for distributionto all concemed authorities.

In compliance with the Terms of Reference of our Consultancy Contract, we submit herewith the Monthly Progress Report No.22 covering the month of October 2014.

Dear Sir,

....~

Submission of October 2014 Monthly Progress Report No.22; WINRIP Loan IBRD No. 8043-10

Subject

Attention: Ir. Agusta Ersada SinulinggaI MT

Officer In Charge PMUWINRIP Directorate General of Highways, MPW JI. Pafirnura 20 Kebayoran Baru Jakarta Selatan

Indonesia

Jakarta, November 14, 2014 Our Ref.No . :zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA03_02/CT NO/M -10.2014

MINISTRY OF PUBLIC WORKS

DIRECTORATE GENERAL OF HIGHWAYS

DIRECTORATE OF PLANNING Core Team Consultant for

Western Indonesia National Roads Improvement Project (WIN RIP) IBRD Loan No. 8043-10

Table of Contents

1 EXECUTIVE SUMMARY ...1

1.1 Current Implementation Situation... 1

1.2 Disbursement... 2

1.3 Visit... 3

1.4 Procurement... 3

1.5 Consolidated Update of the Progress of the Project ... 6

2 PROJECT DESCRIPTION ...8

2.1 Background... 8

2.2 Project Development... 8

2.3 Project Objective ... 13

3 CONSULTANCY SERVICES ...14

3.1 CTC Consultants ... 14

3.1.1 Scope of Services

... 14

3.1.2 CTC Manning

... 15

3.1.3 CTC Contract

... 17

3.2 DSC Consultants... 18

3.3 Technical Assistance for Capacity Building for Disaster Risks Reduction... 18

4 CIVIL WORKS...19

4.1 Detailed Design Preparation... 19

4.2 Procurements... 20

4.3 Civil Works Implementation... 21

4.4 Civil Works Progress... 22

4.5 Quality Assurance... 24

4.6 Environmental and Social Considerations ... 25

4.7 Anti Corruption Issues... 38

4.7.1 Anti Corruption Action Plan (ACAP)

... 38

4.7.2 Community Representative Observers (CRO)

... 38

4.7.3 Publication / Disclosure

... 39

4.7.4 Complaints Handling Mechanism (CHS)

... 40

4.7.5 Third Party Monitoring (TPM)

... 41

4.8 Road Safety Audit ... 41

5 FINANCIAL & MANAGEMENT INFORMATION SYSTEMS ...43

5.1 Draw Downs and Future Costs... 43

5.2 Disbursement... 43

6 PROJECT PERFORMANCE...46

6.1 World Bank and GOI Compliance ... 46

6.1.1

World Bank Missions

... 46

6.1.2 Agreed Key Actions and Mission Plans During Recent World Bank Visit

... 46

6.1.3 Performance Indicators

... 49

6.2 Implementation Support Components... 49

6.2.1 Core Team Consultant (CTC)

... 49

6.2.2 Design and Supervision Consultant (DSC)

... 50

6.2.3 Road Sector Institutional Development

... 50

6.4 Anti Corruption Issues... 52

6.4.1 Anti-Corruption Action Plan (ACAP)

... 52

6.4.2 Community Representative Observers (CRO)

... 53

6.4.3 Third Party Monitoring (TPM)

... 53

6.4.4 Complaint Handling System (CHS)

... 55

6.4.5. Publication / Disclosures

... 55

6.4.6. Action Plan for Next Months

... 56

6.5 Road Safety Audit ... 56

6.6 Environmental and Social Impact Issues... 58

6.6.1 Package No.01: Krui

Biha

... 58

6.6.2 Package No.02: Padang Sawah

Simpang Empat

... 58

6.6.3 Package No.03: Manggopoh

Padang Sawah

... 58

6.6.4 Package No.04: Ipuh

Bantal

... 58

6.6.5 Package No.05: Sp. Rampa

Poriaha

... 59

6.6.6 Package No.06: Psr.Pedati

Kerkap

... 59

6.6.7 Package No.07: Indrapura

Tapan

... 59

6.6.8 Package No.08: Bts Kota Pariaman

Manggopoh

... 59

6.6.9 Package No.09: Rantau Tijang

Kota Agung

... 59

6.6.10 Package No.10: Sp. Empat

Air Balam

... 60

6.6.11 Package No.11: Bantal - Mukomuko

... 60

6.6.12 Package No12: Kambang

Indrapura

... 60

6.6.13 Package No.13: Sp. Rukis

Tj. Kemuning

... 60

6.6.14 Package No.14: Painan

Kambang

... 60

6.6.15 Package No.15: Sibolga

Bts. Tapsel

... 61

6.6.16 Package No.16: Sebelat

Ipuh

... 61

6.6.17 Package No.17: SP. Gunung Kemala

Pg. Tampak

... 61

6.6.18 Package No.18: Mukomuko

Bts. Sumbar

... 61

6.6.20 Package No.20: Lubuk Alung

Sicincin

... 62

6.6.21 Package No.21: Lubuk Alung

Kuraitaji

... 62

6.7 Management Information System... 62

6.8 Quality Assurance... 70

6.9 Project Risks and Mitigation Measures ... 70

6.9.1 Risks Related to Delays

... 70

6.9.2 Financial Risks

... 70

6.9.3 Risks Related to Quality

... 70

7 ISSUES and RECOMMENDATIONS ...72

7.1 Current Situation ... 72

7.2 Actions Required... 72

ABBREVIATIONS AND ACRONYMS

ACAP : Anti Corruption Action Plan

AER : Application Evaluation Report

AIP : Australian Indonesia Partnership

AMDAL : Environmental Management (Analisis Mengenai Dampak

Lingkungan)

ANDAS : Analisis Dampak Sosial

AWPs : Annual Work Programs

Balai : Regional Office for National Roads Implementation

BAPPENAS : Badan Perencanaan Pembangunan Nasional (National

Development Planning Agency of GOI)

Bappedalda : Regional Environmental Impact Agencies

BBPJN : Balai Besar Pelaksanaan Jalan Nasional (Regional Office for

National Roads Implementation)

BER : Bid Evaluation Report

BLH : Badan Lingkungan Hidup

BPK : Badan Pemeriksaan Keuangan (Audit Board of the Government

of Indonesia)

CAD : Computer Aided Design

CHS : Complaint Handling System

CTC : Core Team Consultant

CHU : Complaint Handling Unit

CRO : Community Representative Observer ( = WPM)

DIA : Directorate of Implementing Affairs

DOP : Directorate of Planning

DGH : Directorate General of Highways

DMS : Document Management System

DTA : Directorate of Technical Affairs

DMS : Document Management System

DSC : Design and Supervision Consultants

EA : Executing Agency

EINRIP : Eastern Indonesian National Roads Improvement Project

EIRTP-1 : Eastern Indonesia Regional Transport Project First Project

ESAMP : Environmental and Social Assessment Plan

ESS : Environmental and Social Safeguards

FMIS : Financial Management Information System

FMIS : Financial Management Information System

GIS : Geographic Information System

GOI : Government of Indonesia

IA : Implementation Agency

IBRD : International Bank for Reconstruction and Development

IFR : Internal Financial Report

IRMS : Integrated Road Management System

Kabupaten : Regency

KPIs : Key Performance Indicators

KPPN : Kantor Pelayanan Perbendaharaan Negara (Indonesian: State

Treasury Service Office)

LAN : Local Area Network

LARAP : Land Acquisition and Resettlement (Rencana Tindak Pengadaan

Tanah dan Pemukiman Kembali)

MIS : Management Information System

MOF : Ministry of Finance

MPW : Ministry of Public Work

MPRs : Monthly Progress Reports

P2JN : Perencanaan Pengawasan Jalan dan Jembatan Nasional

PDF : Portable Document Format

PMU : Project Management Unit

PAPs : Project Affected Peoples

PMM : Project Management Manual

PMU : Project Management Unit (WINRIP)

POKJA : Bina Marga Project Managers and Procurement Committes

PPC : Project Preparation Consultants

PP3 : Pemantau Pihak ke 3

PPK : Sub Project Manager

PPR : Project Progress Report

QPRs : Quarterly Progress Reports

RKL/RPL : Rencana Pengelolaan/Pemantauan Lingkungan

RS : Road Safety

Satker : Satuan Kerja (Work Unit for Road Project Implementation)

SPPL : Surat Pernyataan Pengelolaan Lingkungan

SRIP : Strategic Road Infrastructure Project

TOR : Terms of Reference

UKL/UPL : Upaya Pengelolaan Lingkungan / Upaya Pemantauan Lingkungan

(Site Specific Environmental and Monitoring Plan)

WINRIP : Western Indonesia Roads Improvement Project

WB : World Bank

WP : Work Program

WPs : Works Programs

WPM : Wakil Pengamat dari Masyarakat (or Community Representative

APPENDICES

Appendix A

:

Overall Loan Progress

Appendix B

:

Highway Design Progress

Appendix C

:

Financial Progress

Appendix D

:

Quality Assurance Progress

Appendix E

:

Environmental and Social Progress

Appendix F

:

Procurement Plan and Progress

Appendix G

:

WINRIP Website Progress

Appendix H

:

ACAP Training/Dissemination Progress

Appendix I

:

Performance Indicator

Appendix J

:

Correspondences

ANNEXES

Annex P-1

:

Package No. 1

Annex P-2

:

Package No. 2

Annex P-3

:

Package No. 3

1

EXECUTIVE SUMMARY

1.1 Current Implementation Situation

Civil Works

Implementation of the WINRIP Project is scheduled to be implemented into three (3) Annual Work Programs (AWP s).

AWP-1 original implementation is scheduled to begin with the pre-construction activities (procurement) in mid 2011 and the actual work implementation to start in mid 2012.

AWP-2 consist of three (3) implementation stages. The 1st stage is the preparation of Tender

Documents (construction drawings, bid documents, special specs and other related documents) by Design Supervision Consultant (DSC), 2nd stage is the procurement and the 3rd stage is the actual implementation of the works. AWP-2 is originally scheduled to start in mid 2013 and to be implemented at the beginning of Year 2014.

AWP-3 implementation stages are of the same sequence with that of AWP-2. The only difference is that AWP-3 is originally schedule to take-off beginning the 1st month of the Year 2013 and to be

implemented in the 1stmonth of the Year 2015.

But to due some unavoidable circumstances, the original schedules incurred delays. Actual implementation status are shown below.

AWP No. of

Packages

Implementation Status as of October 31, 2014

AWP-1 4 4 Nos. Under construction

AWP-2 9

1 No. Bid Evaluation Report (BER) under final evaluation and finalization.

2 Nos. Bids were submitted and opened. Bid Evaluation Report (BER) were finalized and forwarded to World Bank for request of No Objection Letter (NOL).

1 No. Bid preparation (Post Qualification) NCB.

4 Nos. DED on-going revision by BALAI II prior to submission to World Bank for NOL.

1 No. Replacement road, still to be finalized.

AWP-3 8

1 No. World Bank issued NOL on the Bid Evaluation Report with concurrence to award the Contract to the lowest bidder. Letter of Acceptance to the lowest bidder was issued by PPK.

2 Nos. Bid preparation (Post Qualification)ICB and NCB. 4 Nos. Detailed Engineering Design (DED) on-going. 1 Nos. Replacement roads, still to be finalized.

1.2 Disbursement

Loan Allocation and Percent (%) Disbursement To Date

1.45

4.35 4.35

0.00 10.00 20.00 30.00 40.00 50.00 60.00 70.00 80.00 90.00 100.00

Month

%

C

o

m

p

le

te

Actual Expenditure USD 6.99 mil (2.80 %)

WINRIP ACTUAL PROGRESS UP TO OCTOBER 2014 AND FORECAST UP TO DECEMBER 2017

ACTUAL October 2014

Forecast October 2014 Forecast Expenditure USD

116.00 mil (46.40%)

Deviation = 43.60%

The total disbursement from the loan to the end of October 2014 was USD 6,991,757.97

equivalent to approximately2.80%of the loan funds. The following table summarizes the individual

disbursementsas calculated by CTCbut retaining the total disbursement fromClient Connection

at the end ofOctober 2014.Appendix Ashows the Overall Loan Progress Status.

Category Description Loan Restructuring

Amount US$

Disbursement This Period

Previous Disbursement

Totals Disbursed to

End October in US$ % Disbursed

1

Part 1Betterment and Capacity Expansion of

National Roads.

220,400,000.00 310,453.52 4,446,969.05 4,757,422.97 2.16

2 Part 2

Implementation Support 16,000,000.00 133,841.61 1,848,059.18 1,981,900.79 12.39

3

Part 3

Road Sector Institutional Development

1,000,000.00 0,00 0 0 0

4

Part 4

Contingency for Disaster Risk Response

0 0 0 0

Unallocated 12,600,000.00 0,00 0 0 0

LN 8043

DA-A 252,434.61 252,434.61 0

Original Loan

Amount 250,000,000.00 444,295.13 6,547,462.84 6,991,757.97 2.80

The amount disbursed during this month ofOctober 2014are Statement of Work Accomplished

for Package No.1 Contractor covering the Monthly Certificate Nos. 5, 6 and 7 amounting to

USD 133,901.61, and for Package No.3 Contractor for Monthly Certificate Nos.5 and 6 with an

1.3 Visit

No World Bank Implementation Review mission and site visit during the month.

1.4 Procurement

As of this reporting month of October 2014, two (2) sub-projects were bidded and Bid Evaluation Reports (BER) were forwarded to World Bank requesting the issuance of No Objection Letter (NOL) and concurrence to award the Contract to the responsive lowest bidder. While one (1) sub-project which was bidded in the middle part of September 2014, Bid Evaluation Report (BER) is still to be finalized for submission to the World Bank. These three (3) sub-projects are programmed and clustered under AWP-2.

Under AWP-3, World Bank issued No Objection Letter (NOL) on the Bid Evaluation Report (BER) and concurrence to award the Contract for one (1) sub-project to the lowest responsive bidder. Letter of Acceptance to the lowest bidder was issued by PPK.

The current status of Contract Packages which are under procurement stage are as follows :

1. Package 17 (Sp. Gunung Kemala Pugung Tampak) AWP-3.

During the period (October 2014), the Bid Evaluation Report (BER) and recommendation by DGH to award the Contract to the lowest responsive bidder, PT. Jaya Konstruksi Manggala Pratama was forwarded to the World Bank for request of concurrence and issuance of No Objection Letter (NOL).

After World Bank s final review of the submitted documents and DGH s recommendation to award the Contract in the amount of Rp. 199,551,233,999 (corrected amount) to the lowest responsive bidder, Bank issued on October 14, 2014 their concurrence and No Objection Letter (NOL).

As the month was about to end, a Letter of Acceptance to the winning bidder was issued by PPK with instruction to the winning Contractor to submit within 28 days the Performance Security and an irrevocable line of credit of 6.0 million US dollars from a reputable bank.

2. Package 11 (Bantal Mukomuko) AWP-2

As mentioned in previous Monthly Report of September 2014, there were three (3) applicant bidders who were issued Invitation to Bid by the Procurement Committee (POKJA) Bengkulu. The three (3) bidders submitted their respective bid on October 3, 2014 and bids were opened as schedule on the same day.

Following are the three (3) pre-qualified applicant bidders with their respective bid price as read-out by the Procurement Committee Chairman during the bid opening :

a. PT. Waskita Karya (Persero), Tbk : Rp. 231,050,000,000

b. PT. Hutama Karya

(Persero)-PT. Daya Mulya Turangga, J.O : Rp. 228.899.000.000

c. PT. Yasa Patria Perkasa : Rp. 235.023.800.000

The lowest canvassed bid was submitted by a joint venture of PT. Hutama Karya (Persero)/PT. Daya Mulya Turangga with an amount of Rp. 228,899,000,000 or 0,99% below the Owner s Estimate (OE) of Rp. 231,182,517,000

Procurement Committee with recommendation to award the Contract to the lowest bidder, PT. Hutama Karya (Persero) / PT. Daya Mulya Turangga Joint Operation for a corrected contract price of Rp. 228,899,717,000.

After final review by CTC of the Bid Evaluation Report (BER), CTC officially endorsed the documents to PMU, recommending the award of Contract to the lowest responsive bidder with the corrected contract amount of Rp. 228,899,717,000 with bid validity to remain valid until January 31, 2015.

It is expected that the DGH Director of Planning will forward on the 1st week of

November 2014 to the World Bank the documents and contract award recommendation for Bank s final review and issuance of No Objection Letter (NOL)

3. Package 13 (Sp. Rukis Tj. Kemuning) AWP-2

As mentioned in previous Monthly Report of September 2014, there were three (3) applicant bidders who were issued Invitation to Bid by the Procurement Committee (POKJA) Bengkulu. The three (3) bidders submitted their respective bid on October 3, 2014 and bids were opened as schedule on the same day.

Following are the three (3) pre-qualified applicant bidders with their respective bid price as read-out by the Procurement Committee Chairman during the bid opening :

a. PT. Waskita Karya (Persero), Tbk : Rp. 292,700,000,000

b. PT. Hutama Karya

(Persero)-PT. Conblock Infratechno, J.O : Rp. 314,791,000,000

c. Hala Co. PT. Daya Mulya Turangga J.V : Rp. 301,706,925,300

The lowest canvassed bid was submitted by PT. Waskita Karya (Persero) with an amount

of Rp. 292,700,000,000 or 1,52% below the Owner s Estimate (OE) of

Rp.297,209,388,000

During this reporting period, the Bid Evaluation Report (BER) was finalized by the Procurement Committee with recommendation to award the Contract to the lowest bidder, PT. Waskita Karya (Persero) for a contract price of Rp. 292,700,000,000.

After final review by CTC of the Bid Evaluation Report (BER), CTC officially endorsed the documents to PMU, recommending the award of Contract to the lowest responsive bidder with contract amount of Rp. 292,700,000,000 with bid validity to remain valid until January 31, 2015.

It is expected that the DGH Director of Planning will forward on the 1st week of

November 2014 to the World Bank the documents and contract award recommendation for Bank s final review and issuance of No Objection Letter (NOL)

4. Packages 5 (Simpang Rampa Poriaha) AWP-2

There were 14 (fourteen) contractor applicants (13 single company and 1 (one) joint venture operation) who submitted their prequalification documents. Three (3) contractor applicants failed to prequalify due to failure to satisfy the qualification criteria. Likewise, the 11 (Eleven) contractors who passed the qualification criteria were issued an Invitation To Bid to submit their respective tenders for the execution of the Works.

Ten (10) out of the eleven (11) pre-qualified applicant bidders who were issued

2014 in Medan and opening of bids followed immediately at 10:15 am.

The lone prequalified bidder who failed to submit bid for unknown reason was PT. Nindya Karya (Persero).

The lowest canvassed bid was submitted by PT. Nusa Konstruksi Enjiniring, Tbk with an amount of Rp. 107,321,260,000 or 26.40% below the approved Owner s Estimate of Rp.145,815,316,000. while the highest bid was quoted by PT. Yasa Patria Perkasa in the amount of Rp. 151,361,000,000 or 3,80% above the approved Owner s Estimate.

Following are the ten (10) prequalified applicant bidders who submitted their bids

with their respective bid prices as read-out during bid opening are as follows :

a. PT. Adhi Karya (Persero), Tbk (Indonesia) : Rp. 113,325,400,000

b. PT. Bangun Cipta Kontraktor (Indonesia) : Rp. 127,588,401,500

c. PT. Brantas Abipraya (Persero) (Indonesia) : Rp. 115,098,070,721

d. PT. Hutama Karya (Persero)

PT. Seneca Indonesia JO (Indonesia) : Rp. 139,890,000,000

e. PT. Multi Structure (Indonesia) : Rp. 123,067,753,000

f. PT. Nusa Konstruksi Enjiniring, Tbk (Indonesia) : Rp. 107,321,260,000

g. PT. Pembangunan Perumahan (Persero (Indonesia) : Rp. 108,270,000,000

h. PT. Waskita Karya (Persero, Tbk (Indonesia) : Rp. 111,625,800,000

i. PT. WIdya Sapta Colas (Indonesia) : Rp. 127,716,417,000

j. PT. Yasa Patria Perkasa (Indonesia) : Rp. 151,361,000,000

There was slight delay in the preparation and finalization of the Bid Evaluation Report (BER) due to some more time were needed to address and resolve some outstanding issues.

Bid Evaluation Report (BER) is under preparation and expected to be finalized for

submission to DGH on before the 2ndweek of November 2014.

Procurement of Other Contract Packages

The present status of other Contract Packages which are about to be put on tender are as follow :

1. Package No. 6 (Pasar Pedati Kerkap)

This sub-project is under implementation schedule AWP-2. The project roadline is located in the Province of Bengkulu having an approximate length of 20.90 .

The Contract Package is ready to be procured thru the National Competitive Bidding (NCB) as an agreement between MPW and World Bank concerning three (3) issues on Model Bidding Document for Procurement of Works were settled.

During this period, the bidding documents intended to be used on this Contract Package are under finalization by incorporating all the agreements reached during the recently concluded meeting.

2. Package No.19 (Lais Bintunan)

This sub-project is under implementation schedule AWP-3. The project roadline is located in the Province of Bengkulu having an approximate length of 10.80 kilometers.

The Contract Package is ready to be procured thru the National Competitive Bidding (NCB) as an agreement between MPW and World Bank concerning three (3) issues on Model Bidding Document for Procurement of Works were settled.

During this period, the bidding documents intended to be used on this Contract Package are under finalization by incorporating all the agreements reached during the recently concluded meeting.

It is expected that bid for this NCB project can be invited by DGH anytime this coming month of November 2014.

3. Package No. 15 (Sibolga Batas Tapsel)

This sub-project is included in the implementation schedule AWP-3. The project road is 36 kilometer long and located in the Province of Sumatera Utara.

The Bank agreed on DGH to pilot the use of MPW s full e-procurement system, using the World Bank ICB Standard Bidding Documents (SBD) for procurement of works after incorporating in the ICB bidding documents for this package the changes required for use e-procurement system.

It is expected that DGH can invite bids within this coming month of November 2014.

Procurement of Three (3) Consultancy Packages Under Category 3 of the Loan Agreement, Part 3 : Road Sector Institutional Development

1. Technical Assistance for Capacity Building for Disaster Risk Reduction

Request for Expression of Interest and Terms of Reference had been finalized based on previous comments from the World Bank.

The documents are expected for resubmission to World Bank for final review and issuance of No Objection Letter.

2. Technical Assistance for Capacity Building for Environmental Management

Consultant still to be procured.

3. Technical Assistance for Capacity Building for Road Safety

Consultant still to be procured.

1.5 Consolidated Update of the Progress of the Project

DED Technical Design Review Road Safety Audit

Status Doc Requirement Status Doc Requirement Status Budget

Allocation Status

Est'd. Start

Duration (Months) 1 Krui - Bha Completed Completed Completed SPPL & AMDAL

(No.1 & 17)

SPPL OK P2JN 2010 & AMDAL Subdit TLKJ OK 2012 . WB NOL issues on 20 Nov 2013

1).LARAP 2). LARAP Mon

Report

1).NOL WB 4 Jan 13 2.NOL WB

Satker PJN

Prov 98% Completed Jan-14 21.00 A

Padang Sawah - Sp. Ampat

Including Air Gadang Bridge

3 Manggopoh - Padang Sawah Completed Completed Completed SPPL

OK P2JN 2010.(No need NOL WB for SPPL/UKL&UPL)

1).LARAP 2). LARAP Mon

Report

1).NOL WB 13 Dec 12 2).Pending compensation payment for the remaining

3 PAP

APBD Provinsi 99% Completed Jan-14 24.00 A

4 Ipuh - Bantal Completed Completed Completed SPPL & UKL&UPL

SPPL OK P2JN 2010 & UKL/UPL OK, 31 Oct. 2014 recommended by BLH

1).LARAP 2). LARAP Mon

Report

1).NOL WB 10 Dec 12 2). 15 New PAP not yet

paid

Satker PJN

Provinsi 96% Completed Jan-14 24.00 A

5 Sp. Rampa - Poriaha Completed Completed Completed UKL/UPL

OK Balai 1 2011. (No need NOL WB for

SPPL/UKL&UPL)

1).SLARAP 2). LARAP Mon

Report

1).Nol WB 10 Dec 12 2).Relocation 1 kiosk affected project w ill be done paralel construction

Satker PJN Provinsi

Not Applicable. No Land Acquisition

Bids opened on

Sept. 22, 2014 Des-14 18.00 C

6 Ps. Pedati - Kerkap Completed Completed Completed UKL/UPL

OK TLKJ 2011. NOL WB issued on 20 Nov

2013

1).SLARAP 2). LARAP Mon

Report

1).NOL WB 20 Nov 2013 2). Target of a Mon Report

on Dec 2014

Satker PJN Propinsi

Comp payment

in process Not Yet Started Dec-14 15.00 D

7 Indrapura - Tapan Completed Completed Completed AMDAL

OK TLKJ , 20 Feb 2014. NOL WB issues on 8

Aug 2014

1).SLARAP 2). LARAP Mon

Report

1).NOL WB 10 Oct 2014 2). Target of a Mon Report

on 2015

APBD Provinsi 2015

Socialization

process Not Yet Started Jan-15 21.00 B

8 Bts. Kota Pariaman - Manggopoh Completed Completed Completed AMDAL

OK TLKJ 2013 . NOL WB issued on 14 April

2014

1).LARAP 2). LARAP Mon

Report

1).NOL WB 12 Aug 2014 2). Target of a Mon Report

on 2015

APBD Propinsi Socialization

process Not Yet Started Feb-15 24.00 B

9 Rantau Tijang - Kota Agung be

changed with Bengkunat - Biha UKL/UPL

OK TLKJ 2011. NOL WB issued on 20 Nov

2013

Social and Env safeguards

screening

Being prepared by Consultant recuirement

(Balai 3)

Satker PJN

Provinsi Not Yet Started Jun-15 21.00 I

10 Sp. Empat - Sp. Air Balam Completed Completed Completed AMDAL

OK TLKJ 2013 . NOL WB issued on 14 April

2014

1).LARAP 2). LARAP Mon

Report

1).NOL WB 12 Aug 2014 2). Target of a Mon Report

on 2015

APBD Provinsi Socialization

process Not Yet Started Feb-14 24.00 B

11 Bantal - Mukomuko Completed Completed Completed AMDAL OK TLKJ 2014. NOL WB issues on 8 Aug 2014

1).LARAP 2). LARAP Mon

Report

1).Nol WB: 20 Nov 2013 2).Target a MR in Dec

2014

Satker PJN Provinsi

35 from 209 PAP already paid (17%)

On Going Dec-14 24.00 E

12 Kambang - Indrapura Completed Completed Completed AMDAL OK TLKJ 2014 .NOL WB issues on 8 Aug 2014

1).LARAP 2). LARAP Mon

Report

1).NOL WB 10 Oct 2014 2). Target of a MR on

2015

APBD Provinsi Socialization

process Not Yet Started Feb-15 24.00 B

13 Sp. Rukis - Tj.Kemuning Completed Completed Completed UKL/UPL

OK P2JN 2011. (No need NOL WB for

SPPL/UKL&UPL)

1).LARAP 2). LARAP Mon

Report

1).NOL WB:20 Nov 2013 2).Target a MR in Mar

2015

Satker PJN Provinsi

Socialization

process On Going Dec-14 24.00 E

14 Painan - Kambang On Going AMDAL OK TLKJ 2014 .NOL WB issues on 8 Aug 2014 SLARAP

Finalization of LARAP doc

by CTC APBD Provinsi Staking Out Not Yet Started Mar-15 21.00 H

15 Sibolga - Bts.Tap Sel Completed Completed Completed UKL/UPL

OK Balai 1 2011. (No need NOL WB for

SPPL/UKL&UPL)

1).LARAP 2). LARAP Mon

Report

1).NOL WB: 5Feb 2014 2).Target a MR on Dec 2014 - Mar 2015

Satker PJN Provinsi

Affected asset appraisal process

Not Yet Started Feb-15 30.00 D

Seblat - Ipuh including Air Lalang & Air Guntung Bridge

18 Mukomuko - Bts.Sumbar be changed

with Sibolga - Sorkam UKL/UPL

OK TLKJ 2011. (No need NOL WB for SPPL/UKL&UPL)

Social and Env safeguards

screening

Being prepared by Consultant recuirement

(Balai 2)

Satker PJN

Provinsi Not Yet Started May-15 18.00 I

19 Lais - Bintuan Completed Completed Completed UKL/UPL

OK TLKJ 2011.(No need NOL WB for

SPPL/UKL&UPL)

1).LARAP 2). LARAP Mon

Report

1).Nol WB: 20 Nov 2013 2).Target a MR in Dec

2014

Satker PJN Provinsi

Comp payment

in process Not Yet Started Dec-14 10.00 D

20 Lubuk Alung - Sicincin On Going UKL/UPL

OK TLKJ 2011.(No need NOL WB for

SPPL/UKL&UPL)

SLARAP Finalization of LARAP doc

by CTC APBD Provinsi Staking Out Not Yet Started Feb-15 18.00 H

21 Lubuk Alung - Kurajati On Going UKL/UPL

OK TLKJ 2011. (No need NOL WB for SPPL/UKL&UPL)

SLARAP Finalization of LARAP doc

by CTC APBD Provinsi Staking Out Not Yet Started Feb-15 18.00 H

Remarks :

A On going Construction = 3 Packages in 1 study AMDAL (West Sumatera Province) B Design revision by Balai II (Padang)

C Finalizing Bid Evaluation Report by POKJA = 2 Packages in 1 study AMDAL (Bengkulu Province) D For invitation to bid

E For Bank issuance of NOL to award the Contract F Design finalization by DSC G For Contract signing w ith the w inning bidder H Detailed design by DSC on-going I Proposed to be replaced

Completed

21.00 Mar-15 Not Yet Started Comp payment in process Satker PJN Provinsi Satker PJN Provinsi OK TLKJ 2014 . NOL

WB issues on 8 Aug 2014 Completed AMDAL

Completed AMDAL (No.1 &17)

1).NOL WB: 20 Nov 2014 2).Target a MR on Dec

2014 1).LARAP

2). LARAP Mon Report G F AWP-3 Hire appraisal process

Bids opened on

August. 15, 2014 Oct-14 24.00 OK TLKJ 2011. NOL

WB issued on 20 Nov 2013

1).LARAP 2). LARAP Mon

Report

1).NOL WB: 16 Sep 2014 2).Target a MR on Mar

2015 16 On Going Completed

17 Sp.Gunung Kemala - Pg.Tampak Completed

AWP-2

Remarks

Contract Implementation Plan

Loan Package Name

2 Completed Completed Completed SPPL&UKL/ UPL Bridge

OK P2JN 2010 (No need NOL WB for SPPL/UKL&UPL)

Environmental Social Land Acquisition

24.00 A

Group Pack.No. ProcurementStatus

AWP-1

1).LARAP 2). LARAP Mon

Report

1).NOL WB 13 Dec 12 2).Pending Compensation for the remaining 21 PAP and 24 new PAP

APBD Provinsi 80% Completed Jan-14

Consolidated Project Status As Of End October 2014

2

PROJECT DESCRIPTION

2.1

Background

The Government of Indonesia wishes to continue strengthening of the National Road system in Indonesia while the Eastern Indonesia National Roads Improvement Project (EINRIP which is assisted by AusAID through the Australian Indonesia Partnership or AIP), is providing support program of National road and bridge improvement works in Eastern Indonesia. The Western Indonesia National Road Improvement Project (WINRIP) will provide similar support for National road and bridge in the Sumatera region of Indonesia. The focus of WINRIP will be roads administered directly by the National Government, including those currently classified as Provincial, Kabupaten (District) or non-status roads which are in process of being reclassified as National roads. In addition, provision will be made for major bridge repair works, rehabilitation, duplication and replacement as necessary to complement road betterment works.

2.2

Project Development

The loan effectiveness date for the WINRIP is 12 March 2012 and key project data is shown in the following detail.

Key Project Data WINRIP Loan No. 8043-ID

Project Cost US$350 million

Original Loan Amount US$250 million

Revised Loan Amount N/A

Board Approval Date 26 May 2011

Loan Signing Date 14 December 2011

Effectiveness Date 12 March 2012

Disbursement (as of 31 December 2013) US$ 2.2 million (0.88%)

Original Closing Date 31 December 2017

Environmental Category B-Partial Assessment

The IBRD loan amount is US$250 million. The Project is intended to finance a part of the DGH investment program for national roads with a particular focus on the Western corridor of Sumatera. The corridor is one of the three main corridors in Sumatera and connects the city of Padang (with a population of around one million) to major towns along the west coast (Bukittinggi, Sibolga and Bengkulu). It also connects through connector roads on the West coast to Medan in the northeast and to Pekanbaru in the centre of the island. The project has four components:

Project Component 1: Betterment and Capacity Expansion of National Roads

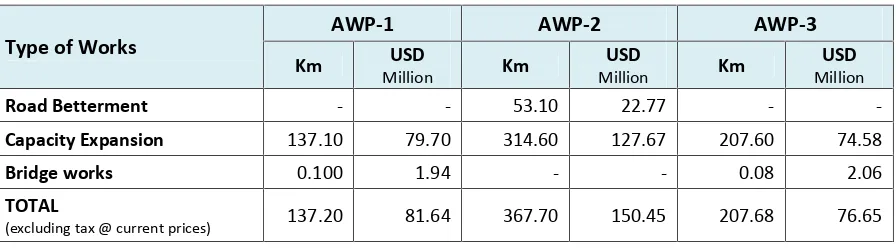

According to the Loan Agreement, this component will cover three work programs of betterment and capacity expansion of approximately 715.6 km including replacement of 194 meters of bridges. This civil works program will be executed in three Annual Work Programs(AWP), as summarized in

[image:21.595.75.522.379.554.2](year of implementation) prices, excluding taxes.

Table 2.1 Proposed Physical Works by DGH Program

Type of Works

AWP-1 AWP-2 AWP-3

Km USD Million Km USD Million Km USD Million

Road Betterment - - 53.10 22.77 -

-Capacity Expansion 137.10 79.70 314.60 127.67 207.60 74.58

Bridge works 0.100 1.94 - - 0.08 2.06

TOTAL

(excluding tax @ current prices) 137.20 81.64 367.70 150.45 207.68 76.65

The batches of projects are termed Annual Work Programs (AWPs) in line with terminology used in other Bina Marga projects. They are not in fact annual programs as such but rather a series of multi-year programs, each commencing in consecutive years. Hence, hereinafter it will call as just Work Programs (WPs). It is expected that implementation of the first Works Program (WP-1) will commence in the third quarter of 2013 and be completed by third quarter or late 2015. The second Work Program (WP-2) is expected to commence in early 2014 and be completed by late 2015 or middle 2016. The third Work Program (WP-3) is expected to commence in early 2015 and be

completed by mid-2017. The loan will be closed onDecember 2017.

Table 2.2presents details of the First Works Program (WP-1). The four packages in this group should

have been free from any land acquisition issues, but in fact two packages (Krui Biha and

Manggopoh Padang Sawah) had land issues which were solved by the DGH properly. Thus, there

[image:22.595.71.521.515.788.2]are no foreseeable impediments to implementation.

Table2.2 IBRD Assisted WINRIP Civil Work WP-1

No Province Link No. Link Name C la ss R o a d T y p e

Road Works Bridge Works Total Cost

Fr

o

m

T

o Len

g th T re a tm e n t C o st ( 2 0 1 0 ) No Le n g th C o st ( 2 0 1 0 ) 2 0 1 0 P ri ce s E q u iv a le n t

Km Km Km Rp mill m Rp mill Rp mill US$ mill

1 Lampung 053.0 Krui

Biha K1 IU 221.5 246.5 25.0

Bett nt

to 7 m. 148,668 148,668 16.52

2 West Sumatera 047.2 PadangSa wa SimpangE mpat

K1 IU 0.0 40.9 40.9Bett nt

to 7 m. 189,810 189,810 21.09

2a West

Sumatera 34.1

AirGadan

gBridge K1 IU

New

Bridge 1 100 17.580 17,580 1.95

3 West Sumatera 047.1 Manggop oh PadangSa wah

K1 IU 102.2 134.2 32.0Bett nt

No Province Link No. Link Name C la ss R o a d T y p e

Road Works Bridge Works Total Cost

Fr

o

m

T

o Len

g th T re a tm e n t C o st (2 0 1 0 ) No Le n g th C o st (2 0 1 0 ) 2 0 1 0 P ri ce s E q u iv a le n t

Km Km Km Rp mill m Rp mill Rp mill US$ mill

4 Bengkulu 015.3 Ipuh

-Bantal K1 IU 0.0 49.7 49.7

Bett nt

to 7 m. 226,275 226,275 25.14

It should be noted that all road sub-projects have been subject to economic appraisal and have estimated Economic Internal Rates of Return (EIRR) in excess of 15%. These were selected for inclusion and are subject to completion of environmental and social screening, to confirm that there is no land acquisition or resettlement requirements remain outstanding.

Final Engineering Designs, Engineer s Estimates and bidding documents have been completed for all projects proposed for WP-1.

Sub-projects to be included in WP-2 and WP-3 have also been determined as listed inTable 2.3. Final

Engineering Designs and Engineer s Estimates for all WP-2 and WP-3 proposed works require preparation or finalization. In the cases of some projects, preliminary Engineering Designs were prepared during Project preparation which will require review and possible amendment by the Design and Supervision Consultant prior to procurement.

The costs presented inTable 2.3are planning estimates only, and the overall scope and contents of

WP-2 and WP-3 may need to be revised as when revised costs and budgets are determined.

Table2.3: IBRD Loan WINRIP Civil Work WP-2 and WP-3

NO. SUBPROJECT LINK NO. AND NAME LENGTH

(KM) ENGINEER S ESTIMATE (RP. MILL) WIDTH (M) IMPLEMENTATION PLAN START DURATION (MONTHS) WP-2

5. Sumut : Link No. 015.xx,

Sp. Rampa Poriaha 9.7 152,870 6.0 Aug 2014 18

6. Bengkulu : Link No. 010.0,

Ps. Pedati Kerkap 20.88 92,127 7.0 June 2014 15

7. Sumbar : Link No. 019.0,

Indrapura Tapan 19.5 207,010 7.0 August 2014 21

8. Sumbar : Link No. 024.0,

Bts. Pariaman Manggopoh 46.8 401,567 7.0 Sep 2014 24

9. Lampung : Link No. 026.1,

Rantau Tijing - Kota Agung 42.0 149,831 7.0 Jan 2015 21

10. Sumbar : Link No. 034.1,

NO. SUBPROJECT LINK NO. AND NAME LENGTH (KM)

ENGINEER S ESTIMATE (RP. MILL)

WIDTH (M)

IMPLEMENTATION PLAN

START DURATION

(MONTHS)

11. Bengkulu : Link No. 015.2,

Bantal Mukomuko 50.1 246,500 6.0 August 2014 24

12. Sumbar : Link No. 017.2,

Kambang Indrapura 55.2 498,619 7.0 Sep 2014 24

13. Bengkulu : Link No. 006.1,

Simpang Rukis - Tanjung Kemuning 56.3 316,305 7.0 August 2014 24

WP-3

14. Sumbar : Link No. 017.1,

Painan Kambang 31.5 118,993 7.0 Jan 2015 21

15. Sumut : Link No. 016.0,

Sibolga - Bts. TapSel 36.0 353,956 7.0 August 2014 30

16.

Bengkulu : Link No. 009.4,

Seblat Ipuh, including Air Galang and Air

Guntung Bridges

34.5

0.052 110,237 6.0 Jan 2015 21

17. Lampung : Link No. 061.1,

Sp. Gunung Kemala - Pugung Tampak 36.8 255,269 6.0 August 2014 24

18. Bengkulu : Link No. 015.3,

Mukomuko - Bts. Sumbar 25.8 69,233 6.0 May 2014 18

19. Bengkulu : Link No. 009.1,

Lais Bintuan 10.8 35,886 7.0 June 2014 10

20. Sumbar : Link No. 002.0,

Lubuk Alung Sicincin 14.6 54,557 7.0 Jan 2015 18

21. Sumbar : Link No. 027.0

Lubuk Alung Kuraitaji 16.8 65,788 7.0 Jan 2015 18

Project Component 2: Implementation Support

Project Management Core Team Consultants (CTC)

The CTC will provide support to the PMU and DGH in the management of the Project, based in Jakarta. Their tasks include financial and progress monitoring and reporting, information management and dissemination, quality assurance and performance review for the Design and Supervision Consultants, implementation and monitoring of the anti-corruption action plan, support for project monitoring and evaluation, and support for implementation of a training program to

support project management and implementation. The CTC contract No.

06-20/CTC/TA/LN/8043/1112was signed on5 November 2012by bothDGHand a Joint Venture ofPT.

PerentjanaDjaja, Yongma Engineering Co,Ltd, and PT. Epadascon Permata Engineering Consultant.

Design and Supervision Consultants (DSC)

A Design and Supervision Consultant (DSC) will be responsible for design of WP-2 and WP-3 civil works and supervision of all civil works. They will have the role of Engineer under a FIDIC-type contract. The tasks include the preparation and maintenance of a quality assurance plan, validation and updating of designs, supervision of all civil works, environmental and social monitoring and management, and support for financial and progress monitoring and reporting. The DSC will also be responsible for quality assurance of materials and workmanship, certifying whether or not contractors have achieved the required results, as well as documentation and reporting based on the financial management plan. They will prepare a Quality Assurance system covering all subprojects, and continuously monitor the effectiveness of their supervision procedures. The team

will be contracted and managed by DGH through the Bina Marga Regional Office(Balai II),and will

be based in Padang, West Sumatera.

Project Component 3: Road Sector Institutional Development

This component will provide technical assistance and support to strengthen disaster risk mitigation in the road sector, including capacity building support for the new environment/risk mitigation and road safety unit of DGH to conduct disaster risk assessments and planning, risk mapping of land-slides, coastal erosion, earthquake and floods, and analysis of alternative designs for road segments

that pass through critical environmental assets and vulnerable areas. The procurement for

consultants under this component has not yet been started. Preparation for the procurement would be coordinated soon by the PMU WINRIP, the CTC and the DGH.

Project Component 4: Contingency for Disaster Risk Response

2.3 Project Objective

The main objective of the program will be to increase the effective use of selected sections of

3

CONSULTANCY SERVICES

3.1

CTC Consultants

3.1.1 Scope of Services

The CTC contract services originally were structured in its different project management elements.

• Inception Phase

A key activity during the inception phase will be to establish lines of communication with PMU-WINRIP and DSC s Team Leader as well as with all Provincial Project Managers (Satkers) where the first works are to be constructed under WP-1.

• Project Management and Support to PMU, including acting DSC until the DSC is established

The Terms of reference identify a number of sub-items to be performed by CTC. The key factor that will ensure success is that the CTC must work pro-actively and alongside PMU counterparts and with DSC team in a professional manner based on mutual respect and trust.

• Preparation of Work Programs

The tendering process for WP 1 sub-projects began as soon as procurement committees have been formed and received appropriate training in the procurement procedures required. The indicative work programs and cost estimates identified for WP-2 and WP-3 are subject to verification, and are likely to change following more detailed investigations. Further preparation for WP-2 and WP-3 will be managed by the PMU supported by the CTC.

• Financial Monitoring

It will be the role of the CTC to first assess the level of understanding of the financial management, monitoring and reporting procedures by the finance staff at the provincial and central level and subsequently devise an appropriate training program and assist the PMU in training delivery.

• Project Progress and Performance Monitoring

CTC will monitor the loan project progress and prepare the report in monthly basis. In the

meantime, GOI and the World Bank have agreed on a set of Key Performance Indicators (KPIs) to

measure the project s performance in achieving its stated development objectives. CTC will therefore first concentrate on the establishment of precise definitions, calculation methods and data collection procedures to monitor the KPIs.

• Support for the Implementation of the ACAP

improvements to processes and procedure.

• ESAMP and LARAP Implementation Monitoring

CTC will closely work with BLH and DSC and will monitor and report the action of the Environmental Management Plan on a periodical basis and/or as required.

• Training to Support Project Implementation

CTC is responsible for preparation and management of all training program required under WINRIP.

• Reporting

CTC is responsible for all reports required under the contract agreement with standardize forms, charts and tables.

3.1.2 CTC Manning

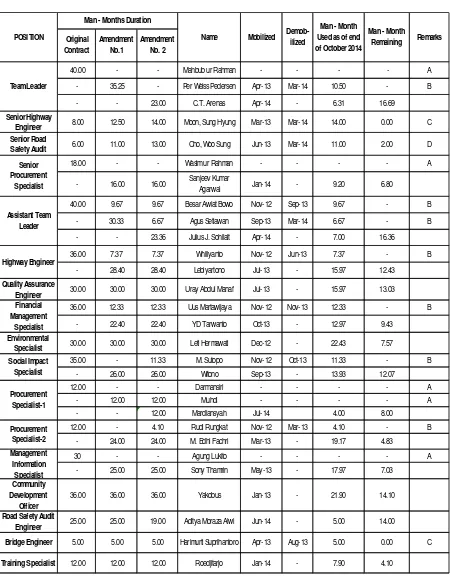

CTC professional staffs involved in the project as of end ofOctober 2014are listed inTable 3.1.

Senior Highway Engineer (International) have completed his allocated man-month in the original contract and Amendment No. 1 and demobilized on March 2014. Likewise, the Senior Road Safety Engineer (International) have also completed his man-month under Amendment No. 1 and temporarily demobilized on March 2014, however, he will be remobilized for two (2) months period under Amendment No. 2 during the post construction phase to conduct final Road Safety Audits.

During this reporting month, the Team Leader took a vacation leave from October 11-28, 2014 to secure extension of work visa from the Indonesian Embassy in Manila, Philippines.

In order to have continuity and not disrupt the operations of the Core Team Consultants, the Co-Team Leader was given full authority by the Co-Team Leader to assume and discharged the duties and task in conjunction with CTC s Terms of Reference.

Table 3.1

40.00 - - Mahbub ur Rahman - - - - A - 35.25 - Per Weiss Pedersen Apr-13 Mar-14 10.50 - B - - 23.00 C.T. Arenas Apr-14 - 6.31 16.69

Senior Highway

Engineer 8.00 12.50 14.00 Moon, Sung Hyung Mar-13 Mar-14 14.00 0.00 C Senior Road

Safety Audit 6.00 11.00 13.00 Cho, Woo Sung Jun-13 Mar-14 11.00 2.00 D

18.00 - - Wasim ur Rahman - - - - A - 16.00 16.00 Sanjeev Kumar

Agarwal Jan-14 - 9.20 6.80

40.00 9.67 9.67 Besar Awiat Bowo Nov-12 Sep-13 9.67 - B - 30.33 6.67 Agus Setiawan Sep-13 Mar-14 6.67 - B - - 23.36 Julius J. Sohilait Apr-14 - 7.00 16.36

36.00 7.37 7.37 Whiliyanto Nov-12 Jun-13 7.37 - B - 28.40 28.40 Lebiyartono Jul-13 - 15.97 12.43

Quality Assurance

Engineer 30.00 30.00 30.00 Uray Abdul Manaf Jul-13 - 15.97 13.03

36.00 12.33 12.33 Uus Martawijaya Nov-12 Nov-13 12.33 - B - 22.40 22.40 YD Tarwanto Oct-13 - 12.97 9.43

Environmental

Specialist 30.00 30.00 30.00 Leti Hermawati Dec-12 - 22.43 7.57

35.00 - 11.33 M. Sutopo Nov-12 Oct-13 11.33 - B - 26.00 26.00 Witono Sep-13 - 13.93 12.07

12.00 - - Darmansiri - - - - A

- 12.00 12.00 Muhdi - - - - A

- - 12.00 Mardiansyah Jul-14 4.00 8.00

12.00 - 4.10 Rudi Rungkat Nov-12 Mar-13 4.10 - B - 24.00 24.00 M. Edhi Fachri Mar-13 - 19.17 4.83

30 - - Agung Lukito - - - - A

- 25.00 25.00 Sony Thamrin May-13 - 17.97 7.03

Community Development Officer

36.00 36.00 36.00 Yakobus Jan-13 - 21.90 14.10

Road Safety Audit

Engineer 25.00 25.00 19.00 Aditya Moraza Alwi Jun-14 - 5.00 14.00

Bridge Engineer 5.00 5.00 5.00 Harimurti Suprihantoro Apr-13 Aug-13 5.00 0.00 C

Training Specialist 12.00 12.00 12.00 Roedjitarjo Jan-14 - 7.90 4.10

Remarks

A - Not able to mobilizied due to poor health or personal reasons B - Resigned due to personal reasons or poor health C - Task assigment completed

D - Remaining man - month for post audit

Demob-ilized

Man - Month Used as of end of October 2014

Man - Month

Remaining Remarks Original

Contract

Amendment No.1

Amendment No. 2

Highway Engineer POSITION

Man - Months Duration

Name Mobilized

Team Leader

Senior Procurement

Specialist

Assistant Team Leader

Financial Management

Specialist

Social Impact Specialist

Procurement Specialist-2 Management Information Specialist Procurement

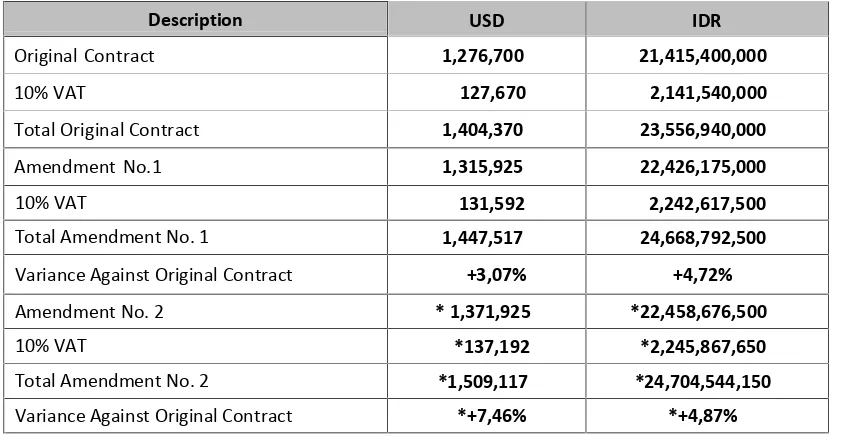

3.1.3 CTC Contract

The CTC contract for Western Indonesia National Roads Improvement Project (Contract No.06-20/CTC/TA/LN/8043/1112) was signed on 05 November 2012. The contract is between the Government of Indonesia represented by Directorate General of Highways in the Ministry of Public Works and PT. Perentjana Djaja in joint venture with Yongma Engineering Co.Ltd. and PT. Epadascon Permata Engineering Consultant.

The Notice To Proceed was issued by letter dated 6 November 2012 from the PPK, and the official starting date of the contract was set at 6 November 2012.

Likewise, Amendment No. 1 to the original contract was signed on 25 October 2013 to cover all requirements of the CTC are summarized below.

• Replacement of the Senior Procurement Specialist

• Extending the assignment of the Senior Highway Engineer.

• Extending the assignment of the Senior Road Safety Audit Engineer.

• Extending the assignment of the Procurement Specialist 2 and replacement of the

Procurement Specialist 1.

• Adding the new position of Bridge Engineer.

• Adding the new position of Training Specialist, and

• Adding the new position of Road Safety Engineer.

Amendment No. 2 is still to be officially approved. Proposed amendment to the Original Contract and Amendment No. 1 are additional man-months for professional and technical staff for international and local, replacement of foreign and local consultants and modification to various

reimbursables to match with the actual requirements. Presented inTable 3.2is the current status

[image:30.595.70.491.548.767.2]of CTC contract.

Table 3.2

Description USD IDR

Original Contract 1,276,700 21,415,400,000

10% VAT 127,670 2,141,540,000

Total Original Contract 1,404,370 23,556,940,000

Amendment No.1 1,315,925 22,426,175,000

10% VAT 131,592 2,242,617,500

Total Amendment No. 1 1,447,517 24,668,792,500

Variance Against Original Contract +3,07% +4,72%

Amendment No. 2 * 1,371,925 *22,458,676,500

10% VAT *137,192 *2,245,867,650

Total Amendment No. 2 *1,509,117 *24,704,544,150

Variance Against Original Contract *+7,46% *+4,87%

3.2

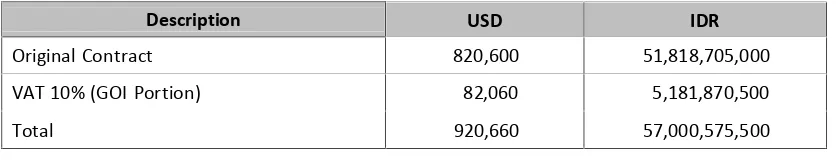

DSC Consultants

A Design and Supervision Consultant (DSC) will be responsible for design of WP-2 and WP-3 civil works and supervision of all civil works. They will have the role of Engineer under a FIDIC-type contract. The tasks include the preparation and maintenance of a quality assurance plan, validation and updating of designs, supervision of all civil works, environmental and social monitoring and management, and support for financial and progress monitoring and reporting. The DSC will also be responsible for quality assurance of materials and workmanship, certifying whether or not contractors have achieved the required results, as well as documentation and reporting based on the financial management plan. They will prepare a Quality Assurance system covering all subprojects, and continuously monitor the effectiveness of their supervision procedures. The team will be contracted and managed by DGH through the Bina Marga Regional Office (Balai II), and will be based in Padang, West Sumatera.

DSC has been established in Balai II Padang following the contract signing on 11 June 2013 between Balai II and Renardet SA in joint venture with PT. Cipta Strada, PT. Daya Creasi Mitrayasa, PT. Seecons and PT. Yodya Karya. The Notice To Proceed was issued by the Balai II on 19 June 2013.

[image:31.595.71.489.387.467.2]Shown inTable 3.3is the present status of the Design Supervision Consultant (DSC) contract.

Table 3.3

Description USD IDR

Original Contract 820,600 51,818,705,000

VAT 10% (GOI Portion) 82,060 5,181,870,500

Total 920,660 57,000,575,500

3.3

Technical Assistance for Capacity Building for Disaster Risks Reduction

Draft Finals of Request for Expression of Interest and Terms of Reference had been finalized by Teknik Lingkungan dan Keselamatan Jalan (TLKJ) based on previous comments from the World Bank.

The Draft Final copies are expected for resubmission to the World Bank for final review and issuance of No Objection Letter (NOL)

3.4

Technical Assistance for Capacity Building for Environmental Management

Consultant still to be procured

3.5

Technical Assistance for Capacity Building for Road Safety

4

CIVIL WORKS

4.1

Detailed Design Preparation

Final Engineering Designs, Engineer s Estimates and bidding documents have been completed for all projects proposed for WP-1.

WP-2 (nine subprojects) and WP-3 (eight subprojects) will be designed by DSC and the construction supervision of all the works programs will be performed by the same DSC team. In parallel with the instruction to speed up the process, detailed engineering design (DED) of some subprojects of WP-2 and WP-3 were prepared and completed by respective P2JN. The CTC has been instructed by DGH to review the DED of seven packages completed by the P2JNs (package 5, 6, 11, 13, 15, 17 and 19).

To date, detailed engineering design for fifteen (15) sub-projects has been completed, four (4) are under preparation and detailed design works of two (2) sub-projects are still pending due to proposal to replace the two (2) originally listed packages.

As previously reported in previous Monthly Progress Report, detailed engineering design drawings accompained by corresponding Engineer s Estimate for the four (4) sub-projects were approved by BALAI II (Padang) and were forwarded to PMU for final checking and review.

However due to the considerable cost estimate in implementing the design the Director of Implementation Affairs of Region I instructed BALAI II (Padang) Project Manager thru Internal Memo (Nota Dinas) No.130/ND/BL2014 to prepare design revisions.

The detailed engineering design drawings for the four (4) sub-project that are under revision by BALAI II are follows :

1. Package 7 : Indrapura Tapan

2. Package 8 : Bts. Pariaman Manggopoh

3. Package 10 : Sp. Empat Sp. Air Balam

4. Package 12 : Kambang Indrapura

To date, the four (4) DED drawing are still to be resubmitted for final review prior to submission to World Bank for request of No Objection Letter (NOL).

With regards to the other two (2) design drawings for Package 20 (Lubuk Alung Sicincin) and Package

21 (Lubuk Alung Sincincin) wherein result of CTC s technical review, comments and

recommendations were transmitted to DSC for incorporation in the preparation of final design drawings, to date, DSC have not yet returned the corrected drawings for final review.

As mentioned earlier, there is a proposal to delete two (2) originally listed packages for implementation under AWP-2 and AWP-3 due to the two (2) listed sub-projects were recently rehabilitated with newly laid asphalt concrete overlay on the existing travelledway.

The sub-projects that are originally listed for implementation in the WINRIP Program and proposed to

be replaced are are Package No. 9 (Rantau Tijang Kota Agung) and Package No. 18 (Mukomuko

The candidate roadlinks that are considered and proposed as repalcements are Biha Bengkunat (Link

No. 028) and Sibolga Sorkam (Link No. 043) both located in Lampung and North Sumatera,

respectively. One (1) of the two (2) proposed road sections which is Biha Bengkunat is already

included in List of Proposed Links For Feasibility Studies on Report from the Technical Assistance of Project Preparation for WINRIP but updating of economic evaluation still to be conducted. While the

other proposed roadlink (Sibolga Sorkam) which is not included in the original List of Proposed Link

For Feasibility Studies needs economic evaluation to determine whether it is feasible for further implementation.

A Technical Analysis Report For Verification of Replacement Road was prepared by the CTC s Co Team, Highway Engineer and Road Safety Audit Engineer from data and informations gathered during the reconnaissance and preliminary surveys and was formally submitted to PMU.

Based on the final review by PMU of the Technical Analysis Report For Verification of Replacement Road, the Directorate of Planning endorsed the proposal to World Bank for the Bank s confirmation and issuance of No Objection Letter (NOL).

In principle, the World Bank thru letter ref. no.WINRIP/187 on October 2, 2014 interpose conditional No Objection to the proposal by DGH to replace the original road sub-projects by two (2) new road links as follows :

(a) the two (2) replacements will be subjected to evaluation of technical and economic point of view by the World Bank and subsequently to restructure the project with loan agreement to change the road section.

(b) DGH to confirm the willingness to fully or partially finance the civil works with ABPN budget in case World Bank s technical and economic evaluation are not satisfactory and / or the loan closing date is not extended.

Progress of Technical Design Review and Road Safety Audit are shown in Appendix B.

4.2

Procurements

Procurement shall be conducted under the Bank s Procurement Procedures as mentioned in the Loan Agreement. The International Competitive Bidding (ICB) based on the Bank letter Ref. WINRIP/136 will apply to the packages with the construction estimated cost more than US$ 25 Million to comply with the new Bank s threshold for ICB. According to the GOI regulation, a prequalification shall be applied for the packages with the construction estimated cost more than IDR 10 Billion. Review from previous procurement process, the World Bank in the Aide Memoire requested to GOI, for next 4 ICB subprojects qualification still used Pre-Qualification and for remaining sub-project must be process with Post Qualification. As well as for all NCB the World Bank also requested to follow Post Qualification in procurement process.

All subprojects for WP-1 have been started with prequalification since 30 December 2011 for ICB multiple contract. This was an advanced procurement action agreed by both DGH and the World Bank prior to the CTC establishment. All AWP-1 sub-projects had signed the contract. The last 2 sub-projects, Package 02: Pd.

6, 2013 and NOL for disbursement for all 4 packages had been issued by the World Bank on December 10, 2013.

As of the reporting month (October 2014), a more detailed current updates are fully described in

Sub-Chapter 1.4 ProcurementonPage 3 of thisReport and consolidated project status in a tabulated format shown inTable 1.1onpage 7of thisReport.

Under Category 3 of Loan Agreement there are three (3) consultancy packages namely ;

1. Capacity Building For Disaster Risks Reduction

2. Capacity Building For Environmental Management

3. Capacity Building For Road Safety

Consultants for the three (3) consultancy packages are still to be procured. A more detailed updates can be

found inSub-Chapter 1.4 ProcurementonPage 6of thisReport.

Draft Terms of References for the three packages are in the process of finalization.

The WINRIP updated Procurement Plan is attached asAppendix F.

4.3

Civil Works Implementation

All 4 contract packages under AWP-1 are currently under construction by different contractors.

Commencement of works for all the 4 packages commenced on the 2ndweek of January 2014.Table

[image:34.595.74.558.481.690.2]4.1shows the details for each contract packages.

Table 4.1

Program

Contract Package

#

Contractor Name of Road Province Contract

Signed

Notice to Proceed

Contract Time

Completion Date

AWP-1 1

Jaya Konstruksi Manggala Pratama Tbk

Biha - Krui Lampung Nov 25, 2013

Jan 8,

2014 640 CD Oct 9, 2015

2

Jaya Konstruksi Manggala Pratama Tbk

Padang Sawah Sp. Empat including Air Gadang

West Sumatera

Dec 6, 2013

Jan 6,

2014 730 CD Jan 5, 2016

3

Jaya Konstruksi Manggala Pratama Tbk

Manggopoh Padang Sawah

West Sumatera

Dec 6, 2013

Jan 6,

2014 730 CD Jan 5, 2016

4

PT. Waskita Karya and PT. Mulya Turangga (JO)

Ipuh - Bantal Bengkulu Nov 14, 2013

Jan 10,

4.4

Civil Works Progress

All the 4 Contractors substantially completed their mobilization and construction of Base Camps in all packages have been completed. Other activities done during this month were repair and restoration of deteriorated existing pavements, roadway excavation, embankment formation, spreading of granular pavement for roadway widening, asphalt paving structural works, construction of stone masonry side ditches, stockpiling of raw material, production of crush aggregates and other minor works. Progress status of the four (4) on-going civil work contracts as of this reporting period

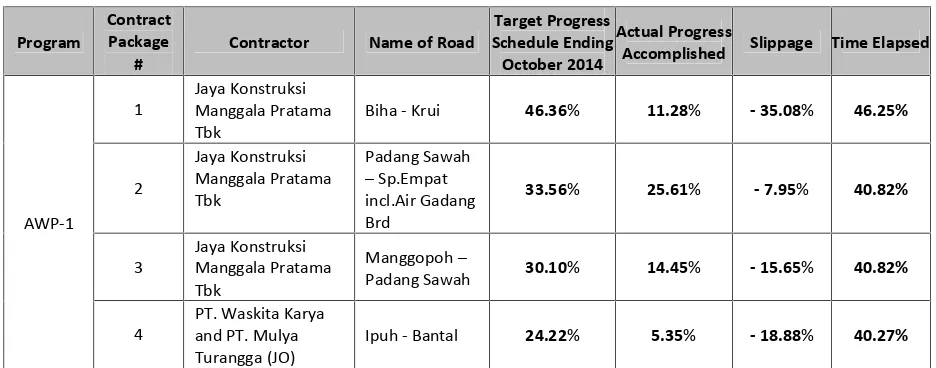

[image:35.595.70.538.266.450.2]are shown inTable 4.2.

Table 4.2

Program

Contract Package

#

Contractor Name of Road

Target Progress Schedule Ending October 2014

Actual Progress

Accomplished Slippage Time Elapsed

AWP-1

1

Jaya Konstruksi Manggala Pratama Tbk

Biha - Krui 46.36% 11.28% - 35.08% 46.25%

2

Jaya Konstruksi Manggala Pratama Tbk

Padang Sawah Sp.Empat incl.Air Gadang Brd

33.56% 25.61% - 7.95% 40.82%

3

Jaya Konstruksi Manggala Pratama Tbk

Manggopoh

Padang Sawah 30.10% 14.45% - 15.65% 40.82%

4

PT. Waskita Karya and PT. Mulya Turangga (JO)

Ipuh - Bantal 24.22% 5.35% - 18.88% 40.27%

At the end of this reporting month of October 2014, all the four (4) contract packages did not achieved any significant accomplishments to catch up with the schedule and were still lagging farther behind schedule. The situation remains the same as in previous month as three (3) of the contract packages continue to follow a downward trend of delayed schedules, while the other one (1) Package No.2 which showed signs of improvement to catch up with the schedule the previous month, is also leading to a downward trend of delayed works.

With time elapsed of more than 40% and approaching the halfway mark of the contract time for each of the four (4) contract packages, the Contractors will have hard time to deliver the Works on the target dates of completion, unless a realistic action plans or Catch-up Schedules will be strictly implemented.

Package No. 1 : Biha Krui

At the end of this month, there was no substantial work accomplished to reduce previous month

slippage of-30.39%,instead the behind works further slipped to 35.08%.

The major work items which brought down the slippage to highly alarming situation are the

drainage works (20.14%) and granular and asphalt pavements (19.47%) which accounted for a total

able to accomplished only1.60%total for the three (3) major work items.

The overall situation of this contract package is so critical with respect to timely completion taking into consideration the short remaining contract time to complete the big amount of remaining works.

The balance of remaining works which is equivalent to 88.72% and still to be completed by the

Contractor within the remaining 53.75% of the contract period or 344 calendar days can still be

attained provided a realistic action plan will be implemented by the Contractor.

As agreed in the 2nd Show Cause Meeting, Test Case covering 2 week (September 28, 2014

October 6, 2014) to attain a minimum of2.53%progress was executed by the Contractor.

However, the Test Case did not produced good results as the Contractor was unable to produced the agreed targeted progress.

To achieved successful completion of the Project, all issues and major problems